Professional Documents

Culture Documents

PSDB Internal Control Standards

PSDB Internal Control Standards

Uploaded by

joachimjack0 ratings0% found this document useful (0 votes)

61 views8 pagesThe document outlines internal control standards adopted by Pride Star Development Bank, Inc. including requirements for proper accounting records, independent balancing of records, segregation of duties, joint custody of important documents and assets, signing authorities, dual control of transactions, number controls, rotation of employee duties, independence of the internal auditor, and annual account confirmation. The standards are intended to establish controls over accounting, cash handling, lending, and other operations.

Original Description:

sample bank internal control standards

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines internal control standards adopted by Pride Star Development Bank, Inc. including requirements for proper accounting records, independent balancing of records, segregation of duties, joint custody of important documents and assets, signing authorities, dual control of transactions, number controls, rotation of employee duties, independence of the internal auditor, and annual account confirmation. The standards are intended to establish controls over accounting, cash handling, lending, and other operations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

61 views8 pagesPSDB Internal Control Standards

PSDB Internal Control Standards

Uploaded by

joachimjackThe document outlines internal control standards adopted by Pride Star Development Bank, Inc. including requirements for proper accounting records, independent balancing of records, segregation of duties, joint custody of important documents and assets, signing authorities, dual control of transactions, number controls, rotation of employee duties, independence of the internal auditor, and annual account confirmation. The standards are intended to establish controls over accounting, cash handling, lending, and other operations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

PRIDE STAR DEVELOPMENT BANK, INC.

INTERNAL CONTROL STANDARDS

The Board of Directors of Pride Star Development Bank, Inc. hereby adopts the

following internal control standards effective as of date hereof:

Proper accounting records

Maintain proper and adequate accounting records.

Keep records up-to-date.

Accounting records should contain sufficient detail to establish an audit

trail.

Tickets should bear official approval; should be initialled by originator and

by another person who checks them.

Independent balanci ng

Records posted by a person or cash held by teller or cashier should be

balanced or counted by another person.

Monthly reconciliation of general ledger balances vs. respective subsidiary

and supporting records and documentation by someone other than

bookkeeper or person handling records.

Irregular and unannounced count of tellers cash and checks and other

cash items at least twice a month by officer not connected with cash

department.

Irregular and unannounced count of vault cash including ATM cash at least

once a month by officer not connected with cash department.

Monthly reconciliation of due frombanks, cash in bank accounts (domestic

and foreign) and due from/to head office/branches by someone other than

person who handles records or posts the general ledger.

Periodic verification of securities and collaterals by someone other than the

custodian.

Periodic verification of accuracy of interest credits to deposit liabilities

accounts.

Segregation/Di vi sion of duties and responsibilities

No single officer or employee shall have complete authority and

responsibility for handling all phases of any transaction frombeginning to

end. There should always be some form of check and balance.

Physical handling of transactions should be separated from their recording

and supervision

Person handling cash does not post ledgers.

Person who posts depositors subsidiary ledgers does not post general ledger.

Lending officer does not disburse proceeds of notes, accept note payments or

post loan ledgers.

Issuance and recording segregated from signing of drafts/checks.

Checks and other cash items shall be maintained by an employee not

handling cash, provided there is adequate control in the custody and

disposition of funds.

Statements fromdepository bank are received by an employee other than the

one connected with the preparation, recording and signingof bank drafts.

Custodians of securities are not allowed to handle security transactions.

Collateral appraisal is done by an employee/officer other than the one who

approves loans.

Incoming checks and other cash items shall be recorded chronologically in a

register by an employee other than the bookkeeper before they are forwarded

for posting purposes.

Credit reports shall be obtained bysomeone other than lending officers.

Mailing of customers statements and delinquent notices shall be done by an

employee other than the one who granted the loan or the one handling the

records.

Extensive background checking of persons intended to be assigned to

handle cash and securities shall be conducted. Frequent follow-up

checking after their employment shall also be made.

Joint custody

J oint custody means that transactions shall be conducted in the presence

of and under the direct observation of a second person. Both persons shall

be equally accountable for the physical protection of the items and records

involved.

Physical protection shall be deemed established through the use of two (2)

locks or combinations on a file chest or vault compartment.

Two (2) or more persons shall be assigned to each half of the control so

that operating efficiency is not impaired if one (1) person is not immediately

available.

Persons who are related to each other within the third degree of

consanguinity or affinity shall not be made joint custodians.

The following shall be under joint custody:

Cash in vault and in ATM cash dispensers

All accountable forms

Collaterals

Securities

Documents of title and/or ownership of properties or fixed assets

Dormant or inactive deposit ledgers/EDP print-outs and corresponding

signature cards

Import documents

Trust receipts

Collection items

Duplicate keys, safe deposit spare locks and keys, and keys to unrented safe

deposit boxes

Safekeeping items

Vault door and safe combinations

Unissued specimen signature books

Correspondents and banks own telegraphic and/or electronic fund transfer

system or cable test keys currently in use

Test key fixed numbers unissued

Unissued and captured ATM cards and similar devices

Access locks and keys to on-line EDP terminals and similar devices

Access locks and keys to EDP mainframes and peripherals.

Signing authorities

Signing authorities for the different levels of officers to sign for and in

behalf of the banks shall be approved by the board of directors and the

extent of each level of authority shall be clearly defined. These signing

authorities shall include but need not be limited to the following:

Lending

Investment

Approval of expense

Various supervisory reports

Bank drafts, managers/cashiers checks, bank money orders and certificates

of time deposit

Dual control

Dual control means that the work of one (1) person is to be verified by a

second person to ensure that the transaction is properly authorized,

recorded and settled.

The routine and completion of each transaction shall involve at least two

(2) or more individuals.

Except as herein provided, the following accounts/transactions shall be

under dual control:

Cashier's/manager's checks, telegraphic transfers (TTs) and electronic fund

transfer system (EFTS) The signature of at least two (2) officers should be

required in the issuance of cashiers/managers checks and payment orders

(incoming and outgoing) of TTs and EFTS. The board of directors may,

however, prescribe a predetermined amount by which one (1) senior officer

can sign checks or payment orders, subject to appropriate control measures.

Certificates of Time Deposit The board of directors may, in its discretion,

determine the number of signatories for the issuance of certificates of time

deposit (CTDs). For this purpose, the Bank shall submit to the appropriate

department of the SES its internal control measures for the issuance of CTDs,

the minimum of which shall include the following activities:

(a) J oint custody of unissued CTD forms

(b) Accounting for all issued/cancelled CTDs

(c) Signature requirement for the issuance of CTDs

(d) Counterchecking of issued CTDs vs. tellers proofsheets/validated

slips

(e) Recording of CTD transactions

Any change in the internal control measures shall be submitted to the

appropriate department of the SES not later than thirty (30) days prior to

implementation.

Bank Drafts. The signature of two (2) authorized officers should be required in

the issuance of bank draft.

Borrowings - The signature of at least two (2) authorized officers should be

required.

All transactions giving rise to Due to or Due from accounts and all instruments

of remittances evidencing these transactions particularly those involving

substantial amounts should be approved bytwo (2) authorized officers.

Number control

Sequence number controls shall be incorporated in the accounting system

and should be used in registering notes, in issuing official checks and in

other similar situations. Bank management shall designate a person who

is detached from the banking operations involved to monitor said sequence

number controls.

The following forms, instruments and accounts should be number-

controlled:

Bank drafts

Managers and cashiers checks

Promissory notes

Savings deposit accounts

Demand deposit accounts

CTDs

Letters of credit

Collection items

Official and provisional receipts

Certificates of stocks

Loan accounts

Expense vouchers

Payment orders (incoming and outgoing ) of TTs and EFTS

Transfer requests through EFTS involving banks accounts abroad

EDP batch transmittal slips of documents

Due to/from head office/branches

Tickets

Rotation of duties

The duties of personnel handling cash, securities and bookkeeping records

shall be rotated.

Rotation assignment shall be irregular, unannounced and long enough to

permit disclosure of any irregularities or manipulations.

Tellers/cashiers shall be temporarily relieved of their duties during the

actual count of their cash accountabilities by BSP examiners or by

internal/external auditors.

Independence of the internal auditor

The by-laws shall provide for the position of internal auditor together with

the duties and responsibilities, scope and objectives of internal auditing.

The internal auditor shall report directly to the board of directors or to an

audit committee composed of directors who do not hold executive positions

in the Bank.

The internal auditor shall not install nor develop procedures, prepare

records or engage in other activities which he normally reviews or

appraises.

The internal auditor should be able to review risk management procedures,

measurement tools and assumptions.

Confirmation of accounts

At least once a year, the internal auditing staff shall confirm by direct

verification with bank clients, the following:

Balances of loans and credit accommodations of borrowers

Deposit account balances, particularly new deposit accounts, inactive or

dormant accounts and closed accounts

Outstanding balances of borrowings and other liabilities

Outstanding balances of receivables/payables

Other internal control standards

Deposit accounts

Entries to dormant account ledgers shall be verified and approved by a

designated officer. His initials shall be placed next to the entry on the

ledger sheet.

Dormant accounts shall be segregated from active account ledgers with a

separate subsidiary control.

Signature cards for dormant accounts shall be removed from active files.

All new current accounts shall be approved by a designated officer.

Signature cards and deposit ledger sheets shall be authenticated by some

form of validation. Subsequent changes shall also be validated.

Signature cards and deposit ledger sheets shall be accessible only to

authorized persons.

Deposit tickets shall be occasionally examined at irregular intervals to

determine that postings are made on the actual date deposits are received.

Checks shall be cancelled as soon as they have been paid and posted.

Reports on closed accounts and returned checks shall be prepared daily.

All current account statements shall be mailed or e-mailed or such other

electronic means direct to depositors. Undelivered statements shall be

retained by an organizational unit not responsible for demand deposit

account processing.

An officer shall be designated to attend to customers who report

differences on their statements.

Checkbooks shall be issued only against requisition forms signed by an

authorized signatory to the account.

The identity of depositors shall be clearly established.

Miscellaneous

Loan applications and related documents shall be verified to ensure their

authenticity particularly the name, residence, employment and current

reputation of the borrower.

Tellers paying checks to strangers shall obtain positive identification of the

person and the account on which the checks are drawn should be verified.

No employee shall be permitted to process transaction affecting his own

account.

Tellers and other employees having contact with customers are prohibited

from preparing deposit ticket, withdrawal slip or other forms for the

customer.

A sound recruitment policy shall be adopted.

All accountable officers and employees shall be bonded.

Internal control procedures for dormant/inacti ve accounts

Dormant or inactive accounts refers to the following:

Current or checking accounts showing no activity (deposit or withdrawals) for

a period of one (1) year.

Savings account showing no activity (deposit or withdrawals) for a period of

two (2) years.

Dormant accounts shall be reviewed and segregated at least once in

every semester.

Internal control measures:

As a matter of policy, efforts shall be exerted to prevent checking and

savings accounts from becoming dormant. When it becomes apparent

that an account is inactive, a short letter should be sent to the depositor

encouraging him to use his account. In case of checking accounts,

monthly statement of accounts shall be sent to depositors. If the

depositors cannot be located, the following steps should be undertaken:

(a) Check any significant changes or fluctuations in the depositors

account balances over a period of time with emphasis on accounts

with decreasing balances.

(b) Verify apparent reactivation entries, represented either by deposit or

withdrawal, that appears to have prevented the account from being

classified as dormant.

(c) Investigate any obvious alteration of the ledger records.

Segregated dormant accounts shall be placed under joint custody of two

(2) responsible officers/employees.

A separate ledger control for dormant accounts shall be maintained.

Signature cards for dormant accounts shall also be segregated fromactive

files and held under joint custody.

Entries to dormant account ledgers shall be verified and approved by a

designated officer. His initials shall be placed next to the entry on the

ledger sheet.

All inquiries on dormant accounts shall be coursed to one officer who

should obtain sufficient identification from the inquirer to assure that he is

entitled to the information.

A trial balance of dormant account ledgers shall be taken periodically and

balances with the general control account by an employee other than the

bookkeeper.

Dormant or inactive accounts shall be verified directly with depositors.

All transactions affecting dormant accounts shall be subject to audit by the

internal auditor.

A semestral report on deposit accounts transferred to dormant shall be

rendered to bank management.

Adopted on __11___ J une 2010.

You might also like

- Cash NarrativeDocument4 pagesCash NarrativeCaterina De LucaNo ratings yet

- Cash ManagementDocument8 pagesCash ManagementDeirdre Mae Kindipan100% (1)

- Larson12e 04Document60 pagesLarson12e 04samas7480No ratings yet

- Bank Branch Internal Audit Work ProgramDocument31 pagesBank Branch Internal Audit Work Programozlem100% (1)

- Deposit Function PDFDocument75 pagesDeposit Function PDFrojon pharmacyNo ratings yet

- Internal Controls-Accounting DepartmentDocument9 pagesInternal Controls-Accounting DepartmentInes Hamoy JunioNo ratings yet

- Sample Revenue PolicyDocument6 pagesSample Revenue Policyvb_krishnaNo ratings yet

- Financial & Accounting Policies & ProceduresDocument34 pagesFinancial & Accounting Policies & ProceduresAnnabel Strange100% (6)

- CH 2.0-PLAN THE CASH EXAMINATIONDocument12 pagesCH 2.0-PLAN THE CASH EXAMINATIONBon Carlo Medina MelocotonNo ratings yet

- MBOF912D-Financial Management-Assignment-1Document15 pagesMBOF912D-Financial Management-Assignment-1Utkarsh Singh0% (1)

- Books 5Document53 pagesBooks 5Nagesh BabuNo ratings yet

- Chapter No.02: Internal ControlDocument28 pagesChapter No.02: Internal ControlMasood khanNo ratings yet

- Chapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashDocument35 pagesChapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashEmey CalbayNo ratings yet

- Balance Means Misstatement of Some Other AccountsDocument3 pagesBalance Means Misstatement of Some Other AccountsKaila Mae Tan DuNo ratings yet

- Unit 2 Audit of Cash and Marketable SecuritiesDocument9 pagesUnit 2 Audit of Cash and Marketable Securitiessolomon adamuNo ratings yet

- 4.account Opening RequirmentsDocument16 pages4.account Opening RequirmentsTaonga Jean BandaNo ratings yet

- CashDocument9 pagesCashHenok EnkuselassieNo ratings yet

- Chapter 2 Audit Cash PDFDocument6 pagesChapter 2 Audit Cash PDFalemayehu100% (2)

- Concurrent-Audit GuideDocument71 pagesConcurrent-Audit GuideFenil RamaniNo ratings yet

- Section X 185 - Internal Control SystemDocument12 pagesSection X 185 - Internal Control SystemThessaloe B. FernandezNo ratings yet

- Cash Handling and Accounts Receivable Policy PresentationDocument22 pagesCash Handling and Accounts Receivable Policy PresentationJSNo ratings yet

- Sample Internal Controls Policy: 1. GeneralDocument2 pagesSample Internal Controls Policy: 1. Generalvb_krishnaNo ratings yet

- AUD Module 3 - Audit of CashDocument25 pagesAUD Module 3 - Audit of CashChristine CariñoNo ratings yet

- 03 Audit of CashDocument14 pages03 Audit of CashJoyce Anne GarduqueNo ratings yet

- Cash Management:: Revenue DepositsDocument26 pagesCash Management:: Revenue DepositsMomel FatimaNo ratings yet

- Annexure I (Scope of Audit - Concurrent Auditor)Document29 pagesAnnexure I (Scope of Audit - Concurrent Auditor)Niraj JainNo ratings yet

- Chapter 4 - Cash and Internal ControlsDocument10 pagesChapter 4 - Cash and Internal Controlsvictoria.05.santosNo ratings yet

- RICS - Client's Money - 04 April 2011 (HC)Document10 pagesRICS - Client's Money - 04 April 2011 (HC)jawadkollackanNo ratings yet

- 6 Cash TransactionsDocument29 pages6 Cash TransactionsZindgiKiKhatirNo ratings yet

- Vouching of Trading Transactions: Unit 2Document6 pagesVouching of Trading Transactions: Unit 2Muskan TyagiNo ratings yet

- VouchingDocument8 pagesVouchingGyanesh DoshiNo ratings yet

- Scope of Concurrent AuditDocument17 pagesScope of Concurrent AuditAnandNo ratings yet

- Roles and Responsibilities & Taking Over: Module-1Document15 pagesRoles and Responsibilities & Taking Over: Module-1kailas bankNo ratings yet

- Unit-2 Audit of Cash and Marketable SecuritiesDocument6 pagesUnit-2 Audit of Cash and Marketable SecuritiesKiya AbdiNo ratings yet

- Infolink University Collge Coursetitle: Auditing Principles and Practics Ii Credit HRS: 3 Contact Hrs:3 InstructorDocument94 pagesInfolink University Collge Coursetitle: Auditing Principles and Practics Ii Credit HRS: 3 Contact Hrs:3 InstructorBeka AsraNo ratings yet

- Chapter-2: Audit of Cash and Marketable SecuritiesDocument27 pagesChapter-2: Audit of Cash and Marketable Securitiesbikilahussen100% (1)

- Chapter 6 - Cash & Internal ControlDocument12 pagesChapter 6 - Cash & Internal ControlHareem Zoya WarsiNo ratings yet

- The Deposit FunctionDocument17 pagesThe Deposit FunctionNigel N. SilvestreNo ratings yet

- Chapter 20 - Answer PDFDocument10 pagesChapter 20 - Answer PDFjhienellNo ratings yet

- Bank AlfalahDocument19 pagesBank Alfalahsaba_qmarNo ratings yet

- Cash Receipts CycleDocument4 pagesCash Receipts CycleYenNo ratings yet

- 13application of Audit Process To Transaction Part 1Document5 pages13application of Audit Process To Transaction Part 1palicpicestepanyaNo ratings yet

- Clearing House OperationDocument22 pagesClearing House Operationshivam_7074k100% (1)

- Sub Treasury Training ReportDocument7 pagesSub Treasury Training ReportsrmurralitharanNo ratings yet

- Universal Teller - Hyderabad, Sukkur & GujranwalaDocument2 pagesUniversal Teller - Hyderabad, Sukkur & GujranwalaBilalTariqNo ratings yet

- E2C-FMP-008 Accounting and Finance ProcedureDocument12 pagesE2C-FMP-008 Accounting and Finance ProcedureVPN NetworkNo ratings yet

- Accounting For Government Revenue and Expenditure.Document19 pagesAccounting For Government Revenue and Expenditure.ERICK MLINGWANo ratings yet

- Branch Operations ControlDocument49 pagesBranch Operations ControlCASIDSID, JONALYN A.No ratings yet

- Chapter 2 AUDIT OF CASH& MARKETABLE SECURITYDocument7 pagesChapter 2 AUDIT OF CASH& MARKETABLE SECURITYsteveiamidNo ratings yet

- Approach For Safety of Loans Follow Up and Monitoring Process Q3Document6 pagesApproach For Safety of Loans Follow Up and Monitoring Process Q3maunilshahNo ratings yet

- Unit 2Document11 pagesUnit 2fekadegebretsadik478729No ratings yet

- RB Chapter 2A-Current Account-MITCDocument9 pagesRB Chapter 2A-Current Account-MITCRohit KumarNo ratings yet

- Internal Control Procedures Chapter 4Document32 pagesInternal Control Procedures Chapter 4lukeNo ratings yet

- F.2. Basic Bank Documents and Terminologies Related To BankDocument28 pagesF.2. Basic Bank Documents and Terminologies Related To BankSecret DeityNo ratings yet

- BankingDocument47 pagesBankingDeepansh GoyalNo ratings yet

- Secretarial Accounting 2Document98 pagesSecretarial Accounting 2NabuteNo ratings yet

- Sample Sacco Internal Controls PolicyDocument11 pagesSample Sacco Internal Controls PolicyAmulioto Elijah MuchelleNo ratings yet

- Bank Reconciliation Best PracticesDocument3 pagesBank Reconciliation Best Practiceshossainmz100% (2)

- Universal Teller - Karachi, Lahore, Islamabad, Abbottabad, KhairpurDocument2 pagesUniversal Teller - Karachi, Lahore, Islamabad, Abbottabad, KhairpurBilalTariqNo ratings yet

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementFrom EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNo ratings yet

- The beautiful side to border townsDocument2 pagesThe beautiful side to border townsjoachimjackNo ratings yet

- La Estrella, AragonDocument9 pagesLa Estrella, AragonjoachimjackNo ratings yet

- Metrobank List of RequirementsDocument1 pageMetrobank List of RequirementsjoachimjackNo ratings yet

- Review of Scruton's book On Human NatureDocument7 pagesReview of Scruton's book On Human NaturejoachimjackNo ratings yet

- Adoro te devote translationDocument1 pageAdoro te devote translationjoachimjackNo ratings yet

- PQF LevelsDocument2 pagesPQF LevelsjoachimjackNo ratings yet

- Whose Common Good CountsDocument19 pagesWhose Common Good CountsjoachimjackNo ratings yet

- Michel Foucault (from Fazio book)Document4 pagesMichel Foucault (from Fazio book)joachimjackNo ratings yet

- Answering a leading questionDocument3 pagesAnswering a leading questionjoachimjackNo ratings yet

- Derrida and Rorty (from Fazio book)Document5 pagesDerrida and Rorty (from Fazio book)joachimjackNo ratings yet

- Finnis-What Is A LawDocument7 pagesFinnis-What Is A LawjoachimjackNo ratings yet

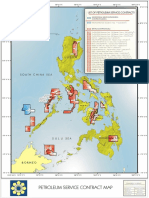

- PECR Petroleum Area Map FDocument1 pagePECR Petroleum Area Map FjoachimjackNo ratings yet

- The Spanish-American War, 1898: MILESTONES: 1866-1898Document2 pagesThe Spanish-American War, 1898: MILESTONES: 1866-1898joachimjackNo ratings yet

- dc2007-5847 EDCDocument1 pagedc2007-5847 EDCjoachimjackNo ratings yet

- SCMAPDocument1 pageSCMAPjoachimjackNo ratings yet

- The Role of History in ScienceDocument9 pagesThe Role of History in SciencejoachimjackNo ratings yet

- POs and PEOsDocument8 pagesPOs and PEOsjoachimjackNo ratings yet

- Historical Case Against Roe v. WadeDocument7 pagesHistorical Case Against Roe v. WadejoachimjackNo ratings yet

- PSALM - Industry ProspectusDocument15 pagesPSALM - Industry ProspectusjoachimjackNo ratings yet

- Sec Cert - Simlong Energy Increase of Capital Stock 07-13-21Document1 pageSec Cert - Simlong Energy Increase of Capital Stock 07-13-21joachimjackNo ratings yet

- Committee On Accountability of Public Officers and Investigations (Blue Ribbon)Document38 pagesCommittee On Accountability of Public Officers and Investigations (Blue Ribbon)joachimjackNo ratings yet

- Active Petroleum Contracts RevisedDocument2 pagesActive Petroleum Contracts RevisedjoachimjackNo ratings yet

- Why Did CJ Roberts Disagree With Overturning Roe V WadeDocument4 pagesWhy Did CJ Roberts Disagree With Overturning Roe V WadejoachimjackNo ratings yet

- Philippine Historiography and Colonial DDocument26 pagesPhilippine Historiography and Colonial DjoachimjackNo ratings yet

- Summa Theologica On LawDocument2 pagesSumma Theologica On LawjoachimjackNo ratings yet

- Archbishop Niederauer On Pelosi's Abortion RemarksDocument4 pagesArchbishop Niederauer On Pelosi's Abortion RemarksjoachimjackNo ratings yet

- Dovie Beams and Philippine Politics A PRDocument42 pagesDovie Beams and Philippine Politics A PRjoachimjackNo ratings yet

- On The Code of MaragtasDocument7 pagesOn The Code of MaragtasjoachimjackNo ratings yet

- Statement of Income and Expenditures (CY2002) Provinces/Cities/Municipalities CombinedDocument19 pagesStatement of Income and Expenditures (CY2002) Provinces/Cities/Municipalities CombinedjoachimjackNo ratings yet

- HBS Article - The Process of Strategy Definition and ImplementationDocument9 pagesHBS Article - The Process of Strategy Definition and ImplementationSHAILY KASAUNDHANNo ratings yet

- Erp Implementation of Ifrs For Smes: DissertationDocument68 pagesErp Implementation of Ifrs For Smes: DissertationGaurav Kumar Kureel100% (1)

- 1q Entrep Module Week 1 MidtermDocument29 pages1q Entrep Module Week 1 MidtermjerrilynagaraoNo ratings yet

- Domestic Travel ReadingDocument3 pagesDomestic Travel ReadingBenian TuncelNo ratings yet

- Adam SmithDocument13 pagesAdam Smithshabbar aliNo ratings yet

- Triveni Turbine PDFDocument144 pagesTriveni Turbine PDFmpgzyahNo ratings yet

- International Cha 2Document26 pagesInternational Cha 2felekebirhanu7No ratings yet

- Management by Objectives (MBO)Document25 pagesManagement by Objectives (MBO)John BerkmansNo ratings yet

- Senior Relationship ManagerDocument1 pageSenior Relationship ManagerParamjit singh MakkarNo ratings yet

- Thomas L. Wheelen J. David HungerDocument19 pagesThomas L. Wheelen J. David HungerAriel AlvarezNo ratings yet

- Bridgeport CT Adopted Budget 2010-2011Document552 pagesBridgeport CT Adopted Budget 2010-2011BridgeportCTNo ratings yet

- Agri TourismDocument5 pagesAgri TourismPradeep Reddy BoppidiNo ratings yet

- 5 - Econ - Advanced Economic Theory (Eng)Document1 page5 - Econ - Advanced Economic Theory (Eng)David JackNo ratings yet

- FROM: 4. TO:: LM - PodDocument1 pageFROM: 4. TO:: LM - PodBewabaNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 64-2020 Issued On June 24, 2020 CircularizesDocument2 pagesREVENUE MEMORANDUM CIRCULAR NO. 64-2020 Issued On June 24, 2020 CircularizesAceGun'nerNo ratings yet

- ECO 306 Final Project II Sarai SternzisDocument8 pagesECO 306 Final Project II Sarai SternzisSarai SternzisNo ratings yet

- Appellants Memorial - RDocument42 pagesAppellants Memorial - RNiteshMaheshwari100% (1)

- Case On Restrutthis Case Is To Understand Capital RestructuringDocument17 pagesCase On Restrutthis Case Is To Understand Capital RestructuringPriyanka DwivediNo ratings yet

- Lange - On The Economic Theory of Socialism PDFDocument2 pagesLange - On The Economic Theory of Socialism PDFCarlosAntonioPerezGuzmanNo ratings yet

- JVZOO Cash Ebook PDFDocument38 pagesJVZOO Cash Ebook PDFderic soon100% (2)

- Industryanalysis-Porter'S Five Forces FrameworkDocument9 pagesIndustryanalysis-Porter'S Five Forces FrameworkHaseeb TariqNo ratings yet

- COBIT OverviewDocument17 pagesCOBIT OverviewPriambodoNo ratings yet

- Catherine Morris - Demystifying SustainabilityDocument34 pagesCatherine Morris - Demystifying SustainabilityshivalikaNo ratings yet

- Southern University BangladeshDocument1 pageSouthern University BangladeshRaihanNo ratings yet

- Uw 19 Phy Bs 059Document1 pageUw 19 Phy Bs 059Afghan LoralaiNo ratings yet

- Paper The Prophet of InnovationDocument11 pagesPaper The Prophet of InnovationDiogo FidelesNo ratings yet

- Topic: Key Account Management, Strategies & Practices in Pharmaceutical Industry of India. A SynopsisDocument5 pagesTopic: Key Account Management, Strategies & Practices in Pharmaceutical Industry of India. A Synopsissanjeev_soni725951No ratings yet

- Bharathidasan University, Tiruchirappalli.: M.B.A.November-2021 Examinations Time TableDocument3 pagesBharathidasan University, Tiruchirappalli.: M.B.A.November-2021 Examinations Time TableSiva MoorthyNo ratings yet