Professional Documents

Culture Documents

ESP II - Vietnam

ESP II - Vietnam

Uploaded by

King ShinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ESP II - Vietnam

ESP II - Vietnam

Uploaded by

King ShinCopyright:

Available Formats

3. Vietnam: Shoul we devalue the exchange rate?

Currently, the State bank of Vietnam adjusts USD / VND rate with increasing by 1-2% / year, but

VND is overvalued more than 20%, some ideas that should devalue VND at 3 usd -4% / year.

Then Should we devalue the rate? According to recent documents on economic newspapers

such as vneconomy.vn, intestment, VOV,.... our group concluded 6 basic reasons for not

devaluating VND

First, theoretically, adjusting exchange rate is to be comparable to the inflation rates between 2

countries. Practically, Vietnam and the United States have disparate infation rates, therefore, It

should not be based on inflations for exchange rate adjustment:

Infations of Vietnam and USD from 2009 - 2013

2009 2010 2011 2012 2013

The USA -0.4 1.6 3.2 2.1 1.5

VN 6.8 11.75 18.12 6.81 6.04

Second, though some argue that exchange rates should be adjusted to support exports,

Vietnam's experience showed that exchange rate adjustment had no significant impact to the

international trade. The reason is that Vietnam is a small economy with a large aperture. Many

essential items meeting the needs of domestic consumption is imported, but domestic

production is not enough to replace; over 70% of imported goods is to serve domestic

production and exports.

Third, Vietnam's foreign debt index is not good, according to the Ministry of Finance, Vietnam's

foreign debt by the end of 2013 was 56.2 % GDP Therefore, the exchange rate devaluation

would also increase the burden of foreign debt, make significant impacts to the national

financial security and sustainability of macroeconomic stability

Fourth, foreign bank's experts themselves also said that Vietnam dong is not overvalued. If

foreign investors considered Vietnam dong overvalued, they woul do "speculation", but now

they have no moves whatsoever.

Fifth, exchange rate adjustment will increase inflation and hamper Goverment's efforts to

stabilize the macro-economy

Finally, during this time, the Sate bank of Vietnam has kept exchange rate market sentiment

stable and trust in VND. If the central bank devalue VND 3-4% annually, there will be inceasing

in expected rates, will disrupt the State bank of Vietnam's effort to stabilize the exchange rate

and market sentiment; which lead to turbelent market and the trust in the value of USD is

easily abraded

Vocabulary

ENGLISH DEFINITION VIETNAMESE

disparate There are a lot differences Khc bit ln

aperture An opening to allow something m

domestic Inside the country Ni a

sustainability Can countinue for a long time Tnh bn vng

macroeconomy Large economic systems Kinh t v m

speculation Buy much goods because of

expecting it to have high price

u c

Whatsoever Not at all Chng g ht

hamper Prevent from achieving something Ngn cn

disrupt Prevent from doing somthing Ngn cn

Market sentiment The way market reacts with changes Tm l th trng

abrade damage Bo mn

LM POWER POINT

3. Vietnam: Should we devalue VND?

=> NO

6 reasons:

- Have disparate inflation rates

- Wont support International trade

- Foreign debt

- Foreign experts point of view

- Increase in inflation

- Disrupt ecnomony stability

( Ci ny l i vo c th, mi l do th hin bng s liu, con s tng ng, mi l do/slide)

- Have disparate infation rates:

2009 2010 2011 2012 2013

The USA -0.4 1.6 3.2 2.1 1.5

VN 6.8 11.75 18.12 6.81 6.04

- Wont support International trade: 70% of imported goods is to serve domestic production and

exports.

- Foreign debt: by the end of 2013 was 56.2 GDP- PV

- Foreign experts: dont have the same point of view + have no "speculation", no moves

whatsoever

- Increase in inflation ( cho hnh mi tn i ln g )

- Disrupt ecnomony stability: devalue VND 3-4% => lose trust, make market disruptive

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Movie Recommendation SystemDocument41 pagesMovie Recommendation SystemSowmya Srinivasan100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Final Report of SIPDocument56 pagesFinal Report of SIPRahul Parashar100% (1)

- Transfer PricingDocument8 pagesTransfer PricingAnamir Bello Carillo50% (2)

- Nas-1000 Ais SartDocument2 pagesNas-1000 Ais SartAntonio VellaraNo ratings yet

- Regional Trial Court: Motion To Quash Search WarrantDocument3 pagesRegional Trial Court: Motion To Quash Search WarrantPaulo VillarinNo ratings yet

- Dwnload Full Organization Development The Process of Leading Organizational Change 4th Edition Anderson Test Bank PDFDocument35 pagesDwnload Full Organization Development The Process of Leading Organizational Change 4th Edition Anderson Test Bank PDFliamhe2qr8100% (15)

- PDFDocument1 pagePDFMiguel Ángel Gálvez FernándezNo ratings yet

- KW950E Course RecorderDocument1 pageKW950E Course RecorderСКБ ФИОЛЕНТNo ratings yet

- Gagas 2018Document233 pagesGagas 2018UnggulRajevPradanaNo ratings yet

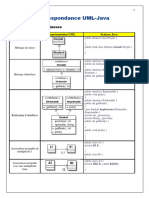

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet

- Dicionário Assírio SDocument452 pagesDicionário Assírio SAlexandre Luis Dos Santos100% (1)

- Mr. Anil Wanarse PatilDocument29 pagesMr. Anil Wanarse PatilANIL INTERAVIONNo ratings yet

- CS Lecture Notes PDFDocument138 pagesCS Lecture Notes PDFNikhil GaidhaneNo ratings yet

- Naac Lesson Plan Subject-WsnDocument6 pagesNaac Lesson Plan Subject-WsnAditya Kumar TikkireddiNo ratings yet

- Internship ReportDocument61 pagesInternship ReportAheen ImtiazNo ratings yet

- COCOMO II ExampleDocument26 pagesCOCOMO II ExampleQuốc ĐạiNo ratings yet

- A GMM Approach For Dealing With Missing DataDocument41 pagesA GMM Approach For Dealing With Missing DataraghidkNo ratings yet

- Pilz PNOZ Sigma PDFDocument16 pagesPilz PNOZ Sigma PDFCristopher Entena100% (1)

- Cut List Cheat SheetDocument1 pageCut List Cheat SheetmeredithNo ratings yet

- Operating System (5th Semester) : Prepared by Sanjit Kumar Barik (Asst Prof, Cse) Module-IiiDocument41 pagesOperating System (5th Semester) : Prepared by Sanjit Kumar Barik (Asst Prof, Cse) Module-IiiJeevanantham KannanNo ratings yet

- AECES Night Lights Sound ReservationDocument1 pageAECES Night Lights Sound ReservationVincent Carl CatigayNo ratings yet

- PNP ACG - Understanding Digital ForensicsDocument76 pagesPNP ACG - Understanding Digital ForensicsTin TinNo ratings yet

- Hotel Administration and Management Network - AbstractDocument3 pagesHotel Administration and Management Network - AbstractMehadi Hasan RoxyNo ratings yet

- Fusing Concurrent Orthogonal Wide-Aperture Sonar Images For Dense Underwater 3D ReconstructionDocument8 pagesFusing Concurrent Orthogonal Wide-Aperture Sonar Images For Dense Underwater 3D ReconstructionVincent WenNo ratings yet

- Pumba Cap 3 2022Document15 pagesPumba Cap 3 2022adityakamble070103No ratings yet

- Altagamma Bain Worldwide Market Monitor - Update 2019 PDFDocument15 pagesAltagamma Bain Worldwide Market Monitor - Update 2019 PDFHaider RazaNo ratings yet

- Macquarie University:: 1.) Musec SchoolDocument6 pagesMacquarie University:: 1.) Musec SchoolUtsav ShroffNo ratings yet

- Final Broucher 11-4 NewDocument3 pagesFinal Broucher 11-4 Newmilan07No ratings yet

- MLCC Model enDocument6 pagesMLCC Model enrahmanakberNo ratings yet

- CDUXLSIMDocument336 pagesCDUXLSIMlocoboeingNo ratings yet