Professional Documents

Culture Documents

Misclassifying Cash Flows From Operations: Intentional or Not?

Misclassifying Cash Flows From Operations: Intentional or Not?

Uploaded by

toyekss0 ratings0% found this document useful (0 votes)

120 views15 pagesThis document summarizes a research study that investigated the accuracy of cash flows from operations reported on the statement of cash flows of Canadian companies. The researchers analyzed 786 observations from 262 companies over three time periods. They found companies were more likely to overstate cash flows from operations, presenting a better financial picture than supported by the balance sheet accounts. This suggests other cash flow sections may be understated. The presence of acquisitions reduced overstatements, possibly due to more auditor scrutiny. The study expands on previous case-by-case research to provide more generalizable findings on potential misstatements of cash flows from operations.

Original Description:

financial reporting

Original Title

frs

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes a research study that investigated the accuracy of cash flows from operations reported on the statement of cash flows of Canadian companies. The researchers analyzed 786 observations from 262 companies over three time periods. They found companies were more likely to overstate cash flows from operations, presenting a better financial picture than supported by the balance sheet accounts. This suggests other cash flow sections may be understated. The presence of acquisitions reduced overstatements, possibly due to more auditor scrutiny. The study expands on previous case-by-case research to provide more generalizable findings on potential misstatements of cash flows from operations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

120 views15 pagesMisclassifying Cash Flows From Operations: Intentional or Not?

Misclassifying Cash Flows From Operations: Intentional or Not?

Uploaded by

toyekssThis document summarizes a research study that investigated the accuracy of cash flows from operations reported on the statement of cash flows of Canadian companies. The researchers analyzed 786 observations from 262 companies over three time periods. They found companies were more likely to overstate cash flows from operations, presenting a better financial picture than supported by the balance sheet accounts. This suggests other cash flow sections may be understated. The presence of acquisitions reduced overstatements, possibly due to more auditor scrutiny. The study expands on previous case-by-case research to provide more generalizable findings on potential misstatements of cash flows from operations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 15

Misclassifying cash ows from

operations: intentional or not?

Karen Lightstone

Accounting Department, Saint Marys University, Halifax, Canada

Karrilyn Wilcox

Toronto, Canada, and

Louis Beaubien

Accounting Department, Saint Marys University, Halifax, Canada

Abstract

Purpose The purpose of this paper is to investigate the accuracy and informational quality of the

cash from operations section of the cash ow statement.

Design/methodology/approach This paper empirically tested the accuracy of the cash from

operations reported by Canadian non-nancial companies. The authors studied 262 companies at three

different time periods providing 786 rm observations. For each observation, the balance sheet was

used to conrm the gures reported in the statement of cash ows. In addition, the authors

investigated managements disclosure of the particular working capital items.

Findings The ndings suggest that in recent years, companies are more likely to overstate their

cash ow from operations, thereby presenting a better nancial picture than is supported by the

balance sheet accounts. This would suggest that the investing or nancing section would be

correspondingly understated. The presence of acquisitions reduces overstatements, which may be the

result of more auditor presence.

Research limitations/implications This paper extends previous research from documented

single, isolated instances of cash from operations being misstated to include a signicant sample with

more generalizable ndings. The data are Canadian which may limit the generalizability to other

countries. Future research should address the extent to which nancial analysts rely on the reported

cash from operations gure.

Practical implications This preliminary study may have implications for nancial analysts and

others relying on the free cash ow gure.

Originality/value This study expands on previous research which has taken place only on a

case-by-case basis.

Keywords Canada, Legitimacy theory, Accounting, Institutional theory, Cash ow from operations,

Statement of cash ows

Paper type Research paper

The great enemy of truth is very often not the lie deliberate, contrived and dishonest but

the myth persistent, persuasive, and unrealistic ( John Kennedy, 1961).

The establishment and acceptance of accounting practice is as much a technical

matter as one governed by the social context in which the practice emerges,

is justied and reviewed, and, ultimately gains acceptance (or not). Mezias (1990;

The current issue and full text archive of this journal is available at

www.emeraldinsight.com/1834-7649.htm

JEL classication M

The authors would like to thank the participants at the European Accounting Association

Conference in Rome, Italy for their helpful comments as well as other anonymous reviewers.

Received 16 July 2012

Revised 10 October 2012

15 November 2012

27 November 2012

Accepted 28 November 2012

International Journal of Accounting

and Information Management

Vol. 22 No. 1, 2014

pp. 18-32

qEmerald Group Publishing Limited

1834-7649

DOI 10.1108/IJAIM-07-2012-0039

IJAIM

22,1

18

Mezias and Scarselletta, 1994) examines the institutional inuences associated

with the development of nancial reporting practices in the Fortune 200 suggesting

these practices are driven by structural inuences that are inscribed with certain goals

and motivations. The potency of institutional forces is such that organizations imitate

procedures adopted by other organizations (mimetic isomorphism) and strive to

conform to perceptions of how things should be done (normative isomorphism)

whether that is advocated deliberately and explicitly, or implicitly (Moll et al. 2006).

Meyer and Rowan (1977) point out that very often the rationale, and the rationalizing,

about a given organizational procedure is subsumed by the myth of correct action,

once the behavior has become institutionalized as the appropriate mode of action

(Lightstone and Driscoll, 2009). In other words, if a given practice is held up as correct

and becomes a normative force, its validity is immaterial, what is material however, is

that the practice is perceived and accepted as correct. As Potter (2005) points out, in the

social and institutional processes that are implicated in the enactment of accounting

practices, there is rarely an unfolding of those practices by organizational

participants. Their actions are shaped by the interpretations and actions that have

come before them, and surround them. This surfaces a question of particular relevance

to accountancy: what if the institutionalized practices we have accepted as being

correct, were in fact different than anticipated, or worse wrong?

Academics have long advocated the importance and usefulness of the statement of

cash ows (Gup and Dugan, 1988; Hodgson and Stevenson-Clark, 2000; Hossain et al.,

2011; Jones, 1998; Purr, 2004; Sharma and Iselin, 2003). The statement of cash ows is

unique from other nancial statements because it is relatively free from bias. Other

studies support this perspective, arguing cash owinformation to be as, or more useful,

than accrual information for decision-making ( Jones and Widyaya, 1998; Sharma and

Iselin, 2003). However, recent examinations question the quality and clarity of

information in the statement of cash ows; arguing it is not clear nor conducive to

providing the information investors require, as classications are poorly dened and not

necessarily consistent (Broome, 2004; Hill et al., 2003). This paper investigates the

accuracy and reliability of the statement of cash ows and demonstrates in the absence

of strict denitions and dened work procedures, poor practices concerning

the reporting of cash ows may emerge from organizational practice.

The denition of operating cash ows is subject to interpretive discretion, and

in the spirit of Potters (2005) assertion of the social construction of accounting policies,

distortions of meaning may emerge. Researchers continue to point out individual

cases containing material misstatements (Broome, 2004; Siegel, 2006; Mulford and

Comiskey, 2005). For instance, Enron Corporation used investing proceeds to increase

operating cash ows ( Jopson, 2006). Consequently, management could misstate

operating activities and external users would be unable to readily discern the fraud.

Hill et al. (2003) suggest cash ow from operations is the hardest component of the

statement of cash ows to understand yet it is one of the most used gures in

determining available cash in the future (Wampler et al., 2009).

Previous research concerning the statement of cash ows of public companies has

been on a case-by-case basis. In this study, we investigate three years of rm-level data

drawn from 262 publicly traded companies, providing 786 observations, to examine

consistency between reported cash ows from operations and the amount calculated

using changes in the balance sheet accounts. Further, we posit an institutional

Misclassifying

cash ows from

operations

19

mechanism for the emergence of cash ow reporting practices found in evidence.

We focus on the operating activities section of the statement of cash ows because it is

the most difcult to reconcile from the other statements and previous research has

indicated a tendency to misclassify elements resulting in more favourable cash ows

from operations than can be supported by the balance sheet and income statement.

Cash ow statement reporting: practices and institutions

The statement of cash ows encompasses changes in all balance sheet items over a

period in terms of cash inows (source) and outows (use). Instances where a change

in a balance sheet account will not be accurately reected on the statement of cash

ows include acquisitions and dispositions of business segments, foreign exchange

translation adjustments, and asset write-offs. However, material adjustments require

disclosure in the notes to the nancial statements and therefore can assist in the

recalculation. The statement of cash ows can be prepared using either the indirect or

the direct method. According to Barsky and Catanach (2007) the use of the indirect

method presents several opportunities for misreporting the cash ow position.

Although the Canadian Institute of Chartered Accountants handbook (CICA, 2006),

recommends the direct method, the indirect method is widely used in practice (CICA,

Section 1540.2). In our study, over 99.9 percent of our observations used the indirect

method for reporting. One company changed from the indirect to the direct method in

one year but subsequently reverted back to the indirect method. Therefore, our

discussion will focus on the indirect method of reporting.

The CICA handbook, which presents the accounting standards in Canada, has

required some formof a cash owstatement since the early 1970s (Matulich et al., 1982).

Initially, the statement followed funds which could be either cash or working capital.

The intent was to supplement inadequate information provided by the balance sheet

and income statement with information deemed essential for decision-making

(Matulich et al., 1982, p. 704). In 1985, the funds ow statement was replaced by the

statement of cash ows, which was intended to be more accurate, informative and

useful to decision makers (Donleavy, 1992). In 1998, the CICA eliminated the need to

include non-cash transactions (CICA, Section 1540.46, 1998). Currently, Canada uses

International Financial Reporting Standards (IFRS, 2008). The accounting standard

addressing the statement of cash ows (IAS 7) contains no changes that are relevant to

our study, and allows the direct or indirect method for reporting cash ows.

Cash ow misstatement

Enron used misstatements of operating cash ows to misappropriate assets and

present fraudulent nancial reports in one of the most famous cases of nancial

reporting deception in recent history (Siegel, 2006; Mulford and Comiskey, 2005).

Fraser and Ormiston (2003) suggest some companies have developed creative

approaches to manipulate operational cash ows to foster the appearance of a more

robust nancial position. Single company studies Mulford and Comiskey

(2005; Hill et al., 2003; Sender, 2002) have demonstrated how oil and gas companies

have attributed nancing and debt repayment as operational cash ows and

Revsine et al. (2005) disclose the manipulation of cash ow gures applied in long-term

contracts related to capital restructuring, foreign currency translation and acquisitions

and divestitures.

IJAIM

22,1

20

Currently, investors, stakeholders and analysts cannot reproduce the entire

statement of cash ows because of a lack of access to the primary data used to

construct the nancial statements, namely the cost and associated accumulated

amortization for capital asset disposals. However, all other items on the statement of

cash ows can be derived from changes in the balance sheet accounts and adjustments

to the income statement. Current standards do not require disclosure of these capital

asset amounts, nor do they clearly specify what constitutes operating cash ows. By

contrast there is an acceptance in the accounting industry that cash ows may not

always match the balance sheet reconciliation exactly, due to full disclosure of

accruals, acquisitions, and dispositions (Bernard and Stober, 1989).

Given conservatism is a foundational principle of accounting, it might be expected

that under estimating cash ows from operating activities would emerge as the

convention, rather than over estimation (Madsen, 2011; Dechow, 1994). For example,

Gigler et al. (2009) found that organizations frequently adopt projections of cash ows to

cover debt obligations reecting the minimum likely cash ows. This reects a

conservative approach to estimation consistent with general accounting practices

(Watts, 2003a) wherein cautious approaches are adopted in the estimation of benets

and costs to the rm. There is variation in individual interpretation of how a

conservative approach is implemented or interpreted (Madsen, 2011). However, the

general consensus in the market suggests cautious approaches to commentary on the

health of the rm, nancial or otherwise, are deemed more valuable and accurate as

opposed to more aggressive or optimistic assessments (Barton et al., 2010). Thus, as a

generous estimation of cash ows may be interpreted to benet the rm, Watts (2003b)

suggests a conservative approach may lead to a more cautious (and therefore lesser)

estimation of cash ows.

The combination of incomplete information and pervasive vagueness provides

motivated management with a way to misstate operating and investing activities cash

ows: a cash ow statement will balance despite a misclassication between

non-current assets and operating cash ows. The absence of stated denitions and

practices, surfaces questions on the practice of reporting cash ows from operations,

such as: how have practices emerged for cash ows from operations in the absence of

guidance? What are the implications for the quality of information for cash ow

statements? Why does the statement of cash ows continue to be deemed important

given its possibly unreliable character?

Mezias and Scarselletta (1994) argue institutional pressure is implicated in the

establishment of nancial reporting data (Mezias, 1990), suggesting internal and

external pressures result in some perceptions and approaches that may be more highly

valued than others. Managing the reporting of nancial results, particularly using the

income statement is not new. Wang et al. (2010) nd a high percentage of Taiwanese

companies present positive earnings when a small loss should be reported. In the context

of cash ow statements, it might be reasonable to assume in a given industry, when a

critical mass of organizations have adopted particular techniques for reporting cash

ows legitimate or otherwise organizations without established practices

(or with contradictory practices) may follow suit and adopt such reporting practices in

an isomorphic fashion. For instance, if a majority of oil and gas companies report

nancing and repayment as operational cash ows, as noted above, other rms in the

industry may feel pressure to adopt these practices. These rms may even be aware

Misclassifying

cash ows from

operations

21

the reporting technique is incorrect, but must be complicit, otherwise they will appear to

be inconsistent withindustry averages even if those averages create a false impression

of organizational health. This introduces a second form of inuence: the analyst.

Investment analysts assess a corporations health, and thereby its potential as an

investment through a (hopefully) careful examination of its nancial metrics. Billings

and Morton (2002) demonstrate the perceived importance of operating cash ows for

assessing the credit risk of a company and estimating opportunity costs. Cheng et al.

(1996) suggest operating cash ows are deemed to provide a stronger signal for future

performance when the transitory components of earnings are relatively high (for

further examples see: Allen and Cote, 2005; DeFond and Hung, 2003; Barth et al., 2001).

As such, organizations aspire to satisfy the expectations of analysts and follow

prescribed guidance on what nancial performance should be.

Given the demonstrably high misstatement of cash ow reporting noted above,

despite the institutionalized notions that cash ow reporting is a valuable tool in

organizational analysis, the rst proposition is:

P1. Reported cash ows from operating activities cannot be accurately derived

from changes in the balance sheet accounts.

A discrepancy between the reported and calculated numbers does not necessarily mean

users decisions would be affected as differences could be considered immaterial and

therefore inconsequential. To test if the difference affects user decisions, we used the

upper limit for each material criterion dened by Pany et al. (1996), providing the most

liberal denition. This leads us to our second proposition:

P2. The difference between cash ows from operating activities as reported and

cash ows as calculated from the balance sheet is material.

There is one alteration of cash ow reporting standards during the time-span of our

study: the elimination of non-cash transactions (CICA, Section 1540.46, 1998). This

results in a decrease in quantity of information reported on the statement of cash ows,

however it does not directly impact the statement. For instance, the purchase of capital

assets through direct issuance of shares in kind, would result in no acknowledgement

of the transaction on the statement. Given the nature of dealings that could fall into this

transaction category, signicant changes could occur to assets, liabilities and equity

invisibly to the statement of cash ows. Thus, we posit post-1998 cash ow statements

are less connected to the balance sheet and income statement, and therefore the

accuracy of cash ow constructions from these statements will be diminished, leading

to the third and nal proposition:

P3. Reported cash ows from operating activities are less likely to be accurately

derived from changes in the balance sheet accounts post-1998 than pre-1998.

Data and sample description

Our sample period included 1997, 1998, and 2004 providing data from a pre-standard

change year, a straddle change year, and a post-standard change year. Burns (2000)

suggests a reasonable amount of time is needed for the assimilation and adaptation of

new accounting rules. Therefore, we used 2004 as our third data point. To be

considered in our study, we also required the company be:

IJAIM

22,1

22

.

in existence from 1996 to 2005;

.

a Canadian publicly traded company that used Canadian generally accepted

accounting principles (GAAP); and

.

not acquired during the study period by another company included in our

sample.

We excluded insurance companies and nancial institutions because these companies

produce nancial reports that are closely regulated by the Ofce of the Superintendent

of Financial Institutions. This resulted in a statistical sample of 262 companies

(providing 786 observations). Each rms audited nancial statements were retrieved

from the System for Electronic Document and Analysis Retrieval (SEDAR).

Since the initial portion of the cash ow from operating activities section of the

statement of cash ows commences with net income and adjustments, which can be

traced to the income statement, the main focus of our calculation was the non-cash

working capital amount. For each company the non-cash working capital amount was

calculated from the balance sheet and compared to the amount reported on the

statement of cash ows. If the amount did not agree, the statement was reviewed to

ensure amounts included in the calculation were not reported elsewhere. For instance,

the current portion of long-term debt is commonly reported as part of the change in

total long-term debt and included with nancing activities. Also, if the company

provided notes in the nancial statements disclosing the components of the change in

non-cash working capital, we examined the accounts disclosed and calculate the

changes in those accounts. Another example would be the use of an other account

that might have been listed on the balance sheet as a non-current asset or liability. If the

change in that account accounted for the difference between our calculation and the

reported gure, we considered the non-cash working capital amount to be accurately

reported. We also considered information provided in the statements with respect to

acquisitions and foreign currency transactions as a possible source of reconciling the

calculated and reported differences.

Two researchers collected the data and one senior researcher conrmed the accuracy

of the data on a test basis. To ensure consistency, an initial practice session was

conducted, where all three researchers calculated the cash ow from operations for

several companies. The differences from the reported gure found on the statement of

cash ows and the calculated amount from changes in balance sheet accounts were

investigated and discussed to establish a consistent method for analysis. Any

irreconcilable difference was identied either as an understatement or overstatement.

For example, if the company reported non-cash working capital as a source of cash of

$100 and the calculated amount was a source of $110, the difference would be considered

to be an understatement. The reverse would be an overstatement.

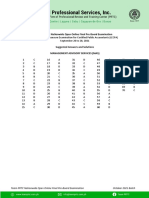

Descriptive statistics

Table I shows descriptive statistics for 2004. The sample included a wide variation in

terms of size and nancial health.

Further, we grouped our rms into industries using ve broad classications.

Table II provides the breakdown of our sample by industry.

The other category represents companies that are diversied and therefore not

tting into another classication.

Misclassifying

cash ows from

operations

23

Empirical results of statement of the operating cash ow position

As discussed earlier, the information contained on the balance sheet can be used to

derive the information reported on the statement of cash ows. In this section, we rst

control for the effects of restructurings, acquisitions, divestitures or translation

changes and examine if the information reported for the cash ow from operating

activities concurs with the balance sheet. Further, we examine if the difference is

signicantly large to affect the decisions of users of nancial statements. Finally, we

examine the agreement between the calculated and reported amounts both pre-1998

and post-1998, before and after the standard change.

Difference in reported and calculated amounts

Table III provides the differences between the calculated and reported gure for each

of the three years. There was a 36 percent decline in the number of companies with

agreement between the calculated and reported gures from 1997 to 2004. The shift

was toward more companies with an overstated position (25 percent increase)

compared to an understated amount (18 percent increase). This means companies in

their 2004 audited annual nancial statements tended to present a stronger cash ow

from non-cash working capital items than could be supported by the balance sheet

position. Only 30 companies (11.5 percent) agreed in all three years. These ndings

Total assets Total revenue Net income

Mean $2,124,020,141 $1,409,647,734 $105,480,784

Median 80,778,000 117,881,566 3,078,838

SD 5,462,530,872 3,532,046,831 347,667,620

Minimum 48,045 0 2307,644,000

Maximum 40,032,538,700 24,885,000,000 3,513,000,000

Note: n 262

Table I.

Descriptive statistics

for sample companies

for 2004

Industry Percentage

Service 13.7

Manufacturing 24.8

Resource 40.5

Technology 5.4

Other 15.6

Total 100.0

Table II.

Industry groupings

1997 (%) 1998 (%) 2004 (%)

No difference 37.4 39.3 24.0

Reported amount is higher than calculation (overstatement) 30.9 28.6 38.5

Reported amount is lower than calculated (understatement) 31.7 32.1 37.4

Note: n 262

Table III.

Results of calculated

vs reported non-cash

working capital

IJAIM

22,1

24

support Broome (2004) and Hill et al.s (2003) suggestion that the statement is no longer

clear and does not provide the information investors require. It is interesting to note

more companies (74.2 percent) disclosed the components of their non-cash working

capital in 2004 than in previous years (31.7 percent in 1997 and 35.6 percent in 1998).

The ndings from Table III support our P1. In 2004, in only 24 percent of the sample

companies non-cash working capital amounts could be accurately calculated from the

balance sheet accounts. A repeated measures general linear model was signicant and

conrms these results F (2,481) 10.303, p , 0.001, h

2

0.038. In 2004, it is more

likely cash ows from operations will be overstated (M 0.85, SD 0.05) compared to

1998 (M 1.12, SD 0.05) and 1997 (M 1.07, SD 0.05).

Material difference in reported and calculated amounts

Table IV provides results for all three measures of materiality in each of the years

under consideration.

The results in Table IV indicate the number of companies with material differences

grew each year. With respect to net income as a measure of materiality, the percentage

of companies with a material difference between reported and calculated non-cash

working capital gures increased 33.9 percent from 1997 to 2004. Our P3 is supported

by these ndings. Material differences in 1998 are more prevalent than in 1997 before

the standard change. The direction of the difference also changed, again focusing on

net income, from 1997 with 42 percent of the companies materially overstating to

50.5 percent in 2004. For all three measures of materiality, the percentage of companies

overstating increased from year-to-year. This supports P2.

Effect of acquisitions and foreign exchange

Revsine et al. (2005) suggest rms acquiring other companies during the year or

accounting for foreign exchange transactions, might not be able to reconcile the cash

from operating activities with changes in the balance sheet accounts. In our sample, we

identify the number of rms with acquisitions and/or foreign exchange effects disclosed

inthe notes to the nancial statements and investigate whether these disclosures explain

any unresolved differences. Although we found two companies with information

regarding acquisitions that explained any unresolved differences, we wanted to test if

the presence of acquisitions and foreign exchange was a predictor for a reconcilable cash

ow from operating activities. The following table shows the results of a multinominal

logit regression test evaluating the likelihood of agreement between the reported and

calculated gures when there is an acquisition during the reporting year. The dependant

variable is trichotomous with categories representing non-cash working capital

Net income Total assets Total revenue

Year % Over Under % Over Under % Over Under

1997 31.0 42.0 58.6 28.2 35.1 64.9 33.7 38.6 61.4

1998 36.4 44.2 55.8 28.5 41.9 58.1 35.4 40.2 58.7

2004 41.5 50.5 49.5 34.0 54.5 45.5 43.8 49.6 50.4

Note: Materiality is 10 percent of net income, 1 percent of total assets and 1 percent of total revenues

Source: Pany et al. (1996, p. 235)

Table IV.

Percent of companies

with materially

overstated or understated

non-cash working capital

positions for each

materiality measure

Misclassifying

cash ows from

operations

25

differences between reported and calculated amounts that understate the position,

are in agreement, and overstate the position. The control variables are total assets, total

revenue, and net income. The reference category is overstatement of the non-cash

working capital position (Table V).

For all three years the likelihood of agreement between the reported and calculated

non-cash working capital gures increases when there is a disclosed acquisition in the

reporting year. For 2004, total revenue is also a predictor of overstatement, as total

revenue increases the likelihood of disagreement decreases. These ndings are

consistent with results of previous research into earnings management and auditor

decisions (Chong et al., 2012; Nelson et al., 2003; Kinney and Martin, 1994). These

ndings suggest there may be greater auditor inuence in the classication of

operating, investing and nancing activities when there is an acquisition. However,

prior research into cash ow management has not considered the mitigating inuence

of auditors.

Working capital disclosure

Examining working capital disclosures during the sample period reveals 32 percent of

rms disclose the components of working capital used to report the cash ow from

operations gure in 1997. This number grew to 36 percent in 1998 and to 74 percent

in 2004. Overall the data reveal an increase in the number of companies

providing voluntary working capital information. With respect to industry,

Table VI illustrates the percentage of disclosing rms for each of the ve identied

industries.

We observe manufacturing rms, prior to 2004, tend to provide the working capital

component. However, technology companies had the most improvement with only

18 percent disclosing the components in 1997 and over 80 percent in 2004.

Industry 1997 (%) 1998 (%) 2004 (%)

Service 30.0 33.3 67.6

Manufacturing 38.1 50.0 68.4

Resource 30.0 28.6 76.8

Technology 18.2 33.3 80.0

Other 33.3 34.5 80.6

Table VI.

Disclosure of working

capital components

by industry

1997 1998 2004

B Sig. B Sig. B Sig.

Intercept 21.360 0.019 20.634 0.223 21.807 0.002

Total assets 0.000 0.591 0.000 0.402 0.000 0.338

Total revenue 0.000 0.623 0.000 0.392 0.000 0.029

* *

Net income 0.000 0.211 0.000 0.072 0.000 0.311

Acquisitions 2.238 0.000

*

1.604 0.000

*

1.546 0.003

*

Exchange effect 20.077 0.885 20.074 0.884 0.715 0.085

Note: Signicant at:

*

1 and

* *

5 percent levels

Table V.

Multinominal logit

regression analysis

regarding the likelihood

of reconciling given

the presence of

various factors

IJAIM

22,1

26

Nature of working capital information

The most frequent accounts used in the reported non-cash working capital are: accounts

receivable, inventories, prepaid expenses, accounts payable and accrued liabilities, and

income taxes. However, in total, ndings suggest ve different variants of non-cash

working capital. Variations might include deferred revenue, current portion of

non-current assets or liabilities, and notes receivable. This wide variation suggests that

comparability of non-cash working capital across rms may be difcult. Similarly,

examination of non-cash working capital disclosures demonstrate only 47 (of 262) rms

use the same denition of non-cash working capital across periods. Our results provide

empirical evidence of the lack of consistency and comparability of non-cash working

capital information, suggested byBroome (2004) and Hill et al. (2003). This inconsistency

can lead to misinterpretation of nancial statements when users are relying on differing

denitions of working capital information.

Discussion

The results suggest in the absence of strict denitions and dened work procedures,

practices concerning the reporting of cashows may emerge fromorganizational practice.

Consistent with the theoretical underpinnings of institutional theory, reporting practices

will be reied over time and become the defacto standard, implicitly in the absence of an

explicit standard. These ndings also have implications for the perceived value and

quality of information contained in the statement of cash ows.

Accounting practices are subject to institutional inuences, and are shaped by

internal and external forces. The common assumption is as institutional actors become

entrenched in particular modes of action and, as particular perceptions and procedures

become concretized they become the explicit standard (Mezias, 1990; Mezias and

Scarselletta, 1994). Thus, denitions of what something is, and rules for how

something should be treated are emplaced as the correct mode of action, and deviating

from these perceptions and actions jeopardizes the legitimacy of the entity seeking

an alternate interpretation (Beaubien, 2008; Carpenter and Feroz, 1992, 2001). However,

examination of the data of cash ow reporting suggests the institutionalization of

relevant reporting practices have evolved in a different fashion. Rather than the

emergence of a specic denition of operating cash ows, and an inexible method

of reporting; a non-rigid denition has been institutionalized. In other words,

operating cash ows have become accepted as an amorphous entity with rules which

can be applied with a great degree of variance. Further, the evidence suggests that, in

contrast to a principle of conservatism[1] which Watts (2003a; see also Watts, 2003b;

Gigler et al., 2009; Madsen, 2011) suggest would result in the under-reporting of

cash ows; the majority of organizations adopt practices that over-report cash ows.

Modell (2002) demonstrates institutional forces that impact the development of

practices, and the ways in which those practices are used, are inuenced by

organizations that are industry leaders which are often deemed standard setters.

As such, there are isomorphic tendencies among organizations as they seek to be

deemed legitimate through the adoption of like practices and standards (Carpenter and

Feroz, 2001). This inuence is largely tacit, in that the inuencing entity is not seeking

to exert inuence; but rather is inuential merely by occupying the position held.

Call et al. (2009) argue the inclusion of cash ow analysis with nancial forecasting

improves the quality of the analysis, and the authors posit this is due to anincrease in the

Misclassifying

cash ows from

operations

27

rigor of the analysis. However, LeHavy (2009) takes exception, suggesting that

concordance between cash owanalysis and forecast accuracy diminishes precipitously

after 2004 and further research is required to assess the value of cash ows in

forecasting. This is consistent with Ramnath et al. (2008; see also Demirakos and

Strong, 2004) who nd that cash ows are thought to be an important indicator, but are

becoming less commonly used. This may be in part due to questions regarding the

quality of information and sometimes willful misstatement of material information that

can be found in the statement (Broome, 2004). Thus, despite evidence suggesting the

value (a properly constructed) the statement of cash ows might provide (Purr, 2004),

stakeholders seem to decline to use the resource in recent years (Ramnath et al., 2008).

Conclusion

The institutionalization of the statement of cash ows (particularly the denition of

operating cash ows) appears to be a mutually reinforced construction between

organizations and their various stakeholders. From one position, the reporting of

operating cash ows has attained an unquestioned and reied structure as a exible

repository of transactions. And, given its ill-dened nature, organizations can

incorporate elements into the operating cash ows, which under a stricter regime would

not be allowed. This practice is reinforced as it allows organizations to manage, to some

degree, the image of its nancial health and provides a rhetorical device in the form of a

statement such as, The company is doing well, our operating cash ows showed a

positive trend [. . .]. For these practices to be established, they must have been accepted

by the stakeholders, which must accept the appearance of nancial stability an

organization creates when presenting a statement of cash ows (Burns, 2000; Meyer and

Rowan, 1977). And, most commonly, they do. Rather than challenge the institutional

orthodoxy of how a statement of cash ows might be prepared, stakeholders accept the

presentation of the statement of cash ows, and over time, reify a practice. The

alternative to challenge the statement is made difcult byinstitutional representations

of legitimacy and authority (Carpenter and Feroz, 1992, 2001; Modell, 2002). To

challenge the statement of cash ows is to challenge the professional accountants, the

organization, the auditors, the lawyers that have claried the standards, and so on.

The danger of the unquestioned presentation and acceptance of the statement of

cash ows exists in its reication. If the statement of cash ows remains unreexively

accepted in an incorrect form, then decisions may be made on data that is

demonstrably in error, but assumed, or accepted as accurate. The lesser hazard exists

in that a form of information that has proven value and benets will continue to be

inappropriately used, and provide no true benet the equivalent of a warn-down

speed-bump passed over and barely noticed.

Limitations and future research

Areas of future research may point to a direction as to how the statement of cash ows,

and operating cash ows, might be recaptured as an accurate and valuable tool of

making the operations of an organization transparent. This can be affected through

approaches to practices and standards that seek a useful and productive denition and

set of rules for the reporting of cash ows. Other areas that might prove fruitful for

further inquiry include an examination of how cash ow reporting might change under

international nancial reporting standards and the differences in practice that exist

IJAIM

22,1

28

within and between industries in the presentation and use of cash ow statements.

Other researchers could conduct the same study in other countries where other

accounting practices occur to determine how widespread the tendency is to overstate

cash from operations. Although auditor presence is suggested as the reason for

improved reporting of cash ows from operations when acquisitions are reported, there

may be alternative explanations. Future research should address the extent to which

nancial analysts rely on the reported cash from operations gure.

Although this research found that the statement of cash ows is more likely to be

reconciled from changes in the balance sheet accounts when the company had an

acquisition, it does not provide alternative explanations that may, in fact, exist. The

companies investigated are all Canadian public companies. Our ndings may not be

generalizable to other companys cash ow statements in other countries. However,

prior research citing individual cases of cash owmisclassication or misrepresentation

indicates this is not the case.

Note

1. Conservatism in an accounting framework suggests that when one is presented with the

choice between two options the one that does not overstate assets or income should be

chosen. By expansion, this would include operating cash ows.

References

Allen, M.F. and Cote, J. (2005), Creditors use of operating cash ows: an experimental study,

Journal of Managerial Issues, Vol. 17 No. 2, pp. 198-211.

Barsky, N.P. and Catanach, A.H. (2007), Are your borrowers operating cash ows real?,

Commercial Lending Review, March/April, pp. 3-12.

Barth, M.E., Cram, D.P. and Nelson, K.K. (2001), Accruals and the prediction of future cash

ows, The Accounting Review, Vol. 76 No. 1, pp. 27-58.

Barton, J., Hansen, T.B. and Pownall, G. (2010), Which performance measures do investors

around the world value the most and why?, The Accounting Review, Vol. 85 No. 3,

pp. 753-789.

Beaubien, L. (2008), Constitutive practice and institutional change: ethics and behavior, Journal

of Accounting & Organizational Change, Vol. 4 No. 1, pp. 47-66.

Bernard, V.L. and Stober, T.L. (1989), The nature and amount of information in cash ows and

accruals, The Accounting Review, Vol. 64, pp. 624-652.

Billings, B.K. and Morton, R.M. (2002), The relation between SFAS No. 95 cash ows from

operations and credit risk, Journal of Business Finance & Accounting, Vol. 29, June/July,

pp. 787-805.

Broome, O.W. (2004), Statement of cash ows: time for change!, Financial Analysts Journal,

Vol. 60 No. 2, pp. 16-22.

Burns, J. (2000), The dynamics of accounting change: inter-play between new practices, routines,

institutions, power and politics, Accounting, Auditing & Accountability Journal, Vol. 13,

pp. 566-596.

Call, A.C., Chen, S. and Tong, Y.H. (2009), Are analysts earnings forecasts more accurate when

accompanied by cash ow forecasts?, Review of Accounting Studies, Vol. 14 No. 203,

pp. 358-391.

Misclassifying

cash ows from

operations

29

Carpenter, V.L. and Feroz, E. (1992), GAAP as a symbol of legitimacy: New York states decision

to adopt generally accepted accounting principles for external nancial reporting,

Accounting, Organizations and Society, Vol. 17 No. 7, pp. 613-643.

Carpenter, V.L. and Feroz, E. (2001), Institutional theory and accounting rule choice: an analysis

of four US state governments decisions to adopt generally accepted accounting

principles, Accounting, Organisations and Society, Vol. 26, pp. 565-596.

Cheng, C.S.A., Liu, C.S. and Schaefer, T.S. (1996), Earnings performance and the incremental

information content of cash ows from operations, Journal of Accounting Research,

Vol. 34, pp. 173-181.

Chong, G., Huang, H. and Zhang, Y. (2012), Do US commercial banks use FAS 157 to manage

earnings?, International Journal of Accounting and Information Management, Vol. 20

No. 1, pp. 78-83.

CICA (1998), Handbook Revisions Release Nos. 95 & 96, Canadian Institute of Chartered

Accountants, Toronto, June.

CICA (2006), Cash Flow Statements, General Accounting Section 1540, Canadian Institute of

Chartered Accountants, available at: www.knotia.ca (accessed March 16, 2006).

Dechow, P. (1994), Accounting earnings and cash ows as measures of rm performance:

the role of accounting accruals, Journal of Accounting and Economics, Vol. 18, pp. 3-42.

Defond, M.L. and Hung, M. (2003), An empirical analysis of analysts cash ow forecasts,

Journal of Accounting & Economics, Vol. 35, pp. 73-100.

Demirakos, E. and Strong, N. (2004), What valuation models do analysts use?, Accounting

Horizons, Vol. 18 No. 4, pp. 221-240.

Donleavy, G.D. (1992), The funds statement: an inquest, Managerial Finance, Vol. 18 No. 6,

p. 27.

Fraser, L. and Ormiston, A. (2003), Understanding the Corporate Annual Report: Nuts, Bolts,

and a Few Loose Screws, Prentice-Hall, New York, NY.

Gigler, F., Kanodia, C., Sapra, H. and Venugopalan, R. (2009), Accounting conservatism and the

efciency of debt contracts, Journal of Accounting Research, Vol. 47, pp. 767-797.

Gup, B.E. and Dugan, M.T. (1988), The cash ow statement: the tip of an iceberg, Business

Horizons, Vol. 31 No. 6, pp. 6-9.

Hill, R., Benston, G.J. and Hartgraves, A. (2003), Measuring corporate performance: the perils of

turning to cash ow, Public Utilities Fortnightly, Vol. 141 No. 10, pp. 20-22.

Hodgson, A. and Stevenson-Clarke, P. (2000), Earnings, cash ows and returns: functional

relations and the impact of rm size, Accounting and Finance, Vol. 40, pp. 51-73.

Hossain, M., Mitra, S. and Rezaee, Z. (2011), Incremental information content of option-related

excess tax benet under FASB Statement No. 123R: a research note, International Journal

of Accounting and Information Management, Vol. 19 No. 2, pp. 146-168.

International Accounting Standards Board (2008), International Financial Reporting Standards

(IFRSs) 2008, International Accounting Standards Committee Foundation, London.

Jones, S. (1998), An evaluation of user ratings of cash vs accrual based nancial reports

in Australia, Managerial Finance, Vol. 24 No. 11, p. 16.

Jones, S. and Widyaya, L. (1998), The decision usefulness of cash ow information: a note,

Abacus, March, p. 34.

Jopson, B. (2006), The numbers puzzle every week, it seems, companies unveil startling prots

but how much do these gures actually reveal about corporate performance and

efciency?, Financial Times, Vol. 10, June, p. 42 (Surveys edition).

IJAIM

22,1

30

Kinney, W.R. Jr and Martin, R.D. (1994), Does auditing reduce bias in nancial reporting?

A review of audit-related adjustment studies, Auditing, Vol. 13 No. 1, p. 149.

LeHavy, R. (2009), Discussion of are analysts earnings forecasts more accurate when

accompanied by cash ow forecasts, Review of Accounting Studies, Vol. 14, pp. 392-410.

Lightstone, K. and Driscoll, C. (2009), Disclosing elements of disclosure: a test of legitimacy

theory and company ethics, Canadian Journal of Administrative Sciences, Vol. 25, pp. 7-21.

Madsen, P.E. (2011), How standardized is accounting?, The Accounting Review, Vol. 86 No. 5,

pp. 1679-1708.

Matulich, S., Heitger, L.E. and Var, T. (1982), Financial Accounting, First Canadian edition,

McGraw-Hill Ryerson, Toronto.

Meyer, J. and Rowan, B. (1977), Institutionalized organizations: formal structure as myth and

ceremony, American Journal of Sociology, Vol. 83, pp. 340-363.

Mezias, S. (1990), An institutional model of organizational practice: nancial reporting at the

Fortune 200, Administrative Science Quarterly, Vol. 35, pp. 431-457.

Mezias, S. and Scarselletta, M. (1994), Resolving nancial reporting problems: an institutional

analysis of the process, Administrative Science Quarterly, Vol. 39 No. 4, pp. 654-678.

Modell, S. (2002), Institutional perspectives on cost allocations: integrations and extensions,

European Accounting Review, Vol. 11, pp. 653-679.

Moll, J., Burns, J. and Major, M. (2006), Institutional theory, in Hoque, Z. (Ed.), Methodological

Issues in Accounting Research, Spiramus Press, London, pp. 183-205.

Mulford, C.W. and Comiskey, E.E. (2005), Creative Cash Flow Reporting Uncovering Sustainable

Financial Performance, Wiley, Hoboken, NJ.

Nelson, M.W., Elliott, J.A. and Tarpley, R.L. (2003), How are earnings managed? Examples from

auditors, Accounting Horizons, Vol. 17 No. 17 (Quality of Earnings).

Pany, K., Whittington, O.R. and Lam, W.P. (1996), Auditing, Revised Canadian edition,

Times Mirror Professional Publishing Ltd, Toronto.

Potter, B. (2005), Accounting as a social and institutional practice: perspectives to enrich our

understanding of accounting change, Abacus, Vol. 41 No. 3, pp. 265-289.

Purr, J. (2004), Re-assessing 21st century risk: the reaction to risky nancial reporting the rise

and rise of cash, Balance Sheet, Vol. 12 No. 1, pp. 18-21.

Ramnath, S., Rock, S. and Shane, P. (2008), The nancial analyst forecast literature: a taxonomy

withsuggestions for future research, International Journal of Forecasting, Vol. 24, pp. 34-75.

Revsine, L., Collins, D.W. and Johnson, W.B. (2005), Financial Reporting and Analysis, 3rd ed.,

Pearson Prentice-Hall, Upper Saddle River, NJ.

Sender, H. (2002), Cash ow? It isnt always what it seems, Wall Street Journal, May 8,

p. C1 (Eastern edition).

Sharma, D.S. and Iselin, E.R. (2003), The decision usefulness of reported cash ow and accrual

information in a behavioural eld experiment, Accounting & Business Research, Vol. 33

No. 2, pp. 123-135.

Siegel, M.A. (2006), Accounting Shenanigans on the cash ow statement, The CPA Journal,

Vol. 76 No. 3, pp. 38-43.

Wampler, B., Smolinski, H. and Vines, T. (2009), Making stronger statements: cash ow and

income, Strategic Finance, Vol. 91 No. 4, pp. 43-49.

Wang, C., Yung, S., Chen-Chang, L., Lan-Fen, W. and Ching-Hui, L. (2010), Earnings management

using asset sales: interesting issues for further study under unique institutional settings,

International Journal of Accounting and Information Management, Vol. 18 No. 3, pp. 237-251.

Misclassifying

cash ows from

operations

31

Watts, R.L. (2003a), Conservatism in accounting part I: explanations and implications,

Accounting Horizons, Vol. 17 No. 3, pp. 207-221.

Watts, R.L. (2003b), Conservatism in accounting part II: evidence and research opportunities,

Accounting Horizons, Vol. 17 No. 4, pp. 287-301.

About the authors

Karen Lightstone is an Associate Professor whose research includes nancial statement

reporting, risk management, and case studies. Karen Lightstone is the corresponding author and

can be contacted at: karen.lightstone@smu.ca

Karrilyn Wilcox has experience in researching and valuating companies, capital stock,

xed income securities and intangible assets. She is also contributing author of IFRS Fair Value

Guide by James P. Catty, has published several research articles, and received several awards in

business, nance and accounting.

Louis Beaubien is an Assistant Professor whose research includes corporate governance,

accounting theory and who teaches management accounting.

IJAIM

22,1

32

To purchase reprints of this article please e-mail: reprints@emeraldinsight.com

Or visit our web site for further details: www.emeraldinsight.com/reprints

You might also like

- Mergers and Acquisitions Strategy for Consolidations: Roll Up, Roll Out and Innovate for Superior Growth and ReturnsFrom EverandMergers and Acquisitions Strategy for Consolidations: Roll Up, Roll Out and Innovate for Superior Growth and ReturnsRating: 3 out of 5 stars3/5 (2)

- SB4001 Part 2 Assessment TemplateDocument11 pagesSB4001 Part 2 Assessment TemplatePaul MumoNo ratings yet

- A Note On Venture Capital IndustryDocument9 pagesA Note On Venture Capital Industryneha singhNo ratings yet

- Corporate Restructuring Combinations and DivestituresDocument11 pagesCorporate Restructuring Combinations and Divestituresapi-1948267850% (2)

- Washington PostBuffett Analysis1Document2 pagesWashington PostBuffett Analysis1Calvin ChangNo ratings yet

- Facebook Initiating ReportDocument39 pagesFacebook Initiating Reportmiyuki urataNo ratings yet

- Pitch Deck Sebastian AmievaDocument9 pagesPitch Deck Sebastian AmievaJay LewisNo ratings yet

- Hedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersDocument184 pagesHedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersHedge Clippers100% (2)

- TheHighDivAdvantageStudyFUNDweb PDFDocument24 pagesTheHighDivAdvantageStudyFUNDweb PDFdmoo10No ratings yet

- Eileen Segall of Tildenrow Partners: Long On ReachLocalDocument0 pagesEileen Segall of Tildenrow Partners: Long On ReachLocalcurrygoatNo ratings yet

- Summary New Venture ManagementDocument57 pagesSummary New Venture Managementbetter.bambooNo ratings yet

- Fidelity-Stock Pitch TemplateDocument1 pageFidelity-Stock Pitch TemplateDaniel AspinNo ratings yet

- Fae3e SM ch03Document19 pagesFae3e SM ch03JarkeeNo ratings yet

- Michael Kao The Tao of Asymmetric InvestingDocument18 pagesMichael Kao The Tao of Asymmetric InvestingValueWalk100% (1)

- Coho Capital Letter 2016Document13 pagesCoho Capital Letter 2016raissakisNo ratings yet

- BAM Airport Thesis 2020.08 FINALDocument17 pagesBAM Airport Thesis 2020.08 FINALYog MehtaNo ratings yet

- The Playing Field - Graham Duncan - MediumDocument11 pagesThe Playing Field - Graham Duncan - MediumPradeep RaghunathanNo ratings yet

- Stern Stewart Accounting Is Broken Here Is How To Fix ItDocument32 pagesStern Stewart Accounting Is Broken Here Is How To Fix ItFernando Archila-RuizNo ratings yet

- Network To Net Worth - Exploring Network DynamicsDocument32 pagesNetwork To Net Worth - Exploring Network Dynamicspjs15No ratings yet

- EV The Price of A BusinessDocument11 pagesEV The Price of A BusinessseadwellerNo ratings yet

- Pershing Q1 2010 Investor LetterDocument13 pagesPershing Q1 2010 Investor LetterguruekNo ratings yet

- Discounted Cash Flow ModelDocument21 pagesDiscounted Cash Flow Modelvaibhavsachdeva0326No ratings yet

- Impact of Short Selling Bans in EuropeDocument5 pagesImpact of Short Selling Bans in EuropeGeorge AdcockNo ratings yet

- Published July 20, 2005 News Index - News Arch: Alumni DirectoryDocument4 pagesPublished July 20, 2005 News Index - News Arch: Alumni DirectoryBrian LangisNo ratings yet

- Understanding Financial StatementsDocument32 pagesUnderstanding Financial StatementsLuis FernandezNo ratings yet

- Brian Arthur - Increasing Returns and The New World of BusinessDocument11 pagesBrian Arthur - Increasing Returns and The New World of BusinessLuis Gonzalo Trigo SotoNo ratings yet

- Wisdom From Seth Klarman - Part 1Document3 pagesWisdom From Seth Klarman - Part 1suresh420No ratings yet

- CGRP38 - Corporate Governance According To Charles T. MungerDocument6 pagesCGRP38 - Corporate Governance According To Charles T. MungerStanford GSB Corporate Governance Research InitiativeNo ratings yet

- Burton, Katherine - Adapt or Die (Paul Tudor Jones)Document2 pagesBurton, Katherine - Adapt or Die (Paul Tudor Jones)DavidNo ratings yet

- Synopsis: Warren Buffet - Harmaein Shirlesther G. Kua FM 4-1Document6 pagesSynopsis: Warren Buffet - Harmaein Shirlesther G. Kua FM 4-1Harmaein KuaNo ratings yet

- WMTC17 Presentation Ben CarlsonDocument19 pagesWMTC17 Presentation Ben CarlsonBen CarlsonNo ratings yet

- What Are The Differences Between TradersDocument14 pagesWhat Are The Differences Between TradersAldo RaquitaNo ratings yet

- EdelweissMF CommonStocksDocument3 pagesEdelweissMF CommonStocksAlex DavidNo ratings yet

- Complexity in Economic and Financial MarketsDocument16 pagesComplexity in Economic and Financial Marketsdavebell30No ratings yet

- Understanding DilutionDocument4 pagesUnderstanding DilutionKunalNo ratings yet

- Buffett On Valuation PDFDocument7 pagesBuffett On Valuation PDFvinaymathew100% (1)

- IBIG 04 01 Core ConceptsDocument32 pagesIBIG 04 01 Core ConceptsKrystleNo ratings yet

- Ceo Power The Effect On Capital Structure and Firm Performance PDFDocument10 pagesCeo Power The Effect On Capital Structure and Firm Performance PDFShtaringan PiroNo ratings yet

- Retired Investor - Getting Through Difficult Markets, AAII, 2011Document2 pagesRetired Investor - Getting Through Difficult Markets, AAII, 2011Ryan Reitz100% (1)

- MGM Stock PitchDocument1 pageMGM Stock Pitchapi-545367999No ratings yet

- The End of Arbitrage, Part 1Document8 pagesThe End of Arbitrage, Part 1Carmine Robert La MuraNo ratings yet

- Spinoff Investing Checklist: - Greggory Miller, Author of Spinoff Investing Simplified Available OnDocument2 pagesSpinoff Investing Checklist: - Greggory Miller, Author of Spinoff Investing Simplified Available OnmikiNo ratings yet

- A R I M: Ccounts Eceivable AND Nventory AnagementDocument33 pagesA R I M: Ccounts Eceivable AND Nventory AnagementtennimNo ratings yet

- ACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFDocument7 pagesACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFnixn135No ratings yet

- The Big ShortDocument5 pagesThe Big ShortАлександр НефедовNo ratings yet

- Merits of CFROIDocument7 pagesMerits of CFROIfreemind3682No ratings yet

- Economicmodel of Roic Eva WaccDocument29 pagesEconomicmodel of Roic Eva Waccbernhardf100% (1)

- Unit-1 SlidesDocument32 pagesUnit-1 Slidesekeneal157No ratings yet

- ID2021 CapitalRaising Urquhart FINALDocument20 pagesID2021 CapitalRaising Urquhart FINALHemad IksdaNo ratings yet

- Corner of Berkshire & Fairfax Message Board: Hello ShoelessDocument15 pagesCorner of Berkshire & Fairfax Message Board: Hello Shoelessgl101No ratings yet

- Notes From Buffett Letters (1957-2014)Document49 pagesNotes From Buffett Letters (1957-2014)Rishab WahalNo ratings yet

- Financial EconomicsDocument18 pagesFinancial EconomicsvivianaNo ratings yet

- Jensen Return On Equity Whitepaper 14 FinalDocument14 pagesJensen Return On Equity Whitepaper 14 FinallimesinferiorNo ratings yet

- How To Save The Bond Insurers Presentation by Bill Ackman of Pershing Square Capital Management November 2007Document145 pagesHow To Save The Bond Insurers Presentation by Bill Ackman of Pershing Square Capital Management November 2007tomhigbieNo ratings yet

- Office of Career Development CAREER PATH: Investment Banking / Private WealthDocument31 pagesOffice of Career Development CAREER PATH: Investment Banking / Private WealthanupdodiaNo ratings yet

- Investment Strategy - WSJDocument3 pagesInvestment Strategy - WSJComprachosNo ratings yet

- How To Handle Your MoneyDocument7 pagesHow To Handle Your Moneypjs150% (1)

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachFrom EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachNo ratings yet

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- Partnership Dissolution ProblemsDocument9 pagesPartnership Dissolution ProblemsKristel DayritNo ratings yet

- PRTC-FINAL PB - Answer Key 10.21 PDFDocument38 pagesPRTC-FINAL PB - Answer Key 10.21 PDFLuna VNo ratings yet

- Mutual: FundsDocument20 pagesMutual: FundsNitin GuptaNo ratings yet

- WAKA PLC Budget SummaryDocument1 pageWAKA PLC Budget Summarygetachew kumeraNo ratings yet

- Annual ReporDocument177 pagesAnnual ReporShakir EbrahimiNo ratings yet

- BusinessAcumen SafrinHeruwanto HelmiDocument181 pagesBusinessAcumen SafrinHeruwanto HelmiTrisni Kencana DewiNo ratings yet

- Zfak HR Income Tax CalcDocument35 pagesZfak HR Income Tax CalcfahadnavaidkNo ratings yet

- Commutation of Pension - Some Question and Answers On Retirement Benefits - Pensioners PortalDocument3 pagesCommutation of Pension - Some Question and Answers On Retirement Benefits - Pensioners PortalTvs ReddyNo ratings yet

- Account Statement 25-05-2023T02 58 36Document1 pageAccount Statement 25-05-2023T02 58 36SHEHERYAR QAZI 26488No ratings yet

- Date Security Name: NSE Nifty Faster EMA Slower EMA Crossover Price Signal Close Price 3 5Document3 pagesDate Security Name: NSE Nifty Faster EMA Slower EMA Crossover Price Signal Close Price 3 5Avnit ChaudharyNo ratings yet

- Purchasing Power Parity Theory and ExchaDocument24 pagesPurchasing Power Parity Theory and ExchaTharshiNo ratings yet

- Ibp Exemption List 211222 182126Document9 pagesIbp Exemption List 211222 182126Muhammad TalhaNo ratings yet

- Mitul - 151479254Document3 pagesMitul - 151479254asdasdNo ratings yet

- Mock Exam On InvestmentDocument5 pagesMock Exam On InvestmentDhaneshNo ratings yet

- Easy To Pay Centogene": 1. Payment by Bank TransferDocument2 pagesEasy To Pay Centogene": 1. Payment by Bank TransferEh MohamedNo ratings yet

- Juhayna Food Industries Swot Analysis BacDocument13 pagesJuhayna Food Industries Swot Analysis Backeroules samirNo ratings yet

- 1 LifeInsur-E311-2022-10-9ED (001-044)Document44 pages1 LifeInsur-E311-2022-10-9ED (001-044)bruno.dematteisk47No ratings yet

- Adjudication Order in Respect of M/s Custom Capsules Private Limited in The Matter of M/s Niraj Cement Structurals LimitedDocument24 pagesAdjudication Order in Respect of M/s Custom Capsules Private Limited in The Matter of M/s Niraj Cement Structurals LimitedShyam SunderNo ratings yet

- BMX State Point Calculation Worksheet: VLOOKUP and Data Validation ListDocument18 pagesBMX State Point Calculation Worksheet: VLOOKUP and Data Validation ListasdfNo ratings yet

- Capital Market Theory-Topic FiveDocument62 pagesCapital Market Theory-Topic FiveRita NyairoNo ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- 2 - CW France - Residential Invest Market 2020 - VA PDFDocument2 pages2 - CW France - Residential Invest Market 2020 - VA PDFliuNo ratings yet

- Portfoliopython: 1 Week 1 Section 1 - Fundamentals of Risk and ReturnsDocument23 pagesPortfoliopython: 1 Week 1 Section 1 - Fundamentals of Risk and ReturnsHoda El HALABINo ratings yet

- Tips For The Toppers ComDocument55 pagesTips For The Toppers ComAkshat KumarNo ratings yet

- Love School of Business CheckseetDocument1 pageLove School of Business Checkseetapi-283792537No ratings yet

- UPSE Securities Limited v. NSE - CCI OrderDocument5 pagesUPSE Securities Limited v. NSE - CCI OrderBar & BenchNo ratings yet

- 06.2 - LiabilitiesDocument2 pages06.2 - LiabilitiesDonna Abogado100% (1)

- Merger and AccutionDocument3 pagesMerger and Accutionankit6233No ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet