Professional Documents

Culture Documents

0901 Revenue

0901 Revenue

Uploaded by

PriyaGnaeswaranCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Corporate Finance: Fifth EditionDocument97 pagesCorporate Finance: Fifth EditionEnock KotchiNo ratings yet

- Nciii Bookkeeping PDFDocument28 pagesNciii Bookkeeping PDFStephanie Cruz100% (10)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Business AnalysisDocument456 pagesBusiness AnalysisFahim Yusuf100% (6)

- Who Benefits From The Child Tax Credit?Document26 pagesWho Benefits From The Child Tax Credit?Katie CrolleyNo ratings yet

- Discussion Paper On The Wheat-Flour Industry in PakistanDocument59 pagesDiscussion Paper On The Wheat-Flour Industry in PakistanMashhood AhmadNo ratings yet

- WR User's Manual SD 100330 AllDocument79 pagesWR User's Manual SD 100330 All이천수No ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument56 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegemartinus linggoNo ratings yet

- 1979 Banking Branch Manager Interview Questions Answers GuideDocument14 pages1979 Banking Branch Manager Interview Questions Answers GuideMohammad HusainNo ratings yet

- A-Levels - Business Studies Solved Paper (MJ 2008) - Paper 3Document9 pagesA-Levels - Business Studies Solved Paper (MJ 2008) - Paper 3Rafay Mahmood100% (7)

- Accounting Activation AssignmentDocument19 pagesAccounting Activation AssignmentKen WuNo ratings yet

- Investments 3Document5 pagesInvestments 3Marinel AbrilNo ratings yet

- Public Private Partnerships in BDDocument10 pagesPublic Private Partnerships in BDAhmed Imtiaz33% (3)

- Financial Performance Analysis of Banking Sector in Bangladesh - A Case Study On Selected Commercial BanksDocument70 pagesFinancial Performance Analysis of Banking Sector in Bangladesh - A Case Study On Selected Commercial BanksAshaduzzamanNo ratings yet

- Kupdf Summary PDFDocument28 pagesKupdf Summary PDFHardin LavistreNo ratings yet

- FINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Document20 pagesFINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Nicole BabatundeNo ratings yet

- BDO Indirect Tax News - Issue 3, February 2011Document12 pagesBDO Indirect Tax News - Issue 3, February 2011BDO TaxNo ratings yet

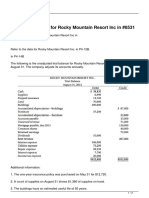

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- At The Beginning of October Bowser Co S Inventory Consists ofDocument1 pageAt The Beginning of October Bowser Co S Inventory Consists ofMiroslav GegoskiNo ratings yet

- Taxation 1 ReviewerDocument10 pagesTaxation 1 ReviewerRey ObnimagaNo ratings yet

- Check List For Auditing Statutory RecordsDocument6 pagesCheck List For Auditing Statutory RecordsShrikant Naik0% (1)

- FM2 - NCP1 Practice QuestionsDocument9 pagesFM2 - NCP1 Practice QuestionsKAIF KHANNo ratings yet

- 6 ECCI - Karthik SubbaramanDocument13 pages6 ECCI - Karthik SubbaramanThe Outer MarkerNo ratings yet

- Benefit Cost AnalysisDocument35 pagesBenefit Cost AnalysisRizwanNadeemNo ratings yet

- IpolDocument3 pagesIpolamelNo ratings yet

- TNPSC WebDocument45 pagesTNPSC Webadhitsur100% (22)

- Lat. Soal Completing Accounting Cycle 1Document1 pageLat. Soal Completing Accounting Cycle 1Cindy Cornelia Wahyu WardaniNo ratings yet

- 251 0405Document23 pages251 0405api-27548664No ratings yet

- Ma1 Specimen j14Document17 pagesMa1 Specimen j14Shohin100% (1)

- India Post Conference Notes Day 1 Feb 12 EDELDocument104 pagesIndia Post Conference Notes Day 1 Feb 12 EDELjayantsharma04No ratings yet

- Debtors SystemDocument4 pagesDebtors SystemRohit ShrivastavNo ratings yet

0901 Revenue

0901 Revenue

Uploaded by

PriyaGnaeswaranCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0901 Revenue

0901 Revenue

Uploaded by

PriyaGnaeswaranCopyright:

Available Formats

January 2009

IAS Plus Update.

Discussion paper proposes new basis for revenue recognition

In December 2008, the International Accounting

Standards Board (IASB) published for public comment

a discussion paper (DP) entitled Preliminary Views on

Revenue Recognition in Contracts with Customers.

The DP represents the first step jointly with the US

Financial Accounting Standards Board (FASB) in the

development of a new, converged Standard on this subject.

The IASB has requested comments on the DP by

19 June 2009.

Key proposals

The DP discusses the framework that should underpin

revenue recognition requirements, but does not address

specific application issues. These will be covered in the

next stage of the project. Key proposals in the DP include:

basing revenue recognition on contracts with a

customer specifically, on increases in an entitys net

position in a contract with a customer as a result of

the entity satisfying its performance obligations under

the contract;

recognising revenue for each performance obligation

when the customer obtains control of the promised

asset (good or service), so that it is the customers

asset;

regarding both the supply of goods and the supply of

services as being the transfer of an asset to a customer;

accounting for performance obligations separately to

the extent that the promised assets (goods or

services) are transferred to the customer at different

times (this is sometimes referred to as unbundling or

multiple element accounting, although the DP does

not use these terms); and

IFRS global office

Global IFRS leader

Ken Wild

kwild@deloitte.co.uk

allocating the transaction price at inception between

the performance obligations on the basis of the

relative stand-alone selling prices of the associated

goods and services.

Although these proposals draw on a framework that

has much in common with existing practice, they would

result in significant changes to revenue recognition for

some entities. One of the most important changes

proposed is the focus on recognising revenue only

when the customer obtains control of the associated

asset. This could, for example, significantly affect

entities that currently apply a percentage of completion

approach for construction contracts, but where the

customer does not control the asset during the period

of construction. Under the proposed model, such

entities would instead recognise revenue only when the

customer obtains control of the asset, which might not

be until the end of the construction period.

IAS Plus website

We have had more

than 7.7 million

visits to our

www.iasplus.com

website. Our goal is

to be the most

comprehensive

source of news

about international

financial reporting on

the Internet. Please

check in regularly.

Objectives of the revenue project

The IASB believes that the principles underlying the two

main revenue recognition Standards at present (IAS 18

Revenue and IAS 11 Construction Contracts) are

inconsistent and vague. In the US, revenue recognition

guidance comprises more than a hundred standards,

many being industry-specific, which can produce

conflicting results for economically similar transactions.

The boards objective is to develop a model that can

replace most of the existing revenue standards, to

improve the comparability and understandability of

revenue for users of financial statements.

IFRS centres of excellence

Americas

New York

Robert Uhl

iasplusamericas@deloitte.com

Montreal

Robert Lefrancois

iasplus@deloitte.ca

Asia-Pacific

Hong Kong

Stephen Taylor

iasplus@deloitte.com.hk

Melbourne

Bruce Porter

iasplus@deloitte.com.au

Europe-Africa

Johannesburg

Graeme Berry

iasplus@deloitte.co.za

Copenhagen

Jan Peter Larsen

dk_iasplus@deloitte.dk

London

Veronica Poole

iasplus@deloitte.co.uk

Paris

Laurence Rivat

iasplus@deloitte.fr

Revenue would be recognised based on

increases in an entitys net position (the

combination of its rights and obligations

under a contract).

The boards have yet to decide whether any particular

contracts with customers should be excluded from the

proposed model. The DP notes that the proposed

model might not always provide decision-useful

information about contracts with high potential

volatility (e.g. some contracts for financial instruments

or commodities) and some insurance contracts.

A contract-based revenue recognition principle

The DP proposes that revenue should be recognised

based on increases in an entitys net position in a

contract with a customer. The entitys net contract

position is the combination of its rights and obligations

under the contract. A contract need not be in writing

it is any agreement between two or more parties that

creates enforceable obligations.

The DPs focus on contracts means, for example, that

gains recognised under IAS 41 Agriculture as a result of

biological transformation would not be regarded as

revenue for the purposes of the DP. This is because such

gains relate to changes in value in a biological asset,

and not to a contract with a customer.

Whether the entitys net contract position is a contract

asset, a contract liability or a net nil position depends

on the measurement of the remaining rights and

obligations in the contract. For example, where a

customer has paid in full for goods or services before

they have been supplied, this will typically give rise to

a contract liability, because the entity will have an

obligation to supply those goods or services, but will

have no right to receive further consideration from the

customer. Conversely, where the entity has satisfied all

its obligations under a contract, it will typically have a

contract asset for any further consideration that is due

from the customer.

The DP proposes that revenue should be recognised

when a contract asset increases or a contract liability

decreases (or some combination of the two) as a result

of the entity satisfying its performance obligations

under the contract.

Performance obligations

The boards preliminary view is that an entitys

performance obligation is a promise in a contract with

a customer to transfer an asset (such as a good or a

service) to that customer. A contractual promise can

be explicit or implicit.

The DP gives the example of a contract to provide

painting services in which it is understood that the seller

(the entity) will source the paint. If the contract does

not contain an explicit obligation for the seller to supply

paint, such an obligation is nevertheless implicit.

When an entity promises to provide a good, it is clear

that it is promising to transfer an asset to the customer.

The DP argues that a promise to provide a service is

similarly a promise to transfer an asset. From the

customers perspective, a service is an asset when

received, even though the customer may consume that

asset immediately and, therefore, recognise an

immediate expense.

The approach taken in the DP means that revenue will

typically be recognised as goods or services are

transferred to a customer under a contract. Therefore, it

will be necessary to account for performance

obligations separately to the extent that the promised

assets (goods or services) are transferred to the

customer at different times.

By arguing that a service is an asset when received by

the customer, the DP is able to specify a single principle

for revenue recognition that applies equally to goods

and to services. Under IAS 18, different approaches are

adopted for goods and for services, so that it is

necessary to distinguish between them. In some

circumstances, this distinction is not easy to draw.

Satisfaction of performance obligations

a control-based approach

An entity will satisfy a performance obligation and,

therefore, recognise revenue when it transfers a

promised asset (such as a good or a service) to the

customer. The DP proposes that an entity has

transferred a promised asset when the customer obtains

control of that asset, so that it has become the

customers asset (which, in the case of a service, may

need to be recognised as an expense immediately).

Typically, a customer will obtain control of a good when

the customer takes physical possession of the good.

Similarly, in the case of a service, the service will

typically become the customers asset when the

customer receives the promised service.

The DPs proposed focus on control is perhaps the most

significant change from the existing model for revenue

recognition, which is driven by risks and rewards and

distinguishes between goods and services.

It means, for example, that in a contract to construct an

asset for a customer, an entity satisfies a performance

obligation during construction (and, therefore,

recognises revenue) only if assets are transferred to the

customer throughout the construction process. That

would only be the case if the customer controls the

partially constructed asset as it is being constructed.

One example cited in the DP in which the customer

would have control is where the customer has the right

to take over the partially constructed asset and to

engage another supplier to complete it. Thus, where

the customer has the right to take over such a partially

constructed asset, revenue would be recognised as

construction activity progresses irrespective of

whether the contract meets the definition of

a construction contract.

The DP proposes a rebuttable presumption that an asset

to be used by an entity in satisfying another

performance obligation in the contract is not

transferred to the customer until the asset is used in

satisfying that other performance obligation. Thus, for

example, paint to be used in providing a painting

service would be transferred only as painting takes

place. The proposed presumption would be rebutted if

other factors, such as the terms of the contract or the

operation of law, clearly indicate that the asset is

transferred to the customer at a different time. For

example, in the circumstances described earlier, the

presumption would be rebutted where the customer

has the right to retain the paint after delivery and to

engage another painter to perform the painting service.

Measurement of performance obligations

The boards debated several different approaches to the

measurement of performance obligations. The DP

proposes an approach to measurement which is called

the allocated transaction price approach. Although the

boards favour this approach, they acknowledge that

there are concerns associated with it for some contracts.

The DP proposes that performance obligations be

measured initially at the transaction price, i.e. the

consideration payable by the customer. Where a

contract includes more than one performance

obligation, the transaction price would be allocated at

inception between those performance obligations on

the basis of the relative stand-alone selling prices of the

associated goods and services. The boards acknowledge

that identifying stand-alone selling prices may be

difficult, and will require the use of estimates where

stand-alone selling prices do not exist. However,

because this approach will be consistent with the

principle that revenue is recognised as the entitys

obligations under the contract are satisfied (rather than

when all obligations under the contract have been

satisfied), they believe the use of estimates is appropriate.

As performance obligations are subsequently satisfied,

through the delivery of goods or services, the amount

of the transaction price allocated to each performance

obligation would be recognised as revenue. As a result,

over the life of the contract, the total amount of revenue

recognised would be equal to the transaction price.

This approach is called the allocated transaction price

approach because, after contract inception, it is

proposed that performance obligations would not be

remeasured, with one exception: the measurement of a

performance obligation would be updated if that

performance obligation becomes onerous. The DP

proposes that a performance obligation would be

considered onerous when an entitys expected cost of

satisfying the performance obligation exceeds the

carrying amount of that performance obligation. In

such circumstances, the performance obligation would

be remeasured to the entitys expected cost of

satisfying the performance obligation, and the entity

would recognise a contract loss for the difference.

The transaction price would be allocated

at inception between performance

obligations on the basis of the relative

stand-alone selling prices of the goods

and services.

The boards currently favour this approach, which uses

a historical allocation of the transaction price, in part

because of the practical difficulties in obtaining reliable

information to remeasure performance obligations on

an ongoing basis. Nevertheless, there are some

concerns as to whether the approach is suitable for all

revenue contracts, particularly those with highly variable

outcomes, such as long-term, fixed-price contracts for

goods and services with volatile prices (e.g. a take-orpay contract for electricity or a commodity). The boards

are considering scope, disclosures and another

measurement approach for some contracts in order to

address these concerns, but have not yet reached a

preliminary view on the best way forward. Appendix B to

the DP discusses three approaches that could be used for

subsequent measurement of performance obligations.

Potential effects on current practice

Although the approach proposed in the DP has much

in common with the existing model, it would change

practice in a number of areas. The DP identifies the

following as areas that would be affected.

Use of a contract-based revenue recognition principle

The DP proposes that an entity would recognise

revenue from increases in its net position in a contract

with a customer as a result of satisfying a performance

obligation. Increases in other assets (such as cash,

inventory not yet transferred to the customer or

biological assets) would not trigger revenue recognition.

Entities that at present recognise revenue on a

percentage of completion basis for construction-type

contracts would recognise revenue during construction

only if the customer controls the item as it is constructed.

(Conversely, although the DP does not make this explicit,

entities that at present recognise revenue only on delivery

of completed goods would apparently recognise revenue

during construction if it can be demonstrated that the

customer controls the item as it is constructed perhaps

because the customer has the right to take over the

partially constructed asset and to engage another

supplier to complete it.)

Identification of performance obligations

At present, entities account for some warranties by

accruing for expected costs rather than deferring a

portion of revenue for future warranty services that may

need to be provided. Under the model proposed in the

DP, warranty obligations would be regarded as

performance obligations, and the revenue allocated

to them would be recognised only as the warranty

obligations are satisfied.

Use of estimates

Entities currently complying with the US guidance in

Emerging Issues Task Force Issue 00-21 and AICPA

Statement of Position No. 97-2 sometimes do not

recognise revenue for a delivered item if there is no

objective and reliable evidence of the selling price of

the undelivered items. Under the model proposed in the

DP, such entities would estimate the stand-alone selling

prices of the undelivered goods and services and

recognise revenue when goods and services are delivered

to the customer.

Capitalisation of costs

At present, some entities capitalise certain costs of

obtaining contracts, such as commissions paid to a third

party for obtaining a contract with a customer. Under

the model proposed in the DP, costs would be

capitalised only if they qualify for capitalisation in

accordance with other Standards, which would not

typically be the case for such commissions. Accordingly,

an entity would recognise such costs as expenses as

incurred, which may not be in the same period as that

in which the related revenue is recognised.

Topics not covered in the discussion paper

The boards deliberations in this area are ongoing.

The panel on the next page sets out a number of topics

to be discussed at future meetings as a draft Standard

is developed.

Illustrative examples

As explained above, the proposals set out in the DP

would change the recognition of revenue in a number

of areas, and would introduce some new concepts.

Appendix A to the DP sets out a number of examples

which are intended to illustrate the proposed revenue

recognition model.

Next steps

Comments on the DP are due by 19 June 2009. During

the comment period, the IASB and the FASB plan to

conduct field visits, focusing initially on industries with

contracts that the proposed model is most likely to

affect. The boards will evaluate the findings from these

visits, along with the comment letters received on the

DP, with a view to publishing an exposure draft in 2010.

The boards will also decide, in the light of comments

received, whether to hold public hearings to discuss the

proposed model.

Topics not covered in the discussion paper

Scope of a general revenue recognition Standard

Contract renewal and cancellation options (including return rights)

Combining contracts

Changes in a contracts terms and conditions after contract

inception

Measurement of rights, including:

the time value of money;

Whether a different measurement approach is required for some

contracts and, if so, the criteria for determining when that approach

is required and the measurement basis for that approach

Which costs should be included in the test for whether a

performance obligation is onerous and in the remeasurement

of an onerous performance obligation

At what unit of account the test for an onerous obligation should

operate (e.g. a single performance obligation, the remaining

performance obligations in a contract or a portfolio of

homogeneous performance obligations)

uncertainty (including credit risk and contingent consideration);

and

Gross or net presentation of the rights and obligations in a contract

non-cash consideration.

Gross or net presentation of contract liabilities and contract assets

Application guidance to help entities identify performance

obligations consistently

Display of remeasurements in the statement of comprehensive

income

Application guidance to help entities assess when performance

obligations are satisfied

Gross versus net presentation of revenue

Application guidance on how an entity should determine standalone selling prices for the purpose of allocating the transaction

price to separate performance obligations

Transition guidance and effective date

Disclosure requirements

Consequential amendments to other Standards

For more information on Deloitte Touche Tohmatsu, please access our website at www.deloitte.com

Deloitte provides audit, tax, consulting, and financial advisory services to public and private clients spanning multiple industries.

With a globally connected network of member firms in 140 countries, Deloitte brings world-class capabilities and deep local expertise

to help clients succeed wherever they operate. Deloittes 150,000 professionals are committed to becoming the standard of excellence.

Deloittes professionals are unified by a collaborative culture that fosters integrity, outstanding value to markets and clients,

commitment to each other, and strength from cultural diversity. They enjoy an environment of continuous learning, challenging

experiences, and enriching career opportunities. Deloittes professionals are dedicated to strengthening corporate responsibility,

building public trust, and making a positive impact in their communities.

Deloitte refers to one or more of Deloitte Touche Tohmatsu, a Swiss Verein, and its network of member firms, each of which is

a legally separate and independent entity. Please see www.deloitte.com/about for a detailed description of the legal structure of

Deloitte Touche Tohmatsu and its member firms.

This publication contains general information only and is not intended to be comprehensive nor to provide specific accounting,

business, financial, investment, legal, tax or other professional advice or services. This publication is not a substitute for such

professional advice or services, and it should not be acted on or relied upon or used as a basis for any decision or action that may

affect you or your business. Before making any decision or taking any action that may affect you or your business, you should

consult a qualified professional advisor.

Whilst every effort has been made to ensure the accuracy of the information contained in this publication, this cannot be guaranteed,

and neither Deloitte Touche Tohmatsu nor any related entity shall have any liability to any person or entity that relies on the

information contained in this publication. Any such reliance is solely at the users risk.

Deloitte Touche Tohmatsu 2009. All rights reserved.

Designed and produced by The Creative Studio at Deloitte, London. 28894

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Corporate Finance: Fifth EditionDocument97 pagesCorporate Finance: Fifth EditionEnock KotchiNo ratings yet

- Nciii Bookkeeping PDFDocument28 pagesNciii Bookkeeping PDFStephanie Cruz100% (10)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Business AnalysisDocument456 pagesBusiness AnalysisFahim Yusuf100% (6)

- Who Benefits From The Child Tax Credit?Document26 pagesWho Benefits From The Child Tax Credit?Katie CrolleyNo ratings yet

- Discussion Paper On The Wheat-Flour Industry in PakistanDocument59 pagesDiscussion Paper On The Wheat-Flour Industry in PakistanMashhood AhmadNo ratings yet

- WR User's Manual SD 100330 AllDocument79 pagesWR User's Manual SD 100330 All이천수No ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument56 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegemartinus linggoNo ratings yet

- 1979 Banking Branch Manager Interview Questions Answers GuideDocument14 pages1979 Banking Branch Manager Interview Questions Answers GuideMohammad HusainNo ratings yet

- A-Levels - Business Studies Solved Paper (MJ 2008) - Paper 3Document9 pagesA-Levels - Business Studies Solved Paper (MJ 2008) - Paper 3Rafay Mahmood100% (7)

- Accounting Activation AssignmentDocument19 pagesAccounting Activation AssignmentKen WuNo ratings yet

- Investments 3Document5 pagesInvestments 3Marinel AbrilNo ratings yet

- Public Private Partnerships in BDDocument10 pagesPublic Private Partnerships in BDAhmed Imtiaz33% (3)

- Financial Performance Analysis of Banking Sector in Bangladesh - A Case Study On Selected Commercial BanksDocument70 pagesFinancial Performance Analysis of Banking Sector in Bangladesh - A Case Study On Selected Commercial BanksAshaduzzamanNo ratings yet

- Kupdf Summary PDFDocument28 pagesKupdf Summary PDFHardin LavistreNo ratings yet

- FINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Document20 pagesFINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Nicole BabatundeNo ratings yet

- BDO Indirect Tax News - Issue 3, February 2011Document12 pagesBDO Indirect Tax News - Issue 3, February 2011BDO TaxNo ratings yet

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- At The Beginning of October Bowser Co S Inventory Consists ofDocument1 pageAt The Beginning of October Bowser Co S Inventory Consists ofMiroslav GegoskiNo ratings yet

- Taxation 1 ReviewerDocument10 pagesTaxation 1 ReviewerRey ObnimagaNo ratings yet

- Check List For Auditing Statutory RecordsDocument6 pagesCheck List For Auditing Statutory RecordsShrikant Naik0% (1)

- FM2 - NCP1 Practice QuestionsDocument9 pagesFM2 - NCP1 Practice QuestionsKAIF KHANNo ratings yet

- 6 ECCI - Karthik SubbaramanDocument13 pages6 ECCI - Karthik SubbaramanThe Outer MarkerNo ratings yet

- Benefit Cost AnalysisDocument35 pagesBenefit Cost AnalysisRizwanNadeemNo ratings yet

- IpolDocument3 pagesIpolamelNo ratings yet

- TNPSC WebDocument45 pagesTNPSC Webadhitsur100% (22)

- Lat. Soal Completing Accounting Cycle 1Document1 pageLat. Soal Completing Accounting Cycle 1Cindy Cornelia Wahyu WardaniNo ratings yet

- 251 0405Document23 pages251 0405api-27548664No ratings yet

- Ma1 Specimen j14Document17 pagesMa1 Specimen j14Shohin100% (1)

- India Post Conference Notes Day 1 Feb 12 EDELDocument104 pagesIndia Post Conference Notes Day 1 Feb 12 EDELjayantsharma04No ratings yet

- Debtors SystemDocument4 pagesDebtors SystemRohit ShrivastavNo ratings yet