Professional Documents

Culture Documents

Technology

Technology

Uploaded by

Srinivasan IyerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technology

Technology

Uploaded by

Srinivasan IyerCopyright:

Available Formats

Quick Success Series - Technology

April 24, 2010

Quick Success Series

Technology

Promotional Exams for the Year

2012-13 are round the corner. We

at SBLC Deoghar, have made a sincere & honest effort to present all

information spread over various

guides, books & circulars on a particular topic through our Quick

Success Series for your benefit.

We have taken all care to provide

correct, complete though concise

information related to the topic. In

case any discrepancy is observed

please feel free to advise us

through Email or Mobile as given

below.

We are indebted to numerous callers from the length and breadth of

the country who have compelled

us to revise and update the series

so that it can help them to achieve

their career goals.

We also thank many readers who

succeeded in their exams and expressed their gratitude through

emails and calls encouraging us to

continue our efforts.

I thank Sri Shailesh Kumar (ex faculty), who conceived the idea of

QSS. Also my sincere thanks to

faculty members

Sri A.

K. Mishra, Sri S.P.Jha,

Sri Rajeev Shankar, Sri Champak Das

and

Sri Rakesh Roshan, who

have worked hard to update and

revise the current series.

Wishing you all grand success

S K Rana

Assistant General Manager,

State Bank Learning Centre,

Deoghar- 814112

Origianlly Compiled By: Shailesh Kumar

Update By: Rakesh Roshan

Manager Training, SBLC Deoghar

Mobile- 9162370185

Email- r.roshan@sbi.co.in

Phone- 06432-232895

Fax - 06432-231810

E-mail: agmstc.deoghar@sbi.co.in

Updated Upto 15thMar 2012

[Type text] Page 1

Quick Success Series - Technology

Mar 15, 2012

ABBREVIATIONS

RAM - Random Access Memory

ROM Read Only Memory

CPU Central Processing Unit

CDMA- Code Division Multiple Access

EDP Electronic Data Processing

EDI - Electronic Data Interchange

EFT - Electronic Fund Transfer

GPRS General Packet Radio Service

MICR - Magnetic Ink Character Recognition

WWW - World Wide Web

SFMS - Structured Financial Messaging Solutions

GUI - Graphical User Interface

HTMLHyper Text Markup Language

HTTP Hyper Text Transfer Protocol

FTP File Transfer Protocol

ISDN Integrated Service Digital Network

IMPS- Interbank Mobile payment service.

VSAT - Very Small Aperture Terminal

USSD - Unstructured Supplementary Services

Data

SAR- Chip based card in Saudi Riyal

SGD-Singapore Dollar currency

TERMINOLOGY

BIT The smallest amount of information that can be transmitted

BYTE A unit of information that corresponds to a character (Eight bits)

FTP A protocol used to provide file

transfers across a wide variety of systems

UPLOAD - To Transfer a file from Clients

computer to hosts computer (Server)

DOWNLOAD - To Transfer a File From Host

(Server) to Clients Computer

URL - Uniform Resource Locator, the form of

the site address that reveals the name of

server where the sites files are stored

ENCRYPTION -Conversion of Plain Text to Cipher Text using certain logic

DECRYPTION -Conversion of Cipher Text message to plain Text

ATM

ATM stands for- Automated Teller Machine

FIRST ATM in the world was installed by Barclays Bank in London in 1967

FIRST ATM in INDIA was installed by HSBC in

Kolkata in 1987

FIRST PSB to Install ATM in INDIA Indian

Bank

Page 2

Installation of FIRST ATM By SBI- At Jamshedpur in 1993

ATM Switch Centre (ASC) is located at CBD

Belapur, Navi Mumbai

Application software used at ASC- Base 24

supplied by ACI Worldwide, Singapore

Tandem Server of HP Himalaya Series is installed at ASC. It is fail-safe, fault tolerant &

highly scaleable.

PIN authentication hardware installed at ASC

Host Security Module (HSM) supplied by

Racal, UK

Connectivity to the ATM network is through

State Bank Connect, VSATs and CDMA

Connectivity Service Providers: Sate Bank

Connect Datacraft; VSAT HCL Comnet;

CDMA Reliance Infocomm

Central Hub of HCL Comnet is located at NOIDA.

CDMA technology is used where SB Connect is

not available and CDMA Signals are powerful.

It also has a distinct advantage over VSATs in

that no permission is required from the landlord for its set up.

ASC has been awarded with the ISO Certification - 27001 indicating highest technical and

Security/safety standards

ATM Maintenance Service Providers NCR,

DIEBOLD & FSS

Facility Management Services at ASC is provided by Financial Software & Systems (P) Ltd

(FSS) Chennai.

PBF Updation Process at ASC is managed by

Laser Soft Infosystems Ltd. (LSIL)

Uploading Data on ATM Web for entire State

Bank Group is also being done by LSIL

ATM Card is a plastic card with a magnetic

stripe on the reverse containing relevant details of the Card Holder.

Presently ATM cum Debit Card is being issued

with the Brand Name as State Bank Cash Plus

The front face of the card displays 19 digit card

number in addition to the name of the cardholder

& the month from which the card is valid. The Debit Card portfolio of the Bank has the following

types of Cards, at present:

(a) Debit Cards with a long validity period (i.e., all

Maestro Cards having expiry date as Jan

2049)

(b) Debit Cards with a validity period of 5 years

from date of issue (i.e., Gold International,

Quick Success Series - Technology

Mar 15, 2012

Platinum International, Silver International, Classic, Yuva Debit Cards, etc.).These Cards

are being issued on VISA/MasterCard platform.

2. The Bank has decided to renew the Cards mentioned in (b) above without the customer

making request for the same. The Renewal Policy

for such Debit Cards is given below:

The renewed Card will be 16 digit PIN-based

with fall back on signature in line with our

New Debit Card will be issued on the same

platform (Visa/MasterCard) as the existing

Card which is about to expire.

(ii) The renewed Card will have a new number

(i.e., different from the number of the existing

Card) and will also have a new PIN.

(iii) The existing Card will not be renewed if, at

the time of renewal,

(a) The status of the Card is blocked

(b) The Card has not been used at all during

the entire validity period, or

(c) The primary account is inoperative/closed.

(iv) The renewed Card will have all the accounts linked as was with the old Card.

(v) The renewed Card will be sent to the customer and the PIN for the renewed Card will

be sent to the current Home Branch of the

primary account as per the record

available with the Bank. The renewed Cards

and PINs will be sent to customers /

Branches respectively 2 to 3 months in advance.

The new Card will be issued in the active

mode

The expiry date of the old Card is the last day

of the month which is mentioned as expiry

month on the Card.

The first 6 digits of the ATM Card number

represent the Banks Institutional Identification Number (BIN), the next five digits

represent the branch code, 12th digit

represents type of card (0-domestic, 7-Kisan,

8- International), next 6 digits represent the

serial number of card issued at the branch

and the last digit is the check digit.

Personal Identification Number (PIN) is a 4

Digit Number

PIN can be changed on SB group ATMs only.

In case the PIN is entered wrongly thrice in

succession, the ATM will not permit any more

attempts during that day.

SBI ATM Cards are Processed & Issued By

Venture Infotek Global Private Ltd, DEI Cards

& Fulfillment Division, Global IT Centre, CBD

Belapur

All Savings Bank & Current Account holders

are eligible for issuance of ATM-cum-Debit

Card except in case of: Accounts operated

jointly by all the account holders, Minors excluding those who are eligible to open and

operate cheque book facility account and Illiterate Customers.

In case of joint accounts operated by Either

or Survivor or Anyone or Survivor a card

may be issued to each account holder authorized to operate the account.

In case of joints accounts operated by Former

or Survivor, the card can be issued only to the

Former.

Two new variants of ATM cardsSTATE BANK

CLASSIC DEBIT CARD & STATE BANK SILVER

INTERNATIONAL DEBIT CARD introduced.

State Bank Classic Debit Card : A 16-digit PINbased (Signature fallback)MasterCard / VISA

Debit Card with CVV and Expiry date of 5

years from the date of issue for all new non

Cheque Book accounts. This card is valid only

in India, i.e. for domestic transactions, and

State Bank Silver International Debit Card: A

16-digit PIN-based (Signature fallback) MasterCard / VISA Debit Card with CVV and Expiry

date of 5 years from the date of issue for all

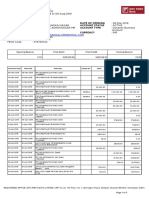

Card Type

Daily Cash Withdrawal Limit(India/Abroad) Daily POS Limit(India/Abroad)

1. Domestic

Rs 40000/NA

Rs 50000/NA

2. International

Rs 45000/USD 1000

Rs 100000/USD 2000

3. Visa Gold/Master

Gold/YUVA Card Rs 50000/USD 1000

Rs 200000/USD 4000

4. Platinum Intl

Card

Rs100000/USD 2000

Rs 200000/USD 4000

Page 3

Quick Success Series - Technology

Mar 15, 2012

new Cheque Book accounts.

Value Propositions Classic Daily Cash Limit at

ATMs Rs 40,000 Silver Rs 40,000 Daily PoS

Limit Rs 50,000 Silver Rs 75,000

Classic:Domestic (valid in India)Silver: International Debit Card

SMS Alert Cash withdrawal / PoS spend

For all ATM/PoS transactions

Loyalty Points Classic & Silver

(1 point=25paise) 2.5 points per

Rs 100 spend at PoS

Charge For Issue of New ATM Card -NIL

Annual Service Charge from 2nd YR - Rs 100/Replacement of Debit Card if magnetic stripe /

Chip of the card is not working / card is damaged-Nil for replacement. Rs. 100/- from the

second replacement onwards.

Replacement of Debit Card, if card is lost-Rs.

200/- per replacement

Maestro Debit Card holders are given Master

Card as replacement card-Nil

Replacement of card if validity of Debit Card

has expired-Nil

Charge For Issuance of Duplicate/ATM Card Rs 200/Charge for Issue of International ATM Card Rs 200/Annual Service Charge for Intl Cards from 2nd

YR - Rs 100/Charge for Issue of Platinum Intl Debit Card

NIL

Annual Service Charge for Platinum Intl Card

from 2nd Year Rs 100

Charge for Issue of Duplicate PIN - Rs 50/ATM Card Returned by Courier due to wrong

Address Rs 50/Charge for Using Other Banks ATM (SB A/C)

Permissible Max. 5 transactions including

Cash Withdrawal and Balance enquiry in a

Month Free- Above 5 Withdrawals Rs 20/PerWithdrawal

For CA and KCC -Balance Enquiry Free- Rs 20/Per Cash Withdrawal

Maximum Cash Wdl from other Bank ATM Rs 10,000/- per Transaction

Hot listing of Card refers to deactivation of

Lost Cards at ASC

Hot listing of Card be Done by Customer himself By calling at 24x7 Contact Centre through

BSNL/MTNL Landline (1800112211) or

through any other Phone (080-26599990)

Page 4

Hot listing of Card can also be done by Branch

official through Contact Centre or by sending

an email to contactcentre@sbi.co.in on written request by Customer

Contact Centre is Located at Bangalore & Baroda - Operated by M/s Mphasis

Combo Card is a chip & magnetic stripe based

Photo card issued to the faculty, student &

staff of Manipal University of Higher Education (MAHE). It is a Multifunctionality Card.

Can be used as library card, identity card,

ATM cum Debit Card, etc.

Army Card & IIM-L are also photo cards exclusively for ARMY Personnel & Indian Institute

of Management Lucknow respectively.

Gold Debit Card (VISA /MASTER) can be issued to customers maintaining QAB of Rs

20000/- or to all salary account holders declaring gross salary of Rs 25000/- and above or

to all customers of Personal Banking Branches

PIN based at ATM & Signature based at

POS/ME.

4 reward points of .25 paisa each on every

purchase of Rs 100/- on POS/Internet. 50 bulk

reward points after first three usage at POS

YUVA card can be issued to youth segment in

age group of 18-30 years. Operates on VISA

Platform as VISA Classic Card. Validity 10

years. PIN based at ATM and signature based

at POS/ME. One loyalty point of Re 0.25 for

every purchase of Rs 100/- at POS. 50% concession on Loan Processing Fee. 50% concession on Demat AMC charges. 25 basis point

concession in interest rate on Education,

Housing & Vehicle loans to the card holders

who maintain their salary / revenue account

with us.

Platinum Intl Debit Card can be issued to

customers with annual income above Rs 10

lac or customers with aggregate deposit balance of more than 5 lacs. BM may waive or relax the criteria based on value of relationship.

PIN based at ATM & Signature based at

POS/ME. 4 point of Re .25 each for every purchase of Rs 100 at POS/ME.

eZ-Pay Card is a prepaid Indian rupee VISA

CARD suitable for periodical payments like

salary, TA /Medical Bill, incentives etc by a

listed/Non-listed Corporate including PSUs

from a single point to all employees working

at different locations. Employer to certify the

Quick Success Series - Technology

Mar 15, 2012

bonafide, identity & proof of residence. Reloadable, only by debit to Bank account any

number of times. Min Rs 100 & Max Rs 50000

per month per employee. Cash withdrawal &

Enquiry restricted to State Bank Group ATMs

only. Free statement through Internet. Validity 10 years.

GIFT CARD is also a prepaid Indian rupee VISA

CARD- an excellent substitute of Gift Vouchers. Min amt of Issue Rs 500 in multiples of Rs

1/- , Max Rs 50000/-.

Issue Charges waived upto 31st Mar 2011

Validity- 1 Yrs from the date of print

Request to issue gift card should be done by

debit to only fully KYC compliant account and

to Banks customer only,and its one-time

loading (Top up) can be made through Internet Banking

Services Available at ATM- Cash withdrawal,

Balance Enquiry, Mini Statement (Last 10

Txns), College Fee Payment, Online collection

of Application Fee (GATE /JMET), Mobile Top

Up, Temple/Trust Donation, Payment of Utility Bills, Cash Point for SBI Cards, SBI Card Bill

Payment, SBI Life Premium Payment, Fund

Transfer.

Ways of Fund Transfer- Visa Money Transfer,

C2C Transfer, Money Send

Visa Money Transfer (VMT) facility enables

any card holder of the Bank to transfer funds

through the SBI Group ATM and all INB Users

with transactions rights to any VISA Debit

Card / Credit Card issued by the bank or any

other bank in India. The card holder has to

make one time registration and set up the VISA Card to which he proposes to transfer

funds through www.onlinesbi.co.in. Transaction Limit- Rs 50000/- and Charge Rs 20/- +

service tax.

Card to Card Transfer (C2C) enables card

holders to transfer funds to any card holder

within State Bank Group through any State

Bank ATM. Transaction Limit Rs 50000/-. Date

of Credit- Next Working Day. Charges- As applicable to Inter Core Transactions.

Money Send is launched by Master Card

Worldwide (MCW). It enables our card holders to remit funds to any Maestro/Master

Card holder of other banks within the country

through State Bank Group ATMs. Transaction

Limit- below Rs 50000/- per transaction.

Page 5

Charges- Upto Rs 25000/- Rs 20.00 per transaction and More than Rs 25000/- Rs 30 per

transaction. Day of Credit- (T+1) in case of

Maestro Card and (T+2) in case of Master

Card & VISA.

Undelivered ATM Cards & PIN should be in

separate custody.

ATM Cards not delivered within a period of 45

days should be hot listed through Contact

Centre.

PIN Mailers not delivered within a period of

45 days should be destroyed and Cards hot

listed through Contact Centre.

ATM Dispute Resolution: Dispute is settled by

Debit to Suspense Account. TXn should have

been made through State Bank ATM. Claim

should have been made within 90 days of Txn.

Account should be maintained for one year.

No such claim should have been made in last

6 months. Claimant to submit a letter of undertaking. Dispute upto Rs 15000/- may be

settled if claimant produces transaction Slip. If

claimant does not produce transaction slip,

then claim upto Rs 5000/- can only be settled.

RBI- ATM related complaint to be resolved

within 07 working days from the date of complaint; else Bank has to compensate the customer with Rs. 100/- per day beyond the 07th

day.

To be Paid by Debit to BGL A/C No 2399995

Charges (ATM Compensation)

Centralisation of ATM Complaints Registration. Complaint Management System (CMS)

launched with effect from 21st Dec 2009.

URL

Address

for

CMS

is

https://10.0.22.170:8070/CMS. Can be assessed at Branch, Contact Centre, Administrative offices and ASC

SBI customer can lodge the complaint in CMS

either by calling the contact centre or at any

branch (not necessarily customer branch) for

following five categories:

i) Account debited but cash not dispensed

ii) Account debited twice for the same withdrawal

iii) Amount debited but amount not transferred to merchant establishment

iv) Account debited twice for the same transaction at POS

v) Regeneration of PIN

Quick Success Series - Technology

Mar 15, 2012

Following transactions can also be lodged

through CMS wef 20.10.2010

ATM Services: B to B transactions, C to C

transactions, VISA money transfer, Trust donations, FEE payments, Mobile Top up, SBI

card payments

Payment gateway transactions: Online transactions through SBI debit card

Customer can also track his complaint by calling at contact centre or sending a SMS ATM

ticket number to 567676 (for e.g. ATM

AT429212345)

The complaint will be resolved at the

Branches but the closure cannot be effected

unless the CM (Admin) / Authorised official of

the Administrative Unit authorizes the closure.

User ID will be the standard email ID of the

Branch

/

controlling

offices,

eg.

sbi.04260/agmr1.zopat/gm1.lhopat etc excluding sbi.co.in. Default password will be

same as user ID. Will be forced to change at

First Login.

Error Codes in ATM:

51- Expired Card

52- Invalid Card

53- Invalid PIN

56- Ineligible Account (Selection of wrong

type of A/C)

62- PIN Tries Exceeded

Changes introduced in ATM transaction flow

to safe guard customer interest and Banks

image

i) Screen Receipt cannot be printed, do you

want to continue removed - to prevent the

frauds committed by jamming the receipt

printer

ii) 2 digit security screen introduced - to prevent the key pad tampering frauds

iii) PIN entry time reduced from 30 seconds to

20 seconds and display time of screen Do

you want some more time reduced from 60

seconds to 05 seconds - to restrict the time

availability to the miscreants for manipulations

INTERNET BANKING

Site for Internet Banking www.onlinesbi.com

Site is verified by Verisign & Secured by 256

bit encryption

Page 6

Site is maintained by Satyam / SIFY

URL

Address

for

Branch

login:

http://192.168.25.52

PPK stands for Pre Printed Kit

Each PPK has a unique 10 digit Number

First Five Digit of PPK denotes Packet Number

6th & 7th Digit of PPK denotes Circle Code

(SBI Circle in which PPK will be issued)

8th & 9th Digit of PPK Denotes Serial Number

(ranging from 00 to 99)

10th Digit of PPK Denotes Checksum Number

PPK is available for Retail Customers & Khata

Type Corporate Customers

Three types of user rights facility is available

under RINB

View rights only

View and transaction rights

Limited transactions rights

Under Limited Transaction Rights, Customer

can use following features of INB

i) Funds transfer within his/her own accounts

ii) Opening of new deposit accounts under eTDR/e-STDR scheme.

iii) Request for opening new accounts under

the same CIF through branch intervention

Minor can also be given INB Facility Only with

View rights

MIT stands for Manual Intervention Transactions (Transactions for which requests received from the customer are placed in CBS

by the INB system)

Campaign for Promotion of Retail Internet

Banking SANKALP for current financial year.

Services where No Manual Intervention is required- i)Balance Enquiry ii) Account Statement iii)Fund Transfer to Self Accounts

iv)Third Party Fund Transfer v) Inter Bank

Payee Fund Transfer vi) PPF transfer vii) E-Tax

Payment viii) E-ticketing ix) Bill Payments x)

Visa Money Transfer xi) Making Donations xii)

eZ Trade xiii) Setting up Standing Instruction

xiv) Issuance of Cheque Book xv) TDS related

enquiry xvi) DEMAT Enquiry xvii) Online Application for IPO xviii) Opening of eTDR/eSTDR

Services where Manual Intervention is required- i) Opening of new account (Savings,

Current, TDR & RD except eTDR/eSTDR) ii) Issue of Draft iv) deposit renewal v) closure of

loan account

Quick Success Series - Technology

Mar 15, 2012

e-RD

1.No manual intervention

required by

branches for opening / closure of recurringdeposit account under (e-RD).

2. Domestic, NRE & NRO customers & Staff

members can avail this facility.

3. The online opening / closure facility

through e-RD available between 08:00 HRS

IST and 20:00 HRS IST. Requests received for

e-RD creation /closure

beyond this period will be scheduled for next

opening hours, if user opts for the same.

4. The RD a/c in INR will be opened in the

same name(s) and mode of operation as in

the debit a/c from which first installment of eRD a/c is paid. The customer can select the

debit a/c as per his/her choice at the time of

opening e-RD, if he/she has more than one

transactional accounts

mapped to his/her username.

5. The period and minimum amount limit of eRD will same as mentioned for RD product

code in CBS.

6. e-RD will create recurring deposit a/c .In

the same session, setting up SI possible. The SI

created through this process cancelles automatically on online closure /

premature closure of e-RD The SI created

(Separately through Internet Banking or

through Branch) will need to be cancelled by

the customer/Branch.

7. Passbook for e-RD accounts will not be

generated online. Customers can print statement of e-RD account

through IN Banking/home branch, if they

need a passbook for their e-RD accounts.

8. For enquiring current deposit interest rates,

a hyperlink of our Corporate

web-site

(www.sbi.co.in

/

www.statebankofindia.com)has been provided on e-RD request page,

9. Senior citizens (Public & Staff) will not be

able to avail privileged rate of interest facility

in e-RD. the branch.

10. Benefit of interest rate to staff will be

available only if the debit a/c is categorized as

staff account in Core & INB database.

11. The e-RD details will contain the e-RD a/c

no., debit a/c no. from which the e-RD a/c is

funded, period selected by customer, Interest

rate and maturity date.

Page 7

The RD accounts not opened through e-RD,

cannot be closed online through Close a/c

tab under e-RD.

12. The nominee of the selected debit a/c will

be retained to e-RD account, if the customer

opts for the same. Home branch can set the

new nominee(s) on the request of customer

after receiving appropriate documents from

him/her.

13. Instructions/ rules/guidelines for normal

RD account will mutatis mutandis be applicable for e-RD accounts also.

Profile Password is needed to access all links

under profile tab. It is created at the time of

First Login.

Maximum Limit of Amount for opening

eTD/eSTD- Rs 10 Lakh. No online Payment of

eTD/eSTD. Senior Citizen interest privilege not

available. Nomination available at the Branch

as per instruction.

Max Limit for Intra Branch Fund Transfer- Rs

10 Lakhs

Max Limit for Inter Branch Fund Transfer Rs

5 lakhs

For Demand Draft- Rs 5 lakhs

For Third Party Transfer- Rs 5 lakhs

For Bill Payment- Rs 5 Lakhs

For RTGS/NEFT/GRPT- Rs 5 lakhs (exclusive of

Commission)

For Merchant Payment- Rs 5 lakhs

For VISA Transfer- Rs 25000/- per txn & Rs

50000/- per day per user.

For PPF Rs 500 to Rs 70000/- per day per

customer.

For Tax Payment (Direct & Indirect)- Rs 10

lakhs to 2 crores per day

For DEMAT Limit- Rs 1 Crore

For Donation- 5 Lakhs per day per user

INTERNET BANKING : ELECTRONIC BILL PAYMENT FACILITY INTRODUCTION OF SBI INSTAPAY SERVICESBI-InstaPay has been introduced in onlinesbi.com

The salient features of this product are as under: i) Prior registration with the biller is not

required.ii) The customer can make the payment by debit to his account in SBI.iii) A wide

variety of billers like electricity and other utility bills, pre-paid / post-paid mobile phones,

insurance premium, credit card, DTH and donations are available.

Quick Success Series - Technology

Mar 15, 2012

Corporate Internet Bank ing has four variantsKHATA, KHATA PLUS, VYAPAR & VISTAAR.

KHATA- Enquiry Only / used for enquiry on all

accounts at one branch

KHATA PLUS- Enquiry Only/ used for enquiry

on all accounts at various branches across the

country

VYAPAR- Enquiry & transaction / for corporate maintaining account at any one SBI

Branch. Single Transaction Limit Enhanced

from 5.00 Lakh to 50.00 Lakh. Permitted

Transactions - Fund Transfer/Third Party

Payment/ Inter Bank Payment/Draft Issue/Payment to Registered Suppliers/ E-Tax.

VISTAAR- (Complete range of online transactions for corporate maintaining account at

multiple branches of SBI) TP Fund Transfer upto Rs 100.00 Crore per transaction/ request

for issue of Demand Draft - Rs 1.00 crore per

transaction/ No limit on No of Transaction.

Permitted Transaction: Fund Transfer/Third

Party Payment/Inter Bank Payment/Draft Issue/Payment to Registered Suppliers/Bulk

Upload

Facility/E-Tax/DGFT

Payments/Customs Payments/ Excise Duty Payments.

A simplified single user interface with functional and security features similar to Retail

Internet Banking facility called CINB Saral

has been launched. CINB Saral will facilitate

penetration of CINB among a larger section of

SME customers and micro enterprises as the

facility is single user based, operated on the

lines of RINB and hence highly user friendly.

MOBILE BANKING

Brand Name- SBI Freedom

MBS available to satisfactory running Current

/ Savings Account holders of P segment &

SME customers.(For SME customers only enquiry right of their last 5 transactions).

It can be availed over:

A) Application Software

B) Wireless Application Protocol

C) Unstructured Supplementary Data Services

(USSD)

D) Mobile Banking service on SMS platform

Functionalities available under A) & B)Balance Enquiry / Mini Statement (Last 5

Txns) / Fund Transfer (To accounts with SBI &

other Banks) / Cheque Book Issue / Bill pay-

Page 8

ment (Telephone Bill, LIC & SBI Life Premium,

SBI Credit Card Bill, etc) / Mobile Top Up / M

Commerce / Online enquiry of DEMAT Accounts

Maximum Daily Transaction per Customer- Rs

50000/- within an overall Calendar Month

Limit of Rs 250000/SMS Mobile banking transaction is restricted

up to daily limit of Rs.1,000/-with a calendar

month limit of Rs.50,000/-as per RBI directives.

MBS on SMS platform -available on any Mobile Handsets

Application software is installed in users

Mobile. It can be downloaded from SBIs website www.sbi.co.in under link services > mobilebanking.

On SMS platform User ID & MPIN is obtained by sending an SMS <MBSREG> to

567626/9223440000.

The customer is required to accept terms and

conditions of the services by sending a SMS to

9223440000 as <saccept><userID><Mpin>

For Change Mpin <Smpin><UserId><Old

Mpin><New Mpin>

Balance of account <Sbal><UserId><Mpin>

Mini

statement

of

account

<Smin><UserId><Mpin>

Mobile

Top-up

<Stopup><UserId><Mpin><telecom operator of

beneficiary Mobile><Mob no of beneficiary

><Amount>

DTH recharge <Sdth><UserId><Mpin><Service

Provider><DTH serial number><amount>

IMPS fund transfer

<IMPS><Mobile

No><MMID><amount><User

ID><MPIN><Purpose(optional field- up to 20

char-Alpha numeric)>

User ID 6 characters First three Alpha &

Last three Numeric

MPIN 6 digits

Transaction processed through SMS or GPRS

GPRS is cheaper to SMS Mode

Activation of service either through ATM or at

the Branch

The registration for MBS is now available online through CBS

Only one Account enabled through ATM

Maximum 5 Accounts can be enabled for P

Seg.customrs and only 1 accounts for non

P.Segment customers.

Quick Success Series - Technology

Mar 15, 2012

End to End security using 128 bit AES encryption

MBS over WAP available on all mobile

phones (Java/non java) with GPRS Connectivity.

Installation of software not required.

Used through browsing Verisign certified secured

site

http://mobile.prepaid.com/sbiwap/

In addition to User ID & MPIN, WAP Login ID is

also provided

MBS over USSD- available to all subscribers of

Vodafone, Idea, Airtel & Aircell

Features- Balance Enquiry / Mini Statement

(Last 5 Transactions) / Fund Transfer to SBI

Accounts only / Mobile Top Up

Maximum Daily Transaction per Customer for

Fund Transfer & Mobile Topup Rs 1000/within an overall Calendar Month Limit of Rs

5000/User ID & MPIN is obtained in the same

process.

For starting session SMS SBMBS to

5616199

In all cases, MPIN is required to be changed

before registering at ATM or Branch.

Branches

can

now

lodge

requests/issues/complaints relating to MBS

transactions at StateBank Group Service

Deskon the url http://10.4.236.151:8080

/CAisd/pdmweb.exe

New Product: State Bank Mobi Cash

Launch of Mobile Wallet

Mobile Wallet issuable to customers and to

non customers also in association with other

entities. It is a virtual prepaid account accessible over mobile phones enabled with a mobile based application which allows its users/subscribers to make payments to any designated affiliates /appointed network of merchants. State Bank has named its Mobile Wallet as State Bank MobiCash.

While mobile banking is a channel to access

customers savings or current account, Mobile

wallet is a payment product. A non account

holder can also take the wallet and avail the

facility offered by State Bank Mobi Cash. It is

being launched in partnership with M/s. OXIGEN Services (India) Pvt. Ltd (Oxigen) and

M/s. Sahyog Microfinance Foundation (SMF).

While Oxigen will provide Mobile Based front

Page 9

end application and Transaction processing

platform, SMF would bring in Customer Service Points (CSP) which will be the delivery

points of services like providing applications

for mobile wallets, Cash-in & Cash-out, other

assisted services, closure of mobile wallets,

etc.

RTGS & NEFT

RTGS Real Time Gross Settlement

NEFT- National Electronic Fund Transfer

Nationwide Fund transfer system maintained

by RBI for enabling transfer of funds from remitters account in a particular bank to the

beneficiarys account in another bank anywhere in the country.

Banks can only originate credit transactions

RTGS- Used for high Value remittances of Rs

2.00 Lakh & above / Transactions processed &

settled on Real Time Basis / Transactions settled individually & continuously on a transaction by transaction basis / Remittance sent in

rounded off rupees.

NEFT- For Retail Remittances/No minimum

stipulated transaction amount/Operates on

Deferred Net Settlement (DNS) basis/Settled

in batches- 6 times a day/Can be sent inclusive of paisa component

RTGS Transaction Types:

a) R-41 (Customer to Customer)

b) R-42 (Bank to Bank)

RBI has decided to levy the following charges

on the member banks for all outward RTGS

transactions like Membership fee (Per

month),Transaction fee (Per month),Time varying tariff (Varies on the time of settlement

at RBI)

RTGS Timing wef 1st Oct 2011 has been

changed and time varying tariff has been introduced as :

9.00 hours to 12.00 hours for transaction of

Rs.2.00 lac to Rs.5.00 lac is Rs.25.00 & above

Rs.5.00 lac is Rs.50.00

After 12.00 hours to 15.30 hours (13.30 hours

on Saturday) for transaction of Rs.2.00 lac to

Rs.5.00 lac is Rs.26.00 & above Rs.5.00 lac is

Rs.51.00

After 15.30 hours to 16.30 hours on weekdays

for transaction of Rs.2.00 lac to Rs.5.00 lac is

Rs.30.00 & above Rs.5.00 lac is Rs.55.00

Quick Success Series - Technology

Mar 15, 2012

IFSC- Indian Financial System Code- It is an

alpha numeric code allotted to all RTGS/NEFT

enabled branches. It is of 11 characters.

In our Bank, IFSC code is designed as SBIN

000BBBB

IFSC code is available at http://10.0.1.183/

or

For

Bankers

link

at

http://www.rbi.org.in

Every Message released by a bank to RBI is

assigned a Unique Transaction Reference

(UTR)

Inward- NIL

State Bank Group Payment Transfer (SBGRPT)

Applicable to fund transfer between SBI &

Associate banks

Menu in CBS

Inter Bank Transfers >> SBGRPT >> Create

Outgoing Message.

Data Entry Screen is similar to the NEFT

screen

SBGRPT transactions are closed at 4:30 PM on

weekdays and at 1:00 PM on Saturdays.

Thereafter the net funds (receivable/payable)

are settled between the Banks through RTGS

(R 42) on the net balance available in the

Payment Settlement Accounts of the Associate Banks as at the end of the day.

Other terms & conditions are as applicable to

RTGS/NEFT

Western Union Money Transfer (WUMT)

Western Union Financial Services (WU), a subsidiary of First Data Corporation, is a Fortune

500 company

It is the largest money transfer organisation in

the world, operating from over 150,000 locations spread over 197 countries

They operate in India under a RBI License

Our Bank has entered into an agreement with

WU for paying out their remittances into india

Maximum Limit Per Transaction- USD 2500/Beneficiary can Receive Maximum of 12

transactions in a calendar year

Maximum cash amount paid out to the receiver is INR 50,000/If the amount exceeds INR 50,000/- an account payee cheque will be issued or the account of the beneficiary has to be credited for

the entire amount

WU will be responsible for ensuring compliances under MTSS guidelines and AML

measures at the send side of the transaction

Page

10

Beneficiary of Remittance provides the followings:

Valid ID

Senders name

Originating country (City & State for

USA/Mexico)

Estimated amount (+/- 10% USD or equivalent)

Money Transfer Control Number (MTCN) advised by Remitter (10 digit Number)

(TO RECEIVE MONEY FORM is required to be

filled in)

Branch official/Employee logs on to WU Software (Translink) and marks the MTCN as paid

Payment to beneficiary is made by debit to

BGL A/c No 98842065610 styled as Western

Union Payment Account Number opened at

NRI Kochi Branch (Nodal Branch)

WU through the Principal Agent will reimburse the day's total pay out to the Nodal

Branch along with the appropriate share of

commission and Forex spread.

The Nodal branch reconciles the amounts debited by various branches for the day and the

reimbursement provided by WU.

The commission and forex spread earned by

the branches will be distributed to the

branches @ 75% of the income earned by respective branches at the end of each quarter

based on the amounts paid out by them.

Western Union reimbursement is based on

marking off the entries in WU system. If entry

is not marked off properly, Bank will not get

reimbursement.

It should always be ensured that remittance is

not paid to the beneficiary without markingoff into Western Union system.

Otherwise beneficiary may claim remittance

from any other location and bank will not get

the reimbursement from WU

STATE BANK VISHWA YATRA FOREIGN TRAVEL

CARD (VYFTC)

VYFTC Cards in the eight Currencies viz. USD,

GBP, EURO, AUD, CAD, JPY, SAR,& SGD

MISC

Central Data Centre (CDC) is located at Belapur, Navi Mumbai

Disaster Recovery Site is located at Chennai

Front end software used in CBS- Bancslink

(Current Version- 2.9.5)

Quick Success Series - Technology

Mar 15, 2012

Posting of Transaction at CDC- Bancs 24 software- Procured from FNS Australia

System Integrator- TCS

FNS Taken Over by TCS

Corporate General Ledger (CGL) - Finance one

Vendor- Comlink USA

Trade Finance Software- CS Eximbills Vendor

China Systems, Taiwan

Overseas Branches- Finacle- Vendor- Infosys

OFSA- Oracle Financial Services Application

Suite- Provides a platform for Asset Liability

Management

Treasury Management Solution- Procured

from Reuters/Unisys

Page

11

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- IDFC FIRST Bank Statement As of 08 AUG 2019 PDFDocument5 pagesIDFC FIRST Bank Statement As of 08 AUG 2019 PDFSuhail Ameer100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- National Bank StatementDocument4 pagesNational Bank StatementAyazNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Std11 Acct EMDocument159 pagesStd11 Acct EMniaz1788100% (1)

- 01 08-BGLDocument40 pages01 08-BGLmevrick_guy100% (2)

- Sr. No. Particulars AnnexureDocument18 pagesSr. No. Particulars AnnexureSrinivasan IyerNo ratings yet

- National Pension System (NPS) : Subscriber Registration Form (All Citizen Model) eNPS FormDocument5 pagesNational Pension System (NPS) : Subscriber Registration Form (All Citizen Model) eNPS FormSrinivasan IyerNo ratings yet

- Repco Home Finance LTD - Detail ReportDocument11 pagesRepco Home Finance LTD - Detail ReportSrinivasan IyerNo ratings yet

- ALM Policy of HFCDocument13 pagesALM Policy of HFCSrinivasan IyerNo ratings yet

- StudyGuides PMstudy Project Scope ManagementDocument19 pagesStudyGuides PMstudy Project Scope ManagementrlatorreNo ratings yet

- Jubliant Food Works ReportDocument6 pagesJubliant Food Works ReportSrinivasan IyerNo ratings yet

- Case AnalysisDocument11 pagesCase AnalysisSrinivasan IyerNo ratings yet

- Evolving Banking Regulation Asia Pacific 2013 v3Document28 pagesEvolving Banking Regulation Asia Pacific 2013 v3Srinivasan IyerNo ratings yet

- Nurse Hospital Work Pay PromotionDocument18 pagesNurse Hospital Work Pay PromotionSrinivasan IyerNo ratings yet

- NO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahDocument1 pageNO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahMuhammad ikmail KhusaimiNo ratings yet

- Smartcard ListDocument231 pagesSmartcard Listmatthewbraunschweig65No ratings yet

- Class DiagramDocument7 pagesClass Diagrammanognamanu802_10982No ratings yet

- Mobile Wallet Payments Recent Potential Threats AnDocument8 pagesMobile Wallet Payments Recent Potential Threats AnAisha SinghNo ratings yet

- Thesis Topics On Banking SectorDocument7 pagesThesis Topics On Banking Sectorlizhernandezalbuquerque100% (2)

- Pratik JadhavDocument64 pagesPratik JadhavSandip ChavanNo ratings yet

- Sqe As 181121Document12 pagesSqe As 181121Priyanka ShankarNo ratings yet

- Aditya Birla Sunlife Common Application With SIPDocument8 pagesAditya Birla Sunlife Common Application With SIPRakesh LahoriNo ratings yet

- Semporna 1 31/03/24Document30 pagesSemporna 1 31/03/24muhdnasrullahhafizlimabdullahNo ratings yet

- Upsc Classroom Online Courses 2023 Vajiram and RaviDocument2 pagesUpsc Classroom Online Courses 2023 Vajiram and RaviSHOUBHIK MUKHERJEENo ratings yet

- PesoNet InstaPay FAQsDocument4 pagesPesoNet InstaPay FAQsTom SNo ratings yet

- Img 20240216 0001Document16 pagesImg 20240216 0001Online ComputerNo ratings yet

- Web-Based Billing and Collection System For A Municipal Water and Services UnitDocument30 pagesWeb-Based Billing and Collection System For A Municipal Water and Services UnitJonel NaquitaNo ratings yet

- Form 990 Information Gathering Account Opening Form 2023Document4 pagesForm 990 Information Gathering Account Opening Form 2023Geney BothaNo ratings yet

- Kotak Mahindra Bank What Makes Kotak Different From Others - A Comparative Story KotakDocument68 pagesKotak Mahindra Bank What Makes Kotak Different From Others - A Comparative Story KotakshiprapathaniaNo ratings yet

- Card Management Signature Brochure September 2015 EMEADocument2 pagesCard Management Signature Brochure September 2015 EMEAVignesh PalaniNo ratings yet

- Q4 NUP - Promo Mechanics - 1004 (Final)Document4 pagesQ4 NUP - Promo Mechanics - 1004 (Final)Lyht TVNo ratings yet

- Accounting Procedure in Government DepartmentDocument5 pagesAccounting Procedure in Government DepartmentAnonymous fnFwazyINo ratings yet

- BN101 Foundation Course in Banking IDocument134 pagesBN101 Foundation Course in Banking IDevashish NigamNo ratings yet

- Kotak TCS One Pager 16th Aug 2021Document1 pageKotak TCS One Pager 16th Aug 2021PavanNo ratings yet

- Merger and Acquisition of HDFC and CbopDocument24 pagesMerger and Acquisition of HDFC and CbopARUN KUMAR SAINI69% (13)

- City Bank Report GB PDFDocument77 pagesCity Bank Report GB PDFEkram EkuNo ratings yet

- Internship ReportDocument13 pagesInternship ReportBernard BempongNo ratings yet

- Calculator: Terms & Conditions - Insta Jumbo LoanDocument3 pagesCalculator: Terms & Conditions - Insta Jumbo LoanANUDEEP CommunityNo ratings yet

- Account Statement 270219 280319Document1 pageAccount Statement 270219 280319Krishna JangirNo ratings yet

- KFS HBL Islamic Saving Account Bilingual June22Document4 pagesKFS HBL Islamic Saving Account Bilingual June22Tatheer ZeeshanNo ratings yet

- A Minor Project ON "Consumer Perception Towards Adoptiong Electronic Payments System in Mayur Vihar Phase 3"Document22 pagesA Minor Project ON "Consumer Perception Towards Adoptiong Electronic Payments System in Mayur Vihar Phase 3"Anshika SharmaNo ratings yet