Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

36 viewsPSDB Audit Committee Charter

PSDB Audit Committee Charter

Uploaded by

joachimjackThe Pride Star Development Bank Audit Committee Charter establishes the committee to assist the board in overseeing the integrity of financial reporting, internal controls, and the independence and performance of internal and external auditors. The charter outlines the committee's appointment, membership, authority, responsibilities, and functions. Key responsibilities include setting up the internal audit department, appointing the internal and external auditors, reviewing quarterly and annual financial statements, overseeing financial risk exposure and controls, and addressing staff concerns about improprieties.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Financial Policy and Procedures ManualDocument18 pagesFinancial Policy and Procedures ManualAahna Mittal100% (1)

- Answer PDFDocument17 pagesAnswer PDFميلاد نوروزي رهبرNo ratings yet

- C2 Topic 1 - Legal, Regulatory and Ethical IssuesDocument35 pagesC2 Topic 1 - Legal, Regulatory and Ethical IssuesRodric PeterNo ratings yet

- Woodbarn Case Analysis PresentationDocument12 pagesWoodbarn Case Analysis PresentationNyein WaiNo ratings yet

- Returned Checks Audit Work ProgramDocument4 pagesReturned Checks Audit Work ProgramozlemNo ratings yet

- ERM CharterDocument3 pagesERM ChartertitooluwaNo ratings yet

- Audit Engagement LetterDocument3 pagesAudit Engagement LetterMakeup Viral StudiosNo ratings yet

- US Internal Audit Policy FormatDocument5 pagesUS Internal Audit Policy Formatshubhs vijayNo ratings yet

- Historical Financial Analysis - CA Rajiv SinghDocument78 pagesHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- Operational Risk Management Plan A Complete Guide - 2020 EditionFrom EverandOperational Risk Management Plan A Complete Guide - 2020 EditionNo ratings yet

- 2008 - 01spe 101491 MS P PDFDocument10 pages2008 - 01spe 101491 MS P PDFSusan Li HBNo ratings yet

- Audit and Accounting Guide - Depository and Lending Institutions: Banks and Savings Institutions, Credit Unions, Finance Companies, and Mortgage CompaniesFrom EverandAudit and Accounting Guide - Depository and Lending Institutions: Banks and Savings Institutions, Credit Unions, Finance Companies, and Mortgage CompaniesNo ratings yet

- Audit Committee CharterDocument5 pagesAudit Committee CharterMeenakshi ChumunNo ratings yet

- Interest Rate Risk AuditDocument4 pagesInterest Rate Risk AuditpascaruionNo ratings yet

- Internal Controls and Risk ManagementDocument15 pagesInternal Controls and Risk Managementpatrick kumpheNo ratings yet

- Internal Audit Manual - v4.1 - 27 Nov 2012 PDFDocument57 pagesInternal Audit Manual - v4.1 - 27 Nov 2012 PDFJi YuNo ratings yet

- Instructor Mr. Shyamasundar Tripathy Management Faculty (HR)Document30 pagesInstructor Mr. Shyamasundar Tripathy Management Faculty (HR)Aindrila BeraNo ratings yet

- Audit and Risk Committee CharterDocument11 pagesAudit and Risk Committee CharterKarine SNo ratings yet

- CBK Corporate Governance ManualDocument33 pagesCBK Corporate Governance ManualVeena HingarhNo ratings yet

- Public Islamic Bank: Corporate Governance DisclosuresDocument46 pagesPublic Islamic Bank: Corporate Governance DisclosuresAna FienaNo ratings yet

- Practitioner's Guide To Audit of Small EntitiesDocument315 pagesPractitioner's Guide To Audit of Small Entitiesswat2kk5No ratings yet

- 2018 Internal Audit CharterDocument4 pages2018 Internal Audit CharterAlezNg100% (1)

- WIP IA Manual - Audit Program - PayablesDocument6 pagesWIP IA Manual - Audit Program - PayablesMuhammad Faris Ammar Bin ZainuddinNo ratings yet

- Checklist - Risk Management EssentialsDocument2 pagesChecklist - Risk Management EssentialsambrosiustNo ratings yet

- ICP 8 Risk Management and Internal ControlsDocument21 pagesICP 8 Risk Management and Internal Controlsjloganteng5673No ratings yet

- A. Engagement Letter From Client To CPA - PALACIODocument2 pagesA. Engagement Letter From Client To CPA - PALACIOPinky DaisiesNo ratings yet

- Corporate GovernanceDocument47 pagesCorporate GovernanceShivani100% (1)

- Credit Risk Management PracticeDocument28 pagesCredit Risk Management Practiceqiumuou44No ratings yet

- Internal Audit Stakeholder Management and The Three Lines of Defense Slide DeckDocument12 pagesInternal Audit Stakeholder Management and The Three Lines of Defense Slide DeckSheyam SelvarajNo ratings yet

- More On Rebates: What Is A Rebate Program?Document4 pagesMore On Rebates: What Is A Rebate Program?CheenaNo ratings yet

- ML and TF in The Securities SectorDocument86 pagesML and TF in The Securities SectorYan YanNo ratings yet

- Technical Proposal To Provide Finacial Training For YNSD - YCI Project Finacial StaffsDocument5 pagesTechnical Proposal To Provide Finacial Training For YNSD - YCI Project Finacial Staffsfirehwot2017No ratings yet

- Chapter 4 Ethics and AcceptanceDocument10 pagesChapter 4 Ethics and Acceptancerishi kareliaNo ratings yet

- SG Audit Business Advisory Services BrochureDocument16 pagesSG Audit Business Advisory Services BrochureBagus Deddy AndriNo ratings yet

- Source and Evaluation of Risks: Learning OutcomesDocument34 pagesSource and Evaluation of Risks: Learning OutcomesNATURE123No ratings yet

- Going Concern Issues in Financial ReportingDocument74 pagesGoing Concern Issues in Financial ReportingshantipNo ratings yet

- Chapter 11 Audit Reports On Financial StatementsDocument54 pagesChapter 11 Audit Reports On Financial StatementsKayla Sophia PatioNo ratings yet

- Comprehensive Deposit PolicyDocument13 pagesComprehensive Deposit PolicyShakirkapraNo ratings yet

- AuditingDocument92 pagesAuditingyared100% (1)

- Audit CharterDocument2 pagesAudit CharterbukhariNo ratings yet

- Internal Controls 101Document25 pagesInternal Controls 101Arcee Orcullo100% (1)

- Risk Management PolicyDocument1 pageRisk Management PolicyAngu-NLNo ratings yet

- Managing Core Risks in Banking: Internal ControlDocument54 pagesManaging Core Risks in Banking: Internal ControlatiqultitoNo ratings yet

- Risk Management ManualDocument78 pagesRisk Management ManualSaudi MindNo ratings yet

- C Hap Ter 1 3 Overviewof Internal ControlDocument53 pagesC Hap Ter 1 3 Overviewof Internal ControlMariel Rasco100% (1)

- Vigil Mechanism Whistle Blower Policy, 25th April, 2019Document12 pagesVigil Mechanism Whistle Blower Policy, 25th April, 2019RashmiNo ratings yet

- Code of EthicsDocument37 pagesCode of EthicsTricia De JesusNo ratings yet

- Operational Risk ManagementDocument9 pagesOperational Risk ManagementAneeka NiazNo ratings yet

- Qms Policy ChecklistDocument2 pagesQms Policy ChecklistBheki XabaNo ratings yet

- CoE UNDP Quality AssuranceDocument64 pagesCoE UNDP Quality AssuranceboranscribdNo ratings yet

- Statutory Audit ModuleDocument75 pagesStatutory Audit ModulecaanusinghNo ratings yet

- Nonprofit Noboard Eval FMLDocument12 pagesNonprofit Noboard Eval FMLcitraNo ratings yet

- Eyob Finance ManualDocument46 pagesEyob Finance ManualMiki DeregeNo ratings yet

- Internal Control System For Banking OrganizationDocument34 pagesInternal Control System For Banking OrganizationLovelyn AtienzaNo ratings yet

- Ffp-English-Finance and Accounting Manual - v3 PDFDocument78 pagesFfp-English-Finance and Accounting Manual - v3 PDFTin Zaw ThantNo ratings yet

- Risk ManagementDocument3 pagesRisk ManagementLokesh Chawla100% (1)

- Client Survey QuestionsDocument3 pagesClient Survey QuestionsOumayma NizNo ratings yet

- NIB Risk Appetite Statement June 2019Document11 pagesNIB Risk Appetite Statement June 2019leonciongNo ratings yet

- Internal Control FrameworkDocument47 pagesInternal Control Frameworknico2176100% (2)

- Internal Control ConceptsDocument14 pagesInternal Control Conceptsmaleenda100% (1)

- At 04 Auditing PlanningDocument8 pagesAt 04 Auditing PlanningJelyn RuazolNo ratings yet

- G.R. NO. 136975Document24 pagesG.R. NO. 136975joachimjackNo ratings yet

- Derrida and Rorty (from Fazio book)Document5 pagesDerrida and Rorty (from Fazio book)joachimjackNo ratings yet

- G.R. NO. 153204 (Manila Mining)Document18 pagesG.R. NO. 153204 (Manila Mining)joachimjackNo ratings yet

- The beautiful side to border townsDocument2 pagesThe beautiful side to border townsjoachimjackNo ratings yet

- La Estrella, AragonDocument9 pagesLa Estrella, AragonjoachimjackNo ratings yet

- Whose Common Good CountsDocument19 pagesWhose Common Good CountsjoachimjackNo ratings yet

- Answering a leading questionDocument3 pagesAnswering a leading questionjoachimjackNo ratings yet

- G.R. no. 232663Document31 pagesG.R. no. 232663joachimjackNo ratings yet

- Adoro te devote translationDocument1 pageAdoro te devote translationjoachimjackNo ratings yet

- Michel Foucault (from Fazio book)Document4 pagesMichel Foucault (from Fazio book)joachimjackNo ratings yet

- Review of Scruton's book On Human NatureDocument7 pagesReview of Scruton's book On Human NaturejoachimjackNo ratings yet

- Finnis-What Is A LawDocument7 pagesFinnis-What Is A LawjoachimjackNo ratings yet

- PQF LevelsDocument2 pagesPQF LevelsjoachimjackNo ratings yet

- POs and PEOsDocument8 pagesPOs and PEOsjoachimjackNo ratings yet

- Metrobank List of RequirementsDocument1 pageMetrobank List of RequirementsjoachimjackNo ratings yet

- SCMAPDocument1 pageSCMAPjoachimjackNo ratings yet

- dc2007-5847 EDCDocument1 pagedc2007-5847 EDCjoachimjackNo ratings yet

- PSALM - Industry ProspectusDocument15 pagesPSALM - Industry ProspectusjoachimjackNo ratings yet

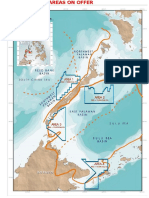

- PECR Petroleum Area Map FDocument1 pagePECR Petroleum Area Map FjoachimjackNo ratings yet

- Active Petroleum Contracts RevisedDocument2 pagesActive Petroleum Contracts RevisedjoachimjackNo ratings yet

- Historical Case Against Roe v. WadeDocument7 pagesHistorical Case Against Roe v. WadejoachimjackNo ratings yet

- The Role of History in ScienceDocument9 pagesThe Role of History in SciencejoachimjackNo ratings yet

- Dovie Beams and Philippine Politics A PRDocument42 pagesDovie Beams and Philippine Politics A PRjoachimjackNo ratings yet

- Summa Theologica On LawDocument2 pagesSumma Theologica On LawjoachimjackNo ratings yet

- Archbishop Niederauer On Pelosi's Abortion RemarksDocument4 pagesArchbishop Niederauer On Pelosi's Abortion RemarksjoachimjackNo ratings yet

- The Spanish-American War, 1898: MILESTONES: 1866-1898Document2 pagesThe Spanish-American War, 1898: MILESTONES: 1866-1898joachimjackNo ratings yet

- Philippine Historiography and Colonial DDocument26 pagesPhilippine Historiography and Colonial DjoachimjackNo ratings yet

- On The Code of MaragtasDocument7 pagesOn The Code of MaragtasjoachimjackNo ratings yet

- Statement of Income and Expenditures (CY2002) Provinces/Cities/Municipalities CombinedDocument19 pagesStatement of Income and Expenditures (CY2002) Provinces/Cities/Municipalities CombinedjoachimjackNo ratings yet

- MM & J Prequalification 24 June 2017Document7 pagesMM & J Prequalification 24 June 2017Moses Utumbe namandwaNo ratings yet

- Pfmea CR-V AmefDocument8 pagesPfmea CR-V AmefJose Antonio Santoyo RayaNo ratings yet

- My Value Trade Equity DP NSDL FormDocument56 pagesMy Value Trade Equity DP NSDL FormchetanjecNo ratings yet

- Chapter 11 Supply Chain Management 8th Ed 2011Document16 pagesChapter 11 Supply Chain Management 8th Ed 2011johnSianturiNo ratings yet

- Audit - PurchaseDocument7 pagesAudit - PurchaseCoco YenNo ratings yet

- Pobre Vs Defensor SantiagoDocument9 pagesPobre Vs Defensor SantiagoJohn Robert BautistaNo ratings yet

- 233 2011 2012 Egmont Group Annual ReportDocument49 pages233 2011 2012 Egmont Group Annual ReportMarina MihalachiNo ratings yet

- 01-SSRN-Tucker (2003) Sudah PrintDocument33 pages01-SSRN-Tucker (2003) Sudah PrintyosuaNo ratings yet

- Part 2Document179 pagesPart 2api-253241169No ratings yet

- Jawaban Tugas 2: Disusun Guna Memenuhi Tugas Auditing Dosen Pengampu: Muhrom Ali Rozai, S.E., M.E. Sy., M.Si., CRMODocument5 pagesJawaban Tugas 2: Disusun Guna Memenuhi Tugas Auditing Dosen Pengampu: Muhrom Ali Rozai, S.E., M.E. Sy., M.Si., CRMOnovitasariNo ratings yet

- Fatca Form NewDocument1 pageFatca Form NewgaurdevNo ratings yet

- SAP125 SAP Navigation 2005: SAP SCM-Procurement (MM) Academy ECC 6.0Document9 pagesSAP125 SAP Navigation 2005: SAP SCM-Procurement (MM) Academy ECC 6.0kngane8878No ratings yet

- Opm Problem Assignment 2Document10 pagesOpm Problem Assignment 2Aimes AliNo ratings yet

- Applying Innovation Resistance Theory To Understand User Acceptance of Online Shopping PDFDocument6 pagesApplying Innovation Resistance Theory To Understand User Acceptance of Online Shopping PDFdicksonhtsNo ratings yet

- Personal Information: Middleware & Java EngineerDocument5 pagesPersonal Information: Middleware & Java EngineerDonal GurningNo ratings yet

- DB2 9.7 LUW Full Online Backups - Experiments and ConsiderationsDocument26 pagesDB2 9.7 LUW Full Online Backups - Experiments and Considerationsraul_oliveira_83No ratings yet

- Computer Science Project Topics and Materials in NigeriaDocument13 pagesComputer Science Project Topics and Materials in Nigeriaለዛ ፍቅር50% (2)

- NetApp SnapMirrorDocument4 pagesNetApp SnapMirrorVijay1506No ratings yet

- IAE - International BrochureDocument12 pagesIAE - International BrochurediemthanhvuNo ratings yet

- Output and Performance-Based Roads Contract: A Case Study of Kaduna State, NigeriaDocument77 pagesOutput and Performance-Based Roads Contract: A Case Study of Kaduna State, NigeriaYusuf GiwaNo ratings yet

- KAMDAR-Annualreport2009 (1.7MB)Document87 pagesKAMDAR-Annualreport2009 (1.7MB)Kee_Mei_Chwen_2087No ratings yet

- Advances in Banking Technology and Management Impacts of ICT and CRM Premier Reference SourceDocument381 pagesAdvances in Banking Technology and Management Impacts of ICT and CRM Premier Reference SourceShilpakumari Sudhamani100% (1)

- 12 Chapter 04Document42 pages12 Chapter 04Lokesh Ujjainia UjjainiaNo ratings yet

- Case Study Arce Dairy Ice CreamDocument4 pagesCase Study Arce Dairy Ice CreamEj Lorido100% (1)

- Mind GamesDocument9 pagesMind Gamesjbnewbie60% (5)

- 2.1 Readiness AssessmentDocument4 pages2.1 Readiness AssessmentDwi DharmawanNo ratings yet

PSDB Audit Committee Charter

PSDB Audit Committee Charter

Uploaded by

joachimjack0 ratings0% found this document useful (0 votes)

36 views3 pagesThe Pride Star Development Bank Audit Committee Charter establishes the committee to assist the board in overseeing the integrity of financial reporting, internal controls, and the independence and performance of internal and external auditors. The charter outlines the committee's appointment, membership, authority, responsibilities, and functions. Key responsibilities include setting up the internal audit department, appointing the internal and external auditors, reviewing quarterly and annual financial statements, overseeing financial risk exposure and controls, and addressing staff concerns about improprieties.

Original Description:

sample audit committee charter

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Pride Star Development Bank Audit Committee Charter establishes the committee to assist the board in overseeing the integrity of financial reporting, internal controls, and the independence and performance of internal and external auditors. The charter outlines the committee's appointment, membership, authority, responsibilities, and functions. Key responsibilities include setting up the internal audit department, appointing the internal and external auditors, reviewing quarterly and annual financial statements, overseeing financial risk exposure and controls, and addressing staff concerns about improprieties.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

36 views3 pagesPSDB Audit Committee Charter

PSDB Audit Committee Charter

Uploaded by

joachimjackThe Pride Star Development Bank Audit Committee Charter establishes the committee to assist the board in overseeing the integrity of financial reporting, internal controls, and the independence and performance of internal and external auditors. The charter outlines the committee's appointment, membership, authority, responsibilities, and functions. Key responsibilities include setting up the internal audit department, appointing the internal and external auditors, reviewing quarterly and annual financial statements, overseeing financial risk exposure and controls, and addressing staff concerns about improprieties.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

PRIDE STAR DEVELOPMENT BANK, INC.

AUDIT COMMITTEE CHARTER

PURPOSE

The Audit Committee of Pride Star Development Bank (the Bank) is appointed by the

Board to assist the Board in monitoring (1) the integrity of the financial statements of the

Bank, (2) the Banks financial reporting and control, and (3) the independence and

performance of the Banks internal and external auditors.

APPOINTMENT, MEMBERSHIP AND QUALIFICATIONS

The Board shall appoint the members of the Audit Committee. The Audit Committee

shall be composed of members of the board of directors, at least two (2) of whom shall

be independent directors, including the Chairman,

The members of the Audit Committee shall meet the independence and experience

requirements of the Bangko Sentral ng Pilipinas which, among other requirements,

require that the members of the Audit Committee have accounting, auditing, or related

financial management expertise or experience.

AUTHORITY AND RESPONSIBILITY

The Audit Committee shall be responsible for the setting up of the internal audit

department and for the appointment of the internal auditor as well as the independent

external auditor who shall both report directly to the Audit Committee. It shall monitor

and evaluate the adequacy and effectiveness of the internal control system.

The audit committee shall have authority to investigate any matter within its scope, full

access to and cooperation by management and full discretion to invite any director or

executive officer to attend its meetings, and adequate resources to enable it to

effectively discharge its functions.

FUNCTIONS

The Audit Committee shall:

1. Review the adequacy of this Charter annually and recommend any proposed

changes to the Board for approval.

2. Review the annual audited financial statements with management, including major

issues regarding accounting and auditing principles and practices as well as the

adequacy of internal controls, including financial, operational and compliance controls,

that could significantly affect the Banks financial statements.

3. Review an analysis prepared by management and the independent auditor of

significant financial reporting issues and judgments made in connection with the

preparation of the Banks financial statements.

4. Review with management and the independent auditor the Banks quarterly financial

statements.

5. Meet periodically with management to review the Banks major financial risk exposure

and the steps management has taken to monitor and control such exposures.

6. Review major changes to the Banks auditing and accounting principles and practices

as suggested by the independent auditor, internal auditors or management.

7. Recommend to the Board the appointment of the independent auditor, who is

ultimately accountable to the Audit Committee and the Board.

8. Approve the fees to be paid to the independent auditor.

9. Review the significant reports to management prepared by the internal auditing

department and managements responses.

10. Meet with the independent auditor prior to the audit to review the planning and the

staffing of the audit.

11. Review with the independent auditor any problems or difficulties the auditor may

have encountered and any management letter provided by the auditor and the Banks

response to that letter. Such review should include:

Any difficulties encountered in the course of the audit work, including any

restrictions on the scope of the activities or access to required information.

Any changes required in the planned scope of the independent audit.

12. Prepare the reports required by the rules of the applicable regulatory authorities.

13. Review with the Banks management those matters that may have a material impact

on the financial statements, the Banks compliance policies and any material reports or

inquiries received from regulators or government agencies.

14. Establish and maintain mechanisms by which officers and staff may, in confidence,

raise concerns about possible improprieties or malpractices in matters of financial

reporting, internal control, auditing or other issues to persons or entities that have the

power to take corrective action.

15. Ensure that arrangements are in place for the independent investigation,

appropriate follow-up action, and subsequent resolution of complaints.

16. Meet at least annually with the Treasurer and the independent auditor. While the

Audit Committee has the responsibilities and powers set forth in this Charter, it is not

the duty of the Audit Committee to plan or conduct audits or to determine that the

Banks financial statements are complete and accurate and are in accordance with

generally accepted accounting principles. This is the responsibility of management and

the independent auditor. Nor is it the duty of the Audit Committee to conduct

investigations, to resolve disagreements, if any, between management and the

independent auditor.

REPORTING

Since the Committee consists of Board members, no additional reporting from the

Committee to the Board is required.

You might also like

- Financial Policy and Procedures ManualDocument18 pagesFinancial Policy and Procedures ManualAahna Mittal100% (1)

- Answer PDFDocument17 pagesAnswer PDFميلاد نوروزي رهبرNo ratings yet

- C2 Topic 1 - Legal, Regulatory and Ethical IssuesDocument35 pagesC2 Topic 1 - Legal, Regulatory and Ethical IssuesRodric PeterNo ratings yet

- Woodbarn Case Analysis PresentationDocument12 pagesWoodbarn Case Analysis PresentationNyein WaiNo ratings yet

- Returned Checks Audit Work ProgramDocument4 pagesReturned Checks Audit Work ProgramozlemNo ratings yet

- ERM CharterDocument3 pagesERM ChartertitooluwaNo ratings yet

- Audit Engagement LetterDocument3 pagesAudit Engagement LetterMakeup Viral StudiosNo ratings yet

- US Internal Audit Policy FormatDocument5 pagesUS Internal Audit Policy Formatshubhs vijayNo ratings yet

- Historical Financial Analysis - CA Rajiv SinghDocument78 pagesHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- Operational Risk Management Plan A Complete Guide - 2020 EditionFrom EverandOperational Risk Management Plan A Complete Guide - 2020 EditionNo ratings yet

- 2008 - 01spe 101491 MS P PDFDocument10 pages2008 - 01spe 101491 MS P PDFSusan Li HBNo ratings yet

- Audit and Accounting Guide - Depository and Lending Institutions: Banks and Savings Institutions, Credit Unions, Finance Companies, and Mortgage CompaniesFrom EverandAudit and Accounting Guide - Depository and Lending Institutions: Banks and Savings Institutions, Credit Unions, Finance Companies, and Mortgage CompaniesNo ratings yet

- Audit Committee CharterDocument5 pagesAudit Committee CharterMeenakshi ChumunNo ratings yet

- Interest Rate Risk AuditDocument4 pagesInterest Rate Risk AuditpascaruionNo ratings yet

- Internal Controls and Risk ManagementDocument15 pagesInternal Controls and Risk Managementpatrick kumpheNo ratings yet

- Internal Audit Manual - v4.1 - 27 Nov 2012 PDFDocument57 pagesInternal Audit Manual - v4.1 - 27 Nov 2012 PDFJi YuNo ratings yet

- Instructor Mr. Shyamasundar Tripathy Management Faculty (HR)Document30 pagesInstructor Mr. Shyamasundar Tripathy Management Faculty (HR)Aindrila BeraNo ratings yet

- Audit and Risk Committee CharterDocument11 pagesAudit and Risk Committee CharterKarine SNo ratings yet

- CBK Corporate Governance ManualDocument33 pagesCBK Corporate Governance ManualVeena HingarhNo ratings yet

- Public Islamic Bank: Corporate Governance DisclosuresDocument46 pagesPublic Islamic Bank: Corporate Governance DisclosuresAna FienaNo ratings yet

- Practitioner's Guide To Audit of Small EntitiesDocument315 pagesPractitioner's Guide To Audit of Small Entitiesswat2kk5No ratings yet

- 2018 Internal Audit CharterDocument4 pages2018 Internal Audit CharterAlezNg100% (1)

- WIP IA Manual - Audit Program - PayablesDocument6 pagesWIP IA Manual - Audit Program - PayablesMuhammad Faris Ammar Bin ZainuddinNo ratings yet

- Checklist - Risk Management EssentialsDocument2 pagesChecklist - Risk Management EssentialsambrosiustNo ratings yet

- ICP 8 Risk Management and Internal ControlsDocument21 pagesICP 8 Risk Management and Internal Controlsjloganteng5673No ratings yet

- A. Engagement Letter From Client To CPA - PALACIODocument2 pagesA. Engagement Letter From Client To CPA - PALACIOPinky DaisiesNo ratings yet

- Corporate GovernanceDocument47 pagesCorporate GovernanceShivani100% (1)

- Credit Risk Management PracticeDocument28 pagesCredit Risk Management Practiceqiumuou44No ratings yet

- Internal Audit Stakeholder Management and The Three Lines of Defense Slide DeckDocument12 pagesInternal Audit Stakeholder Management and The Three Lines of Defense Slide DeckSheyam SelvarajNo ratings yet

- More On Rebates: What Is A Rebate Program?Document4 pagesMore On Rebates: What Is A Rebate Program?CheenaNo ratings yet

- ML and TF in The Securities SectorDocument86 pagesML and TF in The Securities SectorYan YanNo ratings yet

- Technical Proposal To Provide Finacial Training For YNSD - YCI Project Finacial StaffsDocument5 pagesTechnical Proposal To Provide Finacial Training For YNSD - YCI Project Finacial Staffsfirehwot2017No ratings yet

- Chapter 4 Ethics and AcceptanceDocument10 pagesChapter 4 Ethics and Acceptancerishi kareliaNo ratings yet

- SG Audit Business Advisory Services BrochureDocument16 pagesSG Audit Business Advisory Services BrochureBagus Deddy AndriNo ratings yet

- Source and Evaluation of Risks: Learning OutcomesDocument34 pagesSource and Evaluation of Risks: Learning OutcomesNATURE123No ratings yet

- Going Concern Issues in Financial ReportingDocument74 pagesGoing Concern Issues in Financial ReportingshantipNo ratings yet

- Chapter 11 Audit Reports On Financial StatementsDocument54 pagesChapter 11 Audit Reports On Financial StatementsKayla Sophia PatioNo ratings yet

- Comprehensive Deposit PolicyDocument13 pagesComprehensive Deposit PolicyShakirkapraNo ratings yet

- AuditingDocument92 pagesAuditingyared100% (1)

- Audit CharterDocument2 pagesAudit CharterbukhariNo ratings yet

- Internal Controls 101Document25 pagesInternal Controls 101Arcee Orcullo100% (1)

- Risk Management PolicyDocument1 pageRisk Management PolicyAngu-NLNo ratings yet

- Managing Core Risks in Banking: Internal ControlDocument54 pagesManaging Core Risks in Banking: Internal ControlatiqultitoNo ratings yet

- Risk Management ManualDocument78 pagesRisk Management ManualSaudi MindNo ratings yet

- C Hap Ter 1 3 Overviewof Internal ControlDocument53 pagesC Hap Ter 1 3 Overviewof Internal ControlMariel Rasco100% (1)

- Vigil Mechanism Whistle Blower Policy, 25th April, 2019Document12 pagesVigil Mechanism Whistle Blower Policy, 25th April, 2019RashmiNo ratings yet

- Code of EthicsDocument37 pagesCode of EthicsTricia De JesusNo ratings yet

- Operational Risk ManagementDocument9 pagesOperational Risk ManagementAneeka NiazNo ratings yet

- Qms Policy ChecklistDocument2 pagesQms Policy ChecklistBheki XabaNo ratings yet

- CoE UNDP Quality AssuranceDocument64 pagesCoE UNDP Quality AssuranceboranscribdNo ratings yet

- Statutory Audit ModuleDocument75 pagesStatutory Audit ModulecaanusinghNo ratings yet

- Nonprofit Noboard Eval FMLDocument12 pagesNonprofit Noboard Eval FMLcitraNo ratings yet

- Eyob Finance ManualDocument46 pagesEyob Finance ManualMiki DeregeNo ratings yet

- Internal Control System For Banking OrganizationDocument34 pagesInternal Control System For Banking OrganizationLovelyn AtienzaNo ratings yet

- Ffp-English-Finance and Accounting Manual - v3 PDFDocument78 pagesFfp-English-Finance and Accounting Manual - v3 PDFTin Zaw ThantNo ratings yet

- Risk ManagementDocument3 pagesRisk ManagementLokesh Chawla100% (1)

- Client Survey QuestionsDocument3 pagesClient Survey QuestionsOumayma NizNo ratings yet

- NIB Risk Appetite Statement June 2019Document11 pagesNIB Risk Appetite Statement June 2019leonciongNo ratings yet

- Internal Control FrameworkDocument47 pagesInternal Control Frameworknico2176100% (2)

- Internal Control ConceptsDocument14 pagesInternal Control Conceptsmaleenda100% (1)

- At 04 Auditing PlanningDocument8 pagesAt 04 Auditing PlanningJelyn RuazolNo ratings yet

- G.R. NO. 136975Document24 pagesG.R. NO. 136975joachimjackNo ratings yet

- Derrida and Rorty (from Fazio book)Document5 pagesDerrida and Rorty (from Fazio book)joachimjackNo ratings yet

- G.R. NO. 153204 (Manila Mining)Document18 pagesG.R. NO. 153204 (Manila Mining)joachimjackNo ratings yet

- The beautiful side to border townsDocument2 pagesThe beautiful side to border townsjoachimjackNo ratings yet

- La Estrella, AragonDocument9 pagesLa Estrella, AragonjoachimjackNo ratings yet

- Whose Common Good CountsDocument19 pagesWhose Common Good CountsjoachimjackNo ratings yet

- Answering a leading questionDocument3 pagesAnswering a leading questionjoachimjackNo ratings yet

- G.R. no. 232663Document31 pagesG.R. no. 232663joachimjackNo ratings yet

- Adoro te devote translationDocument1 pageAdoro te devote translationjoachimjackNo ratings yet

- Michel Foucault (from Fazio book)Document4 pagesMichel Foucault (from Fazio book)joachimjackNo ratings yet

- Review of Scruton's book On Human NatureDocument7 pagesReview of Scruton's book On Human NaturejoachimjackNo ratings yet

- Finnis-What Is A LawDocument7 pagesFinnis-What Is A LawjoachimjackNo ratings yet

- PQF LevelsDocument2 pagesPQF LevelsjoachimjackNo ratings yet

- POs and PEOsDocument8 pagesPOs and PEOsjoachimjackNo ratings yet

- Metrobank List of RequirementsDocument1 pageMetrobank List of RequirementsjoachimjackNo ratings yet

- SCMAPDocument1 pageSCMAPjoachimjackNo ratings yet

- dc2007-5847 EDCDocument1 pagedc2007-5847 EDCjoachimjackNo ratings yet

- PSALM - Industry ProspectusDocument15 pagesPSALM - Industry ProspectusjoachimjackNo ratings yet

- PECR Petroleum Area Map FDocument1 pagePECR Petroleum Area Map FjoachimjackNo ratings yet

- Active Petroleum Contracts RevisedDocument2 pagesActive Petroleum Contracts RevisedjoachimjackNo ratings yet

- Historical Case Against Roe v. WadeDocument7 pagesHistorical Case Against Roe v. WadejoachimjackNo ratings yet

- The Role of History in ScienceDocument9 pagesThe Role of History in SciencejoachimjackNo ratings yet

- Dovie Beams and Philippine Politics A PRDocument42 pagesDovie Beams and Philippine Politics A PRjoachimjackNo ratings yet

- Summa Theologica On LawDocument2 pagesSumma Theologica On LawjoachimjackNo ratings yet

- Archbishop Niederauer On Pelosi's Abortion RemarksDocument4 pagesArchbishop Niederauer On Pelosi's Abortion RemarksjoachimjackNo ratings yet

- The Spanish-American War, 1898: MILESTONES: 1866-1898Document2 pagesThe Spanish-American War, 1898: MILESTONES: 1866-1898joachimjackNo ratings yet

- Philippine Historiography and Colonial DDocument26 pagesPhilippine Historiography and Colonial DjoachimjackNo ratings yet

- On The Code of MaragtasDocument7 pagesOn The Code of MaragtasjoachimjackNo ratings yet

- Statement of Income and Expenditures (CY2002) Provinces/Cities/Municipalities CombinedDocument19 pagesStatement of Income and Expenditures (CY2002) Provinces/Cities/Municipalities CombinedjoachimjackNo ratings yet

- MM & J Prequalification 24 June 2017Document7 pagesMM & J Prequalification 24 June 2017Moses Utumbe namandwaNo ratings yet

- Pfmea CR-V AmefDocument8 pagesPfmea CR-V AmefJose Antonio Santoyo RayaNo ratings yet

- My Value Trade Equity DP NSDL FormDocument56 pagesMy Value Trade Equity DP NSDL FormchetanjecNo ratings yet

- Chapter 11 Supply Chain Management 8th Ed 2011Document16 pagesChapter 11 Supply Chain Management 8th Ed 2011johnSianturiNo ratings yet

- Audit - PurchaseDocument7 pagesAudit - PurchaseCoco YenNo ratings yet

- Pobre Vs Defensor SantiagoDocument9 pagesPobre Vs Defensor SantiagoJohn Robert BautistaNo ratings yet

- 233 2011 2012 Egmont Group Annual ReportDocument49 pages233 2011 2012 Egmont Group Annual ReportMarina MihalachiNo ratings yet

- 01-SSRN-Tucker (2003) Sudah PrintDocument33 pages01-SSRN-Tucker (2003) Sudah PrintyosuaNo ratings yet

- Part 2Document179 pagesPart 2api-253241169No ratings yet

- Jawaban Tugas 2: Disusun Guna Memenuhi Tugas Auditing Dosen Pengampu: Muhrom Ali Rozai, S.E., M.E. Sy., M.Si., CRMODocument5 pagesJawaban Tugas 2: Disusun Guna Memenuhi Tugas Auditing Dosen Pengampu: Muhrom Ali Rozai, S.E., M.E. Sy., M.Si., CRMOnovitasariNo ratings yet

- Fatca Form NewDocument1 pageFatca Form NewgaurdevNo ratings yet

- SAP125 SAP Navigation 2005: SAP SCM-Procurement (MM) Academy ECC 6.0Document9 pagesSAP125 SAP Navigation 2005: SAP SCM-Procurement (MM) Academy ECC 6.0kngane8878No ratings yet

- Opm Problem Assignment 2Document10 pagesOpm Problem Assignment 2Aimes AliNo ratings yet

- Applying Innovation Resistance Theory To Understand User Acceptance of Online Shopping PDFDocument6 pagesApplying Innovation Resistance Theory To Understand User Acceptance of Online Shopping PDFdicksonhtsNo ratings yet

- Personal Information: Middleware & Java EngineerDocument5 pagesPersonal Information: Middleware & Java EngineerDonal GurningNo ratings yet

- DB2 9.7 LUW Full Online Backups - Experiments and ConsiderationsDocument26 pagesDB2 9.7 LUW Full Online Backups - Experiments and Considerationsraul_oliveira_83No ratings yet

- Computer Science Project Topics and Materials in NigeriaDocument13 pagesComputer Science Project Topics and Materials in Nigeriaለዛ ፍቅር50% (2)

- NetApp SnapMirrorDocument4 pagesNetApp SnapMirrorVijay1506No ratings yet

- IAE - International BrochureDocument12 pagesIAE - International BrochurediemthanhvuNo ratings yet

- Output and Performance-Based Roads Contract: A Case Study of Kaduna State, NigeriaDocument77 pagesOutput and Performance-Based Roads Contract: A Case Study of Kaduna State, NigeriaYusuf GiwaNo ratings yet

- KAMDAR-Annualreport2009 (1.7MB)Document87 pagesKAMDAR-Annualreport2009 (1.7MB)Kee_Mei_Chwen_2087No ratings yet

- Advances in Banking Technology and Management Impacts of ICT and CRM Premier Reference SourceDocument381 pagesAdvances in Banking Technology and Management Impacts of ICT and CRM Premier Reference SourceShilpakumari Sudhamani100% (1)

- 12 Chapter 04Document42 pages12 Chapter 04Lokesh Ujjainia UjjainiaNo ratings yet

- Case Study Arce Dairy Ice CreamDocument4 pagesCase Study Arce Dairy Ice CreamEj Lorido100% (1)

- Mind GamesDocument9 pagesMind Gamesjbnewbie60% (5)

- 2.1 Readiness AssessmentDocument4 pages2.1 Readiness AssessmentDwi DharmawanNo ratings yet