Professional Documents

Culture Documents

Facebook Q3 2014 Earnings

Facebook Q3 2014 Earnings

Uploaded by

WanHeöOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Facebook Q3 2014 Earnings

Facebook Q3 2014 Earnings

Uploaded by

WanHeöCopyright:

Available Formats

Quarterly Earnings Slides

Q3 2014

Non-GAAP Measures

In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These

non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance

prepared in accordance with U.S. GAAP. A reconciliation of non-GAAP financial measures to the corresponding

GAAP measures is provided in the appendix to this presentation.

2

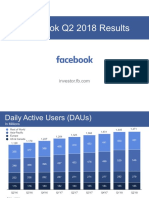

132 135 139 142 144 147 150 152 155

160

169

179

182

188

195

203

206

212

141

153

167

181

189

200

216

228

242

152

161

180

195

208

216

233

244

256

584

618

665

699

728

757

802

829

864

Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

3

Daily Active Users (DAUs)

DAUs / MAUs

Q3'12 Q4'12 Q1'13 Q2'13 Q313 Q4'13 Q1'14 Q2'14 Q3'14

58% 59% 60% 61% 61% 62% 63% 63% 64%

Rest of World

Asia

Europe

US & Canada

Please see Facebook's most recent quarterly or annual report filed with the SEC for definitions of user activity used to determine the number of our DAUs, mobile

DAUs, MAUs, and mobile MAUs. The number of DAUs, mobile DAUs, MAUs, and mobile MAUs do not include Instagram users unless they would otherwise qualify

as such users, respectively, based on their other activities on Facebook.

In Millions

4

Mobile Daily Active Users (Mobile DAUs)

In Millions

329

374

425

469

507

556

609

654

703

Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Please see Facebook's most recent quarterly or annual report filed with the SEC for definitions of user activity used to determine the number of our DAUs, mobile

DAUs, MAUs, and mobile MAUs. The number of DAUs, mobile DAUs, MAUs, and mobile MAUs do not include Instagram users unless they would otherwise qualify

as such users, respectively, based on their other activities on Facebook.

189 193 195 198 199 201 202 204 206

253

261

269

272 276

282

289 292 296

277

298

319

339

351

368

390

410

426

288

304

327

346

362

376

395

411

423

1,007

1,056

1,110

1,155

1,189

1,228

1,276

1,317

1,350

Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

5

Monthly Active Users (MAUs)

In Millions

Rest of World

Asia

Europe

US & Canada

Please see Facebook's most recent quarterly or annual report filed with the SEC for definitions of user activity used to determine the number of our DAUs, mobile

DAUs, MAUs, and mobile MAUs. The number of DAUs, mobile DAUs, MAUs, and mobile MAUs do not include Instagram users unless they would otherwise qualify

as such users, respectively, based on their other activities on Facebook.

6

Mobile Monthly Active Users (Mobile MAUs)

In Millions

604

680

751

819

874

945

1,008

1,070

1,124

Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Please see Facebook's most recent quarterly or annual report filed with the SEC for definitions of user activity used to determine the number of our DAUs, mobile

DAUs, MAUs, and mobile MAUs. The number of DAUs, mobile DAUs, MAUs, and mobile MAUs do not include Instagram users unless they would otherwise qualify

as such users, respectively, based on their other activities on Facebook.

7

Mobile-Only Monthly Active Users (Mobile-Only MAUs)

In Millions

254

296

341

399

456

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Mobile-only MAUs are defined as users who accessed Facebook solely through mobile apps or mobile versions of our website, or used our Messenger app, in the

last 30 days of the given quarter. The number of mobile-only MAUs do not include Instagram users unless they would otherwise qualify as such users based on

their other activities on Facebook.

$1,086

$1,329

$1,245

$1,599

$1,798

$2,344

$2,265

$2,676

$2,957

$176

$256

$213

$214

$218

$241

$237

$234

$246

$1,262

$1,585

$1,458

$1,813

$2,016

$2,585

$2,502

$2,910

$3,203

Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Payments and other fees

Advertising

Revenue

In Millions

8

*In the fourth quarter of 2012 we recognized revenue from four months of Payments transactions for accounting reasons detailed on pages 47 and 48 of our

Form 10-K filed on February 1, 2013.

*

$637

$780

$679

$848

$962

$1,206

$1,179

$1,308

$1,514

$341

$440

$423

$505

$538

$727

$698

$824

$844

$154

$198

$197

$247

$278

$341

$354

$431

$492

$130

$167

$159

$213

$238

$311

$271

$347

$353

$1,262

$1,585

$1,458

$1,813

$2,016

$2,585

$2,502

$2,910

$3,203

Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Rest of World

Asia

Europe

US & Canada

9

Revenue by User Geography

Revenue by user geography is geographically apportioned based on our estimation of the geographic location of our users when they perform a revenue-

generating activity. This allocation differs from our revenue by geography disclosure in our consolidated financial statements where revenue is geographically

apportioned based on the location of the marketer or developer.

In Millions

Rest of World

Asia

Europe

US & Canada

10

Advertising Revenue by User Geography

Revenue by user geography is geographically apportioned based on our estimation of the geographic location of our users when they perform a revenue-

generating activity. This allocation differs from our revenue by geography disclosure in our consolidated financial statements where revenue is geographically

apportioned based on the location of the marketer or developer.

$538

$631

$552

$721

$832

$1,068

$1,039

$1,175

$1,362 $295

$374

$367

$451

$482

$658

$631

$757

$783

$133

$168

$176

$225

$255

$318

$333

$408

$469

$120

$156

$150

$202

$229

$300

$262

$336

$343

$1,086

$1,329

$1,245

$1,599

$1,798

$2,344

$2,265

$2,676

$2,957

Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

In Millions

Rest of World

Asia

Europe

US & Canada

$99

$149

$127 $127

$130

$138 $140

$133

$152

$46

$66

$56

$54

$56

$69 $67

$67

$61

$21

$30

$21

$22

$23

$23 $21

$23

$23

$10

$11

$9

$11

$9

$11

$9

$11

$10

$176

$256

$213

$214

$218

$241

$237

$234

$246

Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

11

Payments & Other Fees Revenue by User Geography

Revenue by user geography is geographically apportioned based on our estimation of the geographic location of our users when they perform a

revenue-generating activity. This allocation differs from our revenue by geography disclosure in our consolidated financial statements where

revenue is geographically apportioned based on the location of the marketer or developer.

*In the fourth quarter of 2012 we recognized revenue from four months of Payments transactions for accounting reasons detailed on pages 47

and 48 of our Form 10-K filed on February 1, 2013.

In Millions

*

12

Average Revenue per User (ARPU)

$1.76

$2.36

$2.21

$2.61

$2.66

$0.20

$0.25

$0.23

$0.23

$0.21

$1.96

$2.61

$2.44

$2.84

$2.87

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Europe

$0.74

$0.88 $0.88

$1.02

$1.12

$0.07

$0.06 $0.06

$0.06

$0.06

$0.81

$0.95 $0.93

$1.08

$1.18

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Asia

Revenue by user geography is geographically apportioned based on our estimation of the geographic location of our users when they perform

a revenue-generating activity. This allocation differs from our revenue by geography disclosure in our consolidated financial statements where revenue is

geographically apportioned based on the location of the marketer or developer. Please see Facebooks most recent quarterly or annual report filed with the

SEC for the definition of ARPU.

$0.65

$0.81

$0.68

$0.83 $0.82

$0.03

$0.03

$0.02

$0.03

$0.02

$0.67

$0.84

$0.70

$0.86

$0.85

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Rest of World

$1.53

$1.94

$1.81

$2.06

$2.22

$0.19

$0.20

$0.19

$0.18

$0.18

$1.72

$2.14

$2.00

$2.24

$2.40

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Worldwide

$4.19

$5.34

$5.16

$5.79

$6.64

$0.65

$0.69

$0.69

$0.66

$0.74

$4.85

$6.03

$5.85

$6.44

$7.39

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

US & Canada

Payments

Advertising

13

Expenses as a % of Revenue

10% 10%

11%

10%

10%

12%

11%

13%

12%

12%

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Marketing & Sales

9%

9%

10%

9%

11%

9%

7%

8%

8%

8%

18%

16%

18%

17%

19%

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Research & Development

6% 5%

5% 5%

6%

8%

10%

7%

7%

8%

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

General & Administrative

Share-based compensation + Payroll tax related to share-based compensation All other expenses

24%

18%

18%

15%

16%

25%

19%

18%

16%

18%

Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Cost of Revenue

Amortization of intangibles

Income from Operations

$373

$562

$736

$1,133

$1,075

$1,390 $1,397

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP Income from Operations (In Millions)

$596

$830

$1,024

$1,498

$1,415

$1,753

$1,820

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Non-GAAP Income from Operations (In Millions)

14

Non-GAAP income from operations excludes share-based compensation expense, payroll tax expenses related to share-based compensation, and amortization of

intangiblessee the Appendix for a reconciliation of this non-GAAP measure to GAAP income from operations.

15

Operating Margin

41%

46%

51%

58%

57%

60%

57%

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Non-GAAP Operating Margin

26%

31%

37%

44%

43%

48%

44%

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP Operating Margin

Non-GAAP operating margin excludes share-based compensation expense, payroll tax expenses related to share-based compensation, and amortization of

intangiblessee the Appendix for a reconciliation of this non-GAAP measure to GAAP operating margin.

16

Effective Tax Rate

GAAP Effective Tax Rate

Non-GAAP Effective Tax Rate

Q1 Q2 Q3 Q4 Q1 Q2 Q3

($ in millions) 2013 2013 2013 2013 2014 2014 2014

GAAP income before provision for income taxes 353 $ 545 $ 726 $ 1,130 $ 1,075 $ 1,386 $ 1,336 $

GAAP provision for income taxes 134 212 301 607 433 595 530

Effective Tax Rate 38% 39% 41% 54% 40% 43% 40%

Q1 Q2 Q3 Q4 Q1 Q2 Q3

($ in millions) 2013 2013 2013 2013 2014 2014 2014

Non-GAAP income before provision for income taxes 576 813 1,014 1,495 1,415 1,749 1,759

Non-GAAP provision for income taxes 241 294 348 681 489 627 610

Effective Tax Rate 42% 36% 34% 46% 35% 36% 35%

17

Net Income

$219

$333

$425

$523

$642

$791 $806

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Non-GAAP net income excludes share-based compensation expense, payroll tax expenses related to share-based compensation, related income

tax adjustments, and amortization of intangiblessee the Appendix for a reconciliation of this non-GAAP measure to GAAP net income.

$335

$519

$666

$814

$926

$1,121

$1,149

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP Net Income (In Millions)

Non-GAAP Net Income (In Millions)

18

Diluted Earnings Per Share

$0.09

$0.13

$0.17

$0.20

$0.25

$0.30 $0.30

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

$0.13

$0.21

$0.27

$0.32

$0.35

$0.43 $0.43

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP Diluted Earnings Per Share

Non-GAAP Diluted Earnings Per Share

Non-GAAP diluted earnings per share excludes share-based compensation expense, payroll tax expenses related to share-based compensation,

related income tax adjustments, and amortization of intangiblessee the Appendix for a reconciliation of this non-GAAP measure to GAAP

diluted earnings per share.

19

Capital Investments

In Millions

Property and equipment acquired

under capital leases

Purchases of property

and equipment

$606

$1,235

$1,362

$473

$340

$1,079

$1,575

$1,373

2011 2012 2013

Annual

$879

$1,314

$890

$1,314

YTD Q3'13 YTD Q3'14

Quarterly

Appendix

21

Reconciliations

Income from Operations (in millions) Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP income from operations 373 $ 562 $ 736 $ 1,133 $ 1,075 $ 1,390 $ 1,397 $

Share-based compensation expense 170 224 239 273 274 314 353

Payroll tax expenses related to share-based compensation 20 8 12 53 25 8 11

Amortization of intangible assets 33 36 37 39 41 41 59

Non-GAAP income from operations 596 $ 830 $ 1,024 $ 1,498 $ 1,415 $ 1,753 $ 1,820 $

Operating Margin Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP operating margin 26% 31% 37% 44% 43% 48% 44%

Share-based compensation expense 12% 12% 12% 11% 11% 11% 11%

Payroll tax expenses related to share-based compensation 1% 0% 1% 2% 1% 0% 0%

Amortization of intangible assets 2% 2% 2% 2% 2% 1% 2%

Non-GAAP operating margin 41% 46% 51% 58% 57% 60% 57%

Net Income (in millions) Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP net income 219 $ 333 $ 425 $ 523 $ 642 $ 791 $ 806 $

Share-based compensation expense 170 224 239 273 274 314 353

Payroll tax expenses related to share-based compensation 20 8 12 53 25 8 11

Amortization of intangible assets 33 36 37 39 41 41 59

Income tax adjustments (107) (82) (47) (74) (56) (33) (80)

Non-GAAP net income 335 $ 519 $ 666 $ 814 $ 926 $ 1,121 $ 1,149 $

Diluted Earnings Per Share Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP diluted earnings per share 0.09 $ 0.13 $ 0.17 $ 0.20 $ 0.25 $ 0.30 $ 0.30 $

Non-GAAP adjustments to net income 0.04 0.08 0.10 0.12 0.10 0.13 0.13

Non-GAAP adjustments to diluted shares - - - - - - -

Non-GAAP diluted earnings per share 0.13 $ 0.21 $ 0.27 $ 0.32 $ 0.35 $ 0.43 $ 0.43 $

Effective Tax Rate (in millions) Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

GAAP income before provision for income taxes 353 $ 545 $ 726 $ 1,130 $ 1,075 $ 1,386 $ 1,336 $

GAAP provision for income taxes 134 212 301 607 433 595 530

GAAP effective tax rate 38% 39% 41% 54% 40% 43% 40%

GAAP income before provision for income taxes 353 $ 545 $ 726 $ 1,130 $ 1,075 $ 1,386 $ 1,336 $

Share-based compensation and related payroll tax expenses 190 232 251 326 299 322 364

Amortization of intangibles 33 36 37 39 41 41 59

Non-GAAP income before provision for income taxes 576 $ 813 $ 1,014 $ 1,495 $ 1,415 $ 1,749 $ 1,759 $

Non-GAAP provision for income taxes 241 294 348 681 489 627 610

Non-GAAP effective tax rate 42% 36% 34% 46% 35% 36% 35%

22

Reconciliations (continued)

23

Reconciliations (continued)

Free Cash Flow (in millions) Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14

Net cash provided by operating activities 719 $ 1,322 $ 950 $ 1,231 $ 1,285 $ 1,341 $ 1,248 $

Purchases of property and equipment 327 268 284 483 363 469 482

Property and equpiment acquired under capital leases 11 - - - - - -

Free Cash Flow 381 $ 1,054 $ 666 $ 748 $ 922 $ 872 $ 766 $

Limitations of Key Metrics and Other Data

The numbers for our key metrics, which include our daily active users (DAUs), mobile DAUs, monthly active users (MAUs),

mobile MAUs, and average revenue per user (ARPU), as well as certain other metrics such as mobile-only MAUs, are

calculated using internal company data based on the activity of user accounts. While these numbers are based on what we

believe to be reasonable estimates of our user base for the applicable period of measurement, there are inherent challenges

in measuring usage of our products across large online and mobile populations around the world.

For example, there may be individuals who maintain one or more Facebook accounts in violation of our terms of service,

despite our efforts to detect and suppress such behavior. We estimate, for example, that duplicate accounts (an account

that a user maintains in addition to his or her principal account) may have represented between approximately 4.3% and

7.9% of our worldwide MAUs in 2013. We also seek to identify false accounts, which we divide into two categories: (1)

user-misclassified accounts, where users have created personal profiles for a business, organization, or non-human entity

such as a pet (such entities are permitted on Facebook using a Page rather than a personal profile under our terms of

service); and (2) undesirable accounts, which represent user profiles that we determine are intended to be used for purposes

that violate our terms of service, such as spamming. In 2013, for example, we estimate user-misclassified accounts may

have represented between approximately 0.8% and 2.1% of our worldwide MAUs and undesirable accounts may have

represented between approximately 0.4% and 1.2% of our worldwide MAUs. We believe the percentage of accounts that are

duplicate or false is meaningfully lower in developed markets such as the United States or the United Kingdom and higher in

developing markets such as India and Turkey. However, these estimates are based on an internal review of a limited sample

of accounts and we apply significant judgment in making this determination, such as identifying names that appear to be fake

or other behavior that appears inauthentic to the reviewers. As such, our estimation of duplicate or false accounts may not

accurately represent the actual number of such accounts. We are continually seeking to improve our ability to identify

duplicate or false accounts and estimate the total number of such accounts, and such estimates may be affected by

improvements or changes in our methodology. Due to inherent variability in such estimates at particular dates of

measurement, we disclose these estimates as a range over a recent period.

24

Limitations of Key Metrics and Other Data (cont.)

Our data limitations may affect our understanding of certain details of our business. For example, while user-provided data indicates a

decline in usage among younger users, this age data is unreliable because a disproportionate number of our younger users register

with an inaccurate age. Accordingly, our understanding of usage by age group may not be complete.

Some of our metrics have also been affected by applications on certain mobile devices that automatically contact our servers for regular

updates with no user action involved, and this activity can cause our system to count the user associated with such a device as an

active user on the day such contact occurs. For example, we estimate that less than 5% of our estimated worldwide DAUs as of

December 31, 2011 resulted from this type of automatic mobile activity, and that this type of activity had a substantially smaller effect on

our estimate of worldwide MAUs and mobile MAUs. The impact of this automatic activity on our metrics varies by geography because

mobile usage varies in different regions of the world. In addition, our data regarding the geographic location of our users is estimated

based on a number of factors, such as the users IP address and self-disclosed location. These factors may not always accurately

reflect the users actual location. For example, a mobile-only user may appear to be accessing Facebook from the location of the proxy

server that the user connects to rather than from the users actual location. The methodologies used to measure user metrics may also

be susceptible to algorithm or other technical errors. For example, in early J une 2012, we discovered an error in the algorithm we used

to estimate the geographic location of our users that affected our attribution of certain user locations for the period ended March 31,

2012. While this issue did not affect our overall worldwide DAU and MAU numbers, it did affect our attribution of users across different

geographic regions. We estimate that the number of MAUs as of March 31, 2012 for the United States & Canada region was overstated

as a result of the error by approximately 3% and this overstatement was offset by understatements in other regions. The number of such

users for the period ended March 31, 2012 presented herein reflect the reclassification to more correctly attribute users by geographic

region. Our estimates for revenue by user location are also affected by these factors.

We regularly review our processes for calculating these metrics, and from time to time we may make adjustments to improve their

accuracy. These adjustments may result in the recalculation of our historical metrics, which are immaterial unless otherwise noted. In

addition, our MAU and DAU estimates will differ from estimates published by third parties due to differences in methodology. For

example, some third parties are not able to accurately measure mobile users or do not count mobile users for certain user groups or at

all in their analyses.

The numbers of DAUs, mobile DAUs, MAUs, mobile MAUs, and mobile-only MAUs represented in these slides, as well as ARPU, do

not include users of Instagram unless they would otherwise qualify as such users, respectively, based on their other activities on

Facebook.

25

You might also like

- Assessing Earnings Quality at NuwareDocument7 pagesAssessing Earnings Quality at Nuwaresatherbd21100% (4)

- Audit Reconsideration Memorandum Baker SCRIBDDocument7 pagesAudit Reconsideration Memorandum Baker SCRIBDMichael AlaoNo ratings yet

- Chapter 11 Answers RepportDocument12 pagesChapter 11 Answers RepportJudy56% (16)

- Branches of Government QR Code Stations ActivityDocument9 pagesBranches of Government QR Code Stations Activityapi-485477475No ratings yet

- Facebook Q4 2012 Investor Slide DeckDocument25 pagesFacebook Q4 2012 Investor Slide DeckJoshLowensohnNo ratings yet

- Q2 2018 Earnings PresentationDocument19 pagesQ2 2018 Earnings PresentationZerohedge100% (1)

- FY14 Q3 Earnings SlidesDocument23 pagesFY14 Q3 Earnings SlidesWahyu SetyawanNo ratings yet

- Travelzoo Webcast Presentation 01-23-14Document25 pagesTravelzoo Webcast Presentation 01-23-14mshuffma971518No ratings yet

- 3Q15 PresentationDocument16 pages3Q15 PresentationMultiplan RINo ratings yet

- WWWW Investor Presentation May 2013Document29 pagesWWWW Investor Presentation May 2013sl7789No ratings yet

- Managerialfinance UberDocument31 pagesManagerialfinance UberSercanİnceNo ratings yet

- Fin 320 Company Analysis 3Document10 pagesFin 320 Company Analysis 3api-319942276No ratings yet

- FB 12.31.2019 Exhibit 99.1 r61 - FinalDocument8 pagesFB 12.31.2019 Exhibit 99.1 r61 - FinalAlexNo ratings yet

- 2Q15 PresentationDocument16 pages2Q15 PresentationMultiplan RINo ratings yet

- To Our Business Partners: Usual." We Said This To Give Comfort To Our InsuranceDocument10 pagesTo Our Business Partners: Usual." We Said This To Give Comfort To Our InsurancenabsNo ratings yet

- Financial PlanDocument18 pagesFinancial Planashura08No ratings yet

- Presentation 3Q14Document16 pagesPresentation 3Q14Multiplan RINo ratings yet

- FXCM Q1 2014 Earnings PresentationDocument21 pagesFXCM Q1 2014 Earnings PresentationRon FinbergNo ratings yet

- Local Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Document19 pagesLocal Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Rushbh PatilNo ratings yet

- CSU Presidents Letter 2014Document8 pagesCSU Presidents Letter 2014bpd3kNo ratings yet

- Twitter Final Q1'22 Earnings ReleaseDocument12 pagesTwitter Final Q1'22 Earnings ReleaseSimon AlvarezNo ratings yet

- Laporan Keuangan Negara AmerikaDocument15 pagesLaporan Keuangan Negara AmerikaRiyanti AjengNo ratings yet

- Laporan Negara AmerikaDocument15 pagesLaporan Negara AmerikaRiyanti AjengNo ratings yet

- 3Q16 Earnings PresentationDocument18 pages3Q16 Earnings PresentationmisterbeNo ratings yet

- Presentation 1Q15Document14 pagesPresentation 1Q15Multiplan RINo ratings yet

- PLAY Jan 2016 Investor PresentationDocument26 pagesPLAY Jan 2016 Investor PresentationAla BasterNo ratings yet

- 2014 Q3 Call Slides FINAL PDFDocument36 pages2014 Q3 Call Slides FINAL PDFokaysigeokayNo ratings yet

- Apresenta??o Da Confer?ncia Do Bank of America Merril Lynch em Nova York (Vers?o em Ingl?s)Document14 pagesApresenta??o Da Confer?ncia Do Bank of America Merril Lynch em Nova York (Vers?o em Ingl?s)Multiplan RINo ratings yet

- FlixDocument14 pagesFlixandre.torresNo ratings yet

- Financial Analysis Task 1 Passed Submitted 4-25-13Document24 pagesFinancial Analysis Task 1 Passed Submitted 4-25-13mdjoseNo ratings yet

- Oracle Fusion HRMS SA Payroll BalancesDocument58 pagesOracle Fusion HRMS SA Payroll BalancesFeras AlswairkyNo ratings yet

- Presentation 4Q13Document25 pagesPresentation 4Q13Multiplan RINo ratings yet

- Facebook Reports Third Quarter 2018 ResultsDocument11 pagesFacebook Reports Third Quarter 2018 ResultsNivetha ThomasNo ratings yet

- Town Sports International Holdings, Inc. Announces First Quarter 2014 Financial ResultsDocument8 pagesTown Sports International Holdings, Inc. Announces First Quarter 2014 Financial Resultspathanfor786No ratings yet

- Yelp - Q4 2014 Earnings SlidesDocument8 pagesYelp - Q4 2014 Earnings SlidesRoberto SantanaNo ratings yet

- Presentation 2Q13Document17 pagesPresentation 2Q13Multiplan RINo ratings yet

- 2020.11.18 PAGS 3Q20 Earnings ReleaseDocument17 pages2020.11.18 PAGS 3Q20 Earnings ReleaseRenan Dantas SantosNo ratings yet

- MIS ScripDocument4 pagesMIS ScripYou Pang PhuahNo ratings yet

- GrouponDocument9 pagesGroupondonna_tam_3No ratings yet

- Uber Q4 23 Earnings Supplemental DataDocument28 pagesUber Q4 23 Earnings Supplemental Datadivbrown0No ratings yet

- Presentation 3Q13Document19 pagesPresentation 3Q13Multiplan RINo ratings yet

- Yahoo Q2 2013Document11 pagesYahoo Q2 2013jolieodellNo ratings yet

- 1H15 PPT - VFDocument29 pages1H15 PPT - VFClaudio Andrés De LucaNo ratings yet

- A Presentation ON: Financial Analysis of Hero CycleDocument37 pagesA Presentation ON: Financial Analysis of Hero CycleVishal AnandNo ratings yet

- Q4 2018 Earnings ReleaseDocument8 pagesQ4 2018 Earnings ReleaseMacy AndradeNo ratings yet

- Resultado PagSeguroDocument17 pagesResultado PagSeguroBruno Enrique Silva AndradeNo ratings yet

- 2Q13 Press Release 83cdDocument16 pages2Q13 Press Release 83cdeconomics6969No ratings yet

- 2013Q4 Google Earnings SlidesDocument14 pages2013Q4 Google Earnings Slides10TAMBKANo ratings yet

- CAT Business AcumenDocument13 pagesCAT Business AcumenAftab AhmadNo ratings yet

- PepsiCo Segments CaseDocument4 pagesPepsiCo Segments CaseAntonio J AguilarNo ratings yet

- 4Q15 PresentationDocument21 pages4Q15 PresentationMultiplan RINo ratings yet

- Q1 2012 Supplemental InformationDocument6 pagesQ1 2012 Supplemental InformationMihir BhatiaNo ratings yet

- Microsoft Commercial Strength Powers Second Quarter ResultsDocument12 pagesMicrosoft Commercial Strength Powers Second Quarter ResultsRochak JainNo ratings yet

- Tesla Motors, Inc. TSLA-Buy-$222 PT: Risks/ValuationDocument7 pagesTesla Motors, Inc. TSLA-Buy-$222 PT: Risks/Valuationavijit0706No ratings yet

- Laquayas Research Paper - NetflixDocument18 pagesLaquayas Research Paper - Netflixapi-547930687No ratings yet

- 1Q16 PresentationDocument19 pages1Q16 PresentationMultiplan RINo ratings yet

- GOCOLORS 03052024135039 PressReleaseuploadDocument4 pagesGOCOLORS 03052024135039 PressReleaseuploadroy.pritibilash4uNo ratings yet

- Far 1Document13 pagesFar 1Sonu NayakNo ratings yet

- FRSH Jan 2016 Investor PresentationDocument32 pagesFRSH Jan 2016 Investor PresentationAla BasterNo ratings yet

- Pag SegurosDocument16 pagesPag SegurosRenan Dantas SantosNo ratings yet

- 2014 12 FY - PresentationDocument23 pages2014 12 FY - PresentationAnkit SawhneyNo ratings yet

- Ec Current 2013Document3 pagesEc Current 2013Jose ValentinNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- African ReportDocument160 pagesAfrican ReportYasin Ozturk0% (1)

- Chapter 6 - Instalment PurchasedDocument6 pagesChapter 6 - Instalment PurchasedyasmeenNo ratings yet

- Affidavit of Prejudice in Order To Show Cause To DisqualifyDocument8 pagesAffidavit of Prejudice in Order To Show Cause To DisqualifySLAVEFATHER100% (1)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnJulie Payne-King100% (2)

- Netskope Security Cloud Platform: Data-Centric. Cloud-Smart. FastDocument4 pagesNetskope Security Cloud Platform: Data-Centric. Cloud-Smart. FastPacNo ratings yet

- Starkville Dispatch Eedition 7-1-20Document16 pagesStarkville Dispatch Eedition 7-1-20The DispatchNo ratings yet

- Financial StatementsDocument7 pagesFinancial StatementsJoel BlairNo ratings yet

- Itdesk - Info - Project of Computer E-Education With Open AccessDocument12 pagesItdesk - Info - Project of Computer E-Education With Open Accessfriendly usernameNo ratings yet

- Full TextDocument36 pagesFull TextPringal SoniNo ratings yet

- BookDocument5 pagesBookGodfrey Loth Sales Alcansare Jr.No ratings yet

- STOADocument110 pagesSTOAfranklin_ramirez_8100% (1)

- Rules and Jurisprudence On The Use of AliasDocument17 pagesRules and Jurisprudence On The Use of AliasThessaloe B. FernandezNo ratings yet

- The Origin of Rubiah IslandDocument2 pagesThe Origin of Rubiah IslandSiallang NgonNo ratings yet

- 2241 International LawDocument8 pages2241 International LawDakshita DubeyNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessDocument8 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessNinia Cresil Ann JalagatNo ratings yet

- Martin Luther King British English Pre Intermediate GroupDocument2 pagesMartin Luther King British English Pre Intermediate GroupPopovici AdrianaNo ratings yet

- Bihar Public Service Ciommission vs. Saiyed Hussain Abbas Rizwi & Anr.Document30 pagesBihar Public Service Ciommission vs. Saiyed Hussain Abbas Rizwi & Anr.Sravan VeldiNo ratings yet

- Entrepreneurial Organizational Forms and Overview of Setting Up An EnterpriseDocument30 pagesEntrepreneurial Organizational Forms and Overview of Setting Up An Enterprisesonam_kansalNo ratings yet

- Asset Based Finance Project ReportDocument52 pagesAsset Based Finance Project ReportkamdicaNo ratings yet

- Secondary (Social Studies) - Legazpi - 9-2019 PDFDocument66 pagesSecondary (Social Studies) - Legazpi - 9-2019 PDFBicol Telephone and Telegraph, Inc.No ratings yet

- Special Proceeding NotesDocument27 pagesSpecial Proceeding NotesKate Kim DeeNo ratings yet

- State Immunity - VMPSI V PC Chief and PC SUSIADocument1 pageState Immunity - VMPSI V PC Chief and PC SUSIAJoanna FandialanNo ratings yet

- Pakistan Studies Assignment 1Document28 pagesPakistan Studies Assignment 1natasha zafarNo ratings yet

- 26.8.2022 6.1. Syllabus-BLAW220 - Introduction To Law and Business TransactionsDocument8 pages26.8.2022 6.1. Syllabus-BLAW220 - Introduction To Law and Business TransactionsLinh NvNo ratings yet

- The Grammar of Civil War. A Mexican Case Study, 1857-61Document333 pagesThe Grammar of Civil War. A Mexican Case Study, 1857-61Belaid HadjiNo ratings yet

- Argicutural Lien PDFDocument36 pagesArgicutural Lien PDFlifeisgrand100% (3)