Professional Documents

Culture Documents

Inter Met Trading Guidelines 2005

Inter Met Trading Guidelines 2005

Uploaded by

frshiwani0 ratings0% found this document useful (0 votes)

24 views13 pagesThe document outlines guidelines for internet trading in 2005, including:

1) Requiring internet trading service providers to submit details of their service and demonstrate their ability to comply with the guidelines before commencing service.

2) Specifying service requirements around ensuring confidentiality, integrity of the service, availability, identity verification, order allocation, and risk management.

3) Requiring service agreements that disclose risks and assess client suitability for internet trading.

4) Specifying security measures for data including encryption, firewalls, and automatic logoffs for inactivity.

Original Description:

Internet trading guide

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines guidelines for internet trading in 2005, including:

1) Requiring internet trading service providers to submit details of their service and demonstrate their ability to comply with the guidelines before commencing service.

2) Specifying service requirements around ensuring confidentiality, integrity of the service, availability, identity verification, order allocation, and risk management.

3) Requiring service agreements that disclose risks and assess client suitability for internet trading.

4) Specifying security measures for data including encryption, firewalls, and automatic logoffs for inactivity.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

24 views13 pagesInter Met Trading Guidelines 2005

Inter Met Trading Guidelines 2005

Uploaded by

frshiwaniThe document outlines guidelines for internet trading in 2005, including:

1) Requiring internet trading service providers to submit details of their service and demonstrate their ability to comply with the guidelines before commencing service.

2) Specifying service requirements around ensuring confidentiality, integrity of the service, availability, identity verification, order allocation, and risk management.

3) Requiring service agreements that disclose risks and assess client suitability for internet trading.

4) Specifying security measures for data including encryption, firewalls, and automatic logoffs for inactivity.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 13

INTERNET TRADING GUIDELINES, 2005

1. Short Title and Scope:-

(1). Theses Guidelines are called the Internet Trading Guidelines, 2005.

(2). The scope of the Guidelines extends to all trading service providers. The

Guidelines shall not apply to proprietary trade networks or private trading

networks operated between Stock or Commodity Exchange and its

members.

2. Definitions:-

(1). In these Guidelines, unless there is anything repugnant in the subject or

context,

(a). Advanced Electronic Signature has the same meaning as given in

section 2(1)(e) of the Electronic Transaction Ordinance, 2002.

(b). Broker means any broker registered with the Commission under Broker

and Agents Registration Rules, 2001 or under the Commodity Exchange

and Future Contracts Rules, 2004;

(c). Commission has the same meaning as given in section 2(2)(g) of the

Securities and Exchange Commission of Pakistan Act, 1997;

(d). Commodity Exchange has the same meaning as given in section

2(1)(cc) of the Securities & Exchange Ordinance, 1969;

(e). Electronic Signature has the same meaning as given in section 2(1)(n) of

the Electronic Transaction Ordinance, 2002;

(f). Internet trading service provider means any person offering trading

service in securities through the internet under these Guidelines;

(g). person has the same meaning as given in section 2(1)(j) of the Securities

and Exchange Ordinance, 1969;

(h). Securities or Security has the same meaning as given in section 2(1)(1)

of the Securities and Exchange Ordinance, 1969;

(i). Stock or Commodity Exchange means:

(i). any Stock Exchange defined under section 2(1)(m) of the

Securities and Exchange Ordinance, 1969;

(ii). any Commodity Exchange defined under clause 2(1)(cc) of

the Securities and Exchange Ordinance, 1969; and

(2). All other words and expression used but not defined in these Guidelines

shall have the same meaning as are assigned to them in the Companies

Ordinance, 1984 (XLVII of 1984), the Securities and Exchange

Ordinance, 1969 (XVII of 1969) and the Securities and Exchange

Commission of Pakistan Act, 1997 (XLII of 1997).

3. Commencement of Service:-

(1). Prior to commencement of service every internet trading service provider

shall submit details to the Commission of the service to be provided.

(2). Prior to commencement of service every internet trading service provider

shall demonstrate its ability to provide the service under these Guidelines.

(3). Prior to commencement every internet trading service provider shall have

the system, control and procedures of the internet trading service audited

independently by an audited firm approved by the Commission.

(4). All existing internet trading service providers shall comply with these

Guidelines within six weeks of the date of issue of these Guidelines.

4. Service Requirement:-

Every internet trading service provider shall ensure that satisfactory arrangements

are in place to:

(1). Ensure confidentiality of information in such a way that information is

only accessible to an authorized person or system; and in particular that

satisfactory measures are in place to prevent:

(a). unwanted disclosure of inter alia personal data, transactions,

activity and presence on the internet;

(b). misappropriation of IDs;

(c). impersonation, leading to unauthorized (illegal) transactions;

(d). unauthorized usage and inability to detect such malpractice in a

timely fashion and/or identify the perpetrator;

(e). attack from third parties designed to interrupt the service or aimed

at the service becoming an agent for an attack against another

website;

(f). analysis of data by unauthorized third parties.

(2). Safeguard the integrity of the service including control to prevent:

(a). non-compliance with laws, rules, regulations and Guidelines issued

by the Commission, leading to illegal transactions, fraud or

malpractice;

(b). presentation of incorrect data, whether unintentionally or

malevolently;

(c). false presentation, or the use of incomplete information for

transactions;

(d). manipulation of data;

(e). viruses, leading to inter alia loss of data, unauthorized access to or

manipulation of data, unavailability or threat of unavailability of

system;

(f). cyber extortion, selling or provision of data stolen from (or

illegally obtained from) service providers.

(3). Ensure the availability of the service in the event that:

(a). the site is not reachable, and that there is no possibility to trade, or

to get or give information; or

(b). that parts of the site are not reachable either through a denial of

service attack or lack of capacity; or

(c). that the provider of the service is unable to give timely access to

the site or parts of the site.

(4). Ensure that satisfactory alternative arrangements and contingency plans

are in place to ensure that business can continue in the event of a large

scale disruption (Disaster Recovery Planning/Business Continuity

Planning);

(5). Ensure that identity of the person or system accessing the service is

properly verified by the use of PINs, passwords, electronic signatures or

such other approved mechanism so as to exclude unauthorized access;

(6). Ensure the satisfactory arrangement are in place so that a broker can at all

times uniquely identity each and every order during the different stages of

processing;

(7). Ensure that orders placed through its system are fairly allocated in

accordance with the rules of the relevant Stock or Commodity Exchange;

(8). Ensure that there is an effective audited trial to address risks arising from:

(a). the opening, modification or closing of a client account;

(b). any transaction with significant financial consequences;

(c). any authorization granted to a customer to exceed a limit;

(d). any granting, modification or revocation of systems access rights

or privileges.

5. Service Agreement/Arrangement:-

Every internet trading service provider shall,

(a). have an agreement with clients to whom it offers an internet

trading service that contains appropriate and prominent risk

disclosures highlighting the risks associated with internet

transactions;

(b). have appropriate arrangements in place to assess a clients

suitability to undertake securities transactions via the internet;

(c). have appropriate arrangements in place to approve a clients

account for day trading;

(d). have adequate risk management systems for controlling exposure

to internet clients and in particular for monitoring margin trading;

(e). have an adequate number of suitability qualified staff to control

and monitor transactions and render clients services in accordance

with the rules and Guidelines;

(f). either have suitably qualified staff to operate and maintain the

system used for internet trading services or have an irrevocable

agreement with a suitably qualified third party service provider for

the operation and maintenance of those systems;

(g). be responsible for settlement of each and every trade executed

through the internet trading service.

6. Requirements by the Exchange:-

A Stock or Commodity Exchange may specify its own requirements, in addition

to these Guidelines, for allowing an internet trading service provider to continue

its business.

7. Client Identity:-

Every internet trading service provider shall submit to the Commission the details

as to how it will satisfy itself as to the true identity of a person opening an account

and what measures it intends to take to ensure that the account will be maintained

and operated by the person opening the account.

8. Security of Data:-

(1). To reduce the risk of third party interception of information sent between a

clients computer and the system of an internet trading service provider, every

internet trading service provider is required to use some form of encryption.

(a). The encryption shall apply only to orders being entered but to any

communication with clients that contains confidential information.

(b). Every internet trading service provider is also required to use a

firewall to prevent intrusions by unauthorized persons (e.g., a

cracker or hacker, who may obtain unauthorized access to a

computer system by bypassing passwords or otherwise breaching

computer security).

(c). Every internet trading service provider shall ensure that its system

shall be configurable to allow auto-logoff in case of inactivity of

the trading terminal and the trading website.

(d). Every internet trading service provider shall demonstrate that they

have in place a written security policy based on or containing these

Guidelines as part of their security policy.

9. Operational Capacity :-

Every internet trading service provider shall ensure that its operational capacity is

re-evaluated at regular intervals and every internet trading service provider shall

give the Commission details of the procedures for undertaking such an evaluation,

the time at which such an evaluation will be undertaken, and a copy of the results

of such evaluation.

10. System Modification:-

Every internet trading service provider is required to submit to the Commission,

in advance, with information relating to any significant changes to its system or

any changes to the functionality of its system identifying the areas and the reasons

for the change.

11. Periodic Audit:-

(1). Every internet trading service provider shall ensure that its system, control

and procedures are audited independently by an audited firm approved by

the Commission once every financial year

.

(2). Every internet trading service provider shall submit report of the auditor to

the Commission within four months of the date of the close of its financial

year.

12. Customer Information:-

(1). Every internet trading service provider shall ensure that its system shall

provide the following information in plain English or Urdu language and

in an easily accessible form:

(a). a basic explanation of securities trading; including definitions of

common terms used on the trading screen;

(b). a general statement and information regarding the manner in which

orders are accepted, processed, settled and cleared via the internet;

(c). disclosure about the risk of securities trading, including the risk of

systems outages and failure and any alternative means of placing

orders;

(d). disclosure about the risk involved in trading securities in a margin

account;

(e). procedure to cancel pending orders during a system failure;

(f). a glossary explaining key investment terms and concepts such as;

(i). the difference between the various types of orders that may

be placed (e.g., a market order, a limit order);

(ii). notice that a market order may be executed at a price higher

or lower than the quote displayed on the website at the time

of order entry;

(iii). An explanation of how the customers orders are executed;

(iv). Any situation in which customers may not receive an

execution;

(v). any restriction on the types of orders that customers can

place; and

(vi). How market volatility can affect customers order.

(g). the rules and Guidelines affecting inter alia client broker

relationship, arbitration rules, investor protection rules.

(h). a hyperlink to the website/page on the website of the relevant

Stock pr Commodity Exchange displaying rules/Guidelines

/Circulars; and

(i). a Terms of Use policy document which includes proper and fair

disclaimers.

(2). Every internet trading service provider shall ensure that its

ticker/quote/order book displayed will display the time stamp as well as

the source of such information against the given information.

13. Duplicate Orders:-

Every internet trading service provider is required to ensure that its system has

mechanism to prevent execution of unintended duplicate orders.

14. Independent Assessment:-

The Commission may employ technical experts to undertake an independent

assessment of the operational capacity and security of a system.

15. Orders/Trade Confirmation:-

(1). Every internet trading service provider shall ensure the trade

confirmations and contract notes are sent to the client. Subject to the rules and

regulations of the Stock or Commodity Exchange, these may be sent by email on

condition that the broker:

(a). notifies the Stock or Commodity Exchange concerned of the

intention to use of electronic trade confirmations and/or contract

notes one month in advance; and

(b). obtain prior written consent from the clients concerned.

(2). Every internet trading service provider shall ensure that any trade

confirmations and/or contracts notes sent by email shall be digitally signed

by the Electronic Signature or Advanced Electronic Signature.

16. Outstanding:-

(1). Every internet trading service provider considering entering into

outstanding arrangements with a third party supplier of internet trade

services shall ensure that they cannot contract out of their core functions

and regulatory obligations.

(2). Every internet trading service provider when negotiating an outsourcing

arrangement may, inter alia, consider the following:

(a). notification and reporting requirements;

(b). intellectual property and information ownership rights,

confidentiality agreement and Chinese Walls;

(c). the need for, and adequacy of, any guarantees or indemnities;

(d). compliance with the internet trading service providers own

policies, for example on information security;

(e). arrangements to ensure business continuity and the extent to which

facilities that provide the outsourcing are or are not available to

provide business continuity for third parties;

(f). approval process for changes to outsourcing arrangements; and

(g). agreed conditions for terminating outsourcing arrangements.

(3). Every internet trading service provider entering into outsourcing

arrangements with a supplier of internet trading services shall enter into a

service level agreement that include:

(h). qualitative and quantitative performance target

(i). evaluation of performance, for example by third parties, internal

audited, self certification; and

(j). remedial action and escalation process for dealing with inadequate

performance.

(4). Every internet trade service provider that enters into an outsourcing

arrangements with a supplier of internet trading services shall have

appropriate contingency arrangements in place in the event that the

supplier of the service is unable to continue to provide service.

17. Monthly Reporting:-

Every internet trading service provider shall provide monthly reports to the

Commission on the reliability of the service. These reports must show:

(a). number of users of the system as at the end of he month:

(i). for Stock or Commodity Exchanges this is umber of brokers;

(ii). for brokers this is the number of clients.

(b). daily average number of transactions (of all types) processed by the

system during the month and the highest number of transactions processed

by the system on a single day during the month;

(c). percentage of the schedule time for availability for which the service was

not available, and

(d). reason for non-availability.

18. Dispute Resolution:-

In case of any dispute arising between Broker and Broker, and Broker and Client,

the matter will be resolved in accordance with the existing procedures of

arbitration and dispute resolution of the Stock or Commodity Exchange.

19. Cooperation with Commission:-

(1). To assist the Commission in investigating instances of suspected market

abuses such as insider trading and market manipulation, internet trading

service providers shall provide full and prompt responses to all requests

for information by the Commission.

(2). Every internet trading service provider shall ensure that information

displayed on its website is kept in an accessible form for a minimum of

twelve months.

Guidance Notes:

Clause Guidance Note

1 Scope The scope of the Guidelines extends to trading

through the internet. The Guidelines do not apply to

proprietary trading networks or private trading

networks operated between an exchange and its

members. However, the Guidelines do apply if that

trading service internet based and extends beyond the

member to clients of the member. If in doubt,

exchanges and /or their members should consult with

the Commission.

3 (1) Prior to commencement of

service every internet trading

service provider shall submit

details to the Commission of

the service to be provided.

Internet trading service providers are required to

provide details of the service to be offered and must

demonstrate compliance with the Guidelines. The

Commission will not prescribe what systems should

be implemented for internet trading as this would

tend to stifle innovation. Instead, the Commission

will satisfy itself that the systems to be used have

adequate controls and procedures in place to ensure

confidentiality of information, integrity and

availability of the service; together with contingency

plans in the event of a loss of service.

Internet trading service providers should state details

and/or examples of how the internet trading service

provider is ensuring confidentiality of information;

how the internet trading service provider is

safeguarding the integrity of the service; what plans

the internet trading service provider has for enabling

clients to trade to trade in the event of the temporary

loss of service; what plans the internet trading service

provider has for coping with a disaster scenario such

as loss of premises hosting the service etc.

3 (3) Prior to commencement every

internet trading service

provider shall have the

systems, controls and

procedures of the internet

trading service audited

independently by an audit firm

approved by the Commission

The audit of internet trading service providers

systems, controls and procedures must be conducted

by a firm drawn from a panel selected by the

Commission.

4 (2) (a) presentation of incorrect

data, whether unintentionally

or malevolently;

Concern has been expressed that delayed data might

be interpreted as inaccurate or false data. The

Commission will not take this view where data has

(b) false presentation, or the

use of incomplete information

for transactions;

been delayed due to exceptional circumstances.

However, the Commission will expect internet

trading service providers to be responsible for

timeliness of distribution of data from its central

systems and Commission will in particular want

internet trading service providers demonstrate that all

clients accessing the systems are treated fairly and

equally depending upon their method of access.

4 (2) (e) viruses, leading to inter

alia loss of data, unauthorized

access to or manipulation of

data, unavailability or threat of

unavailability of systems;

The Commission will expect internet trading service

providers to have effective anti-virus software in

place and that this will be updated in accordance with

the manufactures recommendations.

4 (3) Ensure the availability of the

service in the event that:

(a) the site is not

reachable, and that

there is no possibility

to trade, or to get or

give information; or

(b) that parts of the site

are not reachable

either through a

denial of service

attack or lack of

capacity; or

(c) that the provider of

the service is unable

to give timely access

to the site or parts of

the site.

The Commission will wish to see from the internet

trading service provider what arrangements are in

place for the temporary interruption in the service

either because the site cannot be reached or that parts

of the site cannot be reached or that there is a

degradation in timeliness of access to the site or parts

of the site.

This could be a dedicated telephone help desk or

other means of accepting orders from clients.

What is not acceptable is that the internet trading

service provider does not have alternative

arrangements in place.

The Commission will want to be satisfied that

alternative arrangement are in place and that these

have been notified to clients in advance.

5 (a)

and

5 (b)

Have an agreement with

clients to whom it offers an

internet trading service that

contains appropriate and

prominent risk disclosures

highlighting the risks

associated with internet

transactions;

have appropriate arrangements

in place to assess a clients

suitability to undertake

securities transaction via the

internet;

Brokers will be expected to have separate client

agreement letters for those clients to whom it offers

an internet trading service.

With online trading comes the increased popularity of

day trading which can pose unique investor

protection concerns. Individuals engaging in day

trading activities often trade their accounts

aggressively. However, the ability to engage

effectively in day trading requires not only sufficient

capital but also a sophisticated understanding of

securities markets and trading techniques. Such

investors should be made aware that the risk of loss

of capital can be very high.

5 (e) have an adequate number of The number and qualifications of the staff will vary

suitably qualified staff to

control and monitor

transactions and render clients

services in accordance with the

rules and Guidelines;

according to the service being offered but clearly

there must be staff employed or contracted on a

permanent basis who have the business and technical

skills to be able to operate the service on behalf of the

internet trading service provider. This would include

staff who will provide emergency cover and

assistance in the event of a temporary interruption in

the normal service.

8(1) (a) The encryption should

apply not only to orders being

entered but to any

communication with clients

that contains confidential

information.

Encryption should be such that it is designed to

prevent unauthorized interception of the information

by a third party during transmission using an

encryption and electronic signature system that

ensure the authenticity, integrity and confidentiality

of the information sent.

9 Every internet trading service

provider shall ensure that its

operational capacity is

reevaluated at regular intervals

and every internet trading

service provider shall give the

Commission details of the

procedures for undertaking

such an evaluation, the time at

which such an evaluation will

be undertaken, and a copy of

the results of such evaluation.

The frequency of evaluation of operational capacity

will depend upon a number of factors including the

growth rate of the service being provided by the

internet trading services provider. If growth is rising

faster than all expectations, operational capacity must

the re-evaluated more frequently to ensure that the

service can meet future growth. At minimum

however, operational capacity should be reviewed on

at least an annual basis.

10 Every internet trading service

provider is required to submit

to the Commission, in

advance, with information

relation to any significant

changes to its systems or any

changes to the functionality of

its systems identifying the

areas and the reasons for the

change.

Rectification of software defects or minor

modifications to systems and software need not be

notified but any major upgrades to systems and

changes to the functionality of a system should be

notified to the Commission in advance.

13 Every internet trading service

provider is required to ensure that its

system has mechanisms to prevent

executions of unintended duplicate

orders

Duplicate orders can happen when reports of fills or

order cancellations are significantly delayed ( by

hours or even days) so that a customer may assume

that his/her initial order was not executed. Duplicate

orders have resulted in customers placing unintended

short sales or buying beyond their available funds.

Mechanisms to eliminate duplicate orders may

include ( but are not limited to):

(i) the provision of trading status screens that

provide information as to whether an

order has been filled or is still pending;

(ii) a lock on the securities, funds, or

buying power subject to a sell or buy

request, which is not removed until

confirmation of the cancellation is

received from the marketplace;

(iii) automatic notification to investors of an

order pending in the same security

whenever they enter a new buy or sell

order.

You might also like

- Learn How to Earn with Cryptocurrency TradingFrom EverandLearn How to Earn with Cryptocurrency TradingRating: 3.5 out of 5 stars3.5/5 (3)

- Aml KycDocument6 pagesAml KycChristopher Berlandier100% (2)

- Security Testing Handbook for Banking ApplicationsFrom EverandSecurity Testing Handbook for Banking ApplicationsRating: 5 out of 5 stars5/5 (1)

- Opl 3 DatabaseDocument19 pagesOpl 3 Databasedeep_sorari7No ratings yet

- Annex 1 - E-Money (Transtech)Document4 pagesAnnex 1 - E-Money (Transtech)Sarah Jean CaneteNo ratings yet

- Annexure A' Proposed Framework For Securities Trading Using Wireless TechnologyDocument6 pagesAnnexure A' Proposed Framework For Securities Trading Using Wireless TechnologyShivapuje Gurusiddappa BhyreshNo ratings yet

- Terms and CondistionsDocument29 pagesTerms and Condistionsmoniquebateman20No ratings yet

- BSP Circular No. 1166 S. 2023Document26 pagesBSP Circular No. 1166 S. 2023Bernadette Kaye DumaNo ratings yet

- SE-00005-2011-Technical Requirements For Securities Exchange MemberDocument5 pagesSE-00005-2011-Technical Requirements For Securities Exchange MemberReagen Lodeweijke MokodompitNo ratings yet

- Internet Banking Laws in IndiaDocument7 pagesInternet Banking Laws in Indiamadhav225No ratings yet

- Terms of Reference FORDocument17 pagesTerms of Reference FORNader MehdawiNo ratings yet

- Rules Cyber CafeDocument5 pagesRules Cyber Cafenik.narenNo ratings yet

- GATEWAY AGREEMENT Updating DocsDocument11 pagesGATEWAY AGREEMENT Updating DocsFitsum DojuNo ratings yet

- Browsing Centre Regulation Rules and ApplicationDocument11 pagesBrowsing Centre Regulation Rules and ApplicationThanigesan MahalingamNo ratings yet

- Celex 32018R0389 en TXTDocument21 pagesCelex 32018R0389 en TXTKurt RadlerNo ratings yet

- Letter 2Document7 pagesLetter 2NitinNo ratings yet

- Legal-Guidelines ISPDocument7 pagesLegal-Guidelines ISPPeter DokpesiNo ratings yet

- Draft Monitoring and Reconciliation of Telephony Traffic Regulations, 2009Document5 pagesDraft Monitoring and Reconciliation of Telephony Traffic Regulations, 2009simply.ravianNo ratings yet

- 701 Electronic Banking ServicesDocument5 pages701 Electronic Banking ServicesHiraeth WeltschmerzNo ratings yet

- Terms and Conditions of Wexopay Cryptocurrency Services: 1. Basic ProvisionsDocument5 pagesTerms and Conditions of Wexopay Cryptocurrency Services: 1. Basic ProvisionsClaudioNo ratings yet

- Systems Integrator AgreementDocument45 pagesSystems Integrator AgreementShatarupaa RupaNo ratings yet

- Information Technology Law "Cyber Law": Assignment ON Topic-"Document9 pagesInformation Technology Law "Cyber Law": Assignment ON Topic-"sandybhai1No ratings yet

- Cyber Security and Cyber Resilience Framework of Stock Exchanges, Clearing Corporation and DepositoriesDocument10 pagesCyber Security and Cyber Resilience Framework of Stock Exchanges, Clearing Corporation and DepositoriesShyam SunderNo ratings yet

- Internal Controls For Clearing and Trading MembersDocument4 pagesInternal Controls For Clearing and Trading MembersJoshuaNo ratings yet

- ( - The Gazette of Extraordinary: P II S 3 (I) )Document5 pages( - The Gazette of Extraordinary: P II S 3 (I) )Add KNo ratings yet

- SEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Document5 pagesSEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Diya PandeNo ratings yet

- Guidelines On Insurance E-CommerceDocument18 pagesGuidelines On Insurance E-CommerceJeetSoniNo ratings yet

- Cirmrd 25Document2 pagesCirmrd 25sunnybhuNo ratings yet

- General ConditionDocument10 pagesGeneral Conditionrabia.jamilNo ratings yet

- Information Technology Act 2000: Submitted ToDocument27 pagesInformation Technology Act 2000: Submitted ToAnupama GoswamiNo ratings yet

- E-Wallet Security Controls 1.0Document5 pagesE-Wallet Security Controls 1.0SadeNo ratings yet

- Spectre Dapp Terms v13Document19 pagesSpectre Dapp Terms v13Surya BirdnestNo ratings yet

- Terms of Use - SPS - 0.0.1 - enDocument5 pagesTerms of Use - SPS - 0.0.1 - enAbiy MulugetaNo ratings yet

- Terms and ConditionsDocument17 pagesTerms and Conditionsnishantkataria206No ratings yet

- TermsandConditionsI ExDocument6 pagesTermsandConditionsI ExandymyenyNo ratings yet

- Guideline For Automated Teller Machine (ATM) and Point of Sale (PoS), 2020 FinalDocument18 pagesGuideline For Automated Teller Machine (ATM) and Point of Sale (PoS), 2020 FinalgizataynayeNo ratings yet

- Permohonan HasilDocument8 pagesPermohonan HasilSujanaNo ratings yet

- TermsDocument8 pagesTermschannel bengkulu Bengkulu IndonesiaNo ratings yet

- Regulation 80-2019Document9 pagesRegulation 80-2019YohanNo ratings yet

- 1668419557536 (2)Document9 pages1668419557536 (2)Jom JeanNo ratings yet

- Terms of Reference (TOR) For Selection of Consulting Audit Firm For Conducting Information Systems Audit of Banglalink Digital Communications LTD PDFDocument5 pagesTerms of Reference (TOR) For Selection of Consulting Audit Firm For Conducting Information Systems Audit of Banglalink Digital Communications LTD PDFফয়সাল হোসেনNo ratings yet

- Advisory - Aug18 ATMDocument2 pagesAdvisory - Aug18 ATMBhavani BhushanNo ratings yet

- AIP DRAFT CAO Draft Submitted V.5 3 15 2017Document9 pagesAIP DRAFT CAO Draft Submitted V.5 3 15 2017Adrian PerezNo ratings yet

- Information Security Assignment 2Document8 pagesInformation Security Assignment 2Tshireletso PhuthiNo ratings yet

- Central Depositories Licensing and Operations Regulations 2016 PDFDocument50 pagesCentral Depositories Licensing and Operations Regulations 2016 PDFasadNo ratings yet

- Terms of UseDocument6 pagesTerms of UseArdian SaputraNo ratings yet

- Objectives of The IT Act 2000: Name: Darshan S Rawal Code: CS801 PRN: 2001106055 Sub:Cyber CrimeDocument5 pagesObjectives of The IT Act 2000: Name: Darshan S Rawal Code: CS801 PRN: 2001106055 Sub:Cyber CrimeDarshan RawalNo ratings yet

- Chairman Persatuan Pengendali Internet Malaysia (Myix)Document10 pagesChairman Persatuan Pengendali Internet Malaysia (Myix)Raven RajNo ratings yet

- Companies Act 2013 Cs Vinit Nagar 1Document22 pagesCompanies Act 2013 Cs Vinit Nagar 1gayathris111No ratings yet

- Master Direction On Digital Payment Security ControlsDocument10 pagesMaster Direction On Digital Payment Security Controlsgolfclashpd1No ratings yet

- UntitledDocument14 pagesUntitledБаро АбуискандерNo ratings yet

- Regulatory Framework For The Accreditation of Gaming SystemDocument8 pagesRegulatory Framework For The Accreditation of Gaming SystemBobby Olavides SebastianNo ratings yet

- Malta MGA Fact Sheets 2018 1Document27 pagesMalta MGA Fact Sheets 2018 1CarlosMacedoDasNevesNo ratings yet

- Annex-I Guidelines On Internet Banking Facility To Customers of Cooperative BanksDocument4 pagesAnnex-I Guidelines On Internet Banking Facility To Customers of Cooperative BanksAditi SoniNo ratings yet

- Postal Ballot Regulations 2018 Latest Amended VersionDocument16 pagesPostal Ballot Regulations 2018 Latest Amended Versioniqbalfawad66No ratings yet

- VASP Checklist Hong KongDocument6 pagesVASP Checklist Hong KongVisakh AntonyNo ratings yet

- QP - Vendor Registration T&CDocument3 pagesQP - Vendor Registration T&CRammeshwar D GuptaNo ratings yet

- CIL Manual For E-Procurement of Works & ServicesDocument51 pagesCIL Manual For E-Procurement of Works & ServicesNehal AhmedNo ratings yet

- Marking Guidelines 26 September 2023Document4 pagesMarking Guidelines 26 September 2023Frédé AmouNo ratings yet

- Rules For Upload October 2019 - FinalDocument19 pagesRules For Upload October 2019 - FinalMalone KyneNo ratings yet

- Surveying Lab 2.0Document41 pagesSurveying Lab 2.0omay12No ratings yet

- 2012 Behringer Catalog en v1Document45 pages2012 Behringer Catalog en v1Kang AmorNo ratings yet

- Allegheny 316 PDFDocument13 pagesAllegheny 316 PDFJoshua WalkerNo ratings yet

- Wago-I/O-System 750: ManualDocument46 pagesWago-I/O-System 750: ManualHaris bayu kurniawanNo ratings yet

- Archimedes: Leon Kalashnikov 6-1Document3 pagesArchimedes: Leon Kalashnikov 6-1LeoNo ratings yet

- Hazel Facilities & SRS Use Agreement (Execution) 57909382 - 8Document22 pagesHazel Facilities & SRS Use Agreement (Execution) 57909382 - 8antopaul2No ratings yet

- Bombardier Data SheetDocument4 pagesBombardier Data SheetLalu Giat AjahNo ratings yet

- Chemical HazardsDocument17 pagesChemical HazardsLloydy HemsworthNo ratings yet

- Opium 160604163652Document14 pagesOpium 160604163652roberto cabungcagNo ratings yet

- Nurse Sarah QuizzesDocument39 pagesNurse Sarah QuizzesAYANAMI T PASCUANo ratings yet

- PG To Metric Conversion TableDocument1 pagePG To Metric Conversion TableKyaw La Pyi Wunn0% (1)

- Dav Gandhinagar Holiday HomeworkDocument8 pagesDav Gandhinagar Holiday Homeworkafodfexskdfrxb100% (1)

- BKM Chapter 9Document4 pagesBKM Chapter 9Ana Nives RadovićNo ratings yet

- CHAPTER 10 With Answer KeyDocument2 pagesCHAPTER 10 With Answer KeyAngela PaduaNo ratings yet

- Microbiology Identification PDFDocument31 pagesMicrobiology Identification PDFAntony Barzola GaldosNo ratings yet

- Li ReportDocument47 pagesLi ReportRizal RizalmanNo ratings yet

- Parent-Teacher Relationships and The Effect On Student SuccessDocument19 pagesParent-Teacher Relationships and The Effect On Student SuccessCzarina CastilloNo ratings yet

- 1 StatDocument30 pages1 StatbutardoandreanicoleNo ratings yet

- Reading and Writing TOS With ExamDocument2 pagesReading and Writing TOS With Examjoy grace jaraNo ratings yet

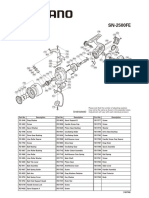

- 16SN2500FEDocument1 page16SN2500FEGergely IvánovicsNo ratings yet

- Nature of BusinessDocument4 pagesNature of BusinessLeslie Ann IgnacioNo ratings yet

- ASPECDocument7 pagesASPECMickaela Kassandra P. ParanNo ratings yet

- Getting To Grips With FDADocument84 pagesGetting To Grips With FDATanishq VashisthNo ratings yet

- L36GL Data Sheet PDFDocument2 pagesL36GL Data Sheet PDFManuel ValdiviesoNo ratings yet

- Mankind and Mother Earth - A Narrative History of The World (PDFDrive)Document680 pagesMankind and Mother Earth - A Narrative History of The World (PDFDrive)Naveen RNo ratings yet

- Accounting Group AssignmentDocument2 pagesAccounting Group AssignmentEmbassy and NGO jobsNo ratings yet

- Pneumatic Micro Die Grinder: Operation & Parts ManualDocument12 pagesPneumatic Micro Die Grinder: Operation & Parts ManualHeli CarlosNo ratings yet

- HSEC-B-09: Group Standard H3 - Manual Tasks and Workplace Ergonomics ManagementDocument3 pagesHSEC-B-09: Group Standard H3 - Manual Tasks and Workplace Ergonomics ManagementJohn KalvinNo ratings yet

- Iota PDFDocument6 pagesIota PDFariniNo ratings yet