Professional Documents

Culture Documents

Highlights of The Budget

Highlights of The Budget

Uploaded by

ahtradaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Highlights of The Budget

Highlights of The Budget

Uploaded by

ahtradaCopyright:

Available Formats

Highlights of the Budget:

* Income tax exemption limit raised by Rs 50,000 to Rs 2.5 lakh and for senior citizens to Rs 3

lakh

* Exemption limit for investment in financial instruments under 80C raised to Rs 1.5 lakh from

Rs 1 lakh.

* Investment limit in PPF raised to Rs 1.5 lakh from Rs 1 lakh

* Deduction limit on interest on loan for self-occupied house raised to Rs 2 lakh from Rs 1.5

lakh.

Union Budget Direct tax proposals an Individual Point of view

Introduction: Union budget-2014-15 presented by the Finance Minister today. New

Government has presented this budget with facing several challenges like economic growth,

GDP, Inflation and expectations from various sectors including individuals. This budget is not

fulfilled everyone expectation, however it covered the steps which revive the economic growth

in positive ways, this only has been told by the Finance minister that steps are only beginning of

the journey towards a sustained growth of 7-8 % or above within 3-4 years along with macro-

economic stabilization. In this article I would like to discuss about the direct tax proposals by the

point of view of individual.

1. Increase of Basic exemption limit: Major expectation of increase in basic exemption limit

has been given in the budget; the limit has been increased from Rs.2 lakhs to Rs. 2.50 lakhs for

individuals except senior citizens and for senior citizens between 60 to 80 years has been

increased from Rs. 2.50 lakhs to Rs. 3 lakhs. The revised income tax slabs are given below the

table

Rates for Individuals below 60 years

Income slabs Income tax rate

Income up to Rs. 2.50 lakhs Nil

Rs. 2.50 to Rs. 5 lakhs 10%

Rs.5 Lakhs to Rs. 10 Lakhs 20%

Rs. 10 lakhs above 30%

Rates for Individuals below 60 years below 80 Years

Income slabs Income tax rate

Income up to Rs. 3 lakhs Nil

Rs. 3 to Rs. 5 lakhs 10%

Rs.5 Lakhs to Rs. 10 Lakhs 20%

Rs. 10 lakhs above 30%

Rates for Individuals 80 years & above

Income slabs Income tax rate

Income up to Rs. 3 lakhs Nil

Rs. 3 to Rs. 5 lakhs Nil

Rs.5 Lakhs to Rs. 10 Lakhs 20%

Rs. 10 lakhs above 30%

Surcharge of 10% on Income tax those taxable income exceeds Rs. 10 crore will apply.

Education cess will apply 3% on the Income tax & Surcharge will apply for all.

These changes in slab will give to individuals a minimum tax relief of Rs.5150

2. Increase in limit under section 80C: Very famous section among individuals is section 80C,

the section gives rebate for various savings scheme till now Rs. 1 lakhs has been enhanced to Rs.

1.50 lakhs . This changes will give boost to habit of savings by the individuals and also give the

minimum tax relief of Rs.5150

3. Increase in Public provident fund: Present investment cap of Rs. 1 Lakh under PPF scheme

has been enhanced to Rs.1.50 lakhs which will help in the cap under section 80C. This change

will attract & help to make savings under PPF by the individuals

4. Increase in housing interest deduction: One more major section which individuals claim is

housing loan interest under section 24. Existing limit of Rs.1.50 lakhs for self occupied property

interest deduction has been enhanced to Rs. 2 lakhs. This will give the marginal tax relief of

Rs.5150 for those are claiming interest for self occupied property.

5. Increase tax rate on long term capital gain: Current tax rate on Long term capital gain has

been increased from 10% to 20% on transfer of units of Mutual funds except equity oriented

funds.

Conclusion: As an individual tax payer point of view, this budget given the minimum marginal

relief of Rs. 5150 without any additional savings & Rs. 10,300 with an additional savings of Rs.

50000/-. Also made marginal satisfaction on those have saving more than Rs. 1 Lakh and unable

to claim earlier years.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Best Buy Order DetailsDocument2 pagesBest Buy Order DetailsWilliams Jones100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Millenium Card StatementDocument3 pagesMillenium Card Statementshahid2opu100% (1)

- Turnover Tax Text BookDocument6 pagesTurnover Tax Text BookMulugeta AkaluNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Three Column Cash BookDocument5 pagesThree Column Cash Bookvinodksrini007100% (2)

- Tutorial Questions Week1Document6 pagesTutorial Questions Week1HuiMinHorNo ratings yet

- Data AkunDocument2 pagesData AkunYadinuNo ratings yet

- Retail CC FormDocument4 pagesRetail CC FormservicedeptNo ratings yet

- Invoice 4Document1 pageInvoice 4Namagiri Lakshmi TBNo ratings yet

- Basics of Custom DutyDocument3 pagesBasics of Custom DutyKeshav JhaNo ratings yet

- Generated Schedule and Assessment: Malayan Colleges LagunaDocument1 pageGenerated Schedule and Assessment: Malayan Colleges LagunaVince Alvin DaquizNo ratings yet

- Congratulations On The Bonus Accrued!: Gajbhiye AmitkumarDocument2 pagesCongratulations On The Bonus Accrued!: Gajbhiye Amitkumaramit gajbhiyeNo ratings yet

- Dave and Diane Starr of New Orleans Louisiana Both ofDocument1 pageDave and Diane Starr of New Orleans Louisiana Both ofCharlotteNo ratings yet

- Current Electric Service - General Service-CommercialDocument1 pageCurrent Electric Service - General Service-CommercialvanminNo ratings yet

- InvoiceDocument1 pageInvoicePabitra Kumar PuhanNo ratings yet

- Corporate Income Tax: Section A - Multiple Choice QuestionsDocument36 pagesCorporate Income Tax: Section A - Multiple Choice QuestionsWanda NguyenNo ratings yet

- Basilan V CIRDocument2 pagesBasilan V CIRReinier Jeffrey AbdonNo ratings yet

- Inv190 PDFDocument4 pagesInv190 PDFHitesh ThakkerNo ratings yet

- Fee Notification of Under-Graduate BAMS, BHMS, BNYS, BUMS, BHA, BPO & B.SC Allied Health Sciences During September2017Document4 pagesFee Notification of Under-Graduate BAMS, BHMS, BNYS, BUMS, BHA, BPO & B.SC Allied Health Sciences During September2017passionNo ratings yet

- Request For A Business Number and Certain Program AccountsDocument13 pagesRequest For A Business Number and Certain Program AccountsDattadharmawardhaneNo ratings yet

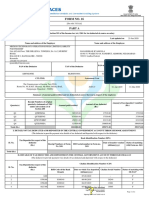

- Form No. 16: Part ADocument10 pagesForm No. 16: Part ARAJASHEKAR KYAROLLANo ratings yet

- Hdfcbank Credit CtalogueDocument1 pageHdfcbank Credit CtalogueDrSudhanshu MishraNo ratings yet

- Alt - Bank Company Brief PDFDocument1 pageAlt - Bank Company Brief PDFBruno MottaNo ratings yet

- Account Statement From 3 Jan 2020 To 26 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 3 Jan 2020 To 26 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancebhairav ghimireNo ratings yet

- 215f3 Index of Statements DocumentsDocument6 pages215f3 Index of Statements DocumentsIngole j pNo ratings yet

- Quiz Audit of CashDocument4 pagesQuiz Audit of CashIPray ForUNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceTuhin ChakrabortyNo ratings yet

- DocBuilder InvoiceDocument1 pageDocBuilder InvoiceNayem Al ImranNo ratings yet

- Tax Quick Reviewer - Edward Arriba PDFDocument70 pagesTax Quick Reviewer - Edward Arriba PDFDanpatz GarciaNo ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- Project On Income Tax - Project-On-Income-TaxDocument24 pagesProject On Income Tax - Project-On-Income-TaxDisha BaitadeNo ratings yet