Professional Documents

Culture Documents

Economic Overview - Impact of Recent Mining Strikes

Economic Overview - Impact of Recent Mining Strikes

Uploaded by

Jay Kothari0 ratings0% found this document useful (0 votes)

18 views3 pagesthis document deals with the economic overview of the impact of recent mining strikes

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentthis document deals with the economic overview of the impact of recent mining strikes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views3 pagesEconomic Overview - Impact of Recent Mining Strikes

Economic Overview - Impact of Recent Mining Strikes

Uploaded by

Jay Kotharithis document deals with the economic overview of the impact of recent mining strikes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

SUMMER 2012

Economic overview - the Impact

of mining strikes on the economy

Although mining as a whole makes up about 5% of South Africas overall GDP, it makes up approximately

50% of the countrys total exports, a third of these are platinum. Therefore a drop in output results in a

drop in the countrys export performance.

The mining strikes affected directly the overall platinum production, and mining contributing the largest

share of provincial GVA in the North West province, it most certainly will have a negative impact on the

provincial economy over all.

According to Global Insight, the 41 day strike at Lonmins Marikana mine alone resulted in production loss

of about 186 000 ounces of PGM, which is approximately 15% of the mines 2011 annual output. Thus,

the total estimated loss in production from this particular strike will be between 1.1 and 1.5% of total

PGM output in South Africa.

The loss will be even more as the Marikana strike had a mothball effect on other PGM miners in the

region thus interrupting their production negatively as well.

What does this mean for the North West?

The loss in output to the Rustenburg and Madibeng (Brits) economies will be higher as their economies

are strongly influenced by platinum mining.

Rustenburgs loss will range between 0.9% and 1.3% of the 2011 output, whereas Madibeng will

experience and even greater loss in PGM production (between 5.5% and 8.1%) of 2011 output.

The impact of the mining strikes in the Bojanala region will not have immediate catastrophic results for

the economy of Rustenburg; as it is one of the largest city economies in South Africa and thus can handle

a few years of negative platinum output. However, in the long run, because of an undiversified economy

in the region the result could be similar to that of the Welkom and western Gauteng areas after the gold

mining output declined. Madibeng on the other hand has a more diversified economy than Rustenburg,

but 80% of its PGM production is reliant on Lonmins operations and its economy is much smaller than

that of Rustenburg.

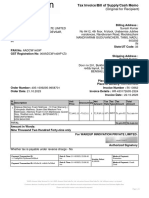

Table: Gross Value Add by Region (GVA-R), Broad Economic Sectors, Sector Share of Regional Sector

2011(Source: IHS Global Insight Regional eXplorer version 646)

Graph: Comparison of economic sectors in the Madibeng region (Source: IHS Global Insight Regional eXplorer

version 646)

For more info contact Hantie Hoogkamer

General Manager : Trade and Investment Planning

+27 14 594 2570

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Evolution of Entrepreneurship in The PhilippinesDocument17 pagesEvolution of Entrepreneurship in The PhilippinesAndrew Mercader83% (18)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Op-Ed 1Document3 pagesOp-Ed 1api-302030134No ratings yet

- Sample Memo For Moot Court CompetitionsDocument33 pagesSample Memo For Moot Court CompetitionsJay Kothari100% (3)

- The Art of Strategy A Game Theorists Guide To Success in Business and Life PDFDocument3 pagesThe Art of Strategy A Game Theorists Guide To Success in Business and Life PDFRoger Mario Lopez0% (3)

- J&K Residential & Commercial Tenancy Act-2012Document33 pagesJ&K Residential & Commercial Tenancy Act-2012Jay Kothari0% (1)

- India - EU Free Trade AgreementDocument3 pagesIndia - EU Free Trade AgreementJay KothariNo ratings yet

- Workshop Paper On "Plaint"Document57 pagesWorkshop Paper On "Plaint"Jay KothariNo ratings yet

- The Goa, Daman and Diu Building (Lease, Rents and Evictions) COntrol Act, 1968Document40 pagesThe Goa, Daman and Diu Building (Lease, Rents and Evictions) COntrol Act, 1968Jay KothariNo ratings yet

- Black Money Act, 2015Document30 pagesBlack Money Act, 2015Jay KothariNo ratings yet

- Charitable & Religious Trusts Act 1920 PDFDocument6 pagesCharitable & Religious Trusts Act 1920 PDFJay KothariNo ratings yet

- The Tripura Building Lease and Rent Control Act 1975Document23 pagesThe Tripura Building Lease and Rent Control Act 1975Jay KothariNo ratings yet

- Family Law II MemoDocument11 pagesFamily Law II MemoJay KothariNo ratings yet

- Indian Limitation Act, 1963 PDFDocument21 pagesIndian Limitation Act, 1963 PDFJay Kothari50% (2)

- Air (Prevention and Control of Pollution) Act, 1981 PDFDocument35 pagesAir (Prevention and Control of Pollution) Act, 1981 PDFJay KothariNo ratings yet

- Bombay Industrial Relations Act, 1946Document29 pagesBombay Industrial Relations Act, 1946Jay Kothari100% (1)

- Bihar Hindu Religious Trusts Act, 1950Document22 pagesBihar Hindu Religious Trusts Act, 1950Jay KothariNo ratings yet

- P115 PDFDocument30 pagesP115 PDFJay KothariNo ratings yet

- General Clauses Act 1897Document20 pagesGeneral Clauses Act 1897Jay KothariNo ratings yet

- R115Document29 pagesR115rahulNo ratings yet

- All India Provisional Merit ListDocument13 pagesAll India Provisional Merit ListJay KothariNo ratings yet

- Reservation in IndiaDocument20 pagesReservation in IndiaJay KothariNo ratings yet

- Mock Test Notice April 2014Document1 pageMock Test Notice April 2014Jay KothariNo ratings yet

- Current Affairs QuizDocument3 pagesCurrent Affairs QuizJay KothariNo ratings yet

- Current Affairs2013Document1 pageCurrent Affairs2013Jay KothariNo ratings yet

- Group A FinalDocument2 pagesGroup A Finalapi-380281979No ratings yet

- Financial Planning EbookDocument51 pagesFinancial Planning EbookSiddharth PatilNo ratings yet

- Engagement Opportunity GuideDocument40 pagesEngagement Opportunity GuideDavid BriggsNo ratings yet

- Debate On The Developmental State: by Ethiopian ScholarsDocument70 pagesDebate On The Developmental State: by Ethiopian ScholarsYemane HayetNo ratings yet

- Tushar SIP Final ReportDocument92 pagesTushar SIP Final ReportJayesh GarachhNo ratings yet

- KPMG - Indonesian TaxDocument13 pagesKPMG - Indonesian Taxbang bebetNo ratings yet

- Making Cement BricksDocument3 pagesMaking Cement BricksCampbell OGENRWOTNo ratings yet

- Position PaperDocument10 pagesPosition PaperMark Jessie MagsaysayNo ratings yet

- Tahir Qarayev Accounting Imtahan SuallariDocument6 pagesTahir Qarayev Accounting Imtahan SuallariEli HüseynovNo ratings yet

- Pride of CowsDocument92 pagesPride of CowsSurbhi GargNo ratings yet

- INSPECTIONDocument43 pagesINSPECTIONdharampurhaNo ratings yet

- Sellsation 2023 Round 1 CaseDocument4 pagesSellsation 2023 Round 1 CaseAbusayed aponNo ratings yet

- InvoiceDocument1 pageInvoiceSuresh STNo ratings yet

- Real EstateDocument15 pagesReal EstateDiego OmeroNo ratings yet

- What Does The G20 DoDocument9 pagesWhat Does The G20 DoParvez ShakilNo ratings yet

- Indian Cement Industry: Holtec Consulting, IndiaDocument14 pagesIndian Cement Industry: Holtec Consulting, IndiaDeepakNo ratings yet

- Ethics in Business DisciplineDocument16 pagesEthics in Business DisciplineSonal TiwariNo ratings yet

- What Are The Best Kpis For Purchasing DepartmentsDocument6 pagesWhat Are The Best Kpis For Purchasing DepartmentsAKHILESH BirlaNo ratings yet

- A Donor's Guide: Vehicle DonationDocument10 pagesA Donor's Guide: Vehicle Donationriki187No ratings yet

- Sri Lankan Economy Contracted by 1.5 Percent - Census & Statistics Dept.Document4 pagesSri Lankan Economy Contracted by 1.5 Percent - Census & Statistics Dept.Ada DeranaNo ratings yet

- Swot Analysis of Tata MotorsDocument2 pagesSwot Analysis of Tata MotorsVaibhav KediaNo ratings yet

- Edited 12Document74 pagesEdited 12Mikiyas TeshomeNo ratings yet

- Environmental Impact Assessment in Ethiopia: A General Review of History, Transformation and Challenges Hindering Full ImplementationDocument9 pagesEnvironmental Impact Assessment in Ethiopia: A General Review of History, Transformation and Challenges Hindering Full ImplementationAmanu WorkuNo ratings yet

- Spokesperson, Honda Motorcycle & Scooter India Pvt. LTD., in 2005Document4 pagesSpokesperson, Honda Motorcycle & Scooter India Pvt. LTD., in 2005Sheetal Shinde YewaleNo ratings yet

- Size and Performance of 5-Star Hotel Chains in GreeceDocument37 pagesSize and Performance of 5-Star Hotel Chains in GreeceTatianaNo ratings yet

- Model of Sustainable Urban Infrastructure at Coastal Reclamation of North JakartaDocument10 pagesModel of Sustainable Urban Infrastructure at Coastal Reclamation of North Jakartaronal bahrawiNo ratings yet

- Final Caiib MatDocument227 pagesFinal Caiib MatPrince VenkatNo ratings yet