Professional Documents

Culture Documents

Chart of Accounts

Chart of Accounts

Uploaded by

ifyjoslynOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chart of Accounts

Chart of Accounts

Uploaded by

ifyjoslynCopyright:

Available Formats

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH

OFFERINGS

10.01 Sundays & Holydays

10.02 Pew Rent

10.03 Votive Lights

10.04 Donation Boxes

10.05 Stipends

10.99 Other Offerings

BEQUESTS AND SPECIAL GIFTS

20.01 Contributions from Parish Organizations

20.02 Total amount in each bequest over $5,000

20.03 Total amount in each bequest less than or equal to $5,000

20.04 Education Endowment

20.05 Gifts and Memorials

20.99 Other

DESIGNATED COLLECTIONS

30.01 Funds for Religious Retirement

30.02 Bishop's Overseas Relief

30.03 Good Friday I Holy Land Shrines

30.04 Respect Life

30.05 St. Vincent De Paul.

30.06 Ash Wednesday I Central & Eastern Europe

30.07 Mission Sunday

30.08 Campaign for Human Development

30.09 Holy Father I Peter's Pence

30.10 Special Mission Appeal

30.11 Archbishop's Annual Fund Drive

30.12 Operation Rice Bowl

30.13 CISE / Seeds of Growth

30.99 Other

PARISH ACTIVITIES

50.01 Socials

50.02 Festival

50.03 Parish Bulletin I Newsletter

50.04 Fund-raisers

50.99 Other

PARISH FUND DRIVES

60.00 Parish Fund Drives

OTHER REVENUE

70.01 Catholic Telegraph

70.02 Interest & Dividends

70.03 Rentals

70.04 Media I Book Racks

70.05 Insurance Settlements

70.06 Religious Education Fees

70.07 Elementary School Tuition

70.08 Education Endowment Interest

70.99 Other

NON-OPERATING REVENUES

80.00 Archdiocesan Subsidy 90.00 Sale of Property

OTHER CASH RECEIPTS

100.01 Withdrawal from Savings (other than Archdiocesan notes)

100.02 Withdrawal from Archdiocesan Notes

100.03 Authorized Loan Proceeds

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH

CLERGY SALARIES

200.01 Pastor / Parish Administrator

200.02 Associate

200.03 Clergy- Extra Help

LAY SALARIES

210.01 Office Personnel

210.02 Pastoral Staff

210.03 Maintenance Staff

210.99 Other

RECTORY & HOUSEHOLD

220.01 Room & Board

220.02 Ordinary Repairs & Maintenance

220.03 Utilities

220.04 Insurance

220.05 Property Taxes

220.99 Other

OFFICE

230.01 Telephone / Connectivity

230.02 Postage

230.03 Supplies

230.04 Equipment Rental & Repairs

230.05 Staff Benefits

230.06 Printing

230.07 Subscriptions / Reference Materials

230.08 Service Fees

230.09 Stewardship Program

230.10 Contractual Services

230.99 Other

PAYROLL TAXES / EMPLOYEE FRINGE BENEFITS

240.01 FICA (Employer's Portion)

240.02 Workers' Compensation Insurance

240.03 Health Care

240.04 Ohio Unemployment Compensation Insurance

240.05 Pension

240.99 Other

TRANSPORTATION & SEMINARS

250.01 Local Transportation

250.02 Conferences / Conventions / Seminars

250.03 Auto Repairs & Maintenance

250.04 Professional Reimbursement

250.99 Other

PARISH ACTIVITIES

260.01 Socials

260.02 Festival

260.03 Parish Bulletin / Newsletter

260.04 Fund-raisers

260.99 Other

PARISH FUND DRIVES

270.00 Parish Fund Drives

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH

ALTAR, SANCTUARY, AND LITURGICAL

280.01 Altar & Sanctuary

280.02 Missals / Hymnals

280.03 Votive Lights

280.04 Music Ministry

280.99 Other

PARISH MINISTRY PROGRAMS

290.10 Religious Education

290.20 Adult Faith Formation

290.30 Youth Ministry

290.40 Pastoral Ministry

MISCELLANEOUS ADMINISTRATIVE EXPENSES

300.01 Catholic Telegraph

300.02 Donations

300.03 Social Action Projects

300.04 Media I Book Rack

300.05 Dues / Memberships

300.06 Professional Fees

300.99 Other

BUILDING & ORDINARY MAINTENANCE 310.00 Utilities

320.01 Supplies

320.02 Ordinary Repairs & Maintenance

320.03 Contractual Services

320.04 Insurance

320.05 Property Taxes

320.06 Rent 6

320.07 Rental Property Expenses

320.99 Other

DESIGNATED COLLECTIONS REMITTANCES

(3)30.01 Fund for Religious Retirement

(3)30.02 Bishop's Overseas Relief

(3)30.03 Good Friday / Holy Land Shrines

(3)30.04 Respect Life

(3)30.05 St. Vincent De Paul

(3)30.06 Ash Wednesday I Central & Eastern Europe

(3)30.07 Mission Sunday

(3)30.08 Campaign for Human Development

(3)30.09 Holy Father / Peter's Pence

(3)30.10 Special Mission Appeal

(3)30.11 Archbishop's Annual Fund Drive

(3)30.12 Operation Rice Bowl

(3)30.13 CISE / Seeds of Growth

(3)30.99 Other

PAYMENTS TO SCHOOLS

340.01 High Schools

340.02 Elementary Schools

PAYMENTS TO ARCHDIOCESE

350.01 General Assessment

350.02 High School Equalizing

350.99 Other Special Assessments

INTEREST EXPENSE

360.00 Interest Expense

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH

CAPITAL EXPENDITURES -LAND & BUILDINGS

370.01 Land

370.02 Church - New

370.03 Church - Additions & Remodeling

370.04 Church -Extraordinary Repairs

370.05 Rectory -New

370.06 Rectory -Additions & Remodeling

370.07 Rectory -Extraordinary Repairs

370.08 Parish Center- New

370.09 Parish Center -Additions & Remodeling

370.10 Parish Center- Extraordinary Repairs

370.11 Parish Offices -New

370.12 Parish Offices -Additions & Remodeling

370.13 Parish Offices -Extraordinary Repairs

370.99 Other

CAPITAL EXPENDITURES -FURNITURE & EQUIPMENT

380.01 Vehicles

380.02 Office Equipment

380.03 Church Furnishings

380.04 Rectory Furnishings

380.05 Parish Center Furnishings

380.06 Technology

380.99 Other

OTHER CASH DISBURSEMENTS

390.00 Loan Repayments

391.00 Transfers to Savings Account(s)

392.00 Transfers to Archdiocesan. Investment Notes

400.00 Exchange Account

PAYROLL TAXES WITHHELD & PAID

393.01 Payroll Deduction - Federal

393.02 Payroll Deduction -FICA

393.03 Payroll Deduction -State

393.04 Payroll Deduction -Local

393.05 Payroll Deduction -Annuity / 403(b)

393.06 Payroll Deduction -United Way

393.07 Payroll Deduction -Dental

393.99 Payroll Deduction -Other

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

OFFERINGS

10.01 Sundays & Holydays

All Sunday & Holyday collections except Designated Collections.

10.02 Pew Rent

Offering to reserve pew for Sunday worship.

10.03 Votive Lights

Offering from votive lights.

10.04 Donation Boxes

Offering from donation boxes used for parish managed charity.

10.05 Stipends

Mass stipends for which the Mass obligation has been satisfied."

10.99 Other Offerings

Any other offering not included in the above accounts.

BEQUESTS AND SPECIAL GIFTS

20.01 Contributions from Parish Organizations

Funds received from parish organizations such as Rosary Altar, etc.

20.02 Total amount in each bequest over $5,000

Amount of each bequest that exceeds $5,000.

20.03 Total amount in each bequest less than or equal to $5,000

First $5,000 of each bequest.

20.04 Education Endowment

Funds received for Education Endowment established by parish.

NOTE: Endowment must be approved by Archbishop and the principal of such funds is to

be deposited in the Deposit & Loan Fund in accord with Paragraph 55 of the

Temporal Affairs Document.

20.05 Gifts and Memorials

Contributions and/or gifts received for specific parish programs.

NOTE: Gifts of equipment, furnishings or other items of intrinsic value greater than $500

should be recorded in this account with the offsetting entry made in the proper

Capital Expense account.

20.99 Other

Any other gift not included in the above accounts.

DESIGNATED COLLECTIONS

Funds pertaining to specific collections listed below which are to be forwarded directly to the

Chancery for record and distribution, such as Missions, or organization such as St. Vincent De

Paul, Little Sisters of the Poor, etc.

30.01 Funds for Religious Retirement

30.02 Bishop's Overseas Relief

30.03 Good Friday / Holy Land Shrines

30.04 Respect Life

30.05 St. Vincent De Paul

30.06 Ash Wednesday / Central & Eastern Europe

30.07 Mission Sunday

30.08 Campaign for Human Development

30.09 Holy Father / Peter's Pence

30.10 Special Mission Appeal

30.11 Archbishop's Annual Fund Drive

30.12 Operation Rice Bowl

30.13 CISE / Seeds of Growth

30.99 Other

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

PARISH ACTIVITIES

50.01 Socials

Gross revenues from parish social events including bingo.

50.02 Festival

Gross revenues from parish festival.

50.03 Parish Bulletin I Newsletter

Advertising revenues from parish bulletin or newsletter.

50.04 Fund-raisers

Gross revenues from parish fund-raising activities which are for the benefit of parish

programs which include raffles, script and grocery certificates, etc.

50.99 Other

Any other parish activity revenue not included in the above accounts.

PARISH FUND DRIVES

60.00 Parish Fund Drives

All gross receipts from building or debt reduction fund drives. ,

NOTE: Expenses relating directly to the drive are to be entered in A/C #270.00.

OTHER REVENUE

70.01 Catholic Telegraph

Revenues from Catholic Telegraph subscriptions.

70.02 Interest & Dividends

Gross interest & dividend income received on all parish checking & savings accounts as well

as parish investments.

NOTE: Bank service fees should be recorded in Service Fees A/C #230.08, and not netted

against A/C #70.02.

70.03 Rentals

Gross receipts from the rental of property acquired for parish expansion.

NOTE: Fees collected for use of parish church or hall should be recorded in A/C #70.99

70.04 Media I Book Racks

Gross receipts from the sale of media items, books & magazines.

70.05 Insurance Settlements

Funds received in settlement for damages suffered by the parish.

70.06 Religious Education Fees

Fees collected from students enrolled in the Parish School of Religion.

70.07 Elementary School Tuition

Tuition collected which is to be forwarded to the school in which the student is enrolled. This

account is not to be used to record tuition collected from families using the parish parochial

school.

70.08 Education Endowment Interest

Interest from education endowment funds.

NOTE: Interest from endowment funds that is automatically re-invested in Archdiocesan

Investment notes is to be recorded in this account with the offsetting entry recorded

in A/C #392.00.

70.99 Other

Any other revenue not included in the above accounts.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

NON-OPERATING REVENUES

80.00 Archdiocesan Subsidy

Funds received from the Archdiocese as a parish subsidy.

NOTE: If the subsidy is provided as support to the school, it should be recorded in A/C #

500.05.

90.00 Sale of Property

Proceeds received from the sale of parish property including land, buildings and equipment.

OTHER CASH RECEIPTS

100.01 Withdrawal from Savings (other than Archdiocesan notes)

All withdrawals from parish savings accounts (listed on Schedule of Surplus Funds)

transferred to the parish operating account.

NOTE: Parish expenses cannot be paid directly from parish savings accounts. Instead, a

check is drawn on the parish savings account and deposited in the parish operating

account. A parish check is then drawn to pay for the designated expense.

100.02 Withdrawal from Archdiocesan Notes

All withdrawals from Archdiocesan Investment notes (listed on Schedule of Surplus Funds)

transferred to the parish operating account.

100.03 Authorized Loan Proceeds, Proceeds from an authorized loan from the Archdiocesan Deposit

& Loan Fund.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

CLERGY SALARIES

200.01 Pastor I Parish Administrator

Gross salary paid to the pastor or parish administrator. 200.02 Associate

Gross salary paid to the associate pastor. 200.03 Clergy -Extra Help

Stipends paid for sacramental services provided by other clergy.

LAY SALARIES

210.01 Office Personnel

Gross salaries paid to office personnel including secretaries, bookkeepers, & other clerical

personnel.

210.02 Pastoral Staff

Gross salaries paid to members of the pastoral staff including Director of Religious

Education, Youth Ministers, Lay Pastoral Ministers, Music Ministers, and Business

Managers.

NOTE: Report organists, other musicians & choir members who are paid as outside

contractors (not on parish payroll) in Music Ministry A/C #280.04.

210.03 Maintenance Staff

Gross salaries paid to maintenance personnel.

210.99 Other

Gross salaries paid to other personnel not included in the above accounts, such as

housekeepers and cooks.

RECTORY & HOUSEHOLD

220.01 Room & Board

Expenses associated with the living arrangement(s) of the parish priest(s) or administrator.

220.02 Ordinary Repairs & Maintenance

Expenses associated with maintaining the rectory.

220.03 Utilities

Utility charges related to the rectory.

220.04 Insurance

Premiums for property insurance for rectory.

NOTE: Record portion of property & liability insurance relating to parish property (other

than rectory) in A/C #320.04 and portion relating to school property in A/C #

810.05.

220.05 Property Taxes

Real estate taxes for rectory (if subject to property taxes).

NOTE: Parish properties used as residences are subject to property taxes. Former residences

currently utilized for office space or portion of current residence used for office

space are not subject to property taxes and receive a split tax exemption from the

local county auditor.

220.99 Other

Any other rectory expense not included in above accounts.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

OFFICE

230.01 Telephone

Expenses associated with monthly phone service, internet connection, etc.

230.02 Postage

Cost of postage used for parish mailings.

230.03 Supplies

Expenses for purchases of parish office supplies such as paper, envelopes, toner, etc.

230.04 Equipment Rental & Repairs

Expenses relating to leases, repairs and service agreements for office equipment.

230.05 Staff Benefits

Expenses related to staff lunches, awards, holiday parties, etc.

230.06 Printing

Expenses incurred for printing & copying whether internal or outsourced.

230.07 Subscriptions / Reference Materials

Expenses for magazine subscriptions, reference materials, etc.

230.08 Service Fees

Bank service charges -not to be netted against interest earned on the parish account.

230.09 Stewardship Program

Expenses associated with the parish stewardship including the cost of collection envelopes,

posters, etc.

230.10 Contractual Services

Costs of outsourced services such as payroll services & temporary help.

230.99 Other

All other office administrative costs not included in the above accounts.

PAYROLL TAXES / EMPLOYEE FRINGE BENEFITS

240.01 FICA (Employer's Portion)

Social Security and Medicare taxes paid by employer.

NOTE: Do not include amounts withheld from the employee's gross pay.

240.02 Workers' Compensation Insurance

Premiums paid for workers' compensation insurance.

240.03 Health Care

Premiums paid for health, life & long-term disability.

NOTE: Employee portion of Health Care premiums withheld from gross pay should be

credited to this account. Employee portion relating to less than full time status.

240.04 Ohio Unemployment Compensation Insurance

Premiums paid for State of Ohio unemployment compensation insurance.

240.05 Pension

Quarterly employer contributions paid to Lay Employees Pension Plan.

240.99 Other

Payments to religious orders for Social Security & Medicare, long-term disability, and

unemployment.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

TRANSPORTATION & SEMINARS

250.01 Local Transportation

Mileage reimbursement for local travel by parish priest(s) & office personnel.

250.02 Conferences / Conventions / Seminars

Expenses incurred by parish priest(s) & office personnel in relation to travel and convention

attendance or Archdiocesan meetings and conferences.

250.03 Auto Repairs & Maintenance

Expenses associated with the operation and maintenance of parish owned vehicles.

250.04 Professional Reimbursement

Reimbursement of professional ministerial expenses of parish priest(s).

NOTE: Current limit on reimbursement may be obtained from the Priest Personnel Office.

PARISH ACTIVITIES

260.01 Socials

Expenses associated with parish social events including bingo.

260.02 Festival

Expenses related to parish festival.

260.03 Parish Bulletin / Newsletter

Expenses directly related to the parish bulletin or newsletter.

260.04 Fund-raisers

Expenses directly related to parish fund-raising activities which are for the benefit of parish

programs' which include raffles, script and grocery certificates; etc.

260.99 Other

Any other parish activity expense not included in the above accounts.

PARISH FUND DRIVES

270.00 Parish Fund Drives

Expenses directly related to the parish fund drive such as envelopes, postage, fund-raiser fees,

etc.

NOTE: Construction costs and Architect fees should be recorded in the proper Capital

Account.

ALTAR, SANCTUARY, AND LITURGICAL

280.01 Altar, Sanctuary, & Liturgical

Expenses for sanctuary supplies, altar bread & wine, flowers, vestments, etc.

280.02 Missals I Hymnals

Cost of parish missals & hymnals.

280.03 Votive Lights

Cost of votive lights.

280.04 Music Ministry

Expenses associated with the music ministry such as the organist & choir.

NOTE: Record salary paid to organist in Pastoral Staff Salaries A/C #210.02.

280.99 Other

Any other altar, sanctuary and liturgical expense not included in the above accounts.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

PARISH MINISTRY PROGRAMS

Parishes should report expenses associated with each of the following four parish ministry

programs in summary using the following four accounts. Each parish is encouraged to establish sub-

accounts within the range of each program in order to provide greater detail for internal parish review.

NOTE: Salaries for personnel involved in Parish Ministry Programs should be recorded in Pastoral

Staff Salaries A/C #210.02.

290.10 Religious Education

Expenses relating to the Parish School of Religion.

290.20 Adult Faith Formation

Expenses relating to Adult Faith Formation such as RCIA programs, etc.

290.30 Youth Ministry

Expenses relating to the Youth Ministry program.

290.40 Pastoral Ministry

Expenses associated with other parish ministry programs not included in the above accounts.

MISCELLANEOUS ADMINISTRATIVE EXPENSES

300.01 Catholic Telegraph

Cost of Catholic Telegraph subscriptions.

300.02 Donations

Contributions to other charitable organizations from general parish funds.

300.03 Social Action Projects

Expenses (other than direct contributions A/C #300.02) associated with parish social action

or other charitable projects.

300.04 Media I Book Rack

Cost of media items, books and magazines purchased for sale by parish.

300.05 Dues I Memberships

Expenses related to parish dues & memberships.

300.06 Professional Fees

Professional fees including consulting.

NOTE: Any contact with attorneys requires the permission of the Chancellor.

300.99 Other

Any other miscellaneous administrative expense not included in the above accounts.

BUILDING & ORDINARY MAINTENANCE

310.00 Utilities

All utility expenses (i.e. gas, electric, water & sewer) related to parish buildings.

NOTE: Allocate utility bills between buildings based upon usage, square footage, etc.

320.01 Supplies

Cost of supplies purchased for cleaning & upkeep of parish plant.

320.02 Ordinary Repairs & Maintenance

Expenses relating to the normal maintenance of parish property. Ordinary repairs and

maintenance include any activity necessary to maintain the property but which does not add to

the existing property, nor extend the useful life, nor change the property to make it more

useful.

NOTE: The expenditure of more than $10,000 requires the prior permission of the Director

of Financial Services.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

BUILDING & ORDINARY MAINTENANCE (Continued)

320.03 Contractual Services

Expenses for building services provided on a regular monthly / annual contractual basis such

as trash removal, janitorial services, security, etc.

320.04 Insurance

Cost of property & liability insurance for parish properties.

NOTE: Record portion of property & liability insurance relating to rectory in A/C #220.04

and portion relating to school property in A/C #810.05.

320.05 Property Taxes

Real estate taxes for parish property (other than rectory) (if subject to property taxes)

NOTE: Parish properties used as residences are subject to property taxes. Former residences

currently utilized for office space or portion of current residence used for office

space are not subject to property taxes. Contact the Chancellors office for assistance

if there are questions about property tax.

320.06 Rent

Any rent paid in the conduct of parish operations such as rental of modular buildings, musical

instruments tools, etc.

320.07 Rental Property Expenses

Expenses directly associated with the rental of parish property other than parish church or

hall.

320.99 Other

Any other building expense not included in the above accounts.

DESIGNATED COLLECTIONS REMITTANCES

Funds pertaining to specific collections listed below which are forwarded directly to the Chancery for

record and distribution, such as Missions, or organization such as St. Vincent De Paul, Little Sisters of

the Poor, etc.

(3)30.01 Fund for Religious Retirement

(3)30.02 Bishop's Overseas Relief

(3)30.03 Good Friday / Holy Land Shrines

(3)30.04 Respect Life

(3)30.05 St. Vincent De Paul

(3)30.06 Ash Wednesday / Central & Eastern Europe

(3)30.07 Mission Sunday

(3)30.08 Campaign for Human Development

(3)30.09 Holy Father / Peters Pence

(3)30.10 Special Mission Appeal

(3)30.11 Archbishop's Annual Fund Drive

(3)30.12 Operation Rice Bowl

(3)30.13 CISE / Seeds of Growth (3)30.99 Other

PAYMENTS TO SCHOOLS

340.01 High Schools

Payments to High Schools relating to tuition.

NOTE: Payments to the High School Equalizing Fund should be recorded in A/C #350.02.

340.02 Elementary Schools

Payments to elementary schools for tuition collected from parents (see A/C #70.07) as well

as parish portion of tuition paid to consolidated school.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

PAYMENTS TO ARCHDIOCESE

350.01 General Assessment

Payments to Archdiocese based on cel1ain parish revenue items times assessment rate (5.7%).

350.02 High School Equalizing

Payments to Archdiocese for parish affiliated students attending parochial high schools which

are in turn disbursed to the individual high schools.

350.99 Other Special Assessments

Any other assessment paid to the Archdiocese not included in the above accounts.

NOTE: Superintendents assessment should be recorded in A/C #610.06.

INTEREST EXPENSE

360.00 Interest Expense

Interest paid on funds borrowed from the Archdiocesan Deposit & Loan Fund.

NOTE: Principal payments on borrowed funds should be recorded in A/C #390.00.

CAPITAL EXPENDITURES - LAND & BUILDINGS

The expenditure of more than $10,000 requires the prior permission of the Director of

Financial Services. New construction requires that the policies of the Steps in a Building Process be

referenced.

370.01 Land

Cost of new land purchased for church purposes. Also include the cost of major

improvements to the grounds of the church such as new landscaping, paving I blacktop, etc.

NOTE: Expenses relating to routine annual landscaping upkeep should be recorded in A/C #

320.02.

370.02 Church - New

Cost associated with the building of a new church facility including architect fees.

370.03 Church - Additions & Remodeling

Cost associated with major addition to or remodeling of the current church facility.

370.04 Church - Extraordinary Repairs

Cost associated with extraordinary repairs or major improvements to the current church.

NOTE: Extraordinary repairs include substantial repairs, alterations or changes that extend

the useful life of buildings, or change the facilities to make them more useful.

370.05 Rectory - New

Cost associated with the building of a new rectory including architect fees. Also includes the

purchase price of house for use as rectory.

370.06 Rectory - Additions & Remodeling

Cost associated with major addition to or remodeling of the current rectory.

370.07 Rectory - Extraordinary Repairs

Cost associated with extraordinary repairs or major improvements to the current rectory.

370.08 Parish Center - New

Cost associated with the building of a new parish center including architect fees.

370.09 Parish Center - Additions & Remodeling

Cost associated with major addition to or remodeling of the current parish center.

370.10 Parish Center - Extraordinary Repairs

Cost associated with extraordinary repairs or major improvements to the current parish center.

370.11 Parish Offices - New

Cost associated with the building of new parish offices including architect fees.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

CAPITAL EXPENDITURES - LAND & BUILDINGS - (Continued)

370.12 Parish Offices - Additions & Remodeling

Cost associated with major addition to or remodeling of the current parish offices.

370.13 Parish Offices - Extraordinary Repairs

Cost associated with extraordinary repairs or major improvements to the current parish

offices.

370.99 Other

Any other capital expenditure for land or buildings not included in the above accounts.

CAPITAL EXPENDITURES - FURNITURE & EQUIPMENT

380.01 Vehicles

Purchase price of vehicles owned by parish.

380.02 Office Equipment

Cost of new equipment used in church offices.

380.03 Church Furnishings

Cost of new church furnishings such as pews, baptismal fonts, etc.

380.04 Rectory Furnishings

Cost of new furnishings for rectory.

380.05 Parish Center Furnishings

Cost of new furnishings for parish center.

380.06 Technology

Cost of new technology equipment such as computers, printers, etc.

380.99 Other

Any other capital expenditure for furniture & equipment not included in the above accounts.

OTHER CASH DISBURSEMENTS

390.00 Loan Repayments

Principal payments made on loans from Archdiocesan Deposit & Loan Fund.

391.00 Transfers to Savings Account(s) (other than Archdiocesan notes)

All transfers from parish operating accounts to savings accounts (listed on Schedule of

Surplus Funds).

NOTE: Funds cannot be deposited directly into parish savings accounts. All funds received

by the parish must be recorded in the parish operating account and then transferred to

the savings account.

392.00 Transfers to Archdiocesan Investment Notes

All transfers from parish operating accounts to Archdiocesan Investment Notes.

400.00 Exchange Account

Use this account for cash receipts & disbursements which are not actual revenue or expense

items of the parish but rather pertain to custodial type transactions where cash is either held

on a temporary basis for future disbursement or cash is paid pending reimbursement to the

parish.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

PARISH DESCRIPTIONS

PAYROLL TAXES WITHHELD & PAID

393.01 Payroll Deduction - Federal

Liability account credited for deduction from gross pay for Federal withholding taxes with

offsetting entry made when Federal taxes are paid.

393.02 Payroll Deduction -FICA

Liability account credited for deduction from gross pay for FICA taxes with offsetting entry

made when FICA taxes are paid.

NOTE: Employer portion of FICA taxes should be recorded in A/C #240.01 (parish

personnel) and A/C #620.01 (school personnel) when paid.

393.03 Payroll Deduction - State

Liability account credited for deduction from gross pay for State withholding taxes with

offsetting entry made when State taxes are paid.

393.04 Payroll Deduction - Local

Liability account credited for deduction from gross pay for Local withholding taxes with

offsetting entry made when Local taxes are paid.

393.05 Payroll Deduction -Annuity / 403(b)

Liability account credited for deduction from gross pay for annuity I 403(b) plan with

offsetting entry made when annuity 1403(b) amount is paid to vendor I provider.

393.06 Payroll Deduction - United Way

Liability account credited for deduction from gross pay for employee contribution to United

Way with offsetting entry made when employee contribution is paid to United Way.

393.07 Payroll Deduction - Dental

Liability account credited for deduction from gross pay for dental ~a premium with

offsetting entry made when premium is paid to dental plan provider.

393.99 Payroll Deduction - Other

Liability account credited for deduction from gross pay for any other item not included in

above accounts with offsetting entry made when the withheld amount is paid.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

STUDENT RECEIPTS

500.01 Tuition

500.02 Tuition -Non Parish Affiliated

500.03 Administrative Cost Reimbursement

500.04 Student Fees

500.05 Financial Aid - Diocesan

500.06 Financial Aid - Other

500.99 Other

OTHER RECEIPTS

510.00 Gifts & Donations

515.00 Fund-raisers

520.00 Sale and Rental of Books

525.00 Interest (Consolidated Schools)

526.01 Withdrawal from Savings Account(s) (Consolidated Schools)

526.02 Withdrawal from Archdiocesan Notes (Consolidated Schools)

529.00 Authorized Loan Proceeds (Consolidated Schools)

STUDENT SERVICES & AUXILIARY PROGRAMS

530.01 Athletics / Boosters

530.02 Student Activities (Except Athletics / Boosters)

530.03 Milk Receipts

530.04 Lunch Program - State Funds

530.05 Cafeteria Food Services

530.06 After School Programs

530.07 PTO

530.99 Other

BUILDING SERVICE FEES

540.00 Rental Fees

541.00 User Fees

ADMINISTRATIVE & OFFICE SALARIES

600.01 Religious

600.02 Lay

ADMINISTRATIVE & OFFICE EXPENSES

610.01 Telephone

610.02 Postage

610.03 Supplies

610.04 Equipment Rental & Repairs

610.05 Travel, Seminars, and Workshops

610.06 Archdiocesan Education Office Fees

610.07 Subscriptions

610.08 Printing

610.09 Staff Benefits

610.10 Contractual Services

610.11 Service Fees

610.12 Interest (Consolidated Schools)

610.99 Other

PAYROLL TAXES / EMPLOYEE FRINGE BENEFITS

620.01 FICA (Employer's Portion)

620.02 Workers' Compensation Insurance

620.03 Health Care

620.04 Ohio Unemployment Compensation

620.05 Pension

620.99 Other

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL

INSTRUCTIONAL SALARIES

630.01 Religious

630.02 Lay

INSTRUCTIONAL EXPENSES

640.01 Supplies

640.02 Equipment

640.03 Textbooks

640.04 Contractual Services

640.99 Other

RELIGION SALARIES

650.01 Religious

650.02 Lay

RELIGION EXPENSES

660.01 Supplies

660.02 Equipment

660.03 Textbooks

660.99 Other

LIBRARY SALARIES

670.01 Religious

670.02 Lay

LIBRARY EXPENSES

680.01 Media I Books

680.02 Equipment

680.03 Supplies

680.99 Other

TECHNOLOGY / COMPUTER LAB SALARIES

690.01 Religious

690.02 Lay

TECHNOLOGY / COMPUTER LAB EXPENSES

700.01 Supplies

700.02 Equipment

700.03 Software

700.04 Equipment Rental & Repairs

700.99 Other

STUDENT SERVICES & AUXILIARY PROGRAM SALARIES

710.01 After School Programs

710.02 Other

710.03 Cafeteria

STUDENT SERVICES & AUXILIARY PROGRAM EXPENSES

720.01 Athletics I Boosters

720.02 Student Activities (Except Athletics I Boosters)

720.03 Health Services

720.99 Other

CAFETERIA EXPENSES

730.01 Milk -Government Program

730.02 Commodities- Government Program

730.03 Commodities - Other

730.04 Utilities

730.05 Rent

730.06 Equipment

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL

CAFETERIA EXPENSES - (Continued)

730.07 Maintenance

730.99 Other

AFTER SCHOOL PROGRAMS

740.00 After School Programs

PLANT OPERATION SALARIES

800.01 Lay

PLANT OPERATION EXPENSES

0810.01 Utilities

810.02 Supplies

810.03 Ordinary Repairs & Maintenance

810.04 Equipment

810.05 Insurance

810.06 Property Taxes

810.07 Contractual Services

810.99 Other

SCHOOL RESIDENCE SALARIES

830.01 Lay

SCHOOL RESIDENCE EXPENSES

840.01 Utilities

840.02 Supplies

840.03 Ordinary Repairs & Maintenance

840.04 Equipment

840.05 Automobile Repairs & Maintenance

840.06 Insurance

840.07 Property Taxes

840.08 Telephone

840.09 Separate Quarters Allowance

840.99 Other

CAPITAL EXPENDITURES - LAND & BUILDINGS

900.01 Land

900.02 School Building - New

900.03 School Building - Additions & Remodeling

900.04 School Building - Extraordinary Repairs

900.05 School Residences - New

900.06 School Residences - Additions & Remodeling

900.07 School Residences - Extraordinary Repairs

900.99 Other

CAPITAL EXPENDITURES - FURNITURE & EQUIPMENT

910.01 Teaching Aids

910.02 Classroom Furnishings

910.03 Library

910.04 Technology / Computer Lab

910.99 Other

OTHER DISBURSEMENTS

990.00 Loan Repayments (Consolidated Schools)

991.00 Transfers to Savings Account(s) (Consolidated Schools)

992.00 Transfers to Archdiocesan Investment Notes (Consolidated Schools)

1000.00 Exchange

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

STUDENT RECEIPTS

500.01 Tuition

All tuition payments received from parishioners or from parents of students from outside the

parish.

500.02 Tuition - Non Parish Affiliated

All tuition payments received from another parish for its students.

500.03 Administrative Cost Reimbursement

Administrative cost reimbursement received from the State of Ohio.

500.04 Student Fees

All fees charged to students including registration, books, etc.

500.05 Financial Aid - Diocesan

Funds received directly from the Archdiocese in the form of student aid (TA-132 subsidy).

500.06 Financial Aid - Other

Funds received from sources other than directly from the Archdiocese such as CISE, Hansen,

PACE Seeds of Growth, etc.

500.99 Other

Any other student receipt not specifically covered by the above accounts. .

OTHER RECEIPTS

510.00 Gifts & Donations

Gifts & donations received which are restricted by the donor for school use.

515.00 Fund-raisers

Gross receipts associated with fund raising projects, conducted by the school, which directly

benefit the school.

520.00 Sale and Rental of Books

Receipts from the sale or rental of books & supplies.

525.00 Interest (Consolidated Schools only)

Gross interest & dividend income received on all school checking & savings accounts as well

as school investments.

NOTE: Bank service fees should be recorded in Service Fees A/C #610.11, and not netted

against A/C #525.00.

526.01 Withdrawal from Savings Account(s) (Consolidated Schools only)

All withdrawals from school savings accounts (listed on Schedule of Surplus Funds)

transferred to the school operating account.

NOTE: School expenses cannot be paid directly from school savings accounts. Instead, a

check is drawn on the school savings account and deposited in the school operating

account. A school check is then drawn to pay for the designated expense.

526.02 Withdrawal from Archdiocesan Notes (Consolidated Schools only)

All withdrawals from Archdiocesan Investment notes (listed on Schedule of Surplus Funds)

transferred to the school operating account.

529.00 Authorized Loan Proceeds (Consolidated Schools only)

Proceeds from an authorized loan fromthe Archdiocesan Deposit & Loan Fund.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

STUDENT SERVICES & AUXILIARY PROGRAMS

530.01 Athletics / Boosters

Receipts from students related to athletic & booster programs.

530.02 Student Activities (Except Athletics / Boosters)

Receipts from students related to band and other student activities except athletics I boosters.

530.03 Milk Receipts

Receipts from government milk program.

530.04 Lunch Program - State Funds

Receipts from state government for lunch programs.

530.05 Cafeteria Food Services

Gross receipts from cafeteria and vending machines.

530.06 After School Programs

Receipts from after school programs such as daycare, etc.

530.07 PTO

Gross receipts from funds raised by PTO.

530.99 Other

Any other student services receipt not specifically covered by the above accounts.

BUILDING SERVICE FEES

540.00 Rental Fees

Receipts from rental fees received for the use of school facilities.

NOTE: Only another not-for-profit agency may rent school facilities. All other charges made for use

of facilities by parishioners and parents are to be recorded in A/C #540.01 -User Fees.

540.01 User Fees

Receipts from parishioners and parents using school facilities.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

ADMINISTRATIVE & OFFICE SALARIES

600.01 Religious

Gross salaries paid to administrative religious office personnel including the principal, bookkeeper,

secretary, etc.

600.02 Lay

Gross salaries paid to administrative lay office personnel including the principal, bookkeeper,

secretary, etc.

ADMINISTRATIVE & OFFICE EXPENSES

610.01 Telephone

Expenses associated with monthly phone service, internet connection, etc.

610.02 Postage

Cost of postage used for school mailings.

610.03 Supplies

Expenses for purchases of school office supplies such as paper, envelopes, toner, etc.

610.04 Equipment Rental & Repairs

Expenses relating to leases, repairs and service agreements for office equipment.

610.05 Travel, Seminars, and Workshops

Expenses incurred by school office personnel in relation to travel and convention attendance or

Archdiocesan meetings and conferences.

610.06 Archdiocesan Education Office Fees

Fees paid to Archdiocesan Education Office such as superintendents assessment, etc.

610.07 Subscriptions

Expenses for magazine subscriptions, reference materials, etc.

610.08 Printing

Expenses incurred for printing & copying whether internal or outsourced.

610.09 Staff Benefits

Expenses related to staff lunches, awards, holiday parties, etc.

610.10 Contractual Services

Costs of outsourced services such as payroll services & temporary help.

610.11 Service Fees

Bank service charges -not to be netted against interest earned on the school account.

610.12 Interest (Consolidated schools only)

Interest paid on funds borrowed from the Archdiocesan Deposit & Loan Fund.

NOTE: Principal payments on borrowed funds should be recorded in A/C #990.00.

610.99 Other

All other office administrative costs not included in the above accounts.

PAYROLL TAXES / EMPLOYEE FRINGE BENEFITS

620.01 FICA {Employer's Portion)

Social Security and Medicare taxes paid by employer.

NOTE: Do not include amounts withheld from the employee's gross pay.

620.02 Workers' Compensation Insurance

Premiums paid for workers' compensation insurance.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

PAYROLL TAXES / EMPLOYEE FRINGE BENEFITS (Continued)

620.03 Health Care

Premiums paid for health, life & long-term disability.

NOTE: Employee portion of Health Care premiums withheld from gross pay should be credited to

this account Employee portion relating to less than full time status.

620.04 Ohio Unemployment Compensation

Premiums paid for State of Ohio unemployment compensation insurance.

620.05 Pension

Quarterly employer contributions paid to Lay Employees Pension Plan.

620.99 Other

Payments to religious orders for Social Security & Medicare, long-term disability, and unemployment

INSTRUCTIONAL SALARIES

630.01 Religious

Gross salaries paid to religious teachers which is attributable to the teaching of secular subjects.

630.02 Lay

Gross salaries paid to lay teachers which are attributable to the teaching of secular subjects.

INSTRUCTIONAL EXPENSES

640.01 Supplies

Cost of supplies to be used for secular instruction in the classrooms such as chalk, erasers, etc.

640.02 Equipment

Cost of instructional equipment used in teaching of secular subjects in the classroom.

640.03 Textbooks

Cost of textbooks, workbooks, and manuals purchased for secular instruction in the classroom.

640.04 Contractual Services

Cost of outsourced services for secular instruction such as music, art, physical education, etc.

640.99 Other

All other secular instructional costs not included in the above accounts.

RELIGION SALARIES

650.01 Religious

Gross salaries paid to religious teachers which is attributable to the teaching of religion.

650.02 Lay

Gross salaries paid to lay teachers which are attributable to the teaching of religion.

RELIGION EXPENSES

660.01 Supplies

Cost of supplies to be used for religious course work in the classrooms such as chalk, erasers, etc.

660.02 Equipment

Cost of instructional equipment used in teaching of religion in the classroom.

660.03 Textbooks

Cost of textbooks, workbooks, and manuals used for teaching religion in the classroom.

660.99 Other

All other instructional costs for teaching religion not included in the above accounts.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

LIBRARY SALARIES

670.01 Religious

Gross salaries paid to religious personnel which are attributable to work performed in the library.

670.02 Lay

Gross salaries paid to lay personnel which are attributable to work performed in the library.

LIBRARY EXPENSES

680.01 Media / Books

Expenses for books, CDs and on-line services utilized in the library.

680.02 Equipment

Cost of equipment used in the library.

680.03 Supplies

Cost of supplies used in the library such as writing instruments, paper, etc.

680.99 Other

All other library expenses not included in the above accounts.

TECHNOLOGY I COMPUTER LAB SALARIES

690.01 Religious

Gross salaries paid to religious personnel which are attributable to work performed in the computer

lab. 690.02 Lay

Gross salaries paid to lay personnel which are attributable to work performed in the computer lab.

TECHNOLOGY / COMPUTER LAB EXPENSES

700.01 Supplies

Cost of supplies used in the computer lab such as toner, paper, etc.

700.02 Equipment

Cost of equipment used in the computer lab which are not capital expenses including hardware.

NOTE: Record the cost of capital expenditures such as computers, printers, etc. in A/C #910.04.

700.03 Software

Non-capitalized costs for software expenditures that may include updates, etc.

700.04 Equipment Rental & Repairs

Expenses relating to leases, repairs and service agreements for computer lab equipment.

700.99 Other

All other technology I computer lab expenses not included in the above accounts.

STUDENT SERVICES & AUXILIARY PROGRAM SALAI

710.01 After School Programs

Gross salaries of employees working in after school programs.

710.02 Other

Gross salaries of employees not included in any other salary category.

710.03 Cafeteria

Gross salaries of employees working in school cafeteria.

STUDENT SERVICES & AUXILIARY PROGRAM EXPENSES

720.01 Athletics / Boosters

Expenses related to athletic and booster programs.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

STUDENT SERVICES & AUXILIARY PROGRAM EXPENSES (Continued)

720.02 Student Activities (Except Athletics / Boosters)

Expenses related to band and other student activities except athletics / boosters.

720.03 Health Services

All expenses associated with student health services such as salaries, supplies, etc.

720.99 Other

All other student services expenses not included in above accounts.

CAFETERIA EXPENSES

730.01 Milk - Government Program

Cost of milk purchased in connection with government milk program.

730.02 Commodities - Government Program

Cost of food purchased in connection with government lunch programs.

730.03 Commodities - Other

Cost of food items purchased which is not part of government lunch program.

730.04 Utilities

Utility expenses allocated to cafeteria operations.

730.05 Rent

Any fees charged / allocated to cafeteria operation.

730.06 Equipment

Cost of equipment purchased for cafeteria operation such as ovens, freezers, etc.

730.07 Maintenance

Expenses relating to maintenance and repairs of cafeteria property and equipment.

730.99 Other

All other cafeteria expenses not included in above accounts.

AFTER SCHOOL PROGRAMS

740.00 After School Programs

All expenses associated with after school programs (except salaries recorded in A/C #

710.01).

PLANT OPERATION SALARIES

800.01 Lay

Gross salaries paid to custodians and other maintenance personnel for maintenance and

upkeep of school property.

PLANT OPERATION EXPENSES

810.01 Utilities

All utility expenses (i.e. gas, electric, water & sewer) related to school buildings.

NOTE: Allocate utility bills between buildings based upon usage, square footage, etc.

810.02 Supplies

Cost of supplies purchased for cleaning & upkeep of school plant.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

PLANT OPERA TION EXPENSES - (Continued)

810.03 Ordinary Repairs & Maintenance

Expenses relating to the normal maintenance of school property. Ordinary repairs and

maintenance include any activity necessary to maintain the property but which does not add to

the existing property, nor extend the useful life, nor change the property to make it more

useful.

NOTE: The expenditure of more than $10,000 requires the prior permission of the Director

of Financial Services.

810.04 Equipment

Cost of equipment purchased to replace existing maintenance equipment.

810.05 Insurance

Cost of property & liability insurance for school properties.

NOTE: Record portion of property & liability insurance relating to school residences in A/C

#840.06.

810.06 Property Taxes

Real estate taxes for school property (except school residences) subject to property taxes.

NOTE: School properties used as residences are subject to property taxes. Former residences

currently utilized for office space or portion of current residence used for office

space are not subject to property taxes. Contact the Chancellor's office for assistance

if there are questions about property tax.

Record property taxes relating to school residences in A/C #840.07.

810.07 Contractual Services

Expenses for building services provided on a regular monthly / annual contractual basis such

as trash removal, janitorial services, security, etc.

810.99 Other

Any other plant expense not included in the above accounts.

SCHOOL RESIDENCE SALARIES

830.01 Lay

Gross salaries paid to custodians and other maintenance personnel for maintenance and

upkeep of buildings other than classrooms or offices that support the parish school.

SCHOOL RESIDENCE EXPENSES

840.01 Utilities

All utility expenses (i.e. gas, electric, water & sewer) related to school residences.

NOTE: Allocate utility bills between buildings based upon usage, square footage, etc.

840.02 Supplies

Cost of supplies purchased for cleaning & upkeep of school residences.

840.03 Ordinary Repairs & Maintenance

Expenses relating to the normal maintenance of school residences. Ordinary repairs and

maintenance include any activity necessary to maintain the property but which does not add to

the existing property, nor extend the useful life, nor change the property to make it more

useful.

NOTE: The expenditure of more than $10,000 requires the prior permission of the Director

of Financial Services.

840.04 Equipment

Cost of equipment used for school residence property. )

840.05 Automobile Repairs & Maintenance

Expenses associated with the operation of school residence vehicles.

840.06 Insurance

Cost of property & liability insurance for school residence property.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

SCHOOL RESIDENCE EXPENSES (Continued)

840.07 Property Taxes

Real estate taxes for school residence property subject to property taxes.

NOTE: School properties used as residences are subject to property taxes. Former residences

currently utilized for office space or portion of current residence used for office

space are not subject to property taxes.

840.08 Telephone

Expenses associated with monthly phone service, internet connection, etc.

840.09 Separate Quarters Allowance

Amounts paid either to another parish or to a religious community covering the living

expenses, room and board, etc. of religious assigned to the parish.

840.99 Other

All other school residence expenses not included in above accounts.

CAPITAL EXPENDITURES - LAND & BUILDINGS

The expenditure of more than $10,000 requires the prior permission of the Director of Financial

Services. New construction requires that the policies of the Steps in a Building Process be referenced.

900.01 Land

Cost of new land purchased for school purposes. Also include the cost of major improvements

to the grounds of the school such as new landscaping, paving / blacktop, etc.

NOTE: Expenses relating to routine annual landscaping upkeep should be recorded in A/C #

810.03.

900.02 School Building - New

Cost associated with the building of a new school including architect fees.

900.03 School Building - Additions & Remodeling

Cost associated with major addition to or remodeling of the current school.

900.04 School Building - Extraordinary Repairs

Cost associated with extraordinary repairs or major improvements to the current school.

900.05 School Residence - New

Cost associated with the building of a new school residence including architect fees.

900.06 School Residence - Additions & Remodeling

Cost associated with major addition to or remodeling of the current school residence.

900.07 School Residence - Extraordinary Repairs

Cost associated with extraordinary repairs or major improvements to the current school

residence.

CAPITAL EXPENDITURES -FURNITURE & EQUIPMENT

910.01 Teaching Aids

Cost of new teaching aids for the classroom such as VCRs, overhead projectors, etc.

910.02 Classroom Furnishings

Cost of new furnishings purchased for classroom such as desks, blackboards, etc.

910.03 Library

Cost of new furnishings purchased for library such as desks, tables, etc.

910.04 Technology / Computer Lab

Cost of new technology equipment such as computers, printers, etc.

910.99 Other

Any other capital expenditure for furniture & equipment not included in the above accounts.

ARCHDIOCESE OF CINCINNATI

CHART OF ACCOUNTS

SCHOOL DESCRIPTIONS

OTHER DISBURSEMENTS

990.00 Loan Repayments (Consolidated schools only)

Principal payments made on loans from Archdiocesan Deposit & Loan Fund.

991.00 Transfers to Savings Account(s) (Consolidated schools only)

All transfers from school operating accounts to savings accounts (listed on Schedule of

Surplus Funds).

NOTE: Funds cannot be deposited directly into school savings accounts. All funds received

by the school must be recorded in the school operating account and then transferred

to the savings account.

992.00 Transfers to Archdiocesan Investment Notes (Consolidated schools only)

All transfers from school operating accounts to Archdiocesan Investment Notes.

1000.00 Exchange

Use this account for cash receipts & disbursements which are not actual revenue or expense

items of the school but rather pertain to custodial type transactions where cash is either held

on a temporary basis for future disbursement or cash is paid pending reimbursement to the

school.

You might also like

- Downsizing Restructuring and OutsourcingDocument25 pagesDownsizing Restructuring and OutsourcingShibly Noman75% (8)

- Risk Assessment Construction SiteDocument9 pagesRisk Assessment Construction SiteJuned Hamid Khan100% (2)

- 2013 Month Date Yourname Shortanswerquestions 1Document86 pages2013 Month Date Yourname Shortanswerquestions 1jewel22560% (1)

- Summary of Cash Receipts and Disbursements For The Month of March 2015Document9 pagesSummary of Cash Receipts and Disbursements For The Month of March 2015chris jamesNo ratings yet

- Summary of Cash Receipts and Disbursements For The Month of February 2015Document8 pagesSummary of Cash Receipts and Disbursements For The Month of February 2015chris jamesNo ratings yet

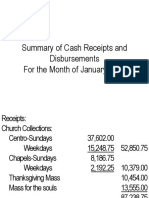

- Summary of Cash Receipts and Disbursements For The Month of January 2015Document8 pagesSummary of Cash Receipts and Disbursements For The Month of January 2015chris jamesNo ratings yet

- 2011 Church COA 3Document22 pages2011 Church COA 3ifyjoslynNo ratings yet

- Summary of Cash Receipts and Disbursements For The Month of April 2015Document8 pagesSummary of Cash Receipts and Disbursements For The Month of April 2015chris jamesNo ratings yet

- Annual Report 2022Document22 pagesAnnual Report 2022api-216343996No ratings yet

- Summary of Cash Receipts and Disbursements For The Month of December 2014Document10 pagesSummary of Cash Receipts and Disbursements For The Month of December 2014chris jamesNo ratings yet

- 2008 CFA Conference ReportDocument3 pages2008 CFA Conference ReporttncircuitriderNo ratings yet

- David Dotterrer Contributions and ExpensesDocument9 pagesDavid Dotterrer Contributions and ExpensesMail TribuneNo ratings yet

- BudgetDocument1 pageBudgetapi-258392501No ratings yet

- StLukeFinancials2021-APPROVED and Signed x2Document9 pagesStLukeFinancials2021-APPROVED and Signed x2Dave AsanteNo ratings yet

- Diocese of Malolos SPPC HagonoyDocument7 pagesDiocese of Malolos SPPC Hagonoyppat25679No ratings yet

- BFHCM FinSt - April3006Document2 pagesBFHCM FinSt - April3006Rodelio C. CatuyNo ratings yet

- b4b 2014 Financial Report FinalDocument1 pageb4b 2014 Financial Report Finalapi-254992746No ratings yet

- Accounts Vestry Report 2016Document4 pagesAccounts Vestry Report 2016api-159338946No ratings yet

- Adv AccountssumsDocument419 pagesAdv Accountssumsmasdram_91849140750% (2)

- Public FinanceDocument8 pagesPublic FinanceSuan Judy Ann A.No ratings yet

- Expense Chart2Document1 pageExpense Chart2api-202200348No ratings yet

- Model Buget LunarDocument1 pageModel Buget LunarAnna BucurNo ratings yet

- 2014 BudgetDocument1 page2014 Budgetapi-258655593No ratings yet

- State of The Church ADDRESS 2021: Christian Bible Baptist Church Rosario La UnionDocument51 pagesState of The Church ADDRESS 2021: Christian Bible Baptist Church Rosario La UnionCBBC RosarioNo ratings yet

- Church Budget Planning Spreadsheet EditableDocument2 pagesChurch Budget Planning Spreadsheet EditableCherry Mae BacaniNo ratings yet

- 01 Income and Expenditure AccountDocument4 pages01 Income and Expenditure AccountPrateek ⎝⏠⏝⏠⎠ Gupta ヅ0% (1)

- 2013 Annual Meeting ReportDocument11 pages2013 Annual Meeting ReportTrinity Episcopal ChurchNo ratings yet

- 2023 Budget PlanDocument4 pages2023 Budget Planpatriciaann881115No ratings yet

- Chart of AccountsDocument6 pagesChart of AccountsifyjoslynNo ratings yet

- Family Monthly Budget PlannerDocument4 pagesFamily Monthly Budget PlannerastephenrajNo ratings yet

- Org Chart - Sept 2014Document1 pageOrg Chart - Sept 2014api-72810932No ratings yet

- Your Money Plan: Matthew Jones, UK, Undergraduate, 14 / 15Document3 pagesYour Money Plan: Matthew Jones, UK, Undergraduate, 14 / 15matthewrjonesrugbyNo ratings yet

- Financial Reportagm14Document4 pagesFinancial Reportagm14api-263720305No ratings yet

- Presbyterian Church of Ghana 2018Document55 pagesPresbyterian Church of Ghana 2018Daniel Padi100% (1)

- Presentations Lusaka Engagement Meeting Final 1Document34 pagesPresentations Lusaka Engagement Meeting Final 1luzangomwateNo ratings yet

- Cash FlowDocument4 pagesCash FlowLevi TomolNo ratings yet

- Springfeld Nor'easters: Marketing PlanDocument19 pagesSpringfeld Nor'easters: Marketing PlanGrant TempletonNo ratings yet

- Presupuesto PersonalDocument9 pagesPresupuesto PersonalAobando10No ratings yet

- Business Initial IdeaDocument7 pagesBusiness Initial IdeaXue Yin LewNo ratings yet

- 2 General-Journal-and-LedgersDocument51 pages2 General-Journal-and-LedgershilarytevesNo ratings yet

- Accounting For Not For Profit OrganizationsDocument13 pagesAccounting For Not For Profit Organizationswambui gatogoNo ratings yet

- Josephine Ong ReyesDocument1 pageJosephine Ong ReyeslynNo ratings yet

- Financial Report of APRIL2024Document3 pagesFinancial Report of APRIL2024marianne.andresNo ratings yet

- 2013-2014 Proposed Conference BudgetDocument1 page2013-2014 Proposed Conference Budgetapi-198906716No ratings yet

- 2014-2015 BudgetDocument1 page2014-2015 Budgetapi-291112075No ratings yet

- 2010-2011 Tax InformationDocument4 pages2010-2011 Tax InformationJosephine GiambattistaNo ratings yet

- Ack ST Paul MukiriDocument3 pagesAck ST Paul MukirimainaNo ratings yet

- Republic of The Philippines Province of Lanao Del Sur Municipality of WaoDocument5 pagesRepublic of The Philippines Province of Lanao Del Sur Municipality of WaoKilikili East100% (1)

- BCBP - ILOILO - Financial Report - SEP - 2021Document164 pagesBCBP - ILOILO - Financial Report - SEP - 2021Angelo ManlangitNo ratings yet

- Org Circles - Divisions - September 2014Document7 pagesOrg Circles - Divisions - September 2014api-72810932No ratings yet

- BudgetportfolioDocument5 pagesBudgetportfolioapi-257276202No ratings yet

- NBC Budget 2014Document3 pagesNBC Budget 2014Northside Baptist ChurchNo ratings yet

- Fellowship Deliverance Ministries, Inc. Trial Balance Statement January 31, 2010Document40 pagesFellowship Deliverance Ministries, Inc. Trial Balance Statement January 31, 2010Dorothy Spearman ClarkNo ratings yet

- Phcusd325boardpolicy8 29 19Document371 pagesPhcusd325boardpolicy8 29 19api-283945466No ratings yet

- For The YearDocument7 pagesFor The YearJayson Andrew Garcia MallariNo ratings yet

- Chicago Archdiocese Financial ReportDocument32 pagesChicago Archdiocese Financial ReportcraignewmanNo ratings yet

- Income Exp Table For SUA MCNDocument4 pagesIncome Exp Table For SUA MCNMfon ObotNo ratings yet

- AZGOP Republican Party of Arizona POA Campaign Finance ReportDocument25 pagesAZGOP Republican Party of Arizona POA Campaign Finance ReportBarbara EspinosaNo ratings yet

- Income Tax CalculationDocument1 pageIncome Tax Calculationsoumyadeep1947No ratings yet

- InangskiDocument2 pagesInangskiMicah Gwen CruzNo ratings yet

- Pressure Points: Managing Those Difficult and Challenging Church Financial IssuesFrom EverandPressure Points: Managing Those Difficult and Challenging Church Financial IssuesNo ratings yet

- A Gift For Msu... : Pledge FormDocument2 pagesA Gift For Msu... : Pledge FormifyjoslynNo ratings yet

- Uw - Pledge Form 2013Document2 pagesUw - Pledge Form 2013ifyjoslynNo ratings yet

- Sample Contribution Pledge FormDocument1 pageSample Contribution Pledge FormifyjoslynNo ratings yet

- Pledge FormDocument1 pagePledge FormifyjoslynNo ratings yet

- January 2015: Wednesday Monday Tuesday SundayDocument2 pagesJanuary 2015: Wednesday Monday Tuesday SundayifyjoslynNo ratings yet

- Royal Mission - Donation Receipt PrintDocument1 pageRoyal Mission - Donation Receipt PrintifyjoslynNo ratings yet

- Donation Receipt - Cash DonationDocument1 pageDonation Receipt - Cash DonationifyjoslynNo ratings yet

- MHC Annual Report 2013 o WebDocument15 pagesMHC Annual Report 2013 o WebifyjoslynNo ratings yet

- Donation Receipt - Cash Donation 2Document1 pageDonation Receipt - Cash Donation 2ifyjoslynNo ratings yet

- Royal Mission - Donation Pledge LogDocument1 pageRoyal Mission - Donation Pledge LogifyjoslynNo ratings yet

- Donation Receipt Request FormDocument1 pageDonation Receipt Request FormifyjoslynNo ratings yet

- ILD Walk MS 2012 Fundraising Authorization LetterDocument1 pageILD Walk MS 2012 Fundraising Authorization LetterifyjoslynNo ratings yet

- Royal Mission - Church Attendance Dashboard TemplateDocument37 pagesRoyal Mission - Church Attendance Dashboard TemplateifyjoslynNo ratings yet

- Sample: Report On Church Attendance (Your Church Name, City, State) (Date of Report)Document1 pageSample: Report On Church Attendance (Your Church Name, City, State) (Date of Report)ifyjoslynNo ratings yet

- Church Attendance Form: Royal Mission International MinistriesDocument1 pageChurch Attendance Form: Royal Mission International MinistriesifyjoslynNo ratings yet

- Church CountDocument168 pagesChurch CountifyjoslynNo ratings yet

- Church Attendance Dashboard TemplateDocument27 pagesChurch Attendance Dashboard TemplateifyjoslynNo ratings yet

- Attendance RecordDocument5 pagesAttendance RecordBhupendraTyagiNo ratings yet

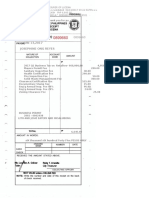

- Royal Mission - Cah VoucherDocument1 pageRoyal Mission - Cah VoucherifyjoslynNo ratings yet

- Royal Mission - Cah VoucherDocument1 pageRoyal Mission - Cah VoucherifyjoslynNo ratings yet

- Lesson 8 Strategic ManagementDocument7 pagesLesson 8 Strategic ManagementAira DerequitoNo ratings yet

- Re-Alignment of The Salary Structure For The Civil Service July 2012Document24 pagesRe-Alignment of The Salary Structure For The Civil Service July 2012Mzee KodiaNo ratings yet

- Creating Job Opportunities For UnemployedDocument4 pagesCreating Job Opportunities For UnemployedhadncsNo ratings yet

- Case 4 - LUX Resorts & HotelsDocument2 pagesCase 4 - LUX Resorts & HotelsRithika SehgalNo ratings yet

- Case Digest - Agoy vs. NLRCDocument1 pageCase Digest - Agoy vs. NLRCgraceNo ratings yet

- Training IssuesDocument22 pagesTraining Issuesdavino_ms50% (2)

- Couple CommunicationDocument16 pagesCouple CommunicationSerbanescu Beatrice100% (1)

- Income Under The Head SalaryDocument14 pagesIncome Under The Head SalaryTarun SinghalNo ratings yet

- Manish Soni - Offer LetterDocument2 pagesManish Soni - Offer LetterMd SharidNo ratings yet

- Case Studies in HboDocument8 pagesCase Studies in HboReyan ArintoNo ratings yet

- Labor Relations-Compilation of DoctrinesDocument69 pagesLabor Relations-Compilation of DoctrinesJose Dula IINo ratings yet

- How Economy GrowsDocument5 pagesHow Economy GrowsRia Ann Digo LubiganNo ratings yet

- Ch01 Introduction SDocument5 pagesCh01 Introduction Sa.mNo ratings yet

- Mactan Workers Union v. AboitizDocument1 pageMactan Workers Union v. AboitizNap GonzalesNo ratings yet

- San Miguel Corporation Employees Union Vs San Miguel Corporation, Magnolia CorporationDocument12 pagesSan Miguel Corporation Employees Union Vs San Miguel Corporation, Magnolia CorporationhotgirlsummerNo ratings yet

- Rais12 SM CH19Document29 pagesRais12 SM CH19Anton VitaliNo ratings yet

- Usdaw Activist 120Document2 pagesUsdaw Activist 120USDAWactivistNo ratings yet

- Shodhganga Case Study of HDFC Bank and Others P14-CHAPTER 5 - F-AL-QUALDocument48 pagesShodhganga Case Study of HDFC Bank and Others P14-CHAPTER 5 - F-AL-QUALBooNo ratings yet

- Stella CorrectionsDocument48 pagesStella CorrectionsWomayi SamsonNo ratings yet

- Hospital Managment Unit 2Document62 pagesHospital Managment Unit 2seemantham123No ratings yet

- HR Toolkit For Small and Medium Nonprofit Actors PDFDocument28 pagesHR Toolkit For Small and Medium Nonprofit Actors PDFsara elalfy100% (1)

- Unit 6 Topic 2 Communication For EmploymentDocument6 pagesUnit 6 Topic 2 Communication For EmploymentNoraimaNo ratings yet

- Departmental IzationDocument4 pagesDepartmental IzationGudiyaNo ratings yet

- Payroll SystemDocument30 pagesPayroll SystemAkmad Ali AbdulNo ratings yet

- Accident Investigation For SupervisorsDocument32 pagesAccident Investigation For SupervisorsGaurav SoodNo ratings yet

- A.M. Oreta & Co., Lnc. v. National Labor Relations CommissionDocument3 pagesA.M. Oreta & Co., Lnc. v. National Labor Relations CommissionAngelette BulacanNo ratings yet

- Ageing and Disability - Job Satisfaction Differentials Across Europe - ScienceDirectDocument2 pagesAgeing and Disability - Job Satisfaction Differentials Across Europe - ScienceDirectGerald NwekeNo ratings yet