Professional Documents

Culture Documents

Coffee Financing Example

Coffee Financing Example

Uploaded by

coffeepathOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coffee Financing Example

Coffee Financing Example

Uploaded by

coffeepathCopyright:

Available Formats

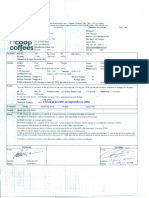

PREFINANCING CONTRACT

This is a blank contract. For legal reasons, completed contracts are not available for posting. Each

Cooperative’s page on FairTradeProof.com notes if a grower has a prefinance contract.

[Name of Borrower]

Address

LENDER:

[Date] This is the lender that is

providing the loan based

Dear Mr/Mrs. [name], on the Cooperative Coffees

purchase contract. We

With reference to your credit application dated [month], [year], we are pleased to inform you that it

was decided that we are prepared to provide a loan to [Name of group]., subject to the following partnered

terms with Root Capital

and conditions: in 2002 to provide most of our

contract prefinancing.

1. Loan agreement: The loan agreement (hereinafter called “Loan Agreement”) is

between Root Capital Inc. (formerly EcoLogic Finance Inc.) of the

United States of America (hereinafter called the “Lender”)“Borrower”

and is the farmer

[Name of group] (hereinafter called: the “Borrower”). Cooperative.

2. Loan amount: A maximum of USD $X (X U.S. DOLLARS 00/100).

3. Risks: Exchange rate risks, transfer risks and other costs associated with

closing this loan shall be borne by the Borrower.

4. Purpose of the loan: Pre-finance the purchase of coffee for export. This is the only purpose

Specifies that the loan is intended

for which the loan may be applied. to finance the costs of growing,

harvesting, and processing the

RISKS: 5. Contracts: The loan will be used to pre-finance the following coffee coffee

purchasebeans that Cooperative

contracts (hereinafter called “Contracts”) with buyer(s) buyer Y

Throughout the world, coffee Coffees has contracted to

(hereinafter called: “Buyer(s)”):

industry trade is conducted purchase.

in US Dollar contracts Number

and Dated Shipment Notes

payments - providing a standard

XXX Mm/dd/yyy Mm/dd/yyy 250 bags of 69 kilos @ $X/lb. FT Org

XXX Mm/dd/yyy Mm/dd/yyy 250 bags of 69 kilos @ $X/lb. FT Org

and reducing currency risk.

Electronic transfer of funds

through the SWIFT system – The Lender will pre-finance a maximum of 60% of the total value of

rather than faxes and telephone the Contracts.

instructions – has eliminated This establishes a mechanism

The Borrower can only submit additional contracts with this for

Buyer(s)

the Cooperative to apply

virtually all risk associated with or with other U.S. or European-based buyers that will serve as a basis

wire transfers. International for this Loan Agreement. Upon the Lender’s approval of thesefor additional loans as they sign

wire transfer fees are typically contracts, the Lender will inform both the Borrower and the export

Buyer(s)contracts with other

$30 per transfer. importers.

which of the existing Contracts can be replaced by newly submitted

contracts.

For every newly submitted contract, new Repayment Instructions

between the Lender, the Borrower and the Buyer must be signed.

675 Massachusetts Avenue, 8th Floor • Cambridge, Massachusetts 02139-3309 • t 617 661 5792 f 617 661 5796 • www.rootcapital.org

You might also like

- Federal Government GrantDocument53 pagesFederal Government GrantOladeji oladotun75% (4)

- Convertible Loan Term SheetDocument8 pagesConvertible Loan Term SheetMarius Angara50% (2)

- Intermediate Accounting 2 Week 3 Lecture AY 2020-2021Document6 pagesIntermediate Accounting 2 Week 3 Lecture AY 2020-2021deeznutsNo ratings yet

- Frank Sillman Expert Report 9019 Filing in ResCap Bankruptcy 2013-10-18Document142 pagesFrank Sillman Expert Report 9019 Filing in ResCap Bankruptcy 2013-10-18Marie McDonnellNo ratings yet

- Loan Agreement TemplateDocument5 pagesLoan Agreement TemplateDenzil ThomasNo ratings yet

- CHAPTERS18&19 Corporate Bonds & Government BondsDocument12 pagesCHAPTERS18&19 Corporate Bonds & Government Bondstconn8276No ratings yet

- SYNOPSIS - Stress ManagementDocument15 pagesSYNOPSIS - Stress Managementsandsoni20020% (1)

- Agreement To Extend Debt PaymentDocument1 pageAgreement To Extend Debt Paymentjason marshNo ratings yet

- Leasing and Factoring : Fin 435: Banking Products and ServicesDocument11 pagesLeasing and Factoring : Fin 435: Banking Products and ServicesPuteri NinaNo ratings yet

- 24 MDKD Master 301019Document29 pages24 MDKD Master 301019CheesyM1keNo ratings yet

- CV Loan AgreementDocument17 pagesCV Loan AgreementankitNo ratings yet

- Introduction : La W C o Ntrac TDocument11 pagesIntroduction : La W C o Ntrac TIacobDorinaNo ratings yet

- Loan Agreement-IndividualsDocument4 pagesLoan Agreement-IndividualsFareya AzfarNo ratings yet

- OUTLINE Cred TransDocument12 pagesOUTLINE Cred TransKara LorejoNo ratings yet

- Business Law With Ucc Applications Student Edition Brown 13th Edition Solutions ManualDocument10 pagesBusiness Law With Ucc Applications Student Edition Brown 13th Edition Solutions ManualPatriciaStonebwyrq100% (94)

- Week 3-Lesson 5 - 6 - 7Document4 pagesWeek 3-Lesson 5 - 6 - 7Hong TrnhNo ratings yet

- LWPYA2 Slide Deck Week 2 Lesson 1Document28 pagesLWPYA2 Slide Deck Week 2 Lesson 1mpho7967No ratings yet

- Guide To Syndicated Leveraged FinanceDocument11 pagesGuide To Syndicated Leveraged FinanceMrigank Agarwal100% (1)

- Credit TransactionsDocument27 pagesCredit TransactionsAleezah Gertrude RaymundoNo ratings yet

- Term Loans and LeasesDocument36 pagesTerm Loans and Leasesirshan amirNo ratings yet

- Two Vel Agg BookDocument32 pagesTwo Vel Agg Bookkirubaharan2022No ratings yet

- Loan Agreement Finca DRCDocument5 pagesLoan Agreement Finca DRCAlinadozpNo ratings yet

- Syndicated Loan Agreement: PartiesDocument10 pagesSyndicated Loan Agreement: PartiesAleezah Gertrude RaymundoNo ratings yet

- Credit TransactionsDocument23 pagesCredit TransactionsAleezah Gertrude RaymundoNo ratings yet

- Template Convertible Loan Short Form 1Document11 pagesTemplate Convertible Loan Short Form 1bie_kingNo ratings yet

- CircualarletterDocument8 pagesCircualarletteravmirzaNo ratings yet

- Letter of IntentDocument7 pagesLetter of Intentilhamidris.myNo ratings yet

- United States Court of Appeals, Third CircuitDocument17 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- MSSC March 2017Document25 pagesMSSC March 2017Bleak NarrativesNo ratings yet

- Surety Bonds Bond Guide PDFDocument5 pagesSurety Bonds Bond Guide PDFLondonguy100% (1)

- Loan Agreement (Rev. 1339ED7)Document5 pagesLoan Agreement (Rev. 1339ED7)KrisNo ratings yet

- Learning Objectives: After Reading This Chapter, You Should Be Able ToDocument27 pagesLearning Objectives: After Reading This Chapter, You Should Be Able ToausantNo ratings yet

- RFP For Firm UnderWritten Syndicated LoansDocument9 pagesRFP For Firm UnderWritten Syndicated Loansoratschilde.aiNo ratings yet

- IFC OTROSI Omnibus AgreementDocument50 pagesIFC OTROSI Omnibus AgreementMaria VelascoNo ratings yet

- Dap Term SheetDocument3 pagesDap Term SheetAnton CastilloNo ratings yet

- Term Loan and LeasesDocument38 pagesTerm Loan and Leasesits4krishna3776No ratings yet

- Bond Subscription Agreement: DATED ThisDocument6 pagesBond Subscription Agreement: DATED Thisbbas6825No ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActMarien MontecalvoNo ratings yet

- loanAgreementV3 EirDocument14 pagesloanAgreementV3 EirtyroneoviedoNo ratings yet

- DATED : BetweenDocument4 pagesDATED : BetweenFeniNo ratings yet

- Loans FormsDocument3 pagesLoans Formswanyama meshackNo ratings yet

- 228-Hale - Demand BondsDocument29 pages228-Hale - Demand BondsMichael McDaidNo ratings yet

- Angel Credit Transactions PDFDocument10 pagesAngel Credit Transactions PDFJay Kent RoilesNo ratings yet

- Intermediate Accounting 2 Week 3 Lecture AY 2020-2021Document6 pagesIntermediate Accounting 2 Week 3 Lecture AY 2020-2021deeznutsNo ratings yet

- Loan Agreement - CorexDocument2 pagesLoan Agreement - CorexSyed Yousuf AliNo ratings yet

- Chapter-2 Issue of Debentures BY: G Arun Kumar Mcom Mba Net Asst Professor in Commerce GDC Men SrikakulamDocument39 pagesChapter-2 Issue of Debentures BY: G Arun Kumar Mcom Mba Net Asst Professor in Commerce GDC Men SrikakulamgeddadaarunNo ratings yet

- Long-Term Debt, Preferred Stock, and Common StockDocument40 pagesLong-Term Debt, Preferred Stock, and Common Stockirshan amirNo ratings yet

- Handouts For Credit TransactionsDocument15 pagesHandouts For Credit TransactionsIrene Sheeran100% (1)

- Chapter 14 Study GuideDocument7 pagesChapter 14 Study GuideStephanie RobinsonNo ratings yet

- Issue of DebenturesDocument39 pagesIssue of Debenturesyashwanth86No ratings yet

- Consumer Credit - Notes - Week 1 - 2Document15 pagesConsumer Credit - Notes - Week 1 - 2hannaNo ratings yet

- Loan Agreement Template (20110303)Document15 pagesLoan Agreement Template (20110303)Melissa FabianNo ratings yet

- Acro Misr Mohamed GamalDocument35 pagesAcro Misr Mohamed Gamalmoh.gamalaaibNo ratings yet

- Kinds of Legal DocumentsDocument16 pagesKinds of Legal Documents✬ SHANZA MALIK ✬100% (1)

- Debt Financing vs. Equity Financing Bonds PayableDocument5 pagesDebt Financing vs. Equity Financing Bonds PayableAmbeleigh Venice Delos SantosNo ratings yet

- EAZZY PLUS (Instalment Loan) Terms & ConditionsDocument2 pagesEAZZY PLUS (Instalment Loan) Terms & ConditionsWinnie OkothNo ratings yet

- Project Financing: Asset-Based Financial EngineeringFrom EverandProject Financing: Asset-Based Financial EngineeringRating: 4 out of 5 stars4/5 (2)

- Soccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2From EverandSoccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2No ratings yet

- Closed at $2.0105 On March 9, 2017Document4 pagesClosed at $2.0105 On March 9, 2017coffeepathNo ratings yet

- Suw161.Suw162 SpotDocument4 pagesSuw161.Suw162 SpotcoffeepathNo ratings yet

- CGM161Document5 pagesCGM161coffeepathNo ratings yet

- Closed at $2.118 On September 1, 2016: (Green)Document7 pagesClosed at $2.118 On September 1, 2016: (Green)coffeepathNo ratings yet

- PED163Document5 pagesPED163coffeepathNo ratings yet

- Nir 163 SpotDocument3 pagesNir 163 SpotcoffeepathNo ratings yet

- Closed at $2.2105 On September 6, 2016Document5 pagesClosed at $2.2105 On September 6, 2016coffeepathNo ratings yet

- SUG172Document5 pagesSUG172coffeepathNo ratings yet

- Superior Customer Experiance Vs Customer Service (JK)Document109 pagesSuperior Customer Experiance Vs Customer Service (JK)Dawit TesfayeNo ratings yet

- Dedication: University of Education, Lower Mall Campus, LahoreDocument7 pagesDedication: University of Education, Lower Mall Campus, LahoreUsman AfzalNo ratings yet

- CLJ 1992 3 611Document9 pagesCLJ 1992 3 611Angel RenaNo ratings yet

- Privy-League-SA - GSFCDocument1 pagePrivy-League-SA - GSFCvisionsameer39No ratings yet

- Report On Shahjalal Islami BankDocument64 pagesReport On Shahjalal Islami BankSaeed HossainNo ratings yet

- Mini Project 2 (Final)Document28 pagesMini Project 2 (Final)Uplaksh KumarNo ratings yet

- Money Market BimbDocument9 pagesMoney Market BimbAncoi Ariff CyrilNo ratings yet

- Statement of AccountDocument5 pagesStatement of AccountJustin DyerNo ratings yet

- Microfinance Provision in Ethiopia: September 2020Document11 pagesMicrofinance Provision in Ethiopia: September 2020yeshitilaNo ratings yet

- Monthly Beepedia August 2022Document129 pagesMonthly Beepedia August 2022Rahul AnandNo ratings yet

- A Study On The Consumer Preferences On TeaDocument76 pagesA Study On The Consumer Preferences On TeaSalmanNo ratings yet

- Walled City of Lahore Authority - Wcla: S T NS T NDocument4 pagesWalled City of Lahore Authority - Wcla: S T NS T NSajidComsats100% (1)

- Fundamentals of AccountancyDocument3 pagesFundamentals of AccountancySheena RobiniolNo ratings yet

- IBReg FormDocument3 pagesIBReg FormMadan MaharanaNo ratings yet

- The Philippine National Bank History and FunctionsDocument10 pagesThe Philippine National Bank History and FunctionsJared Andre CarreonNo ratings yet

- Report On: Summer Internship ProjectDocument44 pagesReport On: Summer Internship ProjectAngad MattaNo ratings yet

- Use Case DiagramDocument8 pagesUse Case DiagramTry SreynaNo ratings yet

- Factura CH204310-FENSTERBLICK SRL-31.12.2022Document1 pageFactura CH204310-FENSTERBLICK SRL-31.12.2022Michael DoerflerNo ratings yet

- Mrunal Economics 02Document70 pagesMrunal Economics 02haroon nazirNo ratings yet

- NewProd2 PDFDocument71 pagesNewProd2 PDFMelissa IsaacNo ratings yet

- Report-Foreign Exchange Mangaemnet of Janata Bank LTDDocument82 pagesReport-Foreign Exchange Mangaemnet of Janata Bank LTDAlex MoonNo ratings yet

- HBL DebitCard Terms and Conditions - Conventional and Islamic PDFDocument43 pagesHBL DebitCard Terms and Conditions - Conventional and Islamic PDFJAWAD KHALIDNo ratings yet

- Working Capital Problem SolutionDocument10 pagesWorking Capital Problem SolutionMahendra ChouhanNo ratings yet

- Risk Management of Islamic Microfinance (IMF) Product by Financial Institutions in MalaysiaDocument8 pagesRisk Management of Islamic Microfinance (IMF) Product by Financial Institutions in Malaysiasajid bhattiNo ratings yet

- Tuition Fees - MMDC PAYMENT CHANNELSDocument7 pagesTuition Fees - MMDC PAYMENT CHANNELSd.guillermo.lawofficeNo ratings yet

- Islamic BankingDocument3 pagesIslamic BankingSheraz BhuttaNo ratings yet

- 7S Electronic Payout MandateDocument1 page7S Electronic Payout MandateMatri SearchNo ratings yet