Professional Documents

Culture Documents

Appendix A: Pricing Products and Services

Appendix A: Pricing Products and Services

Uploaded by

Michelle MirandaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appendix A: Pricing Products and Services

Appendix A: Pricing Products and Services

Uploaded by

Michelle MirandaCopyright:

Available Formats

Appendix A

Pricing Products and Services

Solutions to Questions

A-1 In cost-plus pricing, prices are set

by applying a markup percentage to a

products cost.

A-2 The price elasticity of demand

measures the degree to which a change in

price afects unit sales. The unit sales of a

product with inelastic demand are

relatively insensitive to the price charged

for the product. In contrast, the unit sales

of a product with elastic demand are

sensitive to the price charged for the

product.

A-3 The proft-maimi!ing price should

depend only on the variable "marginal#

cost per unit and on the price elasticity of

demand. $ied costs do not enter into the

pricing decision at all. $ied costs are

relevant in a decision of whether to ofer a

product or service at all, but are not

relevant in deciding what to charge for the

product or service once the decision to

ofer it has been made. %ecause price

afects unit sales, total variable costs are

afected by the pricing decision and

therefore are relevant.

A-4 The markup over variable cost

depends on the price elasticity of demand.

& product whose demand is elastic should

have a lower markup over cost than a

product whose demand is inelastic. If

demand for a product is inelastic, the price

can be increased without cutting as

drastically into unit sales.

A-5 The markup in the absorption

costing approach to pricing is supposed to

cover selling and administrative epenses

as well as providing for an ade'uate return

on the assets tied up in the product. $ull

cost is an alternative approach not

discussed in the chapter that is used

almost as fre'uently as the absorption

approach. (nder the full cost approach, all

costs)including selling and administrative

epenses)are included in the cost base. If

full cost is used, the markup is only

supposed to provide for an ade'uate

return on the assets.

A-6 The absorption costing approach

assumes that consumers do not react to

prices at all)consumers will purchase the

forecasted unit sales regardless of the

price that is charged. This is clearly an

unrealistic assumption ecept under very

special circumstances.

A-7 The protection ofered by full cost

pricing is an illusion. &ll costs will be

covered only if actual sales e'ual or

eceed the forecasted sales on which the

absorption costing price is based. There is

no assurance that a su*cient number of

units will be sold.

A-8 Target costing is used to price new

products. The target cost is the epected

selling price of the new product less the

desired proft per unit. The product

development team is charged with the

responsibility of ensuring that actual costs

do not eceed this target cost.

This is the reverse of the way most

companies have traditionally approached

the pricing decision. +ost companies start

with their full cost and then add their

markup to arrive at the selling price. In

contrast to target costing, this traditional

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 256

approach ignores how much customers

are willing to pay for the product.

.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

261 +anagerial &ccounting, 27th 8dition

Exercise A-1 "71 minutes#

2. +aria makes more money selling the ice cream cones at the

lower price, as shown below9

$1.89

Price

$1.49

Price

(nit sales................... 2,:11 0,7;1

3ales.......................... <0,57:.11 <7,;5=.=1

/ost of sales > <1.;7 =;:.11 2,11=.01

/ontribution margin... 0,261.11 0,;51.;1

$ied epenses.......... =?:.11 =?:.11

@et operating income <2,:2:.11 <2,51:.;1

0. The price elasticity of demand, as defned in the tet, is

computed as follows9

d

A

ln"2BC change in 'uantity sold#

ln"2BC change in price#

A

0,7;1-2,:11

ln"2B #

2,:11

2.;6-2.56

ln"2B #

2.56

D E

F

G

F

G

F

F G

H I

D E

F

G

F

G

FF G

H I

A

ln"2B1.:=111#

ln"2-1.022=;#

A

ln"2.:=111#

ln"1.?557=#

A

1.;;;=6

-1.07?51

A -2.5?

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 262

Exercise A-1 "continued#

7. The proft-maimi!ing price can be estimated using the

following formula from the tet9

d

d

J

4roft-maimi!ing price A Kariable cost per unit

2BJ

-2.5?

A <1.;7

2B"-2.5?#

A 0.2;6; L <1.;7 A <1.60

D E

F

G

F

G

F

G

F G

H I

D E

F

G

F

G

F

F GG

H I

This price is much lower than the prices +aria has been

charging in the past. Mather than immediately dropping the

price to <1.60, it would be prudent to drop the price a bit and

see what happens to unit sales and to profts. The formula

assumes that the price elasticity is constant, which may not be

the case.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

260 +anagerial &ccounting, 27th 8dition

Exercise A-2 "2: minutes#

2.

" #

" #

Me'uired MNI 3elling and administraive

B

L Investment epenses

+arkup percentage

A

on absorption cost

(nit sales L (nit product cost

20C L <?:1,111 B <:1,111

A

2;,111 units L <0: per unit

<2;1,111

A A ;

<7:1,111

1C

0. (nit product cost........... <0:

+arkup ";1C L <0:#..... 21

3elling price per unit..... <7:

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 267

Exercise A-3 "21 minutes#

3ales "711,111 units L <2: per unit#. <;,:11,111

Oess desired proft "20C L

<:,111,111#.................................... =11,111

Target cost for 711,111 units............. <7,611,111

Target cost per unit A <7,611,111 F 711,111 units A <27 per unit

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

26; +anagerial &ccounting, 27th 8dition

Problem A-4 ";: minutes#

2. a. 3upporting computations9

@umber of pads manufactured each year9

75,;11 labor-hours F 0.; labor-hours per pad A 2=,111

pads.

3elling and administrative epenses9

Kariable "2=,111 pads L <6 per

pad#.............................................. <2;;,111

$ied............................................... ?70,111

Total................................................ <5?=,111

" #

" #

Me'uired MNI 3elling and administrative

B

L Investment epenses

+arkup percentage

A

on absorption cost

(nit sales L (nit product cost

0;C L <2,7:1,111 B <5?=,111

A

2=,111 pads L <=1 per pad

<2,011,111

A

<6=1,111

A 20:C

b. Pirect materials................................. < 21.51

Pirect labor....................................... 26.01

+anufacturing overhead................... 71.11

(nit product cost............................... =1.11

&dd markup9 20:C of unit product

cost................................................. ?:.11

3elling price...................................... <27:.11

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 26:

Problem A-4 "continued#

c. The income statement will be9

3ales "2=,111 pads L <27: per pad#.......

<0,2=1,11

1

/ost of goods sold

"2=,111 pads L <=1 per pad#................

6=1,11

1

-ross margin........................................... 2,011,111

3elling and administrative epenses9

3ales commissions...............................

<2;;,11

1

3alaries................................................. 50,111

Qarehouse rent.................................... :1,111

&dvertising and other........................... =11,111

Total selling and administrative epense. 5?=,111

@et operating income.............................

< 70;,11

1

The companys MNI computation for the pads will be9

@et Nperating Income 3ales

MNI A L

3ales &verage Nperating &ssets

<70;,111 <0,2=1,111

A L

<0,2=1,111 <2,7:1,111

A 2:C L 2.= A 0;C

0. Kariable cost per unit9

Pirect materials........................................ <21.51

Pirect labor............................................... 26.01

Kariable manufacturing overhead "2R: L

<71#....................................................... =.11

3ales commissions.................................... 6.11

Total.......................................................... <;:.11

If the company has idle capacity and sales to the retail outlet

would not afect regular sales, any price above the variable

cost of <;: per pad would add to profts. The company should

aggressively bargain for more than this priceS <;: is simply the

rock-bottom Toor below which the company should not go in its

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

26= +anagerial &ccounting, 27th 8dition

pricing.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 26?

Problem A-5 ";: minutes#

2. The postal service makes more money selling the souvenir

sheets at the lower price, as shown below9

$7 Price $8 Price

(nit sales............................ 211,111 5:,111

3ales................................... <?11,111 <=51,111

/ost of sales > <1.51 per

unit................................... 51,111 =5,111

/ontribution margin............ <=01,111 <=20,111

0. The price elasticity of demand, as defned in the tet, is

computed as follows9

d

A

ln"2 B C change in 'uantity sold#

ln"2 B C change in price#

A

5:,111 - 211,111

ln"2 B #

211,111

5 - ?

ln"2 B #

?

D E

F

G

F

G

F

F G

H I

D E

F

G

F

G

FF G

H I

A

ln"2 - 1.2:11#

ln"2 B 1.2;06#

A

ln"1.5:11#

ln"2.2;06#

A

-1.2=0:

1.277=

A -2.02=7

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

265 +anagerial &ccounting, 27th 8dition

Problem A-5 "continued#

7. The proft-maimi!ing price can be estimated using the

following formula from the tet9

4roft-maimi!ing price A

d

d

J

Kariable cost per unit

2BJ

D E

F

G

F

G

F

G

F G

H I

A

-2.02=7

<1.51

2B"-2.02=7#

D E

F

G

F

G

F

F GG

H I

A :.=070 L <1.51 A <;.:1

This price is much lower than the price the postal service has

been charging in the past. Mather than immediately dropping

the price to <;.:1, it would be prudent for the postal service to

drop the price a bit and observe what happens to unit sales and

to profts. The formula assumes that the price elasticity of

demand is constant, which may not be true.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 266

Problem A-5 "continued#

The critical assumption in these calculations is that the

percentage increase "decrease# in 'uantity sold is always the

same for a given percentage decrease "increase# in price. If this

is true, we can estimate the demand schedule for souvenir

sheets as follows9

Price

*

Quantity Sold

<5.11 5:,111

<?.11 211,111

<=.27 22?,=;?

<:.7= 275,;15

<;.=6 2=0,577

<;.21 262,:=6

<7.:6 00:,7?:

<7.2; 0=:,2;?

<0.?: 722,67?

<0.;2 7==,65:

U

The price in each cell in the table is computed by taking ?R5 of

the price Vust above it in the table. $or eample, <=.27 is ?R5 of

<?.11 and <:.7= is ?R5 of <=.27.

W

The 'uantity sold in each cell of the table is computed by

multiplying the 'uantity sold Vust above it in the table by

211,111R5:,111. $or eample, 22?,=;? is computed by

multiplying 211,111 by the fraction 211,111R5:,111.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

011 +anagerial &ccounting, 27th 8dition

Problem A-5 "continued#

The proft at each price in the above demand schedule can

be computed as follows9

Price

(a)

Quantity

Sold (b)

Sales

(a) (b)

Cost o

Sales

$!.8! (b)

Contributio

n "ar#in

<5.11 5:,111 <=51,111 <=5,111 <=20,111

<?.11 211,111 <?11,111 <51,111 <=01,111

<=.27 22?,=;? <?02,2?= <6;,225 <=0?,1:5

<:.7= 275,;15 <?;2,5=? <221,?0= <=72,2;2

<;.=6 2=0,577 <?=7,=5? <271,0== <=77,;02

<;.21 262,:=6 <?5:,;77 <2:7,0:: <=70,2?5

<7.:6 00:,7?: <516,16= <251,711 <=05,?6=

<7.2; 0=:,2;? <570,:=0 <020,225 <=01,;;;

<0.?: 722,67? <5:?,50? <0;6,::1 <=15,0??

<0.;2 7==,65: <55;,;7; <067,:55 <:61,5;=

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 012

Problem A-5 "continued#

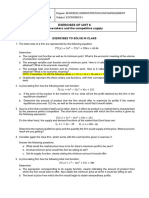

The contribution margin is plotted below as a function of the

selling price9

The plot confrms that the proft-maimi!ing price is about

<;.:1.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

010 +anagerial &ccounting, 27th 8dition

$580,000

$590,000

$600,000

$610,000

$620,000

$630,000

$640,000

$2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00

Selling Price

Problem A-5 "continued#

;. If the postal service wants to maimi!e the contribution margin

and proft from sales of souvenir sheets, the new price should

be9

4roft-maimi!ing price A

d

d

J

Kariable cost per unit

2BJ

D E

F

G

F

G

F

G

F G

H I

A

-2.02=7

<2.11

2B"-2.02=7#

D E

F

G

F

G

F

F G

H I

A :.=070 L <2.11 A <:.=0

@ote that a <1.01 increase in cost has led to a <2.20 "<:.=0 X

<;.:1# increase in selling price. This is because the proft-

maimi!ing price is computed by multiplying the variable cost

by :.=070. %ecause the variable cost has increased by <1.01,

the proft-maimi!ing price has increased by <1.01 L :.=070,

or <2.20.

3ome people may obVect to such a large increase in price as

YunfairZ and some may even suggest that only the <1.01

increase in cost should be passed on to the consumer. The

enduring popularity of full-cost pricing may be eplained to

some degree by the notion that prices should be YfairZ rather

than calculated to maimi!e profts.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 017

Problem A-6 "=1 minutes#

2. The complete, flled-in table appears below9

Sellin#

Price

$sti%ate

d &nit

Sales Sales

'ariable

Cost

(i)ed

$)*enses

+et

,*eratin

#

-nco%e

<0:.11 :1,111 <2,0:1,111 <711,111 <6=1,111 -<21,111

<07.?: :;,111 <2,050,:11 <70;,111 <6=1,111 -<2,:11

<00.:= :5,701 <2,72:,=66 <7;6,601 <6=1,111 <:,??6

<02.;7 =0,65= <2,7;6,?61 <7??,62= <6=1,111 <22,5?;

<01.7= =5,10: <2,75;,656 <;15,2:1 <6=1,111 <2=,576

<26.7; ?7,;=? <2,;01,5:0 <;;1,510 <6=1,111 <01,1:1

<25.7? ?6,7;; <2,;:?,:;6 <;?=,1=; <6=1,111 <02,;5:

<2?.;: 5:,=60 <2,;6:,70: <:2;,2:0 <6=1,111 <02,2?7

<2=.:5 60,:;? <2,:7;,;06 <:::,050 <6=1,111 <26,2;?

<2:.?: 66,6:2 <2,:?;,005 <:66,?1= <6=1,111 <2;,:00

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

01; +anagerial &ccounting, 27th 8dition

Problem A-6 "continued#

0. & chart based on the above table would look like the following9

%ased on this chart, a selling price of about <25 would

maimi!e net operating income.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 01:

Problem A-6 "continued#

7. The price elasticity of demand, as defned in the tet, is

computed as follows9

d

A

ln"2 B C change in 'uantity sold#

ln"2 B C change in price#

A

ln"2B1.15#

ln"2-1.1:#

A

ln"2.15#

ln"1.6:#

A

1.1?=6=

-1.1:206

A -2.:11

The proft-maimi!ing price can be estimated using the

following formula from the tet9

4roft-maimi!ing price A

d

d

J

Kariable cost per unit

2BJ

D E

F

G

F

G

F

G

F G

H I

A

-2.:

<=.11

2B"-2.:#

D E

F

G

F

G

F

F GG

H I

A 7.11 L <=.11 A <25.11

@ote that this answer is consistent with the plot of the data in

part "0# above. The formula for the proft-maimi!ing price

works in this case because the demand is characteri!ed by

constant price elasticity. 8very :C decrease in price results in

an 5C increase in unit sales.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

01= +anagerial &ccounting, 27th 8dition

Problem A-6 "continued#

;. Qe must frst compute the markup percentage, which is a

function of the re'uired MNI of 0C, the investment of

<0,111,111, the unit product cost of <=, and the 3-[&

epenses of <6=1,111.

" #

Me'uired MNI 3elling and administrative

B

L Investment epenses

+arkup percentage

A

on absorption cost

(nit sales L (nit product cost

"0C L <0,111,111# B <6=1,111

A

:1,111 units L <= per unit

A 7.77 "rounded# or 777C

(nit product cost......... < =.11

+arkup "<=.11 L 7.77#. 26.65

3elling price................. <0:.65

/harging <0:.65 "or <0= without rounding# for the software

would be a big mistake if the marketing manager is correct

about the efect of price changes on unit sales. The chart

prepared in part "0# above strongly suggests that the company

would lose lots of money selling the software at this price.

@ote9 It can be shown that the unit sales at the <0:.65 price

would be about ;?,265 units if the marketing manager is

correct about demand. If so, the company would lose about

<2=,65; per month9

3ales ";?,265 units L <0:.65 per unit# <2,00=,01;

Kariable cost ";?,265 units L <= per

unit#................................................... 057,255

/ontribution margin............................. 6;7,12=

$ied epenses.................................... 6=1,111

@et operating income "loss#................. < "2=,65;#

:. If the marketing manager is correct about demand, increasing

the price above <25 per unit will result in a decrease in net

operating income and hence in the return on investment. To

increase the net operating income, the owners should look

elsewhere. They should attempt to decrease costs or increase

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 01?

the perceived value of the product to more customers so that

more units can be sold at any given price or the price can be

increased without sacrifcing unit sales.

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

015 +anagerial &ccounting, 27th 8dition

Problem A-7 "=1 minutes#

2. 3upporting computations9

@umber of hours worked per year9

01 workers L ;1 hours per week L :1 weeks A ;1,111 hours

@umber of surfboards produced per year9

;1,111 hours F 0 hours per surfboard A 01,111 surfboards.

3tandard cost per surfboard9 <2,=11,111 F 01,111 surfboards A

<51 per surfboard.

$ied manufacturing overhead cost per surfboard9

<=11,111 F 01,111 surfboards A <71 per surfboard.

+anufacturing overhead per surfboard9 <: variable B <71 fed

A <7:.

Pirect labor cost per surfboard9 <51 X "<0? B <7:# A <25.

-iven the computations above, the completed standard cost

card would be as follows9

Standar

d

Quantity

or .ours

Standard Price

or /ate

Standar

d Cost

Pirect materials............ = feet <;.:1 per foot <0?

Pirect labor................... 0 hours <6.11 per hourU 25

+anufacturing overhead

0 hours

<2?.:

1

per

hourUU 7:

Total standard cost per

surfboard.................... <51

U <25 F 0 hours A <6 per hour

UU <7: F 0 hours A <2?.:1 per hour

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 016

Problem A-7 "continued#

0. a.

" #

" #

Me'uired MNI 3elling and administrative

B

L Investment epenses

+arkup percentage

A

on absorption cost

(nit sales L (nit product cost

25C L <2,:11,111 B <2,271,111

A

01,111 units L <51 per unit

<2,;11,111

A

<2,=1

A 5?.:C

1,111

b. Pirect materials............... < 0?

Pirect labor..................... 25

+anufacturing overhead. 7:

Total cost to manufacture 51

&dd markup9 5?.:C......... ?1

3elling price.................... <2:1

c. 3ales "01,111 boards L <2:1 per board#. . . .

<7,111,11

1

/ost of goods sold

"01,111 boards L <51 per board#............. 2,=11,111

-ross margin............................................... 2,;11,111

3elling and administrative epenses........... 2,271,111

@et operating income................................. < 0?1,111

@et Nperating Income 3ales

MNI A L

3ales &verage Nperating &ssets

<0?1,111 <7,111,111

A L

<7,111,111 <2,:11,111

A 6C L 0 A 25C

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

021 +anagerial &ccounting, 27th 8dition

Problem A-7 "continued#

7. 3upporting computations9

Total fed costs9

+anufacturing overhead................................. < =11,111

3elling and administrative

\<2,271,111 X "01,111 boards L <21 per

board#]......................................................... 671,111

Total fed costs..............................................

<2,:71,11

1

Kariable costs per board9

Pirect materials............................ <0?

Pirect labor................................... 25

Kariable manufacturing overhead. :

Kariable selling.............................. 21

Kariable cost per board................. <=1

To achieve the 25C MNI, the company would have to sell at

least the 01,111 units assumed in part "0# above. The break-

even volume can be computed as follows9

$ied epenses

%reak-even point

A

in units sold

(nit contribution margin

<2,:71,111

A

<2:1 per board - <=1 per board

A 2?,111 boards

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 022

Problem A-8 ";: minutes#

2. 4roVected sales "211 machines L <;,6:1 per

machine#........................................................... <;6:,111

Oess desired proft "2:C L <=11,111#.................. 61,111

Target cost for 211 machines............................... <;1:,111

Target cost per machine "<;1:,111 F 211

machines#.......................................................... <;,1:1

Oess @ational Mestaurant 3upplys variable

selling cost per machine.................................... =:1

+aimum allowable purchase price per machine. <7,;11

0. The relation between the purchase price of the machine and

MNI can be developed as follows9

Total proVected sales - Total cost

MNI A

Investment

<;6:,111 - "<=:1 B 4urchase price of machines# L 211

A

<=11,111

The above formula can be used to compute the MNI for

purchase prices between <7,111 and <;,111 "in increments of

<211# as follows9

Purc0ase

*rice /,-

<7,111 02.?C

<7,211 01.1C

<7,011 25.7C

<7,711 2=.?C

<7,;11 2:.1C

<7,:11 27.7C

<7,=11 22.?C

<7,?11 21.1C

<7,511 5.7C

<7,611 =.?C

<;,111 :.1C

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

020 +anagerial &ccounting, 27th 8dition

Problem A-8 "continued#

(sing the above data, the relation between purchase price and

MNI can be plotted as follows9

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

3olutions +anual, 4ricing &ppendi 027

Problem A-8 "continued#

7. & number of options are available in addition to simply giving

up on adding the new sorbet machines to the companys

product lines. These options include9

^ /heck the proVected unit sales fgures. 4erhaps more units

could be sold at the <;,6:1 price. .owever, management

should be careful not to indulge in wishful thinking Vust to

make the numbers come out right.

^ +odify the selling price. This does not necessarily mean

increasing the proVected selling price. Pecreasing the selling

price may generate enough additional unit sales to make

carrying the sorbet machines more proftable.

^ Improve the selling process to decrease the variable selling

costs.

^ Methink the investment that would be re'uired to carry this

new product. /an the si!e of the inventory be reduced_ &re

the new warehouse ftures really necessary_

^ Poes the company really need a 2:C MNI_ Poes it cost the

company this much to ac'uire more funds_

, The +c-raw-.ill /ompanies, Inc., 0121. &ll rights reserved.

02; +anagerial &ccounting, 27th 8dition

You might also like

- Full Download Introduction To Managerial Accounting 7th Edition Brewer Solutions ManualDocument22 pagesFull Download Introduction To Managerial Accounting 7th Edition Brewer Solutions Manualstulhokyb100% (35)

- Hilton Chapter 08 SolutionsDocument65 pagesHilton Chapter 08 SolutionsKaustubh Agnihotri75% (8)

- ABC CostingDocument28 pagesABC CostingKiraYamatoNo ratings yet

- Summative TestDocument2 pagesSummative TestShane Camille Abueg100% (3)

- Appendix A: Pricing Products and ServicesDocument24 pagesAppendix A: Pricing Products and Servicesmajidpathan208No ratings yet

- Lesson 6 - PricingDocument13 pagesLesson 6 - PricingAnjo EllisNo ratings yet

- Case 5-49 Activity-Based Costing: Budgeted Operating MarginDocument5 pagesCase 5-49 Activity-Based Costing: Budgeted Operating MarginMurnawaty Narthy0% (1)

- Managerial AccountingDocument39 pagesManagerial Accountingnerurkar_tusharNo ratings yet

- Joint & by ProductDocument22 pagesJoint & by ProductanggandakonohNo ratings yet

- Kotler POM 15e IM Notes Appendix MarketingByTheNumbersDocument49 pagesKotler POM 15e IM Notes Appendix MarketingByTheNumbersMuhammad UmairNo ratings yet

- Cost Volume Profit Analysis: RequiredDocument11 pagesCost Volume Profit Analysis: RequiredkirAn ShAikhNo ratings yet

- Cost-Volume-Profit Analysis: A Managerial Planning Tool: Discussion QuestionsDocument41 pagesCost-Volume-Profit Analysis: A Managerial Planning Tool: Discussion Questionshoodron22100% (1)

- Solution Manual08Document66 pagesSolution Manual08yellowberries100% (2)

- AC 203 Final Exam Review WorksheetDocument6 pagesAC 203 Final Exam Review WorksheetLương Thế CườngNo ratings yet

- 06 OutlinesDocument5 pages06 OutlinesAhmed RawyNo ratings yet

- Cost PDFDocument20 pagesCost PDFUzzalNo ratings yet

- CostDocument16 pagesCostSandeep KulkarniNo ratings yet

- Cost Analysis HandoutsDocument18 pagesCost Analysis HandoutsAndrea ValdezNo ratings yet

- Accounting For Managerial Decision Making - Week 4Document11 pagesAccounting For Managerial Decision Making - Week 4Inès ChougraniNo ratings yet

- Eec ProblemsDocument278 pagesEec ProblemsSachin SahooNo ratings yet

- PM-M2 EditedDocument22 pagesPM-M2 Editedrafiulbiz12No ratings yet

- Case 3-Mueller-Lehmkuhl GmbH Final caseDocument8 pagesCase 3-Mueller-Lehmkuhl GmbH Final caseQuyên QuyênNo ratings yet

- Budgeting, Costing & EstimatingDocument32 pagesBudgeting, Costing & Estimatingmastermind_asia9389No ratings yet

- Solution Manual Chapter - 13Document8 pagesSolution Manual Chapter - 13devrajkinjalNo ratings yet

- CH 08 SMDocument25 pagesCH 08 SMNafisah Mambuay100% (1)

- Unit 2Document7 pagesUnit 2Palak JainNo ratings yet

- Hca14 SM Ch08Document55 pagesHca14 SM Ch08DrellyNo ratings yet

- 01 Exercises U6 - ECON - 2023-24Document5 pages01 Exercises U6 - ECON - 2023-24blancamenendezferNo ratings yet

- Managerial Accounting Canadian 11th Edition Garrison Solutions Manual instant download all chapterDocument77 pagesManagerial Accounting Canadian 11th Edition Garrison Solutions Manual instant download all chaptertrashimbeb100% (8)

- (Download PDF) Managerial Accounting Canadian 11th Edition Garrison Solutions Manual Full ChapterDocument77 pages(Download PDF) Managerial Accounting Canadian 11th Edition Garrison Solutions Manual Full Chapterallenabeshay52100% (8)

- Cost Accounting ManualDocument183 pagesCost Accounting ManualSK Lashari100% (1)

- ACCY121FinalExamInstrManualchs9!11!13 16 AppendixDocument115 pagesACCY121FinalExamInstrManualchs9!11!13 16 AppendixArun MozhiNo ratings yet

- Chap 07Document14 pagesChap 07Syed Hamdan0% (2)

- Profit "Profit Is Return To The Entrepreneur For The Use of His Ability."Document6 pagesProfit "Profit Is Return To The Entrepreneur For The Use of His Ability."tunga computer net centerNo ratings yet

- Lecture #3 Managerial AccountingDocument5 pagesLecture #3 Managerial AccountingBushra HaroonNo ratings yet

- Unit 8Document29 pagesUnit 8Chalermpol CharoenrojanapakNo ratings yet

- Marginal Costing: Definition: (CIMA London)Document4 pagesMarginal Costing: Definition: (CIMA London)Pankaj2cNo ratings yet

- Marginal Costing With Decision MakingDocument38 pagesMarginal Costing With Decision MakingHaresh Sahitya0% (1)

- PM TheoryDocument99 pagesPM Theoryemma valenheart100% (1)

- Chapter 3 Life Cycle Costing: Answer 1 Target Costing Traditional ApproachDocument11 pagesChapter 3 Life Cycle Costing: Answer 1 Target Costing Traditional ApproachadamNo ratings yet

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDocument59 pagesCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisHarold Dela Fuente100% (1)

- Chapter 6Document57 pagesChapter 6Léo Audibert75% (4)

- Break Even Analysis NotesDocument11 pagesBreak Even Analysis NotesAbhijit PaulNo ratings yet

- Distinguish Between Marginal Costing and Absorption CostingDocument10 pagesDistinguish Between Marginal Costing and Absorption Costingmohamed Suhuraab50% (2)

- Kaduna State University: PGD in AccountingDocument12 pagesKaduna State University: PGD in AccountingPAUL TIMMYNo ratings yet

- Activity-Based Costing and Activity-Based ManagementDocument30 pagesActivity-Based Costing and Activity-Based ManagementNitin RajotiaNo ratings yet

- SM ch04Document30 pagesSM ch04Ngurah Panji Putra100% (1)

- Managerial Accounting Module 2 ActivityDocument7 pagesManagerial Accounting Module 2 ActivityDesy Joy UrotNo ratings yet

- Chap 008Document44 pagesChap 008palak32100% (6)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Business Ratios and Formulas: A Comprehensive GuideFrom EverandBusiness Ratios and Formulas: A Comprehensive GuideRating: 3 out of 5 stars3/5 (1)

- An Aviator's Field Guide to Owning an Airplane: Practical insights for successful aircraft ownershipFrom EverandAn Aviator's Field Guide to Owning an Airplane: Practical insights for successful aircraft ownershipRating: 5 out of 5 stars5/5 (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Short Paper ShaneDocument4 pagesShort Paper ShaneShane Camille AbuegNo ratings yet

- Daily Time Sheet DECEMBER 2013-FEBRUARY 2014 Required HRS: 250Document1 pageDaily Time Sheet DECEMBER 2013-FEBRUARY 2014 Required HRS: 250Shane Camille AbuegNo ratings yet

- Original Survey FormDocument7 pagesOriginal Survey FormShane Camille AbuegNo ratings yet

- Table 1 Frequency and Percentage Distributions According To Use of ToothbrushDocument30 pagesTable 1 Frequency and Percentage Distributions According To Use of ToothbrushShane Camille AbuegNo ratings yet

- Net Hours: Paragon Finance CorporationDocument1 pageNet Hours: Paragon Finance CorporationShane Camille AbuegNo ratings yet

- Findings Conclusion and RecommendationDocument12 pagesFindings Conclusion and RecommendationShane Camille AbuegNo ratings yet

- The Level of Effectiveness of Image Design and Quality of ToothmateDocument2 pagesThe Level of Effectiveness of Image Design and Quality of ToothmateShane Camille AbuegNo ratings yet