Professional Documents

Culture Documents

Kbuzz Issue 16 April 12

Kbuzz Issue 16 April 12

Uploaded by

Gaurav AggarwalCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- BNPP Presentation TemplateDocument8 pagesBNPP Presentation TemplateGaurav AggarwalNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NASBITE CGBP Self Study - Review GuideDocument4 pagesNASBITE CGBP Self Study - Review GuideTheDawn10% (1)

- Solution Manual For Introduction To Corporate Finance 2nd Edition by MegginsonDocument27 pagesSolution Manual For Introduction To Corporate Finance 2nd Edition by Megginsona340726614No ratings yet

- Course OutlineDocument6 pagesCourse OutlineGaurav AggarwalNo ratings yet

- BP Energy Outlook 2030: India InsightsDocument1 pageBP Energy Outlook 2030: India InsightsGaurav AggarwalNo ratings yet

- Samartha: Gaurav Aggarwal Faizan SarwarDocument3 pagesSamartha: Gaurav Aggarwal Faizan SarwarGaurav AggarwalNo ratings yet

- CTYL Registration-Form 2013Document3 pagesCTYL Registration-Form 2013Gaurav AggarwalNo ratings yet

- A. How Do You Want To Engage With MicrosoftDocument1 pageA. How Do You Want To Engage With MicrosoftGaurav AggarwalNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Gaurav AggarwalNo ratings yet

- Opportunities For Johnson S Baby Challenges: MoisturizerDocument1 pageOpportunities For Johnson S Baby Challenges: MoisturizerGaurav AggarwalNo ratings yet

- MGTO650n Appex ConsolidateDocument21 pagesMGTO650n Appex Consolidatemkkaran90No ratings yet

- Script For Ultra Truck CustomerDocument1 pageScript For Ultra Truck CustomerGaurav AggarwalNo ratings yet

- Chapter 3 - Organizing in Changing Global Environment BM, Sec-A, Group 1Document1 pageChapter 3 - Organizing in Changing Global Environment BM, Sec-A, Group 1Gaurav AggarwalNo ratings yet

- Bloomberg Assessment TestDocument12 pagesBloomberg Assessment TestManish Gujjar100% (1)

- Business ResearchDocument38 pagesBusiness ResearchGaurav AggarwalNo ratings yet

- Recommending A Strategy: KICC-2014Document5 pagesRecommending A Strategy: KICC-2014Gaurav AggarwalNo ratings yet

- Social Media - A Boon or Bane For Global Business?Document1 pageSocial Media - A Boon or Bane For Global Business?Gaurav AggarwalNo ratings yet

- Top Five Tablet Vendors, Shipments, and Market Share, First Quarter 2013 (Shipments in Millions)Document1 pageTop Five Tablet Vendors, Shipments, and Market Share, First Quarter 2013 (Shipments in Millions)Gaurav AggarwalNo ratings yet

- Mahindra AFS - Automotive - Future of MobilityDocument1 pageMahindra AFS - Automotive - Future of MobilityGaurav AggarwalNo ratings yet

- IRCTC LTD, Booked Ticket PrintingDocument2 pagesIRCTC LTD, Booked Ticket PrintingGaurav AggarwalNo ratings yet

- Joined DataDocument4 pagesJoined DataGaurav AggarwalNo ratings yet

- Contract Costing and Operating CostingDocument13 pagesContract Costing and Operating CostingGaurav AggarwalNo ratings yet

- Robert K Boscarato and Matthew Skaggs Corprate Credit Book Draft 1.Document70 pagesRobert K Boscarato and Matthew Skaggs Corprate Credit Book Draft 1.Robert BoscaratoNo ratings yet

- Tax Amnesty FlyerDocument2 pagesTax Amnesty FlyerAkoSiAudreyNo ratings yet

- Forex DraftDocument9 pagesForex DraftDevang DesaiNo ratings yet

- Chapter 2 - An Introduction of Forward and OptionDocument38 pagesChapter 2 - An Introduction of Forward and Optioncalun12No ratings yet

- HeptalysisDocument36 pagesHeptalysisbodhi_bgNo ratings yet

- Naman and Himani SIP PPT 3Document19 pagesNaman and Himani SIP PPT 3223Kaushal.v.GhunchalaNo ratings yet

- Local Government Finance NotesDocument23 pagesLocal Government Finance NotesBa NyaNo ratings yet

- Quiz#2 - Accounting and FinanceDocument11 pagesQuiz#2 - Accounting and Financew.nursejatiNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- Financial Results For The Quarter Ended 31st December, 2023Document15 pagesFinancial Results For The Quarter Ended 31st December, 2023Sarika ZNo ratings yet

- Isa 530Document13 pagesIsa 530baabasaamNo ratings yet

- Finals Quiz Assignment Private Equity Valuation Method With AnswersDocument3 pagesFinals Quiz Assignment Private Equity Valuation Method With AnswersRille Estrada CabanesNo ratings yet

- Financial Literacy of High School Students: Lewis MandellDocument2 pagesFinancial Literacy of High School Students: Lewis MandellDUDE RYANNo ratings yet

- Development Bank of The Philippines vs. CA, GR. 100937, March 21, 1994Document4 pagesDevelopment Bank of The Philippines vs. CA, GR. 100937, March 21, 1994Kimberly SendinNo ratings yet

- Ifl Enterprises Limited-Rights Issue - 1208160014686315 - 1716796627Document1 pageIfl Enterprises Limited-Rights Issue - 1208160014686315 - 1716796627ghanshyam parmarNo ratings yet

- Final Updated FY 2018-19 Revenue PerformanceDocument8 pagesFinal Updated FY 2018-19 Revenue PerformanceThe Star KenyaNo ratings yet

- AccountingDocument2 pagesAccountingwindell arth MercadoNo ratings yet

- Section A - Group 4 - OaktreeDocument6 pagesSection A - Group 4 - OaktreeArchita JainNo ratings yet

- CanlasDocument7 pagesCanlasAyenGaileNo ratings yet

- The Board Perspective PDFDocument92 pagesThe Board Perspective PDFByronda DucashNo ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- Industrial Development Policy 2015-20Document24 pagesIndustrial Development Policy 2015-2045satishNo ratings yet

- Digest RULE 39 - PantaleonDocument22 pagesDigest RULE 39 - Pantaleonbookleech100% (1)

- Incom Tax Proclamation EnglishDocument65 pagesIncom Tax Proclamation EnglishNegash JaferNo ratings yet

- Disstressed AnalysisDocument5 pagesDisstressed Analysisrafael castro ruiz100% (1)

- RR 2-98 - Withholding TaxesDocument99 pagesRR 2-98 - Withholding TaxesbiklatNo ratings yet

- Chapter 2Document19 pagesChapter 2Juan Oliver Onde100% (1)

- Budgetory ControlDocument6 pagesBudgetory ControlJash SanghviNo ratings yet

Kbuzz Issue 16 April 12

Kbuzz Issue 16 April 12

Uploaded by

Gaurav AggarwalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kbuzz Issue 16 April 12

Kbuzz Issue 16 April 12

Uploaded by

Gaurav AggarwalCopyright:

Available Formats

KBuzz

Sector Insights

Issue 16 April 2012

kpmg.com/in

1 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

The mid of this month saw the much awaited and long delayed move by the RBI, when it

slashed its key lending rate. The repo rate was lowered by 50 bps for the first time in three

years of the RBIs focus on containing inflation. The move, largely based on slowing growth

and reducing inflation, was welcomed by all and is expected to be a key driver of economic

revival in the country

1

.

Illustratively, the headline inflation for March 2012 reduced to 6.9 percent from 7.0 percent

seen in February 2012. Inflation has moderated in India since November 2011, however,

upside risks from fuel price movements still exist.

On the growth side, various indicators of economic activity continue to show weak

performance. Illustratively, growth in the Index of Industrial Production (IIP), an important

indicator of industrial activity in the economy, stands at 3.5 percent from April-February, 2011-

12 compared with 8.1 percent during the same period of the previous year. While, in

February the indicator was up - 4.1 percent vis--vis 1.1 percent noticed in January 2012,

which is much below market expectations

2

.

Additionally, the Purchasing Managers Index (PMI) for manufacturing slowed for a third

consecutive month. It reduced to 54.7 in March,2012 from 56.6 in February, 2012 as growth

in new orders eased and raw material costs displayed upward pressure. PMI for services also

slipped to a five-month low of 52.3 in March from 56.5 in the previous month as growth in

new orders eased and future expectations dimmed to its weakest level since 2009

3

.

Indias external sector also continued to show weak performance. The exports for

February,2012 were up by 4.3 percent while imports rose by a staggering 20.7 percent. The

gap led to a widening of the trade deficit to USD 15.2 billion during February from USD 14.8

billion in January. As per the recent data released by commerce secretary, Rahul Khullar,

Indias exports grew by 21 percent while imports grew by 32.1 percent during 2011-12 and

trade deficit widened to a record USD 184.9 billion in 2011-12. The widening trade deficit

might drive Indias deteriorating current account position and can have adverse implications

for the rupee

4

.

Amidst slowing economic activity, RBIs loosening grip on the monetary policy can play an

important role in reviving business confidence and fueling investment activity, which in turn

can support growth in the Indian economy. However, much would depend upon the

complementary steps taken by the Indian government to tame inflation.

I hope you find this issue of KBuzz engaging and insightful.

Regards,

Rajesh Jain

Head Markets

KPMG in India

Sources:

1- RBI, Monetary Policy Statement for 2012 -2013, April 17, 2012

2- Ministry of Finance, Monthly Economic Report, March 2012

3- Business Standard, Services PMI inches up, May 04, 2012

4- Economic Times. Exports grow 21% at USD 303.7 billion, trade deficit zooms to record high USD185 billion, May 1, 2012

2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Pending

2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Indian Economy 03

Loosening liquidity A right move?

Education 06

A skilled India @ 75 NSDCs role, challenges and opportunities

Energy and Natural Resources 09

PNGRB regulation on IGLs tariff Implications for CGD Industry

Financial Services 12

NBFC gold loan Short term pain, long term gain?

Government 15

Direct cash subsidy and its impact in the Indian context

Healthcare 18

Medical devices sector: Key challenges and methodologies

IT-BPO 21

Future of IT hardware industry in India

Media and entertainment 25

Is the cable industry digital ready?

Private equity 28

2012 could be a good vintage year for private equity investments

Real estate and construction 33

Joint development arrangement Gaining importance and posing

significant challenges

Transportation and logistics 37

Warehousing opportunities in India

Indian

Economy

3 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

4 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Rohit Bammi

Head

Financial Risk Management

rohitbammi@kpmg.com

RBI has fired its big guns

and positively surprised

even the most optimistic

market watchers.

Suppressed inflation,

particularly in petroleum

products, and the current

account deficit would keep

a check on further

aggressive rate cuts

Rohit Bammi

Head

Financial Risk Management

KPMG in India

Loosening liquidity A right move?

RBI in its annual Monetary Policy meet for FY13 started the monetary easing

cycle and aggressively cut the repo rate by 50 basis points first cut in three

years. The move surprised the people from all rungs even the most

optimistic experts who were expecting a 25 bps decline in repo rate amid

concerns over inflation risks from suppressed coal, electricity, fertilizer and oil

prices. With this cut, repo rate stands at 8 percent while CRR remains

unchanged at 4.75 percent and reverse repo at 7 percent.

Guided considerations

The RBI move has been guided by the twin considerations of growth

slowdown and declining inflation. Illustratively, growth declined to almost a

three year low of 6.1 percent in the third quarter of FY12 and headline

inflation accommodating receding demand pressures moderated to below 7

percent in March 2012 as compared to 9.5 percent witnessed in November

2011.

More importantly, core (non-food manufactured products) inflation dropped

from a high of 8.4 per cent in November 2011 to 4.7 per cent in March 2012,

actually coming below 5 per cent for the first time in two years

1

.

The need

The monetary loosening was required as the economic activity plummeted in

the economy last fiscal due to a combination of domestic and external factors.

Domestically, the liquidity tightening measures by the RBI pulled down

consumption and investment drastically during the last fiscal. Illustratively,

investment growth dipped to -2.7 percent in Q2, FY12, which was the lowest

in two years

2

.

Similarly, private consumption, an important demand side driver of growth

(which accounts for around three fifths of the GDP), feeling the heat of

inflation and rate hikes by the RBI, dipped in line with other economic

indicators. The IIP, another indicator of industrial activity, also declined,

posting a negative growth rate of -4.9 percent in October 2011 the lowest

since March 2009

2

.

These domestic pressures coupled with global uncertainty triggered a flight to

safety amongst global investors and led to an outflow of FII that touched a

three year high in August 2011 (USD -1.77 billion). The rush towards the US

Dollar translated into the Rupee weakening, which touched an all time low of

INR 54.30/USD in mid December 2011

3

.

So, the aggressive move of the RBI is justified in order to revive growth in the

economy which remains below pre-crisis level with weak business and

investors sentiments further threatening to pull the growth down in long run.

RBI on the expectations of normal monsoon, revival in industrial activity, and a

relatively better global outlook expects GDP growth in FY 13 to be 7.3

percent

4

. The growth is expected to remain below trend till first quarter of

FY13, however, it is expected to improve gradually thereafter as the impact of

monetary policy easing unfolds and the government also support.

1. RBI Monetary Policy Statement for 2012 -2013, April 17, 2012

2. Ministry of Statistics and Programme Implementation, Reports and Publication

3. SEBI website statistics section

4. RBI Monetary Policy Statement for 2012 -2013, April 17, 2012

5 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG in India point of view - The future course

RBI has also stated a limited room for further monetary policy easing. This is

because the deviation of growth from its trend is modest plus several

upside risks to inflation persist, particularly petroleum products. If the

subsidies targets as set in the Union Budget, 2012-2013 are not met,

demand pressures will remain and could lead to inflationary pressures in the

economy limiting the scope for further monetary easing. The RBI expects

inflation to remain range bound during the year with March 2013 WPI to be

approximately 6.5 percent. Nevertheless, expectations exist for another 25

bps cut in repo rate depending upon the complementary fiscal policy move

from the government on supply side to improve investment climate and

addressing inflationary pressures.

To conclude, the RBI has acted timely however a little more aggressively

than expected. The move is expected to support the real economy, as it will

signal banks to ease lending rates much however would depend upon the

attempts by the government to stick to deal with the supply side

constraints.

Key projections for FY13

Growth in key variables (%)

GDP growth 7.3

March 13WPI inflation 6.5

Deposit growth 16.0

Non-food credit growth 17.0

Money supply growth 15.0

Source: RBI, YES BANK Limited

Loosening liquidity A right move?

Education

6 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

7 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Narayanan Ramaswamy

Head

Education

narayananr@kpmg.com

Overview

Though fate stands in the way, strenuous effort yields fruit. Labour

recompenses what fate denies --- Thirukkural 619

Quoting this famous couplet from a hugely popular Tamil literary work, in his

India @ 75 presentation in 2007, Professor CK Prahalad defined Indias role

as a global power in the year 2022. While this vision document outlines

many a goal for India to achieve and among them a very ambitious goal for

human development to have a 500 million strong skilled labour by 2022.

Today, fulfilment of this audacious goal is driven by no less than the Indian

Prime Ministers office. The Prime Ministers National Council on Skills

Development is pushing for a skilled India through various government

mechanisms as shown in the pie chart below.

1

NSDC A mixed bag of results to date

Among other initiatives, the National Skill Development Corporations

(NSDC) mission is interesting since the model assumes little intervention

from the government beyond its role as an investment partner to private

enterprise and to setup facilitating bodies in the form of sector skills

councils. It funds private sector skills training providers to setup centres that

can train people for employability in various high labour demand sectors. A

quick analysis of its portfolio of investments

2

reveals interesting insights.

As it redoubles its efforts

to transform the skills

training landscape in the

country, it will no doubt

rope in expertise from

international consulting

organizations that can

bring their global

experience in vocational

education and skills

training to bear fruit in the

Indian context. Indeed, it

is in overcoming such

challenges that

opportunities will flourish.

Narayanan Ramaswamy

Head

Education

KPMG in India

1. NSDC Reports,

2. NSDC Annual Report, year ending March 2011, KPMG in India Analysis

A skilled India @ 75 NSDCs role, challenges and opportunities

National Skill

Development

Corporation, 150

Ministry of Labor

and

Employment,

100

Ministry of

Human

Resources and

Development, 50

17 ministries

and

departments,

200

65%

13%

18%

4%

43%

24%

20%

13%

79%

75%

77%

42%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

0%

10%

20%

30%

40%

50%

60%

70%

Top 4 Next 4 Next 10 Next 15

Targets Funding NSDC/ PC

Split of 500million target across various government initiatives

Portfolio analysis - NSDC

8 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

On an average NSDC share in total project cost is approximately 70 percent. The total number

of training centres of investee companies envisaged is approximately 14000 and the average

number of students foreseen per centre per year is approximately 415

3

While the top 4 investments have about 2/3rd of the total committed numbers for skills

development (~58 mn), they account for only 43% of the project costs. This is indicative of

the benefits of scale accruable to investments in this space

4

NSDC has been investing on creation of capacity on a large scale. The typical ratio of NSDC

funding within total project costs is 80 : 20 for the top 4 entities

5

The target for NSDC is to train 0.5 million students per year but its has been able to train only

approximately 75,000 students which is 16 percent of the target

Despite this support for highly scaled models, there is reason to believe, that while NSDCs

smaller investments have been relatively more compliant with their committed targets, large

multi sector/ geography players may have significantly underperformed

In light of the current trends in investment performance, NSDC is likely to significantly tighten

its appraisal & monitoring, tread more cautiously on further disbursements and revise

estimates to indicate a delay of 2 -3 years to achieve current commitments.

Indeed, much of NSDCs initiatives that are currently underway indicate a move toward a more

robust evaluation of investments and Sector Skills Councils (SSC) are bodies which will identify

current and projected skill gaps in the sectors and develop sector-specific competency.

NSDC has already approved 8 SSCs for the following sectors (i) Automobile Manufacturing (ii)

Private Security (iii) Energy (iv) Media, Animation, Gaming, and Films (v) IT and ITeS (vi) Health

care (vii) Retail and (viii) Banking and Financial Services. While approval is only the first

milestone, actual implementation requires expertise and knowledge that multilateral funding

agencies like

6

ADB and World Bank are trying to inculcate, through select SSCs that they

have picked up for funding.

KPMG in India point of view

There can be no doubt that the NSDC, the lean organization that it is has a mammoth task cut

out for itself. As it redoubles its efforts to transform the skills training landscape in the country, it

will no doubt rope in expertise from international consulting organizations that can bring their

global experience in vocational education and skills training to bear fruit in the Indian context.

Indeed, it is in overcoming such challenges that opportunities can flourish.

Mandate of Sector Skill Councils

Research

Identify current and projected skill gaps

Develop sector specific competency standards and benchmark these with international occupation standards

Establish sector specific Labor market information systems.

Quality Assurance

Standardize and streamline the affiliation and accreditation process

Participate in accreditations and certifications in their sectors.

Delivery

Develop and update course modules, and train trainers

Partner with educational institutions to train the trainers

Promote academies of excellence.

3. NSDC Annual Report, year ending March 2011,

A skilled India @ 75 NSDCs role, challenges and opportunities

Energy and

Natural

Resources

9 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

10 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Arvind Mahajan

Head

Energy and Natural

Resources

arvindmahajan@kpmg.com

Overview

The downstream regulator Petroleum and Natural Gas Regulatory Board

(PNGRB) has issued an order determining the transmission tariff and

compression charges for IGL's city gas distribution (CGD) network in Delhi.

As per the order, PNGRB has approved a significantly lower compression

charge of INR 2.75/kg (vs INR6.66/kg as proposed by IGL) and network tariff

of INR 38.58/mmbtu (vs INR 104.05/mmbtu as proposed by IGL)

retrospectively from April, 2008

1

. Thus, the combined new tariff is around 60

percent lower than proposed by the IGL. Moreover, PNGRB has directed

IGL to reduce its selling price for CNG and PNG in accordance with the

lower transmission tariff and compression charges. In response to this

order, IGL has moved to Delhi High court challenging the constitutionality

and legality of the powers of the PNGRB to fix the tariff.

Compression and Network Tariff

Source: PNGRB, IGL

Early stage to judge the impact on IGL profitability

The margins of CGD companies are broken into three segments network

charges, compression charges and marketing margins. As per the current

policy, network and compression charges are determined by the regulator,

whereas marketing margins are unregulated with a view to induce

competition in the CGD industry. The PNGRB decision of fixing the tariffs at

much lower rate than what IGL is currently charging is estimated by many

analysts to have an adverse affect on the companys profitability.

In FY2011, IGL made a net profit of around INR 2.6/scm, with a net profit

margin of approximately 15 percent. If PNGRB order is followed, then end

consumer prices would be reduced by around INR 5.5/scm, implying net

loss for IGL

2

. Further, PNGRBs decision to follow these rates

retrospectively would put an additional burden of around INR 1000 - 1600

crores on the company

3

.

However, it is likely that IGL could offset tariff reduction by increasing

unregulated marketing margins or challenge the basis of tariff computation

and get a revised tariff order.

1 Petroleum and Natural Gas Regulatory Board; http://pngrb.gov.in/newsite/pdf/orders/order9april.pdf

2 IGL website, Financial Results

3 IGL takes a battering on PNGRB ruling; Business Standard, 10 April 2012

PNGRB order on

regulating the tariffs

might have an

unfavorable impact on

future CGD bidding

rounds.

Arvind Mahajan

Head

Energy and Natural

Resources

KPMG in India

PNGRB regulation on IGLs Tariff Implications for CGD

Industry

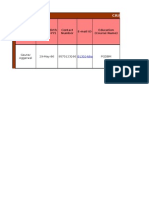

Category Unit IGL Tariff PNGRB Tariff Percentage Reduction

Compression

Charges

INR/KG 6.66 2.75 58.7%

INR/scm 5.35 2.21 58.7%

Network Tariff

INR/mmbtu 104.05 38.58 62.9%

INR/scm 3.75 1.39 62.9%

11 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

PNGRB regulation on IGLs Tariff Implications for CGD

Industry

The current order is only applicable for IGL, but in future, PNGRB might

issue similar regulations for other downstream natural gas players such

Gujarat Gas, Adani Gas, GAIL etc., impacting their profitability.

KPMG in India point of view

PNGRB was created to promote investment in the downstream sector,

foster competition among entities and protect consumers interest. The

recent decision of the Board seems to be a favourable step for natural gas

consumers. However it does open up Pandora's box in terms of issues to

deal with.

Until now, CGD segment has been perceived to be operating in free market

environment with minimum government intervention. Due to possibility of

high operating margins, the previous rounds of CGD bidding had attracted

interests from several private players across industries such as power, real

estate and infrastructure. However, the tariff/margins control by the

government might be seen as a step to quasi-govern the sector, impacting

the attractiveness.

The addition of new cities into the CGD network has already slowed down

due to regulatory impediments. The final awards of the third CGD round are

yet to be made and the fourth round has been cancelled by PNGRB due to

irrational bidding.

Thus the Board has to consider its action vis--vis the market need. It needs

to be debated whether the need is to have an intrusive set of regulations

that determines tariff /margins or a regulation that encourages participation

by players such that competing fuels determine the distribution margins.

Given the target set by PNGRB to cover around 300 cities under CGD

network by 2015, it seems the latter approach could be a prudent approach.

Financial

Services

12 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

13 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

India is known to possess large stocks of gold, estimated at about 11

percent of global gold stock. Over the past ten years, the value of gold in

India has increased at a compounded average growth rate (CAGR) of 13

percent, outpacing the country's real gross domestic product, inflation and

population growth by 6 percent, 8 percent and 12 percent respectively. India

has one of the highest savings rates in the world (34 percent of GDP in

FY10), of which one third is invested in gold.

1

In India, gold prices increased by a staggering 180 percent during FY06-

FY11 and have outperformed practically all known asset classes in the last

decade.

2

It is estimated that 10 per cent of the countrys gold stock is

pledged as collateral for loans, of which approximately 75 percent is in the

unorganized market (money lenders, pawn brokers, etc.), and the remaining

25 percent in the organized market (specialized Non-Banking Finance

Companies (NBFCs), other NBFCs, commercial/cooperative banks, etc).

3

The value of the organized gold loan market in India is estimated at INR 400-

450 billion, with a CAGR of approximately 40 percent during FY02-FY10.

4

Gold loan NBFCs have recorded significant growth in recent years in terms

of both their balance sheet and physical presence. These NBFCs have

increased their books by a little more than 50 percent year-on-year over the

past two years, while banks registered growth of only 32-37 percent.

5

To

meet their growth objectives, the NBFCs have increased their dependence

on public funds, including bank finance and non-convertible debentures

issued to retail investors.

6

With these NBFCs are growing beyond the normal rate, the impact on them

of any future crash in price by the same margin or more could be severe.

The financial sector may also be affected, since NBFCs are often big

borrowers. To rein in the uncontrolled growth of gold loans and reduce the

risks involved (concentration risk and market risk because of adverse

movements in gold prices), the Reserve Bank of India (RBI) has brought in a

slew of measures to tighten regulatory supervision in the sector during the

last year.

Naresh Makhijani

Partner

Tax Financial Services

nareshmakhijani@kpmg.com

In spite of tighter

regulation, the benefits

like flexibility, less

formalities, faster

turnaround time, ability to

service non bankable

customers etc. should

help NBFCs to garner

significant portion of the

gold loan market share in

future.

Naresh Makhijani

Partner

Tax - Financial Services

KPMG in India

Organized gold loan market size (INR bn) Share of organized gold loan market

players (%)

CAGR 40%

25

120

250

375

FY02 FY07 FY09 FY10

14.5 12.1

9.7

18.4 23.6

32.2

14.8

13.7

11.6

52.3 50.6

46.5

FY07 FY09 FY10

Cooperatives NBFCs

Private sector banks Public sector banks

Source: IMACS Gold loan industry report, 2010

1. World Gold Council, Reserve Bank of India, 2010

2. Reserve Bank of India, Handbook of Statistics on Indian Economy, 2010-11

3. IIFL Gold Loans Lending with Comfort, June 2011

4. ICRA Press Release, 22 March 2012

5. ICRA Press Release, 22 March 2012; Business Standard, 18 April 2012

6. Reserve Bank of India, Lending Against Security of Single Product Gold Jewellery, 21 March 2012

NBFC gold loan Short term pain, long term gain?

14 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Earlier, in February 2011, the RBI removed priority sector status from gold loan

companies, which led to a higher cost of borrowings for these companies.

7

In another

step to protect the financial system against any possible adverse movement in gold

prices, RBI introduced the following guidelines for gold loan NBFCs in March 2012:

1. Loan to value (LTV) ratio not to exceed 60 percent for loans granted against the

collateral of gold jewellery

2. Percentage of gold loans to total assets to be disclosed in balance sheets

3. Loans not to be granted against bullion, primary gold, gold coins

4. Tier I capital requirement (currently 10 percent) raised to 12 percent by April 1,

2014 for gold loan NBFCs (where such loans comprise 50 percent or more of their

financial assets).

As there were previously no LTV restrictions, many companies had extended up to

90-95 percent of the value of gold jewellery as loans, and a relatively small proportion

of the lending happened at LTVs of 60 percent or lower.

8

The new LTV cap of 60

percent could result in significantly lower growth rates, as borrowers will have to bring

in additional gold jewellery to obtain a loan of the same amount. The RBIs new

measures could also adversely impact the asset quality of gold loan companies in the

short term as the loan eligibility of borrowers seeking refinance is expected to decline.

In addition, this development could result in business shifting to the unorganized

sector or to banks, which would continue to extend loans at higher LTV ratios. The

current high profitability of gold loan companies may also moderate as they are likely

to reduce pricing in order to protect their market shares and prevent a shift to the

unorganized sector.

The RBI guidelines are expected to impact gold loan NBFCs business in the short-

term. Business growth could fall from more than 50 percent to 20-25 percent per

annum while return on assets could fall from 4.5 percent to 2.5-3 percent.

9

However,

in the long term these guidelines should have an overall positive impact on the sector,

by bringing regulatory clarity. The moderation of growth would increase the

confidence of stakeholders, including banks and other investors, in the sector. In

addition, the LTV cap would lead to better asset quality. Furthermore, slower growth

rates will likely reduce capital requirements over the medium term.

In April 2012, the RBI required banks to reduce exposure to any single NBFC engaged

in the gold loan business from the current 10 percent of their capital funds to 7.5

percent.

10

This means that banks will have fewer funds to lend to these gold loan

NBFCs, which will increase their borrowing cost. Even if the new regulations attempt

to make gold loan NBFCs less attractive, these specialized NBFCs have nevertheless

created a niche for their gold loans capabilities by flexibility, easy access, low levels of

documentation and formalities, quick approval and disbursal of loans, faster

turnaround time, customer trust, ability to service non bankable customers and quality

of service. These unspoken associated benefits will help NBFCs to capture and

sustain a significant portion of the gold loan market share in future, in spite of the

tighter regulations.

To summarize, these guidelines might moderate the growth and impact the

profitability of gold loan NBFCs in short term. In the long term, however, they are

expected to enhance the gold loan NBFCs ability to assimilate the impact of any

sharp decline in gold prices, thereby improving the sector's asset quality. These

guidelines should not only strengthen the well-capitalized established business

players but also help regulate new players which lack the experience or the necessary

understanding of the business, making the gold loan market more mature.

7 Business Standard, 18 April 2012

8 Finance Express, 22 March 2012

9 Crisil Press Release, 22 March 2012

10 Reserve Bank of India, Monetary Policy Statement 2012-13

NBFC gold loan Short term pain, long term gain?

Government

15 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

16 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Direct cash subsidy

would not only eliminate

the opportunity for

benefiting from pilferage

and diversion in the

current system due to sale

of goods at more than one

prices, but also give the

liberty to the beneficiaries

to buy the goods of

their own choice and

choose the place where

they buy their goods from.

Navin Agrawal

Head

Government

KPMG in India

Direct cash subsidy and its impact in the Indian context

Navin Agrawal

Head

Government

navinagrawal@kpmg.com

Existing system and its challenges

Under direct transfer, the difference between the market price and subsidized

price is directly transferred to the beneficiary in the form of cash in proportion

to the quantity uplifted from the market.

1

In the Union Budget 2011, the government announced a direct transfer of

subsidies to BPL households which is a drastic departure from the existing

indirect or price subsidy system wherein subsidies are routed through

manufacturers who are required to sell goods below the market rate.

The change in subsidy policy follows in response to the following shortcomings

in the current system.

Dual-pricing

Market distortions

Unresponsiveness to customer needs

Poor targeting of BPL population

Diversion and leakages

Under recoveries for Oil Manufacturing Companies (OMCs).

The new policy would help poor access basic goods by reducing demand

constraints. Since now the manufacturers and retailers would be selling the

commodities at market determined price universally; this policy would not only

put a check on dual pricing, market distortions and leakages but would also

remove the burden of under recoveries on OMCs. However, the real success

of the policy lies in the accuracy and efficiency in identification of worthy

beneficiaries, i.e. BPL Households.

International best practices

Several countries including Jamaica, Philippines, Turkey, Chile, Mexico,

Indonesia, South Africa, Morocco and United States have adopted this system

in the form of Conditional Cash Transfer (CCT) programs

2

. Under such

programs, direct cash is provided to the poor families on condition that its used

for verifiable investments in human capital, such as regular school attendance

or used in attaining basic nutrition and health care.

The largest and the most successful conditional cash transfer program is the

Bolsa Famlia Program (BFP) in Brazil that covered close to 100 percent of

Brazil's poor in 2007

2

. Under the programme, the government transfers cash

straight to a family subject to conditions such as school attendance, nutritional

monitoring, pre-natal and post-natal tests. The entire system is managed

through efficient targeting, disbursement and regular monitoring of the

disbursed funds.

Evolution in India

The government in order to leverage technology solutions and in particular the

Aadhaar i.e. the Unique Identification (UID) programme for this purpose,

constituted a task force on Direct Transfer of Subsidies on Kerosene, LPG &

Fertilizer headed by Nandan Nilekani (Chairperson of UID Authority). The task

force proposed the Solution Architecture (Core Subsidy Management System

(CSMS)) to achieve a fully electronic back-office process for direct transfer of

subsidy. The system would automate all business processes related to direct

subsidy transfer and can be customized according to the business rules. At the

very core of the system would be: Aadhaar Integration, ERP Integration and

Integration with nodal bank and payments gateway.

1. Financial times Lexicon

2. Direct cash subsidy: Challenges for implementation; Business Standard, 25 April 2011

17 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

As the task force proposed in its report, the new subsidy system for kerosene would

be implemented in 2 phases:

Phase I

Direct transfer of subsidy through state

governments/UT Administration

States purchase commodity from manufacturers

at market price

Central government transfers the differential

subsidy directly to the state govts./UT

Subsidy amount is proportional to commodity

uplifted from the retail points in a state/UT

States reform their distribution system based on

the CSMS system proposed by the Task Force.

Phase II

Subsidy transfer to beneficiaries

The cash equivalent of subsidy is transferred

directly to beneficiaries through their bank

accounts by linking transactions to Aadhaar

The commodity purchase and then transfer of

cash subsidy to their account will be based on

successful authentication of the beneficiary

through Aadhaar at the point of sale.

Impact on government

The new system is expected to reduce this cost and subsidy bill through better targeting

In the Union Budget 2012-13, target is to keep 2012-13 subsidies under 2 percent of GDP

and under 1.75 percent of GDP in the next 3 years

3

Government endeavors to scale up and roll out Aadhaar enabled payments for various

government schemes in at least 50 districts within next 6 months

Public sector OMCs have launched LPG transparency portals to improve customer service

and reduce leakage.

Critical success factors

The governments efficiency in dealing with the fundamental issues like the basis of

targeting, definition of poverty line & identification of intended beneficiaries

Effectively subsidizing the poor for fertilizer or kerosene once the prices are market

determined and are liable to fluctuate

Devising a methodology to transfer the cash subsidy to the poor

State governments endeavor in taking up fundamental reforms required in Public

Distribution System (PDS).

Recommendations

Identification of beneficiaries

Selection criteria should be kept broad-based and inclusive. Lessons can be learnt from the

successful implementation of Brazils Bolsa Famlia Program

Vulnerability to fluctuating market prices

Prices can be averaged out yearly based on forecasts. Cash subsidy should allow flexibility

in the choice of commodity to the beneficiary. The amount of subsidy should be calculated

based on the number of individuals per household rather than assuming an average

household size

Transfer of cash subsidy

To expedite the implementation, bank accounts can initially be opened for one member per

household. The withdrawal can be done at bank branches and ATMs through debit cards

and through the business correspondent model using smart cards, PoS devices, etc.

Direct cash subsidy and its impact in the Indian context

Source: Report submitted by the task force on Direct Transfer of Subsidies on Kerosene, LPG & Fertilizer, GoI.

3. Union Budget 2012-13

Healthcare

18 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

19 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Introduction

The Indian market for medical equipment and supplies ranks among the worlds top 20

but, despite strong growth rates, the market remains disproportionately small with per

capita spending of USD 2, as of 2011, the medical devices market in India was estimated

to be worth USD 2642 million. As the sector gains traction continually over the years,

there is a perpetual demand for high quality products (especially in the private sector).

Although the high-tech end of the medical device market is dominated by multinationals

with extensive service networks, the market for medical supplies and disposable

equipment is dominated by domestic manufacturers.

1

Key issues in the industry and possible solutions

Unstable regulatory environment

The regulation of medical devices is often complicated by legal technicalities. In India, the

Department of Health has nominal jurisdiction over medical devices, evident from the

illegal reprocessing and re-packaging of used syringes for re-sale and the availability of

equipment that fails minimum safety and quality standards

.2

About seven years ago, the use of unregulated implantable devices came to the notice of

the Mumbai High Court who passed orders insisting on regulation of medical devices. As

a result, the office of the Drug Controller General of India (DCGI) announced regulation of

ten categories implantable medical devices on October 7, 2005. A number of issues

arose following this announcement owing to lack of preparation on the side of the

industry and the lack in experience of the regulatory body.

It is imperative all stakeholders in the field; industry, regulators and customers be aware

of the regulatory environment. There is considerable gap in knowledge that needs to be

bridged.

The need for regulations arose primarily due to the safety concerns that surround the field

and hence it is essential to have on board regulatory personnel with qualifications and

knowledge appropriate for regulation of these products.

There are multiple proposals being made to effect the provisions of the Drugs and

Cosmetics Act, hence the regulation of medical devices is likely to be an issue that would

not be taken up immediately and without debate. It would therefore be in the best

interest of all stakeholders of the industry if the Ministry of Health were to separately take

up and fast track the setting up of an independent Medical Device Regulation as well as

an independent authority for its implementation.

Lack of funding in R&D

There has not been much investment in R&D in the segment. Due to various cost cutting

initiatives that have been taken by firms in the healthcare sector, innovation, particularly in

this segment has not been witnessed.

It is important to acknowledge the fact that innovation can only be achieved in a

collaborative manner with the clinicians / healthcare service providers. It is imperative that

they participate in all aspects, from need identification to scientifically documenting

outcomes and ideally subjecting it to stringent peer review. It has to be noted that the

cost and time of development of Medical Devices is high but needs to be amortized over

much smaller numbers over a shorter product lifecycle. This should be understood and

recognized.

It is also important that the industry develop the ability to understand and protect

intellectual property thus created.

Medical devices sector: Key challenges and methodologies

Amit Mookim

Head

Healthcare

amookim@kpmg.com

1. Epsicom Research

2. AmChamreport KPMG

20 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Insufficient skill sets

The Department of Science and Telecom, The Ministry of Health and Family

welfare and Indian Council for Medical Research have taken strong initiatives to

improve the quality manpower in the medical device sector. The Department of

science and Technology and Sree Chitra Tirunal Institute for Medical Sciences

and Technology (SCTIMST) have drafted a recent bill for biomedical devices

regulatory authority to structure the industry dynamics.

The Department of Science and The Ministry of Health and Family welfare have

introduced several courses with an industrial perspective in the biomedical

sector. Namely:

MTech in clinical engineering at IIT Madras in collaboration with Christian

Medical College and Sree Chitra Tirunal Institute for Medical Sciences and

Technology (SCTIMST), Thiruvananthapuram.The course was funded by the

department of science and The Ministry of Health and Family welfare in 2007.

Apart from B-Tech Biomedical programmes in some private and semi-private

institutes, IIT-Bombay, Khagarpur and Madras have some viable programmes in

this stream.

Amalgamation programmes are also catching the attention of students at the

premier institutes which are expected to play a major role in reducing the skill set

crisis. A good model of blend of medical and engineering streams is the Stanford

Biodesign programme, because of which AIIMS and IIT Delhi students are

working together.

Lack of domestic participation

Medical products are manufactured in India by both private companies and

companies incorporated under the Ministry of Health and Family Welfare. A

number of Indian manufacturers are either involved or interested in joint

ventures/licensing agreements with companies in the USA and Europe while

domestic manufacturers dominate the low tech, disposable equipment and

supplies end of the market. Lack of incentives from the government and high

capital requirement with deferred break-even is restricting the entry of domestic

players for manufacturing.

A number of international companies have set up manufacturing facilities in India,

including Bausch &Lomb,B. Braun, Becton Dickinson, Drger, GE Medical

Systems, Siemens, Terumo, and Zeiss etc with some of the domestic giants like

BPL healthcare, Nicholas Piramal (diagnostics kits), Opto Circuits India Ltd, and

Advanced Micronic Devices Ltd coming to the fore

.3

The government needs to attract domestic players by efficient incentive

packages which motivate domestic players to manufacture medical devices and

hence bring the cost of manufacturing to the desired profit base.

Conclusion

The medical technology segment has tremendous potential. This potential is

being recognized by the government and there have been many initiatives to

promote the sector. In the Union Budget 2012-2013, customs duty has been

reduced from 16 percent to 8 percent for medical and veterinary furniture. The

sector is expected to grow at a CAGR of 13.4 percent (USD 4,957.8 million by

2016).

4

3. KPMG Analysis

4. IBEF Research

Medical devices sector: Key challenges and methodologies

IT - BPO

21 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

22 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

India has witnessed remarkable success in the field of information

technology and business process outsourcing (IT-BPO) over the two

decades. Total export revenues earned by IT-BPO sector have grown to

USD 69 billion in FY12, with the overall sector (including hardware) touching

revenues of USD 100 billion.

1

The domestic hardware market comprising

desktops, laptops, servers, printers, storage, networking peripherals is the

largest segment within the domestic IT-BPO market. This segment is

expected to reach revenues of nearly USD 13 billion.

1

This growing market, which is currently sized at USD 13 billion, has been led

by BFSI, Manufacturing and Government, which have the maximum share in

hardware spend in India.

2

Factors such as infrastructure requirement in

public sector, capital-intensive nature of manufacturing firms and increasing

need or modernization of banks has been driving the spending of these

three verticals. While these three verticals lead the market in the current

scenario, sectors such as Communications and Media, Financial Services

and Healthcare are expected to ride the next wave of growth witnessing

growth rates of 12 percent, 11.6 percent and 11.4 percent respectively.

2

The hardware industry in

India is bullish and

promises immense

potential. While significant

opportunity lies ahead of

us, there is a need to

make some policy

changes to tap the latent

potential. Inverted duty

structure duty due to

which importing finished

goods turn out to be

cheaper than assembling

them in India needs an

overhaul. All we need is to

take the right foot forward

towards making India an

electronic manufacturing

hub.

Pradeep Udhas

Head

IT-BPO

KPMG in India

Pradeep Udhas

Head

IT-BPO

pudhas@kpmg.com

1. NASSCOM Strategic Review 2012

2. Ovum, IT Hardware Global Forecast Model, March 2011

Future of IT hardware industry in India

Domestic Hardware Market in India Vertical Split of Domestic Hardware

Market FY 2012(100%=USD13billion)

Source: NASSCOM Strategic Review 2012; Ovum, IT Hardware Global Forecast Model, March 2011

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

FY2011 FY2012

Other Peripherals

Printers

Servers

Storage

Network Equipments

Desktop PCs

Notebooks

3.2

3.6

2.7

2.8

2.2

2.5

0.5

0.5

0.4

0.5

0.4

0.4

2.4

2.6

11.7

12.8

23%

16%

11%

9%

9%

9%

7%

7%

7%

3%

Financial Services

Manufacturing

Government & Education

Communications & Media

Retail & Wholesale

Professional Services

Transportation & Logistics

Energy and Utilities

Healthcare

Other

Estimated Growth of Verticals (2010 15)

Source: Ovum, IT Hardware Global Forecast Model, March 2011

2.0%

11.6%

10.7%

11.2%

12.0%

10.6%

11.1%

11.1%

10.0%

11.4%

10.6%

Financial Services

Manufacturing

Government & Education

Comms & Media

Retail & Wholesale

Professional Services

Transportation & Logistics

Energy and Utilities

Healthcare

Other

4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 0.0%

23 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Although the segment is promising and has immense potential, the

increasing demand-supply gap remains to be a cause of concern. While the

demand for hardware was estimated to be USD 13 billion in FY12, the

production of goods stood merely at USD 6 billion.

3

Growing demand for

hardware fuelled by modernization across verticals, clubbed with the slow

rate of increase in domestic production, is widening the demand-supply gap.

While this is seen as a challenge, it is also also unveils a plethora of

opportunities for hardware manufacturers, be it global or India, who can gain

significantly while bridging this chasm.

Growth drivers of the Indian IT hardware ecosystem

The key drivers of the Indian IT hardware ecosystem are:

Growth in per capita income and corporate spend on hardware: Nearly

10 million households now have income levels above USD 10,000 per

annum in 2012.

3

Transformation of IT hardware from an aspiration to a

utilitarian need has made these products more affordable for people

Government focus on digital education: Various state governments in

the country, like Tamil Nadu and Uttar Pradesh, have mandated laptops

for all school children. This is driving a massive spike in the demand for

laptops and other computer hardware

Increasing spending from IT services industry: IT and ITES industries

continue to drive the demand for the IT equipment. With Indian firms

adopting automation, the demand for IT equipment is increasing

Need for innovative products at low cost: Innovative low cost products

like the Aakash tablet are also driving demand from both consumers as

well as the government.

Challenges faced by Indian IT hardware manufacturers

Inadequate infrastructure interrupting growth: Lack of power, land

acquisitions issues and poor transport links restrict hardware

manufacturing firms

Tax issues: When compared to low cost destinations such as China and

Taiwan, Indias current tax structure makes the final product less

competitive

Limited preferential access for local firms: As of now there are no

preferential laws or incentives in place which enforce usage of domestic

products to some extent.

KPMG in India point of view

The IT hardware industry can play a big role in providing products and

solutions to aid the India growth story. It has the potential to leapfrog India

to next generation of technology adoption and holds immense

transformational potential for various industry verticals.

3 Report of Task Force to suggest measures to stimulate growth of IT-ITeS and Hardware manufacturing industries in India, MIT, Govt. of India, December 2009

Future of IT hardware industry in India

24 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

While India has the fastest growing Hardware market, the absolute size of

the market is still small when compared to leading countries such as China

and Japan in Asia Pacific.

4

Other economies such as China, Malaysia and

Vietnam have been taking significant steps to enhance manufacturing

capabilities. China has become the worlds manufacturing hub, Vietnam has

turned into an attractive destination for Electronic Manufacturing Services

(EMS), and semiconductors and Original Device Manufacturing (ODM), and

Malaysia has also transformed into an industrialized market.

4

In order to drive high growth in the industry, it is imperative for the

government to provide impetus to the domestic IT manufacturing industry.

Some of these measures include Convert existing clusters such as

Sriperumbudur and Noida into Centers of excellence; creating a joint

Government-Industry committee to market India and attract investment in

India; incentivizing investments in India by creating a model where the

subsidy or rebate given to a manufacturer is determined on the basis of the

value addition; focusing on R&D; and creating a fund to promote

manufacturing, business and growth for the industry.

Future of IT hardware industry in India

Industry Vertical Present state Future potential

Access No digital connectivity Wireless connectivity

Education Limited equipment Digital classrooms

Healthcare Accessibility and cost Telemedicine reduces cost, improves access

Digitization Analog to Digital Electronic society, Unique ID

Growth Story of Comparable Countries

Source: KPMG in India Analysis; 3 Report of Task Force to suggest measures to stimulate growth of IT-ITeS and

Hardware manufacturing industries in India, MIT, Govt. of India, December 2009

Initiated SEZ program in the early 1980s, as compared to India, which

started SEZs in 2005

Decentralized power by authorizing local provinces to frame the

guidelines to administer the different zones

Benefits to business units differ across SEZs based on parameters such

as length of operations, use of advanced technologies, etc.

C

h

i

n

a

M

a

l

a

y

s

i

a

V

i

e

t

n

a

m

100% FDI on investments for expansion/diversification of projects

Corporate tax rate was reduced from 26% in 2008 to 25% in 2009.

Government also offers other significant tax incentives under the

Promotion of Investments Act 1986 and the Income Tax Act 1967

Companies are opting for Vietnam to reduce their dependence on China

and evenly spread their business risks in Asia

Strong work ethics, improved infrastructure, reduced labor costs and the

availability of a skilled labor pool have been instrumental in making

Vietnam an attractive destination

4 KPMG in India Analysis; 3 Report of Task Force to suggest measures to stimulate growth of IT-ITeS and Hardware manufacturing industries in India, MIT, Govt. of India,

December 2009

Malaysia

Vietnam

China

Media and

Entertainment

25 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

26 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

The cable television industry in India is poised for one of its most significant

developments in the last decade a transformation to the Digital Addressable

System (DAS) for television distribution. Cable operators in a DAS regime

would be legally bound to transmit only digital signals. Subscribed channels

can be received at the customers premises only through a set-top-box

equipped with a conditional access card, and a subscriber management

system (SMS).

With the parliament clearing the bill to amend the Cable Television Networks

(Regulation) Act in December 2011, the stage has now been set for transition

to DAS, to be implemented across India in four phases. The sunset date of

30th June 2012 has been set for completion of phase-I and the government

seem to be committed towards ensuring a smooth transition within the set

timelines. However, with an installed base of only 6 million

1

set-top-boxes

(STBs), is the cable industry ready to usher the first wave of digitization?

Some of the digital cable operators expect that 70-75 percent of the analog

market has the potential to easily shift to digitization, provided that the cable

industry is prepared for it.

1

Further, they believe that if the cable industry

does not gear itself for the transition, the DTH industry may gather around 40-

45 percent of the market.

1

With rising demand and the lead time for the delivery of STBs being 3-4

months, operators who did not place timely orders for STBs are likely to see

delays as the deadline approaches near. As cable operators begin STB

installation very close to the actual deadline, it is unlikely that all existing

analog cable TV homes will be able to make a transition to digital cable within

the specified time frame. Accordingly, we may witness a delay of

approximately 6 to 12 months for complete digitization across metros (Phase

I). Also, the implementation may vary across the metro cities. The Delhi

market is considered the most challenging, given the highly fragmented

nature of cable industry in the city, while the Mumbai market is largely

consolidated, with fewer MSOs.

We believe that timely installation of STBs is one of the many challenges that

the cable operators will need to confront. The shift will require large capital

expenditure (INR 15-20 billion in phase-I)

1

on digital head-ends, back-end

infrastructure, and STB installation. Regional and smaller Multiple System

Operators (MSOs), which account for approximately 50 percent of the cable

TV market, may find it difficult to raise the required capital for phase-I in

time.

1

Apart from the financial requirements, digitization also presents large

organizational challenges for the MSOs. A consumer focused approach will

be a critical success factor for MSOs to succeed post digitization. While

MSOs will continue to provide technical and manpower assistance to Local

Cable Operators (LCOs) for setting up head-ends and installation of STBs,

they will also need to scale up their back-end infrastructure such as IT

systems, call centres, billing operations and STB management (procurement

and repair). While the back-end infrastructure and required network is largely

in place for Phase-I, however much more work needs to be done to scale-up

billing and customer service operations, which may further lead to large scale

IT outsourcing contracts. This would call for significant manpower

preparedness and deriving learnings from consumer focused industries such

as Telecom where most critical processes are outsourced.

Is the cable industry digital ready?

Jehil Thakkar

Head

Media and

Entertainment

jthakkar@kpmg.com

1. KPMG-FICCI Frames Report 2012, Digital Dawn- The metamorphosis begins

27 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Conclusion

While the industry is excited and positive about successful adoption of

digitization, the transition is not expected to be entirely smooth and there are

bound to be implementation challenges. The Indian consumer also appears to

be ready for digital television, as demonstrated by the high penetration of

DTH platform amongst C&S subscribers. However, the cable industry will

need to accelerate its efforts and ensure that it does not lose out on the

digitization opportunity to the DTH players. In the quest to build a sizeable

subscriber base, going forward, we may witness consolidation amongst

MSOs, LCOs being acquired by MSOs and capital rising by MSOs. The

success will depend on how the players work collaboratively towards

overcoming their operational challenges, ensuring technological and

manpower preparedness and building sustainable processes which will

define the dynamics of the industry.

P

r

o

c

e

s

s

e

s

Telecomindustrys key outsourced processes

Pre-sales Order Fulfillment Billing Support Post Sales

Outbound sales

Inbound sales

Up-sell, cross-sell,

right-sell

Lead management/

maintenance

Pre-sales support

Product configuration

Credit check

Set up payment

process.

Order processing

Credit analysis

and approval

Pricing, billing

and involving

Dispute

resolution

Claims/Returns

handling.

Billing credits/

Adjustments & billing

cycles

Past due accounts,

Account

Status/changes

Service

suspend/Interrupt/

Reinstate

Amount owned on bill

Credit card/Online

payments

Roaming queries

Security deposits

Convergence billing.

Retention

Account maintenance

Collections

Loyalty program

Customer analytics

Local number porting

Installations

Technical trouble

shooting

Provisioning/Field

Support

Customer interaction

centre.

F&A

Payroll Processing

Knowledge Management

HR Services

Document Management

Source: Phocuswright, Vendor websites, Company presentations

Note: The list of processes outsourced, vendors and clients is not exhaustive. A few key processes, vendors and clients have been mentioned for illustration

Is the cable industry digital ready?

Private Equity

2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

28

29 2012 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Union budget 2012-13: Impact analysis

Vikram Utamsingh

Head

Private Equity

vutamsingh@kpmg.com

2012 could be a good

vintage year for private

equity investments against

the backdrop of relatively

low valuations and better

quality deal flow

Vikram Utamsingh

Head

Private Equity

KPMG in India

1. Venture Intelligence, Data does not include real estate deals

2. Repo rate

3. RBI

4. RBI Policy Meeting, 17 April 2012

2012 could be a good vintage year for private equity

investments

Background

The year 2011 was worse than 2010 given a tough fundraising environment

as well as a poorer exit activity. But in a way, 2010 was a hard act to follow,

too, given the blockbuster exits private equity and venture funds had seen

that year. Many Indian funds went to market but found it tough to raise

fresh capital owing to adverse global economic conditions and intense

competition for the LP dollar. The Indian stock markets were one of the

worst performing markets globally with the Bombay Stock Exchanges

bellwether index falling by a quarter in 2011. Exits were also under pressure

and PE exit value fell to USD 2.8 billion in 2011 against USD 4.5 billion in

2010, a decline of nearly 38 percent, as per data by the Indian research

agency, VCCEdge.

However, PE investments rose to USD 9.1 billion across 459 deals in 2011

as compared to USD 7.6 billion across 364 deals in 2010

1

, reaffirming Indias

attractiveness amongst PE investors. We believe that this trend will

continue and 2012 could be a good vintage year for PE investments. We

highlight a few important aspects below which are likely to shape up 2012.

Improving macro-economic environment