Professional Documents

Culture Documents

CIB Industrial Report

CIB Industrial Report

Uploaded by

William HarrisCopyright:

Available Formats

You might also like

- 3rd BOCE MinutesDocument8 pages3rd BOCE MinutesKrishna Kanth KNo ratings yet

- Group 7 - Belle Air CharterDocument6 pagesGroup 7 - Belle Air Charteranubhav110950% (2)

- PSE vs. Litonjua-Oblicon Case DigestDocument2 pagesPSE vs. Litonjua-Oblicon Case Digestc@rpe_diemNo ratings yet

- Source: Grubb and Ellis CB Richard Ellis Spaulding and Slye Economics R Ha ItDocument45 pagesSource: Grubb and Ellis CB Richard Ellis Spaulding and Slye Economics R Ha ItOffice of PlanningNo ratings yet

- Atlanta Office Market Report Q3 2011Document2 pagesAtlanta Office Market Report Q3 2011Anonymous Feglbx5No ratings yet

- Definitions of MarketingDocument2 pagesDefinitions of MarketingEric James AbarroNo ratings yet

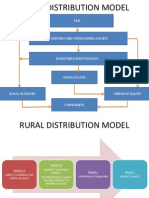

- Hul Distribution ModelDocument5 pagesHul Distribution ModelBhavik LodhaNo ratings yet

- EY Capturing Synergies in DealmakingDocument4 pagesEY Capturing Synergies in DealmakingAndrey PritulyukNo ratings yet

- Ownership of Joint Housing Act 20541997 EnglishDocument14 pagesOwnership of Joint Housing Act 20541997 EnglishDibishPurkotiNo ratings yet

- Industrial PDFDocument4 pagesIndustrial PDFAnonymous Feglbx5No ratings yet

- Spec Development PDFDocument6 pagesSpec Development PDFAnonymous Feglbx5No ratings yet

- Q4 2014 Industrial Market ReportDocument4 pagesQ4 2014 Industrial Market ReportDeven GriffinNo ratings yet

- Q2 2014 Industrial Market ReportDocument4 pagesQ2 2014 Industrial Market ReportDeven GriffinNo ratings yet

- Marketbeat: Industrial SnapshotDocument2 pagesMarketbeat: Industrial SnapshotAnonymous Feglbx5No ratings yet

- Howard County 3Q11Document3 pagesHoward County 3Q11William HarrisNo ratings yet

- Office OverviewDocument22 pagesOffice OverviewAnonymous Feglbx5No ratings yet

- WashingtonDocument2 pagesWashingtonAnonymous Feglbx5No ratings yet

- 2Q14 Atlanta Industrial Market ReportDocument4 pages2Q14 Atlanta Industrial Market ReportBea LorinczNo ratings yet

- CAE Q1 2013 Market ReportsDocument8 pagesCAE Q1 2013 Market ReportsColliersIntlSCNo ratings yet

- Baltimore Highlights Q2 2011 JLLDocument2 pagesBaltimore Highlights Q2 2011 JLLAnonymous Feglbx5No ratings yet

- Industrial 2Q12 Market ViewDocument2 pagesIndustrial 2Q12 Market ViewWayneBeeversNo ratings yet

- Office Market Snapshot: Suburban Maryland Fourth Quarter 2013Document2 pagesOffice Market Snapshot: Suburban Maryland Fourth Quarter 2013Anonymous Feglbx5No ratings yet

- 2Q2013 CIB Retail ReportDocument3 pages2Q2013 CIB Retail ReportAnonymous Feglbx5No ratings yet

- Tenant Report 3Q 2011 DC - FINAL-LetterDocument4 pagesTenant Report 3Q 2011 DC - FINAL-LetterAnonymous Feglbx5No ratings yet

- Palm BeachDocument5 pagesPalm BeachAnonymous Feglbx5No ratings yet

- 1 PDFDocument4 pages1 PDFAnonymous Feglbx5No ratings yet

- Boho Omdraft 051618rDocument86 pagesBoho Omdraft 051618rmacconsaNo ratings yet

- Palm Beach County Office MarketView Q1 2016Document4 pagesPalm Beach County Office MarketView Q1 2016William HarrisNo ratings yet

- Logistics Market View H22010Document6 pagesLogistics Market View H22010Bala Lakshmi NarayanaNo ratings yet

- WR IndustrialMarketReport 2015Q4Document8 pagesWR IndustrialMarketReport 2015Q4Ron JansenNo ratings yet

- BaltimoreOfficeSnapshot Q32012Document2 pagesBaltimoreOfficeSnapshot Q32012Anonymous Feglbx5No ratings yet

- Cleveland Office 2nd Quarter 2011Document2 pagesCleveland Office 2nd Quarter 2011julie_lynch5049No ratings yet

- Team Porter Industrial MarketView: Q1 2014Document4 pagesTeam Porter Industrial MarketView: Q1 2014team_porterNo ratings yet

- Office Market Report: Baltimore Metro Economic Outlook (A Little) BrighterDocument4 pagesOffice Market Report: Baltimore Metro Economic Outlook (A Little) BrighterAnonymous Feglbx5No ratings yet

- Baltimore Office: Quick StatsDocument4 pagesBaltimore Office: Quick StatsAnonymous Feglbx5No ratings yet

- Rock Island Partners ProfileDocument9 pagesRock Island Partners ProfileJoePrimmNo ratings yet

- 1 PDFDocument6 pages1 PDFAnonymous Feglbx5No ratings yet

- CT NoVA 3Q13 SnapshotDocument2 pagesCT NoVA 3Q13 SnapshotAnonymous Feglbx5No ratings yet

- Baltimore I-95 North PDFDocument3 pagesBaltimore I-95 North PDFAnonymous Feglbx5No ratings yet

- Singapore Property Weekly Issue 57Document14 pagesSingapore Property Weekly Issue 57Propwise.sgNo ratings yet

- Q2 2012 OfficeSnapshotDocument2 pagesQ2 2012 OfficeSnapshotAnonymous Feglbx5No ratings yet

- Omr PDFDocument19 pagesOmr PDFAnonymous Feglbx5No ratings yet

- Market & Feasibility Study Prepared byDocument57 pagesMarket & Feasibility Study Prepared byneuoneallNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- CT DC 2Q14 SnapshotDocument2 pagesCT DC 2Q14 SnapshotWilliam HarrisNo ratings yet

- The First Quarter Continues Positive Trends Seen in 2014: ResearchDocument6 pagesThe First Quarter Continues Positive Trends Seen in 2014: ResearchAnonymous Feglbx5No ratings yet

- South Q2 2012 IND ReportDocument3 pagesSouth Q2 2012 IND ReportAnonymous Feglbx5No ratings yet

- Retail Q3 2014 Overview PDFDocument4 pagesRetail Q3 2014 Overview PDFAnonymous Feglbx5No ratings yet

- Steady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterDocument5 pagesSteady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterAnonymous Feglbx5No ratings yet

- North Q4 2012 IND ReportDocument3 pagesNorth Q4 2012 IND ReportAnonymous Feglbx5No ratings yet

- 2014 Office TRENDSDocument20 pages2014 Office TRENDSGreater Baton Rouge Association of REALTORS® Commercial Investment DivisionNo ratings yet

- 2013 2Q Industrial SnapshotDocument2 pages2013 2Q Industrial SnapshotCassidy TurleyNo ratings yet

- 2011Q3 Industrial Report NorthDocument3 pages2011Q3 Industrial Report NorthAnonymous Feglbx5No ratings yet

- South Q1 2014 IND ReportDocument4 pagesSouth Q1 2014 IND ReportAnonymous Feglbx5No ratings yet

- Richmond AMERICAS Alliance MarketBeat Industrial Q32013Document2 pagesRichmond AMERICAS Alliance MarketBeat Industrial Q32013Anonymous Feglbx5No ratings yet

- Miami PDFDocument5 pagesMiami PDFAnonymous Feglbx5No ratings yet

- Q4 2012 OfficeSnapshot-NewDocument2 pagesQ4 2012 OfficeSnapshot-NewAnonymous Feglbx5No ratings yet

- Singapore Property Weekly Issue 44Document15 pagesSingapore Property Weekly Issue 44Propwise.sgNo ratings yet

- T5-6 Feas Study FinalDocument17 pagesT5-6 Feas Study FinalRecordTrac - City of OaklandNo ratings yet

- HAL 1Q24 Earnings ReleaseDocument12 pagesHAL 1Q24 Earnings ReleaseShadowMenNo ratings yet

- Indeks Harga CEPCI 2010Document2 pagesIndeks Harga CEPCI 2010juang_ariandoNo ratings yet

- Abu Dhabi Market Overview - Q1 2012 - FINALDocument3 pagesAbu Dhabi Market Overview - Q1 2012 - FINALAnu ThariyanNo ratings yet

- Industrial StrategyDocument80 pagesIndustrial StrategyPorumbacean RemusNo ratings yet

- Office Q2 2016 FullReportDocument17 pagesOffice Q2 2016 FullReportWilliam HarrisNo ratings yet

- Industrial PDFDocument2 pagesIndustrial PDFAnonymous Feglbx5No ratings yet

- Major Alberta ProjectsDocument71 pagesMajor Alberta Projectsthecolonel77No ratings yet

- District Cooling in the People's Republic of China: Status and Development PotentialFrom EverandDistrict Cooling in the People's Republic of China: Status and Development PotentialNo ratings yet

- 2023 Fast 500 Winners List v1.1Document16 pages2023 Fast 500 Winners List v1.1William HarrisNo ratings yet

- April 2024 CPRA Board Simoneaux 20240415 CompressedDocument37 pagesApril 2024 CPRA Board Simoneaux 20240415 CompressedWilliam HarrisNo ratings yet

- Industry Update H2 2021 in Review: Fairmount PartnersDocument13 pagesIndustry Update H2 2021 in Review: Fairmount PartnersWilliam HarrisNo ratings yet

- Market Report 2023 Q1 Full ReportDocument17 pagesMarket Report 2023 Q1 Full ReportKevin ParkerNo ratings yet

- Q1 2023 AcquisitionsDocument28 pagesQ1 2023 AcquisitionsWilliam HarrisNo ratings yet

- 2023 ASI Impact ReportDocument43 pages2023 ASI Impact ReportWilliam HarrisNo ratings yet

- 2022 Abell Foundation Short Form Report 8yrDocument36 pages2022 Abell Foundation Short Form Report 8yrWilliam HarrisNo ratings yet

- QR 3 - FinalDocument20 pagesQR 3 - FinalWilliam HarrisNo ratings yet

- Development: Washington, DCDocument96 pagesDevelopment: Washington, DCWilliam HarrisNo ratings yet

- Atlanta 2022 Multifamily Investment Forecast ReportDocument1 pageAtlanta 2022 Multifamily Investment Forecast ReportWilliam HarrisNo ratings yet

- 3Q21 I81 78 Industrial MarketDocument5 pages3Q21 I81 78 Industrial MarketWilliam HarrisNo ratings yet

- DSB Q3Document8 pagesDSB Q3William HarrisNo ratings yet

- Copt 2021Document44 pagesCopt 2021William HarrisNo ratings yet

- Gun Stocks: Fear Fires Up Investors To Purchase Gun StocksDocument14 pagesGun Stocks: Fear Fires Up Investors To Purchase Gun StocksWilliam HarrisNo ratings yet

- FP Pharmaceutical Outsourcing Monitor 08.30.21Document30 pagesFP Pharmaceutical Outsourcing Monitor 08.30.21William HarrisNo ratings yet

- FP - CTS Report Q3.20Document13 pagesFP - CTS Report Q3.20William HarrisNo ratings yet

- Healthcare Technology Mailer v14Document4 pagesHealthcare Technology Mailer v14William HarrisNo ratings yet

- Manhattan RetailDocument9 pagesManhattan RetailWilliam HarrisNo ratings yet

- For Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentDocument5 pagesFor Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentWilliam HarrisNo ratings yet

- 2020 Q3 Industrial Houston Report ColliersDocument7 pages2020 Q3 Industrial Houston Report ColliersWilliam HarrisNo ratings yet

- FP - CTS Report H1.21Document13 pagesFP - CTS Report H1.21William HarrisNo ratings yet

- TROW Q3 2020 Earnings ReleaseDocument15 pagesTROW Q3 2020 Earnings ReleaseWilliam HarrisNo ratings yet

- Comms Toolkit For MD Clean Energy Town HallDocument4 pagesComms Toolkit For MD Clean Energy Town HallWilliam HarrisNo ratings yet

- Richmond Office Performance in DownturnsDocument1 pageRichmond Office Performance in DownturnsWilliam HarrisNo ratings yet

- Regional Surveys of Business ActivityDocument2 pagesRegional Surveys of Business ActivityWilliam HarrisNo ratings yet

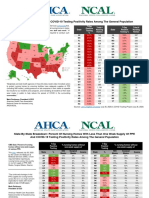

- State-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationDocument2 pagesState-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationWilliam HarrisNo ratings yet

- Kohinoor Textile MillDocument90 pagesKohinoor Textile MillSaMeia FarhatNo ratings yet

- AmdeDocument4 pagesAmdeGoogle ComputerNo ratings yet

- Salesforce Promotion - SirmaurDocument21 pagesSalesforce Promotion - SirmaurAnkit PuniaNo ratings yet

- Biscuit Industry India KuberDocument17 pagesBiscuit Industry India KuberPRIYA KUMARINo ratings yet

- Olpers: Product DefinitionDocument3 pagesOlpers: Product DefinitionAhsan Ul Haq100% (1)

- Bep QuestionDocument5 pagesBep QuestionVinesh KumarNo ratings yet

- Chapter 7 - Making The Sales Call Creating & Communicating ValuesDocument39 pagesChapter 7 - Making The Sales Call Creating & Communicating Valuesnhizza dawn DaligdigNo ratings yet

- Personal Selling..Document35 pagesPersonal Selling..Charu ModiNo ratings yet

- Story of Stuff - Victor LebowDocument9 pagesStory of Stuff - Victor LebowJeff100% (8)

- Lifebuoy MKT MixDocument10 pagesLifebuoy MKT MixThùyTrangAppleNo ratings yet

- Service Failure and Recovery Questionnaire EnglishDocument22 pagesService Failure and Recovery Questionnaire EnglishAli AslamNo ratings yet

- Unit-9 Job Analysis, Recruitment and Selection PDFDocument15 pagesUnit-9 Job Analysis, Recruitment and Selection PDFbhar4tpNo ratings yet

- Bel Brand Laughing Cow ChallengeDocument7 pagesBel Brand Laughing Cow Challengealhamd50% (2)

- Profit Center ProcessDocument21 pagesProfit Center Processjiljil1980No ratings yet

- Accounting Ratios FormulasDocument3 pagesAccounting Ratios FormulasEshan BhattNo ratings yet

- Accounting For Merchandising OperationsDocument32 pagesAccounting For Merchandising OperationsAllen CarlNo ratings yet

- Global CV Model Sales and Production Trend & Forecast 2023Document14 pagesGlobal CV Model Sales and Production Trend & Forecast 2023sinharicNo ratings yet

- Book-Responsibility Actg-SolMan PDFDocument18 pagesBook-Responsibility Actg-SolMan PDFLordson RamosNo ratings yet

- Process Analysis WSDDocument28 pagesProcess Analysis WSDAkhilesh ChaudharyNo ratings yet

- Pankaj Nayan ThakurDocument5 pagesPankaj Nayan ThakurRobbie ShawNo ratings yet

- Summer Training Report 2Document49 pagesSummer Training Report 2Ankit SharmaNo ratings yet

- Diagnostic ExamDocument8 pagesDiagnostic ExamMabelle Dabu FacturananNo ratings yet

- Morning Session Q&ADocument50 pagesMorning Session Q&AGANESH MENONNo ratings yet

CIB Industrial Report

CIB Industrial Report

Uploaded by

William HarrisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIB Industrial Report

CIB Industrial Report

Uploaded by

William HarrisCopyright:

Available Formats

www.colliers.

com/greaterbaltimore

Summer Is Over, But

Construction Is Still Hot

REGIONAL OVERVIEW

Q3 2014 | INDUSTRIAL USE

INDUSTRIAL MARKET REPORT

BALTIMORE METRO AREA

Colliers | Baltimore tracks 55

tenants and buyers in the

market searching for a total

of 3,067,800 sf of space

8 buildings currently under

construction totaling

3,110,773 sf

Almost 1 million square feet

under construction is spec

The Baltimore industrial/fex market continues to perform well as users take large blocks of

space in an already tight market. Overall vacancy rates ended at 10% for both fex and

industrial space, and over 1 million square feet of space absorbed. Industrial vacancy was

unchanged at 10% even with several deliveries during the quarter. Industrial average rental

rates evened out at $4.60 NNN and have not fuctuated much in the past 3 years. Flex asking

rates ended at $10.80 NNN, slightly lower than the past 6 months. Several large projects came

online this quarter including Reliable Churchills new 449,000 sf facility at Crossroads @95

which brings an estimated 500 workers to Baltimore County. Sephora also opened their

655,000 sf facility in Perryman bringing 400 workers to Harford County. One project expected

to begin this year was the CSX intermodal facility and Mount Clare yard in Southwest

Baltimore which was rejected by city leaders and local residents, leaving ofcials and

developers scurrying to fnd an alternative spot before larger ships begin making deliveries to

the port.

Currently, there are 8 buildings under constructions totaling 3,110,773 sf. These include 7210

Preston Gateway Drive in Hanover which will house Coca-Cola for 291,000 sf. Amazons

fulfllment center at 5501 Holabird Avenue for 1,017,550 sf is due to deliver this year. Besides

those build-to-suits, there is also over 1 million sf of spec space under construction which

speaks to the confdence developers have in the market. For example, Chesapeake Real Estate

Group has planned an additional million square feet of spec development in Baltimore County

East, and Cecil County due to break ground later this year.

Leasing activity remained strong in the 3

rd

quarter absorbing over 1 million square feet of

space. Among the largest leases signed were Restoration Hardware at 8416 Kelso Drive for

508,100 sf, and Coastal Sunbelt at 9001 Whiskey Bottom Road for 244,500 sf. Investment and

user sales increased as has been the trend for the last 24 months. Kelso Business Park sold to

FRP Development for $4,850,000. COPT sold their portfolio in White Marsh, including 4969 &

4979 Mercantile Road purchased by Hill Management for $5,900,000. Cabot Properties bought

a 6 building portfolio from First Industrial at Beltway West for $28.5 million.

Vacancy rate for bulk distribution space evened out at 10%. Even with an infux of

speculative development planned, demand will remain strong, and much of that

space will likely be preleased.

Cap rates rose to 8.4%, after declining most of 2014.

www.colliers.com/marketname

DEFINITIONS

> Catalogued Inventory: Class A & B fex buildings over 10,000 sf and distribution warehouse buildings over 100,000 sf. This inventory

includes a total of 1,339 buildings consisting of more than 138,000,000 square feet of space.

> Market Area: Baltimore City and the surrounding counties of Anne Arundel, Howard, Baltimore, Cecil, Harford and Carroll.

> Vacancy Rate: Total vacant space divided by the total inventory.

> Net Absorption: The diference in physically occupied space within a given time period.

> Average Asking Rent: Weighted average rent per square foot, triple net

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2011 2012 2013 2014

T

h

o

u

s

a

n

d

s

Net Absorption

(all product types)

8.0%

9.0%

10.0%

11.0%

12.0%

13.0%

2011 2012 2013 2014

Vacancy Rate

(all product types)

Vacancy rates for fex space steadily decrease ending at 10%, and should

continue that trend throughout the balance of the year.

Spec development is back in a big way with the If we build it, they will come

mentality.

As cap rates continue to compress on Class A product, investor surge is expected

for Class B buildings.

Colliers tracks 55 tenants and buyers in the market searching for a total of

3,067,800 SF of space

Although Prince Georges county is not included in the Baltimore regional statistics, it remains

an important and strategic location for the Baltimore area. PG County consists of 225 existing

buildings and approximately 22,300,000 square feet of space. At the end of the 3

rd

quarter of

2014, more than 3,300,000 square feet of that space was vacant, equivalent to a vacancy

rate of 15%.

MARKET INDICATORS

Q2 2014 Q3 2014

VACANCY

NET ABSORPTION

CONSTRUCTION

RENTAL RATE

$4.00

$4.20

$4.40

$4.60

$4.80

$5.00

$5.20

$5.40

Q3 2013 Q1 2014 Q2 2014 Q3 2014

Bulk & Warehouse Asking Rental Rates (NNN)

$9.50

$10.00

$10.50

$11.00

$11.50

$12.00

Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014

Flex Space Asking Rental Rates (NNN)

RESEARCH & FORECAST REPORT | Q3 2014 | INDUSTRIAL USE | BALTIMORE

www.colliers.com/marketname

INVESTMENT SALES ACTIVITY

PROPERTY ADDRESS SALES DATE SALES PRICE SIZE SF SELLER BUYER PRICE/SF SUBMARKET

504 Advantage Way 9/2014 $31,000,000 528,780 sf ZAIS Group SK Realty $58.63 Aberdeen

1812-1820 Margaret Avenue 8/2014 $4,300,000 42,214 sf Boben Joint Venture ShoreGate of Margaret Ave $101.86 Annapolis

5020 Campbell Boulevard 8/2014 $12,400,000 43,791 sf COPT Douglas Legum Development $92.20 Baltimore County East

7120-7132 Ambassador Road 7/2014 $3,450,880 46,971 sf First Industrial Realty Trust Cabot Properties $73.47 Baltimore Southwest

7155 Montevideo Road 7/2014 $12,499,999 109,540 sf DCT Industrial Trust TA Associates $73.92 Route 1 Corridor

4611 Mercedes Drive 7/2014 $7,650,000 70,133 sf DCT Industrial TA Associates $42.95 Aberdeen

2700 Lord Baltimore Drive 7/2014 $5,700,000 59,057 sf First Industrial Realty Trust Cabot Properties $92.00 Baltimore Southwest

2209 Sulphur Spring Road 7/2014 $11,500,000 313,000 sf Alliance Partners Federal Capital Partners $36.74 Baltimore Southwest

LEASING ACTIVITY

PROPERTY ADDRESS LEASE DATE LEASE SF LESSEE TYPE SUBMARKET

8416 Kelso Drive 9/2014 508,171 sf Restoration Hardware Industrial Baltimore County East

9001 Whiskey Bottom Road 8/2014 244,500 sf Coastal Sunbelt Produce Industrial Route 1 Corridor

6610 Cabot Drive 7/2014 153,452 sf W.R. Grace & Co. Industrial Route 2 Corridor

7020 Dorsey Road 8/2014 22,410 sf Brekford Corporation Industrial BWI/AA County

7195 Troy Hill Drive 7/2014 13,481 sf Comcast Flex BWI/Howard County

3121 Washington Boulevard 7/2014 70,790 sf Arnolds Factory Supplies Industrial Baltimore Southwest

UPDATE: MARKET COMPARISONS

Net Absorption New Construction Rental Rates (NNN)

SUBMARKET/COUNTY TOTAL SF VACANT SF VACANCY % CURRENT QUARTER YTD CURRENT COMPLETED WH/DIST R&D/FLEX

Baltimore Southwest 7,420,565 979,743 13.2% -2,509 40,044 0 0 $3.28 $7.22

Baltimore East 24,659,404 2,862,149 11.6% 479,835 1,114,092 2,092,133 449,299 $3.91 $10.19

Harford/Cecil County 28,088,704 1,746,734 6.2% 1,025,611 1,359,579 571,500 1,600,742 $4.36 $11.02

Anne Arundel County 24,190,523 2,793,722 11.5% -48 -204,670 291,000 243,500 $5.35 $9.19

Howard County 30,476,695 3,913,274 12.8 88,414 -9,221 156,140 241,709 $5.58 $13.36

Carroll County 6,192,816 223,713 3.6% -9,600 206,162 0 0 $8.00 $15.00

Prince Georges County 22,184,124 3,236,405 14.6% -52,260 -228,441 355,803 0 $6.01 $9.13

QUARTERLY COMPARISON AND TOTALS

QUARTER TOTAL RBA VACANT SF VACANCY %

CURRENT Q

ABSORPTION

CURRENT

CONSTRUCTION

COMPLETED

DELIVERIES

AVERAGE RENTAL

RATES (NNN)

Q3 2014 138,518,895 14,016,870 10.1% 1,537,977 3,110,773 2,535,250 $5.57

Q2 2014 135,983,645 13,019,597 9.6% 637,096 4,190,208 30,120 $5.63

Q1 2014 137,656,817 15,329,865 11.1% -938,819 3,873,920 0 $5.78

Q3 2013 137,889,397 sf 14,222,024 sf 10.3% 329,317 sf 1,008,967 sf 51,120 sf $5.70

Q4 2013 137,656,817 14,391,046 10.5% 494,644 3,582,920 80,914 $5.66

RESEARCH & FORECAST REPORT | Q3 2014 | INDUSTRIAL USE | BALTIMORE METRO AREA

Submarkets

HOWARD COUNTY

The industrial market in Howard County straddles

I-95 and Route 1. Major employers include Verizon

and Sysco. The industrial market represents more

than 30,000,000 square feet of space. Vacancy

rates ended the quarter at 12.2%, which was

relatively unchanged for the last 18 months.

Coastal Sunbelt is in the process of building a

240,000 sf facility on Whiskey Bottom Road.

Chicago Metallic signed a 27,300 sf lease at Santa

Barbara Court, and RMP National leased 38,256 sf

at 8242 Sandy Court. Merritt Properties

announced they would construct a new 88,000 sf

facility at 7775 S. Chesapeake Bay Court in

Jessup adjacent to the Maryland Seafood Market.

As for investment sales, TA Associates will now

be Elite Spices landlord at 7151 Montevideo after

buying two buildings for $12.49 million.

ANNE ARUNDEL COUNTY

The industrial and fex market in Anne Arundel

County is adjacent to Howard County and

consists of more than 24,000,000 square feet of

space. Major employers include Fort George G.

Meade, Northrop Grumman and the BWI

Thurgood Marshall Airport. Vacancy rates

continued to rise during 2014, ending the 3

rd

quarter at 11.6%. However, much of the space is

expected to be absorbed. W.R. Grace signed a

151,000 sf lease at 6610 Cabot Drive. Carrier took

180,000 sf at 7481 Coca Cola Drive. Terreno

signed Excel Group, Afterglow Lighting and

Beverage Network at Route 100 Business Park.

Hartz Mountain bought 7448 Candlewood for

$18.7 million, and 1805 Margaret Avenue sold for

$4.3 million.

HARFORD/CECIL COUNTIES

The Harford and Cecil County submarket spans

the I-95 & the Rt. 40 corridor up to the Delaware

line and represents more than 28,000,000 square

feet of space. Major employers in this market

include Rite Aid, Kohls and Sephora. Unlike ofce

vacancy in Harford County, industrial/fex space

is in high demand, and there is not enough of it.

Vacancy rates spiked slightly to 7% with the

delivery of over a million square feet of space this

quarter, however that is expected to absorb

quickly. IKEA signed a 184,000 sf lease at 1840

Clark Road. Proctor & Gamble sold their

warehouse at 1805 Fashion Court for $11.65

million to One Liberty Properties who intend to

reposition the asset after P&Gs lease comes to

end in 2015. Advantage Business Park sold for

$31 million to SK Realty Management, and TA

Associates bought 4611 Mercedes Drive for $7.65

million. Chesapeake Real Estate is expected to

break ground later this year on 610 Chelsea Road,

which will be approximately 570,000 sf spec

building. Besides that, Principio Business Park in

Cecil County is fully permitted, and is the only

property in Maryland capable of up to 600,000 sf

of development.

BALTIMORE EAST

This submarket encompasses the northeast and

southeast portions of Baltimore City, as well as the

eastern portion of Baltimore County, and contains

more than 24,800,000 square feet of industrial/

fex space. Major industrial users for this area

include Middle River Aircraft Systems, General

Motors, Allison Transmission, DAP Products, and

soon, Amazon. Vacancy rates increased to 11.5%

with several buildings delivered, and more

expected before the end of the year. There was a

lot of activity around Kelso Drive this quarter. Royal

Transport took 100,940 sf at 8410 Kelso Drive, and

Restoration Hardware signed a 508,171 sf lease at

8416 Kelso Drive. 8515 & 8525 Kelso Drive sold to

FRP Development for $4.85 million. Investment

sales in the area were hot this quarter with

4969/4979 Mercantile selling for $5.9 million to Hill

Management, and 5020 Campbell Blvd selling to

Douglas Legum Development for $12.4 million.

New life could fnally be breathed into Sparrows

Point as Redwood Capital Investments makes

strides to clean up the land and redevelop it into a

hub for transportation, manufacturing and logistics.

Sun Products has their 900,000 sf facility on

Holabird Avenue for sale, which is considered a

desirable location considering the proximity to the

Port. Chesapeake Real Estate is also expected to

break ground this year at Baltimore

Crossroads@95 for a 435,500 sf building.

BALTIMORE SOUTHWEST

The Southwest Baltimore submarket includes

properties within the citys Central Business

District, Midtown, as well as Woodlawn and

Catonsville. This smaller submarket contains

approximately 7,400,000 square feet of space. At

the end of the 3

rd

quarter of 2014, the vacancy

rate in this submarket was 13.2%, which has been

relatively unchanged for the past 12 months.

Leasing activity spiked during the third quarter

with Ahern Rentals taking 14,560 sf at 2031

Inverness Avenue, and Arnold Factory Supplies

renewing their 70,790 sf lease at 3121

Washington Boulevard. B&E Storage and Transfer

also announced they would relocate from Jessup

to 294,000 sf at Point Breeze Business Center on

Broening Highway. Several sales took place as

well, including 6 buildings on Ambassador Road,

Rutherford Road and Lord Baltimore Drive by

First Industrial for $28.5 million.

CARROLL COUNTY

The Carroll County submarket includes the cities

of Westminster and Hampstead and contains

approximately 6,100,000 sf of fex and industrial

space. Major employers include Jos. A. Banks,

Solo Cup and Random House. At the end of the

3

rd

quarter, vacancy in this submarket dropped

signifcantly to 3.6%. Though there were few

leases signed this quarter, activity surrounding

Fuchs new facility began at North Carroll

Business Park. Questions still loom over the

acquisition of Jos. A. Banks by Mens Warehouse

and how the consolidation could afect the market

if the facility closes, which currently employs over

750 workers.

Accelerating success.

This document/email has been prepared by Colliers

International for advertising and general information

only. Colliers International makes no guarantees,

representations or warranties of any kind, expressed

or implied, regarding the information including, but not

limited to, warranties of content, accuracy as to the

accuracy of the information. This publication is the

copyrighted property of Colliers International and/or

its licensor(s). 2014. All rights reserved.

RESEARCHER:

Nadia Kahler

Vice President, Research &

Transaction Management | Baltimore

100 North Charles Street

Suite 1710

Baltimore, MD 21201

TEL +1 443 543 1222

FAX +1 443 543 0191

485 ofces in

63 countries on

6 continents

United States: 146

Canada: 44

Latin America: 25

Asia Pacifc: 186

EMEA: 84

$2.1 billion in annual revenue

1.46 billion square feet under

management

15,800 professionals

RESEARCH & FORECAST REPORT | Q3 2014 | INDUSTRIAL USE | BALTIMORE METRO AREA

You might also like

- 3rd BOCE MinutesDocument8 pages3rd BOCE MinutesKrishna Kanth KNo ratings yet

- Group 7 - Belle Air CharterDocument6 pagesGroup 7 - Belle Air Charteranubhav110950% (2)

- PSE vs. Litonjua-Oblicon Case DigestDocument2 pagesPSE vs. Litonjua-Oblicon Case Digestc@rpe_diemNo ratings yet

- Source: Grubb and Ellis CB Richard Ellis Spaulding and Slye Economics R Ha ItDocument45 pagesSource: Grubb and Ellis CB Richard Ellis Spaulding and Slye Economics R Ha ItOffice of PlanningNo ratings yet

- Atlanta Office Market Report Q3 2011Document2 pagesAtlanta Office Market Report Q3 2011Anonymous Feglbx5No ratings yet

- Definitions of MarketingDocument2 pagesDefinitions of MarketingEric James AbarroNo ratings yet

- Hul Distribution ModelDocument5 pagesHul Distribution ModelBhavik LodhaNo ratings yet

- EY Capturing Synergies in DealmakingDocument4 pagesEY Capturing Synergies in DealmakingAndrey PritulyukNo ratings yet

- Ownership of Joint Housing Act 20541997 EnglishDocument14 pagesOwnership of Joint Housing Act 20541997 EnglishDibishPurkotiNo ratings yet

- Industrial PDFDocument4 pagesIndustrial PDFAnonymous Feglbx5No ratings yet

- Spec Development PDFDocument6 pagesSpec Development PDFAnonymous Feglbx5No ratings yet

- Q4 2014 Industrial Market ReportDocument4 pagesQ4 2014 Industrial Market ReportDeven GriffinNo ratings yet

- Q2 2014 Industrial Market ReportDocument4 pagesQ2 2014 Industrial Market ReportDeven GriffinNo ratings yet

- Marketbeat: Industrial SnapshotDocument2 pagesMarketbeat: Industrial SnapshotAnonymous Feglbx5No ratings yet

- Howard County 3Q11Document3 pagesHoward County 3Q11William HarrisNo ratings yet

- Office OverviewDocument22 pagesOffice OverviewAnonymous Feglbx5No ratings yet

- WashingtonDocument2 pagesWashingtonAnonymous Feglbx5No ratings yet

- 2Q14 Atlanta Industrial Market ReportDocument4 pages2Q14 Atlanta Industrial Market ReportBea LorinczNo ratings yet

- CAE Q1 2013 Market ReportsDocument8 pagesCAE Q1 2013 Market ReportsColliersIntlSCNo ratings yet

- Baltimore Highlights Q2 2011 JLLDocument2 pagesBaltimore Highlights Q2 2011 JLLAnonymous Feglbx5No ratings yet

- Industrial 2Q12 Market ViewDocument2 pagesIndustrial 2Q12 Market ViewWayneBeeversNo ratings yet

- Office Market Snapshot: Suburban Maryland Fourth Quarter 2013Document2 pagesOffice Market Snapshot: Suburban Maryland Fourth Quarter 2013Anonymous Feglbx5No ratings yet

- 2Q2013 CIB Retail ReportDocument3 pages2Q2013 CIB Retail ReportAnonymous Feglbx5No ratings yet

- Tenant Report 3Q 2011 DC - FINAL-LetterDocument4 pagesTenant Report 3Q 2011 DC - FINAL-LetterAnonymous Feglbx5No ratings yet

- Palm BeachDocument5 pagesPalm BeachAnonymous Feglbx5No ratings yet

- 1 PDFDocument4 pages1 PDFAnonymous Feglbx5No ratings yet

- Boho Omdraft 051618rDocument86 pagesBoho Omdraft 051618rmacconsaNo ratings yet

- Palm Beach County Office MarketView Q1 2016Document4 pagesPalm Beach County Office MarketView Q1 2016William HarrisNo ratings yet

- Logistics Market View H22010Document6 pagesLogistics Market View H22010Bala Lakshmi NarayanaNo ratings yet

- WR IndustrialMarketReport 2015Q4Document8 pagesWR IndustrialMarketReport 2015Q4Ron JansenNo ratings yet

- BaltimoreOfficeSnapshot Q32012Document2 pagesBaltimoreOfficeSnapshot Q32012Anonymous Feglbx5No ratings yet

- Cleveland Office 2nd Quarter 2011Document2 pagesCleveland Office 2nd Quarter 2011julie_lynch5049No ratings yet

- Team Porter Industrial MarketView: Q1 2014Document4 pagesTeam Porter Industrial MarketView: Q1 2014team_porterNo ratings yet

- Office Market Report: Baltimore Metro Economic Outlook (A Little) BrighterDocument4 pagesOffice Market Report: Baltimore Metro Economic Outlook (A Little) BrighterAnonymous Feglbx5No ratings yet

- Baltimore Office: Quick StatsDocument4 pagesBaltimore Office: Quick StatsAnonymous Feglbx5No ratings yet

- Rock Island Partners ProfileDocument9 pagesRock Island Partners ProfileJoePrimmNo ratings yet

- 1 PDFDocument6 pages1 PDFAnonymous Feglbx5No ratings yet

- CT NoVA 3Q13 SnapshotDocument2 pagesCT NoVA 3Q13 SnapshotAnonymous Feglbx5No ratings yet

- Baltimore I-95 North PDFDocument3 pagesBaltimore I-95 North PDFAnonymous Feglbx5No ratings yet

- Singapore Property Weekly Issue 57Document14 pagesSingapore Property Weekly Issue 57Propwise.sgNo ratings yet

- Q2 2012 OfficeSnapshotDocument2 pagesQ2 2012 OfficeSnapshotAnonymous Feglbx5No ratings yet

- Omr PDFDocument19 pagesOmr PDFAnonymous Feglbx5No ratings yet

- Market & Feasibility Study Prepared byDocument57 pagesMarket & Feasibility Study Prepared byneuoneallNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- CT DC 2Q14 SnapshotDocument2 pagesCT DC 2Q14 SnapshotWilliam HarrisNo ratings yet

- The First Quarter Continues Positive Trends Seen in 2014: ResearchDocument6 pagesThe First Quarter Continues Positive Trends Seen in 2014: ResearchAnonymous Feglbx5No ratings yet

- South Q2 2012 IND ReportDocument3 pagesSouth Q2 2012 IND ReportAnonymous Feglbx5No ratings yet

- Retail Q3 2014 Overview PDFDocument4 pagesRetail Q3 2014 Overview PDFAnonymous Feglbx5No ratings yet

- Steady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterDocument5 pagesSteady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterAnonymous Feglbx5No ratings yet

- North Q4 2012 IND ReportDocument3 pagesNorth Q4 2012 IND ReportAnonymous Feglbx5No ratings yet

- 2014 Office TRENDSDocument20 pages2014 Office TRENDSGreater Baton Rouge Association of REALTORS® Commercial Investment DivisionNo ratings yet

- 2013 2Q Industrial SnapshotDocument2 pages2013 2Q Industrial SnapshotCassidy TurleyNo ratings yet

- 2011Q3 Industrial Report NorthDocument3 pages2011Q3 Industrial Report NorthAnonymous Feglbx5No ratings yet

- South Q1 2014 IND ReportDocument4 pagesSouth Q1 2014 IND ReportAnonymous Feglbx5No ratings yet

- Richmond AMERICAS Alliance MarketBeat Industrial Q32013Document2 pagesRichmond AMERICAS Alliance MarketBeat Industrial Q32013Anonymous Feglbx5No ratings yet

- Miami PDFDocument5 pagesMiami PDFAnonymous Feglbx5No ratings yet

- Q4 2012 OfficeSnapshot-NewDocument2 pagesQ4 2012 OfficeSnapshot-NewAnonymous Feglbx5No ratings yet

- Singapore Property Weekly Issue 44Document15 pagesSingapore Property Weekly Issue 44Propwise.sgNo ratings yet

- T5-6 Feas Study FinalDocument17 pagesT5-6 Feas Study FinalRecordTrac - City of OaklandNo ratings yet

- HAL 1Q24 Earnings ReleaseDocument12 pagesHAL 1Q24 Earnings ReleaseShadowMenNo ratings yet

- Indeks Harga CEPCI 2010Document2 pagesIndeks Harga CEPCI 2010juang_ariandoNo ratings yet

- Abu Dhabi Market Overview - Q1 2012 - FINALDocument3 pagesAbu Dhabi Market Overview - Q1 2012 - FINALAnu ThariyanNo ratings yet

- Industrial StrategyDocument80 pagesIndustrial StrategyPorumbacean RemusNo ratings yet

- Office Q2 2016 FullReportDocument17 pagesOffice Q2 2016 FullReportWilliam HarrisNo ratings yet

- Industrial PDFDocument2 pagesIndustrial PDFAnonymous Feglbx5No ratings yet

- Major Alberta ProjectsDocument71 pagesMajor Alberta Projectsthecolonel77No ratings yet

- District Cooling in the People's Republic of China: Status and Development PotentialFrom EverandDistrict Cooling in the People's Republic of China: Status and Development PotentialNo ratings yet

- 2023 Fast 500 Winners List v1.1Document16 pages2023 Fast 500 Winners List v1.1William HarrisNo ratings yet

- April 2024 CPRA Board Simoneaux 20240415 CompressedDocument37 pagesApril 2024 CPRA Board Simoneaux 20240415 CompressedWilliam HarrisNo ratings yet

- Industry Update H2 2021 in Review: Fairmount PartnersDocument13 pagesIndustry Update H2 2021 in Review: Fairmount PartnersWilliam HarrisNo ratings yet

- Market Report 2023 Q1 Full ReportDocument17 pagesMarket Report 2023 Q1 Full ReportKevin ParkerNo ratings yet

- Q1 2023 AcquisitionsDocument28 pagesQ1 2023 AcquisitionsWilliam HarrisNo ratings yet

- 2023 ASI Impact ReportDocument43 pages2023 ASI Impact ReportWilliam HarrisNo ratings yet

- 2022 Abell Foundation Short Form Report 8yrDocument36 pages2022 Abell Foundation Short Form Report 8yrWilliam HarrisNo ratings yet

- QR 3 - FinalDocument20 pagesQR 3 - FinalWilliam HarrisNo ratings yet

- Development: Washington, DCDocument96 pagesDevelopment: Washington, DCWilliam HarrisNo ratings yet

- Atlanta 2022 Multifamily Investment Forecast ReportDocument1 pageAtlanta 2022 Multifamily Investment Forecast ReportWilliam HarrisNo ratings yet

- 3Q21 I81 78 Industrial MarketDocument5 pages3Q21 I81 78 Industrial MarketWilliam HarrisNo ratings yet

- DSB Q3Document8 pagesDSB Q3William HarrisNo ratings yet

- Copt 2021Document44 pagesCopt 2021William HarrisNo ratings yet

- Gun Stocks: Fear Fires Up Investors To Purchase Gun StocksDocument14 pagesGun Stocks: Fear Fires Up Investors To Purchase Gun StocksWilliam HarrisNo ratings yet

- FP Pharmaceutical Outsourcing Monitor 08.30.21Document30 pagesFP Pharmaceutical Outsourcing Monitor 08.30.21William HarrisNo ratings yet

- FP - CTS Report Q3.20Document13 pagesFP - CTS Report Q3.20William HarrisNo ratings yet

- Healthcare Technology Mailer v14Document4 pagesHealthcare Technology Mailer v14William HarrisNo ratings yet

- Manhattan RetailDocument9 pagesManhattan RetailWilliam HarrisNo ratings yet

- For Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentDocument5 pagesFor Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentWilliam HarrisNo ratings yet

- 2020 Q3 Industrial Houston Report ColliersDocument7 pages2020 Q3 Industrial Houston Report ColliersWilliam HarrisNo ratings yet

- FP - CTS Report H1.21Document13 pagesFP - CTS Report H1.21William HarrisNo ratings yet

- TROW Q3 2020 Earnings ReleaseDocument15 pagesTROW Q3 2020 Earnings ReleaseWilliam HarrisNo ratings yet

- Comms Toolkit For MD Clean Energy Town HallDocument4 pagesComms Toolkit For MD Clean Energy Town HallWilliam HarrisNo ratings yet

- Richmond Office Performance in DownturnsDocument1 pageRichmond Office Performance in DownturnsWilliam HarrisNo ratings yet

- Regional Surveys of Business ActivityDocument2 pagesRegional Surveys of Business ActivityWilliam HarrisNo ratings yet

- State-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationDocument2 pagesState-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationWilliam HarrisNo ratings yet

- Kohinoor Textile MillDocument90 pagesKohinoor Textile MillSaMeia FarhatNo ratings yet

- AmdeDocument4 pagesAmdeGoogle ComputerNo ratings yet

- Salesforce Promotion - SirmaurDocument21 pagesSalesforce Promotion - SirmaurAnkit PuniaNo ratings yet

- Biscuit Industry India KuberDocument17 pagesBiscuit Industry India KuberPRIYA KUMARINo ratings yet

- Olpers: Product DefinitionDocument3 pagesOlpers: Product DefinitionAhsan Ul Haq100% (1)

- Bep QuestionDocument5 pagesBep QuestionVinesh KumarNo ratings yet

- Chapter 7 - Making The Sales Call Creating & Communicating ValuesDocument39 pagesChapter 7 - Making The Sales Call Creating & Communicating Valuesnhizza dawn DaligdigNo ratings yet

- Personal Selling..Document35 pagesPersonal Selling..Charu ModiNo ratings yet

- Story of Stuff - Victor LebowDocument9 pagesStory of Stuff - Victor LebowJeff100% (8)

- Lifebuoy MKT MixDocument10 pagesLifebuoy MKT MixThùyTrangAppleNo ratings yet

- Service Failure and Recovery Questionnaire EnglishDocument22 pagesService Failure and Recovery Questionnaire EnglishAli AslamNo ratings yet

- Unit-9 Job Analysis, Recruitment and Selection PDFDocument15 pagesUnit-9 Job Analysis, Recruitment and Selection PDFbhar4tpNo ratings yet

- Bel Brand Laughing Cow ChallengeDocument7 pagesBel Brand Laughing Cow Challengealhamd50% (2)

- Profit Center ProcessDocument21 pagesProfit Center Processjiljil1980No ratings yet

- Accounting Ratios FormulasDocument3 pagesAccounting Ratios FormulasEshan BhattNo ratings yet

- Accounting For Merchandising OperationsDocument32 pagesAccounting For Merchandising OperationsAllen CarlNo ratings yet

- Global CV Model Sales and Production Trend & Forecast 2023Document14 pagesGlobal CV Model Sales and Production Trend & Forecast 2023sinharicNo ratings yet

- Book-Responsibility Actg-SolMan PDFDocument18 pagesBook-Responsibility Actg-SolMan PDFLordson RamosNo ratings yet

- Process Analysis WSDDocument28 pagesProcess Analysis WSDAkhilesh ChaudharyNo ratings yet

- Pankaj Nayan ThakurDocument5 pagesPankaj Nayan ThakurRobbie ShawNo ratings yet

- Summer Training Report 2Document49 pagesSummer Training Report 2Ankit SharmaNo ratings yet

- Diagnostic ExamDocument8 pagesDiagnostic ExamMabelle Dabu FacturananNo ratings yet

- Morning Session Q&ADocument50 pagesMorning Session Q&AGANESH MENONNo ratings yet