Professional Documents

Culture Documents

Chapter 2 Business Structure

Chapter 2 Business Structure

Uploaded by

PaccarKtCopyright:

Available Formats

You might also like

- CXC Accounts NotesDocument60 pagesCXC Accounts NotesNadira Seecharan100% (2)

- Wagner BA 2013 FallDocument78 pagesWagner BA 2013 FalladamNo ratings yet

- Licensing HandbookDocument88 pagesLicensing HandbookajoiNo ratings yet

- Group 1-Chipotle Strategic PlanDocument27 pagesGroup 1-Chipotle Strategic PlanNaushilMaknojia67% (3)

- Reasons Why Individuals Start A BusinessDocument19 pagesReasons Why Individuals Start A BusinessKip 2No ratings yet

- Summary - Chap 5Document5 pagesSummary - Chap 5Đăng Khoa Thạch TrầnNo ratings yet

- Types of Business OrganisationDocument4 pagesTypes of Business Organisationusmanrandhawa67889No ratings yet

- Types of Business OrganizationDocument3 pagesTypes of Business OrganizationSugar CubeNo ratings yet

- Pob Notes: Reasons For Starting A BusinessDocument10 pagesPob Notes: Reasons For Starting A BusinessrohanNo ratings yet

- Business OrganizationsDocument4 pagesBusiness OrganizationsYessameen Franco R. CastilloNo ratings yet

- CH 4 - Types of Business OrganisationDocument25 pagesCH 4 - Types of Business Organisationaysilislam528No ratings yet

- Business Studies Mocks RevisionDocument34 pagesBusiness Studies Mocks RevisionAliza KashifNo ratings yet

- Busiess Structure Notes 2 AS LevelDocument5 pagesBusiess Structure Notes 2 AS Levelmalak sherif100% (1)

- Types of Business OrganisationsDocument9 pagesTypes of Business OrganisationsHills NaomiNo ratings yet

- BST Help Note For ch4Document25 pagesBST Help Note For ch468cq75hqb4No ratings yet

- Revision NotesDocument60 pagesRevision NotesxalishaxpxNo ratings yet

- IGCSE Business Studies RevisionDocument27 pagesIGCSE Business Studies Revisionvyaskush80% (5)

- Week 1 Session 1: Form of Business OrganizationDocument32 pagesWeek 1 Session 1: Form of Business OrganizationMyla D. DimayugaNo ratings yet

- CommerceDocument16 pagesCommercemfoyowenNo ratings yet

- Types of Business Entities NotesDocument6 pagesTypes of Business Entities Noteswill.visit.paris248No ratings yet

- Sole Proprietorship and CooperativesDocument4 pagesSole Proprietorship and CooperativesSw00per100% (1)

- Httpsarushacc - Go.tzstorageappmediauploaded Filescommerce - PDF 2Document16 pagesHttpsarushacc - Go.tzstorageappmediauploaded Filescommerce - PDF 2mgangajacob2No ratings yet

- Business StudiesDocument120 pagesBusiness Studiessdb78bqdmnNo ratings yet

- Revision Notes ReTypedDocument7 pagesRevision Notes ReTypedkvidiniotis99No ratings yet

- Chapter 1: Forms of Business Ownership 1.1 Sole TraderDocument15 pagesChapter 1: Forms of Business Ownership 1.1 Sole TraderBrandon LuuNo ratings yet

- Business Unit 1 NotesDocument19 pagesBusiness Unit 1 Notesamir dargahiNo ratings yet

- Man Project ParthDocument8 pagesMan Project ParthParth KshirsagarNo ratings yet

- Sole Proprietorship Offers The Following ProsDocument13 pagesSole Proprietorship Offers The Following ProsMubeen JavedNo ratings yet

- Chapter - 4, Types of Business OrganisationsDocument5 pagesChapter - 4, Types of Business OrganisationsagyteNo ratings yet

- Enterprise Economy Chapters 1-8Document48 pagesEnterprise Economy Chapters 1-8Martin Pelaez PerezNo ratings yet

- Business Ethics Reviewer (1st Periodical)Document20 pagesBusiness Ethics Reviewer (1st Periodical)casumbalmckaylacharmianNo ratings yet

- New Subtopic 1.2 IB Business New CurriculumDocument15 pagesNew Subtopic 1.2 IB Business New CurriculumANo ratings yet

- Unit 4: Types/ Forms of Business Organisation: Private Sector Public SectorDocument25 pagesUnit 4: Types/ Forms of Business Organisation: Private Sector Public SectormohdportmanNo ratings yet

- Unit 14 - StakeholdersDocument7 pagesUnit 14 - Stakeholders2011050No ratings yet

- Type of Business: Owned by Controlled byDocument17 pagesType of Business: Owned by Controlled byNha HoangNo ratings yet

- Business Revision 1Document30 pagesBusiness Revision 1Sik Hin ChongNo ratings yet

- 4 Types of Business OrganizationsDocument3 pages4 Types of Business OrganizationsAnton AndayaNo ratings yet

- POB Notes - Business OrganizationsDocument16 pagesPOB Notes - Business OrganizationsAIDAN BAYNENo ratings yet

- Notes On Organization and ManagementDocument2 pagesNotes On Organization and ManagementHiyomi IshidaNo ratings yet

- Business EnglishDocument24 pagesBusiness EnglishNatalia JakubowskaNo ratings yet

- Business Revision Notes 1AS2Document7 pagesBusiness Revision Notes 1AS2Piran UmrigarNo ratings yet

- Business Studies Unit 1 Revision Booklet Starting A BusinessDocument37 pagesBusiness Studies Unit 1 Revision Booklet Starting A BusinessPiran UmrigarNo ratings yet

- Hand Out 8Document7 pagesHand Out 8abdool saheedNo ratings yet

- Chapter 5 Business Studies o LevelsDocument10 pagesChapter 5 Business Studies o LevelsRohan JacksonNo ratings yet

- IB Business & Management HLDocument13 pagesIB Business & Management HLjustin bieberNo ratings yet

- IB Business and Management Notes, SLDocument6 pagesIB Business and Management Notes, SLbush0234No ratings yet

- Forms of Business OrganisationDocument6 pagesForms of Business OrganisationmannNo ratings yet

- Business Organisations FormsDocument28 pagesBusiness Organisations Formsharsh vardhanNo ratings yet

- IBDL 1: CH 1 EntrepreneurshipDocument11 pagesIBDL 1: CH 1 EntrepreneurshipWesam Al-Okabi100% (1)

- Forms of Business OrganizationsDocument16 pagesForms of Business OrganizationsakashaniNo ratings yet

- Forms of Business OranizationsDocument6 pagesForms of Business Oranizationskremer.oscar2009No ratings yet

- Chapter One - Introduction To Corporate FinanceDocument8 pagesChapter One - Introduction To Corporate FinanceSH1970No ratings yet

- POB - Lesson 6 - Types of BusinessesDocument5 pagesPOB - Lesson 6 - Types of BusinessesAudrey RolandNo ratings yet

- Private Sector and Public Sector Public SectorDocument8 pagesPrivate Sector and Public Sector Public Sectorpisces_lexNo ratings yet

- Types of OrganizationDocument49 pagesTypes of OrganizationMr. SiddiquiNo ratings yet

- Business Theme 2Document17 pagesBusiness Theme 2CNo ratings yet

- Unit 1 - Business Organization and Environment: 1.1 Introduction To Business ManagementDocument36 pagesUnit 1 - Business Organization and Environment: 1.1 Introduction To Business ManagementAntonio Sesé MartínezNo ratings yet

- Sole TraderDocument3 pagesSole TraderMichael Jawahar Babu RavuriNo ratings yet

- IGCSE Business NotesDocument63 pagesIGCSE Business NotesCrystal Wong97% (39)

- BUSINESS NOTES (July Monthly Test)Document18 pagesBUSINESS NOTES (July Monthly Test)siddhieieichawrijalNo ratings yet

- Top Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomFrom EverandTop Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomNo ratings yet

- Home Based Business Ideas: Business Ideas You Can Do With Little Or No MoneyFrom EverandHome Based Business Ideas: Business Ideas You Can Do With Little Or No MoneyNo ratings yet

- HOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”From EverandHOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”No ratings yet

- SJVN Letter of OfferDocument48 pagesSJVN Letter of Offerveenu68No ratings yet

- Accounting Internship Report - Nguyen Huong Quynh - 11194477Document101 pagesAccounting Internship Report - Nguyen Huong Quynh - 11194477Nguyễn Hương QuỳnhNo ratings yet

- Corpo Lecture NotesDocument40 pagesCorpo Lecture Notesgilberthufana446877100% (1)

- Financing Decision Alembic Glass Industries LTD.: A Project Report OnDocument69 pagesFinancing Decision Alembic Glass Industries LTD.: A Project Report OnkajaltrivedimbaNo ratings yet

- Basic Facts About Nippon Steel & Sumitomo MetalDocument181 pagesBasic Facts About Nippon Steel & Sumitomo MetalDaniel CanalesNo ratings yet

- Director Chapter Ca FinalDocument18 pagesDirector Chapter Ca FinalSudhir Kochhar Fema AuthorNo ratings yet

- Development Bank of Mauritius V Union Enterprises LTD 2014 SCJ 302Document35 pagesDevelopment Bank of Mauritius V Union Enterprises LTD 2014 SCJ 302Priyanka BundhooNo ratings yet

- Djankov, S., LaPorta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008), "The Law and Economics of Self-Dealing", Journal of Financial Economics 88, Pp. 430-465.Document8 pagesDjankov, S., LaPorta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008), "The Law and Economics of Self-Dealing", Journal of Financial Economics 88, Pp. 430-465.Nuria MartorellNo ratings yet

- Corporate Practice: No ClassDocument8 pagesCorporate Practice: No ClassReyshanne Joy B MarquezNo ratings yet

- 3 - G.R. No. 75875Document9 pages3 - G.R. No. 75875Pau SantosNo ratings yet

- Tiangco Vs Uniwide JSIA Vs Sales People's Broadcasting Vs JuezanDocument3 pagesTiangco Vs Uniwide JSIA Vs Sales People's Broadcasting Vs JuezanEmme Cheayanne CeleraNo ratings yet

- Sample MinutesDocument5 pagesSample Minutesel jeo100% (1)

- Investor Relations Beyond Financials: Non-Financial Factors and Capital Market Image BuildingDocument19 pagesInvestor Relations Beyond Financials: Non-Financial Factors and Capital Market Image BuildingA RNo ratings yet

- 1 Beja SR vs. CADocument10 pages1 Beja SR vs. CAFrench Vivienne TemplonuevoNo ratings yet

- AsliDocument35 pagesAsliWidyani Indah DewantiNo ratings yet

- Spare Parts List: 29848944 R909719405 Drawing: Serial NumberDocument27 pagesSpare Parts List: 29848944 R909719405 Drawing: Serial NumberJayath BogahawatteNo ratings yet

- Jurnal Summer 2011Document28 pagesJurnal Summer 2011nugrohoNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of Polaris Realtors India LimitedDocument17 pagesInterim Order Cum Show Cause Notice in The Matter of Polaris Realtors India LimitedShyam SunderNo ratings yet

- CCK - Annual Report 2014Document134 pagesCCK - Annual Report 2014Ryuzanna JubaidiNo ratings yet

- Corporation Code ReviewerDocument20 pagesCorporation Code ReviewerEM DOMINGO67% (3)

- BA Savings Bank v. SiaDocument2 pagesBA Savings Bank v. SiaJay jogsNo ratings yet

- 14 Audit CommitteeDocument3 pages14 Audit CommitteeSurya ShekharNo ratings yet

- Jimmy Savile InvestigationDocument793 pagesJimmy Savile InvestigationAnonymous Hnv6u54H100% (2)

- Executive Position Profile - Northland Foundation - PresidentDocument9 pagesExecutive Position Profile - Northland Foundation - PresidentLars LeafbladNo ratings yet

- Pa Eeroni-@: ShreeDocument50 pagesPa Eeroni-@: ShreeContra Value BetsNo ratings yet

- HRD TransferPolicy GrA 17491Document19 pagesHRD TransferPolicy GrA 17491Sushant KandwalNo ratings yet

- SKB Ar 2017Document102 pagesSKB Ar 2017DudeNo ratings yet

Chapter 2 Business Structure

Chapter 2 Business Structure

Uploaded by

PaccarKtOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 Business Structure

Chapter 2 Business Structure

Uploaded by

PaccarKtCopyright:

Available Formats

Chapter 2: Business Structure

9

th

Feb 2012

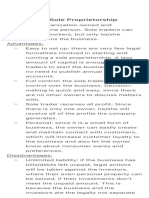

Sole Trader

Sole Trader: - A person who holds the whole business in shape of finance and also

controlling/managing the business and his investment should be fixed for the long term.

An individual who trades under his/her own name.

It is totally independent.

Makes all the important decisions and responsible for paying all of the debts.

Few formalities in setting up.

Can employ as many people as he/she wish.

E.g. carpenter, coffee shop, corner store.

Advantages:-

Easy to start and end the business.

No legal formalities would be requiring.

Not accountable and answerable to anyone if he receive loss.

He is entitled to make the whole profit, so profit cannot be shared.

Can have the customer oriented product due to directed dealing with customer.

Decisions can be made quickly.

Paperwork is minimal.

Problem easier to solve.

Close contact with employees and customers.

Disadvantages:-

o Personally liable for all debts that it occurs. [unlimited liability]

o Less capital available for expansion.

o Taxed at a higher rate than a private company.

o May have difficulty in managing all business functions.

o When the sole trader dies so does the business.

o Raising capital could be difficult for one person.

Partnership

Can have between 2-20 partners.

Set up under the Partnership Act 1890.

A partnership deed can be used to set out the rights of the partners

Aim to make more profit

E.g. doctor, accountant, solicitors.

Advantages:-

More capital is available then for the sole trader because more people are contributing.

Better use of business expertise because each partners can concentrate on what they are

good at.

Better decision making because decisions are made after discussion.

Disadvantages:-

Group decisions making may cause conflict between partners

Like sole trader, partners have unlimited liability thus they are liable for all the business

depts.

Decisions making can be slower which can lead to inflexibility.

Profit must be shared.

Key terms:-

- Unlimited liability: - the owners are personally responsible for paying debts if the

business goes bankrupt.

- Limited liability: - if the company goes into liquidation, the shareholders of the

company are not responsible for paying the debts of the business.

Private Limited Company (ltd)

- A company that is legal entity in its own right.

- It can be sued and can sue.

- Shareholders own the business.

- Groups of between 2-50 people who buy the shares are called the shareholders.

- Cannot sell shares to public.

Public Limited Company (plc.)

Can sell their shared to members of the public through the stock exchange.

Must have at least 7 shareholders with no maximum limit.

Most issue a prospective detailing the history of the company and inviting the public to

buy shares.

Shares are bought and sold on the stock exchange.

Accounts must be published and audited on an annual basis.

An annual report must also be compiled each year.

Advantage (plc.)

- Limited liability.

- Easier than ltd to rise capital.

- Attract top management because of public image.

- Continuity of existence.

- Lots of publicity based on stock exchange quotations.

Disadvantage (plc.)

- High formation costs

- Accounts have to published

- Profits must be distributed to shareholders

- Ownership and control are separated because although the shareholders own the company

the Board of Directors make the decisions

Key terms:

- Shares:

o Long term sources of finance

o Sold to people who became shareholder of the company

o A plc. is able to advertise its shares for sale to the general public

o A private limited company must sell their shares privately.

- Shareholders: these are people who own part of the business.

Source of finance

- Internal sources of finance

o Retained profits

o Stock reduction

o Assets sale

o Limiting credit to customers

- External sources of finance

o Owners capital

o Hire purchase and leaning

o Overdrafts and loans

o Grants

Franchises

- Involves paying a fee and agreeing to produce goods exactly in accordance with the

franchise companys policy.

- Payments are made on a regular basis depending on profits made.

- Training and supervision are provided.

The public and private sector

- The public section includes everything that is owned by the government e.g. (army, police

force, hospital, etc.)

- Public means that they are owned by the government for the benefit of the people who

run them.

- The private sector contains all the business owned by private individuals

- Private means that these businesses are run for the benefits of the people who own them.

Strengths of the free market: private sector.

- Employers and employees can create their own personal wealth through the profit motive

and hard work.

- A greater range of products are supplied.

- People have greater freedom to choose and what they want.

- Competition helps keep prices down and encourages new ideas.

Strengths of the planned public sector

- Public services do not depend on the profit motive and will be supplied even at a loss.

- The provision of basic services available to all regardless of peoples ability to pay them.

16

th

Feb 2012

Companies

Documentation/Legal Formalities

1) Memorandum of association:

- Name of company

- Address of head office

- Share capital

- Aim/Purpose of company

2) Articles of association (internal working)

- Name of company directors

- Shares of company directors

- Meetings records

Key terms

Dividend: - A profit distributed to shares holders as per the value of the shares decided by

Board of Government. It is income for the shareholders but an expense for the company or a

liability for the business.

Co-operatives

- Different members and work together for running up the business.

- Group of people having the one objective and they decide to work together is basically

said as co-operatives.

- All members have equal rights and they have the right of voting at important meetings.

- Profits and loss are also distributed equally among the members.

Advantage

Normally, the members of co-operatives object are one for that they can work together.

o E.g., one person who is accountant and another is a good producer of goods

suppose wheat producer. If they work together the business can process.

In co-operatives, they can buy things in bulk on cheaper rates. Like if one retailer has

required 400 units of toys and another requires 500 units of toys and if they would lose

the advantage of buying in bulk.

Working together can be good for both people in planning and decision making for the

long term and as well as short term.

As they are getting profit equally, there will be more self-motivation because they work

hard to get more benefit equally.

Disadvantage

Poor management skills.

Capital shortage

Slow decision making

Franchise

- A business that uses only the name, logo, and trading system of successful

prevailing/existing business.

- A franchise is not strictly a form of legal structure, but it is a legal contract among two

people/firms/organizations.

1) Franchisee:

a. Who use name of successful prevailing business, and logo marketing methods,

organization structure, the product formation/design, and patents of the

existing companies.

b. Franchisee can use the above discussed while investing his/her money into the

successful business.

c. Entitled to take only partial profit of the business as decided by franchisor.

2) Franchisor:

a. Successful existing/prevailing company.

b. Who make a legal contract with franchisee.

c. The actual ownership rights of logo, marketing structure methods, the style

and design of the product.

d. For enhancement or growth of the business, franchisors make legal contract

with franchisee.

Benefit of Franchising

- Less failing of business.

An established product is already getting good profit and having good name in the

market.

- Proper guidance and training.

Under well trained people they provide the good training and also give proper

guidance in business.

- Advertisement

All marketing and advertisement is normally done by franchisor on national and

international level.

- Quality of goods

The franchisors obtain the goods from well-established and good reputed supplier.

Thats why quality of goods is quite maintained.

- Not to open branch in nearby

As per legal contract, the franchisor cannot open the branch in the local area.

Disadvantages of Franchising

- Shares of the profit have to be paid to franchisor every year.

- Initial franchise licence can be expensive.

- Local promotion has to be paid by franchisee.

- If you are dissatisfied by suppliers products, you cannot change the suppliers unless

receive a consent by franchisors.

- Strict rules over pricing

Join ventures

- Two or more organisations agree to accomplish the assigned project with proper co-

operation on a particular date.

- Costs and risks of a new business venture are shared together.

- Different companied have different strengths, machineries and experiences, thats why if

they work together to project will be finished earlier.

Holding company

- A business organization that owns and controls number of separate business, but does not

unite them into one unified company.

Public corporations

- A business enterprise owned and controlled by the state a.k.a nationalized.

Advantage: -

Main objective is not to take profit.

Loss making service organisations controlled by state might still be kept operating.

Finances mainly raised by government.

Disadvantage: -

Tendency towards inefficiency as they have lack of strict targets achieves.

Subsidies from government can encourage inefficiency.

Government may interfere in business decisions due to political reasons.

Public limited company

- A limited company, often a large business, with the legal right to sell shares to the general

public by quoted on shares stock exchange market.

You might also like

- CXC Accounts NotesDocument60 pagesCXC Accounts NotesNadira Seecharan100% (2)

- Wagner BA 2013 FallDocument78 pagesWagner BA 2013 FalladamNo ratings yet

- Licensing HandbookDocument88 pagesLicensing HandbookajoiNo ratings yet

- Group 1-Chipotle Strategic PlanDocument27 pagesGroup 1-Chipotle Strategic PlanNaushilMaknojia67% (3)

- Reasons Why Individuals Start A BusinessDocument19 pagesReasons Why Individuals Start A BusinessKip 2No ratings yet

- Summary - Chap 5Document5 pagesSummary - Chap 5Đăng Khoa Thạch TrầnNo ratings yet

- Types of Business OrganisationDocument4 pagesTypes of Business Organisationusmanrandhawa67889No ratings yet

- Types of Business OrganizationDocument3 pagesTypes of Business OrganizationSugar CubeNo ratings yet

- Pob Notes: Reasons For Starting A BusinessDocument10 pagesPob Notes: Reasons For Starting A BusinessrohanNo ratings yet

- Business OrganizationsDocument4 pagesBusiness OrganizationsYessameen Franco R. CastilloNo ratings yet

- CH 4 - Types of Business OrganisationDocument25 pagesCH 4 - Types of Business Organisationaysilislam528No ratings yet

- Business Studies Mocks RevisionDocument34 pagesBusiness Studies Mocks RevisionAliza KashifNo ratings yet

- Busiess Structure Notes 2 AS LevelDocument5 pagesBusiess Structure Notes 2 AS Levelmalak sherif100% (1)

- Types of Business OrganisationsDocument9 pagesTypes of Business OrganisationsHills NaomiNo ratings yet

- BST Help Note For ch4Document25 pagesBST Help Note For ch468cq75hqb4No ratings yet

- Revision NotesDocument60 pagesRevision NotesxalishaxpxNo ratings yet

- IGCSE Business Studies RevisionDocument27 pagesIGCSE Business Studies Revisionvyaskush80% (5)

- Week 1 Session 1: Form of Business OrganizationDocument32 pagesWeek 1 Session 1: Form of Business OrganizationMyla D. DimayugaNo ratings yet

- CommerceDocument16 pagesCommercemfoyowenNo ratings yet

- Types of Business Entities NotesDocument6 pagesTypes of Business Entities Noteswill.visit.paris248No ratings yet

- Sole Proprietorship and CooperativesDocument4 pagesSole Proprietorship and CooperativesSw00per100% (1)

- Httpsarushacc - Go.tzstorageappmediauploaded Filescommerce - PDF 2Document16 pagesHttpsarushacc - Go.tzstorageappmediauploaded Filescommerce - PDF 2mgangajacob2No ratings yet

- Business StudiesDocument120 pagesBusiness Studiessdb78bqdmnNo ratings yet

- Revision Notes ReTypedDocument7 pagesRevision Notes ReTypedkvidiniotis99No ratings yet

- Chapter 1: Forms of Business Ownership 1.1 Sole TraderDocument15 pagesChapter 1: Forms of Business Ownership 1.1 Sole TraderBrandon LuuNo ratings yet

- Business Unit 1 NotesDocument19 pagesBusiness Unit 1 Notesamir dargahiNo ratings yet

- Man Project ParthDocument8 pagesMan Project ParthParth KshirsagarNo ratings yet

- Sole Proprietorship Offers The Following ProsDocument13 pagesSole Proprietorship Offers The Following ProsMubeen JavedNo ratings yet

- Chapter - 4, Types of Business OrganisationsDocument5 pagesChapter - 4, Types of Business OrganisationsagyteNo ratings yet

- Enterprise Economy Chapters 1-8Document48 pagesEnterprise Economy Chapters 1-8Martin Pelaez PerezNo ratings yet

- Business Ethics Reviewer (1st Periodical)Document20 pagesBusiness Ethics Reviewer (1st Periodical)casumbalmckaylacharmianNo ratings yet

- New Subtopic 1.2 IB Business New CurriculumDocument15 pagesNew Subtopic 1.2 IB Business New CurriculumANo ratings yet

- Unit 4: Types/ Forms of Business Organisation: Private Sector Public SectorDocument25 pagesUnit 4: Types/ Forms of Business Organisation: Private Sector Public SectormohdportmanNo ratings yet

- Unit 14 - StakeholdersDocument7 pagesUnit 14 - Stakeholders2011050No ratings yet

- Type of Business: Owned by Controlled byDocument17 pagesType of Business: Owned by Controlled byNha HoangNo ratings yet

- Business Revision 1Document30 pagesBusiness Revision 1Sik Hin ChongNo ratings yet

- 4 Types of Business OrganizationsDocument3 pages4 Types of Business OrganizationsAnton AndayaNo ratings yet

- POB Notes - Business OrganizationsDocument16 pagesPOB Notes - Business OrganizationsAIDAN BAYNENo ratings yet

- Notes On Organization and ManagementDocument2 pagesNotes On Organization and ManagementHiyomi IshidaNo ratings yet

- Business EnglishDocument24 pagesBusiness EnglishNatalia JakubowskaNo ratings yet

- Business Revision Notes 1AS2Document7 pagesBusiness Revision Notes 1AS2Piran UmrigarNo ratings yet

- Business Studies Unit 1 Revision Booklet Starting A BusinessDocument37 pagesBusiness Studies Unit 1 Revision Booklet Starting A BusinessPiran UmrigarNo ratings yet

- Hand Out 8Document7 pagesHand Out 8abdool saheedNo ratings yet

- Chapter 5 Business Studies o LevelsDocument10 pagesChapter 5 Business Studies o LevelsRohan JacksonNo ratings yet

- IB Business & Management HLDocument13 pagesIB Business & Management HLjustin bieberNo ratings yet

- IB Business and Management Notes, SLDocument6 pagesIB Business and Management Notes, SLbush0234No ratings yet

- Forms of Business OrganisationDocument6 pagesForms of Business OrganisationmannNo ratings yet

- Business Organisations FormsDocument28 pagesBusiness Organisations Formsharsh vardhanNo ratings yet

- IBDL 1: CH 1 EntrepreneurshipDocument11 pagesIBDL 1: CH 1 EntrepreneurshipWesam Al-Okabi100% (1)

- Forms of Business OrganizationsDocument16 pagesForms of Business OrganizationsakashaniNo ratings yet

- Forms of Business OranizationsDocument6 pagesForms of Business Oranizationskremer.oscar2009No ratings yet

- Chapter One - Introduction To Corporate FinanceDocument8 pagesChapter One - Introduction To Corporate FinanceSH1970No ratings yet

- POB - Lesson 6 - Types of BusinessesDocument5 pagesPOB - Lesson 6 - Types of BusinessesAudrey RolandNo ratings yet

- Private Sector and Public Sector Public SectorDocument8 pagesPrivate Sector and Public Sector Public Sectorpisces_lexNo ratings yet

- Types of OrganizationDocument49 pagesTypes of OrganizationMr. SiddiquiNo ratings yet

- Business Theme 2Document17 pagesBusiness Theme 2CNo ratings yet

- Unit 1 - Business Organization and Environment: 1.1 Introduction To Business ManagementDocument36 pagesUnit 1 - Business Organization and Environment: 1.1 Introduction To Business ManagementAntonio Sesé MartínezNo ratings yet

- Sole TraderDocument3 pagesSole TraderMichael Jawahar Babu RavuriNo ratings yet

- IGCSE Business NotesDocument63 pagesIGCSE Business NotesCrystal Wong97% (39)

- BUSINESS NOTES (July Monthly Test)Document18 pagesBUSINESS NOTES (July Monthly Test)siddhieieichawrijalNo ratings yet

- Top Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomFrom EverandTop Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomNo ratings yet

- Home Based Business Ideas: Business Ideas You Can Do With Little Or No MoneyFrom EverandHome Based Business Ideas: Business Ideas You Can Do With Little Or No MoneyNo ratings yet

- HOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”From EverandHOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”No ratings yet

- SJVN Letter of OfferDocument48 pagesSJVN Letter of Offerveenu68No ratings yet

- Accounting Internship Report - Nguyen Huong Quynh - 11194477Document101 pagesAccounting Internship Report - Nguyen Huong Quynh - 11194477Nguyễn Hương QuỳnhNo ratings yet

- Corpo Lecture NotesDocument40 pagesCorpo Lecture Notesgilberthufana446877100% (1)

- Financing Decision Alembic Glass Industries LTD.: A Project Report OnDocument69 pagesFinancing Decision Alembic Glass Industries LTD.: A Project Report OnkajaltrivedimbaNo ratings yet

- Basic Facts About Nippon Steel & Sumitomo MetalDocument181 pagesBasic Facts About Nippon Steel & Sumitomo MetalDaniel CanalesNo ratings yet

- Director Chapter Ca FinalDocument18 pagesDirector Chapter Ca FinalSudhir Kochhar Fema AuthorNo ratings yet

- Development Bank of Mauritius V Union Enterprises LTD 2014 SCJ 302Document35 pagesDevelopment Bank of Mauritius V Union Enterprises LTD 2014 SCJ 302Priyanka BundhooNo ratings yet

- Djankov, S., LaPorta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008), "The Law and Economics of Self-Dealing", Journal of Financial Economics 88, Pp. 430-465.Document8 pagesDjankov, S., LaPorta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008), "The Law and Economics of Self-Dealing", Journal of Financial Economics 88, Pp. 430-465.Nuria MartorellNo ratings yet

- Corporate Practice: No ClassDocument8 pagesCorporate Practice: No ClassReyshanne Joy B MarquezNo ratings yet

- 3 - G.R. No. 75875Document9 pages3 - G.R. No. 75875Pau SantosNo ratings yet

- Tiangco Vs Uniwide JSIA Vs Sales People's Broadcasting Vs JuezanDocument3 pagesTiangco Vs Uniwide JSIA Vs Sales People's Broadcasting Vs JuezanEmme Cheayanne CeleraNo ratings yet

- Sample MinutesDocument5 pagesSample Minutesel jeo100% (1)

- Investor Relations Beyond Financials: Non-Financial Factors and Capital Market Image BuildingDocument19 pagesInvestor Relations Beyond Financials: Non-Financial Factors and Capital Market Image BuildingA RNo ratings yet

- 1 Beja SR vs. CADocument10 pages1 Beja SR vs. CAFrench Vivienne TemplonuevoNo ratings yet

- AsliDocument35 pagesAsliWidyani Indah DewantiNo ratings yet

- Spare Parts List: 29848944 R909719405 Drawing: Serial NumberDocument27 pagesSpare Parts List: 29848944 R909719405 Drawing: Serial NumberJayath BogahawatteNo ratings yet

- Jurnal Summer 2011Document28 pagesJurnal Summer 2011nugrohoNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of Polaris Realtors India LimitedDocument17 pagesInterim Order Cum Show Cause Notice in The Matter of Polaris Realtors India LimitedShyam SunderNo ratings yet

- CCK - Annual Report 2014Document134 pagesCCK - Annual Report 2014Ryuzanna JubaidiNo ratings yet

- Corporation Code ReviewerDocument20 pagesCorporation Code ReviewerEM DOMINGO67% (3)

- BA Savings Bank v. SiaDocument2 pagesBA Savings Bank v. SiaJay jogsNo ratings yet

- 14 Audit CommitteeDocument3 pages14 Audit CommitteeSurya ShekharNo ratings yet

- Jimmy Savile InvestigationDocument793 pagesJimmy Savile InvestigationAnonymous Hnv6u54H100% (2)

- Executive Position Profile - Northland Foundation - PresidentDocument9 pagesExecutive Position Profile - Northland Foundation - PresidentLars LeafbladNo ratings yet

- Pa Eeroni-@: ShreeDocument50 pagesPa Eeroni-@: ShreeContra Value BetsNo ratings yet

- HRD TransferPolicy GrA 17491Document19 pagesHRD TransferPolicy GrA 17491Sushant KandwalNo ratings yet

- SKB Ar 2017Document102 pagesSKB Ar 2017DudeNo ratings yet