Professional Documents

Culture Documents

Press ? For Keyboard Shortcuts

Press ? For Keyboard Shortcuts

Uploaded by

cherrygalosmo0 ratings0% found this document useful (0 votes)

61 views10 pagesThe document contains 15 multiple choice questions about calculating excise taxes on various imported alcoholic beverages and tobacco products. The questions cover topics such as calculating total excise tax based on import details like number of units, weight, alcohol content, retail price, and tax rates. Students are asked to scan their multiple choice answers and solutions by 12 noon on July 29th, 2014. The sender reminds the students to submit their answers within the given deadline.

Original Description:

BOC

Original Title

Customs

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains 15 multiple choice questions about calculating excise taxes on various imported alcoholic beverages and tobacco products. The questions cover topics such as calculating total excise tax based on import details like number of units, weight, alcohol content, retail price, and tax rates. Students are asked to scan their multiple choice answers and solutions by 12 noon on July 29th, 2014. The sender reminds the students to submit their answers within the given deadline.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

61 views10 pagesPress ? For Keyboard Shortcuts

Press ? For Keyboard Shortcuts

Uploaded by

cherrygalosmoThe document contains 15 multiple choice questions about calculating excise taxes on various imported alcoholic beverages and tobacco products. The questions cover topics such as calculating total excise tax based on import details like number of units, weight, alcohol content, retail price, and tax rates. Students are asked to scan their multiple choice answers and solutions by 12 noon on July 29th, 2014. The sender reminds the students to submit their answers within the given deadline.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 10

Reply to sender [R]

Home

Mail

News

Sports

Finance

Weather

Games

Groups

Answers

Screen

Flickr

Mobile

More

Yahoo Mail

YahooHome

Cherry

o

o

o

o

Help

o

Press ? for keyboard shortcuts.

Tw itter <info@

TARIFF 004 PREFINAL EXAMS (2)

Kristine Joy Longara

To Mejaysonenaje@gmail.comjohnpaulaure@gmail.com and 7 More...

Jul 27 at 10:00 PM

Dear List,

Please see below questions for your Prefinal Exams.

Each correct answer will incur 3 points for your total score.

Kindly send answer before 12 nn - July 29,2014 thru scanning your answers with solutions.

Here are the questions.

1. XYZ Company imported 300 bales of tobacco

twisted by hand with 230 lbs per bale, compute

total excise tax due for this shipment.

2. CBA Corp. imported Cobana Cigars in 50

boxes, each box contains 80 sticks. If NRP/cigar

is Php 590.00, compute for total excise tax.

3. Ilocandia Cigars imported 450 bales of tobacco

for chewing with 220 lbs per bale, compute total

excise tax.

4. Malate Bar imported La Havana Cigars with

NRP of Php 360.00. It is contained in 20 small

boxes; pack in retail of 2 dozens of per box.

.

5. BSCA imported 75 cartons containing 20

reams of 10 packs of Capri Slim Menthol packed

by machine with NRP of P20.00 per pack.

6. A shipment of 500 cases-Johnny Walker Black

arrived at the MICP. Each case contains 6 bottles

with each bottle having a volume capacity of 100

centiliters rated 86 proof. Compute the total

volume in gauge liters.

7. Determine the % alcohol content by volume

for 1,000 bottles of Absolut Vodka with total

proof liters of 675 and volume capacity of 7.5

deciliters per bottle.

8. CBA Corp. imported 2400 bottles of Tall

Brand Whiskey with volume capacity of 330 ml

bottle, 40% alcohol content, and net retail price of

Php 30.00 per bottle. Compute the total excise

tax, VAT included.

9. Determine the total gauge liter of B&G

Partager Blanc in 240 cases and 10 bottles per

case with 28 proof if total excise tax paid is Php

56,160.00.

10. How many bottles of Premium Bottles

(fermented liquor) were imported if the total

excise tax paid were Php 89,460 and NRP/355ml

bottle is Php 40.00.

11.Compute the Total Excise Tax of B&G

Partager Chablis if 120 cases were imported in 12

bottles per case and volume capacity of 7.5

dL/bottle with 36 proof and NRP/1000ml of Php

600.00.

12. If 250 boxes of Perrier Jouet -sparkling wine

were imported, determine the total number bottles

if the total excise tax paid is P682,500.00.

Alcohol content is 18% and volume capacity per

bottle is 700ml, NRP/700ml is Php 400.00.

13. SM Supermarkets imported 410 boxes of

Martell XO, with 10 bottles per box and volume

capacity 75cL per bottle and alcohol content of

40%.NRP per bottle is Php 2,970.00. Compute

the Total ET

14. Compute for the total excise of still wines

imported in 200 cases and each case contains 8

bottles with volume capacity of 750cc, alcohol

content of 20% and NRP per 1L of Php 679.00.

15. ARK Wines imported champagne from Italy

250 boxes with 10 bottles per box and volume

capacity of 100cL, alcohol content is 14% and

NRP per 1L is Php 1,273.00. Compute for the

excise tax.

Reminder submit your scanned answers with solutions within the given period of time

Cut-off : 12 NN JULY 29,2014

Thanks,

Kristine Joy Longara LCB

Reply, Reply All or Forward | More

Kristine Joy Longara

To Mejaysonenaje@gmail.comjohnpaulaure@gmail.com and 7 More...

Today at 3:57 AM

TO ALL,

HAHA..

THIS IS PRELIMINARY EXAMS.. EXCITED LANG.

THANKS.

MAM TIN. :)

Thanks,

Kristine Joy Longara LCB

Reply, Reply All or Forward | More

Click to reply all

Available on iOS and Android

Get the link by text

Message and data rates may apply

Thank you.

The link has been sent to your phone.

You might also like

- Silent Partnership AgreementDocument5 pagesSilent Partnership AgreementAustin Williams60% (10)

- Distillery Business Plan No 2Document4 pagesDistillery Business Plan No 2Derek Shilling100% (2)

- Business Plan: Overseas Workers Welfare AdministrationDocument19 pagesBusiness Plan: Overseas Workers Welfare AdministrationMarly PradoNo ratings yet

- Distillery Business PlanDocument2 pagesDistillery Business PlanRob BrightNo ratings yet

- Grade 12 Basic AccountingDocument3 pagesGrade 12 Basic AccountingChesca Salenga100% (1)

- Cocktail GlassesDocument4 pagesCocktail GlassesKarLo Tabuzo50% (2)

- Linear Programming Exercises: Setup The LP Models For The FollowingDocument3 pagesLinear Programming Exercises: Setup The LP Models For The Followingbackup cmbmpNo ratings yet

- Lesson 2 PresentationDocument38 pagesLesson 2 Presentationpm6ph862gmNo ratings yet

- Finals - Course Req in Tariff 5Document27 pagesFinals - Course Req in Tariff 5MarjorieNo ratings yet

- Finals Course Req in Tariff 5Document26 pagesFinals Course Req in Tariff 5Marinel Piol Marasigan0% (1)

- 200 Problems For Alcohol ProductsDocument51 pages200 Problems For Alcohol ProductsGabriel CarumbaNo ratings yet

- Mgtop 470-Business Modeling With Spreadsheets Washington State University Spring 2017 Problem Set 7 Due: April 20, 2017, in ClassDocument2 pagesMgtop 470-Business Modeling With Spreadsheets Washington State University Spring 2017 Problem Set 7 Due: April 20, 2017, in ClasshehehehehlooNo ratings yet

- Ask and Thou Shalt Receive.: FreeeeeeeeedomDocument9 pagesAsk and Thou Shalt Receive.: FreeeeeeeeedomAnonymous 0ccvqQ8No ratings yet

- Business Plan - Churros LoungeDocument20 pagesBusiness Plan - Churros LoungeMonique G. TagabanNo ratings yet

- Integrated PETA (General Biology - General Mathematics - General Chemistry)Document7 pagesIntegrated PETA (General Biology - General Mathematics - General Chemistry)John Mark MatibagNo ratings yet

- Integrated PETA (General Biology - General Mathematics - General Chemistry)Document7 pagesIntegrated PETA (General Biology - General Mathematics - General Chemistry)John Mark MatibagNo ratings yet

- Business PlanDocument8 pagesBusiness Planapi-438667529No ratings yet

- Aneka Kue CoklatDocument6 pagesAneka Kue Coklatzulfan11No ratings yet

- Marco Pierre Cocktails Steak HouseDocument10 pagesMarco Pierre Cocktails Steak HouseCátia CostaNo ratings yet

- Facultad de Ciencias Empresariales Escuela Académico Profesional de AdministraciónDocument2 pagesFacultad de Ciencias Empresariales Escuela Académico Profesional de AdministraciónJUAN EDUARDO PLACIDO NIQUENNo ratings yet

- Alcohol Fuel 2001Document3 pagesAlcohol Fuel 2001tibork1No ratings yet

- Making Alcohol FuelDocument3 pagesMaking Alcohol FuelEric ZetterlundNo ratings yet

- TM 4Document22 pagesTM 4Ailea Kathleen BagtasNo ratings yet

- Shopping in The MarketDocument6 pagesShopping in The MarketcyndipNo ratings yet

- Pinansilo Let S Analyze Ulo B Week 6 7 Ge 4 4247Document13 pagesPinansilo Let S Analyze Ulo B Week 6 7 Ge 4 4247Vhinz PelenioNo ratings yet

- Bar MenuDocument2 pagesBar MenueatlocalmenusNo ratings yet

- Coles 10th Grocery CatalogDocument28 pagesColes 10th Grocery CatalogVertigonA380No ratings yet

- Atcharap Ni Bugoy: Business ProposalDocument36 pagesAtcharap Ni Bugoy: Business ProposalJun Ryan Lovina100% (3)

- Ooh! Chocolata 2015-16 BrochureDocument19 pagesOoh! Chocolata 2015-16 BrochureRuthNo ratings yet

- Description Packing Price List Unit Vol CTN Bottle: Japanese WhiskyDocument4 pagesDescription Packing Price List Unit Vol CTN Bottle: Japanese WhiskyErina SweetNo ratings yet

- ExamDocument2 pagesExamBehar AbdurahemanNo ratings yet

- Business Plan: Archdiocese of Lingayen-Dagupan Catholic SchoolsDocument16 pagesBusiness Plan: Archdiocese of Lingayen-Dagupan Catholic Schoolsara bellaNo ratings yet

- Cor Jesu College Hospitality Management Department: Submitted By: Keren Kezia DatocDocument4 pagesCor Jesu College Hospitality Management Department: Submitted By: Keren Kezia DatocKeren Kezia DatocNo ratings yet

- Description of The Business: 1 NachonomicsDocument6 pagesDescription of The Business: 1 NachonomicsJeffrey FernandezNo ratings yet

- Coles Current Catalog May 13 2014Document32 pagesColes Current Catalog May 13 2014Christopher ColemanNo ratings yet

- Building Sales Momentum - Monday 11 December (Convenience)Document8 pagesBuilding Sales Momentum - Monday 11 December (Convenience)rehmanfaiza123456No ratings yet

- Chapter 2 Lesson 1 Bar Setup and Bar Checkup Lesson 2 Beverage MerchandisingDocument10 pagesChapter 2 Lesson 1 Bar Setup and Bar Checkup Lesson 2 Beverage MerchandisingJalen RamosNo ratings yet

- Ticket CafeDocument2 pagesTicket CafeMajo RysNo ratings yet

- Leung Yick Price List (1 July 2014)Document35 pagesLeung Yick Price List (1 July 2014)Ally HewittNo ratings yet

- Dress For Success Final Budget ReportDocument2 pagesDress For Success Final Budget Reportapi-252416574No ratings yet

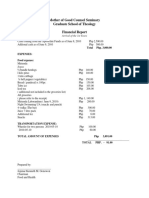

- Mother of Good Counsel Seminary Graduate School of Theology Financial ReportDocument1 pageMother of Good Counsel Seminary Graduate School of Theology Financial ReportVirtus KenoiNo ratings yet

- Hot Chili BeerDocument5 pagesHot Chili BeerJesso GeorgeNo ratings yet

- Tabacundo Educational UnitDocument10 pagesTabacundo Educational UnitVicente MolinaNo ratings yet

- Excise Tax ModuleDocument10 pagesExcise Tax ModuleJenny Rose ToledoNo ratings yet

- Hillgate Wine MenuDocument1 pageHillgate Wine MenuKinvara CorbettNo ratings yet

- LH Mobile CONT OnboardDelights Eng Aug22 FinalDocument13 pagesLH Mobile CONT OnboardDelights Eng Aug22 FinalFlorin SivuNo ratings yet

- Catalogue Cuabar English April 2019Document60 pagesCatalogue Cuabar English April 2019Carlos Gayete DuranNo ratings yet

- Amps Fine Wines - Christmas 2013 BrochureDocument12 pagesAmps Fine Wines - Christmas 2013 BrochureampsfinewinesNo ratings yet

- Ebook International Humanitarian Law and Justice Historical and Sociological Perspectives 1St Edition Mats Deland Editor Online PDF All ChapterDocument25 pagesEbook International Humanitarian Law and Justice Historical and Sociological Perspectives 1St Edition Mats Deland Editor Online PDF All Chaptersusan.greenbaum209100% (7)

- OutlineDocument10 pagesOutlineMica Joy CernalNo ratings yet

- Mix DrinksDocument8 pagesMix DrinksDexter GasconNo ratings yet

- Jamil KwalityDocument6 pagesJamil KwalityGolam MowlaNo ratings yet

- Proposed Sugar Sweetened Beverage TaxDocument1 pageProposed Sugar Sweetened Beverage TaxPhilip TortoraNo ratings yet

- Item Size Quantity Price (Per Unit) C/o Notes: Lacoste Touch of Pink PerfumeDocument4 pagesItem Size Quantity Price (Per Unit) C/o Notes: Lacoste Touch of Pink Perfumelia_sangalangNo ratings yet

- Computation of Excise TaxDocument4 pagesComputation of Excise TaxMax IIINo ratings yet

- Strawberry Fondue: February 21, 2013Document8 pagesStrawberry Fondue: February 21, 2013Harvey MatbaganNo ratings yet

- Industry Analysis by Piel SoberanoDocument17 pagesIndustry Analysis by Piel SoberanoPiel SoberanoNo ratings yet

- Katalog PJDocument96 pagesKatalog PJPrzemysław Goldman GalusNo ratings yet

- Test TestDocument31 pagesTest TestOmkar BhoyeNo ratings yet

- Home Brewing Beer And Other Juicing Recipes: How to Brew Beer Explained in Simple Steps: How to Brew Beer Explained in Simple StepsFrom EverandHome Brewing Beer And Other Juicing Recipes: How to Brew Beer Explained in Simple Steps: How to Brew Beer Explained in Simple StepsNo ratings yet

- Woodridge School V Pe Benito FactsDocument2 pagesWoodridge School V Pe Benito Factsanalyn123No ratings yet

- PW Select October 2016Document22 pagesPW Select October 2016Publishers WeeklyNo ratings yet

- Lesson Plan-Elm 375Document3 pagesLesson Plan-Elm 375api-582006278No ratings yet

- Rocking Snowflake With Aws Co5BhSmnDocument7 pagesRocking Snowflake With Aws Co5BhSmnPrawin RamNo ratings yet

- Python MySQL ConnectivityDocument26 pagesPython MySQL ConnectivityTaniya SwainNo ratings yet

- Ravlt (Cast)Document6 pagesRavlt (Cast)Pau NndNo ratings yet

- Tanween (Nunation) of The Arabic Nouns in 25 Sayings of Prophet Muhammad (PBUH)Document22 pagesTanween (Nunation) of The Arabic Nouns in 25 Sayings of Prophet Muhammad (PBUH)Jonathan MorganNo ratings yet

- IMRAD FormatDocument3 pagesIMRAD FormatEn Ash100% (1)

- MA211 Week 3 Tutorial SolutionDocument5 pagesMA211 Week 3 Tutorial SolutionKrishaal ChandNo ratings yet

- Hersh Et AlDocument11 pagesHersh Et Alapi-3828346No ratings yet

- HORST - Lextutor - Academic VocabularyDocument21 pagesHORST - Lextutor - Academic VocabularyOlga TszagaNo ratings yet

- Macys Inc Store ListingDocument57 pagesMacys Inc Store ListingSurya NarayananNo ratings yet

- Report Opr - 584 107Document34 pagesReport Opr - 584 107maximuspalpatineNo ratings yet

- Liquid Marijuana Cocktail Recipe - How To Make A Liquid Marijuana Cocktail - Drink Lab Cocktail & Drink RecipesDocument1 pageLiquid Marijuana Cocktail Recipe - How To Make A Liquid Marijuana Cocktail - Drink Lab Cocktail & Drink RecipesJazymine WrightNo ratings yet

- EF3e Elem Quicktest 01Document3 pagesEF3e Elem Quicktest 01kujtim78No ratings yet

- Maynilad Assoc V MayniladDocument13 pagesMaynilad Assoc V MayniladEmaleth LasherNo ratings yet

- Quick Pointers in Criminal Law (Book 2: Art 114 - 152)Document32 pagesQuick Pointers in Criminal Law (Book 2: Art 114 - 152)Lawrence VillamarNo ratings yet

- Wesleyan University-Philippines: Basic Education Department PahintulotDocument1 pageWesleyan University-Philippines: Basic Education Department Pahintulotthyme 02No ratings yet

- Report Belt SlipDocument3 pagesReport Belt Slipjunreylaureto003No ratings yet

- Culture of HaryanaDocument2 pagesCulture of HaryanaanittaNo ratings yet

- 01 Risc MF PDFDocument123 pages01 Risc MF PDFmohmmad omarNo ratings yet

- IUFD For 4th Year Medical StudentsDocument19 pagesIUFD For 4th Year Medical StudentsDegefaw BikoyNo ratings yet

- A Longitudinal Study of Team Conflict PPR 1Document4 pagesA Longitudinal Study of Team Conflict PPR 1shahbaz sheikhNo ratings yet

- Paderanga vs. Court of Appeals 247 SCRA 741 G.R. No. 115407 August 28 1995 PDFDocument12 pagesPaderanga vs. Court of Appeals 247 SCRA 741 G.R. No. 115407 August 28 1995 PDFKaren K. GaliciaNo ratings yet

- Eaton Ipm Users Guide en 1.60Document230 pagesEaton Ipm Users Guide en 1.60paijo klimpritNo ratings yet

- General FOB CIF Contract-02 - 3 - 2020 PDFDocument11 pagesGeneral FOB CIF Contract-02 - 3 - 2020 PDFKhánh Linh Mai Trần100% (1)

- Corrective Justice (PDFDrive) PDFDocument365 pagesCorrective Justice (PDFDrive) PDFAnonymous 94TBTBRksNo ratings yet

- ISYE 530 Spring 2020 SyllabusDocument2 pagesISYE 530 Spring 2020 SyllabusswapnilNo ratings yet

- Streptococci: General Characteristics of StreptococciDocument13 pagesStreptococci: General Characteristics of Streptococcidevesh.hsNo ratings yet