Professional Documents

Culture Documents

K. G. Joshi Collage of Arts & N.G. Bedekar College of Commerce

K. G. Joshi Collage of Arts & N.G. Bedekar College of Commerce

Uploaded by

darthvader0050 ratings0% found this document useful (0 votes)

71 views18 pagesThis document provides an introduction and index for a project on Business Process Re-engineering (BPR) at Mahindra & Mahindra. It discusses how M&M restructured by identifying core and non-core businesses and restructuring its farm equipment division. It describes Project Blue-Chip, a major BPR exercise at M&M in 2002 to improve financial returns through cost cutting and streamlining operations. The document also provides updates on M&M's diversification into aerospace through acquisitions in Australia and expanding its tractor business in China through new investments.

Original Description:

123

Original Title

BPR

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an introduction and index for a project on Business Process Re-engineering (BPR) at Mahindra & Mahindra. It discusses how M&M restructured by identifying core and non-core businesses and restructuring its farm equipment division. It describes Project Blue-Chip, a major BPR exercise at M&M in 2002 to improve financial returns through cost cutting and streamlining operations. The document also provides updates on M&M's diversification into aerospace through acquisitions in Australia and expanding its tractor business in China through new investments.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

71 views18 pagesK. G. Joshi Collage of Arts & N.G. Bedekar College of Commerce

K. G. Joshi Collage of Arts & N.G. Bedekar College of Commerce

Uploaded by

darthvader005This document provides an introduction and index for a project on Business Process Re-engineering (BPR) at Mahindra & Mahindra. It discusses how M&M restructured by identifying core and non-core businesses and restructuring its farm equipment division. It describes Project Blue-Chip, a major BPR exercise at M&M in 2002 to improve financial returns through cost cutting and streamlining operations. The document also provides updates on M&M's diversification into aerospace through acquisitions in Australia and expanding its tractor business in China through new investments.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 18

K. G.

JOSHI COLLAGE OF ARTS &

N.G. BEDEKAR COLLEGE OF COMMERCE

T.Y (Banking & Insurance) Semester 6

TH

Submitted By : Ankush Bhole

Roll No. 23

Subject:

TURNAROUND MANAGEMENT

Project on:

BPR (Business Process Re-Engineering) in Mahindra &

Mahindra

Subject Teacher:

PROF. Mrunmayee Thatte

2

Acknowledgement

This project topic of BPR in Mahindra & Mahindra has given

me a great deal of knowledge and understanding of the concept of

BPR and how it is used to turn a sick unit into a profitable one.

I would like to thank my Professor. Mrunmayee Thatte for her

unparalled support for helping me get through this project.

Name; Ankush Bhole

Roll No. 23

Date ; 08/02/2013

3

INDEX

Sr No. Contents Pg No.

1. Introduction

01

2. Restructuring Core and Non-Core Business

02

3. Restructuring Farm Equipment Business

02

4. Project Blue-chip

03

5. Future Trends Latest Updates

06

6. Business Units:

09

7. Management Structure:

11

8. Globalization:

11

9. Road Ahead

14

10. Current Scenario

14

11. Conclusion

15

4

Introduction

M&M was established in 1945 started by two brothers; J.C. Mahindra and K.C.

Mahindra. The Company Started as manufacturer of general purpose utility

vehicle and carried production of 75 jeeps in 1948. The company became

Mahindra and Mahindra Ltd. In 1955 Over the period the company diversified

into hotels, financial services, auto components, IT, infrastructure development

and trading. Companys electronics and instrumentation division was set up in

1968. MOU with British Telecom was signed in 1989 for development of

opportunities in telecommunication. In 1994 company established Mahindra

USA to promote tractor sales worldwide. Philosophy followed by the top

management is to strengthen the competitive position in the domestic market

before launching an ambitious globalization programme. M&M showed

excellent results in 2004 with PAT up by 139% from that of 2002-03. Company

had Rs.1000cr reserves separate for domestic and overseas acquisitions. Top

management realized that M&M had a real opportunity to become a Truly

Global brand. Thus need for restructuring is through realization of

businesses not closely related to core competencies. As a result, a massive

Change Exercise i.e. BPR exercise started in 1994; a change from functional

to SBU structure. The criteria was only those business with a global potential

will be a going concern. As a result of which 6 autonomous SBU were formed

with completely empowered presidents for each SBU. The Intention was to

provide direction for future growth of various business lines.

5

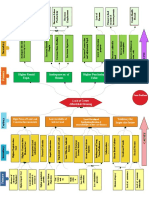

Restructuring - Core & Non-Core Business

Restructuring Core and Non-Core Business

Restructuring Farm Equipment Business

Company thought of restructuring its farm equipment business. Project

Vishwajeetwas a major restructuring programme conceptualized by Mckinsey

aimed at turning M&M into a leading tractor producer in global arena by 2005.

As a part of this strategy, the Farm equipment business was divided into 38

different BU classified under 5 divisions. The divisions were marketing and

customer relations, manufacturing and supply chain, product development and

R&D services, performance management and international operations.

6

Project Blue-chip

Why Project Blue-chip?

In December 2002, M&M reached a low point in its history. Depressed

revenues and high costs reduced profit margins considerably

Share price fell from Rs.322 in 2000 to Rs.114 in 2002 and it was listed

out from BSE index. ROCE reduced from 17.09 to 8.92

M&M set up a CTPO (Corporate Turnaround Programme Office) and

articulated the need for a sharper focus on financial returns. CTPO was set

up as a guiding and monitoring mechanism

With 32 subsidiaries on board, investors were unhappy. 18% of investment

and returns were only 5.7%. But Mr. Anand believed that diversification

was not the problem

Due to this, a restructuring exercise known as Project Blue-chip was initiated to

raise the bar on performance.

What did Project Blue-chip do??

Benchmarks like market share, sales and profits were replaced by free cash

flow and ROCE

ROCE brings in the efficiency of utilizing the capital

Free-cash flow makes businesses see to that some dividends flow back to

M&M so that they can be reallocated

A Policy was imposed. Which stated that - The businesses had to compete

for capital and those with highest returns would get the capital

Operations were overhauled. M&M undertook cost cutting and streamlined

its manufacturing facilities

Senior officers started working along with other workers on shop floor

7

HR angle

Prior to BPR, HR was not a key element of strategy formulation.

Prior to BPR After implementing BPR

Multi layered Flat

Work divided among different people

One person given responsibility for

entire process

Functional departments Interdisciplinary teams

Less training More emphasis on training

Performances were not measured Performance management system

Less "new blood" More "new blood - retiring and fired

No outsourcing

Outsourcing non-core manufacturing

activities

Limited meetings with workers Regular meetings with workers

Impact/Results of Project Blue-chip

Tractor division undertook major cost-cutting exercise and brought down

the BEP from 54,000 units to 35,000 units

Auto business free cash flow target for first half of 2003-04 was Rs.50

crore and it achieved Rs.150 crore

Net sales for first half of 2004 increased by 28%, operating profit was up

by 34%

M&M stock had touched 52 week high of Rs.390.25, up from Rs.112.55 a

year ago

8

Crisis being over, Mr. Anand felt that the next challenge was to make the

businesses globally competitive, drive innovation for old and new businesses

and strive for leadership.

9

Future Trends Latest Updates

1. Mahindra flies into aerospace

Auto maker Mahindra & Mahindra has entered the aerospace market with

acquisition of two Australian aircraft component manufacturing companies.

Mahindra has acquired majority stakes in Aerostaff Australia (AA) and

Gippsland Aeronautics (GA) for a total commitment of approximately Rs 175

crore, jointly with Kotak Private Equity. The Mahindras will hold 75 per cent in

each of the companies, which will enable the Indian engineering group with

interests in software to make small aircraft.The tie-up will enable the company

make 2-20 seater, turboprop aircraft, said to be the fastest growing aircraft

segments in general aviation.

Mahindra will retain the existing managements of GA and AA. Anand

Mahindra, Vice Chairman and Managing Director, Mahindra Group, said,

M&Ms move into the Aerospace segment is deliberate, bold and timely, and

is supported by a renewed demand for economical air transportation around the

world. Our investment in component capability addresses the growing needs of

both the civil and defence markets.

AA is a manufacturer of aircraft components and assemblies for large aerospace

OEMs (other equipment manufacturer). AAs acquisition will help catapult

M&M into the burgeoning Defence Offset and Commercial Aviation market.

GA is an established brand in general aviation and has delivered more than 200

FAR 23 certified planes in 32 countries.

The aerospace deals mark a new high in the evolution of the Mahindra group,

which, besides having a recent high-profile entry into passenger cars, was also

in the news this year as its software arm Tech Mahindra entered as a white

10

knight to rescue Satyam Computer Services, the countrys fourth largest

information technology exporter, from a corporate fraud.

M&M is in to the stage of Business Process Redefinition and is building on

its capabilities to diversify broader in to the automobile segment. From

tractors to aircrafts is an extraordinary development of business.

2. M&M Chinese JV to invest $40 mn for engine plant, R&D unit

Mahindra & Mahindra invested around USD 40 million (Rs 188 crore) in China

to set up a new R&D centre, engine plant and in modernising its tractor unit at

Yancheng. The JV--

The JV--Mahindra Yueda (Yanchang) Tractor Company (MYYTCL)--was set

up in 2008 after Mahindra & Mahindra (M&M) acquired a majority stake in

Yueda Group subsidiary, Yancheng Tractors. M&M currently holds 51 per cent

stake in the JV.

The tractor plant at Yancheng currently has a capacity to produce 38,000 units

annually, manging from 16 horse power (HP) to 125 HP. The modernisation of

tractor plant will improve productivity and quality and consolidate the

Yancheng manufacturing operations.

Commenting on the investment plan, Mahindra Group Vice Chairman and MD

Anand Mahindra said, "I am pleased to see the high level of commitment of

MYYTCL to bring superior products for the Chinese customers, which is being

reinforced by the investment decisions taken by the two partners." Yueda Group

Chairman Chen Yunhua said with the new investment MYYTCL will increase

its presence in the Chinese agricultural machinery market.

11

M&M is moving in to new markets and sectors by leveraging on its Joint

Venture.

3. Mahindra & Mahindra wants to do a Scorpio in scooters

Mahindra & Mahindra, which launched two models in the Scooter segment

Rodeo and Duro in September. The response was stupendous with sales of

7,000 scooters a month. The company plans to expand capacity shortly.

12

Business Units:

The two principal divisions of the company were farm equipment and

automotive. The more diversified groups covered a wide range of markets:

automotive, farm equipment, financial services, infrastructure and development,

IT and automotive components. M & M had two main tractor manufacturing

plants located at Mumbai and Nagpur in Maharashtra.

Around 90% of the tractor exports were to the US for small to medium sizes

uses. They also exported to countries like Nepal, Bangladesh, Sri Lanka as well

as African countries. Mahindra Shubhlabh Services (MSSL) was a virtual

marketplace where farmers and traders of agricultural commodities could sell,

produce, obtain finance, buy seeds and fertilizers, rent farm equipment and

check the latest weather information.

The automotive division manufactured and sold utility vehicles and LCVs. It

had a market share exceeding 50%. M&M also operated Automartindia, a B2C

portal which served as a virtual marketplace that allowed consumers to buy or

sell used automobiles.

From 47028 units in 2002-03, tractor sales went up to 49576 in 2003-04. The

growth came despite exports falling by 17%. The tractor division won the

Deming prize in 2003, the first tractor manufacturer across globe to win the

award. The tractor segment growth was driven by the success of M&Ms three

new launches the Bhumiputra, Sarpanch and Arjun. These 3 brands accounted

for 50% of the total tractor sales reported in 2003-04.

M&M felt that Mahindra Financial Services, in which it had a 97% stake, was a

good candidate for an IPO. M&M believed Mahindra Financial Services was

one of the few companies that actually understood the rural markets. Post-dated

cheques and other sophisticated financial instruments did not work here.

13

Mahindra Financial Services had already started offering insurance products

both life and general.

Mahindra British Telecom (MBT), a joint venture between M&M and British

Telecom (BT) specialized in telecom software, with the former holding a 57%

stake in the joint venture and BT holding the rest. The company filed a draft

prospectus with the Securities and Exchange Board of India in 2000.

Mahindra Consulting, which had partners like Computer Associates, IBM,

Microsoft, SAP and SDRC was headquartered in Austin, Texas. The Group

offered domain expertise in the automotive industry through Mahindra, Logisoft

Business Solutions, a joint venture with the TVS family.

The infrastructure and development segment included real estate, project

consultancy and design engineering consultancy and hospitality.

In 2002-03, Mahindra Holidays and Resorts India generated an income from

operations of Rs. 62 crore with a PAT of Rs. 2.8 crore but accumulated losses

were Rs. 26 crore. Club Mahindra had started targeting non-resident Indians

(NRIs) in a big way. Mahindra City, also involved in infrastructure, was a

business park promoted by M&M and the Tamil Nadu Industrial Development

Corporation.

Siroplast (sheet-moulding compounds and dough-moulding compounds) and

Mahindra Ugine Steel Company (alloy steel products) supplied automotive

components to major OEMs like TELCO, Ashok Leyland, Maruti Udyog and

Bajaj Auto. These companies also exported to the US and Europe.

Incase of the three major business groups farm equipment, automotive and

auto components, M&M had planned to make separate IPOs and spin them off

into separate businesses as the top management felt that the investors seemed to

have preference for focused businesses.

14

Management Structure:

M&M believed in a strong board of directors. Below the board of directors was

a management board, which consisted of Anand, the presidents and the

executive vice-presidents. They met once a month to discuss issues that affected

the company as a whole. The war-room concept introduced in March 1998, was

essentially a monthly meeting of each SBU, in which some people from other

units were also expected to attend.

Globalization:

Our Experiences in US, Greece and South Africa taught me a hard lesson: you

have to go into global markets very methodically and have clear strategic intent

- Anand Mahindra

Anand Mahindra saidEach business of M&M should clearly define :

Markets it wanted to enter.

Market share in each product category

Design the marketing mix.

Cost of building a global brand does not seem to cause much worry. Hence

Aanad was ready to invest once difference between global and domestic brands

is established. All six divisions to go global individually without any cross

subsidization. Each brand needs to be developed on its own. No business would

continue if it does not have global potential.A minimum 20% of revenue of all

M&M companies to come from outside India.

15

Tractor Segment

It is Indias largest exporter of tractors.High potential markets are: China,

Australia and Europe. It formed strategic alliances for broadening product

portfolio. e.g: Tong Yang Mooslan (South Korea), Mitsubishi (Japan),

Jiangling (China).Major success of tractors and SUVs was in china. It had

huge growth in exports to US under its 100% subsidiary MUSA. MUSA

marketed through online web portals, chat and community centers and word

of mouth by US farmers and opinion leaders.In addition other promotional

media such as TV ads, Billboards, auto fairs were also used. Korean and

Japanese tractors were also sold under MUSAs brand name.

Automotive Segment

IT targeted markets like South Asia, South Africa and Latin America which

were similar to India. More than 1600 vehicles exported in the year 03-04.

New target markets like Europe ,Russia, Italy, Spain and Portugal were

sought.Strategic alliances for assembly of CKD kits in these markets were

made to increase volumes.Target was set which is of 20% of volumes from

global countries in next 2 years.

Auto Components/Engineering Services

Emerged as a core business to provide auto components and services to global

auto producers in India and abroad. Acquisition opportunities in international

markets such as Europe.

16

IT and Telecom

MBT provided telecom solution worldwide. It was a joint venture between

M&M and British Telecom. It had global network of offices in US, UK, West

Asia, India, Singapore and Australia.

Bristlecone

Major stake in the company providing supply and consulting services in the US.

Financial Services

Targeted Markets like Sri Lanka, Nepal, Bangladesh, Myanmar and Bhutan for

financing M&M vehicles and tractors.

Trading And Leisure

Using its Expertise in competitive sourcing it had plans to expand in West Asia and Africa.

Mahindra Holiday & Resorts targeted NRIs in US, Dubai, Kuwait and West Asia.

17

Road Ahead

If group or sector is a market leader, widen the gap.

By end of 2004, each SBU needed to be in top 3.

For manufacturing companies, 20% revenues should come from

products not more than 4 years old.

For service companies, 20% of the offerings had to be new.

20% annual revenues should come from exports.

All targets to be achieved by all companies in 3 years.

Current Scenario

Two-wheelers

o Acquisition of Kinetic Motors in 2008 and launched Flyte

o Now its coming up with 2 more 125 cc gearless power scooters

Rodeo and Duo

Media and entertainment firm Mumbai Mantra

o Plans to make 28 releases per year

o Currently making 10 films in Hindi, Bengali, Bhojpuri and in

English at cost of about Rs 130-150 crore.

Leisure Boat manufacturing

o The company is all set to open up a new manufacturing unit to

manufacture fibreglass powerboats, cabin cruisers and catamarans.

The company is planning to foray through Mahindra Ocean Blue, a

joint undertaking with Mumbai-based marine operator Ocean Blue.

18

Conclusion

Before entering the global competition, strengthen position in domestic

market.

Become a global company before becoming a global brand.

BPR exercise leaded to:

o Flat structure removing highly under-productive, militantly

unionized, and bloated workforces.

o Productivity improvement, inventory reduction, quality

improvement and change in mindset of the people

To fight recession further improvisations taken up like cost reduction of

material, operations and manpower as well as the reduction of non-value

added activities (NVAs).

Focus on product development

New measures of performance like ROCE( Return on Capital employed)

and free cash flows facilitated intra-business competition to gain capital.

You might also like

- HuaweiDocument29 pagesHuaweiLi Ying100% (1)

- MAK LubesDocument49 pagesMAK Lubesgaurav_diwakar100% (9)

- MahindraDocument52 pagesMahindraTerry Webster100% (1)

- Mahindra & Mahindra - Implementing BPRDocument13 pagesMahindra & Mahindra - Implementing BPRAshwin Kumar Mohan100% (2)

- Capstone Rport, Group 14, Tata MotorsDocument40 pagesCapstone Rport, Group 14, Tata Motorsprateekramchandani100% (1)

- Chapter 4Document30 pagesChapter 4Dhanny MiharjaNo ratings yet

- Executive Summary: Focus Group ReportDocument4 pagesExecutive Summary: Focus Group ReportkaranNo ratings yet

- TM PPT 1Document15 pagesTM PPT 1Ruth Lopes100% (1)

- Mahindra & Mahindra - Implementing BPR: OPER/008 IBS Center For Management ResearchDocument13 pagesMahindra & Mahindra - Implementing BPR: OPER/008 IBS Center For Management ResearchlalitprrasadsinghNo ratings yet

- Business Strategy: A Case Study of Auto Giant Mahindra & Mahindra LTDDocument5 pagesBusiness Strategy: A Case Study of Auto Giant Mahindra & Mahindra LTDGulatiNo ratings yet

- Mahindra - Case StudyDocument2 pagesMahindra - Case StudyAshvin PatelNo ratings yet

- Mahindra and MahindraDocument26 pagesMahindra and MahindraSaloni Jain 1820343No ratings yet

- B2B MarketingDocument14 pagesB2B MarketingAshok KumarNo ratings yet

- Cost Cia 3RD SemDocument30 pagesCost Cia 3RD SemSaloni Jain 1820343No ratings yet

- M&M Case StudyDocument9 pagesM&M Case Studyneelgala100% (1)

- Business Process Reengineering: Mahindra & MahindraDocument15 pagesBusiness Process Reengineering: Mahindra & MahindrarajeshsasiNo ratings yet

- Review of Automotive Industry in IndiaDocument18 pagesReview of Automotive Industry in IndiarahuljavalkarNo ratings yet

- BEML - Annual Report - FY 2020-2021Document278 pagesBEML - Annual Report - FY 2020-2021NILESH SHETENo ratings yet

- Mahindra & MahindraDocument4 pagesMahindra & MahindramailtovinayvermaNo ratings yet

- Tech Mahindra and Mahindra Satyam Merger AnnouncedDocument4 pagesTech Mahindra and Mahindra Satyam Merger AnnouncedDinesh Kumar0% (1)

- Case Study ERPDocument4 pagesCase Study ERPSiddarth MondalNo ratings yet

- Mahindra Lost Sales AnalysisDocument79 pagesMahindra Lost Sales Analysisamit9024No ratings yet

- M&M Case StudyDocument6 pagesM&M Case Studyvicky3230No ratings yet

- Seminar Paper: International Financial ManagementDocument13 pagesSeminar Paper: International Financial ManagementBogles Paul-AdrianNo ratings yet

- Aman MISDocument15 pagesAman MISAli AhmadNo ratings yet

- Restructuring at BPCL 1Document5 pagesRestructuring at BPCL 1javedaNo ratings yet

- BPR Case StudyDocument5 pagesBPR Case StudyAmol PhadaleNo ratings yet

- Mahindra Tractor MarketingDocument61 pagesMahindra Tractor MarketingBadru DeenNo ratings yet

- A Group 6 Mahindra and MahindraDocument12 pagesA Group 6 Mahindra and Mahindramohitchordiya74No ratings yet

- Case 4 Mahindra and MahindraDocument13 pagesCase 4 Mahindra and MahindraRajkumar RakhraNo ratings yet

- BPR Implementation in Mahindra & MahindrADocument12 pagesBPR Implementation in Mahindra & MahindrAArunav SahayNo ratings yet

- Mahindra and Mahindra WST SchemeDocument50 pagesMahindra and Mahindra WST Schemeohsagar20000% (1)

- MahindraDocument21 pagesMahindraAnonymous ty7mAZNo ratings yet

- Mode of Entry:: 7. Post-Merger vs. Pre-Merger Strategy AnalysisDocument3 pagesMode of Entry:: 7. Post-Merger vs. Pre-Merger Strategy AnalysisHimanshu KumarNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummaryAmar VamanNo ratings yet

- M&M Case StudyDocument24 pagesM&M Case StudyPrasanthviswanathanNo ratings yet

- Name: G.Jitendra Sai REDGNO:201FK01060 Branch:Bba Year:2Nd Section:A Subject: Business EnvironmentDocument8 pagesName: G.Jitendra Sai REDGNO:201FK01060 Branch:Bba Year:2Nd Section:A Subject: Business EnvironmentJittu SaiNo ratings yet

- Global Is at Ion Strategy MahindraDocument6 pagesGlobal Is at Ion Strategy Mahindrarhythm1234No ratings yet

- Finishing Touch-Neha SinghDocument78 pagesFinishing Touch-Neha SinghVaibhav MishraNo ratings yet

- Buisness Valuation Final PresentationDocument13 pagesBuisness Valuation Final PresentationJoydeep GoraiNo ratings yet

- Report 2Document32 pagesReport 2arunk352000No ratings yet

- A Study On Financial Analysis of Automobile IndustriesDocument6 pagesA Study On Financial Analysis of Automobile IndustriesKshama KadwadNo ratings yet

- Harshi HardDocument60 pagesHarshi HardNandeep Hêãrtrøbbér100% (2)

- Corporate Strategy Business Strategy: Types of StrategiesDocument34 pagesCorporate Strategy Business Strategy: Types of StrategiesSayed WahabNo ratings yet

- Crompton Greaves Limited Training DevelopmentDocument70 pagesCrompton Greaves Limited Training DevelopmentJaiHanumanki100% (1)

- GMR Company Analysis: Submitted By: Group 9Document18 pagesGMR Company Analysis: Submitted By: Group 9Rehan Tyagi100% (1)

- 21MBA029,126,147Document23 pages21MBA029,126,147Zeelkumar PatelNo ratings yet

- Managerial Accounting: Hero MotocorpDocument22 pagesManagerial Accounting: Hero MotocorpAnil KumarNo ratings yet

- Shri G. Krishnakumar Takes Over As Chairman and Managing Director of Bharat PetroleumDocument2 pagesShri G. Krishnakumar Takes Over As Chairman and Managing Director of Bharat PetroleumKartik MaheshwariNo ratings yet

- Case StudiesDocument70 pagesCase Studieshvactrg1No ratings yet

- BPR Experiences in Indian IndustryDocument9 pagesBPR Experiences in Indian IndustryKristin Elizabeth KoshyNo ratings yet

- Project Appraisal CIADocument28 pagesProject Appraisal CIAShefali TailorNo ratings yet

- Literature Review of Mahindra AutomobilesDocument5 pagesLiterature Review of Mahindra Automobilesafdtbluwq100% (1)

- BTEC Edexcel Level 7 Extended Diploma in Strategic Management & Leadership Case Study/Assignment ActivityDocument6 pagesBTEC Edexcel Level 7 Extended Diploma in Strategic Management & Leadership Case Study/Assignment ActivityKORAT KOMALNo ratings yet

- Tata MotorsDocument11 pagesTata MotorsashilNo ratings yet

- BKT b2b Project ReportDocument17 pagesBKT b2b Project ReportAshok Kumar50% (2)

- Pionee Diligence & Excellence Since 1996Document25 pagesPionee Diligence & Excellence Since 1996mansivyasNo ratings yet

- Hero MotoCorp Ltd.Document20 pagesHero MotoCorp Ltd.Nivetha0% (1)

- Project of Entrepreneurship: Business Plan of A Start-UpDocument60 pagesProject of Entrepreneurship: Business Plan of A Start-UpMuhammad SaadNo ratings yet

- Sector Study ReportDocument122 pagesSector Study ReporthappytiwariNo ratings yet

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Guidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- K.G.Joshi College of Arts & N.G.Bedekar College of Commerce Certificate of Project WorkDocument2 pagesK.G.Joshi College of Arts & N.G.Bedekar College of Commerce Certificate of Project Workdarthvader005No ratings yet

- Edited MicrofinanceDocument59 pagesEdited Microfinancedarthvader005No ratings yet

- IM 4th SemDocument20 pagesIM 4th Semdarthvader005No ratings yet

- RM 4th SemDocument26 pagesRM 4th Semdarthvader005No ratings yet

- SSC CGL 2013 Preliminary Exam Question PaperDocument16 pagesSSC CGL 2013 Preliminary Exam Question PaperSai Bhargav VeerabathiniNo ratings yet

- Brief OverviewDocument5 pagesBrief Overviewdarthvader005No ratings yet

- Euro Currency MarketDocument42 pagesEuro Currency Marketdarthvader005No ratings yet

- Student - Declaration: Bilin.E.B, East West College of ManagementDocument4 pagesStudent - Declaration: Bilin.E.B, East West College of Managementdarthvader005No ratings yet

- Indian Insurance IndustryDocument51 pagesIndian Insurance Industrydarthvader005No ratings yet

- HRM IndexDocument1 pageHRM Indexdarthvader005No ratings yet

- Project On AseanDocument39 pagesProject On Aseandarthvader005100% (1)

- Infosys LearningMate Recruitment Selection ProcessDocument53 pagesInfosys LearningMate Recruitment Selection Processdarthvader005No ratings yet

- Management Practices and Organiztional Behavior: 1 Suman Tiwari (A-22)Document22 pagesManagement Practices and Organiztional Behavior: 1 Suman Tiwari (A-22)darthvader005No ratings yet

- OD119185277796277000Document4 pagesOD119185277796277000Awadhesh PalNo ratings yet

- BSBSUS601 - Learner Guide (Student)Document77 pagesBSBSUS601 - Learner Guide (Student)Natti Nonglek100% (1)

- Part FourDocument3 pagesPart FourHannah CorpuzNo ratings yet

- Examiners' Commentaries 2014: FN3092 Corporate FinanceDocument19 pagesExaminers' Commentaries 2014: FN3092 Corporate FinanceBianca KangNo ratings yet

- Suitability of Pavement Type For Developing Countries From An Economic Perspective Using Life Cycle Cost AnalysisDocument8 pagesSuitability of Pavement Type For Developing Countries From An Economic Perspective Using Life Cycle Cost AnalysisAlazar DestaNo ratings yet

- GXX - 0002 TableDocument63 pagesGXX - 0002 TableSupratim RayNo ratings yet

- DSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkDocument3 pagesDSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkJames BarlowNo ratings yet

- 06 Alternative Methods of Procurement.09162016Document69 pages06 Alternative Methods of Procurement.09162016Rhea BinayaNo ratings yet

- Matahari Department Store TBK.: August 2018Document4 pagesMatahari Department Store TBK.: August 2018Ana SafitriNo ratings yet

- Enron Scandal PresentationDocument11 pagesEnron Scandal PresentationYujia JinNo ratings yet

- Auditing Problems - 001Document2 pagesAuditing Problems - 001Geoff MacarateNo ratings yet

- Statemant HSBCDocument1 pageStatemant HSBCVera DedkovskaNo ratings yet

- CH 02Document36 pagesCH 02api-3804982100% (1)

- Effective From 1 October 2020 1. Money Transfer-Cnic To Upaisa WalletDocument3 pagesEffective From 1 October 2020 1. Money Transfer-Cnic To Upaisa WalletAzhar Ali0% (1)

- MC Donald 5 Forces AnalysisDocument4 pagesMC Donald 5 Forces AnalysisCurt Russell CagaoanNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- 485 BRIEF Assignment 1Document3 pages485 BRIEF Assignment 1Duyên MaiNo ratings yet

- Akun Impor Ud BuanaDocument1 pageAkun Impor Ud BuanaYusnita dwi kartikaNo ratings yet

- Internal Control ChecklistDocument5 pagesInternal Control ChecklistPHILLIT CLASSNo ratings yet

- Dell Computer: Refining and Extending The Business Model With ITDocument18 pagesDell Computer: Refining and Extending The Business Model With ITTathagataNo ratings yet

- Namma Kalvi 11th Economics em 5 Mark GuideDocument48 pagesNamma Kalvi 11th Economics em 5 Mark GuideManju Bhashini M RNo ratings yet

- Problem Tree 1Document1 pageProblem Tree 1bhbfc project-1No ratings yet

- Indice de Progreso GenuinoDocument7 pagesIndice de Progreso GenuinoAnonymous gTlOTsgeNo ratings yet

- Bearish Engulfing PatternDocument3 pagesBearish Engulfing PatternkosurugNo ratings yet

- Os Report-Anand Water MterDocument44 pagesOs Report-Anand Water MterJason Brown83% (6)

- Recovery Program Pilot Partnerships With Councils in The NWDocument7 pagesRecovery Program Pilot Partnerships With Councils in The NWGuedjeo SuhNo ratings yet

- Introduction To Human Resource ManagementDocument5 pagesIntroduction To Human Resource ManagementJe SacdalNo ratings yet