Professional Documents

Culture Documents

Daily Equity Report PDF

Daily Equity Report PDF

Uploaded by

NehaSharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Report PDF

Daily Equity Report PDF

Uploaded by

NehaSharmaCopyright:

Available Formats

CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

DAILY EQUITY REPORT

10th November 2014

CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

Daily Equity Report

INDIAN FACE

INDIAN MARKET

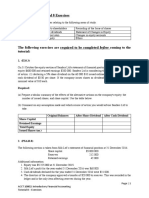

INDICES

CLOSE

PREVIOUS

SENSEX

27,868.63

27,915.88

NIFTY

8,337.00

8,338.30

INDIAN EQUITY BENCHMARK ended flat, amid a volatile

trading session, weighed down by profit taking in select index

ASIAN MARKET

heavyweights after both the benchmark indices hit record

INDICES

CLOSE

PREVIOUS

highs for a fourth straight session on Wednesday, as investors

NIKKEI

16,880.38

16,792.48

took profits in recent outperformers such as SBIN, with

HANG SENG

23,550.24

23,649.31

KOSPI

1,939.87

1,936.48

SECTORIAL INDICES

caution also prevailing ahead of monthly U.S. jobs data

Further, DLF rose 6.24% on reports that the Securities

Appellate Tribunal allowed the company to redeem Rs1806

INDICES

CLOSE

CHANGE (%)

CNX 100

8,287.55

0.16

S&P CNX 500

6,726.30

0.19

CNX MIDCAP

12,003.40

0.22

CNX 200

4,257.60

0.16

BANK NIFTY

17,372.15

0.11

TOP GAINERS

cr in mutual fund holdings in order to service outstanding

loans.

Aurobindo Pharma rose 2.21% after net profit rose 58.41% to

Rs372.18 cr on 51.57% increase in total income to Rs2908.51

cr in Q2 September 2014 over Q2 September 2013.

GLOBAL FACE

SCRIPT

CLOSE

CHANGE (%)

DLF

134.75

6.31

ZEEL

373.20

5.16

wallowed around two-year lows after European Central Bank

DR REDDY

3,395.00

4.40

President Mario Draghi vowed to take more easing steps to

LUPIN

1,425.25

3.18

spark growth in the euro zone.

TOP LOSERS

SCRIPT

CLOSE

CHANGE (%)

BHEL

249.80

-3.16

HEROMOTOCO

2,890.00

-2.47

GAIL

487.00

-2.17

ASIAN PAINT

645.60

-1.78

Asian shares wobbled in early trading, while the euro

European shares were steady, supported by positive corporate

results from blue-chips including Arcelor Mittal as investors

awaited key U.S. monthly jobs data.

US stock index futures poised for a higher opening at the Wall

Street on Friday.

CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

Daily Equity Report

MARKET MOVERS UPSIDE

NIFTY SPOT

SCRIPT

CLOSE

ONGC

409.65

CHANGE

(%)

1.5

INFOSYS

4166.60

1.01

S3

S2

S1

0.8

8189

8259

8298

ICICI BANK

1684.70

SUN PHARMA

894.30

2.62

TREND

STRATEGY

BULLISH

BUY ON DIPS

PIVOT POINTS

P

R1

8329

8368

SUPPORT

S1-8290

S2-8210

NIFTY

R2

R3

8399

8469

RESISTANCE

R1-8370

R2-8430

MARKET MOVERS DOWNSIDE

SCRIPT

CLOSE

TCS

2572.85

CHANGE

(%)

[1.03]

RELIANCE

980.50

[1.09]

ITC

355.65

[0.97]

HDFC BANK

899.45

[1.46]

FII & DII ACTIVITY

INSTITUTION

NET BUY

(CR.)

NET SELL

(CR)

FII

4459.07

3045.73

DII

1334.20

2517.28

NSE TOTALS

BANK NIFTY FUTURE

TREND

BULLISH

PIVOT POINTS

S3

17019

INDICES

ADVANCES

DECLINES

NIFTY

22

27

BANK NIFTY

STRATEGY

BUY ON DIPS

S2

S1

R1

17216

17336

17413

17533

BANK NIFTY

SUPPORT

S1-17290

S2-17150

R2

R3

17610

17807

RESISTANCE

R1-17550

R2-17750

CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

Daily Equity Report

r

MARKET TALKS

Mn for the quarter ended Sep 30, 2014 as compared to Rs. 22.150

L&T Q2 net profit at Rs. 10.42bn

million for the quarter ended Sep 30, 2013. Total Income has

The Group posted consolidated profit after taxes of Rs. 8617.50

increased from Rs. 2254.698 million for the quarter ended Sep 30,

million for the quarter ended September 30, 2014 as compared to

2013 to Rs. 2440.426 million for the quarter ended Sep 30, 2014.

Rs. 8063.50 million for the quarter ended September 30, 2013.

Total Income has increased from Rs. 193837.80 million for the

quarter ended September 30, 2013 to Rs. 213738.80 million for the

Syndicate Bank drops on poor Q2

show

quarter ended September 30, 2014.

Syndicate Bank started on a tentative note swinging in and out of

the positive zone ahead of the Q2 numbers. The bank reported

Bank of Baroda Q2 net profit at Rs.

11.04bn

32.9% fall in Q2FY15 net profit at Rs 315.60 cr when compared with

Rs 470.12 cr in Q2FY14. Total income, however, grew by 17.1% to

Rs 5,681 cr from Rs 4,850.35 cr in the same period.

The Bank has posted a net profit of Rs. 11042.20 million for the

quarter ended September 30, 2014 as compared to Rs. 11681.00

million for the quarter ended September 30, 2013. Total Income has

increased from Rs. 104473.10 million for the quarter ended

Arvind drops further after muted Q2

result.

September 30, 2013 to Rs. 118173.20 million for the quarter ended

The company has reported merely 3.5 per cent growth in Q2 net

September 30, 2014.

profit, from Rs 90.05 crore in Q2FY15 to Rs 93.26 crore in Q2FY14.

Strides

Arcolab

Rs3384.709 mn

Q2

PAT

at

Total income rose by 14.7 per cent to Rs 1,995 crore from Rs 1,739

crore for the above mentioned period. The stock touched an intraday low at Rs 296 and an intra-day high at Rs 313. Now, the stock

Strides Arcolab Ltd has Posted a net profit after tax of Rs. 3384.709

has declined by 2.2 per cent at Rs 302.

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any

responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.

Use of this report in no way constitutes a client/advisor relationship, all information we communicate to you (the subscriber) either through

our Web site or other forms of communications, are purely for informational purposes only. We recommend seeking individual investment

advice before making any investment, for you are assuming sole liability for your investments. Capital Stars will in no way have discretionary

authority over your trading or investment accounts.

All rights reserved.

You might also like

- Aud Rev, Investments Wit Ans KeyDocument17 pagesAud Rev, Investments Wit Ans KeyAngela RamosNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Convertible Note Term SheetDocument2 pagesConvertible Note Term SheetVictorNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Daily Equity Report 3 February 2015Document4 pagesDaily Equity Report 3 February 2015NehaSharmaNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Nifty News Letter-20 October 2015Document8 pagesNifty News Letter-20 October 2015Purvi MehtaNo ratings yet

- Daily Equity Report 6 February 2015Document4 pagesDaily Equity Report 6 February 2015NehaSharmaNo ratings yet

- Daily Equity Report 8 January 2015Document4 pagesDaily Equity Report 8 January 2015NehaSharmaNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryArun ShekharNo ratings yet

- Equity Morning Note 13 August 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 13 August 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Honda Atlas Cars (Pakistan) Limited: 1QFY15 Result Update - Exceptional Growth To Start The YearDocument2 pagesHonda Atlas Cars (Pakistan) Limited: 1QFY15 Result Update - Exceptional Growth To Start The YearArslan IshaqNo ratings yet

- NIFTY MARKET NEWS Updates - 20 OCT 2015Document8 pagesNIFTY MARKET NEWS Updates - 20 OCT 2015Aaliya DubeyNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Daily Equity Report 5 February 2015Document4 pagesDaily Equity Report 5 February 2015NehaSharmaNo ratings yet

- Weekly Equity Tips & Report 18 JanDocument6 pagesWeekly Equity Tips & Report 18 JanRahul SolankiNo ratings yet

- Market Outlook, 21st February, 2013Document14 pagesMarket Outlook, 21st February, 2013Angel BrokingNo ratings yet

- Daily Derivative Report 11.09.13Document3 pagesDaily Derivative Report 11.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Premarket MorningGlance SPA 16.11.16Document3 pagesPremarket MorningGlance SPA 16.11.16Rajasekhar Reddy AnekalluNo ratings yet

- StocksDocument4 pagesStocksNehaSharmaNo ratings yet

- Capitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MDocument8 pagesCapitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MNehaSharmaNo ratings yet

- Market Watch Daily 25.02.2014Document1 pageMarket Watch Daily 25.02.2014Randora LkNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- DLF IdbiDocument5 pagesDLF IdbivivarshneyNo ratings yet

- Nigerian Stock Exchange Weekly Market Report For The Week Ended 14-03-2014Document10 pagesNigerian Stock Exchange Weekly Market Report For The Week Ended 14-03-2014kelanio2002780No ratings yet

- StocksDocument4 pagesStocksNehaSharmaNo ratings yet

- Market Outlook, 25th January 2013Document16 pagesMarket Outlook, 25th January 2013Angel BrokingNo ratings yet

- StocksDocument4 pagesStocksNehaSharmaNo ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Daily Derivative Report 30.09.13Document3 pagesDaily Derivative Report 30.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Morning Call Morning Call: Markets End Higher Led by Telecom SharesDocument4 pagesMorning Call Morning Call: Markets End Higher Led by Telecom SharesrcpgeneralNo ratings yet

- Weekly Equity NewsletterDocument4 pagesWeekly Equity Newsletterapi-210648926No ratings yet

- Market Outlook: Dealer's DiaryDocument16 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument11 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument18 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- India Morning Bell 5th December 2014Document18 pagesIndia Morning Bell 5th December 2014Just ChillNo ratings yet

- Daily Equity ReportDocument3 pagesDaily Equity ReportAditya JainNo ratings yet

- Morning Briefing: Attock Petroleum Limited: A Good BUYDocument2 pagesMorning Briefing: Attock Petroleum Limited: A Good BUYjibranqqNo ratings yet

- Market Outlook: Dealer's DiaryDocument24 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Go Ahead For Equity Morning Note 01 June 2012-Mansukh Investment and Trading SolutionDocument3 pagesGo Ahead For Equity Morning Note 01 June 2012-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- BUY BUY BUY BUY: Aditya Birla Nuvo LTDDocument12 pagesBUY BUY BUY BUY: Aditya Birla Nuvo LTDrohitkhanna1180No ratings yet

- Market Outlook Report, 22nd JanuaryDocument16 pagesMarket Outlook Report, 22nd JanuaryAngel BrokingNo ratings yet

- Equity Morning Note 12 August 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 12 August 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- December Snapshot - Nifty 50Document11 pagesDecember Snapshot - Nifty 50Jignesh BhaiNo ratings yet

- OTC Final Accounts 2016Document57 pagesOTC Final Accounts 2016Ali ZafarNo ratings yet

- Opening Bell: Key Points Index Movement (Past 5 Days)Document14 pagesOpening Bell: Key Points Index Movement (Past 5 Days)Sandeep AnandNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Market Outlook: Dealer's DiaryDocument17 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- With You: All The WAYDocument12 pagesWith You: All The WAYmakhalidiNo ratings yet

- Market Outlook, 11th February, 2013Document21 pagesMarket Outlook, 11th February, 2013Angel BrokingNo ratings yet

- Daily Derivative Report 19.09.13Document3 pagesDaily Derivative Report 19.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Nifty Market News - 23 Oct 2015Document8 pagesNifty Market News - 23 Oct 2015Aaliya DubeyNo ratings yet

- Null O4mf44azdcfh646x.1Document15 pagesNull O4mf44azdcfh646x.1Clipsal ClipsalNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument9 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- 9.05.2024 StrategyDocument10 pages9.05.2024 StrategymithunNo ratings yet

- Daily Technical Report, 22.08.2013Document4 pagesDaily Technical Report, 22.08.2013Angel BrokingNo ratings yet

- Nifty News Letter-18 September 2015Document8 pagesNifty News Letter-18 September 2015NehaSharmaNo ratings yet

- Nifty News Letter-28 August 2015Document8 pagesNifty News Letter-28 August 2015NehaSharmaNo ratings yet

- Nifty News Letter-26 August 2015Document8 pagesNifty News Letter-26 August 2015NehaSharmaNo ratings yet

- Nifty News Letter-25 August 2015Document7 pagesNifty News Letter-25 August 2015NehaSharmaNo ratings yet

- Nifty News-13 August 2015Document8 pagesNifty News-13 August 2015NehaSharmaNo ratings yet

- Nifty News-24 July 2015Document8 pagesNifty News-24 July 2015NehaSharmaNo ratings yet

- Nifty News-30 July 2015Document8 pagesNifty News-30 July 2015NehaSharmaNo ratings yet

- Nifty News-21 August 215Document8 pagesNifty News-21 August 215NehaSharmaNo ratings yet

- Nifty News-27 July 2015Document8 pagesNifty News-27 July 2015NehaSharmaNo ratings yet

- Daily Equity Report 6 February 2015Document4 pagesDaily Equity Report 6 February 2015NehaSharmaNo ratings yet

- Nifty News-20 July 2015Document8 pagesNifty News-20 July 2015NehaSharmaNo ratings yet

- Capitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MDocument8 pagesCapitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MNehaSharmaNo ratings yet

- Daily Equity Report 5 February 2015Document4 pagesDaily Equity Report 5 February 2015NehaSharmaNo ratings yet

- Daily Equity Report 2 February 2015Document4 pagesDaily Equity Report 2 February 2015NehaSharmaNo ratings yet

- Newsletter MC XDocument6 pagesNewsletter MC XNehaSharmaNo ratings yet

- Daily Equity Market Report-16 Jan 2015Document4 pagesDaily Equity Market Report-16 Jan 2015NehaSharmaNo ratings yet

- Daily Equity Report 3 February 2015Document4 pagesDaily Equity Report 3 February 2015NehaSharmaNo ratings yet

- Daily Equity Report 8 January 2015Document4 pagesDaily Equity Report 8 January 2015NehaSharmaNo ratings yet

- Daily Equity Report 9 January 2015Document4 pagesDaily Equity Report 9 January 2015NehaSharmaNo ratings yet

- BuybacksDocument22 pagesBuybackssamson1190No ratings yet

- MM Theory of Dividend Policy: NumericalDocument10 pagesMM Theory of Dividend Policy: NumericalmalavikaNo ratings yet

- Philippine Venture Capital Report 2020 by Foxmont Capital PartnersDocument52 pagesPhilippine Venture Capital Report 2020 by Foxmont Capital PartnersPinky LaysaNo ratings yet

- Dividend TheoriesDocument38 pagesDividend TheoriesMuhammad Azhar Ibné Habib JoomunNo ratings yet

- Dividends - Stock Split - Reverse Split & Bonus ShareDocument2 pagesDividends - Stock Split - Reverse Split & Bonus Sharesaviolopes29No ratings yet

- Tutorial - Investments - For StudentsDocument3 pagesTutorial - Investments - For StudentsBerwyn GazaliNo ratings yet

- Advanced Course BookDocument164 pagesAdvanced Course BookKelvin Lim Wei Liang100% (4)

- Idx Monthly Agustus 2020Document126 pagesIdx Monthly Agustus 2020Muhammad Farhan DesmiNo ratings yet

- SAPM ProblemsDocument7 pagesSAPM ProblemsNavleen KaurNo ratings yet

- Ap04-01 Audit of SheDocument7 pagesAp04-01 Audit of Shenicole bancoroNo ratings yet

- ABC of ETFDocument24 pagesABC of ETFAJITAV SILUNo ratings yet

- Raising Capital: Multiple Choice QuestionsDocument40 pagesRaising Capital: Multiple Choice Questionsbaashii4No ratings yet

- Dividend Month Premium in The Korean Stock MarketDocument34 pagesDividend Month Premium in The Korean Stock Market찰리 가라사대No ratings yet

- Bharat Agri Fert & Realty LTD: Dear Sir, Sub: Outcome of Board Meeting Held On 31st March, 2022Document7 pagesBharat Agri Fert & Realty LTD: Dear Sir, Sub: Outcome of Board Meeting Held On 31st March, 2022Contra Value BetsNo ratings yet

- ACCT10002 Tutorial 8 ExercisesDocument5 pagesACCT10002 Tutorial 8 ExercisesJING NIENo ratings yet

- W6 Module 4 - The Cost of Capital, Capital Structure, and Dividend Policy - PPTDocument14 pagesW6 Module 4 - The Cost of Capital, Capital Structure, and Dividend Policy - PPTDanica VetuzNo ratings yet

- Swayam Academy - Dow TheoryDocument2 pagesSwayam Academy - Dow TheoryvineetkrsinghNo ratings yet

- What Are Some of The Most Mind-Blowing Facts About The Indian Stock Market - QuoraDocument38 pagesWhat Are Some of The Most Mind-Blowing Facts About The Indian Stock Market - QuoraAchint KumarNo ratings yet

- Introduction To Public IssueDocument15 pagesIntroduction To Public IssuePappu ChoudharyNo ratings yet

- Chapter8 #215Document11 pagesChapter8 #215Khail GoodingNo ratings yet

- الصيغ التمويلية المتاحة للمؤسسات الناشئة في الجزائرDocument16 pagesالصيغ التمويلية المتاحة للمؤسسات الناشئة في الجزائرChaouki NsighaouiNo ratings yet

- Department of Business Administration: MVSR Engineering CollegeDocument19 pagesDepartment of Business Administration: MVSR Engineering CollegeSanjay GoudNo ratings yet

- Seminar ProposalDocument7 pagesSeminar ProposalTri MiswantoNo ratings yet

- BDC PrimerDocument7 pagesBDC PrimerflecktechNo ratings yet

- NESCODocument45 pagesNESCOPositive ThinkerNo ratings yet

- Chap 5 - Relative ValuationDocument58 pagesChap 5 - Relative Valuationrafat.jalladNo ratings yet

- Dividend Policy and Retained EarningDocument28 pagesDividend Policy and Retained EarningMd Abusaied AsikNo ratings yet

- Ice CreamDocument35 pagesIce CreamSana SaleemNo ratings yet