Professional Documents

Culture Documents

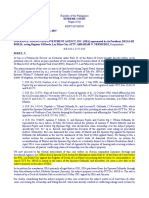

Labor Chart

Labor Chart

Uploaded by

Dailyn JaectinCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Flaxo CaseDocument10 pagesFlaxo CasehemantNo ratings yet

- CSR of Airbnb in COVID-19Document9 pagesCSR of Airbnb in COVID-19Tiegan BlakeNo ratings yet

- La Sallian Educational Innovators FoundationDocument15 pagesLa Sallian Educational Innovators FoundationDailyn JaectinNo ratings yet

- Sup Apo vs. Spouses de Jesus GR No. 198356Document10 pagesSup Apo vs. Spouses de Jesus GR No. 198356Dailyn JaectinNo ratings yet

- Disloyalty of A DirectorDocument2 pagesDisloyalty of A DirectorDailyn Jaectin0% (1)

- Lexber Inc. vs. Dalman GR No. 183587Document9 pagesLexber Inc. vs. Dalman GR No. 183587Dailyn JaectinNo ratings yet

- Africa vs. ISIA GR 206540Document8 pagesAfrica vs. ISIA GR 206540Dailyn JaectinNo ratings yet

- Garcillano Vs HRETDocument2 pagesGarcillano Vs HRETDailyn JaectinNo ratings yet

- Razon Vs IACDocument2 pagesRazon Vs IACDailyn Jaectin0% (1)

- OverviewDocument2 pagesOverviewDailyn JaectinNo ratings yet

- Distinctions (F-I-N-G-S) Salvage Towage Fees Involvement in Needed Consent Governing Law SuccessDocument1 pageDistinctions (F-I-N-G-S) Salvage Towage Fees Involvement in Needed Consent Governing Law SuccessDailyn JaectinNo ratings yet

- Cir Vs AcostaDocument1 pageCir Vs AcostaDailyn JaectinNo ratings yet

- GR No 135385 PDFDocument94 pagesGR No 135385 PDFRanger Rodz TennysonNo ratings yet

- Green-Jama: Report OutlineDocument3 pagesGreen-Jama: Report OutlineDailyn JaectinNo ratings yet

- Legal Technique and LogicDocument3 pagesLegal Technique and LogicDailyn JaectinNo ratings yet

- Alejandro v. Alejandro, Adm. Case No. 4256, Feb 13, 2004, 422 SCRA 527Document6 pagesAlejandro v. Alejandro, Adm. Case No. 4256, Feb 13, 2004, 422 SCRA 527Dailyn JaectinNo ratings yet

- Memo For Job PacketDocument1 pageMemo For Job Packetapi-374800809No ratings yet

- Employment Application Form - FillableDocument1 pageEmployment Application Form - FillableRamon SaldiasNo ratings yet

- Full Final 2Document53 pagesFull Final 2Shajidul HoqueNo ratings yet

- PlotadoDocument6 pagesPlotadoNeph VargasNo ratings yet

- Mavar in The Hackney GazetteDocument1 pageMavar in The Hackney GazetteMavar UKNo ratings yet

- Comments On Contractor's HSE PlanDocument2 pagesComments On Contractor's HSE Planmazen fakhfakhNo ratings yet

- IIPM CoursewareDocument58 pagesIIPM CoursewareAkansha Singh RoyalNo ratings yet

- MCI - Job Application Form - Agus NugrahaDocument3 pagesMCI - Job Application Form - Agus NugrahaAgus NugrahaNo ratings yet

- Resume in JapaneseDocument8 pagesResume in Japanesegyv0vipinem3100% (2)

- Alcohol and Drug Testing Consent FormDocument2 pagesAlcohol and Drug Testing Consent FormglitchygachapandaNo ratings yet

- Royal Crown International vs. NLRC (Case)Document7 pagesRoyal Crown International vs. NLRC (Case)jomar icoNo ratings yet

- Bar QuestionsDocument24 pagesBar QuestionsAisha TejadaNo ratings yet

- DELOITTE Report WITH ORG. STRATEGYDocument27 pagesDELOITTE Report WITH ORG. STRATEGYCzarina CasallaNo ratings yet

- Theories of ManagementDocument15 pagesTheories of ManagementSamiuddin KhanNo ratings yet

- Economic DevelopmentDocument5 pagesEconomic DevelopmentBernardokpeNo ratings yet

- Maternity Benefit Act, 1961Document22 pagesMaternity Benefit Act, 1961bijuanithaNo ratings yet

- Kaizen ConceptDocument7 pagesKaizen ConceptREyma JOy Solivio SipatNo ratings yet

- Job SatisfactionDocument37 pagesJob SatisfactiongirmaNo ratings yet

- Labour Turnover: Causes, Consequences and Prevention: January 2016Document9 pagesLabour Turnover: Causes, Consequences and Prevention: January 2016Michael Atkins sesayNo ratings yet

- Personal Marketing Plan-Islam HelalDocument8 pagesPersonal Marketing Plan-Islam HelalIslam HelalNo ratings yet

- Research ProposalDocument2 pagesResearch ProposalAsemyouba JamirNo ratings yet

- Chapter 10-Establishing Strategic Pay PlansDocument26 pagesChapter 10-Establishing Strategic Pay PlansBilal HashmiNo ratings yet

- Case SummaryDocument11 pagesCase SummaryAditya ChaudharyNo ratings yet

- Sample Financial Aid Appeal LetterDocument1 pageSample Financial Aid Appeal LetterProf. ChrisNo ratings yet

- Human Resource Development (HRD) Practices of NonGovernmental Organisations (NGO's) in Dewrty Foundation - NEELAMDocument82 pagesHuman Resource Development (HRD) Practices of NonGovernmental Organisations (NGO's) in Dewrty Foundation - NEELAMAIMAN FATMA 21GCEMBA013No ratings yet

- RMIT International University Vietnam: Assignment Cover PageDocument9 pagesRMIT International University Vietnam: Assignment Cover Page1DBA-38 Nguyễn Thị Thanh TâmNo ratings yet

- SOP - SCU - The Hotel SchoolDocument6 pagesSOP - SCU - The Hotel SchoolYogesh SharmaNo ratings yet

- Functions of HRMDocument3 pagesFunctions of HRMlanoox100% (1)

Labor Chart

Labor Chart

Uploaded by

Dailyn JaectinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Labor Chart

Labor Chart

Uploaded by

Dailyn JaectinCopyright:

Available Formats

FEMALE EMPLOYEE

REGULAR DAY-TIME EE (RANK-AND-FILE)

14 AND BELOW (AKA BELOW 15)

15 UP TO BELOW 18 YEARS

REGULAR DAY-TIME EE (MANAGERIAL

POSITION)

MINIMUM

AGE

18

N/A

N/A

FREQUENCY OF PAYMENT

Must be paid on certain dates,

intervals of which do not

exceed 16 days, or twice a

month

MODE OF PAYMENT (LEGAL TENDER/IN KIND)

PLACE OF PAYMENT

ART. 104. At or near the place of undertaking. EXCEPTION: (a) When payment cannot be effected at or

near the place of work by reason of the deterioration of peace and order conditions, or by reason of

actual or impending emergencies caused by fire, flood, epidemic or other calamity rendering payment

Art. 102. No employer shall pay the wages of an employee by

thereat impossible;

means of promissory notes, vouchers, coupons, tokens, tickets, chits, or

(b) When the employer provides free transportation to the employees back and forth; and

any object other

(c) Under any other analogous circumstances; Provided, That the time spent by the employees in

than legal tender, even when expressly requested by the employee.

collecting their wages shall be considered as compensable hours worked;

Payment of wages by check or money order shall be allowed when such

(d) No employer shall pay his employees in any bar, night or day club, drinking establishment, massage

manner of payment is customary on the date of effectivity of this Code,

clinic, dance hall, or other similar places or in places where games are played with stakes of money or

or is necessary because of special circumstances as specified in

things representing money except in the case of persons employed in said places. (Sec. 4, Rule VIII, IRR)

appropriate regulations to be issued by the Secretary of Labor and

Also RA 6727, Payment thru BANKS allowed, provided: 25 or more EEs, with the WRITTEN permission of

Employment or as stipulated in a collective bargaining

MAJORITY. Within 1km radius from bank. Within period of payment of Labor Code (aka twice a month).

agreement. EXCEPTION: Facilities. These are articles or services for the

Payment thru ATMS (Labor Advisory) allowed if: with WRITTEN consent of EEs concerned, EEs given

benefit of the EE or his family but shall not include tools of the trade or reasonable time to withdraw from ATM (compensable if during work hours), still twice a month (same as

articles or services primarily for the benefit of the ER or necessary to the Labor Code requirement), there's an ATM within a 1km radius from workplace, upon request of EEs, the

conduct of the ER's business. (Sec. 5. Rule VII-A, IRR)

ER will issue a record of payment of wages, benefits and deductions for a particular period,There won't

be any additional expenses and diminution of benefits as a result of ATM system of payment, And ER

assumes responsibility in case the wage protection provisions of law are not complied with under this

arrangement.

Like a normal employee, a childemployee must be paid on

No specific stipulation in the Code or in the special law. Hence, it is

certain dates, whose intervals presumed that the general rules laid down in the Labor Code applies also

do not exceed 16 days, or

to child-employees

simply twice a month

Like a normal employee, a childemployee must be paid on

No specific stipulation in the Code or in the special law. Hence, it is

certain dates, whose intervals presumed that the general rules laid down in the Labor Code applies also

do not exceed 16 days, or

to child-employees

simply twice a month

MINIMUM WAGE

APPLICATION OF BENEFITS FOR NURSING

EEs (Breastfeeding Act, etc.)

For Cebu: P340 but can be higher.

Lactation stations in the workplace which

must have a lavatory for handwashing

(unless there's one nearby), refrigeration

and appropriate cooling facilities, electrical

outlets, small table, comfortable seats,

others. Extra 40mins (aside from meal

break) to get to and from lactation station.

Applicable to all private and Gov't

establishments.

See Art. 104, Labor Code

Statutory Minimum Wage Applies (Note: The Law specifically

mandates that the wage of the child belongs solely to her and shall

be set aside primarily for her support, education or skills

If at this age, the child-employee already

acquisition; family needs becomes secondary to these priorities,

provided that not more than 20% of such income may be used for has a child and is nursing the infant, there

is no reason why she should not be given

the family's collective needs [Sec. 12-B of RA 9231]) And also, a

this benefit

TRUST FUND must be set up in order to protect such income of the

child, amounting to at least 30% of the earnings. This trust fund

shall be under the child's full control upon reaching the age of

majority [Sec. 12-C of RA 9231]

See Art. 104, Labor Code

Statutory Minimum Wage Applies (Note: The Law specifically

mandates that the wage of the child belongs solely to her and shall

be set aside primarily for her support, education or skills

acquisition; family needs becomes secondary to these priorities,

If at this age, the child-employee already

provided that not more than 20% of such income may be used for has a child and is nursing the infant, there

the family's collective needs [Sec. 12-B of RA 9231]) And also, a

is no reason why she should not be given

TRUST FUND must be set up in order to protect such income of the

this benefit

child, amounting to at least 30% of the earnings. This trust fund

shall be under the child's full control upon reaching the age of

majority [Sec. 12-C of RA 9231]

18

Art. 103 at least once every two (2)

Legal tender and in kind. Payment by check or through atm. Art. 102 LC and Rule

weeks or twice a month at intervals

VIII of the Omnibus Rule

not exceeding (16) days.

ART. 104. At or near the place of undertaking.

Wage Order; For Cebu 340

18

Art. 102. No employer shall pay the wages of an employee by

means of promissory notes, vouchers, coupons, tokens, tickets, chits, or

Must be paid on certain dates,

any object other

intervals of which do not

than legal tender, even when expressly requested by the employee.

exceed 16 days, or twice a

Payment of wages by check or money order shall be allowed when such

month (basis: section 8 of DO

manner of

18-A states that contractors'

payment is customary on the date of effectivity of this Code, or is

employees shall be entitled to

necessary because of

all the rights and privileges as

special circumstances as specified in appropriate regulations to be issued

provided for in the Labor Code,

by the

as amended)

Secretary of Labor and Employment or as stipulated in a collective

bargaining

ART. 104. At or near the place of undertaking. EXCEPTION: (a) When payment cannot be effected at or

near the place of work by reason of the deterioration of peace and order conditions, or by reason of

actual or impending emergencies caused by fire, flood, epidemic or other calamity rendering payment

thereat impossible;

(b) When the employer provides free transportation to the employees back and forth; and

(c) Under any other analogous circumstances; Provided, That the time spent by the employees in

collecting their wages shall be considered as compensable hours worked;

(d) No employer shall pay his employees in any bar, night or day club, drinking establishment, massage

clinic, dance hall, or other similar places or in places where games are played with stakes of money or

things representing money except in the case of persons employed in said places. (Sec. 4, Rule VIII, IRR)

Also RA 6727, Payment thru BANKS allowed, provided: 25 or more EEs, with the WRITTEN permission of

MAJORITY. Within 1km from bank. Within period of payment of Labor Code (aka twice a month).

For Cebu: P340 but can be higher.

Applicable to all nursing EEs in all private

enterprises as well as gov't agencies, including

le or necessary due to the subdivisions and

instrumentalities, and GOCCs, except those

where lactation stations are not feasible due to

the peculiar circumstances of the workplace or

public place taking into consideration, among

others, the number of women EEs, physical

size of the establishment, and the average

number of women who visit. All health and nonhealth, eatablishments or institutions w/c are

exempted in complying provided thatthey give

their EEs the previledge of using them.

PURELY COMMISSION BASIS

PAID IN PIECE-RATE BASIS

EEs OF CONTRACTOR

YES

APPRENTICE

14

Can start at 75% of minimum wage. Can also be no payment in case

required by school or training program curriculum or as a requisite

for graduation or board examination

LEARNER

HANDICAPPED

WORKING IN NIGHTCLUBS, BARS, ETC

NIGHT WORKER

KASAMBAHAY (LIVE-IN/LIVE-OUT)

Art. 102. No employer shall pay the wages of an employee by

means of promissory notes, vouchers, coupons, tokens, tickets, chits, or

any object other than legal tender, even when expressly requested by the

employee. Payment of wages by check or money order shall be allowed

when such manner of payment is customary on the date of effectivity of

this Code, or is necessary because of special circumstances as specified in

18 and above twice a month, 15 days interval

appropriate regulations to be issued by the Secretary of Labor and

Employment or as stipulated in a collective bargaining agreement.

EXCEPTION: Facilities. These are articles or services for the benefit of the

EE or his family but shall not include tools of the trade or articles or

services primarily for the benefit of the ER or necessary to the conduct of

the ER's business. (Sec. 5. Rule VII-A, IRR)

15

At least once a month

article 104

night shift differential- additional compensation of 10% of an

employee's regular wage for each hour of work performed between

10pm and 6:00am

applies

CASH ONLY. No payment by promissory notes, vouchers, coupons,

tokens, tickets, chits, or any object other than cash. Payslip is required

Place of work

A98, LC explicitly excludes the Kasambahay from the statutory

minimum. These rates apply: 2,500/month for NCR; 2,000/month

for cites & municipalities; 1,500/month for other municipalities

Pregnancy leave + Magna Carta leave

No payment (No ER-EE relationship)---Only free schooling

does not apply

does not apply

does not apply

INDUSTRIAL HOMEWORKER

NON-RESIDENT ALIEN

STUDENT/WORKING SCHOLAR

between 15

and 25

For Acad- Regular or Basic Pay. Overload performed beyond 8hour

daily work is overtime pay

ACAD/NON ACAD PERSONNEL

SENIOR CITIZEN

60

not specified (follow LC)

legal tender and in kind (in form of facilities)

not specified (follow general provisions of LC and special laws, i.e. payment thru atm)

at least Minimum Wage

DRIVER/CONDUCTOR

18

not specified (follow LC)

legal tender and in kind (in form of facilities)

not specified (follow general provisions of LC and special laws, i.e. payment thru atm)

Fixed and Performance-based Compensation Scheme *** Fixed -->

amount mutually agreed upon (bet. owner/operator and

driver/conductor) - must not be lower than minimum wage ***

Performance-based --> based on safety perfomance and business

perfomance and other related parameters

SERVICE ESTABLISHMENT

LESS THAN 10 EEs IN ESTABLISHMENT

You've seen a senior citizen breastfeeding?

O____O If yes, apply the general

provisions of the law

HOURS OF WORK

MEAL PERIOD

BREAK PERIOD

Art. 85: not less than 60mins.

Art. 83: shall not exceed 8 hours. Art. 84:

Non-compensable. ER can't

Hours of work includes a) time required to be compel EEs to stay within work IRR Book 3, Rule

on duty at workplace; b) time

premises. If less than 60mins,

1, Sec. 7: 5-20

suffered/permitted to work. EXC: Art. 89:

must not be go lower than

mins

EMERGENCY OVERTIME WORK (5 instances)

20mins, and it becomes

compensable

(NOTE: a day is the 24-hr period starting from compensable time. (IRR Book 3,

break.

the time the EE regularly starts to work)

Rule 1, Sec. 7: 4 instances where

shorter meal time allowed)

OVERTIME PAY (Spec.

Holiday & Rest day

PREMIUM PAY

Art. 87: +25% of regular

wage. If on a holiday or

rest day, +30% of

(includes work on rest

holiday/rest day wage.

day) Addition of not

NON-WAIVABLE. EXC:

less than 30% of

When the alleged

regular wage.

waiver of OT is in

(meaning, can be

consideration of

higher, depending on

benefits and privileges

ER's discretion)

which may be more

than what will acrue to

them.

SERVICE INCENTIVE LEAVE

REG. HOLIDAY PAY

Art. 95: Leave of 5 days IF EE has

rendered at least ONE YEAR of

service (whether continuous or

broken, reckoned from the day

the EE started working, including Art. 94: If not worked, paid

authorized absences and paid

regular wage. If worked,

regular holidays). But if the

+100% of regular wage.

working days in the

contract/company policy is less

than 12 months, then said

period will be counted as a year.

SPEC. HOLIDAY PAY

Art. 93: If not worked,

not compensable. If

worked, +30% of

regular wage.

NIGHT SHIFT DIFFERENTIAL

SERVICE CHARGE

13TH MONTH PAY

PATERNITY/MATERNITY LEAVE

Art. 86: Payment for work

between 10pm-6am. Not less

than 10% addition to regular

wage FOR EACH HOUR. Not

waivable.

Not less than 1/12 of the total basic

salary EARNED by the EE within a

calendar year. To be paid not later

Art. 96: All service

than December 24 of every year.

charges to be distributed

HOWEVER, period of payment can be

at the rate of 85% for all

agreed upon if there's a union. ER can

covered EEs and 15% for

also opt to give half of the pay before

management.

the opening of the regular school

year, and the other half on or before

December 24.

SS Law: Sec. 14-A: 100% daily salary

credit for 60 (normal) or 78

(caesarean) days. PROVIDED she has

paid at least 3 monthly contributions

in the 12-month period immediately

preceding the childbirth/miscarriage.

Available to married and unmarried

ladies. For fathers, entitled to 7 days

full pay, but must be MARRIED &

COHABITING, and can only avail of

the leave if LEGIT SPOUSE is giving

birth. Both maternity and paternity

leaves only good for the first 4

deliveries.

N/A

N/A Omnibus Rule VI sec. 2

Employees Covered - A

used herein, a 'managerial

employee' shall mean one

who is vested with powers

prerogatives to lay down and

execute management

Not less than 1/12 of the total basic salary

policies and/or to hire,

EARNED by the EE within a calendar

transfer, suspend, lay-off, year.

recall, discharge, assign, or

disciplineemployees or to

effectively recommenf such

managerial actions. All

employees not falling whithin

this definition shall be

Same with rank and file.

Art. 86: Payment for work

between 10pm-6am. Not less

than 10% addition to regular

wage FOR EACH HOUR. Not

waivable.

Not less than 1/12 of the total basic

salary EARNED by the EE within a

calendar year. To be paid not later

Art. 96: All service

than December 24 of every year.

charges to be distributed

HOWEVER, period of payment can be

at the rate of 85% for all

agreed upon if there's a union. ER can

covered EEs and 15% for

also opt to give half of the pay before

management.

the opening of the regular school

year, and the other half on or before

December 24.

SS Law: Sec. 14-A: 100% daily salary

credit for 60 (normal) or 78

(caesarean) days. PROVIDED she has

paid at least 3 monthly contributions

in the 12-month period immediately

preceding the childbirth/miscarriage.

Available to married and unmarried

ladies. For fathers, entitled to 7 days

full pay, but must be MARRIED &

COHABITING, and can only avail of

the leave if LEGIT SPOUSE is giving

birth. Both maternity and paternity

Not more than 4 hours per day, 20 hours per

week, and should not work between 8pm6am

Not more than 8 hours per day, 40 hours per

week, and should not work between 10pm6am

N/A

N/A

N/A

Art. 85: not less than 60mins.

Art. 83: shall not exceed 8 hours. Art. 84:

Non-compensable. ER can't

Hours of work includes a) time required to be compel EEs to stay within work IRR Book 3, Rule

on duty at workplace; b) time

premises. If less than 60mins,

1, Sec. 7: 5-20

suffered/permitted to work. EXC: Art. 89:

must not be go lower than

mins

EMERGENCY OVERTIME WORK (5 instances)

20mins, and it becomes

compensable

(NOTE: a day is the 24-hr period starting from compensable time. (IRR Book 3,

break.

the time the EE regularly starts to work)

Rule 1, Sec. 7: 4 instances where

shorter meal time allowed)

N/A

N/A

Art. 87: +25% of regular

wage. If on a holiday or

rest day, +30% of

(includes work on rest

holiday/rest day wage.

day) Addition of not

NON-WAIVABLE. EXC:

less than 30% of

When the alleged

regular wage.

waiver of OT is in

(meaning, can be

consideration of

higher, depending on

benefits and privileges

ER's discretion)

which may be more

than what will acrue to

them.

N/A

N/A

Art. 95: Leave of 5 days IF EE has

rendered at least ONE YEAR of

service (whether continuous or

broken, reckoned from the day

the EE started working, including Art. 94: If not worked, paid

authorized absences and paid

regular wage. If worked,

regular holidays). But if the

+100% of regular wage.

working days in the

contract/company policy is less

than 12 months, then said

period will be counted as a year.

N/A

Art. 93: If not worked,

not compensable. If

worked, +30% of

regular wage.

rest day= (110% + 30%)

x regular hourly rate;

special day= (110% +

30%) x regular hourly

40 minutes for

rate holiday= (110%+

every 8 hour shift

110%)x regular hourly

rate; overtime= (110%

+25%) x regular hourly

rate

10pm-6am

1 hour for every 8 hour shift

yes

yes

yes

plus 10% of hourly rate

does not apply

yes

yes

16 hours per day

N/A

8 hours a day + 24

consecutive hours

a week as rest

day

N/A

N/A

At least 5 days with pay for

Kasambahays who have

rendered at least 1 year of

service (Note that any unused

portion shall not be cumulative

N/A

N/A

N/A

N/A

Not less that 1/12 of total basic

salary EARNED for kasambahays who

have rendered at least 1 month of

service

YES

No set hours of work. No ER-EE relationship

does not apply

does not apply

does not apply

does not apply

does not apply

does not apply

does not apply

does not apply

does not apply

does not apply

does not apply

At least 1hr

within a 12hr shift

(exclusive of meal

breaks)

At least 25% of the

basic wage (ordinary

days), 30% (regular

holigays, special days

and rest days)

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

For teaching or academic personell- shall not

exceed 8hours a day. Any work in addition to

the 8 daily work shall constitute overtime

work

Apply general principles (max 8hrs/day, if

more, entitled to overtime pay)

Normal hours of work - not excced 8hrs/day

*** if required to work overtime max must

not exceed 12hrs/day

SOLO PARENT'S LEAVE

RETIREMENT PAY

Art. 287: retirement age can be

determined by CBA or Employment

Contract. If none, 60-65 years (who

Not more than 7 days per year,

has sereved at least 5 years in the

IN ADDITION to other leave

establishment). For Underground

privileges, BUT must have

Mining EEs, it's 50-60 years.

rendered service for at least a

Retirement benefits also come from

year. Applicable to both males

CBAs and agreements. If none,

and female. (Note: check

retirement pay is equivalent to at

definition of solo parent to see

least 1/2 month salary for every year

who qualifies as such)

of service (a fraction of 6 months is

considered a year). (Check law on

what 1/2 month salary entails)

Same with rank and file.

Same with rank and file.

Art. 287: retirement age can be

determined by CBA or Employment

Not more than 7 days per year, Contract. If none, 60-65 years (who

IN ADDITION to other leave

has sereved at least 5 years in the

privileges, BUT must have

establishment). For Underground

rendered service for at least a

Mining EEs, it's 50-60 years.

year. Applicable to both males Retirement benefits also come from

and female. (Note: check

CBAs and agreements. If none,

definition of solo parent to see

retirement pay is equivalent to at

who qualifies as such)

least 1/2 month salary for every year

of service (a fraction of 6 months is

considered a year). (Check law on

INCENTIVES OF ERs (for hiring them)

ENFORCEMENT OF AGREEMENT

FAMILY PLANNING SERVICES

Magna Carta of Women: SEC. 18. Special Leave Benefits for

Women. A woman employee having rendered continuous

aggregate employment service of at least six (6) months for the

last twelve (12) months shall be entitled to a special leave benefit

of two (2) months with full pay based on her gross monthly

compensation following surgery caused by gynecological

disorders.

None

Art. 134 Establishments, required by

law, that maintain a clinic or infirmary

shall provide free family planning

services to their EEs w/c shall

include, but not limited to, the

application or use of contaceptive

pills and intrauterine devices. Gov't

agencies and DOLE shall prescribe

incentive bonus scheme to

encourage family planning among

female workers.

None

None

OTHERS

Section 9, DO 18-A: (1)Employment

Contract between the contractor and

its employee; (2) Service Agreement

between the principal and the

contractor.

Yes.

Magna Carta of Women: SEC. 18. Special Leave Benefits for

Women. A woman employee

having rendered continuous aggregate employment service of at

least six (6)

months for the last twelve (12) months shall be entitled to a

special leave

benefit of two (2) months with full pay based on her gross

monthly

compensation following surgery caused by gynecological

disorders.

yes

yes

n/a

YES

YES

N/A

does not apply

does not apply

has someone working them for free but

must real opportunity to finish their

chosen education

Deduction from gross income - 15% of the

total amount paid as salaries and wages

*** Provided that, employment of SC shall

continue for a period of at least 6months

and net actual income of SC does not

exceed the poverty level for that year

(Sec.2, Art.13, Rule5, IRR of RA 9994)

Yes

Yes

except employed in agriculture stock

raising fishin maritime transport and

inland navigation

can only be enforced if the

establishment has at least 10 workers

Art. 134 Establishments, required by

law, that maintain a clinic or infirmary

shall provide free family planning

services to their EEs w/c shall

include, but not limited to, the

application or use of contaceptive

pills and intrauterine devices. Gov't

agencies and DOLE shall prescribe

incentive bonus scheme to

encourage family planning among

female workers.

RIGHTS: 1. health assessment 2. mandatory facilities: see sec. 4 of

irr

N/A

Covered under SSS, PhilHealth, and Pag-IBIG provided the

Kasambahay has rendered at least 1 month of service

does not apply

if secondary students, can only be hired during summer or 10-15

days during christmas vacation and for purposes of torts or

damages, there is an employer-employee relationship

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Flaxo CaseDocument10 pagesFlaxo CasehemantNo ratings yet

- CSR of Airbnb in COVID-19Document9 pagesCSR of Airbnb in COVID-19Tiegan BlakeNo ratings yet

- La Sallian Educational Innovators FoundationDocument15 pagesLa Sallian Educational Innovators FoundationDailyn JaectinNo ratings yet

- Sup Apo vs. Spouses de Jesus GR No. 198356Document10 pagesSup Apo vs. Spouses de Jesus GR No. 198356Dailyn JaectinNo ratings yet

- Disloyalty of A DirectorDocument2 pagesDisloyalty of A DirectorDailyn Jaectin0% (1)

- Lexber Inc. vs. Dalman GR No. 183587Document9 pagesLexber Inc. vs. Dalman GR No. 183587Dailyn JaectinNo ratings yet

- Africa vs. ISIA GR 206540Document8 pagesAfrica vs. ISIA GR 206540Dailyn JaectinNo ratings yet

- Garcillano Vs HRETDocument2 pagesGarcillano Vs HRETDailyn JaectinNo ratings yet

- Razon Vs IACDocument2 pagesRazon Vs IACDailyn Jaectin0% (1)

- OverviewDocument2 pagesOverviewDailyn JaectinNo ratings yet

- Distinctions (F-I-N-G-S) Salvage Towage Fees Involvement in Needed Consent Governing Law SuccessDocument1 pageDistinctions (F-I-N-G-S) Salvage Towage Fees Involvement in Needed Consent Governing Law SuccessDailyn JaectinNo ratings yet

- Cir Vs AcostaDocument1 pageCir Vs AcostaDailyn JaectinNo ratings yet

- GR No 135385 PDFDocument94 pagesGR No 135385 PDFRanger Rodz TennysonNo ratings yet

- Green-Jama: Report OutlineDocument3 pagesGreen-Jama: Report OutlineDailyn JaectinNo ratings yet

- Legal Technique and LogicDocument3 pagesLegal Technique and LogicDailyn JaectinNo ratings yet

- Alejandro v. Alejandro, Adm. Case No. 4256, Feb 13, 2004, 422 SCRA 527Document6 pagesAlejandro v. Alejandro, Adm. Case No. 4256, Feb 13, 2004, 422 SCRA 527Dailyn JaectinNo ratings yet

- Memo For Job PacketDocument1 pageMemo For Job Packetapi-374800809No ratings yet

- Employment Application Form - FillableDocument1 pageEmployment Application Form - FillableRamon SaldiasNo ratings yet

- Full Final 2Document53 pagesFull Final 2Shajidul HoqueNo ratings yet

- PlotadoDocument6 pagesPlotadoNeph VargasNo ratings yet

- Mavar in The Hackney GazetteDocument1 pageMavar in The Hackney GazetteMavar UKNo ratings yet

- Comments On Contractor's HSE PlanDocument2 pagesComments On Contractor's HSE Planmazen fakhfakhNo ratings yet

- IIPM CoursewareDocument58 pagesIIPM CoursewareAkansha Singh RoyalNo ratings yet

- MCI - Job Application Form - Agus NugrahaDocument3 pagesMCI - Job Application Form - Agus NugrahaAgus NugrahaNo ratings yet

- Resume in JapaneseDocument8 pagesResume in Japanesegyv0vipinem3100% (2)

- Alcohol and Drug Testing Consent FormDocument2 pagesAlcohol and Drug Testing Consent FormglitchygachapandaNo ratings yet

- Royal Crown International vs. NLRC (Case)Document7 pagesRoyal Crown International vs. NLRC (Case)jomar icoNo ratings yet

- Bar QuestionsDocument24 pagesBar QuestionsAisha TejadaNo ratings yet

- DELOITTE Report WITH ORG. STRATEGYDocument27 pagesDELOITTE Report WITH ORG. STRATEGYCzarina CasallaNo ratings yet

- Theories of ManagementDocument15 pagesTheories of ManagementSamiuddin KhanNo ratings yet

- Economic DevelopmentDocument5 pagesEconomic DevelopmentBernardokpeNo ratings yet

- Maternity Benefit Act, 1961Document22 pagesMaternity Benefit Act, 1961bijuanithaNo ratings yet

- Kaizen ConceptDocument7 pagesKaizen ConceptREyma JOy Solivio SipatNo ratings yet

- Job SatisfactionDocument37 pagesJob SatisfactiongirmaNo ratings yet

- Labour Turnover: Causes, Consequences and Prevention: January 2016Document9 pagesLabour Turnover: Causes, Consequences and Prevention: January 2016Michael Atkins sesayNo ratings yet

- Personal Marketing Plan-Islam HelalDocument8 pagesPersonal Marketing Plan-Islam HelalIslam HelalNo ratings yet

- Research ProposalDocument2 pagesResearch ProposalAsemyouba JamirNo ratings yet

- Chapter 10-Establishing Strategic Pay PlansDocument26 pagesChapter 10-Establishing Strategic Pay PlansBilal HashmiNo ratings yet

- Case SummaryDocument11 pagesCase SummaryAditya ChaudharyNo ratings yet

- Sample Financial Aid Appeal LetterDocument1 pageSample Financial Aid Appeal LetterProf. ChrisNo ratings yet

- Human Resource Development (HRD) Practices of NonGovernmental Organisations (NGO's) in Dewrty Foundation - NEELAMDocument82 pagesHuman Resource Development (HRD) Practices of NonGovernmental Organisations (NGO's) in Dewrty Foundation - NEELAMAIMAN FATMA 21GCEMBA013No ratings yet

- RMIT International University Vietnam: Assignment Cover PageDocument9 pagesRMIT International University Vietnam: Assignment Cover Page1DBA-38 Nguyễn Thị Thanh TâmNo ratings yet

- SOP - SCU - The Hotel SchoolDocument6 pagesSOP - SCU - The Hotel SchoolYogesh SharmaNo ratings yet

- Functions of HRMDocument3 pagesFunctions of HRMlanoox100% (1)