Professional Documents

Culture Documents

BetterInvesting Weekly Stock Screen 10-6-14

BetterInvesting Weekly Stock Screen 10-6-14

Uploaded by

BetterInvestingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BetterInvesting Weekly Stock Screen 10-6-14

BetterInvesting Weekly Stock Screen 10-6-14

Uploaded by

BetterInvestingCopyright:

Available Formats

Company Name Symbol Industry

Sales

(millions)

Hist 10 Yr

Rev Gr

Hist 10 Yr

EPS Gr

Rev R2

10 Yr

EPS R2

10 Yr

Proj 5 Yr

EPS Gr

PE/Hist

EPS Gr

PE/Proj

EPS Gr

Trend

PTI

Trend

ROE

Bed Bath & Beyond BBBY Specialty Retail 11,504.0 9.0% 13.2% 0.99 0.83 13.9% 1.00 1.00 Even ++

Comcast CMCSA Pay TV 64,657.0 14.5% 27.3% 0.97 0.93 13.7% 0.70 1.40 ++ ++

Cognizant Technology Solutions CTSH Information Technology Services 8,843.2 34.5% 30.1% 0.98 0.98 18.4% 0.70 1.10 Even Even

Dollar Tree Stores DLTR Discount Stores 7,840.3 11.1% 23.4% 1 0.97 16.8% 0.90 1.20 ++ ++

Oracle Corporation ORCL Software - Infrastructure 38,275.0 14.5% 18.4% 0.94 0.98 12.4% 0.90 1.30 Even +

O'Reilly Automotive ORLY Specialty Retail 6,649.2 17.9% 20.3% 0.95 0.93 17.0% 1.10 1.40 ++ ++

PetSmart PETM Specialty Retail 6,916.6 8.2% 14.3% 0.98 0.87 17.9% 1.10 0.90 ++ ++

Ross Stores ROST Apparel Stores 10,230.4 10.0% 25.9% 0.99 0.99 12.5% 0.70 1.50 ++ +

Tractor Supply Co TSCO Specialty Retail 5,164.8 12.4% 21.6% 0.99 0.93 18.4% 1.20 1.40 ++ ++

10-year annual sales, EPS growth R2 of 0.80 and higher

Analysts projected 5-year annual EPS growth of at least 8%

Ratio of P/E to both projected and historical five-year EPS growth of 1.5 or less

Trend in pre-tax income and return on equity of at least even

Screen Notes

MyStockProspector screen on Oct. 7

Annual sales of more than $5 billion

10-year annual sales, EPS growth of 8% and above

WEEK OF OCTOBER 6, 2014

You might also like

- Digital Hesitation: Why B2B Companies Aren't Reaching their Full Digital Transformation PotentialFrom EverandDigital Hesitation: Why B2B Companies Aren't Reaching their Full Digital Transformation PotentialRating: 5 out of 5 stars5/5 (1)

- Digital Business Transformation: How Established Companies Sustain Competitive Advantage From Now to NextFrom EverandDigital Business Transformation: How Established Companies Sustain Competitive Advantage From Now to NextRating: 5 out of 5 stars5/5 (1)

- BetterInvesting Weekly Stock Screen 11-07-16Document1 pageBetterInvesting Weekly Stock Screen 11-07-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-28-14Document1 pageBetterInvesting Weekly Stock Screen 4-28-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-4-16Document1 pageBetterInvesting Weekly Stock Screen 7-4-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-21-16Document1 pageBetterInvesting Weekly Stock Screen 11-21-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-28-13Document1 pageBetterInvesting Weekly Stock Screen 10-28-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-20-16Document1 pageBetterInvesting Weekly Stock Screen 6-20-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-14Document1 pageBetterInvesting Weekly Stock Screen 5-27-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-25-16Document1 pageBetterInvesting Weekly Stock Screen 7-25-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-19-15Document1 pageBetterInvesting Weekly Stock Screen 10-19-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-9-17Document1 pageBetterInvesting Weekly Stock Screen 10-9-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-6-16Document1 pageBetterInvesting Weekly Stock Screen 6-6-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-26-13Document1 pageBetterInvesting Weekly Stock Screen 8-26-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-14-18Document1 pageBetterInvesting Weekly Stock Screen 5-14-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-18-16Document1 pageBetterInvesting Weekly Stock Screen 4-18-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-16-15Document1 pageBetterInvesting Weekly Stock Screen 11-16-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-1-14Document1 pageBetterInvesting Weekly Stock Screen 9-1-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-30-15Document1 pageBetterInvesting Weekly Stock Screen 11-30-15BetterInvestingNo ratings yet

- Apple Inc. (AAPL) Cash Flow - Yahoo Finance - Yahoo FinanceDocument4 pagesApple Inc. (AAPL) Cash Flow - Yahoo Finance - Yahoo Financegiovanni.hilaire01No ratings yet

- BetterInvesting Weekly Stock Screen 11-18-13Document1 pageBetterInvesting Weekly Stock Screen 11-18-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-27-17Document1 pageBetterInvesting Weekly Stock Screen 3-27-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-17-14Document1 pageBetterInvesting Weekly Stock Screen 11-17-14BetterInvestingNo ratings yet

- BetterInvesting Weekly - Stock Screen - 3-5-12Document1 pageBetterInvesting Weekly - Stock Screen - 3-5-12BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-25-19Document1 pageBetterInvesting Weekly Stock Screen 2-25-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-28-16Document1 pageBetterInvesting Weekly Stock Screen 11-28-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-11-17Document1 pageBetterInvesting Weekly Stock Screen 9-11-17BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 10-29-18Document1 pageBetterInvesting Weekly Stock Screen 10-29-18BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 11-27-17Document1 pageBetterInvesting Weekly Stock Screen 11-27-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- Clearsight Monitor - Professional Services Industry UpdateDocument9 pagesClearsight Monitor - Professional Services Industry UpdateClearsight AdvisorsNo ratings yet

- BetterInvesting Weekly Stock Screen 12-4-17Document1 pageBetterInvesting Weekly Stock Screen 12-4-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-27-18Document1 pageBetterInvesting Weekly Stock Screen 8-27-18BetterInvestingNo ratings yet

- 8990 Initiation Cimb Format PDFDocument33 pages8990 Initiation Cimb Format PDFrtfirefly168No ratings yet

- BetterInvesting Weekly Stock Screen 3-11-19Document1 pageBetterInvesting Weekly Stock Screen 3-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 091012Document6 pagesBetterInvesting Weekly Stock Screen 091012BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-16Document1 pageBetterInvesting Weekly Stock Screen 5-16-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-26-16Document1 pageBetterInvesting Weekly Stock Screen 9-26-16BetterInvestingNo ratings yet

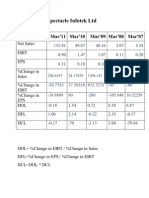

- Spectacle Infotek LTD: Ar'11 Ar'10 Ar'09 Ar'08 Ar'07Document5 pagesSpectacle Infotek LTD: Ar'11 Ar'10 Ar'09 Ar'08 Ar'07Abhishek SinghNo ratings yet

- BetterInvesting Weekly Stock Screen 10-1-18Document1 pageBetterInvesting Weekly Stock Screen 10-1-18BetterInvestingNo ratings yet

- He Watched Tech Stocks Scream Higher With Little InvolvementDocument37 pagesHe Watched Tech Stocks Scream Higher With Little InvolvementShankhadeep Mukherjee100% (1)

- Biweekly Screen 072417Document2 pagesBiweekly Screen 072417BetterInvestingNo ratings yet

- Profit Pool + Problem StructuringDocument5 pagesProfit Pool + Problem StructuringRaj ChauhanNo ratings yet

- Reliance Communications LTDDocument4 pagesReliance Communications LTDSahil JainNo ratings yet

- BetterInvesting Weekly Stock Screen 9-7-15Document1 pageBetterInvesting Weekly Stock Screen 9-7-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-22-17Document1 pageBetterInvesting Weekly Stock Screen 5-22-17BetterInvestingNo ratings yet

- Stock Analysis WorksheetDocument2 pagesStock Analysis Worksheetapi-405542840No ratings yet

- Infosys Financial RatiosDocument2 pagesInfosys Financial RatiosvaasurastogiNo ratings yet

- Global FundsDocument74 pagesGlobal FundsArmstrong CapitalNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-26-18Document1 pageBetterInvesting Weekly Stock Screen 2-26-18BetterInvestingNo ratings yet

- Profit Hot50 2010Document47 pagesProfit Hot50 2010jacket64No ratings yet

- BetterInvesting Weekly Stock Screen 10-31-16Document1 pageBetterInvesting Weekly Stock Screen 10-31-16BetterInvestingNo ratings yet

- BetterInvesing Weekly Stock Screen 12-3-18Document1 pageBetterInvesing Weekly Stock Screen 12-3-18BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 4-14-14Document1 pageBetterInvesting Weekly Stock Screen 4-14-14BetterInvestingNo ratings yet

- Midsize2012booklet 1865031Document250 pagesMidsize2012booklet 1865031maleemNo ratings yet

- IoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsFrom EverandIoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsNo ratings yet

- B4B: How Technology and Big Data Are Reinventing the Customer-Supplier RelationshipFrom EverandB4B: How Technology and Big Data Are Reinventing the Customer-Supplier RelationshipNo ratings yet

- BetterInvesting Weekly Stock Screen 1-27-2020Document3 pagesBetterInvesting Weekly Stock Screen 1-27-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-14-19Document1 pageBetterInvesting Weekly Stock Screen 10-14-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-1-19Document1 pageBetterInvesting Weekly Stock Screen 7-1-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-28-19Document1 pageBetterInvesting Weekly Stock Screen 10-28-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-7-19Document1 pageBetterInvesting Weekly Stock Screen 10-7-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-11-19Document1 pageBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-2-19Document1 pageBetterInvesting Weekly Stock Screen 10-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-9-19Document1 pageBetterInvesting Weekly Stock Screen 9-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-2-19Document1 pageBetterInvesting Weekly Stock Screen 9-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-23-19Document1 pageBetterInvesting Weekly Stock Screen 9-23-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-16-18Document1 pageBetterInvesting Weekly Stock Screen 7-16-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-19-19Document1 pageBetterInvesting Weekly Stock Screen 8-19-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-5-19Document1 pageBetterInvesting Weekly Stock Screen 8-5-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-3-19Document1 pageBetterInvesting Weekly Stock Screen 6-3-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-10-19Document1 pageBetterInvesting Weekly Stock Screen 6-10-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-25-19Document1 pageBetterInvesting Weekly Stock Screen 2-25-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-24-19Document1 pageBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-19Document1 pageBetterInvesting Weekly Stock Screen 5-16-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-11-19Document1 pageBetterInvesting Weekly Stock Screen 3-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-12-18Document1 pageBetterInvesting Weekly Stock Screen 11-12-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-22-19Document1 pageBetterInvesting Weekly Stock Screen 4-22-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-19-18Document1 pageBetterInvesting Weekly Stock Screen 11-19-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-9-19Document1 pageBetterInvesting Weekly Stock Screen 4-9-19BetterInvestingNo ratings yet

- Financial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrDocument2 pagesFinancial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrBetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-23-19Document1 pageBetterInvesting Weekly Stock Screen 1-23-19BetterInvesting100% (1)

- BetterInvesing Weekly Stock Screen 12-3-18Document1 pageBetterInvesing Weekly Stock Screen 12-3-18BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 11-5-18Document1 pageBetterInvesting Weekly Stock Screen 11-5-18BetterInvestingNo ratings yet