Professional Documents

Culture Documents

Estate Planning Tax Alert January 2010

Estate Planning Tax Alert January 2010

Uploaded by

Arnstein & Lehr LLPCopyright:

Available Formats

You might also like

- Past BillsDocument39 pagesPast BillsSal Salas100% (3)

- 0605Document2 pages0605Kath Rivera60% (42)

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Gifts To Reduce Illinois Estate TaxesDocument5 pagesGifts To Reduce Illinois Estate Taxesrobertkolasa100% (1)

- Fair Lending Developments: The End of Discretionary Pricing?Document12 pagesFair Lending Developments: The End of Discretionary Pricing?Arnstein & Lehr LLPNo ratings yet

- Basic Scenario 9: Justin Reedley and Jenna Washington (2018)Document9 pagesBasic Scenario 9: Justin Reedley and Jenna Washington (2018)Center for Economic ProgressNo ratings yet

- Estate Tax UpdateDocument1 pageEstate Tax Updategateway320No ratings yet

- March 2011 Issue SWS NewsBrief FinalDocument2 pagesMarch 2011 Issue SWS NewsBrief FinalnancyhoagNo ratings yet

- Executive Vice President Congressional Relations & Public Policy 202.663.5339Document2 pagesExecutive Vice President Congressional Relations & Public Policy 202.663.5339brucekrastingNo ratings yet

- C L C S: Olorado Egislative Ouncil TaffDocument12 pagesC L C S: Olorado Egislative Ouncil TaffCircuit MediaNo ratings yet

- Agriculture Law: RS20609Document3 pagesAgriculture Law: RS20609AgricultureCaseLawNo ratings yet

- State Ag - 6-04-10 IntroDocument12 pagesState Ag - 6-04-10 IntroAngela WoodhullNo ratings yet

- AIF Statement On Governor Signing HB 33A: For Immediate ReleaseDocument1 pageAIF Statement On Governor Signing HB 33A: For Immediate Releaseapi-248769192No ratings yet

- October 2010 NewsletterDocument2 pagesOctober 2010 NewsletterKen BillburgNo ratings yet

- Making Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime GiftsDocument36 pagesMaking Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime Giftsrobertkolasa100% (1)

- Dwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFDocument36 pagesDwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFsuidipooshi100% (11)

- Full Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions ManualDocument36 pagesFull Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manualblindoralia100% (46)

- Research - 5-10-10 IntroDocument6 pagesResearch - 5-10-10 IntroAngela WoodhullNo ratings yet

- GCF Newsletter Spring 10Document2 pagesGCF Newsletter Spring 10andrealsmithNo ratings yet

- Agriculture Law: RL33070Document19 pagesAgriculture Law: RL33070AgricultureCaseLawNo ratings yet

- US Internal Revenue Service: p950Document12 pagesUS Internal Revenue Service: p950IRSNo ratings yet

- Tax Day PaperDocument5 pagesTax Day PaperCommittee For a Responsible Federal BudgetNo ratings yet

- Withholding DeclarationDocument24 pagesWithholding DeclarationAbdallah SabbaghNo ratings yet

- Making Use of The Illinois Rules - Part 2: Planning For The Illinois QTIP ElectionDocument24 pagesMaking Use of The Illinois Rules - Part 2: Planning For The Illinois QTIP ElectionrobertkolasaNo ratings yet

- AIF Applauds Passage of Legislation To Reduce Communications Services TaxDocument1 pageAIF Applauds Passage of Legislation To Reduce Communications Services Taxapi-157539785No ratings yet

- Volume 1, Issue 5 Page 1 and 2Document2 pagesVolume 1, Issue 5 Page 1 and 2gcuncensoredNo ratings yet

- Lynco Client Alert 3.18.2020 - Tax Updates and The CornoavirusDocument2 pagesLynco Client Alert 3.18.2020 - Tax Updates and The CornoavirusPomelo PinkNo ratings yet

- PEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)Document13 pagesPEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)lbaker2009No ratings yet

- The Impact of Impending Tax Law ChangesDocument3 pagesThe Impact of Impending Tax Law ChangespadgettmichiganNo ratings yet

- HF2480 Article 1 Section 8-9 Incidence Analysis 1 PDFDocument5 pagesHF2480 Article 1 Section 8-9 Incidence Analysis 1 PDFminnesoda238No ratings yet

- One Ohio Now - Top Ten LoopholesDocument1 pageOne Ohio Now - Top Ten LoopholesoneohionowNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Dynasty Trusts EpdDocument5 pagesDynasty Trusts EpdAntwain Utley100% (1)

- Tracking Number: 13285-A Reducing Tax Burden On America's TaxpayersDocument2 pagesTracking Number: 13285-A Reducing Tax Burden On America's TaxpayersIRSNo ratings yet

- Family Tax Planning Forum: 2010 Tax Relief Act Sparks Both Relief and AnxietyDocument4 pagesFamily Tax Planning Forum: 2010 Tax Relief Act Sparks Both Relief and AnxietydhultstromNo ratings yet

- Letter To Legis LeadershipDocument2 pagesLetter To Legis Leadershipcrossbarnet6727No ratings yet

- House Hearing, 112TH Congress - How Business Tax Reform Can Encourage Job CreationDocument123 pagesHouse Hearing, 112TH Congress - How Business Tax Reform Can Encourage Job CreationScribd Government DocsNo ratings yet

- SALT ReportDocument22 pagesSALT ReportrkarlinNo ratings yet

- L210722 To Client - ReportDocument2 pagesL210722 To Client - Reportksgreen16No ratings yet

- 2008 Publication 553 Highlights of 2008 Tax ChangesDocument38 pages2008 Publication 553 Highlights of 2008 Tax ChangesgrosofNo ratings yet

- Blackstone's Tax EngineersDocument7 pagesBlackstone's Tax EngineersLuke ConstableNo ratings yet

- House Hearing, 110TH Congress - Critical Budget Issues Affecting The 2010 CensusDocument36 pagesHouse Hearing, 110TH Congress - Critical Budget Issues Affecting The 2010 CensusScribd Government DocsNo ratings yet

- The Federal Income Tax System For Individuals: WebextensionDocument5 pagesThe Federal Income Tax System For Individuals: WebextensionBecky Bergeon SteeleNo ratings yet

- REBA Estate Planning Using LLC As Single Member For TaxesDocument14 pagesREBA Estate Planning Using LLC As Single Member For Taxesmatthew.b.lane01No ratings yet

- House Hearing, 111TH Congress - Full Committee Hearing On Entrepreneurs and Tax Day: How Irs Policies and Procedures Impact Small BusinessesDocument49 pagesHouse Hearing, 111TH Congress - Full Committee Hearing On Entrepreneurs and Tax Day: How Irs Policies and Procedures Impact Small BusinessesScribd Government DocsNo ratings yet

- Agriculture Law: 05-06Document8 pagesAgriculture Law: 05-06AgricultureCaseLawNo ratings yet

- Repealing The Death Tax Will Create Jobs and Boost EconomyDocument22 pagesRepealing The Death Tax Will Create Jobs and Boost EconomyFamily Research CouncilNo ratings yet

- By: Rob ButlerDocument18 pagesBy: Rob Butlerextramountain63No ratings yet

- House Hearing, 112TH Congress - Public Charity Organizational Issues, Unrelated Business Income Tax, and The Revised Form 990Document139 pagesHouse Hearing, 112TH Congress - Public Charity Organizational Issues, Unrelated Business Income Tax, and The Revised Form 990Scribd Government DocsNo ratings yet

- GST Collection From The New Zealand Property Sector: Iris ClausDocument14 pagesGST Collection From The New Zealand Property Sector: Iris ClausAli NadafNo ratings yet

- 2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”From Everand2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”No ratings yet

- The Cost of Current PolicyDocument8 pagesThe Cost of Current PolicyCommittee For a Responsible Federal BudgetNo ratings yet

- How I Improved My Fatca Form in One DayvbgmjDocument4 pagesHow I Improved My Fatca Form in One Dayvbgmjshieldopera1No ratings yet

- Sen Brown Leg UpdateDocument2 pagesSen Brown Leg Updateapi-215003736No ratings yet

- Answer 1Document7 pagesAnswer 1sv03No ratings yet

- 2010 IRS Notifications To The City of Lauderdake LakesDocument8 pages2010 IRS Notifications To The City of Lauderdake LakesMy-Acts Of-SeditionNo ratings yet

- Senator Chamberlain 2012 Session ReviewDocument2 pagesSenator Chamberlain 2012 Session ReviewNick SherlockNo ratings yet

- Lifetime Giving AND Inter Vivos Gifts: Greenfield Stein & Senior LLP New York, Ny Updated and Co-Authored byDocument30 pagesLifetime Giving AND Inter Vivos Gifts: Greenfield Stein & Senior LLP New York, Ny Updated and Co-Authored byVlad ZernovNo ratings yet

- The Changed Legislative, Regulatory and Litigation Landscape of The Mortgage IndustryDocument13 pagesThe Changed Legislative, Regulatory and Litigation Landscape of The Mortgage IndustryCairo AnubissNo ratings yet

- NAL Legislative Update #7, 112th Congress, 12-1-11Document2 pagesNAL Legislative Update #7, 112th Congress, 12-1-11The Garden Club of AmericaNo ratings yet

- High Taxes HurtDocument7 pagesHigh Taxes HurtZachary JanowskiNo ratings yet

- Property Tax CADocument42 pagesProperty Tax CAElnur5No ratings yet

- House Hearing, 111TH Congress - Full Committee Hearing On Tax Initiatives That Promote Small Business GrowthDocument83 pagesHouse Hearing, 111TH Congress - Full Committee Hearing On Tax Initiatives That Promote Small Business GrowthScribd Government DocsNo ratings yet

- Egyptian God: Apple's Award of A Preliminary Injunction Over Samsung Demonstrates The Potency of Design PatentsDocument3 pagesEgyptian God: Apple's Award of A Preliminary Injunction Over Samsung Demonstrates The Potency of Design PatentsArnstein & Lehr LLPNo ratings yet

- Aligning The Stars2011Document4 pagesAligning The Stars2011Arnstein & Lehr LLPNo ratings yet

- Aligning The Stars in Mortgage ForeclosuresDocument5 pagesAligning The Stars in Mortgage ForeclosuresArnstein & Lehr LLPNo ratings yet

- Defendants' Right To Be Present in New York: A "Constatutory" RightDocument37 pagesDefendants' Right To Be Present in New York: A "Constatutory" RightArnstein & Lehr LLPNo ratings yet

- IRS and Offshore AccountsDocument1 pageIRS and Offshore AccountsArnstein & Lehr LLPNo ratings yet

- Securities Law and Compliance Manual For Regulation S OfferingsDocument26 pagesSecurities Law and Compliance Manual For Regulation S OfferingsArnstein & Lehr LLP100% (1)

- A Strong Sales Contract Is Key To Your BusinessDocument12 pagesA Strong Sales Contract Is Key To Your BusinessArnstein & Lehr LLPNo ratings yet

- So How Does This Affect Me? A Commercial Borrower's Perspective of The Dodd Frank Wall Street Reform and Consumer Protection ActDocument6 pagesSo How Does This Affect Me? A Commercial Borrower's Perspective of The Dodd Frank Wall Street Reform and Consumer Protection ActArnstein & Lehr LLPNo ratings yet

- Estate Planning With Retirement AssetsDocument12 pagesEstate Planning With Retirement AssetsArnstein & Lehr LLPNo ratings yet

- FTC Applies Endorsement Guides To Bloggers Supreme Court InterpretsDocument8 pagesFTC Applies Endorsement Guides To Bloggers Supreme Court InterpretsArnstein & Lehr LLPNo ratings yet

- Experts Debate Bankruptcy 'Contagion Theory' - From The February 3, 2010 Daily Business ReviewDocument3 pagesExperts Debate Bankruptcy 'Contagion Theory' - From The February 3, 2010 Daily Business ReviewArnstein & Lehr LLPNo ratings yet

- Attorney Steven N. Malitz Litigation VictoriesDocument15 pagesAttorney Steven N. Malitz Litigation VictoriesArnstein & Lehr LLPNo ratings yet

- ABA Coverage Newsletter February 2010Document44 pagesABA Coverage Newsletter February 2010Arnstein & Lehr LLPNo ratings yet

- 1702Q FhcsiDocument2 pages1702Q FhcsiRaffy Enix DavisNo ratings yet

- W8 Ben Default - 2021 12 27 - Preview - DocDocument1 pageW8 Ben Default - 2021 12 27 - Preview - DocJavielito RamirezbriosoNo ratings yet

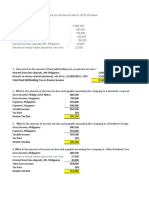

- Assignment 3.1 Comparative Income Tax Payable For Corporations.Document2 pagesAssignment 3.1 Comparative Income Tax Payable For Corporations.Kate HerederoNo ratings yet

- InvoiceDocument1 pageInvoiceRaj KumarNo ratings yet

- MU Syllabus Taxation-2 Transfer-TaxesDocument3 pagesMU Syllabus Taxation-2 Transfer-TaxesDJabNo ratings yet

- Bus TicketDocument1 pageBus TicketChelladurai ANo ratings yet

- Driver Clearance For Grab - PDF - 20230928 - 140406 - 0000Document1 pageDriver Clearance For Grab - PDF - 20230928 - 140406 - 0000jzeb.gonzales18No ratings yet

- Taxation Assignment 7 PDFDocument4 pagesTaxation Assignment 7 PDFKNVS Siva KumarNo ratings yet

- Sa Gosi Calculation OriginalDocument3 pagesSa Gosi Calculation OriginalSaquib.MahmoodNo ratings yet

- Daily Time Record: National Power CorporationDocument2 pagesDaily Time Record: National Power CorporationJaapar HassanNo ratings yet

- Course Plan BTP 2079 ACE CollegeDocument3 pagesCourse Plan BTP 2079 ACE Collegenabin shiwakotiNo ratings yet

- OLA A Ramesh: Fare Breakup Tax BreakupDocument1 pageOLA A Ramesh: Fare Breakup Tax Breakupsasenthil243640No ratings yet

- Invoice IXITRS185875952789718Document1 pageInvoice IXITRS185875952789718PatriotNo ratings yet

- New Income Slab Rates CalculationsDocument6 pagesNew Income Slab Rates Calculationsphani raja kumarNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Intraperiod Tax AllocationDocument2 pagesIntraperiod Tax AllocationAllen KateNo ratings yet

- MSI-20-006 Mask InvoiceDocument1 pageMSI-20-006 Mask Invoicetranshind overseasNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Investment Declaration ManualDocument10 pagesInvestment Declaration ManualAbhinav VivekNo ratings yet

- Circular No. 444 - Amendments To Pag-IBIG Fund Circular No. 388Document3 pagesCircular No. 444 - Amendments To Pag-IBIG Fund Circular No. 388Attorney III DOH CHDNo ratings yet

- Summary SoundCloud Premier G210061521 U865097 2021 03Document2 pagesSummary SoundCloud Premier G210061521 U865097 2021 03danNo ratings yet

- Tax Invoice Trucks and Buyers: Ve Commercials VechilesDocument2 pagesTax Invoice Trucks and Buyers: Ve Commercials VechilesSyam JamiNo ratings yet

- Survey of Mandaluyong RatesDocument4 pagesSurvey of Mandaluyong RatesMarcus DoroteoNo ratings yet

- S Natarajan 1Document44 pagesS Natarajan 1Uday KiranNo ratings yet

- Challenge-Trg Recruitment LTDDocument1 pageChallenge-Trg Recruitment LTDVEROVWO DUKUNo ratings yet

- Santosh Project Ajc College 1Document28 pagesSantosh Project Ajc College 1routh3177No ratings yet

Estate Planning Tax Alert January 2010

Estate Planning Tax Alert January 2010

Uploaded by

Arnstein & Lehr LLPCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estate Planning Tax Alert January 2010

Estate Planning Tax Alert January 2010

Uploaded by

Arnstein & Lehr LLPCopyright:

Available Formats

Chicago, Illinois January 2010

120 South Riverside Plaza, Suite 1200

Chicago, IL 60606 TEMPORARY ESTATE TAX REPEAL:

312.876.7100 phone • 312.876.0288 fax

WHAT HAPPENS NOW?

Hoffman Estates, Illinois

2800 West Higgins Road, Suite 425 We arrive on January 1, 2010 at a place very few people thought possible. As of

Hoffman Estates, IL 60169

847.843.2900 phone • 847.843.3355 fax now, the federal estate and generation skipping transfer (“GST”) taxes are repealed

for the year 2010. Congress adjourned for 2009 without “fixing” the estate (or as

Springfield, Illinois some like to say, “death”) tax rules. Since the current estate tax rules were enacted in

808 South Second Street

Springfield, Illinois 62704

2001, the possibility of arriving at 2010 without an estate tax (albeit only temporar-

217.789.7959 phone • 312.876.6215 fax ily) was viewed as unlikely as lightning striking the same place twice. Let’s see how

we got here (and perhaps more importantly, what it may mean for many individuals).

Boca Raton, Florida

433 Plaza Real, Suite 275

Boca Raton, FL 33432 The current estate tax rules were enacted in 2001. These rules provided (1) an increas-

954.713.7600 phone • 954.713.7700 fax ing federal estate (and GST) tax exemption ($3.5 million for 2009), (2) a $1.0 million

exemption for lifetime gifts, and (3) a maximum gift and estate tax rate on “taxable”

Coral Gables, Florida

201 Alhambra Circle, Suite 601 estates and gifts of 45%. Some states have their own estate tax – others do not. Gen-

(SunTrust Plaza) erally, states with their own estate tax impose the state tax “on top” of the federal tax.

Coral Gables, Florida 33134

305.357.1001 phone • 305.357.1002 fax

The rules now in effect change dramatically in 2010. On January 1, 2010

Fort Lauderdale, Florida – for a one year period – there will be no federal estate or GST tax. The gift

200 East Las Olas Boulevard, Suite 1700 tax exemption will remain at $1.0 million for 2010, but with gift tax rates fall-

Fort Lauderdale, Florida 33301

954.713.7600 phone • 954.713.7700 fax ing to 35%. In addition, the current rules allowing a “step up” (increase) in the

income tax basis of a decedent’s assets is eliminated for 2010. Instead, sub-

Miami, Florida ject to certain limited exceptions, the income tax basis of a decedent’s assets

200 South Biscayne Boulevard, Suite 3600

Miami, FL 33131

will “carry over” to the recipient of the asset (thus potentially increasing capital

305.374.3330 phone • 305.374.4744 fax gains tax when the decedent’s estate or the recipient sells the appreciated asset).

Tampa, Florida

Two Harbour Place

Beginning on January 1, 2011, however, the rules change again – and

302 Knights Run Avenue, Suite 1100 even more dramatically. The estate and GST exemptions fall to $1.0 mil-

Tampa, Florida 33602 lion and the maximum estate and GST tax rates increase to 55%. But

813.254.1400 phone • 813.254.5324 fax the “carryover basis” rule will no longer apply. In effect, the tax rules go

West Palm Beach, Florida back to those in effect in 2001 (before the current rules were enacted).

515 North Flagler Drive, Suite 600

West Palm Beach, FL 33401 Congress has failed to bring stability and certainty to the estate tax rules. Most

561.833.9800 phone • 561.655.5551 fax

Congressional efforts to “fix” the estate tax rules have focused on making the 2009

www.arnstein.com tax rules permanent or temporarily extending the 2009 rules through 2011. These

efforts have, at least for now, proven unsuccessful. Nonetheless, it is very possible

© 2010 ARNSTEIN & LEHR LLP

that Congress will enact legislation in 2010 that overturns the 2010 estate and GST tax repeal, as well

as the other one-year tax law changes taking effect in 2010. What is less certain is when any “remedial”

estate tax legislation will be enacted – and whether the law will apply retroactively to January 1, 2010.

What do these changes mean for you? First, with the uncertainty in the tax rules brought by 2010

also come some possible opportunities. There may be different planning strategies available in 2010

as a result of these unique circumstances. However, there can be no “one size fits all” approach due

to the many variables that may be involved. Second, most estate plans should be reviewed in 2010 to

assure they continue to work as originally intended. For example, if the estate tax is eliminated, many

estate plan documents contain formulas which may automatically “shift” assets away from a surviv-

ing spouse to descendants or other family members. Documents, as well as factual circumstances,

need to be reviewed to assure any unintended consequences can be mitigated. Third, consideration

needs to be given to whether it is appropriate to try to address what the consequences may be if a

person dies in 2010, during the “gap” period (i.e., prior to any remedial legislation being enacted),

depending on whether or not such legislation may be applied retroactively or only prospectively.

The tax law changes occurring in 2010 are unique (and may only be temporary). What happens next

is uncertain. While it is likely Congress will overturn the 2010 estate and GST tax repeal, how and

when the tax rules get “fixed” (and what happens in the interim) is less certain. In the meantime, we

strongly encourage you to contact us to discuss how these changes may impact your estate plan.

TAX NOTICE:

Pursuant to Internal Revenue Service guidance, be advised that any federal tax advice contained in

this written or electronic communication, including any attachments or enclosures, is not intended or

written to be used and it cannot be used by any person or entity for the purpose of (i) avoiding any

tax penalties that may be imposed by the Internal Revenue Service or any other U.S. Federal taxing

authority or agency or (ii) promoting, marketing or recommending to another party any transaction

or matter addressed herein.

You might also like

- Past BillsDocument39 pagesPast BillsSal Salas100% (3)

- 0605Document2 pages0605Kath Rivera60% (42)

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Gifts To Reduce Illinois Estate TaxesDocument5 pagesGifts To Reduce Illinois Estate Taxesrobertkolasa100% (1)

- Fair Lending Developments: The End of Discretionary Pricing?Document12 pagesFair Lending Developments: The End of Discretionary Pricing?Arnstein & Lehr LLPNo ratings yet

- Basic Scenario 9: Justin Reedley and Jenna Washington (2018)Document9 pagesBasic Scenario 9: Justin Reedley and Jenna Washington (2018)Center for Economic ProgressNo ratings yet

- Estate Tax UpdateDocument1 pageEstate Tax Updategateway320No ratings yet

- March 2011 Issue SWS NewsBrief FinalDocument2 pagesMarch 2011 Issue SWS NewsBrief FinalnancyhoagNo ratings yet

- Executive Vice President Congressional Relations & Public Policy 202.663.5339Document2 pagesExecutive Vice President Congressional Relations & Public Policy 202.663.5339brucekrastingNo ratings yet

- C L C S: Olorado Egislative Ouncil TaffDocument12 pagesC L C S: Olorado Egislative Ouncil TaffCircuit MediaNo ratings yet

- Agriculture Law: RS20609Document3 pagesAgriculture Law: RS20609AgricultureCaseLawNo ratings yet

- State Ag - 6-04-10 IntroDocument12 pagesState Ag - 6-04-10 IntroAngela WoodhullNo ratings yet

- AIF Statement On Governor Signing HB 33A: For Immediate ReleaseDocument1 pageAIF Statement On Governor Signing HB 33A: For Immediate Releaseapi-248769192No ratings yet

- October 2010 NewsletterDocument2 pagesOctober 2010 NewsletterKen BillburgNo ratings yet

- Making Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime GiftsDocument36 pagesMaking Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime Giftsrobertkolasa100% (1)

- Dwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFDocument36 pagesDwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFsuidipooshi100% (11)

- Full Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions ManualDocument36 pagesFull Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manualblindoralia100% (46)

- Research - 5-10-10 IntroDocument6 pagesResearch - 5-10-10 IntroAngela WoodhullNo ratings yet

- GCF Newsletter Spring 10Document2 pagesGCF Newsletter Spring 10andrealsmithNo ratings yet

- Agriculture Law: RL33070Document19 pagesAgriculture Law: RL33070AgricultureCaseLawNo ratings yet

- US Internal Revenue Service: p950Document12 pagesUS Internal Revenue Service: p950IRSNo ratings yet

- Tax Day PaperDocument5 pagesTax Day PaperCommittee For a Responsible Federal BudgetNo ratings yet

- Withholding DeclarationDocument24 pagesWithholding DeclarationAbdallah SabbaghNo ratings yet

- Making Use of The Illinois Rules - Part 2: Planning For The Illinois QTIP ElectionDocument24 pagesMaking Use of The Illinois Rules - Part 2: Planning For The Illinois QTIP ElectionrobertkolasaNo ratings yet

- AIF Applauds Passage of Legislation To Reduce Communications Services TaxDocument1 pageAIF Applauds Passage of Legislation To Reduce Communications Services Taxapi-157539785No ratings yet

- Volume 1, Issue 5 Page 1 and 2Document2 pagesVolume 1, Issue 5 Page 1 and 2gcuncensoredNo ratings yet

- Lynco Client Alert 3.18.2020 - Tax Updates and The CornoavirusDocument2 pagesLynco Client Alert 3.18.2020 - Tax Updates and The CornoavirusPomelo PinkNo ratings yet

- PEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)Document13 pagesPEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)lbaker2009No ratings yet

- The Impact of Impending Tax Law ChangesDocument3 pagesThe Impact of Impending Tax Law ChangespadgettmichiganNo ratings yet

- HF2480 Article 1 Section 8-9 Incidence Analysis 1 PDFDocument5 pagesHF2480 Article 1 Section 8-9 Incidence Analysis 1 PDFminnesoda238No ratings yet

- One Ohio Now - Top Ten LoopholesDocument1 pageOne Ohio Now - Top Ten LoopholesoneohionowNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Dynasty Trusts EpdDocument5 pagesDynasty Trusts EpdAntwain Utley100% (1)

- Tracking Number: 13285-A Reducing Tax Burden On America's TaxpayersDocument2 pagesTracking Number: 13285-A Reducing Tax Burden On America's TaxpayersIRSNo ratings yet

- Family Tax Planning Forum: 2010 Tax Relief Act Sparks Both Relief and AnxietyDocument4 pagesFamily Tax Planning Forum: 2010 Tax Relief Act Sparks Both Relief and AnxietydhultstromNo ratings yet

- Letter To Legis LeadershipDocument2 pagesLetter To Legis Leadershipcrossbarnet6727No ratings yet

- House Hearing, 112TH Congress - How Business Tax Reform Can Encourage Job CreationDocument123 pagesHouse Hearing, 112TH Congress - How Business Tax Reform Can Encourage Job CreationScribd Government DocsNo ratings yet

- SALT ReportDocument22 pagesSALT ReportrkarlinNo ratings yet

- L210722 To Client - ReportDocument2 pagesL210722 To Client - Reportksgreen16No ratings yet

- 2008 Publication 553 Highlights of 2008 Tax ChangesDocument38 pages2008 Publication 553 Highlights of 2008 Tax ChangesgrosofNo ratings yet

- Blackstone's Tax EngineersDocument7 pagesBlackstone's Tax EngineersLuke ConstableNo ratings yet

- House Hearing, 110TH Congress - Critical Budget Issues Affecting The 2010 CensusDocument36 pagesHouse Hearing, 110TH Congress - Critical Budget Issues Affecting The 2010 CensusScribd Government DocsNo ratings yet

- The Federal Income Tax System For Individuals: WebextensionDocument5 pagesThe Federal Income Tax System For Individuals: WebextensionBecky Bergeon SteeleNo ratings yet

- REBA Estate Planning Using LLC As Single Member For TaxesDocument14 pagesREBA Estate Planning Using LLC As Single Member For Taxesmatthew.b.lane01No ratings yet

- House Hearing, 111TH Congress - Full Committee Hearing On Entrepreneurs and Tax Day: How Irs Policies and Procedures Impact Small BusinessesDocument49 pagesHouse Hearing, 111TH Congress - Full Committee Hearing On Entrepreneurs and Tax Day: How Irs Policies and Procedures Impact Small BusinessesScribd Government DocsNo ratings yet

- Agriculture Law: 05-06Document8 pagesAgriculture Law: 05-06AgricultureCaseLawNo ratings yet

- Repealing The Death Tax Will Create Jobs and Boost EconomyDocument22 pagesRepealing The Death Tax Will Create Jobs and Boost EconomyFamily Research CouncilNo ratings yet

- By: Rob ButlerDocument18 pagesBy: Rob Butlerextramountain63No ratings yet

- House Hearing, 112TH Congress - Public Charity Organizational Issues, Unrelated Business Income Tax, and The Revised Form 990Document139 pagesHouse Hearing, 112TH Congress - Public Charity Organizational Issues, Unrelated Business Income Tax, and The Revised Form 990Scribd Government DocsNo ratings yet

- GST Collection From The New Zealand Property Sector: Iris ClausDocument14 pagesGST Collection From The New Zealand Property Sector: Iris ClausAli NadafNo ratings yet

- 2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”From Everand2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”No ratings yet

- The Cost of Current PolicyDocument8 pagesThe Cost of Current PolicyCommittee For a Responsible Federal BudgetNo ratings yet

- How I Improved My Fatca Form in One DayvbgmjDocument4 pagesHow I Improved My Fatca Form in One Dayvbgmjshieldopera1No ratings yet

- Sen Brown Leg UpdateDocument2 pagesSen Brown Leg Updateapi-215003736No ratings yet

- Answer 1Document7 pagesAnswer 1sv03No ratings yet

- 2010 IRS Notifications To The City of Lauderdake LakesDocument8 pages2010 IRS Notifications To The City of Lauderdake LakesMy-Acts Of-SeditionNo ratings yet

- Senator Chamberlain 2012 Session ReviewDocument2 pagesSenator Chamberlain 2012 Session ReviewNick SherlockNo ratings yet

- Lifetime Giving AND Inter Vivos Gifts: Greenfield Stein & Senior LLP New York, Ny Updated and Co-Authored byDocument30 pagesLifetime Giving AND Inter Vivos Gifts: Greenfield Stein & Senior LLP New York, Ny Updated and Co-Authored byVlad ZernovNo ratings yet

- The Changed Legislative, Regulatory and Litigation Landscape of The Mortgage IndustryDocument13 pagesThe Changed Legislative, Regulatory and Litigation Landscape of The Mortgage IndustryCairo AnubissNo ratings yet

- NAL Legislative Update #7, 112th Congress, 12-1-11Document2 pagesNAL Legislative Update #7, 112th Congress, 12-1-11The Garden Club of AmericaNo ratings yet

- High Taxes HurtDocument7 pagesHigh Taxes HurtZachary JanowskiNo ratings yet

- Property Tax CADocument42 pagesProperty Tax CAElnur5No ratings yet

- House Hearing, 111TH Congress - Full Committee Hearing On Tax Initiatives That Promote Small Business GrowthDocument83 pagesHouse Hearing, 111TH Congress - Full Committee Hearing On Tax Initiatives That Promote Small Business GrowthScribd Government DocsNo ratings yet

- Egyptian God: Apple's Award of A Preliminary Injunction Over Samsung Demonstrates The Potency of Design PatentsDocument3 pagesEgyptian God: Apple's Award of A Preliminary Injunction Over Samsung Demonstrates The Potency of Design PatentsArnstein & Lehr LLPNo ratings yet

- Aligning The Stars2011Document4 pagesAligning The Stars2011Arnstein & Lehr LLPNo ratings yet

- Aligning The Stars in Mortgage ForeclosuresDocument5 pagesAligning The Stars in Mortgage ForeclosuresArnstein & Lehr LLPNo ratings yet

- Defendants' Right To Be Present in New York: A "Constatutory" RightDocument37 pagesDefendants' Right To Be Present in New York: A "Constatutory" RightArnstein & Lehr LLPNo ratings yet

- IRS and Offshore AccountsDocument1 pageIRS and Offshore AccountsArnstein & Lehr LLPNo ratings yet

- Securities Law and Compliance Manual For Regulation S OfferingsDocument26 pagesSecurities Law and Compliance Manual For Regulation S OfferingsArnstein & Lehr LLP100% (1)

- A Strong Sales Contract Is Key To Your BusinessDocument12 pagesA Strong Sales Contract Is Key To Your BusinessArnstein & Lehr LLPNo ratings yet

- So How Does This Affect Me? A Commercial Borrower's Perspective of The Dodd Frank Wall Street Reform and Consumer Protection ActDocument6 pagesSo How Does This Affect Me? A Commercial Borrower's Perspective of The Dodd Frank Wall Street Reform and Consumer Protection ActArnstein & Lehr LLPNo ratings yet

- Estate Planning With Retirement AssetsDocument12 pagesEstate Planning With Retirement AssetsArnstein & Lehr LLPNo ratings yet

- FTC Applies Endorsement Guides To Bloggers Supreme Court InterpretsDocument8 pagesFTC Applies Endorsement Guides To Bloggers Supreme Court InterpretsArnstein & Lehr LLPNo ratings yet

- Experts Debate Bankruptcy 'Contagion Theory' - From The February 3, 2010 Daily Business ReviewDocument3 pagesExperts Debate Bankruptcy 'Contagion Theory' - From The February 3, 2010 Daily Business ReviewArnstein & Lehr LLPNo ratings yet

- Attorney Steven N. Malitz Litigation VictoriesDocument15 pagesAttorney Steven N. Malitz Litigation VictoriesArnstein & Lehr LLPNo ratings yet

- ABA Coverage Newsletter February 2010Document44 pagesABA Coverage Newsletter February 2010Arnstein & Lehr LLPNo ratings yet

- 1702Q FhcsiDocument2 pages1702Q FhcsiRaffy Enix DavisNo ratings yet

- W8 Ben Default - 2021 12 27 - Preview - DocDocument1 pageW8 Ben Default - 2021 12 27 - Preview - DocJavielito RamirezbriosoNo ratings yet

- Assignment 3.1 Comparative Income Tax Payable For Corporations.Document2 pagesAssignment 3.1 Comparative Income Tax Payable For Corporations.Kate HerederoNo ratings yet

- InvoiceDocument1 pageInvoiceRaj KumarNo ratings yet

- MU Syllabus Taxation-2 Transfer-TaxesDocument3 pagesMU Syllabus Taxation-2 Transfer-TaxesDJabNo ratings yet

- Bus TicketDocument1 pageBus TicketChelladurai ANo ratings yet

- Driver Clearance For Grab - PDF - 20230928 - 140406 - 0000Document1 pageDriver Clearance For Grab - PDF - 20230928 - 140406 - 0000jzeb.gonzales18No ratings yet

- Taxation Assignment 7 PDFDocument4 pagesTaxation Assignment 7 PDFKNVS Siva KumarNo ratings yet

- Sa Gosi Calculation OriginalDocument3 pagesSa Gosi Calculation OriginalSaquib.MahmoodNo ratings yet

- Daily Time Record: National Power CorporationDocument2 pagesDaily Time Record: National Power CorporationJaapar HassanNo ratings yet

- Course Plan BTP 2079 ACE CollegeDocument3 pagesCourse Plan BTP 2079 ACE Collegenabin shiwakotiNo ratings yet

- OLA A Ramesh: Fare Breakup Tax BreakupDocument1 pageOLA A Ramesh: Fare Breakup Tax Breakupsasenthil243640No ratings yet

- Invoice IXITRS185875952789718Document1 pageInvoice IXITRS185875952789718PatriotNo ratings yet

- New Income Slab Rates CalculationsDocument6 pagesNew Income Slab Rates Calculationsphani raja kumarNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Intraperiod Tax AllocationDocument2 pagesIntraperiod Tax AllocationAllen KateNo ratings yet

- MSI-20-006 Mask InvoiceDocument1 pageMSI-20-006 Mask Invoicetranshind overseasNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Investment Declaration ManualDocument10 pagesInvestment Declaration ManualAbhinav VivekNo ratings yet

- Circular No. 444 - Amendments To Pag-IBIG Fund Circular No. 388Document3 pagesCircular No. 444 - Amendments To Pag-IBIG Fund Circular No. 388Attorney III DOH CHDNo ratings yet

- Summary SoundCloud Premier G210061521 U865097 2021 03Document2 pagesSummary SoundCloud Premier G210061521 U865097 2021 03danNo ratings yet

- Tax Invoice Trucks and Buyers: Ve Commercials VechilesDocument2 pagesTax Invoice Trucks and Buyers: Ve Commercials VechilesSyam JamiNo ratings yet

- Survey of Mandaluyong RatesDocument4 pagesSurvey of Mandaluyong RatesMarcus DoroteoNo ratings yet

- S Natarajan 1Document44 pagesS Natarajan 1Uday KiranNo ratings yet

- Challenge-Trg Recruitment LTDDocument1 pageChallenge-Trg Recruitment LTDVEROVWO DUKUNo ratings yet

- Santosh Project Ajc College 1Document28 pagesSantosh Project Ajc College 1routh3177No ratings yet