Professional Documents

Culture Documents

Cement Sector MOST

Cement Sector MOST

Uploaded by

nikhilhslCopyright:

Available Formats

You might also like

- Dividend Policy at FPL Case 4Document4 pagesDividend Policy at FPL Case 4Ankur280475% (4)

- Jack StackDocument7 pagesJack StackAlper AykaçNo ratings yet

- Cci 2019-EngDocument205 pagesCci 2019-EngNuritokerNo ratings yet

- Answer Key Chap 1 3Document18 pagesAnswer Key Chap 1 3Huy Hoàng PhanNo ratings yet

- Shree Cement: CMP: INR9,253 TP: INR9,778 BuyDocument8 pagesShree Cement: CMP: INR9,253 TP: INR9,778 BuyAshish NaikNo ratings yet

- IDirect IndiaCement CoUpdate Oct16Document4 pagesIDirect IndiaCement CoUpdate Oct16umaganNo ratings yet

- Investment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysDocument25 pagesInvestment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysNarnolia Securities LimitedNo ratings yet

- India Cements, 1Q FY 2014Document10 pagesIndia Cements, 1Q FY 2014Angel BrokingNo ratings yet

- India Cement (INDCEM) : Focus Shifts Towards Non-Southern RegionDocument11 pagesIndia Cement (INDCEM) : Focus Shifts Towards Non-Southern RegionumaganNo ratings yet

- Idea Cellular: Wireless Traffic Momentum To SustainDocument10 pagesIdea Cellular: Wireless Traffic Momentum To SustainKothapatnam Suresh BabuNo ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- Best Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Document22 pagesBest Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Narnolia Securities LimitedNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument9 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- TopPicks 020820141Document7 pagesTopPicks 020820141Anonymous W7lVR9qs25No ratings yet

- Investment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverDocument26 pagesInvestment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverNarnolia Securities LimitedNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Sun Pharma: Annual Report 2014 AnalysisDocument8 pagesSun Pharma: Annual Report 2014 AnalysisSohamsNo ratings yet

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- Indian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Document21 pagesIndian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Narnolia Securities LimitedNo ratings yet

- Tata Consultancy Services: CMP: INR1,459 TP: INR1,500 NeutralDocument10 pagesTata Consultancy Services: CMP: INR1,459 TP: INR1,500 NeutralktyNo ratings yet

- Market Outlook 12th April 2012Document5 pagesMarket Outlook 12th April 2012Angel BrokingNo ratings yet

- Sanghvi Movers: Maintaining FaithDocument10 pagesSanghvi Movers: Maintaining FaithDinesh ChoudharyNo ratings yet

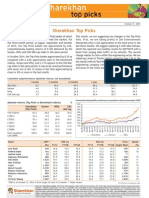

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- India Cements: Performance HighlightsDocument10 pagesIndia Cements: Performance HighlightsAngel BrokingNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Pi Industries Edel Q1fy12Document7 pagesPi Industries Edel Q1fy12equityanalystinvestorNo ratings yet

- Essel Propack Edelweiss PDFDocument33 pagesEssel Propack Edelweiss PDFarushichananaNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- Linc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - BuyDocument6 pagesLinc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - Buynare999No ratings yet

- Trade Advisory Services For Today Buy Stock of Hindustan Zinc LTDDocument27 pagesTrade Advisory Services For Today Buy Stock of Hindustan Zinc LTDNarnolia Securities LimitedNo ratings yet

- India Cements: CMP: Inr71 TP: INR100Document8 pagesIndia Cements: CMP: Inr71 TP: INR100Kirti ChouguleNo ratings yet

- Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- IDBI Bank: BUY Target Price (INR) 170 Promises May Be Delivered This Time AroundDocument32 pagesIDBI Bank: BUY Target Price (INR) 170 Promises May Be Delivered This Time AroundGaurav SrivastavaNo ratings yet

- India Morning Bell 5th December 2014Document18 pagesIndia Morning Bell 5th December 2014Just ChillNo ratings yet

- 4QFY14E Results Preview: Institutional ResearchDocument22 pages4QFY14E Results Preview: Institutional ResearchGunjan ShethNo ratings yet

- Amara Raja Batteries: CMP: INR915 TP: INR1,032 (+13%) BuyDocument12 pagesAmara Raja Batteries: CMP: INR915 TP: INR1,032 (+13%) BuyHarshal ShahNo ratings yet

- WE Research9Document2 pagesWE Research9dwirelesNo ratings yet

- Market Outlook: Dealer's DiaryDocument22 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsDocument9 pagesMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaNo ratings yet

- Hindustan Petroleum Corporation: Proxy For Marketing PlayDocument9 pagesHindustan Petroleum Corporation: Proxy For Marketing PlayAnonymous y3hYf50mTNo ratings yet

- Muhurat Picks 2012 Muhurat Picks 2012 Muhurat Picks 2012Document8 pagesMuhurat Picks 2012 Muhurat Picks 2012 Muhurat Picks 2012Mahendra PratapNo ratings yet

- Apollo TyreDocument12 pagesApollo TyrePriyanshu GuptaNo ratings yet

- Sharekhan Top Picks: April 03, 2010Document6 pagesSharekhan Top Picks: April 03, 2010Kripansh GroverNo ratings yet

- Stock Research Report For Indian HotelDocument5 pagesStock Research Report For Indian HotelSudipta Bose100% (1)

- JK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97Document4 pagesJK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97ajd.nanthakumarNo ratings yet

- Quick Note: Sintex IndustriesDocument6 pagesQuick Note: Sintex Industriesred cornerNo ratings yet

- Sintex Industries: CMP: Inr87 TP: INR115 BuyDocument8 pagesSintex Industries: CMP: Inr87 TP: INR115 BuyMLastTryNo ratings yet

- Will Politics Guide Market Sentiments?Document7 pagesWill Politics Guide Market Sentiments?Atul SuryavanshiNo ratings yet

- Madras Cements 4Q FY 2013Document10 pagesMadras Cements 4Q FY 2013Angel BrokingNo ratings yet

- ABG ShipyardDocument9 pagesABG ShipyardTejas MankarNo ratings yet

- Mangalore Refinery (MRPL) : Phase III Near CompletionDocument10 pagesMangalore Refinery (MRPL) : Phase III Near CompletionDhawan SandeepNo ratings yet

- TVS Motor Company: Another Quarter of Dismal EBITDA Margin Retain SellDocument5 pagesTVS Motor Company: Another Quarter of Dismal EBITDA Margin Retain SellSwastik PradhanNo ratings yet

- Diwali Icici 081112Document8 pagesDiwali Icici 081112Mintu MandalNo ratings yet

- KSL - Ushdev International Limited (IC) - 25 Jan 2013Document12 pagesKSL - Ushdev International Limited (IC) - 25 Jan 2013Rajesh KatareNo ratings yet

- Morning Shout: Fatima: Positives Priced in Downgrade To U/PDocument3 pagesMorning Shout: Fatima: Positives Priced in Downgrade To U/PjibranqqNo ratings yet

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Document20 pagesStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedNo ratings yet

- Ultratech Cement: CMP: INR4,009 TP: INR4,675 (+17%)Document8 pagesUltratech Cement: CMP: INR4,009 TP: INR4,675 (+17%)sandeeptirukotiNo ratings yet

- Amara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Document8 pagesAmara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Harshal ShahNo ratings yet

- Indian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinDocument17 pagesIndian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinNarnolia Securities LimitedNo ratings yet

- Jain Irrigation Motilal Oswal Aug 16Document12 pagesJain Irrigation Motilal Oswal Aug 16Kedar ChoksiNo ratings yet

- Orient Cement: Pricing DragsDocument8 pagesOrient Cement: Pricing DragsDinesh ChoudharyNo ratings yet

- Mayur Uniquotors Analyst ReportDocument50 pagesMayur Uniquotors Analyst ReportS SohNo ratings yet

- Accounting Textbook Solutions - 19Document19 pagesAccounting Textbook Solutions - 19acc-expertNo ratings yet

- Exercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotDocument15 pagesExercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotCherry Doong CuantiosoNo ratings yet

- Managerial Economics Midterm ExamDocument7 pagesManagerial Economics Midterm Exammarkconda21No ratings yet

- 2022 Summer Q2 - Daharki Chemicals Limited (25 Marks)Document4 pages2022 Summer Q2 - Daharki Chemicals Limited (25 Marks)Ehehdhdbdj YsysyeyNo ratings yet

- Assignment FS AnalysisDocument2 pagesAssignment FS AnalysisLorraine Anne TawataoNo ratings yet

- P76981 LCCI Level 2 Certificate in Bookkeeping and Accounting ASE20093 RBDocument8 pagesP76981 LCCI Level 2 Certificate in Bookkeeping and Accounting ASE20093 RBhlaingminnlatt149No ratings yet

- N8 Investment Profitability Analysis. REv AQ CXDocument2 pagesN8 Investment Profitability Analysis. REv AQ CXMichelle MariposaNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- DaburDocument45 pagesDaburMandeep BatraNo ratings yet

- The Smythe Davidson Corporation Just Issued Its Annual Report The CurrentDocument1 pageThe Smythe Davidson Corporation Just Issued Its Annual Report The CurrentMuhammad ShahidNo ratings yet

- Reddit - FAR NotesDocument232 pagesReddit - FAR Notesneha jainNo ratings yet

- Cash DiscountsDocument9 pagesCash DiscountsRahul JainNo ratings yet

- Monthly Financial Statements Summary Excel TemplateDocument6 pagesMonthly Financial Statements Summary Excel Templatesantoshkumar945No ratings yet

- PROFITABILITY ANALYSIS Problems QDocument2 pagesPROFITABILITY ANALYSIS Problems QThalia RodriguezNo ratings yet

- Illustrative Problem 4.1 PDFDocument1 pageIllustrative Problem 4.1 PDFChincel G. ANINo ratings yet

- Unit 7 Portofilio ActivityDocument3 pagesUnit 7 Portofilio ActivityTesfa-Alem AlemNo ratings yet

- TC TFC + TVC Atc Afc + Avc Atc TC / Q Afc TFC / Q Avc TVC / Q MC Change in TC Change in QDocument1 pageTC TFC + TVC Atc Afc + Avc Atc TC / Q Afc TFC / Q Avc TVC / Q MC Change in TC Change in QMJ BotorNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Assignment 2Document4 pagesAssignment 2Ella Davis0% (1)

- Pas 33Document2 pagesPas 33elle friasNo ratings yet

- Leased Assets in SAPDocument7 pagesLeased Assets in SAPgullapalli123No ratings yet

- Management and Organization:: FusionDocument14 pagesManagement and Organization:: Fusionumar1313No ratings yet

- Correct?Document29 pagesCorrect?Hong Anh NguyenNo ratings yet

- Pa - TestbankDocument87 pagesPa - TestbankPhan Phúc NguyênNo ratings yet

- FBM Chapter 1Document31 pagesFBM Chapter 1Claire Evann Villena EboraNo ratings yet

- Strategy: One-Page Strategic Plan (OPSP) : Grupo Reverdeciendo SAS People (Reputation Drivers)Document2 pagesStrategy: One-Page Strategic Plan (OPSP) : Grupo Reverdeciendo SAS People (Reputation Drivers)Cristian H CuellarNo ratings yet

Cement Sector MOST

Cement Sector MOST

Uploaded by

nikhilhslOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cement Sector MOST

Cement Sector MOST

Uploaded by

nikhilhslCopyright:

Available Formats

June Results Preview | 8 July 2014

Cement

Technology

Company name

Demand recovery continues with ~8% growth

ACC

Upgrading FY16 EPS, led by increase in pricing improvement to ~INR20/bag

Ambuja Cements

Birla Corporation

Grasim Industries

India Cements

Shree Cement

Ultratech Cement

Demand recovery continues; expect ~8% growth for our Cement universe

Cement demand recovery continued in 1QFY15, driven by strong rural housing

demand and partial resolution of sand mining issue. We estimate growth of 8.3%

YoY (decline of 4.5% QoQ) for our Cement universe. Capacity utilization would

remain stable YoY at ~74% (down 4pp QoQ). Cement dealers across regions indicate

improved sentiment and sustenance of demand recovery in 2HFY15.

Pre-monsoon price hikes across markets, estimate INR6/bag QoQ increase

While cement prices retraced from the highs of March-April 2014, especially in

North India, as the Binani plant commenced operations, blended prices were still

higher than in 4QFY14. Overall, we expect weighted average national prices to

increase by INR6/bag QoQ (and INR14/bag YoY) in 1QFY15. This includes specific

trends of (a) ~INR14/bag QoQ average increase in South India, benefiting from upto

~INR100/bag price increase in June 2014, (b) ~INR6/bag increase in West and

Central India, (c) INR3/bag increase in North India, and (d) ~INR4/bag decline in East

India. We now factor in INR12.5/INR20/INR20 per bag increase in realizations in

FY15/FY16/FY17 on back of ~INR5/bag decline in FY14 (v/s earlier assumption of

~INR12.5/12.5/15 per bag increase).

Profitability stable QoQ; south players to enjoy partial benefits of price hike

Profitability is likely to remain stable QoQ, as the benefit of higher price gets offset

by freight cost pressure and negative operating leverage, resulting in EBITDA/ton of

~INR731 (down INR73/ton YoY). While players focused on South India would benefit

significantly from sharp pricing recovery, weak pricing would impact profitability of

players based in North and East India. We estimate EBITDA/ton at

INR795/1,075/1,345 for FY15/FY16/FY17, against ~INR673/ton in FY14.

Valuation and view

While our FY15E EPS has seen downgrades, our assumption of higher pricing change

has led to up to 39% upgrade in FY16E EPS. While demand recovery would be

gradual, slowing capacity addition coupled with higher capex and opex cost would

support cement prices and profitability. Demand recovery would be critical for

operating and stock performance. Among large caps, we prefer ACC, UTCEM and

SRCM, and DBEL, JKCE, JKLC, and PRSC in mid-caps.

Jinesh Gandhi (Jinesh@MotilalOswal.com); +91 22 3982 5416

Sandipan

8 July 2014Pal (Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.

June 2014 Results Preview | Sector: Cement

Expected quarterly performance summary (INR m)

Sector

Jun-14

Buy

Neutral

Buy

Buy

Neutral

Buy

Buy

Buy

29,833

25,053

8,083

12,999

12,624

34,727

16,345

55,830

195,493

2,656

3,771

392

1,199

-46

59

3,048

6,186

17,264

Var %

QoQ

-13.9

-15.7

20.3

-3.4

Loss

-93.7

34.1

-18.9

-11.4

Source: Company, MOSL

Utilizations fail to improve in a seasonally strong quarter

8.3

6.1

1QFY15E

1.5

4QFY14

3QFY14

3.4

0.4

2QFY14

1QFY14

1.9

1QFY13

4QFY12

-2.0

3QFY13

8.4

2.7

2QFY13

10.4

3QFY12

Volume growth (%)

13.8

9.4

2QFY12

4.3

4.0

1QFY12

2QFY11

1QFY15E

4QFY14

3QFY14

2QFY14

1QFY14

4QFY13

3QFY13

-2

2QFY13

-5

1QFY13

4QFY12

3QFY12

4QFY11

18

Source: Company, MOSL

Trend in average quarterly cement price (INR/bag)

100%

1QFY14

3QFY14

4QFY14

1QFY15

1QFY15

3QFY14

1QFY14

3QFY13

1QFY13

3QFY12

1QFY12

3QFY11

1QFY11

3QFY10

1QFY10

Source: Company, MOSL

North

East

West

South

Central

277

279

289

295

281

293

298

264

266

262

60%

275

259

245

245

70%

289

272

271

281

287

269

272

316

80%

294

300

281

295

328

324

2QFY14

307

308

90%

8 July 2014

PAT

Var %

YoY

2.5

16.3

-14.8

-46.8

PL

-71.8

7.2

-8.0

-6.6

Jun-14

Volumes (MT) - RHS

MOSL Universe

13

2QFY12

3,889

5,172

650

1,148

1,342

8,592

4,498

10,203

35,495

Var %

QoQ

6.5

-10.5

17.2

-16.9

81.0

-1.5

5.6

-10.7

-2.8

MOSL cement universe volumes to grow 8% YoY (3% QoQ)

10

1QFY12

Jun-14

6.4

IIP Data

15

EBDITA

Var %

YoY

-10.3

5.1

-2.7

-43.3

-29.7

9.5

18.4

-2.7

-1.4

4QFY13

Cement demand recovery apparent in 1QFY15 (%)

Var %

QoQ

0.5

-5.1

3.9

-15.0

16.9

2.1

-1.5

-4.3

-1.7

3.6

ACC

Ambuja Cements

Birla Corporation

Grasim Industries

India Cements

Jaiprakash Associates

Shree Cement

Ultratech Cement

Sector Aggregate

Rating

Sales

Var %

YoY

6.7

6.8

4.7

13.1

1.9

4.8

13.4

12.6

8.5

3QFY11

CMP

(INR)

1,452

224

418

3,388

116

73

7,276

2,604

National

Average

Source: Company, MOSL

June 2014 Results Preview | Sector: Cement

Realization to improve marginally QoQ, as suggested by price Weaker realizations, cost push and weak operating leverage

trend

to keep profitability under pressure

731

1QFY15E

731

4QFY14

574

3QFY14

805

499

1QFY14

Source: Company, MOSL

2QFY14

780

4QFY13

946

2QFY13

764

1,092

1QFY13

3QFY13

956

4QFY12

812

3QFY12

613

1,019

1QFY12

2QFY12

924

4,369

1QFY15E

605

4,309

4QFY14

4QFY11

4,235

3QFY14

3QFY11

4,160

2QFY14

400

4,302

1QFY14

2QFY11

4,331

4,283

4QFY13

4,499

2QFY13

EBITDA (INR/ton)

3QFY13

4,466

1QFY13

4,207

4QFY12

3,835

2QFY12

4,132

4,038

1QFY12

3QFY12

3,879

3,478

3QFY11

4QFY11

3,262

2QFY11

Realization (INR/ton)

Source: Company, MOSL

Revised EPS estimates (INR)

ACC

Ambuja Cement

UltraTech

Birla Corp

India Cement

Shree Cement

JK lakshmi

Ramco Cement

JK Cement

Orient Cement

Prism Cement

Dalmia Cement

Rev

54.4

7.0

91.3

28.7

2.9

280.2

10.5

9.0

22.6

5.3

0.4

-12.3

FY15E/CY14E

Old

Chg (%)

60.4

-9.9

7.0

-0.3

94.9

-3.7

36.1

-20.6

3.8

-25.7

257.8

8.7

11.4

-7.7

8.4

7.5

18.8

20.2

6.6

-19.5

0.2

106.0

-7.2

71.7

Rev

84.1

9.0

133.0

51.4

10.6

431.1

17.1

15.1

45.3

5.4

6.2

24.4

FY16E/CY15E

Old

79.2

8.1

119.9

49.5

8.2

336.9

12.3

13.4

37.0

4.8

5.1

20.4

Chg (%)

6.2

11.6

10.9

3.9

29.1

28.0

38.7

12.2

22.5

12.6

23.3

19.6

Source: MOSL

Comparative valuation

ACC

Ambuja Cements

Birla Corporation

Grasim Industries

India Cements

Jaiprakash Associates

Shree Cement

Ultratech Cement

Dalmia Bharat

J K Cements

JK Lakshmi Cem.

Ramco Cements

Prism Cement

Sector Aggregate

8 July 2014

CMP

(INR)

1,452

224

418

3,388

116

73

7,276

2,604

457

394

235

304

73

Rating

FY15E

Buy

54.4

Neutral 7.0

Buy

28.7

Buy

254.7

Neutral 2.9

Buy

1.5

Buy

280.2

Buy

91.3

Buy

-12.3

Buy

22.6

Buy

10.5

Buy

9.0

Buy

0.4

EPS (INR)

PE (x)

EV/EBIDTA (x)

RoE (%)

FY16E FY17E FY15E FY16E FY17E FY15E FY16E FY17E FY15E FY16E

84.1 119.9 26.7

17.3

12.1

17.7

10.9

7.0

12.8

18.5

9.0

12.3

32.1

24.8

18.2

21.6

15.6

11.4

14.0

16.8

51.4

77.6

14.6

8.1

5.4

7.9

4.3

2.4

8.3

13.3

370.0 586.0 13.3

9.2

5.8

5.5

3.7

2.4

9.9

12.6

10.6

19.0

40.7

11.0

6.1

9.9

6.4

4.4

2.7

8.2

4.1

5.7

48.2

17.8

12.7

10.5

8.8

7.9

2.4

6.3

431.1 610.3 26.0

16.9

11.9

13.2

8.7

5.8

19.5

24.5

133.0 189.0 28.5

19.6

13.8

16.2

11.1

7.7

13.8

17.4

24.4

82.2 -37.0 18.7

5.6

14.6

7.9

4.8

-3.3

6.5

45.3

76.2

17.4

8.7

5.2

8.5

5.5

3.4

8.7

15.8

17.1

34.3

22.3

13.7

6.9

10.4

6.3

4.0

9.2

13.8

15.1

24.1

33.6

20.1

12.6

14.0

10.1

7.2

8.4

12.9

6.2

11.2 177.9 11.7

6.5

12.7

6.0

3.9

2.0

26.8

26.1

16.2

10.7

12.2

8.4

5.9

9.7

14.0

FY17E

23.5

20.5

17.2

16.8

13.2

8.4

27.2

20.7

19.2

22.5

23.8

18.1

35.6

18.1

June 2014 Results Preview | Sector: Cement

ACC

Bloomberg

Equity Shares (m)

ACC IN

187.9

M. Cap. (INR b)/(USD b)

273 / 5

52-Week Range (INR)

1524 / 912

1,6,12 Rel Perf. (%)

-3 / 9 / -16

CMP: INR1,452

Financial and Valuation Summary (INR b)

Y/E Dec

Sales

EBITDA

NP

2013 2014E 2015E 2016E

109.1 116.4 137.0 163.0

13.7

13.8

22.7

33.7

9.1

10.2

15.8

22.5

Adj. EPS (INR) 48.6

54.4

84.1

119.9

EPS Gr. (%)

-29.3

12.1

54.6

42.5

BV/Sh (INR)

416.4

434.9

472.5

545.9

RoE (%)

12.0

12.8

18.5

23.5

RoCE (%)

Payout (%)

15.3

60.2

15.7

68.8

24.1

55.3

31.3

38.8

Valuations

P/E (x)

P/BV (x)

30.3

3.5

27.0

3.4

17.5

3.1

12.3

2.7

EV/EBITDA (x) 17.6

EV/Ton (x)

133.2

16.4

124.9

10.7

120.6

6.8

113.0

Buy

We expect dispatches to grow 4% YoY (decline 2% QoQ) in 2QCY14 to

6.36m tons. Average realization is likely to grow 2.3% QoQ (+2.5%

YoY) to INR4,404/ton.

Revenue would grow 6.7% YoY (1% QoQ) to INR29.8b. EBITDA margin

would shrink 2.5pp YoY (but expand 0.7pp QoQ) to 13% due to

moderate realization growth. We estimate cement EBITDA/ton at

INR600 (INR102 lower YoY; INR48 higher QoQ).

PAT would grow 2.5% YoY (but decline 14% QoQ) to INR2.65b.

We are cutting our CY14 EPS estimate (ex-synergies) by 9.9% to

INR54.4, while raising our CY15 EPS estimate by 6.2% to INR84.1 to

factor in for deferred recovery and higher pricing in FY15.

The stock trades at 16.2x CY15E EPS, and at an EV of 9.9x CY15E

EBITDA and USD120/ton. Maintain Buy with a target price of

INR1,804 (CY15E EV of USD152/ton).

Key issues to watch for

Volume growth recovery and outlook

Cement pricing outlook and sustainability

Progress in ongoing capex for 5m-ton Jamul expansion

Update on synergies and other guided cost saving measures

Quarterly Performance (Standalone)

Y/E December

(INR Million)

CY13

CY14

CY13

CY14E

1Q

2Q

3Q

4Q

1Q

2QE

3QE

4QE

Cement Sales (m ton)

6.42

6.12

5.54

5.85

6.48

6.36

5.76

6.28

23.9

24.89

YoY Change (%)

-4.5

1.2

2.6

-1.5

0.9

4.0

4.0

7.4

-0.7

4.0

4,269

4,298

4,235

4,307

4,304

4,404

4,304

4,554

4,278

4,393

YoY Change (%)

0.9

-5.7

-5.9

3.4

0.8

2.5

1.6

5.7

-1.8

2.7

QoQ Change (%)

2.5

0.7

-1.5

1.7

-0.1

2.3

-2.3

5.8

0.0

0.0

29,111

27,952

25,087

26,934

29,671

29,833

26,500

30,444

109,084

116,448

2.4

1.4

3.2

-13.1

1.9

6.7

5.6

13.0

-2.0

6.8

4,468

4,335

2,254

2,626

3,653

3,889

2,110

4,123

13,683

13,776

15.3

15.5

9.0

9.8

12.3

13.0

8.0

13.5

12.5

11.8

1,383

1,387

1,444

1,526

1,366

1,400

1,440

1,448

5,740

5,654

Cement Realization

Net Sales

YoY Change (%)

EBITDA

Margins (%)

Depreciation

Interest

108

179

110

120

108

106

106

104

517

425

Other Income

1,205

908

1,023

1,438

1,668

1,000

1,200

1,382

4,573

5,250

PBT before EO Item

4,182

3,677

1,722

2,419

3,848

3,383

1,764

3,953

12,000

12,947

PBT after EO Item

5,861

3,677

1,722

3,178

4,975

3,383

1,764

3,953

14,437

14,075

Tax

1,484

1,086

514

396

988

727

379

861

3,479

2,956

Rate (%)

25.3

29.5

29.8

12.5

19.9

21.5

21.5

21.8

24.1

21.0

Reported PAT

4,377

2,591

1,208

2,781

3,987

2,656

1,384

3,092

10,958

11,119

Adjusted PAT

3,124

2,591

1,208

2,117

3,084

2,656

1,384

3,092

9,108

10,228

Margins (%)

10.7

9.3

4.8

7.9

10.4

8.9

5.2

10.2

8.3

8.8

-19.1

-38.0

-51.4

-11.5

-1.3

2.5

14.6

46.0

-29.5

12.3

YoY Change (%)

E: MOSL Estimates; * Merger of RMC business from 4QCY12

8 July 2014

June 2014 Results Preview | Sector: Cement

Ambuja Cements

Bloomberg

Equity Shares (m)

ACEM IN

1979.3

M. Cap. (INR b)/(USD b)

443 / 7

52-Week Range (INR)

CMP: INR224

244 / 148

1,6,12 Rel Perf. (%)

-7 / 1 / -15

Financial and Valuation Summary (INR b)

Y/E Dec

Sales

EBITDA

2013 2014E 2015E 2016E

90.9

99.2 114.6 136.5

15.5

18.7

25.8

35.0

NP

10.5

13.8

Adj. EPS (INR)

17.9

24.3

6.8

7.0

9.0

12.3

EPS Gr. (%)

-32.4

2.9

29.7

36.1

BV/Sh. (INR)

61.2

51.5

56.0

63.8

RoE (%)

11.5

14.0

16.8

20.5

RoCE (%)

Payout (%)

16.3

49.9

19.0

55.7

23.7

50.2

28.9

36.9

Valuations

P/E (x)

P/BV (x)

32.7

3.6

31.8

4.3

24.5

4.0

18.0

3.5

EV/EBITDA (x) 19.0

EV/Ton (USD) 173.3

21.0

224.5

14.8

218.0

10.6

211.1

Neutral

We expect dispatches to grow 3% YoY (decline 7% QoQ) to 5.62m

tons in 2QCY14. Average realization would grow 3.7% YoY (1.8% QoQ)

to INR4,456/ton. We estimate revenue at INR25.1b (up 6.8% YoY, but

down 5% QoQ).

EBITDA margin would remain flat YoY (decline 1.3pp QoQ) to 20.6%.

We estimate EBITDA/ton at ~INR920 (up INR19/ton YoY; down

INR38/ton QoQ).

Adjusted PAT is likely to grow 16% YoY (decline 16% QoQ) to INR3.8b.

We are raising our CY15 EPS estimate (ex-synergies) by 11.6% to

factor in higher realizations. Our CY14 EPS estimate is unchanged.

Maintain Neutral with a target price of INR247 (CY15E EV of

USD160/ton).

Key issues to watch for

Volume growth recovery and outlook

Cement pricing outlook and sustainability

Progress in ongoing mining land acquisition and capex in 4.5m-ton

Nagaur (Rajasthan) plant.

Quarterly Performance

(INR Million)

CY13

Y/E December

Sales Volume (m ton)*

YoY Change (%)

Realization (INR/ton)

YoY Change (%)

QoQ Change (%)

Net Sales

YoY Change (%)

EBITDA

Margins (%)

Depreciation

Interest

Other Income

PBT before EO Item

Extraordinary Inc/(Exp)

PBT after EO Exp/(Inc)

Tax

Rate (%)

Reported Profit

Adj PAT

YoY Change (%)

1Q

5.96

-3.6

4,271

0.3

-0.5

25,448

-3.3

5,118

20.1

1,204

132

1,339

5,121

1,741

6,862

1,983

28.9

4,879

3,641

-28.3

2Q

5.46

-3.1

4,297

-5.7

0.6

23,457

-8.6

4,920

21.0

1,223

171

1,051

4,578

0

4,578

1,336

29.2

3,242

3,242

-30.9

CY14

3Q

4.89

2.0

4,103

-9.2

-4.5

20,049

-7.4

2,554

12.7

1,246

178

940

2,070

481

2,551

891

34.9

1,660

1,346

-60.1

4Q

5.29

-1.8

4,142

-3.5

0.9

21,913

-5.3

2,890

13.2

1,228

169

1,019

2,512

1,046

3,558

393

11.0

3,165

2,234

-2.8

1Q

6.03

1.2

4,376

2.5

5.6

26,398

3.7

5,776

21.9

1,197

161

1,414

5,832

948

6,780

1,579

23.3

5,200

4,473

22.9

2QE

5.62

3.0

4,456

3.7

1.8

25,053

6.8

5,172

20.6

1,225

160

1,175

4,962

0

4,962

1,191

24.0

3,771

3,771

16.3

3QE

5.03

3.0

4,356

6.1

-2.2

21,920

9.3

3,224

14.7

1,275

160

1,100

2,889

0

2,889

693

24.0

2,196

2,196

63.1

4QE

5.67

7.1

4,556

10.0

4.6

25,820

17.8

4,522

17.5

1,272

160

1,311

4,400

0

4,400

1,057

24.0

3,343

3,343

49.6

CY13

0

21.60

-1.8

4,207

-4.4

0.0

90,868

46.1

15,482

17.0

4,901

651

4,349

14,280

3,269

17,549

4,603

26.2

12,946

10,464

-32.2

CY14E

0

22.36

3.5

4,437

5.5

0.0

99,191

40.2

18,694

18.8

4,969

641

5,000

18,084

948

19,031

4,521

23.8

14,510

13,788

31.8

E: MOSL Estimates

8 July 2014

June 2014 Results Preview | Sector: Cement

Birla Corporation

Bloomberg

Equity Shares (m)

BCORP IN

77.0

M. Cap. (INR b)/(USD b)

32 / 1

52-Week Range (INR)

CMP: INR418

429 / 191

1,6,12 Rel Perf. (%)

4 / 32 / 46

Financial and Valuation Summary (INR b)

Y/E March

Sales

EBITDA

NP

2014 2015E 2016E 2017E

29.7

33.3

38.5

43.5

2.1

3.2

5.8

8.5

1.3

2.2

4.0

6.0

Adj. EPS (INR) 16.9

28.7

51.4

77.6

EPS Gr. (%)

-51.9

70.1

79.3

50.9

BV/Sh. (INR) 328.0

346.2

386.0

452.0

RoE (%)

5.1

8.3

13.3

17.2

RoCE (%)

Payout (%)

6.1

55.5

9.0

36.5

14.0

22.6

18.1

15.0

Valuations

P/E (x)

P/BV (x)

24.8

1.3

14.6

1.2

8.1

1.1

5.4

0.9

EV/EBITDA (x) 11.5

EV/Ton (x)

43.4

7.4

42.6

3.8

39.9

2.1

31.7

Buy

We expect volumes to grow 6% YoY (3.9% QoQ) to 1.98m tons in

1QFY15. Average realization is likely to grow 1.6% YoY (decline 1.3%

QoQ) to INR3,813/ton.

EBITDA margin would shrink 0.7pp YoY (but expand 0.9pp QoQ) to

8%. EBITDA/ton (including non-cement business) is likely to decline by

INR29 YoY (but increase by ~INR37 QoQ).

We estimate PAT at INR392m, down 14.8% YoY.

We are cutting our EPS estimate for FY15 by 21% to factor in lower

realizations for the year, but raising our EPS estimate for FY16 by

3.9% to factor in better realizations.

The stock trades at 8.1x FY16E EPS, and at an EV of 3.8x FY16E EBITDA

and USD40/ton. We maintain Buy, with a target price of INR566

(FY16E EV of USD60/ton).

Key issues to watch for

Volume growth recovery and outlook

Cement pricing outlook and sustainability

Timeline and clarity on Rajasthan Mining permission

Quarterly Performance

(INR Million)

FY14

Y/E March

Cement Sales (m ton)

YoY Change (%)

Cement Realization

YoY Change (%)

QoQ Change (%)

Net Sales

YoY Change (%)

EBITDA

Margins (%)

Depreciation

Interest

Other Income

Profit before Tax

Tax

Rate (%)

Reported PAT

EO Income/(Expense)

PAT

Margins (%)

YoY Change (%)

1Q

1.87

14.8

3,864

-3.9

7.9

7,720

17.3

668

8.7

302

207

367

525

66

12.5

460

0

460

6.0

-45.7

2Q

1.85

17.3

3,541

-10.0

-8.3

7,107

13.3

585

8.2

311

249

422

448

32

7.1

416

0

416

5.9

-48.2

FY15

3Q

1.81

16.5

3,579

-5.4

1.1

7,098

15.9

299

4.2

319

202

323

101

-59

-58.0

160

0

160

2.3

-50.4

4Q

1.91

11.6

3,753

4.8

4.8

7,780

16.9

555

7.1

393

198

485

448

186

41.6

262

-109

326

4.2

-55.1

1QE

1.98

6.0

3,813

-1.3

1.6

8,083

4.7

650

8.0

360

200

400

490

98

20.0

392

0

392

4.8

-14.8

2QE

1.96

6.0

3,713

4.8

-2.6

7,818

10.0

555

7.1

365

205

450

435

87

20.0

348

0

348

4.5

-16.3

3QE

1.95

8.0

3,913

9.3

5.4

8,169

15.1

885

10.8

380

215

350

640

128

20.0

512

0

512

6.3

220.4

4QE

2.06

8.0

4,212

12.2

7.6

9,203

18.3

1,118

12.1

391

222

690

1,194

239

20.0

955

0

955

10.4

193.1

FY14

0

7.43

15.0

3,686

-3.7

0.0

29,705

15.9

2,107

7.1

1,326

856

1,598

1,523

225

14.8

1,298

-109

1,391

4.7

-48.5

FY15

0

7.96

7.0

3,916

6.2

0.0

33,273

12.0

3,208

9.6

1,496

842

1,890

2,759

552

20.0

2,207

0

2,207

6.6

58.7

E: MOSL Estimates

8 July 2014

June 2014 Results Preview | Sector: Cement

Grasim Industries

Bloomberg

Equity Shares (m)

GRASIM IN

91.7

M. Cap. (INR b)/(USD b)

311 / 5

52-Week Range (INR)

CMP: INR3,388

3755 / 2121

1,6,12 Rel Perf. (%)

-3 / 4 / -13

Financial and Valuation Summary (INR b)

Y/E March

Sales

EBITDA

Adj. PAT

2014 2015E 2016E 2017E

290.0 323.8 380.8 445.1

45.9

52.9

76.0 103.6

27.6

31.9

46.6

73.9

Adj. EPS (INR) 215.1

254.7

370.0

586.0

-26.1

18.4

45.3

58.4

BV/Sh. (INR) 2,354

2,584

2,928

3,485

EPS Gr. (%)

RoE (%)

9.1

9.9

12.6

16.8

RoCE (%)

Payout (%)

12.9

10.1

14.4

9.5

19.5

7.0

24.2

5.0

Valuations

P/E (x)

P/BV (x)

14.3

1.3

12.1

1.2

8.3

1.1

5.3

0.9

EV/EBITDA (x) 8.4

EV/Ton (x)

106.6

7.5

109.8

5.0

94.8

3.2

76.3

Buy

VSF volumes are likely to grow 10% YoY (but decline 14% QoQ) to

85,270 tons. VSF realizations would to decline by ~INR1/kg QoQ to

INR118.15/kg.

We are assuming price of INR121/kg in FY15 and INR124/kg in FY16.

Standalone EBITDA margin is likely to decline 8.8pp YoY (but remain

stable QoQ) to 13.3%.

EBITDA would decline by 56% YoY (12% QoQ) to INR1.1b, translating

into PAT of INR1.2b, down 47% YoY.

We cut our consolidated EPS estimate by 13% for FY15 but raise our

consolidated EPS estimate by 9.5% for FY16 to factor in deferred

realization uptick in FY16 in both cement and VSF.

The stock trades at 9.2x FY16E consolidated EPS, and at an EV of 5.4x

FY16E EBITDA and USD103/ton. Maintain Buy, with a target price of

INR4,173 (FY16-based SOTP).

Key issues to watch for

Outlook on VSF business and strategy to utilize upcoming

capacities (~47% capacity growth)

Outlook on cement demand and pricing, and status of capacity

addition

Quarterly Performance (Standalone)

Y/E March

VSF Volume (ton)

YoY Change (%)

VSF Realization (INR/ton)

YoY Change (%)

QoQ Change (%)

Net Sales

YoY Change (%)

Total Expenditure

EBITDA

Margins (%)

Depreciation

Interest

Other Income

PBT before EO Items

Extraordinary Inc/(Exp)

PBT after EO Items

Tax

Rate (%)

Reported PAT

Adj. PAT

YoY Change (%)

1Q

77,518

0.7

116,501

-9.0

-2.2

11,489

-7.3

9,464

2,025

17.6

484

78

958

2,420

8

2,429

167

6.9

2,261

2,254

-17.4

(INR Million

FY14

2Q

3Q

93,025

97,049

9.0

23.5

121,590 121,590

-4.0

-0.1

4.4

0.0

14,055

14,558

4.5

19.8

11,443

12,613

2,613

1,945

18.6

13.4

530

547

95

134

2,213

492

4,201

1,757

184

27

4,385

1,783

250

522

5.7

29.3

4,135

1,261

3,962

1,242

3.5

-37.3

4Q

99,385

4.4

119,150

0.0

-2.0

15,284

11.0

13,902

1,382

9.0

635

109

835

1,472

72

1,544

242

15.7

1,303

1,242

-41.7

1QE

85,270

10.0

118,150

1.4

-0.8

12,999

13.1

11,850

1,148

8.8

650

120

1,000

1,378

0

1,378

179

13.0

1,199

1,199

-46.8

FY15

2QE

3QE

102,328 109,665

10.0

13.0

119,150 120,150

-2.0

-1.2

0.8

0.8

15,288

16,047

8.8

10.2

13,794

14,423

1,493

1,625

9.8

10.1

700

720

125

125

2,000

750

2,668

1,530

0

0

2,668

1,530

347

199

13.0

13.0

2,322

1,331

2,322

1,331

-41.4

7.2

4QE

114,736

15.4

125,058

5.0

4.1

17,275

13.0

14,949

2,325

13.5

726

125

1,000

2,474

0

2,474

322

13.0

2,153

2,153

73.4

FY14

FY15

366,977

9.2

119,854

-3.1

0.0

55,386

6.9

47,422

7,964

14.4

2,196

415

4,497

9,850

291

10,141

1,181

11.6

8,960

8,703

-18.1

411,999

12.3

120,854

0.8

0.0

61,608

11.2

55,017

6,591

10.7

2,796

495

4,750

8,050

0

8,050

2,093

26.0

5,957

5,957

-31.5

E: MOSL Estimates

8 July 2014

June 2014 Results Preview | Sector: Cement

India Cements

Bloomberg

Equity Shares (m)

ICEM IN

307.2

M. Cap. (INR b)/(USD b)

36 / 1

52-Week Range (INR)

1 / 72 / 73

Financial and Valuation Summary (INR b)

2014 2015E 2016E 2017E

44.4

50.0

59.1

69.9

5.4

7.1

10.3

13.6

NP

-0.5

1.0

3.3

5.7

Adj. EPS (INR)

-7.9

2.9

10.6

19.0

-235.7 -136.2

269.8

79.7

133.6

148.7

EPS Gr. (%)

BV/Sh (INR)

RoE (%)

125.4

126.4

-1.3

2.7

8.2

13.2

RoCE (%)

Payout (%)

4.2

0.0

6.4

68.9

10.8

32.7

14.8

18.7

Valuations

P/E (x)

P/BV (x)

-14.7

0.9

40.7

0.9

11.0

0.9

6.1

0.8

EV/EBITDA (x) 12.0

EV/Ton (USD) 78.5

9.4

78.1

6.1

72.9

4.2

65.9

Quarterly Performance (Standalone)

Y/E March

Sales Dispatches (m ton)

YoY Change (%)

Realization (INR/ton)

YoY Change (%)

QoQ Change (%)

Net Sales

YoY Change (%)

EBITDA

Margins (%)

Depreciation

Interest

Other Income

PBT before EO expense

Extra-Ord expense

PBT

Tax

Rate (%)

Reported PAT

Adj PAT

YoY Change (%)

Margins (%)

E: MOSL Estimates

8 July 2014

131 / 43

1,6,12 Rel Perf. (%)

Y/E March

Sales

EBITDA

CMP: INR116

1Q

2.65

11.3

4,188

-6.2

-0.8

12,384

3.1

1,910

15.4

680

999

25

257

0

257

89

34.6

168

168

-77.5

1.4

Neutral

We expect volumes to grow 3% YoY (3% QoQ) to 2.73m tons. Strong

uptick in prices in June 2014 should aid 1QFY15 realizations. We

expect 0.5% YoY decline (but 5% QoQ increase) in realizations to

INR4,209/ton.

We estimate EBITDA at INR1.34b, up 81% QoQ. EBITDA margin is

likely to shrink 4.8pp YoY (but expand 3.7pp QoQ) to 10.6%,

translating into net loss of INR46m (v/s INR480m in 4QFY14).

Pure Cements EBITDA/ton is likely to increase by ~INR108/ton QoQ

to INR375/ton.

We are revising our EPS estimates for FY15/FY16 by -26%/+29% to

factor in deferred uptick in cement realizations in FY16.

The stock trades at 11x FY16E EPS, and at an EV of 6.1x FY16E EBITDA

and USD73/ton. Maintain Neutral, with a target price of INR126

(FY16E EV of USD75/ton).

Key issues to watch for

Demand and pricing outlook, especially in South India

Expected timeline and potential cost savings from captive coal

block in Indonesia and AP power plant

Timeline and capex plan for TN expansion of 2.6m tons

(INR Million

FY14

2Q

3Q

2.44

2.29

-2.9

-5.2

4,116

4,429

-5.5

1.5

-1.7

7.6

10,859

10,365

-3.3

-4.2

1,276

1,444

11.7

13.9

682

686

988

773

80

19

-314

4

0

0

-314

4

-89

0

28.3

0.0

-225

4

-225

4

-145.9

-98.4

-2.1

0.0

4QE

2.65

-4.4

4,009

-5.0

-9.5

10,801

-9.3

742

6.9

716

778

272

-480

1,091

-1,571

0

0.0

-1,571

-480

-282.2

-4.4

1QE

2.73

3.0

4,209

0.5

5.0

12,624

1.9

1,342

10.6

680

750

30

-58

0

-58

-12

20.0

-46

-46

-127.4

-0.4

FY15

2QE

2.56

5.0

4,609

12.0

9.5

12,483

15.0

1,989

15.9

700

800

50

539

0

539

108

20.0

431

431

-291.5

3.5

3QE

2.45

7.0

4,409

-0.4

-4.3

11,107

7.2

1,444

13.0

706

825

60

-27

0

-27

-5

20.0

-22

-22

-622.1

-0.2

4QE

2.91

9.5

4,609

15.0

4.5

13,757

27.4

2,373

17.3

710

852

30

841

0

841

168

20.0

673

673

-240.2

4.9

FY14E

FY15E

10.04

-0.2

4,178

-4.2

0.0

44,409

-3.4

5,371

12.1

2,764

3,537

396

-533

1,091

-1,624

0

0.0

-1,624

-533

-130.2

-1.2

10.65

6.1

4,460

6.8

0.0

49,972

12.5

7,148

14.3

2,796

3,227

170

1,296

0

1,296

259

20.0

1,036

1,036

-294.5

2.1

June 2014 Results Preview | Sector: Cement

Shree Cement

Bloomberg

Equity Shares (m)

SRCM IN

34.8

CMP: INR7,276

Buy

We expect 4QFY14 cement volumes to grow 22% YoY (12% QoQ) to

3.86m tons (including clinker) and realizations to grow 9.7% YoY

52-Week Range (INR)

7982 / 3413

(1.6% QoQ) to INR3,925/ton. Moderate rise in realizations and

1,6,12 Rel Perf. (%)

-4 / 41 / 26

benefit of positive operating leverage QoQ would lead to Cement

business profitability at INR1,139/ton (up INR63/ton QoQ).

Financial and Valuation Summary (INR b)

We estimate merchant power sales at 368m units (v/s 536m units

Y/E March

2014 2015E 2016E 2017E

QoQ and 795m QoQ) at ~INR3.3/unit (v/s INR3.3/unit in 3QFY14 and

Sales

58.6

70.7

85.8 102.9

INR3.88/unit in 4QFY13). Power EBITDA contribution would be

EBITDA

13.9

18.4

25.4

33.7

INR104m (v/s INR130m in 4QFY13 and INR840m in 3QFY14). Adjusted

NP

8.2

9.8

15.0

21.3

PAT would be INR3b (v/s INR2.8b in 4QFY13 and INR2.3b in 3QFY14).

Adj EPS (INR) 236.7 280.2 431.1 610.3

We are raising our EPS estimates by 8.7% for FY15 and 28% for FY16

EPS Gr. (%)

-17.9

18.4

53.9

41.6

to factor in higher volumes and realizations.

BV/Sh. (INR) 1,312 1,562 1,958 2,534

The stock trades at 16.9x FY16E EPS, and at an EV of 8.7x FY15E

RoE (%)

19.6

19.5

24.5

27.2

EBITDA and USD162/ton. Buy with a target price of INR8,250 (FY16E

RoCE (%)

19.6

22.0

27.2

31.1

Payout (%)

11.9

10.8

8.1

5.7

EV of USD190/ton).

Valuations

Key issues to watch for

P/E (x)

30.7

26.0

16.9

11.9

Volume and pricing outlook for North India

P/BV (x)

5.5

4.7

3.7

2.9

Pet coke price trend and update on any forward agreements for

EV/EBITDA (x) 17.4

13.2

8.7

5.8

merchant power

EV/Ton (USD) 197.7 174.1 161.9 143.2

Update on planned expansion and progress in capex plans

M. Cap. (INR b)/(USD b)

253 / 4

Quarterly performance

(INR Million)

Y/E June

Sales Dispat. (m ton)

YoY Change (%)

Realization (INR/Ton)

YoY Change (%)

QoQ Change (%)

Net Sales

YoY Change (%)

EBITDA

Margins (%)

Depreciation

Interest

Other Income

PBT before EO Exp

Extra-Ord Expense

PBT

Tax

Rate (%)

Reported PAT

Adj PAT

YoY Change (%)

E:MOSL Estimates

8 July 2014

1Q

3.04

22.4

3,815

12.2

1.7

12,964

52.2

3,902

30.1

942

543

328

2,745

10

2,736

454

16.6

2,281

2,289

438.0

FY13

2Q

3Q

3.00

3.26

5.2

-6.2

3,724

3,498

4.1

-1.7

-2.4

-6.1

14,281

14,281

19.4

0.3

3,717

4,058

26.0

28.4

818

1,265

563

447

323

572

2,659

2,918

120

1

2,539

2,917

365

176

14.4

6.0

2,174

2,741

2,277

2,741

284.6

85.2

4Q

3.17

-6.0

3,578

-4.6

2.3

14,414

0.4

3,800

26.4

1,332

378

913

3,003

0

3,002

159

5.3

2,843

2,843

-19.1

1Q

3.26

7.2

3,334

-12.6

-6.8

12,475

-3.8

2,494

20.0

1,139

312

740

1,783

11

1,773

50

2.8

1,722

1,732

-24.3

FY14

2Q

3.44

14.7

3,430

-7.9

2.9

13,170

-7.8

2,694

20.5

1,156

309

111

1,339

32

1,308

153

11.7

1,155

1,183

-48.0

3Q

3.84

17.8

3,863

10.4

12.6

16,600

16.2

4,261

25.7

1,667

363

546

2,777

59

2,719

494

18.2

2,225

2,273

-17.1

4QE

3.86

21.8

3,925

9.7

1.6

16,345

13.4

4,498

27.5

1,639

394

804

3,269

-48

3,317

225

6.8

3,093

3,048

7.2

FY13

FY14E

12.46

-16.2

3,628

3.4

0.0

55,671

-4.0

15,378

27.6

4,356

1,931

2,114

11,205

11

11,194

1,155

10.3

10,040

10,049

59.6

14.39

15.5

3,656

0.8

0.0

58,590

5.2

13,947

23.8

5,600

1,378

2,200

9,169

0

9,169

921

10.1

8,248

8,248

-17.9

June 2014 Results Preview | Sector: Cement

Ultratech Cement

Bloomberg

Equity Shares (m)

UTCEM IN

274.0

M. Cap. (INR b)/(USD b)

714 / 12

52-Week Range (INR)

CMP: INR2,604

2868 / 1405

1,6,12 Rel Perf. (%)

-3 / 26 / 3

Financial and Valuation Summary (INR b)

Y/E March

Sales

EBITDA

NP

Adj EPS (INR)

2014 2015E 2016E 2017E

200.8 234.6 280.8 334.1

36.2

44.2

62.8

85.9

20.7

25.0

36.5

51.8

75.6

91.3

133.0

189.0

EPS Gr. (%)

-21.2

20.8

45.7

42.1

BV/Sh (INR)

623.5

703.1

823.4

998.4

RoE (%)

12.8

13.8

17.4

20.7

RoCE (%)

Payout (%)

14.4

13.5

15.9

12.7

20.9

9.6

26.2

7.4

Valuations

P/E (x)

P/BV (x)

34.5

4.2

28.5

3.7

19.6

3.2

13.8

2.6

EV/EBITDA (x) 18.7

EV/Ton (USD) 191.7

15.5

193.7

10.9

185.5

7.4

171.2

Hold

We expect cement volumes to grow 14.7% YoY (but decline 5% QoQ)

to 11.57m tons. Realizations are likely to grow 3.1% QoQ (but decline

2.2% QoQ) to INR4,032/ton.

White cement volumes and realizations are likely to grow 8.8% YoY

and 12% YoY, respectively. RMC volumes and realizations would grow

7.1% YoY and 2% YoY, respectively.

We estimate EBITDA/ton at INR871 (down INR55/ton QoQ). EBITDA

margin would decline by 2.9pp YoY (and 1.3pp QoQ) to 18.3%.

EBITDA is likely to de-grow 3% YoY (and 11% QoQ) to INR10.2b,

translating into PAT de-growth of 8% YoY to INR6.2b.

We are revising our FY15/FY16 EPS estimates by -3.7%/+10.9% to

factor in deferred uptick in realizations.

The stock trades at 19.6x FY16E EPS, and at an EV of 10.9x FY16E

EBITDA and USD185/ton. Maintain Buy, with a target price of

INR2,906 (EV of FY16E USD200/ton).

Key issues to watch for

Volume growth recovery and outlook

Cement pricing outlook and sustainability

Progress and timeline of JPA deal

Update on financial performance of Star Cement, UAE

Quarterly Performance

(INR Million)

Y/E March

1Q

10.09

-2.3

FY14

2Q

3Q

9.23

9.98

-0.6

0.4

4Q

12.18

9.4

Sales (m ton)

YoY Change (%)

Grey Cement

Realn.(INR/ton) *

4,120

3,973

3,936

3,912

YoY Change (%)

0.0

-5.8

-2.8

-2.5

QoQ Change (%)

2.7

-3.6

-0.9

-0.6

Net Sales

49,575 45,021 47,864 58,319

YoY Change (%)

-2.3

-4.2

-1.5

8.2

EBITDA

10,491

6,597

7,641 11,429

Margins (%)

21.2

14.7

16.0

19.6

Depreciation

2,521

2,573

2,645

2,785

Interest

660

888

905

739

Other Income

1,882

574

996

1,858

PBT before EO expense

9,192

3,711

5,088

9,763

Extra-Ord expense

0

0

0

-956

PBT after EO Expense

9,192

3,711

5,088 10,719

Tax

2,466

1,070

1,391

2,340

Rate (%)

26.8

28.8

27.3

21.8

Reported PAT

6,726

2,641

3,698

8,379

Adj PAT

6,726

2,641

3,698

7,632

YoY Change (%)

-13.6

-52.0

-38.5

5.1

E: MOSL Estimates; * Grey cement realization is our estimate

8 July 2014

1Q

11.57

14.7

4,032

-2.2

3.1

55,830

12.6

10,203

18.3

2,850

800

1,750

8,303

0

8,303

2,117

25.5

6,186

6,186

-8.0

FY15E

2Q

3Q

10.16

11.18

10.0

12.0

3,932

-1.0

-2.5

49,250

9.4

6,050

12.3

3,000

825

800

3,025

0

3,025

771

25.5

2,254

2,254

-14.7

4,182

6.2

6.4

57,013

19.1

10,437

18.3

3,200

835

1,000

7,402

0

7,402

1,887

25.5

5,514

5,514

49.1

4Q

13.33

9.4

FY14

FY15E

41.5

2.0

46.2

11.5

4,493

3,982

4,179

14.9

-2.9

4.9

7.5

0.0

0.0

72,513 200,779 234,606

24.3

0.3

16.8

17,948 36,160 44,638

24.8

18.0

19.0

3,348 10,523 12,398

855

3,192

3,315

1,600

5,310

5,150

15,345 27,755 34,076

0

-956

0

15,345 28,711 34,076

3,913

7,266

8,689

25.5

25.3

25.5

11,432 21,445 25,386

11,432 20,731 25,386

49.8

-21.9

22.5

10

June 2014 Results Preview | Sector: Cement

NOTES

8 July 2014

11

Disclosures

This report is for personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or

inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution

and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form.

Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its

affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees

to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

The information contained herein is based on publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, MOSt and/or

its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its

affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any

of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of

merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations.

This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision

based on this report or for any necessary explanation of its contents.

MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of

Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report.

Disclosure of Interest Statement

1. Analyst ownership of the stock

2. Group/Directors ownership of the stock

3. Broking relationship with company covered

4. Investment Banking relationship with company covered

Companies where there is interest

No

Birla Corporation

No

Ultratech Cement

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is,

or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally

responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary

to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions.

For U.K.

This report is intended for distribution only to persons having professional experience in matters relating to investments as described in Article 19 of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (referred to as "investment professionals"). This document must not be acted on or relied on by persons who are not investment professionals. Any investment or investment activity

to which this document relates is only available to investment professionals and will be engaged in only with such persons.

For U.S.

Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United

States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under

applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services

described herein are not available to or intended for U.S. persons.

This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major

institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only

available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange

Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the

U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this

report will have to be executed within the provisions of this chaperoning agreement.

The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered brokerdealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a

research analyst account.

For Singapore

Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial

Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed

in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time.

In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited:

Anosh Koppikar

Kadambari Balachandran

Email:anosh.Koppikar@motilaloswal.com

Email : kadambari.balachandran@motilaloswal.com

Contact(+65)68189232

Contact: (+65) 68189233 / 65249115

Office Address:21 (Suite 31),16 Collyer Quay,Singapore 04931

Motilal Oswal Securities Ltd

8 July 2014

Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025

Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com

12

You might also like

- Dividend Policy at FPL Case 4Document4 pagesDividend Policy at FPL Case 4Ankur280475% (4)

- Jack StackDocument7 pagesJack StackAlper AykaçNo ratings yet

- Cci 2019-EngDocument205 pagesCci 2019-EngNuritokerNo ratings yet

- Answer Key Chap 1 3Document18 pagesAnswer Key Chap 1 3Huy Hoàng PhanNo ratings yet

- Shree Cement: CMP: INR9,253 TP: INR9,778 BuyDocument8 pagesShree Cement: CMP: INR9,253 TP: INR9,778 BuyAshish NaikNo ratings yet

- IDirect IndiaCement CoUpdate Oct16Document4 pagesIDirect IndiaCement CoUpdate Oct16umaganNo ratings yet

- Investment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysDocument25 pagesInvestment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysNarnolia Securities LimitedNo ratings yet

- India Cements, 1Q FY 2014Document10 pagesIndia Cements, 1Q FY 2014Angel BrokingNo ratings yet

- India Cement (INDCEM) : Focus Shifts Towards Non-Southern RegionDocument11 pagesIndia Cement (INDCEM) : Focus Shifts Towards Non-Southern RegionumaganNo ratings yet

- Idea Cellular: Wireless Traffic Momentum To SustainDocument10 pagesIdea Cellular: Wireless Traffic Momentum To SustainKothapatnam Suresh BabuNo ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- Best Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Document22 pagesBest Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Narnolia Securities LimitedNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument9 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- TopPicks 020820141Document7 pagesTopPicks 020820141Anonymous W7lVR9qs25No ratings yet

- Investment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverDocument26 pagesInvestment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverNarnolia Securities LimitedNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Sun Pharma: Annual Report 2014 AnalysisDocument8 pagesSun Pharma: Annual Report 2014 AnalysisSohamsNo ratings yet

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- Indian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Document21 pagesIndian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Narnolia Securities LimitedNo ratings yet

- Tata Consultancy Services: CMP: INR1,459 TP: INR1,500 NeutralDocument10 pagesTata Consultancy Services: CMP: INR1,459 TP: INR1,500 NeutralktyNo ratings yet

- Market Outlook 12th April 2012Document5 pagesMarket Outlook 12th April 2012Angel BrokingNo ratings yet

- Sanghvi Movers: Maintaining FaithDocument10 pagesSanghvi Movers: Maintaining FaithDinesh ChoudharyNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- India Cements: Performance HighlightsDocument10 pagesIndia Cements: Performance HighlightsAngel BrokingNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Pi Industries Edel Q1fy12Document7 pagesPi Industries Edel Q1fy12equityanalystinvestorNo ratings yet

- Essel Propack Edelweiss PDFDocument33 pagesEssel Propack Edelweiss PDFarushichananaNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- Linc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - BuyDocument6 pagesLinc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - Buynare999No ratings yet

- Trade Advisory Services For Today Buy Stock of Hindustan Zinc LTDDocument27 pagesTrade Advisory Services For Today Buy Stock of Hindustan Zinc LTDNarnolia Securities LimitedNo ratings yet

- India Cements: CMP: Inr71 TP: INR100Document8 pagesIndia Cements: CMP: Inr71 TP: INR100Kirti ChouguleNo ratings yet

- Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- IDBI Bank: BUY Target Price (INR) 170 Promises May Be Delivered This Time AroundDocument32 pagesIDBI Bank: BUY Target Price (INR) 170 Promises May Be Delivered This Time AroundGaurav SrivastavaNo ratings yet

- India Morning Bell 5th December 2014Document18 pagesIndia Morning Bell 5th December 2014Just ChillNo ratings yet

- 4QFY14E Results Preview: Institutional ResearchDocument22 pages4QFY14E Results Preview: Institutional ResearchGunjan ShethNo ratings yet

- Amara Raja Batteries: CMP: INR915 TP: INR1,032 (+13%) BuyDocument12 pagesAmara Raja Batteries: CMP: INR915 TP: INR1,032 (+13%) BuyHarshal ShahNo ratings yet

- WE Research9Document2 pagesWE Research9dwirelesNo ratings yet

- Market Outlook: Dealer's DiaryDocument22 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsDocument9 pagesMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaNo ratings yet

- Hindustan Petroleum Corporation: Proxy For Marketing PlayDocument9 pagesHindustan Petroleum Corporation: Proxy For Marketing PlayAnonymous y3hYf50mTNo ratings yet

- Muhurat Picks 2012 Muhurat Picks 2012 Muhurat Picks 2012Document8 pagesMuhurat Picks 2012 Muhurat Picks 2012 Muhurat Picks 2012Mahendra PratapNo ratings yet

- Apollo TyreDocument12 pagesApollo TyrePriyanshu GuptaNo ratings yet

- Sharekhan Top Picks: April 03, 2010Document6 pagesSharekhan Top Picks: April 03, 2010Kripansh GroverNo ratings yet

- Stock Research Report For Indian HotelDocument5 pagesStock Research Report For Indian HotelSudipta Bose100% (1)

- JK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97Document4 pagesJK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97ajd.nanthakumarNo ratings yet

- Quick Note: Sintex IndustriesDocument6 pagesQuick Note: Sintex Industriesred cornerNo ratings yet

- Sintex Industries: CMP: Inr87 TP: INR115 BuyDocument8 pagesSintex Industries: CMP: Inr87 TP: INR115 BuyMLastTryNo ratings yet

- Will Politics Guide Market Sentiments?Document7 pagesWill Politics Guide Market Sentiments?Atul SuryavanshiNo ratings yet

- Madras Cements 4Q FY 2013Document10 pagesMadras Cements 4Q FY 2013Angel BrokingNo ratings yet

- ABG ShipyardDocument9 pagesABG ShipyardTejas MankarNo ratings yet

- Mangalore Refinery (MRPL) : Phase III Near CompletionDocument10 pagesMangalore Refinery (MRPL) : Phase III Near CompletionDhawan SandeepNo ratings yet

- TVS Motor Company: Another Quarter of Dismal EBITDA Margin Retain SellDocument5 pagesTVS Motor Company: Another Quarter of Dismal EBITDA Margin Retain SellSwastik PradhanNo ratings yet

- Diwali Icici 081112Document8 pagesDiwali Icici 081112Mintu MandalNo ratings yet

- KSL - Ushdev International Limited (IC) - 25 Jan 2013Document12 pagesKSL - Ushdev International Limited (IC) - 25 Jan 2013Rajesh KatareNo ratings yet

- Morning Shout: Fatima: Positives Priced in Downgrade To U/PDocument3 pagesMorning Shout: Fatima: Positives Priced in Downgrade To U/PjibranqqNo ratings yet

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Document20 pagesStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedNo ratings yet

- Ultratech Cement: CMP: INR4,009 TP: INR4,675 (+17%)Document8 pagesUltratech Cement: CMP: INR4,009 TP: INR4,675 (+17%)sandeeptirukotiNo ratings yet

- Amara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Document8 pagesAmara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Harshal ShahNo ratings yet

- Indian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinDocument17 pagesIndian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinNarnolia Securities LimitedNo ratings yet