Professional Documents

Culture Documents

Trapp To Merge

Trapp To Merge

Uploaded by

Mark Reinhardt0 ratings0% found this document useful (0 votes)

22 views6 pagesThis document provides instructions and information for applying to merge, reorganize, or purchase assets of a trust company with the Texas Department of Banking. It outlines the application process and requirements, including submitting the application in duplicate with any necessary attachments on 8.5x11 paper. It details the required fee and provides contact information for the Corporate Activities Division of the Texas Department of Banking for any questions about preparing or filing the application. The document lists 19 items of information that must be attached to the application, including agreements related to the transaction, articles of merger, balance sheets, strategic plans, and an antitrust analysis of competitive effects.

Original Description:

source: accesscorrections.com

Original Title

Trapp to Merge

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides instructions and information for applying to merge, reorganize, or purchase assets of a trust company with the Texas Department of Banking. It outlines the application process and requirements, including submitting the application in duplicate with any necessary attachments on 8.5x11 paper. It details the required fee and provides contact information for the Corporate Activities Division of the Texas Department of Banking for any questions about preparing or filing the application. The document lists 19 items of information that must be attached to the application, including agreements related to the transaction, articles of merger, balance sheets, strategic plans, and an antitrust analysis of competitive effects.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

22 views6 pagesTrapp To Merge

Trapp To Merge

Uploaded by

Mark ReinhardtThis document provides instructions and information for applying to merge, reorganize, or purchase assets of a trust company with the Texas Department of Banking. It outlines the application process and requirements, including submitting the application in duplicate with any necessary attachments on 8.5x11 paper. It details the required fee and provides contact information for the Corporate Activities Division of the Texas Department of Banking for any questions about preparing or filing the application. The document lists 19 items of information that must be attached to the application, including agreements related to the transaction, articles of merger, balance sheets, strategic plans, and an antitrust analysis of competitive effects.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

451.699-5-01/1 [Rev.

8 9/99] Texas Department of Banking

TRUST COMPANY

APPLICATION TO MERGE,

REORGANIZE OR PURCHASE ASSETS

INFORMATION AND INSTRUCTIONS

This application form has been designed to elicit the minimum information required by The

Texas Department of Banking (the "Department") for the purpose of determining whether a

particular application should be granted. If the space provided is insufficient, a separate page

should be attached. Additional information and documents must be submitted on 8" x 11" paper.

The application, as well as copies of all attachments, must be filed in duplicate. Once the

application and accompanying documents are received by the Department they will be reviewed.

The applicant will be notified if additional information is required to complete the review of the

proposed transaction. Only when it is determined that sufficient information has been filed to

adequately review the proposed transaction, will the application be officially accepted for filing.

Therefore, full and complete answers will facilitate processing of the application.

FEE. A check payable to the Banking Commissioner of Texas is required as a filing fee for each

merger transaction pursuant to 7 TAC 21.2(b). It is not refundable.

FORMS - INTERAGENCY. The Department will accept the completed Interagency Bank

Merger Act Application form in lieu of the State forms provided that the forms are accompanied

by the executed and notarized signature pages on the State forms.

PUBLIC NOTICE. The applicant shall publish a notice in a newspaper of general circulation

in the specified community of the applicant(s), the target(s) and any resultant trust company or

state banks. The published notice must comply with 7 TAC 21.5.

PUBLIC DISCLOSURE OF INFORMATION. All information submitted to the Department

is presumed to be public information, unless it is deemed confidential under the Texas Open

Records Act. Any document in the application for which you request confidential treatment must

be segregated and reference the Texas Open Records Act exception supporting the request. Final

determination as to the confidentiality of any information will rest with the Banking

Commissioner.

Inquiries concerning the preparation and filing of this or any other Corporate application with the

Department should be directed to the Corporate Activities Division of The Texas Department of

Banking, 2601 North Lamar Boulevard, Austin, Texas 78705-4294 (512/475-1300).

451.699-5-01/2 [Rev. 8 9/99] Texas Department of Banking

APPLICATION FOR A

MERGER, REORGANIZATION, OR PURCHASE OF ASSETS

Application to the Commissioner is hereby made for approval of this proposed:

Merger or Reorganization (Section 182.301) __________

Purchase or Sale of Assets (Section 182.401 __________

as required by the Texas Finance Code.

TRUST COMPANY

______________________________________________________________________________

(Title) (Charter #)

(Street Address and P. O., if different)

_________________________________________________________________________________________________

(City, County, State, Zip Code)

OTHER BANK / TRUST COMPANY / ENTITY

(Title) (Charter #)

(Street Address and P. O., if different)

(City, County, State, Zip Code)

RESULTING TRUST COMPANY

Under the Charter of

(Title) (Charter #)

(Street Address and P. O., if different)

(City, County, State, Zip Code)

451.699-5-01/3 [Rev. 8 9/99] Texas Department of Banking

MERGER, REORGANIZATION OR PURCHASE OF ASSETS

HOLDING COMPANY

(Exact Title of Any Holding Company for Trust Company)

(Mailing Address)

(Exact Title of Any Holding Company for Other Bank/Trust Company)

(Mailing Address)

(Exact Title of Any Holding Company for any Resulting State Bank or Trust Company)

(Mailing Address)

CONTACT

Requests for additional information or other communications about this proposal should be directed to:

(Name)

(Title)

(Mailing Address)

(Telephone Number Including Area Code)

451.699-5-01/4 [Rev. 8 9/99] Texas Department of Banking

MERGER, REORGANIZATION OR PURCHASE OF ASSETS

We understand that any misrepresentations or omissions of material facts with respect to this application, any

attachments to it, and any other documents or information provided in connection with the application to merge

may be grounds for denial or revocation of the trust company charter or grounds to require the resignation of

the undersigned as director(s) or officer(s) of the trust company, and may subject the undersigned to other legal

sanctions.

(Acquiring Trust Company)

By:

(Signature of Authorized Officer)

(Typed Name)

(Seal)

(Title)

(Other Bank / Trust Company / Entity)

By:

(Signature of Authorized Officer)

(Typed Name)

(Seal)

(Title)

451.699-5-01/5 [Rev. 8 9/99] Texas Department of Banking

MERGER, REORGANIZATION OR PURCHASE OF ASSETS

Review 7 TAC 21.61 through 21.64 and 21.67 through 21.76 before completing this section. Attach the

following information.

1. Summary - A brief description of proposed transaction.

2. A copy of all agreements related to the proposed transaction executed by an authorized representative

of each party.

3. The Articles of Merger (duplicate originals) related to the proposed transaction incorporating the

restated Articles of Association of any resulting bank or trust company and any other resulting entity

as Exhibit B and the Plan of Merger as Exhibit

a. Indicating approval by at least 2/3 of the shareholders of each merging or acquiring entity;

and,

b. Executed and acknowledged by an authorized officer for each merging or acquiring entity.

4. Resulting Bank/Trust Company or Other Entity:

a. A brief description of future prospects.

b. List of proposed executive officers and directors.

c. List of proposed branches and locations.

d. A map depicting the delineated community. Submit only if the proposal changes the existing

CRA community delineation. This information is required for any resulting trust company

that is FDIC insured or that is a member of the Federal Reserve. The information must also

be provided for any resulting state bank.

e. An assessment of the current regulatory and financial condition of each party to the

transaction.

5. A Current and Pro forma (at consummation and consummation + one year) combined balance sheet

and income statement for all resulting entities.

6. A certification or opinion of counsel that conforms to the requirements contained in 7 TAC 21.61

through 21.64 and 21.67 through 21.76, as applicable.

7. A copy of the most recent Statements of Condition and Income for each trust company or bank and

a current financial statement for any other entity involved in the proposed transaction.

8. A copy that portion of the most recent "watch-list" for each trust company, financial institution or

other entity involved in the proposed transaction, that identifies low-quality assets.

9. Provide a listing of the exact location of any existing and new offices or facilities to be owned by the

resulting trust company or bank.

10. (If applicable) A complete copy with attachments of any application(s) related to the proposed

transaction as filed with any other governmental authority.

11. (If applicable) A copy of the latest annual report for any holding company.

12. As a result of the transaction, will any additional approvals, i.e. overinvestment in fixed assets, etc.,

be required?

451.699-5-01/6 [Rev. 8 9/99] Texas Department of Banking

13. A description of the due diligence review conducted and a summary of findings.

14. A description of all material legal or administrative proceedings involving any party to the transaction.

15. A copy of the Strategic Plan of each resulting trust company or state bank, if different from the

existing plan. See Memorandum 1009.

16. An explanation of compliance with or non-applicability of provisions of governing law relating to

rights of dissenting shareholders or participants. (MERGER ONLY)

17. A copy of all securities offering documents, proxy statements or disclosure materials. (MERGER

ONLY)

18. An explanation of the manner and basis of connecting or exchanging any of the shares or other

evidences of ownership of any entity that is a party to the merger or acquisition.

19. For antitrust purposes, an analysis of the anticipated competitive effect of the proposed transaction in

the affected markets and a statement of the basis of the analysis of the competitive effects or a copy

of the analysis addressed in the companion federal agency application, if any.

You might also like

- Bill of Exchange PDFDocument52 pagesBill of Exchange PDFParesh Vaviya91% (11)

- FIS Authorization Agreement 2021Document1 pageFIS Authorization Agreement 2021Fetch Work2No ratings yet

- CFA L3 Exam ResultDocument2 pagesCFA L3 Exam ResultNITINNo ratings yet

- Certificate of Merger Instructions For FilingDocument6 pagesCertificate of Merger Instructions For FilingMark ReinhardtNo ratings yet

- CertificateDocument829 pagesCertificatemarcopq100% (1)

- Greentree Servicing Llc. P.O. BOX 94710 PALATINE IL 60094-4710Document4 pagesGreentree Servicing Llc. P.O. BOX 94710 PALATINE IL 60094-4710Andy Craemer100% (1)

- Sba Form 413Document2 pagesSba Form 413David WaringNo ratings yet

- Winning Government Contracts: How Your Small Business Can Find and Secure Federal Government Contracts up to $100,000From EverandWinning Government Contracts: How Your Small Business Can Find and Secure Federal Government Contracts up to $100,000Rating: 5 out of 5 stars5/5 (1)

- Effective Guide To Forex Trading - Kelvin Lee PDFDocument67 pagesEffective Guide To Forex Trading - Kelvin Lee PDFoaperuchena100% (2)

- Corp t02Document2 pagesCorp t02Mark ReinhardtNo ratings yet

- Qualification Parameters For Failed Trust Company AcquisitionsDocument10 pagesQualification Parameters For Failed Trust Company AcquisitionsMark ReinhardtNo ratings yet

- Notice To Applicants Application For A Merger, Reorganization, or Share ExchangeDocument2 pagesNotice To Applicants Application For A Merger, Reorganization, or Share ExchangeMark ReinhardtNo ratings yet

- Notice To Applicants Conversion ApplicationDocument2 pagesNotice To Applicants Conversion ApplicationMark ReinhardtNo ratings yet

- Notice To Applicants Acquisition of ControlDocument2 pagesNotice To Applicants Acquisition of ControlMark ReinhardtNo ratings yet

- Corp b18Document4 pagesCorp b18Mark ReinhardtNo ratings yet

- Corp b16Document3 pagesCorp b16Mark ReinhardtNo ratings yet

- Supplement To Interagency Bank Merger Act Application: All FilingsDocument1 pageSupplement To Interagency Bank Merger Act Application: All FilingsMark ReinhardtNo ratings yet

- Tools SBF Form1366Document3 pagesTools SBF Form1366aphexishNo ratings yet

- Notice To Applicants Establishing or Relocating A BranchDocument2 pagesNotice To Applicants Establishing or Relocating A BranchMark ReinhardtNo ratings yet

- Corp b10Document3 pagesCorp b10Mark ReinhardtNo ratings yet

- Corp b17Document4 pagesCorp b17Mark ReinhardtNo ratings yet

- Corp b31Document3 pagesCorp b31Mark ReinhardtNo ratings yet

- Corp m02Document44 pagesCorp m02Mark ReinhardtNo ratings yet

- Chase Short Sale PackageDocument12 pagesChase Short Sale PackageZenMaster1969No ratings yet

- DD 2293Document2 pagesDD 2293klumer_xNo ratings yet

- A. Information Regarding Principal Officers, Directors and 10% Equity Security OwnersDocument4 pagesA. Information Regarding Principal Officers, Directors and 10% Equity Security OwnersJane MendezNo ratings yet

- How To Register A Corporation With SEC PhilippinesDocument2 pagesHow To Register A Corporation With SEC PhilippinesRoger JavierNo ratings yet

- Uniform Interstate AppDocument4 pagesUniform Interstate AppMark ReinhardtNo ratings yet

- Uprading of CategoryDocument15 pagesUprading of CategoryApl Dugui-es ToleroNo ratings yet

- FFATA Data Collection Form.EDocument2 pagesFFATA Data Collection Form.EandresNo ratings yet

- Registration Statement and Filing For A Representative Office (S) of A Foreign Bank CorporationDocument4 pagesRegistration Statement and Filing For A Representative Office (S) of A Foreign Bank CorporationMark ReinhardtNo ratings yet

- Application Guidelines For TARP Capital Purchase ProgramDocument6 pagesApplication Guidelines For TARP Capital Purchase ProgramFOXBusiness.comNo ratings yet

- Waste Connections & Progressive Waste Merger PresentationDocument24 pagesWaste Connections & Progressive Waste Merger PresentationDavid BodamerNo ratings yet

- Upgrading of Contractor'S License Application: Philippine Contractors Accreditation BoardDocument16 pagesUpgrading of Contractor'S License Application: Philippine Contractors Accreditation BoardAyiNo ratings yet

- Application Guidelines For TARP Community Development Capital InitiativeDocument4 pagesApplication Guidelines For TARP Community Development Capital InitiativeREAL SolutionsNo ratings yet

- Charter Relocation ApplicationDocument6 pagesCharter Relocation ApplicationNeliseka XhakazaNo ratings yet

- Format For Seeking PSP AuthorisationDocument20 pagesFormat For Seeking PSP AuthorisationHitesh MishraNo ratings yet

- Upgrading of Contractor'S License Application: Philippine Contractors Accreditation BoardDocument16 pagesUpgrading of Contractor'S License Application: Philippine Contractors Accreditation BoardaefNo ratings yet

- 22890761Document198 pages22890761William HarrisNo ratings yet

- Tools SBF Finasst413 0 PDFDocument2 pagesTools SBF Finasst413 0 PDFRusli FahmadinNo ratings yet

- Greg Imbruce, ASYM-South Texas Oil Company-8K-DIP FinancingDocument10 pagesGreg Imbruce, ASYM-South Texas Oil Company-8K-DIP Financingbluetuna9No ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument679 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Assignment of Agent in TexasDocument5 pagesAssignment of Agent in TexasnilafayeNo ratings yet

- SF 270 (Request For Advance or Reimbursement)Document2 pagesSF 270 (Request For Advance or Reimbursement)Benne JamesNo ratings yet

- Notice To Applicants Change of Home Office: Corporate Activities DivisionDocument3 pagesNotice To Applicants Change of Home Office: Corporate Activities DivisionMark ReinhardtNo ratings yet

- Application For Release From Prohibition or Removal OrderDocument13 pagesApplication For Release From Prohibition or Removal OrderMark ReinhardtNo ratings yet

- Fcca DarleneDocument15 pagesFcca DarleneAdele JeterNo ratings yet

- 17-18 Sub Grantee To SAA EMPG Closeout LetterDocument1 page17-18 Sub Grantee To SAA EMPG Closeout LetterWillie Miyogoh MadeteNo ratings yet

- Ap 185Document8 pagesAp 185Jermaine BrownNo ratings yet

- Section: Permission To Organize A Federal Savings InstitutionDocument20 pagesSection: Permission To Organize A Federal Savings Institutionadsasd3333No ratings yet

- Elon Musk, SEC Reach Agreement Over Tesla CEO's Twitter UseDocument5 pagesElon Musk, SEC Reach Agreement Over Tesla CEO's Twitter UseCNBC.comNo ratings yet

- Tesla CEO Elon Musk and SEC Agree On Restricting Musk's Use of TwitterDocument5 pagesTesla CEO Elon Musk and SEC Agree On Restricting Musk's Use of TwitterThe Verge100% (1)

- Citizens Manual On Registration of Corporation and PartnershipDocument3 pagesCitizens Manual On Registration of Corporation and PartnershipAnonymous b2aRrNWfNo ratings yet

- Sample of Letter of IntentDocument6 pagesSample of Letter of IntentSophia RusconiNo ratings yet

- SBIR Application VCOC CertificationDocument3 pagesSBIR Application VCOC CertificationGOKUL PRASADNo ratings yet

- Debt-to-Equity Conversion Revised PDFDocument0 pagesDebt-to-Equity Conversion Revised PDFAnonymous qDb8S3koENo ratings yet

- Tesla Motion To AmendDocument5 pagesTesla Motion To AmendDave LeeNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- 2018 Commercial & Industrial Common Interest Development ActFrom Everand2018 Commercial & Industrial Common Interest Development ActNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- 43Document12 pages43Mark ReinhardtNo ratings yet

- 7Document6 pages7Mark ReinhardtNo ratings yet

- 6Document5 pages6Mark ReinhardtNo ratings yet

- Patrol LP Scenario03 July2021Document25 pagesPatrol LP Scenario03 July2021Mark ReinhardtNo ratings yet

- 10Document4 pages10Mark ReinhardtNo ratings yet

- 14Document7 pages14Mark ReinhardtNo ratings yet

- 8Document4 pages8Mark ReinhardtNo ratings yet

- 18Document23 pages18Mark ReinhardtNo ratings yet

- 17Document8 pages17Mark ReinhardtNo ratings yet

- Patrol LP Scenario04 July2021Document24 pagesPatrol LP Scenario04 July2021Mark ReinhardtNo ratings yet

- 13Document3 pages13Mark ReinhardtNo ratings yet

- Large Bank Assets (Federal Reserve) 2023Document103 pagesLarge Bank Assets (Federal Reserve) 2023Mark ReinhardtNo ratings yet

- 3Document4 pages3Mark ReinhardtNo ratings yet

- 15Document5 pages15Mark ReinhardtNo ratings yet

- 9Document3 pages9Mark ReinhardtNo ratings yet

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDocument185 pagesMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtNo ratings yet

- 20221230final Order No 35651Document5 pages20221230final Order No 35651Mark ReinhardtNo ratings yet

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Document80 pagesSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtNo ratings yet

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDocument27 pagesWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtNo ratings yet

- H0001Document2 pagesH0001Mark ReinhardtNo ratings yet

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDocument11 pagesCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtNo ratings yet

- Crime Scene Manual Rev3Document153 pagesCrime Scene Manual Rev3Mark ReinhardtNo ratings yet

- A Bill: 117 Congress 1 SDocument22 pagesA Bill: 117 Congress 1 SMark ReinhardtNo ratings yet

- A Bill: 116 Congress 2 SDocument15 pagesA Bill: 116 Congress 2 SMark ReinhardtNo ratings yet

- Bills 113s987rsDocument44 pagesBills 113s987rsMark ReinhardtNo ratings yet

- 137684-1980-Serrano v. Central Bank of The PhilippinesDocument5 pages137684-1980-Serrano v. Central Bank of The Philippinespkdg1995No ratings yet

- Company Analysis ReportDocument32 pagesCompany Analysis ReportATREYA NAYAKNo ratings yet

- Epa 05Document6 pagesEpa 05nripeshtrivediNo ratings yet

- What's On Your Mind?: Extinguishment of ObligationDocument29 pagesWhat's On Your Mind?: Extinguishment of Obligationdanielzar delicanoNo ratings yet

- Citi GPS Metaverse & Money Mar 2022Document184 pagesCiti GPS Metaverse & Money Mar 2022Onz DroidNo ratings yet

- Chapter 1: The Meaning and Objectives of Managerial AccountingDocument12 pagesChapter 1: The Meaning and Objectives of Managerial AccountingNgan Tran Nguyen ThuyNo ratings yet

- Issue 3 Pet. Banking CIA 3Document3 pagesIssue 3 Pet. Banking CIA 3NancyNo ratings yet

- Charles Ngo Reading ListDocument2 pagesCharles Ngo Reading ListCarlos Chizzini MeloNo ratings yet

- ReinsuranceDocument142 pagesReinsuranceabhishek pathakNo ratings yet

- SFA04 G05 Guidelines On FMCLicensing and Registration 7 Aug 2012Document20 pagesSFA04 G05 Guidelines On FMCLicensing and Registration 7 Aug 2012Harpott GhantaNo ratings yet

- GAM-property Plant and EquipmentDocument83 pagesGAM-property Plant and EquipmentRobert CastilloNo ratings yet

- Feizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed FirmsDocument10 pagesFeizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed Firmsgiorgos1978No ratings yet

- May 2018 Professional Examinations Financial Accounting (Paper 1.1) Chief Examiner'S Report, Questions and Marking SchemeDocument28 pagesMay 2018 Professional Examinations Financial Accounting (Paper 1.1) Chief Examiner'S Report, Questions and Marking SchemeJoseph PhaustineNo ratings yet

- IV Revision FMI Sobre ArgentinaDocument88 pagesIV Revision FMI Sobre ArgentinaCronista.comNo ratings yet

- Financial Model PRGFEE - 30-June-2015Document71 pagesFinancial Model PRGFEE - 30-June-2015AbhishekNo ratings yet

- Group Work Fa1 - FPTDocument28 pagesGroup Work Fa1 - FPTCẩm NhungNo ratings yet

- The Functional Design and Application of Computerized Accounting System in The University Financial ManagementDocument5 pagesThe Functional Design and Application of Computerized Accounting System in The University Financial ManagementKathrina RoxasNo ratings yet

- E15-2 (Recording The Issuance of Ordinary and Preference Shares) AbernathyDocument5 pagesE15-2 (Recording The Issuance of Ordinary and Preference Shares) AbernathyAsuna SanNo ratings yet

- FINC1302 - Exer&Asgnt - Revised 5 Feb 2020Document24 pagesFINC1302 - Exer&Asgnt - Revised 5 Feb 2020faqehaNo ratings yet

- Chapter 4 Solution On Language of BusinessDocument2 pagesChapter 4 Solution On Language of BusinessAllen BabasaNo ratings yet

- IntellectEU Secures 2 Million Euro Investment in FundingDocument3 pagesIntellectEU Secures 2 Million Euro Investment in FundingPR.comNo ratings yet

- MGT and Cost ActgDocument14 pagesMGT and Cost Actgdanjay2792No ratings yet

- SureSeats Transaction No 5591075 Has Been APPROVEDDocument2 pagesSureSeats Transaction No 5591075 Has Been APPROVEDMarlon MejiaNo ratings yet

- Notes To Financial StatementsDocument2 pagesNotes To Financial StatementsDheepikaNo ratings yet

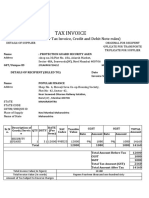

- Tax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Document5 pagesTax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Bharat DafalNo ratings yet

- TPM - Kumala Hadi - Chapter 7 Optimal Risky PortfoliosDocument38 pagesTPM - Kumala Hadi - Chapter 7 Optimal Risky PortfoliosErlin KetnaNo ratings yet

- Carllewisdalidarendon: Page1of3 3Rdfloorauathlete'S Dorm5Thstbrgy 5 5 8 6 - 6 4 8 9 - 2 8 6 3 8 Manilasanmiguel 1 0 0 5Document4 pagesCarllewisdalidarendon: Page1of3 3Rdfloorauathlete'S Dorm5Thstbrgy 5 5 8 6 - 6 4 8 9 - 2 8 6 3 8 Manilasanmiguel 1 0 0 5Carl LewisNo ratings yet