Professional Documents

Culture Documents

North South Airlines

North South Airlines

Uploaded by

ilovemoniiiqueCopyright:

Available Formats

You might also like

- Managerial Decision Analysis Case Study - Akron Zoological ParkDocument6 pagesManagerial Decision Analysis Case Study - Akron Zoological ParkNariman H. B.56% (9)

- Forecasting Problem POM Software:: Case Study (Southwestern University)Document4 pagesForecasting Problem POM Software:: Case Study (Southwestern University)FAYSAL36240% (1)

- Atx Summary Notes Owias MirchawalaDocument47 pagesAtx Summary Notes Owias Mirchawalaleowizofficial100% (1)

- DPC AnalysisDocument2 pagesDPC AnalysisTanza Griffin100% (1)

- Case Study Analysis2Document8 pagesCase Study Analysis2Maviel Maratas SarsabaNo ratings yet

- North South Airlines Case StudyDocument13 pagesNorth South Airlines Case StudyPhilip Joseph100% (2)

- Southwestern UniversityDocument6 pagesSouthwestern Universityhmz1811388167% (3)

- Chapter 14 & 15 HomeworkDocument8 pagesChapter 14 & 15 HomeworkfridaMaldonadoNo ratings yet

- CVP Analysis: Case: Aussie Pies (A)Document35 pagesCVP Analysis: Case: Aussie Pies (A)jk kumar100% (1)

- Vintage Restaurant CaseDocument10 pagesVintage Restaurant Caseanghellow100% (1)

- Case 29. North-South AirlinesDocument1 pageCase 29. North-South AirlinesCharmie Lagdamen100% (1)

- Akron Zoological ParkDocument3 pagesAkron Zoological ParkRick GinezNo ratings yet

- Chapter 4 SolvedDocument21 pagesChapter 4 SolvedQuế Hoàng Hoài ThươngNo ratings yet

- Operations Management Chapter 3 - ForecastingDocument44 pagesOperations Management Chapter 3 - ForecastingGio Mintu100% (2)

- North South AirlineDocument4 pagesNorth South AirlineJordan Angel100% (1)

- Explain Why Prioritizing The Relative Importance of Strengths and Weaknesses To Include in An IFE Matrix Is An Important StrategicDocument1 pageExplain Why Prioritizing The Relative Importance of Strengths and Weaknesses To Include in An IFE Matrix Is An Important Strategiciqra khanNo ratings yet

- Southwestern UniversityDocument4 pagesSouthwestern Universitylazyreaderr0% (1)

- Answers Forecasting NumericalsDocument6 pagesAnswers Forecasting NumericalsAakash PrasadNo ratings yet

- Cost of Capital Brigham Case SolutionDocument7 pagesCost of Capital Brigham Case SolutionShahid Mehmood100% (13)

- Transportation Problem1Document28 pagesTransportation Problem1Dharmesh MistryNo ratings yet

- Cost ReportDocument12 pagesCost ReportpistesilNo ratings yet

- BCA 2015 Operations Planning GuideDocument52 pagesBCA 2015 Operations Planning Guideamenendezam100% (1)

- Chapter 11 Adjusting EntriesDocument91 pagesChapter 11 Adjusting EntriesMelessa Pescador100% (1)

- TB Chapter 09 Test Bank For Cost of Capital Brigham Fundamentals of Financial ManagementDocument59 pagesTB Chapter 09 Test Bank For Cost of Capital Brigham Fundamentals of Financial ManagementThanakrit LerdmatayakulNo ratings yet

- Overview If Railway AccountsDocument40 pagesOverview If Railway AccountsKannan ChakrapaniNo ratings yet

- North South AirlineDocument3 pagesNorth South AirlineJordan Angel100% (1)

- Northern - Southeast Case StudyDocument8 pagesNorthern - Southeast Case StudyYogeshLuhar100% (3)

- Quantitative AnswerssDocument10 pagesQuantitative AnswerssShamim Raja100% (1)

- Case Study ArkonDocument6 pagesCase Study ArkonKotherNo ratings yet

- Activity Based CDocument12 pagesActivity Based CAman Sukhija100% (2)

- Management Accounting Sample QuestionsDocument14 pagesManagement Accounting Sample QuestionsMarjun Segismundo Tugano IIINo ratings yet

- Sensitivity AnalysisDocument25 pagesSensitivity AnalysisYaronBaba100% (2)

- Demand Analysis: Questions & Answers Q5.1 Q5.1 AnswerDocument33 pagesDemand Analysis: Questions & Answers Q5.1 Q5.1 AnswerkillyxNo ratings yet

- QueueDocument14 pagesQueueZharlene SasotNo ratings yet

- Transportation ProblemDocument20 pagesTransportation ProblemChasity WrightNo ratings yet

- Chapter5 NewDocument49 pagesChapter5 Newarturobravo100% (2)

- CH 16 Markov AnalysisDocument37 pagesCH 16 Markov AnalysisRia Rahma PuspitaNo ratings yet

- Short Run Decision AnalysisDocument31 pagesShort Run Decision AnalysisMedhaSaha100% (1)

- Break Even Analysis-MBADocument27 pagesBreak Even Analysis-MBAuchi228567% (3)

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Operations Management Homework 37 PDFDocument3 pagesOperations Management Homework 37 PDFFerdinand MangaoangNo ratings yet

- Tutorial Chapter 6 Job Design and Work MeasurementDocument13 pagesTutorial Chapter 6 Job Design and Work MeasurementNaKib Nahri100% (1)

- Southwestern University Traffic ProblemDocument7 pagesSouthwestern University Traffic ProblemShachin ShibiNo ratings yet

- Which 3 of DemingDocument2 pagesWhich 3 of DemingFALAK NAZ MUHAMMAD HUSSAINNo ratings yet

- Chapter 3 - Cost Volume and Cost Volume Profit AnalysisDocument65 pagesChapter 3 - Cost Volume and Cost Volume Profit AnalysisGabai AsaiNo ratings yet

- Case C Southwestern UnivesityDocument3 pagesCase C Southwestern UnivesityRamez Omar50% (4)

- CAPITAL BUDGETING in Automobile SectorDocument12 pagesCAPITAL BUDGETING in Automobile SectorSheel VictoriaNo ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingAditya SinghNo ratings yet

- Chapter 13 ValuationDocument23 pagesChapter 13 ValuationIndah Dwi RetnoNo ratings yet

- Chapter 15 PDFDocument49 pagesChapter 15 PDFSyed Atiq TurabiNo ratings yet

- Disadvantages or Limitations of Activity Based Costing System..89Document2 pagesDisadvantages or Limitations of Activity Based Costing System..89Sameer MohantyNo ratings yet

- Stability RatioDocument27 pagesStability RatioashokkeeliNo ratings yet

- CASE STUDY Rise and Fall of Subhiksha-ScmDocument2 pagesCASE STUDY Rise and Fall of Subhiksha-ScmTanisha Agarwal100% (1)

- Application of Transportation Model in Business MAINDocument15 pagesApplication of Transportation Model in Business MAINBoobalan RNo ratings yet

- Cost Volume Profit Analysis PDFDocument11 pagesCost Volume Profit Analysis PDFSayma LinaNo ratings yet

- Ch16 - 000 Cost ManagementDocument78 pagesCh16 - 000 Cost ManagementAmanda Esther100% (2)

- Ethics Model AnswersDocument8 pagesEthics Model Answersramancs100% (1)

- Ken Black QA 5th Chapter 10 SolutionDocument46 pagesKen Black QA 5th Chapter 10 SolutionRushabh Vora0% (1)

- North South Airlines Sec1 GRP3Document9 pagesNorth South Airlines Sec1 GRP3Georgette GalesNo ratings yet

- North South Airlines Sec1 GRP3Document9 pagesNorth South Airlines Sec1 GRP3Georgette GalesNo ratings yet

- Case: The North - South Airline: Far Eastern UniversityDocument17 pagesCase: The North - South Airline: Far Eastern UniversityEly CasugaNo ratings yet

- Cost Index ArticleDocument3 pagesCost Index ArticlepepegoesdigitalNo ratings yet

- Aviation Industry ManagementDocument11 pagesAviation Industry ManagementRishabh KaluraNo ratings yet

- Cost Index Explained: Fuel Conservation StrategiesDocument3 pagesCost Index Explained: Fuel Conservation StrategiesAnshu KumarNo ratings yet

- Glossary of Key Terms: International EconomicsDocument21 pagesGlossary of Key Terms: International EconomicsAjay KaundalNo ratings yet

- B01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDocument14 pagesB01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDương Thị Kim HiềnNo ratings yet

- Shubham RaniDocument6 pagesShubham RaniSanchay BhararaNo ratings yet

- 2016 14 PPT Acctg1 Adjusting EntriesDocument20 pages2016 14 PPT Acctg1 Adjusting Entriesash wu100% (3)

- Chapter 3Document19 pagesChapter 3AshiNo ratings yet

- LPO Letter Re Li-CycleDocument4 pagesLPO Letter Re Li-CycleNick PopeNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDr V SaptagiriNo ratings yet

- PJJ Discussion 3 BsiDocument3 pagesPJJ Discussion 3 BsiMultimediaNo ratings yet

- Financial Forecasting, Planning, and BudgetingDocument38 pagesFinancial Forecasting, Planning, and BudgetingjawadzaheerNo ratings yet

- Letter of Credit UpdatedDocument17 pagesLetter of Credit UpdatedKobir HasanNo ratings yet

- Public Finance, Chapter 3Document8 pagesPublic Finance, Chapter 3YIN SOKHENGNo ratings yet

- 1617 1stS MX NBergonia RevDocument11 pages1617 1stS MX NBergonia RevJames Louis BarcenasNo ratings yet

- CH 15Document51 pagesCH 15jjupark2004No ratings yet

- Customer StatementDocument13 pagesCustomer StatementSophia GraysonNo ratings yet

- Financial Instrument NotesDocument3 pagesFinancial Instrument NotesKrishna AdhikariNo ratings yet

- 71 F. Susandra, I. Gandara Pengambilan Keputusan Keuangan Dengan Pendekatan AnalisisDocument11 pages71 F. Susandra, I. Gandara Pengambilan Keputusan Keuangan Dengan Pendekatan Analisiskristina dewiNo ratings yet

- Terms Sheet SampleDocument4 pagesTerms Sheet SampleKamil JagieniakNo ratings yet

- Banking Primer 1Document54 pagesBanking Primer 1vouzvouz7127100% (1)

- HA 222 Finance Practice Prob Chap 7Document6 pagesHA 222 Finance Practice Prob Chap 7Ben Kramer50% (2)

- CBSE Class 11 Accountancy Worksheet - Theory Base of AccountingDocument3 pagesCBSE Class 11 Accountancy Worksheet - Theory Base of AccountingUmesh JaiswalNo ratings yet

- Islamic Structured Investment Products (Sip)Document15 pagesIslamic Structured Investment Products (Sip)Adib .iq02No ratings yet

- The Ford Pinto Case StudyDocument20 pagesThe Ford Pinto Case Studyaman1203100% (2)

- August TriCorner 2015 PDFDocument20 pagesAugust TriCorner 2015 PDFLakeville JournalNo ratings yet

- Volkswagen Finance - An Unusual Interpretation of Business ConnectionDocument4 pagesVolkswagen Finance - An Unusual Interpretation of Business Connectionbhupendra barhatNo ratings yet

- 2nd Year Accounting NotesDocument4 pages2nd Year Accounting NotesMumtazAhmadNo ratings yet

- Invoice 2Document1 pageInvoice 2Ankit GiriNo ratings yet

North South Airlines

North South Airlines

Uploaded by

ilovemoniiiqueCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

North South Airlines

North South Airlines

Uploaded by

ilovemoniiiqueCopyright:

Available Formats

BACKGROUND OF THE COMPANY

Northern Airlines merged with Southeast Airlines to create the fourth largest U.S. carrier in

January 2008. The new NorthSouth Airline inherited both an aging fleet of Boeing 727-300

aircraft and Stephen Ruth. Stephen was a tough former Secretary of the Navy who stepped in

as new president and chairman of the board. Peg Jones on the other hand is the vice president

for operations and maintenance.

DEFINE THE PROBLEM

Stephens objective is to gear the companys financial performance towards stability and

continuous growth. This made him concern that the aging fleet of Boeing 727-300 aircrafts

maintenance cost may impede realization of this goal.

The significant difference in the reported B727-300 maintenance costs (from ATA Form 41s)

both in the airframe and engine areas between Northern Airlines and Southeast Airlines made

him to probe through Peg Jones assistance on determining the quantitative and graphical

report of the following :

Correlation of the average fleet age to direct airframe maintenance costs

Linear relationship between the average fleet age and direct engine maintenance costs

CASE FACTS AND INFORMATION (INCLUDING LIMITATIONS & CONSTRAINTS)

In addition to the aging formulas below, Peg constructed the average age of Northern and

Southeast B727-300 fleets by quarter since the introduction of that aircraft to service by each

airline in late 1993 and early 1994 respectively.

TOTAL FLEET HOURS = TOTAL DAYS IN SERVICE X AVERAGE DAILY UTILIZATION

AVERAGE AGE OF EACH FLEET = TOTAL FLEET HOURS FLOWN

# OF AIRCRAFT IN SERVICE

AVERAGE DAILY UTILIZATION = TOTAL FLEET HOURS FLOWN

TOTAL DAYS IN SERVICE

In getting the average utilization, Peg used the actual fleet hours flown on September 30, 2007

from Northern and Southeast data, and dividing by the total days in service for all aircraft at that

time. The average utilization for Southeast and Northern were 8.3 and 8.7 hours per day

respectively. In addition, available cost data including the average fleet age were calculated for

each yearly period ending at the end of first quarter.

ALTERNATIVE APPROACHES TO SOLVING THE PROBLEM

Business asset depreciation depends on the cost of asset and its useful life. What is distinct about

aircraft depreciation is that each component of an airplane is depreciated at different rates and

depreciation methods. The North-South Airline problem for this instance may also be resolved

by using depreciation methods as follows:

straight line with salvage value method = Asset Cost/ Useful Life

o The advantage of using the straight line method involves the ease of

calculating the annual depreciation amount. The disadvantage of

using the straight line method is that this method does not consider

the rate the asset will actually depreciate in value.

Declining balance method = Remaining Asset Value x Depreciation Rate

o The advantage of using this method is that it accelerates the depreciation

recorded early in the asset's life and thus reduces the taxable income and the taxes

owed during the early years. The disadvantage is that the method can be applied

only when there is a residual value of the asset.

QUANTITATIVE METHOD/S EMPLOYED AND THE SOLUTION TO THE PROBLEM

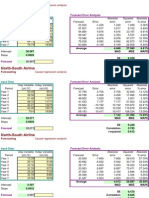

Northern Airlines Data

AIRFRAME

ENGINE

Southern Airlines Data

AIRFRAME

Southeast Airlineairframe maintenance cost:

Cost = 4.60 + 0 (airframe age) = 4.60

Coefficient of determination = 0.39

Coefficient of correlation = 0.62

ENGINE

Northern Airlineairframe maintenance cost:

Cost _ 36.10 _ 0.0025 (airframe age)

Coefficient of determination _ 0.7694

Coefficient of correlation _ 0.8771

Northern Airlineengine maintenance cost:

Cost _ 20.57 _ 0.0026 (airframe age)

Coefficient of determination _ 0.6124

Coefficient of correlation _ 0.7825

Southeast Airlineengine maintenance cost:

Cost __0.671 _ 0.0041 (airframe age)

Coefficient of determination _ 0.4599

Coefficient of correlation _ 0.6782

ETHICAL CONSIDERATIONS

DEPRECIATION USED = SAFETY

The units of production method involves determining the cost to depreciate and dividing that

amount by the estimated production units the company expects to manufacture over the life of

the asset. The advantages of using the units of production method include the ease of calculating

the annual depreciation amount and that the depreciation is matched to the production quantity.

The disadvantage of using the units of production method is that this method assumes the asset

will depreciate evenly over its productive life.

The graphs below portray both the actual data and the regression lines for airframe and engine

maintenance costs for both airlines.Note that the two graphs have been drawn to the same

scale to facilitate comparisons between the two airlines.

Northern Airline: There seem to be modest correlations between maintenance costs and

airframe age for Northern Airline. There is certainly reason to conclude, however, that airframe

age is not the only important factor.

Southeast Airline: The relationships between maintenance costs and airframe age for

Southeast Airline are much less well defined. It is even more obvious that airframe age is not

the only important factorperhaps not even the most important factor.

OVERALL CONCLUSION

Overall, it would seem that:

1. Northern Airline has the smallest variance in maintenance costs, indicating that the day-to-

day management of

maintenance is working pretty well.

2. Maintenance costs seem to be more a function of airline than of airframe age.

3. The airframe and engine maintenance costs for Southeast Airline are not only lower but more

nearly similar than those for Northern Airline, but, from the graphs at least, appear to be rising

more sharply with age.

4. From an overall perspective, it appears that Southeast Airline may perform more efficiently on

sporadic or emergency repairs, and Northern Airline may place more emphasis on preventive

maintenance.

Ms. Youngs report should conclude that:

1. There is evidence to suggest that maintenance costs could be made to be a function of

airframe age by implementing more effective management practices.

2. The difference between maintenance procedures of the two airlines should be investigated.

3. The data with which she is presently working do not provide conclusive results.

You might also like

- Managerial Decision Analysis Case Study - Akron Zoological ParkDocument6 pagesManagerial Decision Analysis Case Study - Akron Zoological ParkNariman H. B.56% (9)

- Forecasting Problem POM Software:: Case Study (Southwestern University)Document4 pagesForecasting Problem POM Software:: Case Study (Southwestern University)FAYSAL36240% (1)

- Atx Summary Notes Owias MirchawalaDocument47 pagesAtx Summary Notes Owias Mirchawalaleowizofficial100% (1)

- DPC AnalysisDocument2 pagesDPC AnalysisTanza Griffin100% (1)

- Case Study Analysis2Document8 pagesCase Study Analysis2Maviel Maratas SarsabaNo ratings yet

- North South Airlines Case StudyDocument13 pagesNorth South Airlines Case StudyPhilip Joseph100% (2)

- Southwestern UniversityDocument6 pagesSouthwestern Universityhmz1811388167% (3)

- Chapter 14 & 15 HomeworkDocument8 pagesChapter 14 & 15 HomeworkfridaMaldonadoNo ratings yet

- CVP Analysis: Case: Aussie Pies (A)Document35 pagesCVP Analysis: Case: Aussie Pies (A)jk kumar100% (1)

- Vintage Restaurant CaseDocument10 pagesVintage Restaurant Caseanghellow100% (1)

- Case 29. North-South AirlinesDocument1 pageCase 29. North-South AirlinesCharmie Lagdamen100% (1)

- Akron Zoological ParkDocument3 pagesAkron Zoological ParkRick GinezNo ratings yet

- Chapter 4 SolvedDocument21 pagesChapter 4 SolvedQuế Hoàng Hoài ThươngNo ratings yet

- Operations Management Chapter 3 - ForecastingDocument44 pagesOperations Management Chapter 3 - ForecastingGio Mintu100% (2)

- North South AirlineDocument4 pagesNorth South AirlineJordan Angel100% (1)

- Explain Why Prioritizing The Relative Importance of Strengths and Weaknesses To Include in An IFE Matrix Is An Important StrategicDocument1 pageExplain Why Prioritizing The Relative Importance of Strengths and Weaknesses To Include in An IFE Matrix Is An Important Strategiciqra khanNo ratings yet

- Southwestern UniversityDocument4 pagesSouthwestern Universitylazyreaderr0% (1)

- Answers Forecasting NumericalsDocument6 pagesAnswers Forecasting NumericalsAakash PrasadNo ratings yet

- Cost of Capital Brigham Case SolutionDocument7 pagesCost of Capital Brigham Case SolutionShahid Mehmood100% (13)

- Transportation Problem1Document28 pagesTransportation Problem1Dharmesh MistryNo ratings yet

- Cost ReportDocument12 pagesCost ReportpistesilNo ratings yet

- BCA 2015 Operations Planning GuideDocument52 pagesBCA 2015 Operations Planning Guideamenendezam100% (1)

- Chapter 11 Adjusting EntriesDocument91 pagesChapter 11 Adjusting EntriesMelessa Pescador100% (1)

- TB Chapter 09 Test Bank For Cost of Capital Brigham Fundamentals of Financial ManagementDocument59 pagesTB Chapter 09 Test Bank For Cost of Capital Brigham Fundamentals of Financial ManagementThanakrit LerdmatayakulNo ratings yet

- Overview If Railway AccountsDocument40 pagesOverview If Railway AccountsKannan ChakrapaniNo ratings yet

- North South AirlineDocument3 pagesNorth South AirlineJordan Angel100% (1)

- Northern - Southeast Case StudyDocument8 pagesNorthern - Southeast Case StudyYogeshLuhar100% (3)

- Quantitative AnswerssDocument10 pagesQuantitative AnswerssShamim Raja100% (1)

- Case Study ArkonDocument6 pagesCase Study ArkonKotherNo ratings yet

- Activity Based CDocument12 pagesActivity Based CAman Sukhija100% (2)

- Management Accounting Sample QuestionsDocument14 pagesManagement Accounting Sample QuestionsMarjun Segismundo Tugano IIINo ratings yet

- Sensitivity AnalysisDocument25 pagesSensitivity AnalysisYaronBaba100% (2)

- Demand Analysis: Questions & Answers Q5.1 Q5.1 AnswerDocument33 pagesDemand Analysis: Questions & Answers Q5.1 Q5.1 AnswerkillyxNo ratings yet

- QueueDocument14 pagesQueueZharlene SasotNo ratings yet

- Transportation ProblemDocument20 pagesTransportation ProblemChasity WrightNo ratings yet

- Chapter5 NewDocument49 pagesChapter5 Newarturobravo100% (2)

- CH 16 Markov AnalysisDocument37 pagesCH 16 Markov AnalysisRia Rahma PuspitaNo ratings yet

- Short Run Decision AnalysisDocument31 pagesShort Run Decision AnalysisMedhaSaha100% (1)

- Break Even Analysis-MBADocument27 pagesBreak Even Analysis-MBAuchi228567% (3)

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Operations Management Homework 37 PDFDocument3 pagesOperations Management Homework 37 PDFFerdinand MangaoangNo ratings yet

- Tutorial Chapter 6 Job Design and Work MeasurementDocument13 pagesTutorial Chapter 6 Job Design and Work MeasurementNaKib Nahri100% (1)

- Southwestern University Traffic ProblemDocument7 pagesSouthwestern University Traffic ProblemShachin ShibiNo ratings yet

- Which 3 of DemingDocument2 pagesWhich 3 of DemingFALAK NAZ MUHAMMAD HUSSAINNo ratings yet

- Chapter 3 - Cost Volume and Cost Volume Profit AnalysisDocument65 pagesChapter 3 - Cost Volume and Cost Volume Profit AnalysisGabai AsaiNo ratings yet

- Case C Southwestern UnivesityDocument3 pagesCase C Southwestern UnivesityRamez Omar50% (4)

- CAPITAL BUDGETING in Automobile SectorDocument12 pagesCAPITAL BUDGETING in Automobile SectorSheel VictoriaNo ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingAditya SinghNo ratings yet

- Chapter 13 ValuationDocument23 pagesChapter 13 ValuationIndah Dwi RetnoNo ratings yet

- Chapter 15 PDFDocument49 pagesChapter 15 PDFSyed Atiq TurabiNo ratings yet

- Disadvantages or Limitations of Activity Based Costing System..89Document2 pagesDisadvantages or Limitations of Activity Based Costing System..89Sameer MohantyNo ratings yet

- Stability RatioDocument27 pagesStability RatioashokkeeliNo ratings yet

- CASE STUDY Rise and Fall of Subhiksha-ScmDocument2 pagesCASE STUDY Rise and Fall of Subhiksha-ScmTanisha Agarwal100% (1)

- Application of Transportation Model in Business MAINDocument15 pagesApplication of Transportation Model in Business MAINBoobalan RNo ratings yet

- Cost Volume Profit Analysis PDFDocument11 pagesCost Volume Profit Analysis PDFSayma LinaNo ratings yet

- Ch16 - 000 Cost ManagementDocument78 pagesCh16 - 000 Cost ManagementAmanda Esther100% (2)

- Ethics Model AnswersDocument8 pagesEthics Model Answersramancs100% (1)

- Ken Black QA 5th Chapter 10 SolutionDocument46 pagesKen Black QA 5th Chapter 10 SolutionRushabh Vora0% (1)

- North South Airlines Sec1 GRP3Document9 pagesNorth South Airlines Sec1 GRP3Georgette GalesNo ratings yet

- North South Airlines Sec1 GRP3Document9 pagesNorth South Airlines Sec1 GRP3Georgette GalesNo ratings yet

- Case: The North - South Airline: Far Eastern UniversityDocument17 pagesCase: The North - South Airline: Far Eastern UniversityEly CasugaNo ratings yet

- Cost Index ArticleDocument3 pagesCost Index ArticlepepegoesdigitalNo ratings yet

- Aviation Industry ManagementDocument11 pagesAviation Industry ManagementRishabh KaluraNo ratings yet

- Cost Index Explained: Fuel Conservation StrategiesDocument3 pagesCost Index Explained: Fuel Conservation StrategiesAnshu KumarNo ratings yet

- Glossary of Key Terms: International EconomicsDocument21 pagesGlossary of Key Terms: International EconomicsAjay KaundalNo ratings yet

- B01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDocument14 pagesB01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDương Thị Kim HiềnNo ratings yet

- Shubham RaniDocument6 pagesShubham RaniSanchay BhararaNo ratings yet

- 2016 14 PPT Acctg1 Adjusting EntriesDocument20 pages2016 14 PPT Acctg1 Adjusting Entriesash wu100% (3)

- Chapter 3Document19 pagesChapter 3AshiNo ratings yet

- LPO Letter Re Li-CycleDocument4 pagesLPO Letter Re Li-CycleNick PopeNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDr V SaptagiriNo ratings yet

- PJJ Discussion 3 BsiDocument3 pagesPJJ Discussion 3 BsiMultimediaNo ratings yet

- Financial Forecasting, Planning, and BudgetingDocument38 pagesFinancial Forecasting, Planning, and BudgetingjawadzaheerNo ratings yet

- Letter of Credit UpdatedDocument17 pagesLetter of Credit UpdatedKobir HasanNo ratings yet

- Public Finance, Chapter 3Document8 pagesPublic Finance, Chapter 3YIN SOKHENGNo ratings yet

- 1617 1stS MX NBergonia RevDocument11 pages1617 1stS MX NBergonia RevJames Louis BarcenasNo ratings yet

- CH 15Document51 pagesCH 15jjupark2004No ratings yet

- Customer StatementDocument13 pagesCustomer StatementSophia GraysonNo ratings yet

- Financial Instrument NotesDocument3 pagesFinancial Instrument NotesKrishna AdhikariNo ratings yet

- 71 F. Susandra, I. Gandara Pengambilan Keputusan Keuangan Dengan Pendekatan AnalisisDocument11 pages71 F. Susandra, I. Gandara Pengambilan Keputusan Keuangan Dengan Pendekatan Analisiskristina dewiNo ratings yet

- Terms Sheet SampleDocument4 pagesTerms Sheet SampleKamil JagieniakNo ratings yet

- Banking Primer 1Document54 pagesBanking Primer 1vouzvouz7127100% (1)

- HA 222 Finance Practice Prob Chap 7Document6 pagesHA 222 Finance Practice Prob Chap 7Ben Kramer50% (2)

- CBSE Class 11 Accountancy Worksheet - Theory Base of AccountingDocument3 pagesCBSE Class 11 Accountancy Worksheet - Theory Base of AccountingUmesh JaiswalNo ratings yet

- Islamic Structured Investment Products (Sip)Document15 pagesIslamic Structured Investment Products (Sip)Adib .iq02No ratings yet

- The Ford Pinto Case StudyDocument20 pagesThe Ford Pinto Case Studyaman1203100% (2)

- August TriCorner 2015 PDFDocument20 pagesAugust TriCorner 2015 PDFLakeville JournalNo ratings yet

- Volkswagen Finance - An Unusual Interpretation of Business ConnectionDocument4 pagesVolkswagen Finance - An Unusual Interpretation of Business Connectionbhupendra barhatNo ratings yet

- 2nd Year Accounting NotesDocument4 pages2nd Year Accounting NotesMumtazAhmadNo ratings yet

- Invoice 2Document1 pageInvoice 2Ankit GiriNo ratings yet