Professional Documents

Culture Documents

QS17 - Class Exercises

QS17 - Class Exercises

Uploaded by

lyk0texCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QS17 - Class Exercises

QS17 - Class Exercises

Uploaded by

lyk0texCopyright:

Available Formats

Accounting 225 Quiz Section #17

Chapter 13-2 Class Exercises

1. Fremont CPA Tax Services is considering investing in two different types of tax

software that will result in cost savings for their business. The investment outflows

associated with their investment options are:

Software Option 1:

Year

Investment Cash Inflow

1

40000

2000

2

5000

4000

3

6000

4

8000

5

10000

6

10000

7

8000

8

8000

9

6000

10

6000

Software Option 2:

Year

Investment Cash Inflow

1

25000

2000

2

2000

3

4000

4

5000

5

6000

6

6000

7

5000

8

3000

9

3000

10

3000

a) Calculate the payback period for each of these options. Based on payback period,

which tax software should Fremont select?

b) What other considerations should Fremont make and which option would you

recommend?

Accounting 225 Quiz Section #17

Chapter 13-2 Class Exercises

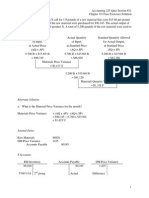

2. Wallingford MicroBrew is considering the purchase of an automated bottling machine

for $80,000. The machine would replace an old piece of equipment that costs $33,000

per year to operate. The new machine would cost $10,000 per year to operate. The old

machine could be sold for a scrap value of $5,000. The new machine would have a

useful life of 10 years (straight line depreciation) and has no salvage value. Compute the

simple (accounting) rate of return on the new bottling machine

3. Blue Ridge Furniture is considering the purchase of two different items of equipment:

Machine A: New machine on the market that compresses sawdust into various shelving

products. Currently sawdust is disposed of as a waste product. Information on this

machine is as follows:

a. The machine costs $780,000 and would have a 25% salvage value at the end of its 10year useful life (straight line depreciation).

b. The shelving products produced by the machine would generate revenues of $350,000

per year. Variable manufacturing costs would be 20% of sales revenue.

c. Fixed annual expenses with the new shelving products would be: advertising $42,000;

salaries $86,000; utilities $9,000; insurance $13,000.

Machine B: This is a new machine that would automate a sanding process that is

primarily done by hand. The following information is available about this machine is:

a. The machine costs $220,000 and would have no salvage value at the end of its 10year useful life (straight line depreciation).

b. Several old pieces of sanding equipment that are fully depreciated would be disposed

of at a scrap value of $7,200.

c. The new machine would provide substantial annual savings in cash operating costs.

It would require an operator at an annual salary of $26,000 and $3,000 of annual

Accounting 225 Quiz Section #17

Chapter 13-2 Class Exercises

maintenance expense. The current, hand operated sanding procedure costs the

company $85,000 per year.

Blue Ridge Furniture requires a simple rate of return of 16% on all equipment purchases.

Also, the company will not purchase equipment unless the equipment has a payback

period of four years or less.

For machine A:

a) Prepare and income statement showing the expected Net Operating Income each year

for the new shelving products (use contribution margin format).

b) Compute simple rate of return.

c) Compute payback period.

Accounting 225 Quiz Section #17

Chapter 13-2 Class Exercises

For machine B:

a) Compute simple rate of return.

b) Compute payback period.

According to the companys criteria, which machine should they purchase?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- QS14 - Class Exercises SolutionDocument4 pagesQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS04 - Class Exercises SolutionDocument3 pagesQS04 - Class Exercises Solutionlyk0texNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- QS16 - Class Exercises SolutionDocument5 pagesQS16 - Class Exercises Solutionlyk0texNo ratings yet

- QS16 - Class ExercisesDocument5 pagesQS16 - Class Exerciseslyk0texNo ratings yet

- QS15 - Class Exercises SolutionDocument5 pagesQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS13 - Class Exercises SolutionDocument2 pagesQS13 - Class Exercises Solutionlyk0texNo ratings yet

- QS09 - Class Exercises SolutionDocument4 pagesQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Midterm 2 Review SolutionDocument7 pagesQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS08 - Class Exercises SolutionDocument5 pagesQS08 - Class Exercises Solutionlyk0texNo ratings yet

- QS12 - Midterm 2 ReviewDocument5 pagesQS12 - Midterm 2 Reviewlyk0texNo ratings yet

- QS06 - Class ExercisesDocument3 pagesQS06 - Class Exerciseslyk0texNo ratings yet

- QS09 - Class ExercisesDocument4 pagesQS09 - Class Exerciseslyk0texNo ratings yet

- QS06 - Class Exercises SolutionDocument2 pagesQS06 - Class Exercises Solutionlyk0texNo ratings yet

- QS02 - Class ExercisesDocument3 pagesQS02 - Class Exerciseslyk0texNo ratings yet

- QS05 - Class Exercises SolutionDocument3 pagesQS05 - Class Exercises Solutionlyk0texNo ratings yet

- QS04 - Class ExercisesDocument3 pagesQS04 - Class Exerciseslyk0texNo ratings yet

- LexDocument9 pagesLexKaustav DeyNo ratings yet

- What Is Goodwill?: Key TakeawaysDocument4 pagesWhat Is Goodwill?: Key TakeawaysTin PangilinanNo ratings yet

- Final AmbulanceDocument45 pagesFinal AmbulanceBeing ShonuNo ratings yet

- Convenience Store Business PlanDocument33 pagesConvenience Store Business Plankinley dorjeeNo ratings yet

- Calculate Your Federal TaxesDocument6 pagesCalculate Your Federal Taxesapi-719544021No ratings yet

- Tle Exam - Business MathDocument3 pagesTle Exam - Business MathCharmaine NiebresNo ratings yet

- Business Ethics Case StudyDocument5 pagesBusiness Ethics Case StudyHershe May Rivas100% (2)

- (Kotak) Vedanta, October 02, 2023Document9 pages(Kotak) Vedanta, October 02, 2023PrakashNo ratings yet

- Estimatingthe Optimal Capital StructureDocument22 pagesEstimatingthe Optimal Capital StructureKashif KhurshidNo ratings yet

- TVPI, DPI, RVPI - Venture Capital ValuationsDocument21 pagesTVPI, DPI, RVPI - Venture Capital Valuationsharshit.dwivedi320No ratings yet

- Group Project: FIN421 Financial Planning & ForecastingDocument15 pagesGroup Project: FIN421 Financial Planning & ForecastingSHAYNo ratings yet

- IMT - Ceres - Tarun Singh ChauhanDocument6 pagesIMT - Ceres - Tarun Singh ChauhanTarun Singh ChauhanNo ratings yet

- Acca f2 Notes j15Document188 pagesAcca f2 Notes j15opentuitionID100% (1)

- Form No. 10BDocument3 pagesForm No. 10BLalit PardasaniNo ratings yet

- Chapter 14Document43 pagesChapter 14Maryane AngelaNo ratings yet

- Lapsable Leave Encashment Policy: Document ID: HRMPL111Document7 pagesLapsable Leave Encashment Policy: Document ID: HRMPL111DheepaNo ratings yet

- Tally Assignment FINAL 3 MONTHS PDFDocument44 pagesTally Assignment FINAL 3 MONTHS PDFrakesh8roy80% (5)

- Quarterly Report Q3 2010 MJNADocument20 pagesQuarterly Report Q3 2010 MJNAcb0bNo ratings yet

- Assignment # 2 Student Zaeem Asif Reg # L1F17BSAF0062 Financial Analysis Submitted To Abid Noor Section BDocument4 pagesAssignment # 2 Student Zaeem Asif Reg # L1F17BSAF0062 Financial Analysis Submitted To Abid Noor Section BWaleed KhalidNo ratings yet

- Swot Analysis D & JDocument10 pagesSwot Analysis D & JJaimin PatelNo ratings yet

- Parks Department Budget PresentationDocument12 pagesParks Department Budget PresentationWVXU NewsNo ratings yet

- Theory of Demand & Supply: STEP - 1: Meaning Definition of Supply, Law of Supply & Factors of SupplyDocument14 pagesTheory of Demand & Supply: STEP - 1: Meaning Definition of Supply, Law of Supply & Factors of SupplyRavindraNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Learning Material 4 PROVISION: Contingent Liability A. Discussion of Accounting PrinciplesDocument11 pagesLearning Material 4 PROVISION: Contingent Liability A. Discussion of Accounting PrinciplesJay GoNo ratings yet

- Chapter 5 SolutionsDocument58 pagesChapter 5 Solutionshayelom0% (1)

- 59 Internal Audit ChecklistDocument2 pages59 Internal Audit ChecklistAnkit Mathran0% (1)

- Cash Flow Statement Via Direct MethodDocument4 pagesCash Flow Statement Via Direct Methodsneel.bw3636No ratings yet

- Answer:: Q1. What Is Marginal Costing? Explain and How Is It Different From Absorption Costing?Document2 pagesAnswer:: Q1. What Is Marginal Costing? Explain and How Is It Different From Absorption Costing?Jay PatelNo ratings yet

- Intacc Chap 16 ReviewerDocument8 pagesIntacc Chap 16 ReviewerJea XeleneNo ratings yet

- PA Personal Income Tax Return InstructionsDocument44 pagesPA Personal Income Tax Return InstructionsRita WhiteNo ratings yet