Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

47 viewsCircle Guarantee Form

Circle Guarantee Form

Uploaded by

Taylor MartinezSample Guarantee form

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Friendly Loan AgreementDocument10 pagesFriendly Loan AgreementKenny Wong95% (19)

- Lease Contract of Heavy EquipmentDocument3 pagesLease Contract of Heavy EquipmentCARLO C. VILLANUEVA JR.100% (8)

- Declaration of TrustDocument2 pagesDeclaration of Trustkyra_kae100% (17)

- Commercial Security AgreementDocument5 pagesCommercial Security AgreementIrth Orbits100% (1)

- Friendly Loan AgreementDocument5 pagesFriendly Loan Agreement7 Rings0% (1)

- UCC SecurityAgreementDocument5 pagesUCC SecurityAgreementTony Britten90% (21)

- Commercial Security AgreemenDocument4 pagesCommercial Security AgreemenFreeman Jackson100% (4)

- Corporate GuaranteeDocument4 pagesCorporate Guaranteesalehin1969No ratings yet

- Agreement of SuretyshipDocument1 pageAgreement of SuretyshipKay AvilesNo ratings yet

- Letter of Guarantee by CorporateDocument6 pagesLetter of Guarantee by CorporateTira MagdNo ratings yet

- NZECP 35 1993 New Zealand Electrical Code of Practice For Power System Earthing - Published 18 March 1993 PDFDocument29 pagesNZECP 35 1993 New Zealand Electrical Code of Practice For Power System Earthing - Published 18 March 1993 PDFTaylor Martinez100% (1)

- Broidy Nader Correspondence Redacted2Document19 pagesBroidy Nader Correspondence Redacted2mary engNo ratings yet

- AbstractDocument3 pagesAbstractMohd YasinNo ratings yet

- Administrative LawDocument7 pagesAdministrative LawChela Emmanuel Mulenga92% (13)

- State Government GuaranteeDocument6 pagesState Government GuaranteeAMAN KUMARNo ratings yet

- Deed of GuaranteeDocument5 pagesDeed of GuaranteeShivam Shiddharth SinghNo ratings yet

- Collateral Agreement TemplateDocument8 pagesCollateral Agreement TemplateRobertNo ratings yet

- Draft For Discussion Purposes Only August07-VI: Page 1 of 12Document12 pagesDraft For Discussion Purposes Only August07-VI: Page 1 of 12Himanshu JaiswalNo ratings yet

- Ang Tibuok Mong KinabuhiDocument6 pagesAng Tibuok Mong KinabuhiJuliet PanogalinogNo ratings yet

- Guarantee Deed Corporate For Retail HL and Lap 065709200147385837011Document13 pagesGuarantee Deed Corporate For Retail HL and Lap 065709200147385837011AMAN KUMARNo ratings yet

- CC tnc1Document2 pagesCC tnc1rinku.markaNo ratings yet

- U.S. Fire Court BondDocument2 pagesU.S. Fire Court Bondanon_529589942No ratings yet

- Orbe Brazil Fund LTD - Subscription Documents - December 2009Document37 pagesOrbe Brazil Fund LTD - Subscription Documents - December 2009José Enrique MorenoNo ratings yet

- M Embership Booklet: Effective April 1, 2022Document21 pagesM Embership Booklet: Effective April 1, 2022James CaronNo ratings yet

- Membership Interest Pledge AgreementDocument6 pagesMembership Interest Pledge AgreementKnowledge Guru100% (1)

- Corporate GuaranteeDocument4 pagesCorporate Guaranteeowenmaraasin5No ratings yet

- Bank Loan AgreementDocument8 pagesBank Loan AgreementSiddhi LikhmaniNo ratings yet

- Subordinated Loan AgreementDocument6 pagesSubordinated Loan AgreementRocketLawyer100% (1)

- Insurance DocumentDocument2 pagesInsurance Documentnikolaigray249No ratings yet

- Note Purchase AgreementDocument7 pagesNote Purchase AgreementM00SEKATEERNo ratings yet

- Sample Agent Commission AgreementDocument20 pagesSample Agent Commission Agreementpilvar600No ratings yet

- American Roads Standing Opinion ExhibitsDocument20 pagesAmerican Roads Standing Opinion ExhibitsChapter 11 DocketsNo ratings yet

- AgreementDocument21 pagesAgreementdevgdev2023No ratings yet

- Inv Consulting Services AgreementDocument8 pagesInv Consulting Services AgreementParvesh KuchwahaNo ratings yet

- Letter of Guarantee and Indemnity FormDocument5 pagesLetter of Guarantee and Indemnity Formpollycummings423No ratings yet

- Agency Agreement TemplateDocument7 pagesAgency Agreement TemplateMikeTantonNo ratings yet

- Corporate Guaranty: Waiver and Modification. The Undersigned Waive Notice of (A) Acceptance of This Guaranty (B)Document2 pagesCorporate Guaranty: Waiver and Modification. The Undersigned Waive Notice of (A) Acceptance of This Guaranty (B)prevrtljivacNo ratings yet

- Loan Agreement SampleDocument9 pagesLoan Agreement SampleEa GabotNo ratings yet

- Security Agreementpledge 2899750 1Document3 pagesSecurity Agreementpledge 2899750 1Shoeiarai Yoshimura PallmallemNo ratings yet

- 9-11 Buringrud LoanDoc PDFDocument50 pages9-11 Buringrud LoanDoc PDFChimkenz01 NuggitzNo ratings yet

- SECURITYAGREEMENTtemplateDocument7 pagesSECURITYAGREEMENTtemplateTroy StrawnNo ratings yet

- Guarantee As Pub. Word. 4:1:2021Document10 pagesGuarantee As Pub. Word. 4:1:2021pl godutiNo ratings yet

- SAVEINSTPL-3249953316714 001 SignedDocument14 pagesSAVEINSTPL-3249953316714 001 SignedAbhayNo ratings yet

- Legal 4Document2 pagesLegal 4jaswinder.singh88688No ratings yet

- UFA Members & Customers, Ufa Credit On Account Program Terms and ConditionsDocument17 pagesUFA Members & Customers, Ufa Credit On Account Program Terms and ConditionsHamadaFreelanceflowNo ratings yet

- 9-11 Buringrud LoanDocDocument50 pages9-11 Buringrud LoanDocAlex SoonNo ratings yet

- Letter of Continuing Guarantee (Joint & Several)Document8 pagesLetter of Continuing Guarantee (Joint & Several)South PointNo ratings yet

- Accounts Receivable, Specific AssignmentDocument4 pagesAccounts Receivable, Specific AssignmentthriveinsuranceNo ratings yet

- GUARANTEE INDEMNITY AND STATEMENT OF NETWORTH (UPDATED 2023) (1)Document6 pagesGUARANTEE INDEMNITY AND STATEMENT OF NETWORTH (UPDATED 2023) (1)tajudeenca2022No ratings yet

- Corporate GuaranteeDocument3 pagesCorporate GuaranteeJigo DacuaNo ratings yet

- Security AgreementDocument5 pagesSecurity Agreementflextechvip100% (1)

- Loan Agreement Sample FormatDocument5 pagesLoan Agreement Sample FormatAnkush Tekam0% (1)

- Agency AgreementDocument7 pagesAgency AgreementRastko PopovićNo ratings yet

- Draft of Undertaking To Be Executed by Lending InstitutionDocument5 pagesDraft of Undertaking To Be Executed by Lending InstitutionSreejith R RetnamNo ratings yet

- Sushil DograDocument4 pagesSushil DograarunNo ratings yet

- P125 PDFDocument2 pagesP125 PDFkismadayaNo ratings yet

- OSA 2015 (Schedule A)Document3 pagesOSA 2015 (Schedule A)Anonymous nYwWYS3ntV100% (4)

- Letter of Consent To Disclosure of Information 1Document3 pagesLetter of Consent To Disclosure of Information 1Hazwani IsmailNo ratings yet

- Regal Bond Information Memorandum 11.05.2015.Issued10thApril - CompressedDocument28 pagesRegal Bond Information Memorandum 11.05.2015.Issued10thApril - Compressedhung_hatheNo ratings yet

- General Continuing GuarantyDocument11 pagesGeneral Continuing GuarantyconsultFLETCHERNo ratings yet

- Account DisclosuresDocument13 pagesAccount DisclosuresDoris RiveraNo ratings yet

- C&C - Asset Sale Process Memorandum - 4th Auction - Going ConcernDocument48 pagesC&C - Asset Sale Process Memorandum - 4th Auction - Going ConcernPalikatowns LLPNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- Ishares Product List en UsDocument12 pagesIshares Product List en UsTaylor MartinezNo ratings yet

- Example SymmCompDocument5 pagesExample SymmCompTaylor MartinezNo ratings yet

- Sunrise BrochureDocument15 pagesSunrise BrochureTaylor MartinezNo ratings yet

- Workshop On Inverter Based Generation R0Document1 pageWorkshop On Inverter Based Generation R0Taylor MartinezNo ratings yet

- Alstom Grid France Alstom Grid UK: 21, Rue D'artois, F-75008 PARISDocument11 pagesAlstom Grid France Alstom Grid UK: 21, Rue D'artois, F-75008 PARISTaylor MartinezNo ratings yet

- Grounding Design For PV PDFDocument6 pagesGrounding Design For PV PDFTaylor Martinez100% (1)

- Hysteresis LoopDocument1 pageHysteresis LoopTaylor MartinezNo ratings yet

- PC37 122 4-G PDFDocument47 pagesPC37 122 4-G PDFTaylor MartinezNo ratings yet

- 8 ' ?:/&'@aba' B'Document58 pages8 ' ?:/&'@aba' B'Taylor MartinezNo ratings yet

- Conductor Current Capacity CurvesDocument1 pageConductor Current Capacity CurvesTaylor MartinezNo ratings yet

- Text of CCA Order Staying Execution of Jeffery WoodDocument10 pagesText of CCA Order Staying Execution of Jeffery WoodScott CobbNo ratings yet

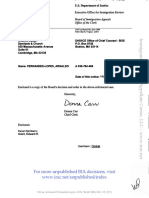

- Armando Fernandes-Lopes, A036 784 465 (BIA Nov. 30, 2017)Document3 pagesArmando Fernandes-Lopes, A036 784 465 (BIA Nov. 30, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Title NO.218 (As Per Workshop List Title No218 PDFDocument16 pagesTitle NO.218 (As Per Workshop List Title No218 PDFIshaNo ratings yet

- Mormugao Port Employees' (Pension and Gratuity) Regulations, 1966Document52 pagesMormugao Port Employees' (Pension and Gratuity) Regulations, 1966Latest Laws TeamNo ratings yet

- Salonga Chap 3-8Document14 pagesSalonga Chap 3-8unicamor2No ratings yet

- 65 Enrile Vs SalazarDocument2 pages65 Enrile Vs SalazarAmberChanNo ratings yet

- Rudul Shah V State of BiharDocument4 pagesRudul Shah V State of BiharVarun Garg75% (4)

- 4 Tanada Vs TuveraDocument1 page4 Tanada Vs TuveraVanityHughNo ratings yet

- PNB Vs CruzDocument2 pagesPNB Vs CruzJuna Aimee Francisco100% (2)

- Law 345Document12 pagesLaw 345Khaled RehmanNo ratings yet

- Van Dorn Vs RomilloDocument4 pagesVan Dorn Vs Romillorafaelturtle_ninjaNo ratings yet

- Economic Duress - A Judicial StudyDocument15 pagesEconomic Duress - A Judicial StudyARJU JAMBHULKARNo ratings yet

- Spouses Lam vs. Metropolitan Bank and Trust CompanyDocument1 pageSpouses Lam vs. Metropolitan Bank and Trust CompanyJon JamoraNo ratings yet

- Per Curiam:: (A.C. No. 4018. March 8, 2005) Omar P. Ali vs. Atty. Mosib A. Bubong DecisionDocument4 pagesPer Curiam:: (A.C. No. 4018. March 8, 2005) Omar P. Ali vs. Atty. Mosib A. Bubong DecisioncloudNo ratings yet

- Indian Penal CodeDocument4 pagesIndian Penal CodePiyush Langade100% (1)

- Dyson Et. Al. v. LG ElectronicsDocument5 pagesDyson Et. Al. v. LG ElectronicsPriorSmartNo ratings yet

- Research Norms and MisconductsDocument11 pagesResearch Norms and Misconductsanabelle labiiNo ratings yet

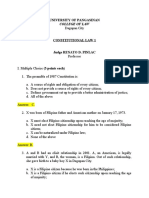

- University of Pangasinan MidtermDocument8 pagesUniversity of Pangasinan MidtermPanfilo Ferrer Dioquino Jr.No ratings yet

- Blairstown OPRA FormDocument2 pagesBlairstown OPRA FormThe Citizens CampaignNo ratings yet

- A Corporation Is An Artificial Legal PersonDocument2 pagesA Corporation Is An Artificial Legal PersonNazmus SaqibNo ratings yet

- Criminal-II Law Justification of Criminal LawDocument21 pagesCriminal-II Law Justification of Criminal LawMARLENE RANDIFIEDNo ratings yet

- Grievance and DiciplineDocument19 pagesGrievance and DiciplineJim MathilakathuNo ratings yet

- Tax 2Document288 pagesTax 2Edelson Marinas ValentinoNo ratings yet

- Delegated LegisltationDocument11 pagesDelegated LegisltationSrishti Goel100% (1)

- Philippine Suburban V Auditor GeneralDocument1 pagePhilippine Suburban V Auditor GeneralAnn QuebecNo ratings yet

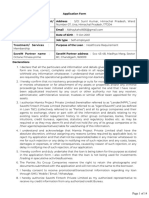

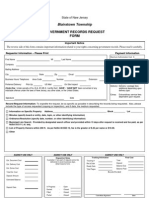

Circle Guarantee Form

Circle Guarantee Form

Uploaded by

Taylor Martinez0 ratings0% found this document useful (0 votes)

47 views4 pagesSample Guarantee form

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSample Guarantee form

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

47 views4 pagesCircle Guarantee Form

Circle Guarantee Form

Uploaded by

Taylor MartinezSample Guarantee form

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

*CA5M*

Guarantee for Multiple Parties

SCHEDULE A

5M

Registered trademark of The Bank of Nova Scotia, used by ScotiaMcLeod under license. ScotiaMcLeod is a division of Scotia Capital Inc. Scotia Capital Inc. is a member of the Canadian

Investor Protection Fund.

8210411 (04/12)

PAGE 1 OF 4

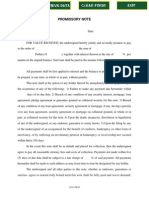

Guarantee for Multiple Parties

FOR VALUABLE CONSIDERATION, each of the undersigned guarantors listed on Schedule A above hereto (each, a Guarantor) hereby

personally and unconditionally guarantees payment to Scotia Capital Inc. (the Member) of all present and future debts and liabilities of

each of the other guarantors listed on Schedule A above hereto (in respect of each Guarantor, each other guarantor a Guaranteed

Party), including, without limitation, all debts and liabilities arising in connection with the accounts of the Guaranteed Party listed on

Schedule A.

AND the Guaranteed Party and the Guarantor agree that:

1. The Guarantor shall not be released nor the Guarantors liability hereunder limited or lessened by the Member granting time, taking or

giving up securities, accepting compositions, granting releases or discharges or otherwise dealing with the Guaranteed Party or other

parties or securities nor by any other thing whatsoever, either of a like nature to the foregoing or otherwise.

2. The Member shall not be bound to exhaust its recourse against the Guaranteed Party or other parties or any securities the Member or

the Guaranteed Party may hold before being entitled to payment from the Guarantor of the amount hereby guaranteed.

3. This guarantee shall be enforceable notwithstanding any change or changes in the name of the Guaranteed Party or, if the Guaranteed

Party be a partnership, any change or changes in the members of the partnership, including by death or by the retirement of one or

more of the partners or by the introduction of one or more other partners, and notwithstanding any incapacity or lack or limitation of

authority or power of the Guaranteed Party, or any of its directors, partners, or agents, or any irregularity, defect, or informality in the

borrowing or obtaining of monies or advances by the Guaranteed Party and notwithstanding any change in the business, powers,

objects, organization or management of the Guaranteed Party.

4. This shall be a continuing guarantee and shall cover all debts and liabilities of the Guaranteed Party to the Member from time to time

and shall apply to and secure any ultimate balance due or remaining unpaid to the Member and shall be binding as a continuing

Guarantor (each also a Guaranteed Party in respect of each of the

No. other Guarantors) (Please list names) Account Number(s)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

security on the Guarantor until receipt by the Member of written notice from the Guarantor (or the executors or administrators of the

Guarantor) to make no further advances or extensions of credit on the security of this guarantee; upon receipt by the Member of such

notice this guarantee shall not apply to any debts or liabilities of the Guaranteed Party to the Member thereafter incurred. The account

of the Guaranteed Party and any assets held therein may be restricted until such time as the debts and liabilities of the Guaranteed

Party are satisfactorily discharged or until an alternative Guarantor acceptable to the Member enters into a written guarantee

agreement on behalf of the Guaranteed Party.

5. Without notice to the Guarantor, the Member is entitled to set off any credit balance in any account of the Guaranteed Party against

any deficit in any other account of the Guaranteed Party or any other debt or obligation of the Guaranteed Party owed to the Member.

In addition, the Member may transfer securities among the Guaranteed Partys various accounts, including joint accounts and those

guaranteed by the Guarantor without notice and without affecting, limiting or discharging the Guarantors liability under this

guarantee.

6. All securities, cash, coins, commodities, contracts for the future delivery thereof, commodity options and forward commodity and

foreign exchange contracts, held or carried by the Member for the account of the Guarantor, shall be pledged and shall be maintained

as collateral security for the payment of any debts and liability of the Guaranteed Party to the Member to the extent of the liability of

the Guarantor hereunder. All such securities and other property may be transferred from time to time without notice at the Members

sole discretion to any of the Guaranteed Partys accounts to satisfy part or all of the debts and liabilities of the Guaranteed Party to the

Member, and the Member may without notice to the Guarantor sell or contract to sell any or all of the assets pledged as collateral to

this guarantee or held by the Member for the account of the Guarantor to satisfy any debt or liabilities of the Guaranteed Party to the

Member, and the Member shall not be liable to the Guarantor for any loss of or in respect of the transfer or sale of such assets, and no

enforcement of this pledge or right to transfer or sell will in any way affect the Guarantors obligations and liability under this guarantee

and no proceedings to enforce this guarantee will in any way diminish this pledge or the Members right to transfer or sell such

securities and other property.

7. The Guarantor and the Guaranteed Party acknowledge, and the Guaranteed Party specifically consents to, the Guarantor receiving at

the Members discretion copies of the Guaranteed Partys statements of account as generated.

8. The Member shall have no obligation to provide the Guarantor with any information concerning the relationship and dealings between

it and the Guaranteed Party. The Guarantor acknowledges that the extent of the Guarantors responsibility under the guarantee will

fluctuate, and that such responsibility is not limited.

9. The Guarantor acknowledges having had an opportunity to consider whether to seek independent legal advice before delivering this

guarantee to the Member and that the Member recommended that the Guarantor do so. The Guarantor acknowledges having read

and understood the terms and conditions of this guarantee before signing and delivering it.

10. If the Guarantor is a spouse of the Guaranteed Party, the Guarantor is advised to seek independent legal advice before executing this

guarantee and, by execution of this guarantee, the Guarantor either acknowledges having received independent legal advice or

acknowledges being urged to seek independent legal advice although the Guarantor has declined to do so.

11. This instrument is in addition and supplemental to all other guarantees held or which may hereafter be held by the Member and shall

enure to the benefit of and be binding upon the respective heirs, executors, administrators, successors and assigns of the Member and

the Guarantor.

12. Personal Information (for individuals only). The Guarantor hereby consents to the Member collecting personal information about the

Guarantor from third persons such as personal information agents, present and past employers, personal and credit references, credit

reporting agencies, a credit bureau, advertising agencies, collection agencies, and any person or corporation with whom the

Guarantor has or may have financial relations and to the release by third parties to the Member of such information. The Guarantor

also consents to the disclosure by the Member of the Guarantors personal information to third persons including personal information

agents, creditors, persons to whom the Guarantor has applied for credit, financial institutions, collection agencies, bailiffs, marketing

and advertising agencies, credit reporting agencies, a credit bureau or any person or corporation with whom the Guarantor has or may

have financial relations or any supplier of services relating to the account or to any other person to whom the Member deems it

necessary for the purpose of fulfilling the object of the file created by the Member under the name of the Guarantor. The Guarantor

acknowledges that it understands the consequences of giving such a consent, which is given freely and will be valid and irrevocable for

so long as it is needed in order to achieve the object of the file.

The object of the file maintained on the Guarantor is to assist the Member in: (i) making its decision with respect to this guarantee and

(ii) monitoring, evaluating, servicing and collecting indebtedness owing to the Member. The personal information in this file will be used

to make any relevant decisions in order to achieve the object of the file and will be made available only to the Members employees

who require it for the performance of their duties. The file will be kept at the address of the Member as indicated from time to time to

the Guarantor. The Guarantor has the right to access the file and rectify any personal information in the file which may be obsolete or

incorrect. To exercise the right of access and rectification, please attend at the designated office of the Member, or write to the

Member, and the information in the file will be provided.

13. The Guarantor acknowledges that the Member shall not review the suitability of transactions in the accounts of the Guaranteed Party in

relation to any Guarantor.

14. All indebtedness and liabilities, present and future, of the Guaranteed Party to the Guarantor are hereby assigned to the Member and

postponed to the debts and liabilities of the Guaranteed Party to the Member, and all monies received by the Guarantor in respect

thereof shall be received in trust for the Member and forthwith upon receipt shall be paid over to the Member, the whole without in

any way limiting or lessening the liabilities of the Guarantor under this guarantee and this assignment and postponement is

independent of the guarantee and shall remain in effect until repayment in full to the Member of all liabilities of the Guaranteed Party

to the Member.

15. This guarantee constitutes the entire agreement of Guarantor and the Member relative to the subject matter hereof. No modification

of, or supplement to, this guarantee shall bind the Member unless the same is in writing and is signed by an authorized officer of the

8210411 (04/12)

PAGE 2 OF 4

8210411 (04/12)

PAGE 3 OF 4

Member. In the event that any part of this guarantee is declared invalid, illegal or unenforceable, then the remaining terms, clauses and

provisions of this guarantee shall not be affected by such declaration and all of the remaining clauses of this Guarantee shall remain

valid, binding and enforceable. The Guarantor hereby waives diligence, presentment, demand of payment, filing of claims with the

court in the event of a receivership or bankruptcy of the Guaranteed Party, protest or notice with respect to the Guaranteed Partys

obligations and all demands whatsoever and covenants that the obligations of the Guarantor will not be discharged, except by

complete performance of the obligations contained herein.

16. Except when the Guarantor or the Guaranteed Party is a resident of Quebec, this guarantee is governed by and shall be construed in

accordance with the laws of Ontario, and the Guarantor agrees that any legal suit, action or proceeding arising out of or relating to this

guarantee may be instituted in such province, and the Guarantor hereby accepts and irrevocably submits to the jurisdiction of the courts

of such province.

17. If this guarantee is executed by more than one Guarantor to guarantee the debts and liabilities of the Guaranteed Party, all agreements

and covenants in the guarantee and all liability arising under the guarantee (whether in one or more instruments) shall be joint and

several.

If either the Guarantor or the Guaranteed Party is a resident of Quebec, the following applies:

18. This guarantee shall be governed by, and construed in accordance with, the laws of the Province of Quebec. This guarantee shall not be

deemed to create any right in any person except as provided herein and shall inure to the benefit of the successors and assigns of the

Member and all obligations of Guarantor shall be binding upon the successors, assigns, heirs, executors, administrators and legal

personal representatives, as the case may be, of Guarantor. This guarantee constitutes the entire agreement of Guarantor and the

Member relative to the subject matter hereof. No modification of, or supplement to, this guarantee shall bind the Member unless the

same is in writing and is signed by an authorized officer of the Member. In the event that any part of this guarantee is declared invalid,

illegal or unenforceable, then the remaining terms, clauses and provisions of this guarantee shall not be affected by such declaration

and all of the remaining clauses of this Guarantee shall remain valid, binding and enforceable. The Guarantor hereby waives diligence,

presentment, demand of payment, filing of claims with the court in the event of a receivership or bankruptcy of the Guaranteed Party,

protest or notice with respect to the Guaranteed Partys obligations and all demands whatsoever and covenants that the obligations of

the Guarantor will not be discharged, except by complete performance of the obligations contained herein. The parties acknowledge

that they have required that this agreement and all related documents be drawn up in English. Les parties reconnaissent avoir exig que

la prsente convention et tous les documents connexes soient rdigs en anglais.

Note: If either the Guarantor or the Guaranteed Party is a resident of Alberta , a Guarantee - Certificate of Notary Public (CA5B)

is required.

Signature(s)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

8210411 (04/12)

PAGE 4 OF 4

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

______________________________________ __________________________________________________ ____________________________________________________

DATE SIGNATURE OF GUARANTOR JOINT GUARANTOR ACCOUNT HOLDER SIGNATURE

__________________________________________________

NAME OF GUARANTOR (PLEASE PRINT)

You might also like

- Friendly Loan AgreementDocument10 pagesFriendly Loan AgreementKenny Wong95% (19)

- Lease Contract of Heavy EquipmentDocument3 pagesLease Contract of Heavy EquipmentCARLO C. VILLANUEVA JR.100% (8)

- Declaration of TrustDocument2 pagesDeclaration of Trustkyra_kae100% (17)

- Commercial Security AgreementDocument5 pagesCommercial Security AgreementIrth Orbits100% (1)

- Friendly Loan AgreementDocument5 pagesFriendly Loan Agreement7 Rings0% (1)

- UCC SecurityAgreementDocument5 pagesUCC SecurityAgreementTony Britten90% (21)

- Commercial Security AgreemenDocument4 pagesCommercial Security AgreemenFreeman Jackson100% (4)

- Corporate GuaranteeDocument4 pagesCorporate Guaranteesalehin1969No ratings yet

- Agreement of SuretyshipDocument1 pageAgreement of SuretyshipKay AvilesNo ratings yet

- Letter of Guarantee by CorporateDocument6 pagesLetter of Guarantee by CorporateTira MagdNo ratings yet

- NZECP 35 1993 New Zealand Electrical Code of Practice For Power System Earthing - Published 18 March 1993 PDFDocument29 pagesNZECP 35 1993 New Zealand Electrical Code of Practice For Power System Earthing - Published 18 March 1993 PDFTaylor Martinez100% (1)

- Broidy Nader Correspondence Redacted2Document19 pagesBroidy Nader Correspondence Redacted2mary engNo ratings yet

- AbstractDocument3 pagesAbstractMohd YasinNo ratings yet

- Administrative LawDocument7 pagesAdministrative LawChela Emmanuel Mulenga92% (13)

- State Government GuaranteeDocument6 pagesState Government GuaranteeAMAN KUMARNo ratings yet

- Deed of GuaranteeDocument5 pagesDeed of GuaranteeShivam Shiddharth SinghNo ratings yet

- Collateral Agreement TemplateDocument8 pagesCollateral Agreement TemplateRobertNo ratings yet

- Draft For Discussion Purposes Only August07-VI: Page 1 of 12Document12 pagesDraft For Discussion Purposes Only August07-VI: Page 1 of 12Himanshu JaiswalNo ratings yet

- Ang Tibuok Mong KinabuhiDocument6 pagesAng Tibuok Mong KinabuhiJuliet PanogalinogNo ratings yet

- Guarantee Deed Corporate For Retail HL and Lap 065709200147385837011Document13 pagesGuarantee Deed Corporate For Retail HL and Lap 065709200147385837011AMAN KUMARNo ratings yet

- CC tnc1Document2 pagesCC tnc1rinku.markaNo ratings yet

- U.S. Fire Court BondDocument2 pagesU.S. Fire Court Bondanon_529589942No ratings yet

- Orbe Brazil Fund LTD - Subscription Documents - December 2009Document37 pagesOrbe Brazil Fund LTD - Subscription Documents - December 2009José Enrique MorenoNo ratings yet

- M Embership Booklet: Effective April 1, 2022Document21 pagesM Embership Booklet: Effective April 1, 2022James CaronNo ratings yet

- Membership Interest Pledge AgreementDocument6 pagesMembership Interest Pledge AgreementKnowledge Guru100% (1)

- Corporate GuaranteeDocument4 pagesCorporate Guaranteeowenmaraasin5No ratings yet

- Bank Loan AgreementDocument8 pagesBank Loan AgreementSiddhi LikhmaniNo ratings yet

- Subordinated Loan AgreementDocument6 pagesSubordinated Loan AgreementRocketLawyer100% (1)

- Insurance DocumentDocument2 pagesInsurance Documentnikolaigray249No ratings yet

- Note Purchase AgreementDocument7 pagesNote Purchase AgreementM00SEKATEERNo ratings yet

- Sample Agent Commission AgreementDocument20 pagesSample Agent Commission Agreementpilvar600No ratings yet

- American Roads Standing Opinion ExhibitsDocument20 pagesAmerican Roads Standing Opinion ExhibitsChapter 11 DocketsNo ratings yet

- AgreementDocument21 pagesAgreementdevgdev2023No ratings yet

- Inv Consulting Services AgreementDocument8 pagesInv Consulting Services AgreementParvesh KuchwahaNo ratings yet

- Letter of Guarantee and Indemnity FormDocument5 pagesLetter of Guarantee and Indemnity Formpollycummings423No ratings yet

- Agency Agreement TemplateDocument7 pagesAgency Agreement TemplateMikeTantonNo ratings yet

- Corporate Guaranty: Waiver and Modification. The Undersigned Waive Notice of (A) Acceptance of This Guaranty (B)Document2 pagesCorporate Guaranty: Waiver and Modification. The Undersigned Waive Notice of (A) Acceptance of This Guaranty (B)prevrtljivacNo ratings yet

- Loan Agreement SampleDocument9 pagesLoan Agreement SampleEa GabotNo ratings yet

- Security Agreementpledge 2899750 1Document3 pagesSecurity Agreementpledge 2899750 1Shoeiarai Yoshimura PallmallemNo ratings yet

- 9-11 Buringrud LoanDoc PDFDocument50 pages9-11 Buringrud LoanDoc PDFChimkenz01 NuggitzNo ratings yet

- SECURITYAGREEMENTtemplateDocument7 pagesSECURITYAGREEMENTtemplateTroy StrawnNo ratings yet

- Guarantee As Pub. Word. 4:1:2021Document10 pagesGuarantee As Pub. Word. 4:1:2021pl godutiNo ratings yet

- SAVEINSTPL-3249953316714 001 SignedDocument14 pagesSAVEINSTPL-3249953316714 001 SignedAbhayNo ratings yet

- Legal 4Document2 pagesLegal 4jaswinder.singh88688No ratings yet

- UFA Members & Customers, Ufa Credit On Account Program Terms and ConditionsDocument17 pagesUFA Members & Customers, Ufa Credit On Account Program Terms and ConditionsHamadaFreelanceflowNo ratings yet

- 9-11 Buringrud LoanDocDocument50 pages9-11 Buringrud LoanDocAlex SoonNo ratings yet

- Letter of Continuing Guarantee (Joint & Several)Document8 pagesLetter of Continuing Guarantee (Joint & Several)South PointNo ratings yet

- Accounts Receivable, Specific AssignmentDocument4 pagesAccounts Receivable, Specific AssignmentthriveinsuranceNo ratings yet

- GUARANTEE INDEMNITY AND STATEMENT OF NETWORTH (UPDATED 2023) (1)Document6 pagesGUARANTEE INDEMNITY AND STATEMENT OF NETWORTH (UPDATED 2023) (1)tajudeenca2022No ratings yet

- Corporate GuaranteeDocument3 pagesCorporate GuaranteeJigo DacuaNo ratings yet

- Security AgreementDocument5 pagesSecurity Agreementflextechvip100% (1)

- Loan Agreement Sample FormatDocument5 pagesLoan Agreement Sample FormatAnkush Tekam0% (1)

- Agency AgreementDocument7 pagesAgency AgreementRastko PopovićNo ratings yet

- Draft of Undertaking To Be Executed by Lending InstitutionDocument5 pagesDraft of Undertaking To Be Executed by Lending InstitutionSreejith R RetnamNo ratings yet

- Sushil DograDocument4 pagesSushil DograarunNo ratings yet

- P125 PDFDocument2 pagesP125 PDFkismadayaNo ratings yet

- OSA 2015 (Schedule A)Document3 pagesOSA 2015 (Schedule A)Anonymous nYwWYS3ntV100% (4)

- Letter of Consent To Disclosure of Information 1Document3 pagesLetter of Consent To Disclosure of Information 1Hazwani IsmailNo ratings yet

- Regal Bond Information Memorandum 11.05.2015.Issued10thApril - CompressedDocument28 pagesRegal Bond Information Memorandum 11.05.2015.Issued10thApril - Compressedhung_hatheNo ratings yet

- General Continuing GuarantyDocument11 pagesGeneral Continuing GuarantyconsultFLETCHERNo ratings yet

- Account DisclosuresDocument13 pagesAccount DisclosuresDoris RiveraNo ratings yet

- C&C - Asset Sale Process Memorandum - 4th Auction - Going ConcernDocument48 pagesC&C - Asset Sale Process Memorandum - 4th Auction - Going ConcernPalikatowns LLPNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- Ishares Product List en UsDocument12 pagesIshares Product List en UsTaylor MartinezNo ratings yet

- Example SymmCompDocument5 pagesExample SymmCompTaylor MartinezNo ratings yet

- Sunrise BrochureDocument15 pagesSunrise BrochureTaylor MartinezNo ratings yet

- Workshop On Inverter Based Generation R0Document1 pageWorkshop On Inverter Based Generation R0Taylor MartinezNo ratings yet

- Alstom Grid France Alstom Grid UK: 21, Rue D'artois, F-75008 PARISDocument11 pagesAlstom Grid France Alstom Grid UK: 21, Rue D'artois, F-75008 PARISTaylor MartinezNo ratings yet

- Grounding Design For PV PDFDocument6 pagesGrounding Design For PV PDFTaylor Martinez100% (1)

- Hysteresis LoopDocument1 pageHysteresis LoopTaylor MartinezNo ratings yet

- PC37 122 4-G PDFDocument47 pagesPC37 122 4-G PDFTaylor MartinezNo ratings yet

- 8 ' ?:/&'@aba' B'Document58 pages8 ' ?:/&'@aba' B'Taylor MartinezNo ratings yet

- Conductor Current Capacity CurvesDocument1 pageConductor Current Capacity CurvesTaylor MartinezNo ratings yet

- Text of CCA Order Staying Execution of Jeffery WoodDocument10 pagesText of CCA Order Staying Execution of Jeffery WoodScott CobbNo ratings yet

- Armando Fernandes-Lopes, A036 784 465 (BIA Nov. 30, 2017)Document3 pagesArmando Fernandes-Lopes, A036 784 465 (BIA Nov. 30, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Title NO.218 (As Per Workshop List Title No218 PDFDocument16 pagesTitle NO.218 (As Per Workshop List Title No218 PDFIshaNo ratings yet

- Mormugao Port Employees' (Pension and Gratuity) Regulations, 1966Document52 pagesMormugao Port Employees' (Pension and Gratuity) Regulations, 1966Latest Laws TeamNo ratings yet

- Salonga Chap 3-8Document14 pagesSalonga Chap 3-8unicamor2No ratings yet

- 65 Enrile Vs SalazarDocument2 pages65 Enrile Vs SalazarAmberChanNo ratings yet

- Rudul Shah V State of BiharDocument4 pagesRudul Shah V State of BiharVarun Garg75% (4)

- 4 Tanada Vs TuveraDocument1 page4 Tanada Vs TuveraVanityHughNo ratings yet

- PNB Vs CruzDocument2 pagesPNB Vs CruzJuna Aimee Francisco100% (2)

- Law 345Document12 pagesLaw 345Khaled RehmanNo ratings yet

- Van Dorn Vs RomilloDocument4 pagesVan Dorn Vs Romillorafaelturtle_ninjaNo ratings yet

- Economic Duress - A Judicial StudyDocument15 pagesEconomic Duress - A Judicial StudyARJU JAMBHULKARNo ratings yet

- Spouses Lam vs. Metropolitan Bank and Trust CompanyDocument1 pageSpouses Lam vs. Metropolitan Bank and Trust CompanyJon JamoraNo ratings yet

- Per Curiam:: (A.C. No. 4018. March 8, 2005) Omar P. Ali vs. Atty. Mosib A. Bubong DecisionDocument4 pagesPer Curiam:: (A.C. No. 4018. March 8, 2005) Omar P. Ali vs. Atty. Mosib A. Bubong DecisioncloudNo ratings yet

- Indian Penal CodeDocument4 pagesIndian Penal CodePiyush Langade100% (1)

- Dyson Et. Al. v. LG ElectronicsDocument5 pagesDyson Et. Al. v. LG ElectronicsPriorSmartNo ratings yet

- Research Norms and MisconductsDocument11 pagesResearch Norms and Misconductsanabelle labiiNo ratings yet

- University of Pangasinan MidtermDocument8 pagesUniversity of Pangasinan MidtermPanfilo Ferrer Dioquino Jr.No ratings yet

- Blairstown OPRA FormDocument2 pagesBlairstown OPRA FormThe Citizens CampaignNo ratings yet

- A Corporation Is An Artificial Legal PersonDocument2 pagesA Corporation Is An Artificial Legal PersonNazmus SaqibNo ratings yet

- Criminal-II Law Justification of Criminal LawDocument21 pagesCriminal-II Law Justification of Criminal LawMARLENE RANDIFIEDNo ratings yet

- Grievance and DiciplineDocument19 pagesGrievance and DiciplineJim MathilakathuNo ratings yet

- Tax 2Document288 pagesTax 2Edelson Marinas ValentinoNo ratings yet

- Delegated LegisltationDocument11 pagesDelegated LegisltationSrishti Goel100% (1)

- Philippine Suburban V Auditor GeneralDocument1 pagePhilippine Suburban V Auditor GeneralAnn QuebecNo ratings yet