Professional Documents

Culture Documents

Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2

Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2

Uploaded by

kaomsheartCopyright:

Available Formats

You might also like

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- BUSI 353 Assignment #6 General Instructions For All AssignmentsDocument4 pagesBUSI 353 Assignment #6 General Instructions For All AssignmentsTan0% (1)

- Musgrave's Business Environment AssignmentDocument19 pagesMusgrave's Business Environment AssignmentDerrick FranklinNo ratings yet

- Ebusiness AssignmentDocument18 pagesEbusiness AssignmentRakesh Sheokand50% (2)

- Business Accounting 1A - Assignment 1 - 0Document4 pagesBusiness Accounting 1A - Assignment 1 - 0DxdNo ratings yet

- Asm-1 - Sample 1620 - 2Document22 pagesAsm-1 - Sample 1620 - 2Nguyễn Trung NguyênNo ratings yet

- COMBINED ASSIGNMENT ONE Business Accounting Business Analysis and Principles of Marketing 200717 PDFDocument18 pagesCOMBINED ASSIGNMENT ONE Business Accounting Business Analysis and Principles of Marketing 200717 PDFRaimundo100% (1)

- BTEC HND Business - Doc Assignment 1Document8 pagesBTEC HND Business - Doc Assignment 1Abbasi Naveed Raja50% (4)

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- How To Raise Money PDFDocument3 pagesHow To Raise Money PDFYash SNo ratings yet

- Yashpreet Kaur 7834156Document8 pagesYashpreet Kaur 7834156Hardeep KaurNo ratings yet

- Multinational Business Finance Assignment 2Document6 pagesMultinational Business Finance Assignment 2Ajay PawarNo ratings yet

- NET SyllabusDocument10 pagesNET SyllabusansNo ratings yet

- A BUSINESS RESEARCH METHODS-Assignment UBISDocument3 pagesA BUSINESS RESEARCH METHODS-Assignment UBISnàvàz_enzêêNo ratings yet

- Business Stratergies AssignmentDocument4 pagesBusiness Stratergies AssignmentAnkur SrivastavaNo ratings yet

- European Business Assignment 1Document5 pagesEuropean Business Assignment 1Serwaa AkotoNo ratings yet

- Business Communiication AssignmentDocument4 pagesBusiness Communiication AssignmentAbid Zain Alam0% (1)

- MBL 925r Business Research Individual Assignment For Courage ShoniwaDocument21 pagesMBL 925r Business Research Individual Assignment For Courage ShoniwaCourage ShoniwaNo ratings yet

- Manufacturing Accounts - Principles of AccountingDocument6 pagesManufacturing Accounts - Principles of AccountingAbdulla Maseeh100% (1)

- Group Assignment - FIN201Document13 pagesGroup Assignment - FIN201NguyễnĐứcBảoNo ratings yet

- Business Finance AssignmentDocument6 pagesBusiness Finance AssignmentAnson LamNo ratings yet

- Business Law AssignmentDocument11 pagesBusiness Law AssignmentfwefwwNo ratings yet

- Video - Int Unit 1Document5 pagesVideo - Int Unit 1Solvita SkgNo ratings yet

- Foray StepsDocument5 pagesForay StepsParuchuri KiranNo ratings yet

- International BusinessDocument4 pagesInternational BusinessVineet SinghNo ratings yet

- Cambodian Mekong University: Understanding Business AssignmentDocument19 pagesCambodian Mekong University: Understanding Business AssignmentAli GMNo ratings yet

- Accounting I 12841Document94 pagesAccounting I 12841vinay kumarNo ratings yet

- Business+Environment Assignment 2009Document4 pagesBusiness+Environment Assignment 2009John RobsonNo ratings yet

- MGT 230 Week 4 Signature Assignment Human Resource Management Organizational Change, Structure, and ManagementDocument6 pagesMGT 230 Week 4 Signature Assignment Human Resource Management Organizational Change, Structure, and Managementacc4918No ratings yet

- Business Communication Assignment 1Document6 pagesBusiness Communication Assignment 1Arpit KapoorNo ratings yet

- Business Math (MAT1001) Week Days AssignmentsDocument2 pagesBusiness Math (MAT1001) Week Days AssignmentsAmjad khanNo ratings yet

- ACNB TestDocument6 pagesACNB Testmohd talalNo ratings yet

- The Impact of e - in The BusinessDocument16 pagesThe Impact of e - in The BusinessVit HorkyNo ratings yet

- International Business - India and Latin AmericaDocument2 pagesInternational Business - India and Latin AmericasankalppatkarNo ratings yet

- CLAP - Brief To MentorsDocument19 pagesCLAP - Brief To Mentorsd2687681No ratings yet

- Business Economics AssignmentDocument5 pagesBusiness Economics AssignmentknirvanahNo ratings yet

- Assignment 412 Answers: Retail POS CustomersDocument12 pagesAssignment 412 Answers: Retail POS CustomersPradeep DhanushkaNo ratings yet

- Legal Aspects of Business AssignmentDocument13 pagesLegal Aspects of Business AssignmentUtkarsh UpadhyayaNo ratings yet

- Business Management Bu4001 Assignment 2 Sept 2016Document5 pagesBusiness Management Bu4001 Assignment 2 Sept 2016Shah-Baz HassanNo ratings yet

- Assignment 3 Business IntelligenceDocument4 pagesAssignment 3 Business IntelligencerebornphenNo ratings yet

- BCOS-183 Computer Application and Business EDocument4 pagesBCOS-183 Computer Application and Business EAnupama SahNo ratings yet

- Basics of Management AccountingDocument16 pagesBasics of Management AccountingSupian Jannatul FirdausNo ratings yet

- BFP1100 (Bega Cheese Assignment) 3B: Greenhouse Business Challenge and Carbon FootprintDocument58 pagesBFP1100 (Bega Cheese Assignment) 3B: Greenhouse Business Challenge and Carbon FootprintrockoNo ratings yet

- Assignment 1 Business LawDocument8 pagesAssignment 1 Business LawJusy BinguraNo ratings yet

- ACC206 Guidance Report Week OneDocument25 pagesACC206 Guidance Report Week OneAssignment writers140% (1)

- Business Operations Group AssignmentDocument7 pagesBusiness Operations Group Assignmentankit gangeleNo ratings yet

- Business AssignmentDocument14 pagesBusiness AssignmentMuhammad SabirNo ratings yet

- Business AssignmentDocument13 pagesBusiness AssignmentKaran PuriNo ratings yet

- Tally Tips - Accounting Heads of Incomes - ExpensesDocument7 pagesTally Tips - Accounting Heads of Incomes - ExpensesSayed Muntazir Hussain100% (3)

- AH MUN Final Full Assignment Business MathematicsDocument4 pagesAH MUN Final Full Assignment Business MathematicsJean HoNo ratings yet

- Business Policy and Strategic Management (BPSM) AssignmentDocument55 pagesBusiness Policy and Strategic Management (BPSM) Assignmentemp_abhinav100% (1)

- Business Finance Assignment 1Document10 pagesBusiness Finance Assignment 1Amar ChotaiNo ratings yet

- Ic Log 127 Annex 2 Offeror LetterDocument5 pagesIc Log 127 Annex 2 Offeror LetterAbdul Rohman VitaeNo ratings yet

- Business Marketing AssignmentDocument9 pagesBusiness Marketing AssignmenthenrydeeNo ratings yet

- Pearson Btec Level 4 HND Diploma in Business Unit 2 Managing Financial Resources and Decision Assignment 1Document8 pagesPearson Btec Level 4 HND Diploma in Business Unit 2 Managing Financial Resources and Decision Assignment 1beautyrubbyNo ratings yet

- Business Environment AssignmentDocument11 pagesBusiness Environment AssignmentlakishikaNo ratings yet

- IB06Document4 pagesIB06riya4250No ratings yet

- Business To Business Marketing AssignmentDocument2 pagesBusiness To Business Marketing Assignmentsirisha_bvsNo ratings yet

- Assignment 1 Business StatisticsDocument2 pagesAssignment 1 Business StatisticsLAgoonNo ratings yet

- Business Plan Assignment Arab Open UniversityDocument2 pagesBusiness Plan Assignment Arab Open UniversityMichael GregoryNo ratings yet

- Business Communication Assignment No 1 Autumn 2020Document15 pagesBusiness Communication Assignment No 1 Autumn 2020Mujtaba AhmedNo ratings yet

- Hellenic Open University Master'S Degree Programme in Business AdministrationDocument6 pagesHellenic Open University Master'S Degree Programme in Business Administrationgiorgos1978No ratings yet

- It's Cookie TimeDocument12 pagesIt's Cookie TimeAngelica AcostaNo ratings yet

- HSC Economics Topic 1 Worksheet 2021Document9 pagesHSC Economics Topic 1 Worksheet 2021JimmyNo ratings yet

- FX Growth Manager ManualDocument6 pagesFX Growth Manager ManualMohammad Akbar BalochNo ratings yet

- Global Fintech Market (2018 - 2023)Document14 pagesGlobal Fintech Market (2018 - 2023)Andrew Thomas100% (1)

- LGB Forge Limited: Summary of Rating ActionDocument7 pagesLGB Forge Limited: Summary of Rating ActionPuneet367No ratings yet

- Stress Testing For Bangladesh Private Commercial BanksDocument11 pagesStress Testing For Bangladesh Private Commercial Banksrubayee100% (1)

- New PPTX PresentationDocument6 pagesNew PPTX PresentationBhumika KhandelwalNo ratings yet

- Vol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..DpDocument15 pagesVol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..Dpbabak1897No ratings yet

- Literature ReviewfDocument24 pagesLiterature Reviewfshashi124No ratings yet

- Unit III Study GuideDocument5 pagesUnit III Study GuideVirginia TownzenNo ratings yet

- CH 9 PDFDocument35 pagesCH 9 PDFhmmmNo ratings yet

- A Study On Customer Satisfaction in Using Cash Deposit MachinesDocument3 pagesA Study On Customer Satisfaction in Using Cash Deposit MachinesJqwertymaidNo ratings yet

- Russian Roulette - Texas Shootout ProvisionsDocument12 pagesRussian Roulette - Texas Shootout ProvisionsJoaquin GoncalvesNo ratings yet

- STHDocument4 pagesSTHIvan MedićNo ratings yet

- VP Director IT Professional Services in Detroit MI Resume Rick PaulDocument3 pagesVP Director IT Professional Services in Detroit MI Resume Rick PaulRickPaulNo ratings yet

- Fin. Analysis & Project FinancingDocument14 pagesFin. Analysis & Project FinancingBethelhem100% (1)

- Survey Questionnaire For UPI PaymentsDocument3 pagesSurvey Questionnaire For UPI PaymentsArun GautamNo ratings yet

- Intensive SBR (INT) 4 WeekDocument9 pagesIntensive SBR (INT) 4 WeekBellaNo ratings yet

- Sponsorship & Gift Aid: North West Air AmbulanceDocument2 pagesSponsorship & Gift Aid: North West Air AmbulanceAbhishek DasNo ratings yet

- Financial Statement As of February 2018Document12 pagesFinancial Statement As of February 2018Jaijai Travel and ToursNo ratings yet

- Yubi's ProjectDocument62 pagesYubi's ProjectyubiprinceNo ratings yet

- Document 1312021 53807 AM ZrAxTn7pDocument8 pagesDocument 1312021 53807 AM ZrAxTn7pGisselle RodriguezNo ratings yet

- Benfords Law CAATSDocument28 pagesBenfords Law CAATSHetNo ratings yet

- Slip Gaji Kapal Api GroupDocument3 pagesSlip Gaji Kapal Api GroupAnjas AdeputNo ratings yet

- 3.slides - July 22, 2019 Wyckoff Workshop 3Document51 pages3.slides - July 22, 2019 Wyckoff Workshop 3chauchauNo ratings yet

- Connick Company Sells Its Product For 22 Per Unit ItsDocument2 pagesConnick Company Sells Its Product For 22 Per Unit ItsAmit PandeyNo ratings yet

- Wealth Management AssignmentDocument6 pagesWealth Management AssignmentRakesh MishraNo ratings yet

- Ic Trad Exam Reviewer 1Document6 pagesIc Trad Exam Reviewer 1Jon EsberNo ratings yet

Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2

Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2

Uploaded by

kaomsheartOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2

Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2

Uploaded by

kaomsheartCopyright:

Available Formats

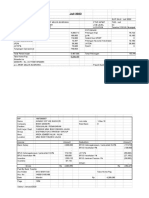

Intermediate Financial Accounting I - ADMN 3221H

Accounting Assignment #2

Professor Wallace Fall 2014

1

Due Date: Tuesday September 30

th

(by 1:50 PM)

! The assignment is marked out of 90

! It accounts for 10% of your total grade

! Discussion questions should be typed, double-spaced

! Accounting questions should be done on accounting paper [using pen (blue or black ink) or

pencil]

! Staple assignment in top left-hand corner

! Ensure your name and student number are clearly visible on the assignment

1. Other comprehensive income is a category of comprehensive income that is made up of specific

gains and losses that are reported separately after net earnings under IFRS. These concepts do

not exist under ASPE. Rather ASPE only requires the reporting of net income.

a. Discuss the rationale for excluding other comprehensive income items from ASPE. Use

examples of items that are currently reported under other comprehensive income and

discuss their treatment under ASPE. [3 marks]

b. Under IFRS, earnings per share (EPS) is calculated using net earnings. Discuss the pros and

cons of calculating EPS on comprehensive income instead. [2 marks]

2. Champlain Lte (Question to be answered on accounting paper) [40 marks]

The following account balances were included in Champlain Ltes adjusted trial balance at June 30,

2013:

Advertising Exp. (sales) $28,930 Maintenance Exp. (office) 9,130

Cost of goods sold 1,071,770 Miscellaneous expense

(office)

6,000

Depreciation (office

furniture & equipment)

7,250 Miscellaneous Expenses

(sales)

4,715

Depreciation overstatement

due error - June 2012 (net

of tax)

17,700 Salary & wages (sales) 56,260

Depreciation on sales

equipment

4,980 Salary & wages (office) 7,320

Dividends declared on

common shares

32,000 Sales Commission Exp. 97,600

Dividends declared on

preferred shares

9,000 Sales Discounts 31,150

Dividend Revenue 38,000 Sales returns & allowances 62,300

Entertainment Exp. (sales) 14,820 Sales Revenue $1,928,500

Freight-out 21,400 Supplies Expense (office) 3,450

Interest expense 18,000 Supplies Expense (sales) 4,850

Income tax 133,000 Telephone Exp.(sales) 9,030

Maintenance Exp. (sales) 6,200 Telephone expense (office) $2,820

Intermediate Financial Accounting I - ADMN 3221H

Accounting Assignment #2

Professor Wallace Fall 2014

2

During 2013 Champlain incurred production salary and wage costs of $710,000, consumed raw

materials and other production supplies of $474,670, and had an increase in work-in-process and

finished goods inventories of $112,900. The Retained Earnings account had a balance of $292,000 at

June 30, 2013, before closing. There are 180,000 common shares outstanding. Assume Champlain has

elected to adopt IFRS. (Hint: production payroll and materials costs reduced by the increase in ending

work-in-process and finished goods inventories = the cost of goods sold).

Required:

A. Prepare an income statement for the year ended June 30, 2013, using the multiple-step

format and showing expenses by function [20 marks]

B. Prepare an income statement for the year ended June 30, 2013, using the single-step

format and showing expenses by nature [15 marks]

C. Prepare the retained earnings portion of the statement of changes in equity for the

year ended June 30, 2013 [5 marks]

3. CCC Corporation [question to be answered on accounting paper]

CCC Corporation

Unadjusted Trial Balance

December 31, 2013

($s)

Debit Credit

Cash & Cash Equivalents $123,500

Accounts Receivable [net] 81,000

Inventory 4,000

Equipment 50,000

Accumulated Depreciation 25,500

Building [historical cost] 290,000

Accumulated Depreciation 21,750

Accounts Payable 34,500

Salary Payable 1,000

Unearned Revenue 9,000

Income Taxes Payable 9,000

Dividends Payable 10,000

Mortgage 140,000

Common Shares 150,000

Retained Earnings 120,000

Consulting Revenue 56,500

Book Sales 8,250

Cost of Goods Sold 4,000

Insurance expense 12,000

Salary expense 5,500

Utilities expense 13,500

Interest expense 2,000

Totals $585,500 $585,500

Additional Information:

Intermediate Financial Accounting I - ADMN 3221H

Accounting Assignment #2

Professor Wallace Fall 2014

3

A. The annual insurance policy of $12,000 was paid in February 2013. The policy is effective

March 1, 2013. When the invoice was paid in February 2013, the bookkeeper made the

following entry:

Dr. insurance expense 12,000

Cr. Cash 12,000

B. Total salary expense for 2013 is $12,000. $6,500 of that amount had not been paid at December

31, 2013.

C. $4,600 of consulting services performed in December 2013 was paid for using gift cards. Since

the transaction did not involve cash the bookkeeper didnt prepare an entry [Hint: gift cards are

part of unearned revenue]

D. The December 2013 utility bill was received on December 30, 2013. The amount of the bill was

$2,700. No entry had been made.

E. The interest rate on the mortgage is 4.25% per year and is payable semi-annually. The mortgage

on the building was advanced on September 1, 2013.

F. The building and equipment are depreciated on a straight-line basis. When purchased the

building had an estimated useful life of 40 years and the equipment had an estimated useful life

of 5 years. Estimated residual values are $0 and $7,500 for the building and the equipment

respectively.

G. Consulting services in the amount of $1,500 were delivered in December 2013 but payment has

not yet been received from the client.

H. A box of books was found during the year-end inventory count. The books had been damaged

during a recent flood in the warehouse. Cost of the books is $1,600 and the resale value is zero

($0).

Required:

A. Prepare the necessary correcting entries [10 marks]

B. Prepare an adjusted trial balance [15 marks]

Intermediate Financial Accounting I - ADMN 3221H

Accounting Assignment #2

Professor Wallace Fall 2014

4

4. Prepare a Cash Flow Statement for Rocket Corp. for the year ended December 31, 2013.

Use the indirect method for the operating section. Use the balances provided below. [10

marks]

Rocket Corporation

Statement of Financial Position

At December 31,

2013 2012

Cash $8,000 $15,000

Accounts Receivable 20,000 15,000

Inventory 15,000 25,000

Prepaid Rent 9,000 6,000

Total Current Assets 52,000 61,000

Land 75,000 75,000

Plant & Equipment 400,000 300,000

Accumulated depreciation (65,000) (30,000)

Total Assets $462,000 $406,000

Accounts payable 12,000 10,000

Income taxes payable 3,000 5,000

Unearned Revenue 35,000 25,000

Total Current Liabilities 50,000 40,000

Bonds payable 75,000 105,000

Common shares 200,000 150,000

Retained earnings 137,000 111,000

Total Shareholders Equity 337,000 261,000

Total Liabilities &

Shareholders Equity

$462,000 $406,000

Additional information:

a. Net Income for 2013 was $26,000

b. Depreciation expense in 2013 was $35,000

c. New plant and equipment items were acquired for cash

d. An issue of bonds was retired at book value

e. Additional common shares were issued for cash

5. Select two (2) public companies from an industry that you are interested in. For example, auto

manufacturing, clothing retail, financial services, foodservices, health care, oil & gas,

technology, etc. Reuters, at www.reuters.com provides lists of industries.

Locate the most current set of financial statements for each company. Financial statements are

often available on the companys website. They can also be found at www.sedar.com. SEDAR is

Intermediate Financial Accounting I - ADMN 3221H

Accounting Assignment #2

Professor Wallace Fall 2014

5

the Canadian Securities Administrators System for Electronic Document and Analysis. Use the

Search Database section of the website and select search for public company documents

Companies may issue a 10K instead of or in addition to the annual financial statements if they are

listed on a US stock exchange e.g. Nasdaq or NYSE. This report is filed with the Securities

Exchange Commission (SEC) in the United States. The 10K may be found on the companys

website.

Required:

a. Complete the attached template for each company.

b. Comment on the similarities and differences that you noted between the two companies.

Your submission should be typed. The template is available as a Word document that can be

downloaded. A copy of the relevant financial statement information MUST be attached to the

template.

Marks

Question #1 / 5

Question #2 / 40

Question #3 / 25

Question #4 / 10

Question #5 / 10

Total / 90

Intermediate Financial Accounting I - ADMN 3221H

Accounting Assignment #2

Professor Wallace Fall 2014

6

ADMN 3221H - Assignment #2 - Company Analysis Template (complete a template for each

company) [5 marks] and answer the questions on p.2 of the template [5 marks] A copy of the

statements and other supporting information must be attached to the template (e.g. significant

accounting policies note). Note: missing statements and/ or supporting information results in a mark

of 0 (zero) for the template component of the question.

Company Name:

Industry / Major Product (s):

Fiscal year-end [day, month &

year]

Reporting currency:

(e.g. Cdn $, , , !, etc.)

GAAP (e.g. FASB, IFRS, Euro-

IFRS, etc.)

Title of each financial

statement:

Number of notes to the

financial statements:

Audit Firm:

Date of Auditors Report:

Why did you choose this

company?

Intermediate Financial Accounting I - ADMN 3221H

Accounting Assignment #2

Professor Wallace Fall 2014

7

Questions #1 and #2 require you to discuss similarities and differences noted between the 2 companies

you selected. Your response should address:

1. Significant accounting policies: Are there major differences in the accounting policies

used for: inventory, cash & cash equivalents, intangible assets, goodwill, investments,

property, plant and equipment, and revenue recognition?

Briefly comment on the differences [3 marks]

2. Other differences noted between the 2 selected companies: For example, date of fiscal year-

end, auditors, content of auditors report. [2 marks]

You might also like

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- BUSI 353 Assignment #6 General Instructions For All AssignmentsDocument4 pagesBUSI 353 Assignment #6 General Instructions For All AssignmentsTan0% (1)

- Musgrave's Business Environment AssignmentDocument19 pagesMusgrave's Business Environment AssignmentDerrick FranklinNo ratings yet

- Ebusiness AssignmentDocument18 pagesEbusiness AssignmentRakesh Sheokand50% (2)

- Business Accounting 1A - Assignment 1 - 0Document4 pagesBusiness Accounting 1A - Assignment 1 - 0DxdNo ratings yet

- Asm-1 - Sample 1620 - 2Document22 pagesAsm-1 - Sample 1620 - 2Nguyễn Trung NguyênNo ratings yet

- COMBINED ASSIGNMENT ONE Business Accounting Business Analysis and Principles of Marketing 200717 PDFDocument18 pagesCOMBINED ASSIGNMENT ONE Business Accounting Business Analysis and Principles of Marketing 200717 PDFRaimundo100% (1)

- BTEC HND Business - Doc Assignment 1Document8 pagesBTEC HND Business - Doc Assignment 1Abbasi Naveed Raja50% (4)

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- How To Raise Money PDFDocument3 pagesHow To Raise Money PDFYash SNo ratings yet

- Yashpreet Kaur 7834156Document8 pagesYashpreet Kaur 7834156Hardeep KaurNo ratings yet

- Multinational Business Finance Assignment 2Document6 pagesMultinational Business Finance Assignment 2Ajay PawarNo ratings yet

- NET SyllabusDocument10 pagesNET SyllabusansNo ratings yet

- A BUSINESS RESEARCH METHODS-Assignment UBISDocument3 pagesA BUSINESS RESEARCH METHODS-Assignment UBISnàvàz_enzêêNo ratings yet

- Business Stratergies AssignmentDocument4 pagesBusiness Stratergies AssignmentAnkur SrivastavaNo ratings yet

- European Business Assignment 1Document5 pagesEuropean Business Assignment 1Serwaa AkotoNo ratings yet

- Business Communiication AssignmentDocument4 pagesBusiness Communiication AssignmentAbid Zain Alam0% (1)

- MBL 925r Business Research Individual Assignment For Courage ShoniwaDocument21 pagesMBL 925r Business Research Individual Assignment For Courage ShoniwaCourage ShoniwaNo ratings yet

- Manufacturing Accounts - Principles of AccountingDocument6 pagesManufacturing Accounts - Principles of AccountingAbdulla Maseeh100% (1)

- Group Assignment - FIN201Document13 pagesGroup Assignment - FIN201NguyễnĐứcBảoNo ratings yet

- Business Finance AssignmentDocument6 pagesBusiness Finance AssignmentAnson LamNo ratings yet

- Business Law AssignmentDocument11 pagesBusiness Law AssignmentfwefwwNo ratings yet

- Video - Int Unit 1Document5 pagesVideo - Int Unit 1Solvita SkgNo ratings yet

- Foray StepsDocument5 pagesForay StepsParuchuri KiranNo ratings yet

- International BusinessDocument4 pagesInternational BusinessVineet SinghNo ratings yet

- Cambodian Mekong University: Understanding Business AssignmentDocument19 pagesCambodian Mekong University: Understanding Business AssignmentAli GMNo ratings yet

- Accounting I 12841Document94 pagesAccounting I 12841vinay kumarNo ratings yet

- Business+Environment Assignment 2009Document4 pagesBusiness+Environment Assignment 2009John RobsonNo ratings yet

- MGT 230 Week 4 Signature Assignment Human Resource Management Organizational Change, Structure, and ManagementDocument6 pagesMGT 230 Week 4 Signature Assignment Human Resource Management Organizational Change, Structure, and Managementacc4918No ratings yet

- Business Communication Assignment 1Document6 pagesBusiness Communication Assignment 1Arpit KapoorNo ratings yet

- Business Math (MAT1001) Week Days AssignmentsDocument2 pagesBusiness Math (MAT1001) Week Days AssignmentsAmjad khanNo ratings yet

- ACNB TestDocument6 pagesACNB Testmohd talalNo ratings yet

- The Impact of e - in The BusinessDocument16 pagesThe Impact of e - in The BusinessVit HorkyNo ratings yet

- International Business - India and Latin AmericaDocument2 pagesInternational Business - India and Latin AmericasankalppatkarNo ratings yet

- CLAP - Brief To MentorsDocument19 pagesCLAP - Brief To Mentorsd2687681No ratings yet

- Business Economics AssignmentDocument5 pagesBusiness Economics AssignmentknirvanahNo ratings yet

- Assignment 412 Answers: Retail POS CustomersDocument12 pagesAssignment 412 Answers: Retail POS CustomersPradeep DhanushkaNo ratings yet

- Legal Aspects of Business AssignmentDocument13 pagesLegal Aspects of Business AssignmentUtkarsh UpadhyayaNo ratings yet

- Business Management Bu4001 Assignment 2 Sept 2016Document5 pagesBusiness Management Bu4001 Assignment 2 Sept 2016Shah-Baz HassanNo ratings yet

- Assignment 3 Business IntelligenceDocument4 pagesAssignment 3 Business IntelligencerebornphenNo ratings yet

- BCOS-183 Computer Application and Business EDocument4 pagesBCOS-183 Computer Application and Business EAnupama SahNo ratings yet

- Basics of Management AccountingDocument16 pagesBasics of Management AccountingSupian Jannatul FirdausNo ratings yet

- BFP1100 (Bega Cheese Assignment) 3B: Greenhouse Business Challenge and Carbon FootprintDocument58 pagesBFP1100 (Bega Cheese Assignment) 3B: Greenhouse Business Challenge and Carbon FootprintrockoNo ratings yet

- Assignment 1 Business LawDocument8 pagesAssignment 1 Business LawJusy BinguraNo ratings yet

- ACC206 Guidance Report Week OneDocument25 pagesACC206 Guidance Report Week OneAssignment writers140% (1)

- Business Operations Group AssignmentDocument7 pagesBusiness Operations Group Assignmentankit gangeleNo ratings yet

- Business AssignmentDocument14 pagesBusiness AssignmentMuhammad SabirNo ratings yet

- Business AssignmentDocument13 pagesBusiness AssignmentKaran PuriNo ratings yet

- Tally Tips - Accounting Heads of Incomes - ExpensesDocument7 pagesTally Tips - Accounting Heads of Incomes - ExpensesSayed Muntazir Hussain100% (3)

- AH MUN Final Full Assignment Business MathematicsDocument4 pagesAH MUN Final Full Assignment Business MathematicsJean HoNo ratings yet

- Business Policy and Strategic Management (BPSM) AssignmentDocument55 pagesBusiness Policy and Strategic Management (BPSM) Assignmentemp_abhinav100% (1)

- Business Finance Assignment 1Document10 pagesBusiness Finance Assignment 1Amar ChotaiNo ratings yet

- Ic Log 127 Annex 2 Offeror LetterDocument5 pagesIc Log 127 Annex 2 Offeror LetterAbdul Rohman VitaeNo ratings yet

- Business Marketing AssignmentDocument9 pagesBusiness Marketing AssignmenthenrydeeNo ratings yet

- Pearson Btec Level 4 HND Diploma in Business Unit 2 Managing Financial Resources and Decision Assignment 1Document8 pagesPearson Btec Level 4 HND Diploma in Business Unit 2 Managing Financial Resources and Decision Assignment 1beautyrubbyNo ratings yet

- Business Environment AssignmentDocument11 pagesBusiness Environment AssignmentlakishikaNo ratings yet

- IB06Document4 pagesIB06riya4250No ratings yet

- Business To Business Marketing AssignmentDocument2 pagesBusiness To Business Marketing Assignmentsirisha_bvsNo ratings yet

- Assignment 1 Business StatisticsDocument2 pagesAssignment 1 Business StatisticsLAgoonNo ratings yet

- Business Plan Assignment Arab Open UniversityDocument2 pagesBusiness Plan Assignment Arab Open UniversityMichael GregoryNo ratings yet

- Business Communication Assignment No 1 Autumn 2020Document15 pagesBusiness Communication Assignment No 1 Autumn 2020Mujtaba AhmedNo ratings yet

- Hellenic Open University Master'S Degree Programme in Business AdministrationDocument6 pagesHellenic Open University Master'S Degree Programme in Business Administrationgiorgos1978No ratings yet

- It's Cookie TimeDocument12 pagesIt's Cookie TimeAngelica AcostaNo ratings yet

- HSC Economics Topic 1 Worksheet 2021Document9 pagesHSC Economics Topic 1 Worksheet 2021JimmyNo ratings yet

- FX Growth Manager ManualDocument6 pagesFX Growth Manager ManualMohammad Akbar BalochNo ratings yet

- Global Fintech Market (2018 - 2023)Document14 pagesGlobal Fintech Market (2018 - 2023)Andrew Thomas100% (1)

- LGB Forge Limited: Summary of Rating ActionDocument7 pagesLGB Forge Limited: Summary of Rating ActionPuneet367No ratings yet

- Stress Testing For Bangladesh Private Commercial BanksDocument11 pagesStress Testing For Bangladesh Private Commercial Banksrubayee100% (1)

- New PPTX PresentationDocument6 pagesNew PPTX PresentationBhumika KhandelwalNo ratings yet

- Vol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..DpDocument15 pagesVol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..Dpbabak1897No ratings yet

- Literature ReviewfDocument24 pagesLiterature Reviewfshashi124No ratings yet

- Unit III Study GuideDocument5 pagesUnit III Study GuideVirginia TownzenNo ratings yet

- CH 9 PDFDocument35 pagesCH 9 PDFhmmmNo ratings yet

- A Study On Customer Satisfaction in Using Cash Deposit MachinesDocument3 pagesA Study On Customer Satisfaction in Using Cash Deposit MachinesJqwertymaidNo ratings yet

- Russian Roulette - Texas Shootout ProvisionsDocument12 pagesRussian Roulette - Texas Shootout ProvisionsJoaquin GoncalvesNo ratings yet

- STHDocument4 pagesSTHIvan MedićNo ratings yet

- VP Director IT Professional Services in Detroit MI Resume Rick PaulDocument3 pagesVP Director IT Professional Services in Detroit MI Resume Rick PaulRickPaulNo ratings yet

- Fin. Analysis & Project FinancingDocument14 pagesFin. Analysis & Project FinancingBethelhem100% (1)

- Survey Questionnaire For UPI PaymentsDocument3 pagesSurvey Questionnaire For UPI PaymentsArun GautamNo ratings yet

- Intensive SBR (INT) 4 WeekDocument9 pagesIntensive SBR (INT) 4 WeekBellaNo ratings yet

- Sponsorship & Gift Aid: North West Air AmbulanceDocument2 pagesSponsorship & Gift Aid: North West Air AmbulanceAbhishek DasNo ratings yet

- Financial Statement As of February 2018Document12 pagesFinancial Statement As of February 2018Jaijai Travel and ToursNo ratings yet

- Yubi's ProjectDocument62 pagesYubi's ProjectyubiprinceNo ratings yet

- Document 1312021 53807 AM ZrAxTn7pDocument8 pagesDocument 1312021 53807 AM ZrAxTn7pGisselle RodriguezNo ratings yet

- Benfords Law CAATSDocument28 pagesBenfords Law CAATSHetNo ratings yet

- Slip Gaji Kapal Api GroupDocument3 pagesSlip Gaji Kapal Api GroupAnjas AdeputNo ratings yet

- 3.slides - July 22, 2019 Wyckoff Workshop 3Document51 pages3.slides - July 22, 2019 Wyckoff Workshop 3chauchauNo ratings yet

- Connick Company Sells Its Product For 22 Per Unit ItsDocument2 pagesConnick Company Sells Its Product For 22 Per Unit ItsAmit PandeyNo ratings yet

- Wealth Management AssignmentDocument6 pagesWealth Management AssignmentRakesh MishraNo ratings yet

- Ic Trad Exam Reviewer 1Document6 pagesIc Trad Exam Reviewer 1Jon EsberNo ratings yet