Professional Documents

Culture Documents

Mint Delhi Mint 17

Mint Delhi Mint 17

Uploaded by

Ashok Kumar U0 ratings0% found this document useful (0 votes)

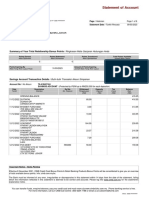

25 views1 pageThis document contains information on interest rates for fixed deposits across various Indian banks. It also includes details on health and life insurance premiums for different ages and policy amounts. Additionally, it lists the net asset values and returns for some pension and equity mutual funds. Fixed deposit rates range from 6.5-10.1% across maturities from 6 months to over 5 years. Health insurance premiums start at around Rs. 1,000 for Rs. 1 lakh coverage and rise to over Rs. 50,000 for Rs. 5 lakh coverage. Term life insurance premiums range from around Rs. 3,000 to over Rs. 60,000 depending on the insured amount and policy term.

Original Description:

Mint_Delhi_Mint_17

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains information on interest rates for fixed deposits across various Indian banks. It also includes details on health and life insurance premiums for different ages and policy amounts. Additionally, it lists the net asset values and returns for some pension and equity mutual funds. Fixed deposit rates range from 6.5-10.1% across maturities from 6 months to over 5 years. Health insurance premiums start at around Rs. 1,000 for Rs. 1 lakh coverage and rise to over Rs. 50,000 for Rs. 5 lakh coverage. Term life insurance premiums range from around Rs. 3,000 to over Rs. 60,000 depending on the insured amount and policy term.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

25 views1 pageMint Delhi Mint 17

Mint Delhi Mint 17

Uploaded by

Ashok Kumar UThis document contains information on interest rates for fixed deposits across various Indian banks. It also includes details on health and life insurance premiums for different ages and policy amounts. Additionally, it lists the net asset values and returns for some pension and equity mutual funds. Fixed deposit rates range from 6.5-10.1% across maturities from 6 months to over 5 years. Health insurance premiums start at around Rs. 1,000 for Rs. 1 lakh coverage and rise to over Rs. 50,000 for Rs. 5 lakh coverage. Term life insurance premiums range from around Rs. 3,000 to over Rs. 60,000 depending on the insured amount and policy term.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

MARKETS &FINANCE 17

MONDAY, JANUARY 9, 2012, DELHI WWW.LIVEMINT.COM

mint money

Axis Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Development Credit Bank

Dhanlaxmi Bank

HDFC Bank

ICICI Bank

IDBI Bank

Indian Overseas Bank

IndusInd Bank

Kotak Mahindra Bank

Oriental Bank of Commerce

State Bank of India

Syndicate Bank

The Federal Bank

Union Bank of India

Vijaya Bank

7.50

7.00-7.75

8.00

7.00-8.80

8.10

8.50

9.25

8.00

6.75

8.75

7.25-8.00

7.00-7.75

9.00-9.25

8.00-8.50

6.50-8.50

7.75-9.00

9.00

7.00-7.75

8.50-9.55

7.00-9.50

8.60-8.75

8.00

9.30-9.40

9.25-9.35

9.00-9.25

9.30

9.25

9.25-9.40

9.50-9.65

9.50-9.60

8.00-10.00

8.75-9.75

7.25-9.25

8.25-9.25

9.50

9.50

8.00-9.50

9.50

9.75

9.25

9.35

9.50-9.75

9.25

9.25

9.30

9.25

9.00

9.30

9.25

9.30

9.25

9.50

8.00-9.50

8.75-9.00

8.50-9.25

8.50-9.25

9.50

9.25

8.75-9.50

9.25

9.25

9.25

9.35

9.25

9.25

9.35

8.50

9.00

8.50-9.00

9.00-9.35

9.25

9.25

9.25

9.30

8.00-9.30

8.75-10.10

8.25-8.50

8.75

9.50

9.25

8.75

9.25

9.25

9.25

9.25

9.25

9.25

9.00

8.50

8.50

8.75

9.00

9.00

9.09

9.00-9.25

8.75

8.00-9.30

9-10.10

8.25

8.75

9.50

9.00

8.75

9.25

9.25

9.25

9.25

9.00

8.50-9.40

8.75

Fixed deposit rates

Source : Apnapaisa Research Bureau, www.apnapaisa.com

Bank 6 months-364 days 1-2 years 2-3 years 3-5 years Above 5 years

FUNDS | INSURANCE | DEPOSITS | LOANS

How to use this data: For each age band, you can pick the cheapest premium

for three insurance amounts. For instance, the cheapest medical cover for a

42-year-old for a cover of R1 lakh, R2 lakh and R5 lakh is given

Health insurance

Age

(years)

Sum insured (R)

1 lakh 2 lakh 5 lakh

20-25

26-30

31-35

36-40

41-45

46-50

51-55

56-60

Premiums in R

National Pension System

Scheme

11.31

11.20

10.51

10.94

9.67

11.23

Net asset value

R (as on 06 January)

ICICI Prudential Pension Fund Scheme E - Tier I

IDFC Pension Fund Scheme E - Tier I

Kotak Pension Fund Scheme E - Tier I

Reliance Pension Fund Scheme E - Tier I

SBI Pension Fund Scheme E - Tier I

UTI Retirement Solutions Pension Fund Scheme E - Tier I

Source: National Security Depository Ltd

Royal Sundaram

1,151

Royal Sundaram

1,850

Royal Sundaram

4,038

New India Assurance

1,434

Bharti AXA

1,955

Bharti AXA

4,908

New India Assurance

1,434

Bharti AXA

1,955

Bharti AXA

4,908

Future Generali

1,542

Future Generali

2,759

Future Generali

5,672

Future Generali

1,542

Future Generali

2,759

Future Generali

5,672

Future Generali

2,508

Future Generali

4,058

Future Generali

9,060

Future Generali

2,508

Future Generali

4,058

Future Generali

9,060

Star Health

3,673

National Insurance

5,655

Future Generali

12,210

Source : Apnapaisa Research Bureau, www.apnapaisa.com

How to use this data: For a 40-year-old who wants a cover of R60 lakh, the

lowest premiumis given. the tenure is 30 years for a 30-year-old, 20 years for

a 40-year-old and 10 years for a 50-year-old person. Note: All the products

mentioned above can be purchased online only

Insurance

Life insurance

Premiums in rupees for the lowest term insurance covers for different sums

assured. The term of the policy is 60 years minus the age.

Sum assured

(R lakh)

Age

30 years 40 years 50 years

Kotak e-Term

2,281

Kotak e-Term

3,453

Kotak e-Term

5,993

Kotak e-Term

3,714

Kotak e-Term

6,056

Future Generali Life

9,574

Aviva i Life

4,277

Kotak e-Term

6,700

Kotak e-Term

11,168

10

20

30

40

50

75

100

125

150

200

Kotak e-Term

5,603

Kotak e-Term

8,630

Kotak e-Term

14,532

Aviva i Life

4,550

Aviva i Life

8,103

Aviva i Life

17,021

Aviva i Life

6,824

Aviva i Life

12,154

Aviva i Life

25,531

Aviva i Life

8,127

Aviva i Life

15,225

Aviva i Life

33,065

Aviva i Life

10,159

Aviva i Life

19,031

Aviva i Life

41,331

Aviva i Life

12,190

Aviva i Life

22,838

Aviva i Life

49,597

Aviva i Life

16,254

Aviva i Life

30,449

Aviva i Life

66,129

Cheapest home loans

Home loans

Axis Bank

Bank of Baroda

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

HDFC Limited*

ICICI Bank*

IDBI Bank*

Indiabulls Housing Finance

Union Bank of India

LIC Housing Finance*

Oriental Bank of Commerce

Punjab National Bank

SBI

EMI per lakh (R)

Home loan company

*This bank has interest rates fixed for the initial few years and thereafter then prevailing rate are applicable; The home loan rates are indicative rates, which may

change according to the credit profile of the customer; fixed interest rates are usually subject to reset clause of two to five years and vary frombank to bank. However,

fixed interest rates of ICICI Bank, HDFC and Axis Bank remain fixed during the entire tenor of the loan; PN: The rates given above are for the first year of the loan tenor.

For the subsequent years, the interest rates vary frombank to bank; DP: does not provide; EMI: equated monthly instalment; DNA: data not available

2,174

2,174

2,159

2,162

2,162

2,207

2,162

2,174

2,174

2,174

2,187

2,164

2,162

2,187

2,149

2,212

DP

DNA

DP

DNA

2,327

2,237

2,353

2,301

DP

2,250

DP

DNA

2,212

DP

5 years

Fixed Floating

1,378

1,392

1,375

1,378

1,378

1,415

1,363

1,378

1,378

1,378

1,406

1,366

1,363

1,406

1,349

1,420

DP

DNA

DP

DP

1,553

1,449

1,583

1,523

DP

DP

DP

DNA

1,435

DP

10 years

Fixed Floating

1,137

1,152

1,149

1,152

1,137

1,178

1,121

1,137

1,137

1,137

1,168

1,124

1,137

1,168

1,105

1,184

DP

DP

DP

DP

1,332

1,216

1,366

1,298

DP

DP

DP

DNA

1,200

DP

15 years

Fixed Floating

1,032

1,066

1,046

1,049

1,032

1,077

1,015

1,032

1,032

1,032

1,084

1,019

1,032

1,084

998

1,084

DP

DP

DP

DP

1,244

1,119

1,280

1,207

DP

DP

DP

DNA

1,119

DP

20 years

Fixed Floating

Home loan EMI per R1 lakh for a loan amount of R30 lakh as on 06 January

MF update

Religare Equity

Edelweiss Diversified Growth Equity Top 100 Plan A

Taurus Bonanza

Birla Sun Life Top 100

ICICI Prudential Dynamic

Canara Robeco Equity Diversified

Birla Sun Life Frontline Equity

Principal Large Cap

Tata Equity Management

UTI Dividend Yield

DWS Investment Opportunity Regular

Fidelity Equity

Magnum Equity

Sundaram Growth Reg

SBI Bluechip

SBI PSU

Daiwa Industry Leaders

Religare Growth

Principal Growth

Fidelity India Growth

Sahara Growth

Magnum Contra

Reliance NRI Equity

SBI One India

LIC Nomura MF Growth

Morgan Stanley Growth

Franklin India Flexi Cap

Reliance Equity

UTI Opportunities

Sundaram India Leadership Reg

ING Core Equity

Reliance Vision

Kotak Equity FoF

Franklin India Prima Plus

Mirae Asset India Opportunities Regular

UTI Equity

LIC Nomura MF India Vision

UTI Contra

Axis Equity

IDFC Classic Equity Plan A

JM Equity

ICICI Prudential Advisor-Very Aggressive

Bharti AXA Equity Reg

Mirae Asset India-China Consumption Reg

Edelweiss Equity Enhancer Plan A

ING OptiMix Multi Manager Equity Option A

Franklin India Opportunities

Tata Pure Equity

Birla Sun Life Advantage

Magnum MultiCap

32.50

26.77

16.48

12.84

11.48

10.82

9.93

8.97

8.74

8.69

8.58

8.54

8.28

8.07

7.50

7.45

7.34

7.32

6.93

6.87

6.72

6.43

6.37

6.34

6.15

6.08

6.08

5.95

5.79

5.77

5.74

5.74

5.33

5.25

5.13

5.05

4.63

4.63

4.47

4.46

4.45

4.22

4.06

3.84

3.54

3.37

3.11

2.97

2.94

2.56

Scheme % of corpus

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

Cash holding of equity funds

Equity: Large and mid cap cash holdings

Figures as on 30th November 2011 Source: Value Research

NAV

(daily)

3-yr

return

5-yr

return

10-yr

return

Expense

ratio

Fund size

(R cr)

Value Research

rating (3-year)

DSPBR Top 100 Equity Reg

Franklin India Bluechip

Goldman Sachs Nifty ETS****

ICICI Prudential Focused Bluechip Equity Retail

Kotak Sensex ETF****

Large-Cap core

Category average

88.06

189.55

485.13

14.81

162.94

18.18

21.40

16.01

25.79

16.27

8.85

7.62

4.44

**

**

*

25.58

*

*

*

1.85

1.83

0.50

1.85

0.50

3051.44

4261.76

566.28

3532.16

36.1

14.93 3.31 18.88

Birla Sun Life Frontline Equity

Fidelity Equity

Franklin India Prima Plus

HDFC Top 200

ICICI Prudential Dynamic

Mirae Asset India Opportunities Regular

UTI Equity

UTI Dividend Yield

Large & Mid Cap core

Category average

Goldman Sachs Nifty Junior BeES****

HDFC Equity

Quantum Long Term Equity

Templeton India Growth

Multi Cap

Core

AIG India Equity Reg

DSPBR Equity

Reliance Regular Savings Equity

Tata Equity PE

Category Average

Satellite

Satellite

DSPBR Small and Mid Cap Reg

HDFC Mid-Cap Opportunities

IDFC Premier Equity Plan A

Religare Mid Cap

Mid & Small Cap

Core

Satellite

Fidelity Tax Advantage

HDFC Taxsaver

Religare Tax Plan

Tax Planning

Core

Category Average

BSE Sensex

S&P CNX Nifty

Birla Sun Life 95

DSPBR Balanced

HDFC Prudence

Tata Balanced

Equity-oriented

Core

FT India Balanced

Category average

Satellite

Birla Sun Life MIP

Canara Robeco MIP

HDFC MIP Long-term

HDFC MIP Short-term

Reliance MIP

Debt-oriented Conservative

Core

Birla Sun Life MIP II Savings 5

UTI Monthly Income Scheme

Category average

Satellite

DSPBR T.I.G.E.R. Reg

ICICI Prudential Infrastructure

Tata Infrastructure

Thematic/Sectoral

74.18

30.67

195.53

175.71

92.76

14.35

48.28

18.8

22.27

18.65

21.66

20.01

25.79

20.99

7.93

7.71

6.82

9.67

6.96

**

8.12

*

*

25.21

28.61

*

*

21.81

28.47 22.68 12.41 *

1.85

1.84

1.89

1.77

1.45

2.39

1.90

1.84

2805.93

3370.77

1786.94

10537.06

3962.49

189.2

1857.63

3451.66

15.84 3.82 21.97

85.82

224.49

19.31

94.07

20.01

23.98

26.5

19.59

3.67

8.78

9.55

7.04

*

28.02

*

22.99

1.00

1.78

1.33

2.11

94.66

9178.82

89.98

709.81

11.11

40.36

23.78

39.74

21.45

19.92

17.70

20.69

18.06

**

8.54

8.26

9.16

4.68

*

26.93

*

*

25.28

2.40

1.87

1.84

2.17

142.96

2471.55

2808.09

641.13

14.17

13.66

28.88

12.45

12.66 31.91

20.79

**

3.46

*

23.39

2.26

26.41

27.20

27.91

27.55

5.90

**

16.39

**

*

*

*

*

1.99

1.95

1.88

2.50

1168.31

1700.35

2407.02

51.91

436.7

18.84

196.36

15.39

22.67

23.75

21.64

8.4

5.77

8.64

*

27.53

*

2.00

2.07

2.48

1124.8

2880.17

103.66

16.81

15.36

15.16

2.91

2.74

3.60

21.51

16.74

15.80

281.60

58.36

189.42

76.75

19.79

16.40

24.75

20.10

9.89

8.42

10.52

9.08

20.05

20.29

25.45

20.77

2.29

2.08

1.79

2.33

501.65

685.22

6100.41

315.37

44.66 14.23

14.60

6.35

4.88

18.38

17.67

2.31 218.41

27.20

30.37

23.03

17.44

21.92

7.96

9.52

12.66

8.39

9.49

7.31

9.19

9.44

6.26

9.56

8.95

11.59

*

*

*

2.13

2.07

1.53

2.02

1.54

18.65

20.31

5.13

8.83

7.92

10.12

8.02

6.89

*

*

10.15

1.30

1.80

398.50

497.22

34.69

22.69

24.17

9.30

7.16

6.79

0.87

3.87

-0.06

*

*

*

1.89

1.86

1.86

1652.54

2114.24

1154.69

FT India Dynamic PE Ratio FoF

Category Average

Asset Allocation core

38.52 15.92

10.96

9.17

4.45

* 0.75 1505.81

DSPBR Micro Cap Reg

Category Average

NR

157.1

340.29

7876.82

322.09

5182.3

Principal Income Short-term

Reliance Short-term

SBI Short Horizon Debt Short Term Ret

Templeton India Short-term Income Ret

UTI Short-term Income Regular

Category average

NSE Treasury Bill Index

NSE G-Sec Composite Index

Short Term

Core

NAV

(daily)

3-month

return

6-month

return

2-year

return

Expense

ratio

Fund size

(R cr)

Value Research

rating (3-year)

18.43

19.57

13.61

2,094.41

18.05

2.64

2.75

2.41

2.22

2.65

2.39

2.32

3.12

5.02

4.72

4.25

4.55

5.13

4.59

3.64

2.84

7.43

6.65

6.66

7.27

7.67

6.80

6.14

3.00

0.75

0.81

1.60

1.30

0.48

19.44

758.62

419.09

4673.89

294.3

NAV and returns are as on 06/01/2012; Value Research rating is as on 31/12/2011; Fund size as on 31/12/2011; * The fund has not yet completed 10

years; ** The fund has not yet completed 5 years; ***The fund has not yet completed 3 years; ****An exchange-traded fund (ETF), this can be bought or

sold only on stocks exchanges. You need a demat account to be able to transact in ETFs; NR: not rated, since the fund is less than 3 years old

Among the various schemes, we have chosen 50 schemes across equity- and

debt-oriented categories that we feel you should choose from. However, you must

not invest in all of them. Pick and choose around seven to 12 schemes fromMint50

to build a portfolio that suits your goals. Dont worry if schemes, you are already

invested in, are not a part of Mint50. Not all schemes that are outside Mint50 are

bad. Just because your existing scheme is not a part of Mint50 does not mean you

must sell it. While poorly managed schemes are aplenty in the market, there are

many that are decent, but not a part of Mint50 because we think these are better

alternatives. Mint50 is not a guide to existing investments. Refer to it if you

choose to invest afresh. After ascertaining howmuch you want to put in equity

and howmuch in debt funds, take a core and satellite approach. The core

schemes are the rock solid, long-termperformers that come with a good track

record. You can consider staying invested in themfor a long time. Depending on

your risk profile, this should forma significant chunk of your portfolio. The

satellite portion can be used to add the returns kicker or a flavour to your

portfolio, such as thematic, infrastructure funds or those that have a promising

track record but are relatively new. If you are planning to invest afresh, start by

putting money in large-cap funds and later diversify into mid-cap funds. One last

thing: Value Research pitches active and passive funds in the same category. So, it

is possible that passive funds, such as Benchmark Nifty BeES and Franklin India

Index Fund, have a lower Value Research rating. In rising markets, exchange-traded

funds and index funds typically underperformactively managed funds and, hence,

a lower star rating. But since a passive funds mandate is never to outperformthe

index, but to mimic it, a lower rating doesnt matter.

Source:

How to use Mint50

There are over a thousand mutual fund schemes in the market. Picking and choosing the right one can be tough.

Here's where Mint50 comes in. We have run quantitative and qualitative filters on all schemes to come up with a

chosen set of 50 schemes across categories for you to pick and choose from.

Mutual fund schemes to invest in

Rates for deposits up to R15 lakh as on 06 January Interest rates in % per annum

You might also like

- Techstars Investors in Europe v1Document1 pageTechstars Investors in Europe v1Vlad AndriescuNo ratings yet

- Indusind BankDocument65 pagesIndusind BankNadeem KhanNo ratings yet

- Fixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaDocument15 pagesFixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaebeanandeNo ratings yet

- Mint Delhi Mint 17Document1 pageMint Delhi Mint 17Kedar KulkarniNo ratings yet

- Quick Reference Guide For Financial Planning Aug 2012Document7 pagesQuick Reference Guide For Financial Planning Aug 2012imygoalsNo ratings yet

- Screenshot 2023-07-02 at 11.14.42 PMDocument6 pagesScreenshot 2023-07-02 at 11.14.42 PMUttam JaiswalNo ratings yet

- Fixed Deposit Interest Rates - Compare Latest FD Interest Rates 2023 PDFDocument11 pagesFixed Deposit Interest Rates - Compare Latest FD Interest Rates 2023 PDFomkar kothuleNo ratings yet

- ValueGuide Sep13 PDFDocument67 pagesValueGuide Sep13 PDFMajumder ArpanNo ratings yet

- Maths Assignment 2022-23 NewDocument10 pagesMaths Assignment 2022-23 NewLokesh gowdaNo ratings yet

- Portfolio Review Genus: Alternative To Ultra-Short Duration FundsDocument8 pagesPortfolio Review Genus: Alternative To Ultra-Short Duration FundsspeedenquiryNo ratings yet

- Tata Retirement Savings Fund - Final RoadshowDocument70 pagesTata Retirement Savings Fund - Final RoadshowViral ShuklaNo ratings yet

- Banking Theory and Practice: Digital Assignment 1Document5 pagesBanking Theory and Practice: Digital Assignment 1muthu kumaranNo ratings yet

- VJP Fund ParametersDocument4 pagesVJP Fund ParametersVivek PathakNo ratings yet

- WZ Wealth Ideas November 11Document4 pagesWZ Wealth Ideas November 11satish kumar0% (1)

- Share Sansar Samachar of 27th November' 2011Document3 pagesShare Sansar Samachar of 27th November' 2011sharesansarNo ratings yet

- Term PlansDocument1 pageTerm PlansjanakNo ratings yet

- Meth ProjectDocument3 pagesMeth Projectjha.smritiNo ratings yet

- ValueResearchFundcard ICICIPrudentialDiscovery 2012may20Document6 pagesValueResearchFundcard ICICIPrudentialDiscovery 2012may20Dinanath DabholkarNo ratings yet

- ValueResearchFundcard SBIMagnumIncome 2013jul17Document6 pagesValueResearchFundcard SBIMagnumIncome 2013jul17Chiman RaoNo ratings yet

- Quick Reference Guide For Financial Planning July 2012Document7 pagesQuick Reference Guide For Financial Planning July 2012imygoalsNo ratings yet

- Bank RD Interest Rates (General Public) Senior Citizen RD RatesDocument3 pagesBank RD Interest Rates (General Public) Senior Citizen RD RatesKushal MpvsNo ratings yet

- Fixed Deposit Interest Rates - Best FD Rates of Top Banks in India 2022Document12 pagesFixed Deposit Interest Rates - Best FD Rates of Top Banks in India 2022pitax31866No ratings yet

- Whypension 27012023 AgDocument36 pagesWhypension 27012023 AgMadhu Prathipati PNo ratings yet

- School of Management Studies: Summer Internship Program 16Document13 pagesSchool of Management Studies: Summer Internship Program 16samalanuNo ratings yet

- Live Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Document15 pagesLive Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Shakthi ShankaranNo ratings yet

- Short Term InvestmentDocument16 pagesShort Term Investmentluckey racerNo ratings yet

- Bharat Thakkar.: Welcomes You!!!Document35 pagesBharat Thakkar.: Welcomes You!!!mickey4482No ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksrajdeeppawarNo ratings yet

- Maths: Sequences and SeriesDocument6 pagesMaths: Sequences and SeriesVivan AbhvaniNo ratings yet

- Risk Assessment of The City Bank Limited.Document15 pagesRisk Assessment of The City Bank Limited.MdRuhulRAfinNo ratings yet

- Review of Literature "Online Stock Trading in India: An Empirical Investigation"Document12 pagesReview of Literature "Online Stock Trading in India: An Empirical Investigation"Sree Raj100% (1)

- State Bank of India (SBI) : Fortune Global 500Document14 pagesState Bank of India (SBI) : Fortune Global 500Varsha RayaluNo ratings yet

- Indian Oversea Bank and Development Credit Bank of India: Presented by Group 10Document13 pagesIndian Oversea Bank and Development Credit Bank of India: Presented by Group 10Karan GujralNo ratings yet

- ProjectDocument20 pagesProjectKonark JainNo ratings yet

- BANKING Math Project by PranayDocument37 pagesBANKING Math Project by Pranay;LDSKFJ ;No ratings yet

- Price To Book Value Stocks 161008Document2 pagesPrice To Book Value Stocks 161008Adil HarianawalaNo ratings yet

- Risky RiskDocument20 pagesRisky RiskVibhorBajpaiNo ratings yet

- All Funds - Period (Last 5 Years)Document3 pagesAll Funds - Period (Last 5 Years)vivekNo ratings yet

- The Need To InvestDocument10 pagesThe Need To InvestÂj AjithNo ratings yet

- Asia Credit Compendium 2014 04 12 13 05 19Document500 pagesAsia Credit Compendium 2014 04 12 13 05 19BerezaNo ratings yet

- ValueResearchFundcard HDFCTop200 2011oct05Document6 pagesValueResearchFundcard HDFCTop200 2011oct05SUNJOSH09No ratings yet

- Financial Planning: Prepared By:-Chirag Rankja (302214) Guide: - Prof. Laxman RahalkarDocument42 pagesFinancial Planning: Prepared By:-Chirag Rankja (302214) Guide: - Prof. Laxman RahalkarChirag RankjaNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksLaharii MerugumallaNo ratings yet

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173No ratings yet

- One From Everyone NEWDocument14 pagesOne From Everyone NEWPratik KathuriaNo ratings yet

- Assets & Liabilities Management AT The Union Co-Operative Bank LTDDocument21 pagesAssets & Liabilities Management AT The Union Co-Operative Bank LTDapluNo ratings yet

- A Comparative Study of Loan Performance SandraDocument23 pagesA Comparative Study of Loan Performance SandraSandra DennyNo ratings yet

- Indiabulls Gilt FundDocument4 pagesIndiabulls Gilt FundYogi173No ratings yet

- "A SURVEY REPORT ON CONSUMER BUYING BEHAVIOUR OF ICICI PRUDENTIAL" by AbhishekDocument39 pages"A SURVEY REPORT ON CONSUMER BUYING BEHAVIOUR OF ICICI PRUDENTIAL" by AbhishekAbhishek Roy.100% (8)

- Sreekarayil ChitsDocument16 pagesSreekarayil ChitsSatyamev JayateNo ratings yet

- SKCILDocument16 pagesSKCILSatyamev JayateNo ratings yet

- NCL Industries (NCLIND: Poised For GrowthDocument5 pagesNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyNo ratings yet

- Axis Bank - ConsolidatedDocument43 pagesAxis Bank - ConsolidatedamolkhadseNo ratings yet

- Fundcard MiraeAssetEmergingBluechipRegular 2014feb26Document4 pagesFundcard MiraeAssetEmergingBluechipRegular 2014feb26Yogi173No ratings yet

- Technology Innovations For Business Growth: Ashutosh Athavale Shashank Udupa Parita ThakkarDocument20 pagesTechnology Innovations For Business Growth: Ashutosh Athavale Shashank Udupa Parita Thakkaryogi9998No ratings yet

- ValueResearchFundcard HDFCTop200 2011aug03Document6 pagesValueResearchFundcard HDFCTop200 2011aug03ShaishavKumarNo ratings yet

- Cumulative FD - Non-Cumulative Fixed DepositDocument10 pagesCumulative FD - Non-Cumulative Fixed Depositconfirm@No ratings yet

- Share Sansar Samachar of 14th November' 2011Document4 pagesShare Sansar Samachar of 14th November' 2011sharesansarNo ratings yet

- Fundcard DWSCashOpportunitiesRegDocument4 pagesFundcard DWSCashOpportunitiesRegYogi173No ratings yet

- Car FinanceDocument2 pagesCar FinanceRohit Yadav100% (1)

- Redefining Strategic Routes to Financial Resilience in ASEAN+3From EverandRedefining Strategic Routes to Financial Resilience in ASEAN+3No ratings yet

- SYLLABUS - 2008: Application No: 155536 Registration No: 02112043926 Old Registration No: SRR/043926Document1 pageSYLLABUS - 2008: Application No: 155536 Registration No: 02112043926 Old Registration No: SRR/043926Ashok Kumar UNo ratings yet

- Blackheads: Use Toothpaste or Pasupu To Get Rid ofDocument1 pageBlackheads: Use Toothpaste or Pasupu To Get Rid ofAshok Kumar UNo ratings yet

- Ashnew IPAfrenchDocument1 pageAshnew IPAfrenchAshok Kumar UNo ratings yet

- Levels 1 To 3Document1 pageLevels 1 To 3Ashok Kumar UNo ratings yet

- Succeed in Life: To, You Need Three ThingsDocument24 pagesSucceed in Life: To, You Need Three ThingsAshok Kumar UNo ratings yet

- Ifcb2009 04Document106 pagesIfcb2009 04Raja Rao KamarsuNo ratings yet

- Maiden Lane III: AIG Counterparty AnalysisDocument4 pagesMaiden Lane III: AIG Counterparty Analysisoctothorpe2294No ratings yet

- A GUIDE TO TRULY RICH CLUB by BO SANCHEZDocument4 pagesA GUIDE TO TRULY RICH CLUB by BO SANCHEZRaymunda Rauto-avilaNo ratings yet

- Medium Term Bond FundDocument1 pageMedium Term Bond FundYannah HidalgoNo ratings yet

- 2024 28 1 11 02 18 Statement - 1706419938603Document26 pages2024 28 1 11 02 18 Statement - 1706419938603Hai ByeNo ratings yet

- Ifsc 3Document831 pagesIfsc 3salboniNo ratings yet

- XXXXXXXXXX1125 - 20240111095720671255 (1) - ProtectedDocument38 pagesXXXXXXXXXX1125 - 20240111095720671255 (1) - Protectedr6540073No ratings yet

- Public Sector Bank Details of Nodal Officer Bank Name Name Gms Land Line EmailDocument2 pagesPublic Sector Bank Details of Nodal Officer Bank Name Name Gms Land Line EmailAayush Kumar SinghNo ratings yet

- Settlements CY2018Document4 pagesSettlements CY2018Alyssa RobertsNo ratings yet

- Mutual Funds: An Overview Shaleen PrakashDocument41 pagesMutual Funds: An Overview Shaleen PrakashSudham SandeepNo ratings yet

- Ca 30042017Document11 pagesCa 30042017Alakh AdvtNo ratings yet

- Screenshot 2023-10-18 at 7.51.35 PM 2Document10 pagesScreenshot 2023-10-18 at 7.51.35 PM 2happymansukhani05No ratings yet

- VIII Foreign Contribution-MergedDocument12 pagesVIII Foreign Contribution-MergedSimardeep SinghNo ratings yet

- Saraswat Bank (4908)Document27 pagesSaraswat Bank (4908)manya009pNo ratings yet

- Full Report - Worldwide Investments in Cluster MunitionsDocument275 pagesFull Report - Worldwide Investments in Cluster MunitionsForeclosure FraudNo ratings yet

- List of Banks in IndiaDocument3 pagesList of Banks in IndiaAtul krishna PatraNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument15 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHunterNo ratings yet

- Crystal Super AdministrationDocument4 pagesCrystal Super AdministrationJagdeep ArryNo ratings yet

- 3.contractor Wise Details-CommitteeDocument114 pages3.contractor Wise Details-CommitteeGURUDEV ENGINEERSNo ratings yet

- Network Bank Name Bank Name (Short) Bank CodeDocument4 pagesNetwork Bank Name Bank Name (Short) Bank CodeTanmoy Hasan100% (1)

- Banks in IslamabadDocument14 pagesBanks in IslamabadMohammad Ismail100% (1)

- Sri Lanka CISODocument4 pagesSri Lanka CISOVikram0% (1)

- 9276 4c3b 8c0e E489f7ff74bfDocument6 pages9276 4c3b 8c0e E489f7ff74bfKUGAN A/L PARAMAVATHAR MoeNo ratings yet

- Kohat TextileDocument10 pagesKohat TextileHashim AfzalNo ratings yet

- Thailand SMART Member Bank CodeDocument1 pageThailand SMART Member Bank CodenatascoeurNo ratings yet

- SK Tunjangan Khusus Smtr2 - 2020 - OkDocument12 pagesSK Tunjangan Khusus Smtr2 - 2020 - OkOnniNo ratings yet

- GRVSP00700530000014298 NewDocument3 pagesGRVSP00700530000014298 NewRakesh PatnaikNo ratings yet

- Govt Witness List Rashad TrialDocument4 pagesGovt Witness List Rashad TrialJason TrahanNo ratings yet

- MYPF Pref Database 15may'13Document319 pagesMYPF Pref Database 15may'13Fiachra O'DriscollNo ratings yet