Professional Documents

Culture Documents

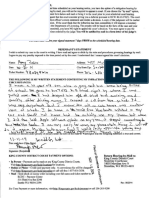

Background Check Self-Certification Form: For Money Services Business

Background Check Self-Certification Form: For Money Services Business

Uploaded by

Mark Reinhardt0 ratings0% found this document useful (0 votes)

7 views3 pagesThis document is a background check self-certification form for a money services business license holder. It requires the executive officer to certify that adequate background checks have been performed on a principal to ensure they meet the qualifications required by Texas law. These qualifications include that the principal has not been convicted of certain crimes within the last 10 years, is not on any terrorism lists, and meets financial responsibility and experience requirements. The executive officer must sign and date the form along with the principal to certify they meet all necessary qualifications.

Original Description:

source: accesscorrections.com

Original Title

corp-i07

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a background check self-certification form for a money services business license holder. It requires the executive officer to certify that adequate background checks have been performed on a principal to ensure they meet the qualifications required by Texas law. These qualifications include that the principal has not been convicted of certain crimes within the last 10 years, is not on any terrorism lists, and meets financial responsibility and experience requirements. The executive officer must sign and date the form along with the principal to certify they meet all necessary qualifications.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views3 pagesBackground Check Self-Certification Form: For Money Services Business

Background Check Self-Certification Form: For Money Services Business

Uploaded by

Mark ReinhardtThis document is a background check self-certification form for a money services business license holder. It requires the executive officer to certify that adequate background checks have been performed on a principal to ensure they meet the qualifications required by Texas law. These qualifications include that the principal has not been convicted of certain crimes within the last 10 years, is not on any terrorism lists, and meets financial responsibility and experience requirements. The executive officer must sign and date the form along with the principal to certify they meet all necessary qualifications.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Background Check Self-Certification Form

For Money Services Business

I certify on behalf of the license holder named below that adequate background check procedures

have been performed regarding (Principal) to determine that he or

she meets the qualifications required by Texas Finance Code (TFC) Chapter 151.202 (attached).

Specifically, TFC Chapter 151.202 requires that all executive officers, directors, general

partners, trustees, managers, and persons in control of a license holder must meet certain

requirements.

Accordingly, I acknowledge that failure of the Principal named above to meet any of these

requirements may have consequences with respect to our license. Therefore I certify the

background check positively determined that:

Principal is not on the specifically designated nationals and blocked persons list

maintained by the United States Department of the Treasury;

Principal has demonstrated good financial responsibility and is in good financial

condition;

Principals financial and business experience are appropriate for his or her position;

Principal does not owe any fees or assessments to the Texas Department of Banking or to

any other federal or state agency; and

Principal has not been convicted within the last ten years of a felony criminal offense

under state or federal law, or of a similar offense under the laws of a foreign country.

Additionally, Principal certifies that:

Principal has never engaged in fraud, knowing misrepresentation, deceit, or gross

negligence in connection with the operation of a money services business;

Principal has never breached a trust or a fiduciary duty;

Principal is familiar with and agrees to fully comply with all applicable state and federal

laws and regulations, specifically including TFC Chapters 151 and 271, the Bank Secrecy

Act, and the USA PATRIOT Act;

Principal has never knowingly failed to file a report required by these statutes; and

Principal has never knowingly accepted money for transmission or exchange which was

derived from illegal activity.

Name of License Holder

__________________

Name & Title of Executive Officer Signature Date

__________________

Name of Principal Signature Date

CORP-I07 [10/13] Texas Department of Banking

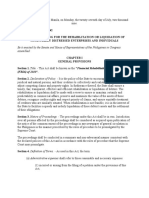

Texas Finance Code 151.202. Qualifications for License.

(a) Subject to Subsections (b) and (c), to qualify for a license under this chapter, an applicant must

demonstrate to the satisfaction of the commissioner that:

(1) the financial responsibility and condition, financial and business experience, competence,

character, and general fitness of the applicant justify the confidence of the public and warrant the belief

that the applicant will conduct business in compliance with this chapter and the rules adopted under this

chapter and other applicable state and federal law;

(2) the issuance of the license is in the public interest;

(3) the applicant, a principal of the applicant, or a person in control of the applicant does not owe

the department a delinquent fee, assessment, administrative penalty, or other amount imposed under this

chapter or a rule adopted or order issued under this chapter;

(4) the applicant, if a partnership, and any partner that would generally be liable for the

obligations of the partnership, does not owe a delinquent federal tax;

(5) the applicant, if a corporation:

(A) is in good standing and statutory compliance in the state or country of incorporation;

(B) is authorized to engage in business in this state; and

(C) does not owe any delinquent franchise or other taxes to this state;

(6) the applicant, if not a corporation, is properly registered under the laws of this state or another

state or country and, if required, is authorized to engage in business in this state; and

(7) the applicant, a principal of the applicant, or a principal of a person in control of the applicant

is not listed on the specifically designated nationals and blocked persons list prepared by the United States

Department of the Treasury, or designated successor agency, as a potential threat to commit or fund

terrorist acts.

(b) In determining whether an applicant has demonstrated satisfaction of the qualifications identified

in Subsection (a)(1), the commissioner shall consider the financial responsibility and condition, financial

and business experience, competence, character, and general fitness of each principal of, person in control

of, principal of a person in control of, and proposed responsible individual of the applicant and may deny

approval of the application on the basis that the applicant has failed to demonstrate satisfaction of the

requisite qualifications with respect to one or more of those persons.

(c) The commissioner may not issue a license to an applicant if the applicant or one of the following

persons has been convicted within the preceding 10 years of a criminal offense specified in Subsection

(e):

(1) if the applicant is an individual, the spouse or proposed responsible individual or individuals

of the applicant;

(2) if the applicant is an entity that is wholly owned, directly or indirectly, by a single individual,

the spouse of the individual; or

(3) if the applicant is a person other than an individual, a principal of, person in control of,

principal of a person in control of, or proposed responsible individual or individuals of the applicant.

(d) The commissioner, on a finding that the conviction does not reflect adversely on the present

likelihood that the applicant will conduct business in compliance with this chapter, rules adopted under

CORP-I07 [10/13] Texas Department of Banking

this chapter, and other applicable state and federal law, may waive a disqualification under Subsection (c)

based on the conviction of a spouse or a corporate applicant or corporate person in control of an applicant.

(e) For purposes of Subsection (c), a disqualifying conviction is a conviction for a felony criminal

offense:

(1) under state or federal law that involves or relates to:

(A) deception, dishonesty, or defalcation;

(B) money transmission or other money services, including a reporting, recordkeeping or

registration requirement of the Bank Secrecy Act, the USA PATRIOT ACT, or Chapter 271;

(C) money laundering, structuring, or a related financial crime;

(D) drug trafficking; or

(E) terrorist funding; and

(2) under a similar law of a foreign country unless the applicant demonstrates to the satisfaction

of the commissioner that the conviction was based on extenuating circumstances unrelated to the person's

reputation for honesty and obedience to law.

(f) For purposes of Subsection (c), a person is considered to have been convicted of an offense if the

person has been found guilty or pleaded guilty or nolo contendere to the charge or has been placed on

probation or deferred adjudication without regard to whether a judgment of conviction has been entered

by the court.

CORP-I07 [10/13] Texas Department of Banking

You might also like

- JCF Application FormDocument9 pagesJCF Application FormDray Day67% (9)

- Debt Validation PDF TemplateDocument5 pagesDebt Validation PDF TemplateValerie Lopez100% (36)

- Fiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / BeneficiaryDocument6 pagesFiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / Beneficiarytony100% (23)

- FCPA Compliance ChecklistDocument18 pagesFCPA Compliance ChecklistmrvirginesNo ratings yet

- Affidavit of CreditDocument2 pagesAffidavit of CreditMill Bey83% (12)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Debt Collector Disclosure StatementDocument5 pagesDebt Collector Disclosure StatementBhakta Prakash94% (16)

- Gemini - Institution - Account ApplicationDocument16 pagesGemini - Institution - Account ApplicationAnthony YacobucciNo ratings yet

- Law On Other Business Transactions 20181Document365 pagesLaw On Other Business Transactions 20181Leonel King0% (1)

- Administrative Discretion and Judicial Review-3Document40 pagesAdministrative Discretion and Judicial Review-3Niraj PandeyNo ratings yet

- 98-2-21565-8 Domectic Violence - Amy Pasco - Paralegal - Veronica Freitas LawDocument24 pages98-2-21565-8 Domectic Violence - Amy Pasco - Paralegal - Veronica Freitas LawfreebazilNo ratings yet

- Hot Fuzz StoryboardDocument5 pagesHot Fuzz StoryboardmlaadikNo ratings yet

- Peter Strzok - DOJ Motion To Dismiss - 11.18.19Document151 pagesPeter Strzok - DOJ Motion To Dismiss - 11.18.19Victor I Nava100% (2)

- Symfonie Angel Ventures AML 20130715Document13 pagesSymfonie Angel Ventures AML 20130715Symfonie CapitalNo ratings yet

- SBIR Application VCOC CertificationDocument3 pagesSBIR Application VCOC CertificationGOKUL PRASADNo ratings yet

- F204.7-3 Rev 2 Int'l Representations & Certifications Feb 2021Document4 pagesF204.7-3 Rev 2 Int'l Representations & Certifications Feb 2021Fale Inglês Com GaspwNo ratings yet

- Latin Node Plea AgreementDocument11 pagesLatin Node Plea AgreementMarc BohnNo ratings yet

- CA SPSL - For Profit Applicant CertificationsDocument3 pagesCA SPSL - For Profit Applicant CertificationsChristina MaierNo ratings yet

- 01 All Homes Insured by Us Government Usda RD Section 502 7 CFR Part 1980Document4 pages01 All Homes Insured by Us Government Usda RD Section 502 7 CFR Part 1980camwills2No ratings yet

- Sam GovDocument3 pagesSam Govheffsworld440No ratings yet

- Why and Where To Set Up A Foreign Trust For Asset Protectionffjqr PDFDocument3 pagesWhy and Where To Set Up A Foreign Trust For Asset Protectionffjqr PDFshirticicle02100% (1)

- A. Information Regarding Principal Officers, Directors and 10% Equity Security OwnersDocument4 pagesA. Information Regarding Principal Officers, Directors and 10% Equity Security OwnersJane MendezNo ratings yet

- Delayed Deposit Services Licensing Act Chapter 45, Article 9 45-901 To 45-931Document21 pagesDelayed Deposit Services Licensing Act Chapter 45, Article 9 45-901 To 45-931Jocelyn CyrNo ratings yet

- Fria Concurrence and Preference of CreditsDocument38 pagesFria Concurrence and Preference of CreditsAlex M TabuacNo ratings yet

- Vik Supplimental Material-My Favorite Assignment Tax Case KPMG InternshipsDocument10 pagesVik Supplimental Material-My Favorite Assignment Tax Case KPMG InternshipssukeshNo ratings yet

- rd1980-21 2-2013Document4 pagesrd1980-21 2-2013api-196037134No ratings yet

- FRIA Important SectionsDocument7 pagesFRIA Important Sectionslouis jansenNo ratings yet

- GFXHGJGKGKLDocument2 pagesGFXHGJGKGKLJornel MandiaNo ratings yet

- Marc J. Carmel (Admitted Pro Hac Kirkland & Ellis LLP 300 North Lasalle Drive Chicago, Illinois 60654 3406 Telephone: (312) 862-2000Document152 pagesMarc J. Carmel (Admitted Pro Hac Kirkland & Ellis LLP 300 North Lasalle Drive Chicago, Illinois 60654 3406 Telephone: (312) 862-2000Chapter 11 DocketsNo ratings yet

- Alabama Small Loan ActDocument20 pagesAlabama Small Loan Actstudent_physicianNo ratings yet

- Bonding Products Declaration and IndemnityDocument7 pagesBonding Products Declaration and Indemnitydavid parulianNo ratings yet

- LCCR Q & R 013910-14083 Questionnaire and Response Dated 10/12/2001Document96 pagesLCCR Q & R 013910-14083 Questionnaire and Response Dated 10/12/2001LCCR AdminNo ratings yet

- Fiduciaryappointment TEMPLATEDocument7 pagesFiduciaryappointment TEMPLATEJerry100% (2)

- Senate Bill 98Document12 pagesSenate Bill 98KTVLNo ratings yet

- Validation of Proof of CalimDocument5 pagesValidation of Proof of CalimSharvar DanielsNo ratings yet

- Sprint UtilitiesDocument4 pagesSprint Utilitiesgordon scottNo ratings yet

- Fria ReviewerDocument31 pagesFria ReviewerWhere Did Macky Gallego100% (4)

- Fair Debt Collection Practices Act (ELI Highlights)Document27 pagesFair Debt Collection Practices Act (ELI Highlights)ExtortionLetterInfo.com60% (5)

- Angelo Millones Records - Contrato Con La DEADocument18 pagesAngelo Millones Records - Contrato Con La DEAFigueroa AgostoNo ratings yet

- Rehabilitation Receiver NotesDocument19 pagesRehabilitation Receiver NotesMarvin TuasonNo ratings yet

- FRIADocument16 pagesFRIABianca Viel Tombo CaligaganNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010Document7 pagesFinancial Rehabilitation and Insolvency Act of 2010Alyssa Clarizze MalaluanNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument679 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Steve Powell BankruptcyDocument33 pagesSteve Powell BankruptcyThe Salt Lake TribuneNo ratings yet

- Ga Rule 1 15-IiiDocument3 pagesGa Rule 1 15-IiigoentrustNo ratings yet

- Sba Form 1623 Certification Regarding Debarment Suspension and Other Responsibility MattersDocument2 pagesSba Form 1623 Certification Regarding Debarment Suspension and Other Responsibility MattersDiana JuanNo ratings yet

- R.A. 10142Document54 pagesR.A. 10142Sheila GarciaNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument54 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledPatricia Anne GonzalesNo ratings yet

- Executive Order No. 2Document21 pagesExecutive Order No. 2The (Bergen) RecordNo ratings yet

- Fria A&bDocument34 pagesFria A&bMoress JarieNo ratings yet

- Debt Validation Letter Incomplete 2012Document9 pagesDebt Validation Letter Incomplete 2012minosnada100% (2)

- Orbe Brazil Fund LTD - Subscription Documents - December 2009Document37 pagesOrbe Brazil Fund LTD - Subscription Documents - December 2009José Enrique MorenoNo ratings yet

- REPUBLIC ACT NoDocument36 pagesREPUBLIC ACT NoYlnne Cahlion KiwalanNo ratings yet

- Draft Film Financing Agreement1Document4 pagesDraft Film Financing Agreement1Mike KrauseNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument38 pagesFinancial Rehabilitation and Insolvency ActBevz23No ratings yet

- LBA:MNLA Regulations and Red FlagsDocument5 pagesLBA:MNLA Regulations and Red Flagspascalg19No ratings yet

- FATCA Declaration Individual HUFDocument7 pagesFATCA Declaration Individual HUFprofessionalassociates97No ratings yet

- Operating AgreementDocument7 pagesOperating AgreementFull Spectrum Domino100% (1)

- Fria PDF Pam VersionDocument23 pagesFria PDF Pam VersionMaricrisNo ratings yet

- Defend RMC 12-2018Document4 pagesDefend RMC 12-2018John Evan Raymund BesidNo ratings yet

- BILL NO. - Date of Intro. - Ref.Document6 pagesBILL NO. - Date of Intro. - Ref.api-280725427No ratings yet

- Compliance Letter CC en-USDocument6 pagesCompliance Letter CC en-USRex RoadNo ratings yet

- Prospectus Wise IncomeDocument203 pagesProspectus Wise IncomesmulyuzNo ratings yet

- New Application Checklist: Jurisdiction-Specific RequirementsDocument3 pagesNew Application Checklist: Jurisdiction-Specific RequirementsVishal NaikNo ratings yet

- 20240212075131_43Document12 pages20240212075131_43Mark ReinhardtNo ratings yet

- 20240209082549_6Document5 pages20240209082549_6Mark ReinhardtNo ratings yet

- 20240209104714_14Document7 pages20240209104714_14Mark ReinhardtNo ratings yet

- 20240209082733_7Document6 pages20240209082733_7Mark ReinhardtNo ratings yet

- 20240209105918_18Document23 pages20240209105918_18Mark ReinhardtNo ratings yet

- 20240209105227_17Document8 pages20240209105227_17Mark ReinhardtNo ratings yet

- 20240209080229_3Document4 pages20240209080229_3Mark ReinhardtNo ratings yet

- 20240209084551_8Document4 pages20240209084551_8Mark ReinhardtNo ratings yet

- 20240209104221_13Document3 pages20240209104221_13Mark ReinhardtNo ratings yet

- 20240209103522_10Document4 pages20240209103522_10Mark ReinhardtNo ratings yet

- 20240209095921_9Document3 pages20240209095921_9Mark ReinhardtNo ratings yet

- Crime Scene Manual Rev3Document153 pagesCrime Scene Manual Rev3Mark ReinhardtNo ratings yet

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Document80 pagesSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtNo ratings yet

- Patrol LP Scenario04 July2021Document24 pagesPatrol LP Scenario04 July2021Mark ReinhardtNo ratings yet

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDocument185 pagesMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtNo ratings yet

- 20240209104739_15Document5 pages20240209104739_15Mark ReinhardtNo ratings yet

- Large Bank Assets (Federal Reserve) 2023Document103 pagesLarge Bank Assets (Federal Reserve) 2023Mark ReinhardtNo ratings yet

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDocument27 pagesWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtNo ratings yet

- Patrol LP Scenario03 July2021Document25 pagesPatrol LP Scenario03 July2021Mark ReinhardtNo ratings yet

- 20221230final Order No 35651Document5 pages20221230final Order No 35651Mark ReinhardtNo ratings yet

- Bills 113s987rsDocument44 pagesBills 113s987rsMark ReinhardtNo ratings yet

- A Bill: 117 Congress 1 SDocument22 pagesA Bill: 117 Congress 1 SMark ReinhardtNo ratings yet

- H0001Document2 pagesH0001Mark ReinhardtNo ratings yet

- A Bill: 116 Congress 2 SDocument15 pagesA Bill: 116 Congress 2 SMark ReinhardtNo ratings yet

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDocument11 pagesCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtNo ratings yet

- Resumen Corto de Just Like A MovieDocument4 pagesResumen Corto de Just Like A MovieKelvin Orellana40% (5)

- Drivers Handbook and Examination Manual PDFDocument98 pagesDrivers Handbook and Examination Manual PDFkhaireddinNo ratings yet

- Pestilos vs. PeopleDocument2 pagesPestilos vs. PeopleJay-r TumamakNo ratings yet

- Fraud & Malpractice Policy StatementDocument5 pagesFraud & Malpractice Policy StatementMobolaji KamsonNo ratings yet

- SANDEEP KUMAR (Registration Number 11201713244) E-Recruitment Online ApplicationDocument2 pagesSANDEEP KUMAR (Registration Number 11201713244) E-Recruitment Online ApplicationAnonymous tqfjwlYNo ratings yet

- Lea2 ReviewerDocument55 pagesLea2 ReviewerAngelica Delos SantosNo ratings yet

- Other Law Enforcement OperationDocument8 pagesOther Law Enforcement Operationreyvinalon199No ratings yet

- 2023 01127 Shooting Suspect ArrestedDocument4 pages2023 01127 Shooting Suspect ArrestedAki SogaNo ratings yet

- Northville RecordDocument1 pageNorthville RecordfbfirmNo ratings yet

- Tamayo v. PeopleDocument2 pagesTamayo v. PeopleDominique PobeNo ratings yet

- Criminal Justice e Portfolio 2Document6 pagesCriminal Justice e Portfolio 2api-240491361No ratings yet

- Presidential Decree No. 2018Document2 pagesPresidential Decree No. 2018Xtine CampuPotNo ratings yet

- Complaint - Michael JoslinDocument4 pagesComplaint - Michael JoslinFOX40 NewsNo ratings yet

- BL 02 - Contracts Lecture Notes - SupplementaryDocument8 pagesBL 02 - Contracts Lecture Notes - SupplementaryLizza Marie CasidsidNo ratings yet

- Criminal Law OutlineDocument6 pagesCriminal Law OutlineJennylyn Biltz AlbanoNo ratings yet

- False Imprisonment: Submitted To: Mrs. Neha NimeshDocument12 pagesFalse Imprisonment: Submitted To: Mrs. Neha NimeshSimranNo ratings yet

- Factsheet Eu-Us: Negotiations On Data ProtectionDocument3 pagesFactsheet Eu-Us: Negotiations On Data ProtectionvampiriNo ratings yet

- PNP Aidsotf Celebrates 8th Founding Anniversary With Full Commitment To The Continuing Fight AgainstDocument2 pagesPNP Aidsotf Celebrates 8th Founding Anniversary With Full Commitment To The Continuing Fight AgainstSheena Lyn MontieroNo ratings yet

- Front PageDocument10 pagesFront Pagemd.jewel rana100% (1)

- Check PointDocument31 pagesCheck PointDennis TolentinoNo ratings yet

- Venue Staff Application Form: Part 1 Personal Information Personal Contact DetailsDocument5 pagesVenue Staff Application Form: Part 1 Personal Information Personal Contact Detailsphils_skoreaNo ratings yet

- Litonjua vs. Marcelino DigestDocument3 pagesLitonjua vs. Marcelino DigestEmir MendozaNo ratings yet

- WORKSHEET Crime in AmericaDocument2 pagesWORKSHEET Crime in AmericaBart van NieuwenhoveNo ratings yet

- Integrated National Police Personnel Professionalization Law of 1977Document17 pagesIntegrated National Police Personnel Professionalization Law of 1977mralexisabinesNo ratings yet

- Pinellas County Sheriff Robert Gualtieri Public Records Lawsuit Request For Admissions 4-11-19Document6 pagesPinellas County Sheriff Robert Gualtieri Public Records Lawsuit Request For Admissions 4-11-19James McLynasNo ratings yet