Professional Documents

Culture Documents

Rtgs Neft Form

Rtgs Neft Form

Uploaded by

anaga1982Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rtgs Neft Form

Rtgs Neft Form

Uploaded by

anaga1982Copyright:

Available Formats

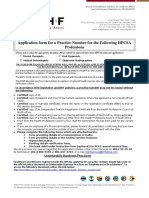

Application cum Debit Authority form for RTGS/NEFT Transfer

Payment Type & Customer Type

(Please tick appropriate type)

Debit Account Number

Name of Account Holder / Non Customer

Mobile No. / Email Id of the Non Customer

Cheque Number

RTGS* OR

NEFT

CUSTOMER

________________ Branch

Date: DD/MM/YYYY

*Minimum value per RTGS transaction

is

2 lacs

NON CUSTOMER

Kindly furnish the credit instruction details in Part A or B as per requirement:

Part A For local RTGS and NEFT Remittances:

Beneficiary Bank Name

Total Amount

(in figures and words)

Beneficiary Bank

Branch

Beneficiary Branch

IFSC Code

Beneficiary Account

#

Number

Re-confirm Beneficiary

Account Number

Beneficiary Name

Amount

(in figures)

____________________ (Rupees _______________________________________________________________________________________

Part B - For Indo Nepal Remittances only (Amount should not exceed Rs 50,000/- inclusive of commission)

Beneficiary Account

#

Number

Total Amount

(in words)

#

Beneficiary Bank Name

Beneficiary Name

Beneficiary Address

Beneficiary Citizenship /

PAN Card / Passport

Number

Beneficiary Mobile /

Landline Number

Amount

(in figures)

Rupees _______________________________________________________________________________________________________________

RTGS / NEFT credits will be executed solely on the basis of beneficiary account number/s provided. Beneficiary name will NOT be validated for processing credit instruction/s.

Remit the amount (s) as per above details, by debiting my/our account for the above mentioned amount (s). We confirm having read the Terms of remittance on the reverse / attached

herewith.

_________________________________

Authorized Signatory/ies / Seal

Customer Acknowledgement Form

Payment Type

Date:

RTGS* OR

DD/MM/YYYY

Cheque No.

Total Amount Remitted (in figures)

Time:

NEFT

HH:MM

ECN No. & Signature

Branch Seal

Application cum Debit Authority form for RTGS/NEFT Transfer

________________ Branch

Date: DD/MM/YYYY

FOR BANK'S USE ONLY

Signature Verified by

Logged by

Authorized by

Banks Outward Reference No

Reviewed by

Conditions for Transfer

1.

Remitting bank shall not be liable for any loss or damage arising or resulting from delay in transmission delivery or non delivery of Electronic message or any mistake, omission, or error in

transmission or delivery thereof or in deciphering the message from any cause whatsoever or from its misinterpretation received or the action of the destination Bank or any inaccuracy of the

particulars provided in the application or any act or event beyond control.

2.

All payment instructions should be checked carefully by the remitter. Customer agrees that in the event of any delay in the completion of the Funds Transfer or any loss on account of error in the

execution of the Funds Transfer pursuant to a payment order, the bank's liability shall be limited to the extent of payment of interest at the Bank Rate for any period of delay in the case of

delayed payment and refund of the amount together with interest at the Bank Rate up to the date of refund, in the event of loss on account of error, negligence or fraud on the part of any

employee of the bank. Bank assumes no liability for non-execution of the remittance for any reason, beyond its control, including the technical reasons in the security procedure and natural

calamities.

3.

Messages received after cut-off time will be processed on the next working day.

4.

Customer agrees that payment order becomes irrevocable and customer shall be bound by any payment order executed by the Bank in good faith and in compliance with the security procedure

followed by the Bank.

5.

Customer hereby authorizes the Bank to debit customers account for any liability incurred to the Bank or any other charges for execution of any of the payment order issued by the customer

and shall ensure availability of funds in the account for execution of remittance. If, however, Bank executes the payment order without sufficient funds being available in the account, customer

shall be bound to pay to the Bank the amount debited to customers account for the remittance together with the charges and interest payable to the Bank.

You might also like

- Bdo Check Transaction SlipDocument2 pagesBdo Check Transaction SliprinaagbuyaNo ratings yet

- UNFCU External Transfer Agreement - Terms of UseDocument3 pagesUNFCU External Transfer Agreement - Terms of UseAnusionwu Stanley ObinnaNo ratings yet

- Bills Purchase Line AgreementDocument4 pagesBills Purchase Line AgreementJonathan P. OngNo ratings yet

- Sop Sap Outgoing Payment 0.1Document12 pagesSop Sap Outgoing Payment 0.1supendra phuyal100% (1)

- Consent Letter For Transfer of Funds To Different AccountDocument2 pagesConsent Letter For Transfer of Funds To Different AccountImanNo ratings yet

- University of Southern California Statement of Account: Account Summary Current AddressDocument3 pagesUniversity of Southern California Statement of Account: Account Summary Current AddressNorisk NanungNo ratings yet

- Telnor Online Payment Enrollment TranslationDocument2 pagesTelnor Online Payment Enrollment Translationjdonovan9476No ratings yet

- SCB - Personal Loan Terms and ConditionsDocument13 pagesSCB - Personal Loan Terms and Conditionsmytake100No ratings yet

- PayoneerDocument6 pagesPayoneerwomutuNo ratings yet

- AHPRA RefundDocument1 pageAHPRA RefundEsmerusNo ratings yet

- EcsmandateformDocument1 pageEcsmandateformmohan@skillnetinc.comNo ratings yet

- PF Claim Form - UnitechDocument2 pagesPF Claim Form - UnitechThiruvengadam Sivanandan100% (1)

- Affix Your Photo: Company ConfidentialDocument3 pagesAffix Your Photo: Company ConfidentialseventhhemanthNo ratings yet

- Paying and Collecting BankerDocument12 pagesPaying and Collecting BankerartiNo ratings yet

- Bank Deposits Daily: 2. Safe Count:: Form CH1-F4Document1 pageBank Deposits Daily: 2. Safe Count:: Form CH1-F4joanna7988No ratings yet

- Welcome To Prosperous Living: Application FormDocument6 pagesWelcome To Prosperous Living: Application FormHeeresh Kumar AryaNo ratings yet

- ECS Mandate Form For StudentsDocument1 pageECS Mandate Form For StudentsrakeshagrawalNo ratings yet

- 1390388459576-Own Request Transfer FormatDocument3 pages1390388459576-Own Request Transfer FormatAkhilesh BhuraNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormReal Infotech KumtaNo ratings yet

- Standard Operating Procedures For Financial Department: Hockey IndiaDocument13 pagesStandard Operating Procedures For Financial Department: Hockey IndiaAnnuNo ratings yet

- Mövenpick - Secure Authorization Form SampleDocument1 pageMövenpick - Secure Authorization Form Samplebadai_utmNo ratings yet

- Central Bank of N TSA Initiative: Manual For Remita Partner BanksDocument153 pagesCentral Bank of N TSA Initiative: Manual For Remita Partner BanksDamilNo ratings yet

- CAMSDocument39 pagesCAMSSterling FincapNo ratings yet

- Merchant Integration GuideDocument28 pagesMerchant Integration GuideMuhammad AtharNo ratings yet

- Arens AAS17 SM 22Document17 pagesArens AAS17 SM 22Nurul FarzanaNo ratings yet

- Check Out ProceduresDocument14 pagesCheck Out Proceduresmadhu anvekarNo ratings yet

- Ftmo General Terms and ConditionsDocument20 pagesFtmo General Terms and ConditionsFrancisco CaicedoNo ratings yet

- The Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderDocument1 pageThe Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderarvinfoNo ratings yet

- Manager Cash PolicyDocument4 pagesManager Cash Policyhayleyofarrell18No ratings yet

- SirDocument3 pagesSirVA AccountsNo ratings yet

- Samco Closure FormDocument1 pageSamco Closure Formgovindbhai purohitNo ratings yet

- National Electronic Fund Transfer (NEFT) Mandate FormDocument1 pageNational Electronic Fund Transfer (NEFT) Mandate FormKiran KagitapuNo ratings yet

- Revised Form A2 Cum Application FormDocument3 pagesRevised Form A2 Cum Application FormnoshadNo ratings yet

- Disbursements by CashDocument6 pagesDisbursements by CashAG R OhcnaNo ratings yet

- National Electronic Funds Transfer (NEFT) Is A Nation-Wide System That FacilitatesDocument5 pagesNational Electronic Funds Transfer (NEFT) Is A Nation-Wide System That FacilitatesMounika TadikondaNo ratings yet

- Payment NotificationDocument1 pagePayment Notificationglobaltradex3No ratings yet

- Network?: Ans: No, There Is No Restriction of Centres or of Any Geographical Area Inside TheDocument4 pagesNetwork?: Ans: No, There Is No Restriction of Centres or of Any Geographical Area Inside TheRajiv RanjanNo ratings yet

- Settlement Letter 5102053 2023-04-07Document2 pagesSettlement Letter 5102053 2023-04-07Venkatesh DoodamNo ratings yet

- SOP - HOtel Credit Policy and PRoceduresDocument4 pagesSOP - HOtel Credit Policy and PRoceduresImee S. YuNo ratings yet

- Verification of Deosit Request FormDocument1 pageVerification of Deosit Request FormLincoln Reserve Group Inc.No ratings yet

- Account Closure Form - v2Document1 pageAccount Closure Form - v2OTHER Work100% (1)

- Hotel Advance DepositDocument2 pagesHotel Advance DepositSumit PratapNo ratings yet

- Indemnity For Email Instructions Standard IndividualDocument2 pagesIndemnity For Email Instructions Standard IndividualOladayo OmisopeNo ratings yet

- Account Reconciliation Policy - Sample 2Document5 pagesAccount Reconciliation Policy - Sample 2Muri EmJay100% (1)

- Very Easy Money Transfer: E-ChequeDocument15 pagesVery Easy Money Transfer: E-ChequeKartheek AldiNo ratings yet

- Payment Notification PDFDocument1 pagePayment Notification PDFThabang MohaleNo ratings yet

- Part 3Document29 pagesPart 3Rajib DattaNo ratings yet

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementxxpinkywitchxxNo ratings yet

- Cancellation FormDocument2 pagesCancellation FormAkash TebaliyaNo ratings yet

- Application Form For Dental Therapists, Medical Technologists and Diagnostic Radiographers - Doc2Document8 pagesApplication Form For Dental Therapists, Medical Technologists and Diagnostic Radiographers - Doc2pieterinpretoria391No ratings yet

- ArticleonLetterofCredit Part-IIDocument3 pagesArticleonLetterofCredit Part-IIessakiNo ratings yet

- Bank Release OrderDocument2 pagesBank Release Ordercallvk50% (2)

- Cash Handling PolicyDocument9 pagesCash Handling PolicyPasti TerengganuNo ratings yet

- Tools and Aids in Colllecting AccountsDocument6 pagesTools and Aids in Colllecting AccountsIsseah Gaño OcampoNo ratings yet

- PayWay API Developers GuideDocument48 pagesPayWay API Developers GuideSimbwa PhillipNo ratings yet

- Electronic Fund Transfer SystemDocument7 pagesElectronic Fund Transfer SystemJatin BhatiaNo ratings yet

- IFCI Long Term Infra Bonds Application FormDocument2 pagesIFCI Long Term Infra Bonds Application FormPrajna CapitalNo ratings yet

- Vendor Creation FormDocument1 pageVendor Creation FormRahul RSNo ratings yet

- Acctg Cash003 5-15 - Drop LogDocument1 pageAcctg Cash003 5-15 - Drop LogDebbie LangolfNo ratings yet

- RTGS ApplicationDocument2 pagesRTGS ApplicationChidanandCkm29% (7)

- Application For Admission For The 2009-2010 Academic Year 2013-2014Document2 pagesApplication For Admission For The 2009-2010 Academic Year 2013-2014anaga1982No ratings yet

- (See Rule 12 (2) ) : (At The Time ofDocument2 pages(See Rule 12 (2) ) : (At The Time ofanaga1982No ratings yet

- SNAP 2010 Question Paper and Ans KeyDocument19 pagesSNAP 2010 Question Paper and Ans Keyanaga1982No ratings yet

- Re Advertisement 5-13Document27 pagesRe Advertisement 5-13anaga1982No ratings yet

- Assignment 1711948030Document3 pagesAssignment 1711948030Robin Rahman 1711948030No ratings yet

- (MAA 1.5) PERCENTAGE CHANGE - FINANCIAL APPLICATIONS - SolutionsDocument6 pages(MAA 1.5) PERCENTAGE CHANGE - FINANCIAL APPLICATIONS - SolutionsAleya NajihaNo ratings yet

- Level Four Code 2 Project One: Process PayrollDocument3 pagesLevel Four Code 2 Project One: Process PayrollbiniamNo ratings yet

- Inv4163363102 Original PDFDocument1 pageInv4163363102 Original PDFHeru WicaksonoNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentRITU NANDAL 144No ratings yet

- DIMINISHING-MUSHARIKA-14112021-072718pmDocument24 pagesDIMINISHING-MUSHARIKA-14112021-072718pmAwn AqdasNo ratings yet

- Accrued Liablities PolicyDocument3 pagesAccrued Liablities PolicyMuri EmJayNo ratings yet

- Q Part 4Document10 pagesQ Part 4kajkargroupNo ratings yet

- Solved in Recent Years As Described in This Chapter Both TheDocument1 pageSolved in Recent Years As Described in This Chapter Both TheM Bilal SaleemNo ratings yet

- History of Banking Sector in PakistanDocument18 pagesHistory of Banking Sector in Pakistanshahzad AhmadNo ratings yet

- Course Module 3 and 4 Mathematics of InvestmentDocument22 pagesCourse Module 3 and 4 Mathematics of InvestmentAnne Maerick Jersey OteroNo ratings yet

- Fundamentals of AccountancyDocument28 pagesFundamentals of AccountancyCharity AmboyNo ratings yet

- The Essential Guide To ReinsuranceDocument51 pagesThe Essential Guide To Reinsurancefireblastrer100% (1)

- Assignment 1Document2 pagesAssignment 1Baburam Ad100% (1)

- Kim FebDocument6 pagesKim FebClyde ThomasNo ratings yet

- Debt Reduction CalculatorDocument6 pagesDebt Reduction CalculatorAnonymous fE2l3DzlNo ratings yet

- OLD Pension OptionDocument5 pagesOLD Pension OptionEC1 CPWDNo ratings yet

- Form No. 12BB: (See Rule 26C)Document2 pagesForm No. 12BB: (See Rule 26C)m 418No ratings yet

- Credit Risk Management of Pubali Bank LimitedDocument11 pagesCredit Risk Management of Pubali Bank Limitedsweet-smileNo ratings yet

- Problem: 1Document8 pagesProblem: 1PRIYA SHARMA EPGDIB (On Campus) 2019-20No ratings yet

- AMFI Sample 500 QuestionsDocument36 pagesAMFI Sample 500 QuestionsSuraj KumarNo ratings yet

- Diplomski Rad ZavrsniiiiDocument33 pagesDiplomski Rad ZavrsniiiiMagicVision Doo Kalesija100% (1)

- Advanced Financial ManagementDocument107 pagesAdvanced Financial ManagementdirectoricpapNo ratings yet

- Chargeback GuideDocument716 pagesChargeback GuideAna Paola T Munoz0% (1)

- E-Banking in India: Current and Future Prospects: January 2016Document14 pagesE-Banking in India: Current and Future Prospects: January 2016Varsha GuptaNo ratings yet

- Account SummaryDocument1 pageAccount Summaryvanita kunnoNo ratings yet

- Tikona BillDocument2 pagesTikona Billabhietwup50% (2)

- Ibs Sungai Buloh 1 31/03/22Document9 pagesIbs Sungai Buloh 1 31/03/22Muhammad FaizalNo ratings yet

- Aether Industries LTD.: Complex Chemistry in The MakingDocument10 pagesAether Industries LTD.: Complex Chemistry in The MakingProlin NanduNo ratings yet

- Ishika Jain 2021346 PDFDocument59 pagesIshika Jain 2021346 PDFsanu duttaNo ratings yet