Professional Documents

Culture Documents

Top 10 Things To Know About Doing Business in India

Top 10 Things To Know About Doing Business in India

Uploaded by

manedeepOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Top 10 Things To Know About Doing Business in India

Top 10 Things To Know About Doing Business in India

Uploaded by

manedeepCopyright:

Available Formats

TOP10THINGSTOKNOWABOUTDOINGBUSINESSININDIA

ByDezanShira&Associates,DelhiOffice

delhi@dezshira.com

1.Whataremyoptionsforinvestment?

ForeigninvestmentintoIndiacancomeinavarietyofdifferentlegalentities.Your

choiceofentitydependsonthekindofworkyouplantododuringyourtimein

thecountry.

LiaisonOffices

AforeigncompanycanopenaliaisonofficeinIndiatoengageinthefollowingactivities:

Representingtheparentcompany/groupcompaniesinIndia

Promotingexport/importfrom/toIndia

Promotingtechnicalorfinancialcollaborationbetweenparent/groupcompaniesandIndian

companies

ActingasacommunicationschannelbetweentheparentcompanyandIndiancompanies

Aliaisonofficeisnotallowedtocommenceanycommercial,tradingorindustrialactivities,

directlyorindirectly,andisrequiredtosustainitselfoutofprivateremittancesreceivedfromits

foreignparentcompanythroughusualbankingchannels.

BranchOffices

ForeigncompaniesengagedinmanufacturingandtradingactivitiesoutsideofIndiamayopen

branchofficesforthepurposesof:

Representingtheforeignparentcompanyorotherforeigncompaniesinvariousmattersin

India,suchasactingasbuyingandsellingagents

Conductingresearchinwhichtheforeignparentcompanyisengaged

PromotingtechnicalandfinancialcollaborationsbetweenIndianandparentoroverseasgroup

companies

Renderingprofessionalorconsultancyservices

Renderingservicesininformationtechnologyanddevelopmentofsoftware

Renderingtechnicalsupportforproductssuppliedbyparent/groupcompanies

Abranchofficesallowablescopeofactivitiesisbroaderthanthatofaliaisonoffice,however

branchofficesarestillgenerallyforbiddenfromengaginginretailtrading,manufacturingor

processingactivitieswithinIndia.

ProjectOffices

Aprojectoffice,whichisessentiallyabranchofficesetupwiththelimitedpurposeofexecuting

aspecificproject,allowscompaniestoestablishapresenceforalimitedperiodoftime.Project

officesareparticularlycommonamongforeigncompaniesengagedinturnkeyoperations.

WhollyOwnedSubsidiariesandJointVentures

Foraforeignenterprisetoengageinactivitiesnotlistedwithinthelimitsofliaison,branchand

projectoffices,whollyownedsubsidiariesorjointventurecompaniescanbeestablished.

Bothwhollyownedsubsidiariesandjointventurecompanieshaveindependentlegalstatusas

Indiancompaniesdistinctfromtheforeignparentcompany.

Whollyownedsubsidiariesandjointventuresaresetupasprivatelimitedcompanies.Private

limitedcompaniesarethemostsuitableandwidelyusedformofbusinessenterpriseforforeign

investorsinIndiabecausetheyallowtotalcontroloverbusinessoperations,providelimited

liability,andhavefewerrestrictionsonbusinessactivitiesthanliaisonofficesandprojectoffices.

2.HowdoIestablishacompany?

EstablishingacompanyinIndiacanbealengthyadministrativeprocessthatrequires

communicationwithmanydifferentauthorities.Amongsttheseareaninitialclarificationasto

whetherthebusinessactivitiesrequiresReserveBankofIndiaapprovalornot.Seeking

professionalhelpwillensurethatyougetitrightfirsttimeanddonothavetomakecostly

changeslateron.

Privatelimitedcompaniesarethemostcommoncompanyformusedbyforeigninvestors.

PrivatelimitedcompaniesmaybeintheformofjointventurecollaborationswithanIndian

partnerand/orpublicissues,orwhollyownedsubsidiarieshaving100percentforeign

ownership.EstablishingaprivateliabilitycompanyinIndiatakesapproximatelysixtoeight

weeks.

Shareholderliabilityislimitedtothepaidandunpaidcapital.Theminimumpaidupshare

capital,alsoknownasauthorizedcapital,isINR100,000.Thecompanymustmaintainthefull

amountofauthorizedcapitalinaspecifiedbankaccountforthedurationofitsexistence;this

capitalcanonlybewithdrawninthecaseofliquidationorinthecasethattheamountof

authorizedcapitalisloweredbyaresolutionatameetingofshareholders.Penaltiesmayapplyif

acompanyfailstomaintainthefullamountofauthorizedcapital.

Theincorporationofprivatelimitedcompaniesfallsundertheautomaticrouteorthe

approvalroute.Investmentsmadeundertheautomaticroutearedonewithoutapprovalof

thecentralgovernment.TheapprovalrouterequirespriorapprovaloftheForeignInvestment

PromotionBoard.

Afterestablishingbutbeforecommencingbusiness,allcompaniesincorporatedinIndia,

whetherlocallyorforeignowned,mustapplyforaPermanentAccountNumber(PAN)for

taxationpurposes.Thisuniqueidentificationcodeisusedforcommunicationsbetweenthe

companyandthetaxauthorities.

Additionalgovernmentalapprovalsmayalsoberequired.Thesemayincludeanindustrial

licenseorstatutoryclearancesrelatingtopollutioncontrol,dependingonindustry,investment

amountandlocation.Otherapprovalsandclearancesatthestatelevelincludeland,water,

electricityandadditionalregistrations.

3.WhatarethekeypositionsinanIndiancompany?

Incorporatingaprivatelimitedcompanyrequiresaminimumoftwodirectors,andbetweentwo

andfiftyshareholders.Shareholder(s)arethehighestauthorityofthecompany.Thedirectoror

boardofdirectorssetstheagendaofthecompanysoperationsaccordingtoshareholder

decisions.Directorscanbemanagingdirectors,executivedirectorsornonexecutivedirectors.

Aspartofannualcompliancerequirements,companiesmustappointanauditortoundertakea

fullauditofcompanyaccountspriortotheAnnualGeneralMeeting(AGM).Theauditormustbe

acharteredaccountantappointedbytheboardofdirectors.Sheorhemaynotbeanemployee

orpartnerofthecompany,holdsecurityofthecompanynorbeindebtedtoit.Sheorheis

alwaysappointedfromoneAGMtoanotherbytheshareholders,exceptforthefirstauditor,

whoisresponsiblefromstartofbusinessuntilthefirstAGM.Auditorsshallhaverightofaccess

atalltimestothebooks,accountsandvouchersofthecompany.

ForcompanieswithpaidupcapitalofmorethanINR1million,acompanysecretarymustbe

appointedtosignanannualcompliancecertificate;forthosewithpaidupcapitalofmorethan

INR50million,afulltimecompanysecretarymustbeappointedtoactasacomplianceofficer.

4.WhatkindofIPRconsiderationsshouldbetakenintoaccount?

AnimportantissuethatneedstobetakencareofwheninvestinginIndiaisregistrationofyour

trademark.

Registrationinvolvesseveralfilingprocedures,takesabout12monthsfromcommencementto

issuanceofthecertificate,andcanbecarriedoutbylicensedIndiantrademarklawyersat

TrademarkRegistryOfficesinAhmadabad,Chennai,Kolkata,MumbaiorNewDelhi.

Atrademarkcanbeplaceduponabrand,heading,label,ticket,name,signletter,text,word,

numeral,slogan,baseline,shape,colororanycombinationofanyofthese.Theobjectofthe

markmustbedistinctive,mustnotbeidenticalorsimilartoamarkalreadyregisteredor

pendingapplicationforregistration,mustnotbeprohibitedbylaw,andmustbeownedbythe

applicant.

5.WhatareIndia'smajortaxes?

TaxReformhasbeenonthepoliticalagendaforsometime,withdecreasestoexpectedinboth

CorporateandIndividualIncomeTaxes.However,politicalwranglingbetweendifferentregional

governmentsandthecentralgovernmentoverthecontrolofVATandGSTrateshave

consistentlyinterruptedtheintendedreforms.Anestimatedtimeframeforchangewouldbe

2014.AsatSeptember2012,themaintaxesimpactingforeigninvestorsareasfollows:

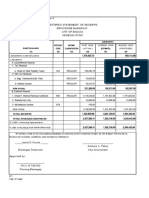

IndiaTaxRates

(September2012)

Corporateincometax 30%40%

Standardtaxondividends

(Overseasparentco.)

15%

Valueaddedtax 12.5%

6.Howisaccountingandbookkeepingdone?

InIndia,accountingisdoneaccordingtotheAccountingStandardsissuedbythe

InstituteofCharteredAccountantsofIndiaandapprovedbytheParliamentofIndia.

Therearemorethan30accountingstandards,eachgoverningdifferentaspectsof

accountingstatements.Theseaccountingstandardshavelegalrecognitionthrough

theCompaniesAct.

TheAccountingStandardsareformulatedonthebasisoftheInternationalFinancial

ReportingStandardswithaviewtoharmonizingIndiasaccountingstandardswith

therestoftheworld.Theyincludestandardsonthevaluationofinventories,cash

flowstatements,netprofitorlossfortheperiodofaccounts,accountingforfixed

assetsandrevenuerecognition.

TheRBIregulatesthecountrysforeignexchangemarketsandprescribesexchange

controlnorms.TheIndianrupeeisfullyconvertibleonthecurrentaccount,which

meansthatforeignexchangeisfreelyavailableformakingandreceivingtraderelated

payments.However,onthecapitalaccount,theIndianrupeeisonlypartially

convertible.

7.Whataretheannualcompliancerequirements?

Annualcompliancerequirementsdifferforentitiesdependingonwhethertheyareforeign

representativeofficesorcompanies.

Allincorporatedcompanies,whetherpublicorprivate,arerequiredtoundertakeanannual

auditofaccounts.Auditedfinancialreportsalongwiththeauditorsreportmustbesenttothe

shareholderswellbeforetheAnnualGeneralMeeting(AGM)isheld.Companyaccountsmust

besubmittedtotheofficeoftheconcernedRegistrarofCompanies(ROC)annually,followingan

AGM.

Inadditiontotherequiredfourboardmeetingsperannum(whichcanbeconductedinIndiaor

abroad),anAGMmustbeheldonceineverycalendaryearbeforeSeptember30,withthetime

periodbetweentwoAGMsnotlastingmorethan15months.Themainagendapointsinany

AGMincludepresentationoftheannualaccounts,andappointmentofstatutoryauditors.

Inaddition,companieswithpaidupcapitalofbetweenINR1millionandINR20millionare

requiredtofileanAnnualComplianceCertificatealongwiththeAnnualReport.Companieswith

paidupcapitalofmorethanINR20millionarerequiredtoemployafulltimecompanysecretary

whowillactastheircomplianceofficer.

Sinceliaisonofficesandbranchofficesarepermittedtoconductonlyalimitedsetofactivities,

theseofficesareobligedtodemonstratethattheyareoperatingwithintheirlegallypermissible

areasofactivityonceayear.ThisreportingtakestheformofanAnnualActivityCertificate,

whichmustbeproducedinaspecifiedformatprovidedbytheofficesauditor.Itprovides

detailsandsourcesoffundsreceived,andthenatureofexpensesonwhichfundshavebeen

spent.

8.Howistransferpricingconducted?

Transferpricingconcernsthepriceschargedbetweenassociatedenterprises(thoselinked

throughmanagement,controlorcapital)establishedindifferenttaxjurisdictionsfortheir

intercompanytransactions.

Fortaxandauditingpurposes,internationaltransactionsbetweenassociatedenterpriseshave

tobeassessedonthebasisofthearmslengthprinciple.Thisarmslengthnaturehastobe

supportedbydocumentationsignedandverifiedbyanaccountant.Taxpayersinvolvedin

internationallyrelatedpartytransactionsarealsorequiredtomaintainaseriesofmoredetailed

documentsshowingtheownershipstructure,property/serviceinvolvedandsoon.

TransferpricingdocumentsneedtobesubmittedbyOctober31followingthecloseofthe

relevantyear.Recordsalsoneedtobemaintainedforatleast8yearsfromtheendofthe

relevantfiscalyear.Atransferpricingauditisrequirediftherelatedpartytransactionexceeds

INR150million.EvenifarelatedpartytransactionislowerthanINR150million,anauditisstill

possible.Therefore,documentsontransferpricingshouldbemaintainedbyallfirms.

9.Whatvisasareneededformyforeignstaff?

AllforeignersvisitingIndia(excludingoverseascitizensofIndia,personsholdingaPersonof

IndianOrigincardandNepaleseorBhutanesenationals)needavisa.

Indiaissuestouristvisas,generallyfor180dayswithmultipleentries.Atouristvisaonarrival

(TVOA)schemehasbeensetupbytheIndianImmigrationDepartmentforupto30daysfor

nationalsofCambodia,Finland,Indonesia,Japan,Laos,Luxembourg,Myanmar,NewZealand,

Philippines,Singapore,andVietnam.Applicationsmustbemadeattheconsularsectionatthe

nearestembassyorhighcommission.ForUKnationals,Indiahasoutsourceditsvisaapplication

servicestoVFServicesandapplicationsattheembassyinLondonarenolongeraccepted.Inthe

UnitedStates,IndiasvisaapplicationservicesarehandledbyTravisaOutsourcing.

Forbusinessactivities,twoothertypesofvisaareimportanttonote:businessvisa(forwhich

theperiodofstayinIndiapervisitislimitedtosixmonths)andemploymentvisa.Forthelatter,

thereareadditionalrequirementsforemployeesoftheITandjournalismsectors,andaless

restrictiveregimeforthepowerandsteelsectors.

ForallforeignersintendingtostayinIndiaforlongerthan180days(onanytypeoflongterm

visa),thereisarequirementtoregisterwiththelocalForeignersRegionalRegistrationOffice

(FRRO).Inmostcases,thisregistrationneedstobedonewithin14daysofarrivalinIndia.

10.WhatshouldIlookoutforwhensigninglaborcontracts?

Indianlaborlawsprovideaminimumofguaranteesandbenefitstoallemployeesandthese

lawssupersedetheprovisionsoflaborcontracts.

TherearethreetypesofcontractsinIndia:

Permanent(direct)contract

Fixedcontract

Temporarycontract

InvestorsshouldpayspecialattentiontotheIndustrialDisputesAct,whichprovidesalarge

numberofprotectionsforemployees;theShopsandEstablishmentsAct,whichgovernsthe

hoursofwork,paymentofwages,leave,holidays,termsofserviceandotherconditions;aswell

astheseveralwageandremunerationacts,whichregulatethepaymentofwages,bonuses,and

equalizepayformenandwomen.

Anyterminationpolicyshouldbecheckedagainstthecurrentlawpriortoitiscarriedout.For

example,companiesthatemploymorethan100workersneedgovernmentpermissionto

conductlayoffs.

Besidescompanyrulesandregulations,clausesrelatedtothefollowingpointscanbe

incorporatedintocontracts:

Nondisclosure

Employeepoaching

Unfaircompetition

Trademarks,patentsandtradesecrets

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Marketing Analytical Nano DegreeDocument6 pagesMarketing Analytical Nano DegreemanedeepNo ratings yet

- Snow Itsm OvervDocument5 pagesSnow Itsm OvervmanedeepNo ratings yet

- Utility GuideDocument630 pagesUtility GuidemanedeepNo ratings yet

- HCM92ERDInstructions FinalDocument8 pagesHCM92ERDInstructions FinalmanedeepNo ratings yet

- Poweredge Made DetailsDocument15 pagesPoweredge Made DetailsmanedeepNo ratings yet

- Simpleworkflow in The Cloud: Poa June 17, 2010 Alan Robbins and Rick SearsDocument99 pagesSimpleworkflow in The Cloud: Poa June 17, 2010 Alan Robbins and Rick SearsmanedeepNo ratings yet

- Cheques The Facts 2012Document35 pagesCheques The Facts 2012manedeepNo ratings yet

- Changing Character Set To UTF8 For Oracle DatabaseDocument9 pagesChanging Character Set To UTF8 For Oracle DatabasemanedeepNo ratings yet

- About Peoplesoft Feature PackDocument15 pagesAbout Peoplesoft Feature PackmanedeepNo ratings yet

- Bearing The Burden of DSTDocument3 pagesBearing The Burden of DSTchris cardinoNo ratings yet

- Ethics of Tax AvoidanceDocument13 pagesEthics of Tax AvoidanceRashmi SharmaNo ratings yet

- Zakon o Potvrdjivanju ZajmaDocument41 pagesZakon o Potvrdjivanju ZajmaSlavoljub AleksicNo ratings yet

- Assgn-I Marketing Mix Zara and H&MDocument40 pagesAssgn-I Marketing Mix Zara and H&Mzayana kadeeja100% (1)

- Past Year Current Year Budget Year (Actual) (Proposed)Document16 pagesPast Year Current Year Budget Year (Actual) (Proposed)Saphire DonsolNo ratings yet

- Minimum Alternate Tax: Prepared by - Dhaval Girishkumar TrivediDocument21 pagesMinimum Alternate Tax: Prepared by - Dhaval Girishkumar TrivediSmit NareshNo ratings yet

- Chapter 9 BusinessDocument26 pagesChapter 9 BusinessAnamta RizwanNo ratings yet

- Section 54ED, Income Tax Act, 1961 2015: Explanation.-For The Purposes of This Sub SectionDocument2 pagesSection 54ED, Income Tax Act, 1961 2015: Explanation.-For The Purposes of This Sub SectionSushil GuptaNo ratings yet

- PBCom v. CIR DigestDocument1 pagePBCom v. CIR DigestRonnie Garcia Del RosarioNo ratings yet

- Siya - BCH 17 216 (Project)Document42 pagesSiya - BCH 17 216 (Project)ManthanNo ratings yet

- Net 57,000 Date (5.II.e)Document11 pagesNet 57,000 Date (5.II.e)Kyree VladeNo ratings yet

- Secial Terms and Conditions of RFQ 1.0 CommunicationDocument14 pagesSecial Terms and Conditions of RFQ 1.0 CommunicationKarandeep SinghNo ratings yet

- Worst Fracking RegsDocument6 pagesWorst Fracking RegsJames "Chip" NorthrupNo ratings yet

- Receipt - 25-10-2021 (1.)Document2 pagesReceipt - 25-10-2021 (1.)Lim LikweeNo ratings yet

- Financial Planning F-FIBA306Document261 pagesFinancial Planning F-FIBA306Cornelius NarteyNo ratings yet

- An Enquiry Into The Effect of GST On Real Estate Sector of IndiaDocument5 pagesAn Enquiry Into The Effect of GST On Real Estate Sector of IndiaEditor IJTSRDNo ratings yet

- Obillos, Jr. vs. Cir - 139 Scra 436Document4 pagesObillos, Jr. vs. Cir - 139 Scra 436Ygh E SargeNo ratings yet

- EY Budget Flash 2021Document12 pagesEY Budget Flash 2021Anam IqbalNo ratings yet

- Government Spending, Public Debt and Economic Growth in KenyaDocument12 pagesGovernment Spending, Public Debt and Economic Growth in KenyaResearch ParkNo ratings yet

- Doing Business in The Philippines (Why The Philippines?)Document14 pagesDoing Business in The Philippines (Why The Philippines?)Lianna RodriguezNo ratings yet

- DTC Agreement Between United Kingdom and Gambia, TheDocument36 pagesDTC Agreement Between United Kingdom and Gambia, TheOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- IE MergedDocument173 pagesIE MergedOm PrakashNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Nishkarsh SinghNo ratings yet

- Drilon v. Lim, GR. No. 112497, August 4, 1994Document1 pageDrilon v. Lim, GR. No. 112497, August 4, 1994Pio Guieb AguilarNo ratings yet

- Agreement To Demolish/Remove and Reconstruct Improvement (Adri)Document4 pagesAgreement To Demolish/Remove and Reconstruct Improvement (Adri)PANGINOON LOVENo ratings yet

- Tax 05 Final Taxes Part 1Document5 pagesTax 05 Final Taxes Part 1Panda CocoNo ratings yet

- Amount Chargeable (In Words) E. & O.EDocument1 pageAmount Chargeable (In Words) E. & O.EManish JaiswalNo ratings yet

- BMBEs (RA 9178), IRRDocument5 pagesBMBEs (RA 9178), IRRtagabantayNo ratings yet

- RMC No. 44-2021 RevisedDocument2 pagesRMC No. 44-2021 RevisedDessere Ann AnchetaNo ratings yet

- Compilation of Band 9 Essays For Ielts Writing Task 2Document20 pagesCompilation of Band 9 Essays For Ielts Writing Task 2tim man100% (1)