Professional Documents

Culture Documents

December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Setton

December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Setton

Uploaded by

api-273992067Copyright:

Available Formats

You might also like

- NIBM - Risk MGMTDocument5 pagesNIBM - Risk MGMTNB SouthNo ratings yet

- MBS Basics: Nomura Fixed Income ResearchDocument31 pagesMBS Basics: Nomura Fixed Income ResearchanuragNo ratings yet

- Cryptocurrency Scams 2022 V8Document18 pagesCryptocurrency Scams 2022 V8CBS 11 News100% (4)

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- 2010-09-21 - Fed Side by Side StatementsDocument2 pages2010-09-21 - Fed Side by Side Statementsglerner133926No ratings yet

- Fomc Pres Conf 20141217Document23 pagesFomc Pres Conf 20141217JoseLastNo ratings yet

- SidebysidefedDocument1 pageSidebysidefedandrewbloggerNo ratings yet

- January - March FOMC Statement ComparisonDocument1 pageJanuary - March FOMC Statement Comparisonshawn2207No ratings yet

- FOMC RedLineDocument2 pagesFOMC RedLineEduardo VinanteNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- Fed Statements Side by SideDocument1 pageFed Statements Side by SideTaylor CottamNo ratings yet

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- FOMC0810Document2 pagesFOMC0810arborjimbNo ratings yet

- US Fed FOMC Press Conference 18 September 2013 No TaperDocument26 pagesUS Fed FOMC Press Conference 18 September 2013 No TaperJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- 2018.01.31 FED Press ReleaseDocument2 pages2018.01.31 FED Press ReleaseTREND_7425No ratings yet

- Fomc Septiembre 2015Document2 pagesFomc Septiembre 2015cocoNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- Fomc Pres Conf 20240501Document4 pagesFomc Pres Conf 20240501gustavo.kahilNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- FOMCstatementDocument2 pagesFOMCstatementCBNo ratings yet

- Transcript of Chairman Bernanke's Press Conference April 25, 2012Document23 pagesTranscript of Chairman Bernanke's Press Conference April 25, 2012CoolidgeLowNo ratings yet

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Document4 pagesTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNo ratings yet

- FedDocument4 pagesFedandre.torresNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument1 pageFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Fomc Pres Conf 20231101Document26 pagesFomc Pres Conf 20231101Quynh Le Thi NhuNo ratings yet

- Fomc Pres Conf 20130918Document7 pagesFomc Pres Conf 20130918helmuthNo ratings yet

- Monetary 20240501 A 1Document4 pagesMonetary 20240501 A 1gustavo.kahilNo ratings yet

- FOMCpresconf 20230920Document4 pagesFOMCpresconf 20230920KHAIRULNo ratings yet

- Fed Statement June 2009Document2 pagesFed Statement June 2009andrewbloggerNo ratings yet

- FOMCpresconf 20210922Document26 pagesFOMCpresconf 20210922marcoNo ratings yet

- PowellDocument4 pagesPowellandre.torresNo ratings yet

- Comptabilité Tle G3 Et G2Document24 pagesComptabilité Tle G3 Et G2albertvalk2.0No ratings yet

- 2018.09.26 FED Press ReleaseDocument1 page2018.09.26 FED Press ReleaseTREND_7425No ratings yet

- Fed Redline FebruaryDocument2 pagesFed Redline FebruaryPradeep SolankiNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- Press ReleaseDocument2 pagesPress Releaseapi-26018528No ratings yet

- Conférence de Presse BCE JanvierDocument2 pagesConférence de Presse BCE JanvierToroloNo ratings yet

- FOMCpresconf20240501Document26 pagesFOMCpresconf20240501David SimõesNo ratings yet

- Monetary 20230614 A 1Document4 pagesMonetary 20230614 A 1Jhony SmithYTNo ratings yet

- FOMCpresconf 20230503Document25 pagesFOMCpresconf 20230503Edi SaputraNo ratings yet

- Fomc Statements - Side-By-sideDocument2 pagesFomc Statements - Side-By-sideurbanovNo ratings yet

- Fomc Pres Conf 20230614Document26 pagesFomc Pres Conf 20230614LAKHAN TRIVEDINo ratings yet

- FOMCpresconf 20230614Document5 pagesFOMCpresconf 20230614Jhony SmithYTNo ratings yet

- resconfDocument4 pagesresconfgothurded24No ratings yet

- Monetary 20230201 A 1Document4 pagesMonetary 20230201 A 1tamhid nahianNo ratings yet

- Federal Reserve: Unconventional Monetary Policy Options: Marc LabonteDocument37 pagesFederal Reserve: Unconventional Monetary Policy Options: Marc Labonterichardck61No ratings yet

- Monetary Policy Summary: Publication Date: 3 August 2017Document3 pagesMonetary Policy Summary: Publication Date: 3 August 2017TraderNo ratings yet

- Jerome Powell's Written TestimonyDocument5 pagesJerome Powell's Written TestimonyTim MooreNo ratings yet

- Summer Training ReportDocument76 pagesSummer Training ReportRibhanshu RajNo ratings yet

- Intro To Mathematical Finance Part I: Lecture 1: 1.1: The One-Period Binomial ModelDocument21 pagesIntro To Mathematical Finance Part I: Lecture 1: 1.1: The One-Period Binomial ModelSoham KumarNo ratings yet

- Bonds PayableDocument52 pagesBonds PayableJohn Charles Andaya100% (2)

- Account Statement 4000Document1 pageAccount Statement 4000ebmk oeibNo ratings yet

- Cmd. 00427991823303 Cmd. 00427991823303 Cmd. 00427991823303 Cmd. 00427991823303Document1 pageCmd. 00427991823303 Cmd. 00427991823303 Cmd. 00427991823303 Cmd. 00427991823303irfanNo ratings yet

- Wichita Old Town Warren Theatre LLC Term LoanDocument2 pagesWichita Old Town Warren Theatre LLC Term LoanBob WeeksNo ratings yet

- What Is International TradeDocument2 pagesWhat Is International Tradeeknath2000No ratings yet

- BRMDocument69 pagesBRMpatesweetu1No ratings yet

- Scam 1992 - A Web Series On Harshad Mehta ScamDocument2 pagesScam 1992 - A Web Series On Harshad Mehta ScamAavish GuptaNo ratings yet

- Negotiable Instrument (Discharge of Instrument)Document15 pagesNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- Telus 40042789 2023 03 25Document10 pagesTelus 40042789 2023 03 25Harold KumarNo ratings yet

- Soa300822Document1 pageSoa300822Sandy SavitraNo ratings yet

- Understanding Investment - Class 6 PDFDocument4 pagesUnderstanding Investment - Class 6 PDFDebabrattaNo ratings yet

- Cash and CequizDocument5 pagesCash and CequizMaria Emarla Grace CanozaNo ratings yet

- Rip-Off by The Federal Reserve (Revised)Document13 pagesRip-Off by The Federal Reserve (Revised)Oldereb100% (2)

- Financial InstrumentsDocument93 pagesFinancial InstrumentsLuisa Janelle BoquirenNo ratings yet

- BUDGET AT A GLANCE Full PDFDocument440 pagesBUDGET AT A GLANCE Full PDFTamilnadu KaatumanarkovilNo ratings yet

- Account Statement As of 05-06-2020 12:14:26 GMT +0530Document9 pagesAccount Statement As of 05-06-2020 12:14:26 GMT +0530Arun VeeraniNo ratings yet

- Discounted Cash Flow Valuation PDFDocument130 pagesDiscounted Cash Flow Valuation PDFayca_No ratings yet

- Sap Fi/Co: Transaction CodesDocument51 pagesSap Fi/Co: Transaction CodesReddaveni NagarajuNo ratings yet

- 158 634353431366610342 New Test 2Document14 pages158 634353431366610342 New Test 2Mara Shaira SiegaNo ratings yet

- Basic Finance Prelim Q1Document5 pagesBasic Finance Prelim Q1Michelle EsperalNo ratings yet

- NGN ArbitrageDocument4 pagesNGN Arbitragewraje01No ratings yet

- Cottco H1 2016 ResultsDocument2 pagesCottco H1 2016 ResultsaddyNo ratings yet

- Character, Ability, Margin, Purpose, Amount, Repayment, Insurance/Security or FiveDocument7 pagesCharacter, Ability, Margin, Purpose, Amount, Repayment, Insurance/Security or FiveRuohui ChenNo ratings yet

- PGBP NotesDocument24 pagesPGBP NotesYogesh Aggarwal100% (2)

- Americandownload b2 Extra Tasks and KeyDocument12 pagesAmericandownload b2 Extra Tasks and Keyangelos1apostolidisNo ratings yet

December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Setton

December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Setton

Uploaded by

api-273992067Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Setton

December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Setton

Uploaded by

api-273992067Copyright:

Available Formats

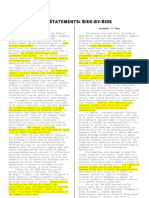

December 17, 2014 compared with October 29, 2014

Jeremie Cohen-Setton

For immediate release

Information received since the Federal Open Market Committee met in

September suggests that economic activity is expanding at a moderate

pace. Labor market conditions improved somewhat further, with solid job

gains and a lower unemployment rate. On balance, a range of labor market

indicators suggests that underutilization of labor resources continues to

diminish is gradually diminishing. Household spending is rising moderately

and business fixed investment is advancing, while the recovery in the

housing sector remains slow. Inflation has continued to run below the

Committee's longer-run objective, partly reflecting declines in energy

prices. Market-based measures of inflation compensation have declined

somewhat further; survey-based measures of longer-term inflation

expectations have remained stable.

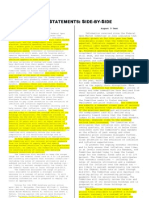

Consistent with its statutory mandate, the Committee seeks to foster

maximum employment and price stability. The Committee expects that,

with appropriate policy accommodation, economic activity will expand at a

moderate pace, with labor market indicators and inflation moving toward

levels the Committee judges consistent with its dual mandate. The

Committee sees the risks to the outlook for economic activity and the labor

market as nearly balanced. The Committee expects inflation to rise

gradually toward 2 percent as the labor market improves further and the

transitory effects of lower energy prices and other factors dissipate. The

Committee continues to monitor inflation developments closely. Although

inflation in the near term will likely be held down by lower energy prices

and other factors, the Committee judges that the likelihood of inflation

running persistently below 2 percent has diminished somewhat since early

this year.

The Committee judges that there has been a substantial improvement in

the outlook for the labor market since the inception of its current asset

purchase program. Moreover, the Committee continues to see sufficient

underlying strength in the broader economy to support ongoing progress

toward maximum employment in a context of price stability. Accordingly,

the Committee decided to conclude its asset purchase program this month.

The Committee is maintaining its existing policy of reinvesting principal

payments from its holdings of agency debt and agency mortgage-backed

securities in agency mortgage-backed securities and of rolling over

maturing Treasury securities at auction. This policy, by keeping the

Committee's holdings of longer-term securities at sizable levels, should help

maintain accommodative financial conditions. [paragraph moved below]

To support continued progress toward maximum employment and price

stability, the Committee today reaffirmed its view that the current 0 to 1/4

percent target range for the federal funds rate remains appropriate. In

determining how long to maintain this target range, the Committee will

assess progress--both realized and expected--toward its objectives of

maximum employment and 2 percent inflation. This assessment will take

into account a wide range of information, including measures of labor

market conditions, indicators of inflation pressures and inflation

expectations, and readings on financial developments. Based on its current

assessment, tThe Committee judges that it can be patient in beginning to

normalize the stance of monetary policy. anticipates, based on its current

assessment, The Committee sees this guidance as consistent with its

previous statement that it likely will be appropriate to maintain the 0 to 1/4

percent target range for the federal funds rate for a considerable time

following the end of its asset purchase program in October this month,

especially if projected inflation continues to run below the Committee's 2

percent longer-run goal, and provided that longer-term inflation

expectations remain well anchored. However, if incoming information

indicates faster progress toward the Committee's employment and inflation

objectives than the Committee now expects, then increases in the target

range for the federal funds rate are likely to occur sooner than currently

anticipated. Conversely, if progress proves slower than expected, then

increases in the target range are likely to occur later than currently

anticipated.

The Committee is maintaining its existing policy of reinvesting principal

payments from its holdings of agency debt and agency mortgage-backed

securities in agency mortgage-backed securities and of rolling over

maturing Treasury securities at auction. This policy, by keeping the

Committee's holdings of longer-term securities at sizable levels, should help

maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it

will take a balanced approach consistent with its longer-run goals of

maximum employment and inflation of 2 percent. The Committee currently

anticipates that, even after employment and inflation are near mandateconsistent levels, economic conditions may, for some time, warrant

keeping the target federal funds rate below levels the Committee views as

normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair;

William C. Dudley, Vice Chairman; Lael Brainard; Stanley Fischer; Richard W.

Fisher; Loretta J. Mester; Charles I. Plosser; Jerome H. Powell; and Daniel K.

Tarullo.

Voting against the action was were Richard W. Fisher, who believed that,

while the Committee should be patient in beginning to normalize

monetary policy, improvement in the U.S. economic performance since

October has moved forward, further than the majority of the Committee

envisions, the date when it will likely be appropriate to increase the

federal funds rate; Narayana Kocherlakota, who believed that the

Committee's decision, in light of in the context of ongoing low inflation

continued sluggishness in the inflation outlook and falling the recent slide

in market-based measures of longer-term inflation expectations, created

undue downside risk to the credibility of the 2 percent inflation target;

the Committee should commit to keeping the current target range for the

federal funds rate at least until the one-to-two-year ahead inflation outlook

has returned to 2 percent and should continue the asset purchase program

at its current level. and Charles I. Plosser, who believed that the statement

should not stress the importance of the passage of time as a key element

of its forward guidance and, given the improvement in economic

conditions, should not emphasize the consistency of the current forward

guidance with previous statements.

You might also like

- NIBM - Risk MGMTDocument5 pagesNIBM - Risk MGMTNB SouthNo ratings yet

- MBS Basics: Nomura Fixed Income ResearchDocument31 pagesMBS Basics: Nomura Fixed Income ResearchanuragNo ratings yet

- Cryptocurrency Scams 2022 V8Document18 pagesCryptocurrency Scams 2022 V8CBS 11 News100% (4)

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- 2010-09-21 - Fed Side by Side StatementsDocument2 pages2010-09-21 - Fed Side by Side Statementsglerner133926No ratings yet

- Fomc Pres Conf 20141217Document23 pagesFomc Pres Conf 20141217JoseLastNo ratings yet

- SidebysidefedDocument1 pageSidebysidefedandrewbloggerNo ratings yet

- January - March FOMC Statement ComparisonDocument1 pageJanuary - March FOMC Statement Comparisonshawn2207No ratings yet

- FOMC RedLineDocument2 pagesFOMC RedLineEduardo VinanteNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- Fed Statements Side by SideDocument1 pageFed Statements Side by SideTaylor CottamNo ratings yet

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- FOMC0810Document2 pagesFOMC0810arborjimbNo ratings yet

- US Fed FOMC Press Conference 18 September 2013 No TaperDocument26 pagesUS Fed FOMC Press Conference 18 September 2013 No TaperJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- 2018.01.31 FED Press ReleaseDocument2 pages2018.01.31 FED Press ReleaseTREND_7425No ratings yet

- Fomc Septiembre 2015Document2 pagesFomc Septiembre 2015cocoNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- Fomc Pres Conf 20240501Document4 pagesFomc Pres Conf 20240501gustavo.kahilNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- FOMCstatementDocument2 pagesFOMCstatementCBNo ratings yet

- Transcript of Chairman Bernanke's Press Conference April 25, 2012Document23 pagesTranscript of Chairman Bernanke's Press Conference April 25, 2012CoolidgeLowNo ratings yet

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Document4 pagesTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNo ratings yet

- FedDocument4 pagesFedandre.torresNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument1 pageFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Fomc Pres Conf 20231101Document26 pagesFomc Pres Conf 20231101Quynh Le Thi NhuNo ratings yet

- Fomc Pres Conf 20130918Document7 pagesFomc Pres Conf 20130918helmuthNo ratings yet

- Monetary 20240501 A 1Document4 pagesMonetary 20240501 A 1gustavo.kahilNo ratings yet

- FOMCpresconf 20230920Document4 pagesFOMCpresconf 20230920KHAIRULNo ratings yet

- Fed Statement June 2009Document2 pagesFed Statement June 2009andrewbloggerNo ratings yet

- FOMCpresconf 20210922Document26 pagesFOMCpresconf 20210922marcoNo ratings yet

- PowellDocument4 pagesPowellandre.torresNo ratings yet

- Comptabilité Tle G3 Et G2Document24 pagesComptabilité Tle G3 Et G2albertvalk2.0No ratings yet

- 2018.09.26 FED Press ReleaseDocument1 page2018.09.26 FED Press ReleaseTREND_7425No ratings yet

- Fed Redline FebruaryDocument2 pagesFed Redline FebruaryPradeep SolankiNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- Press ReleaseDocument2 pagesPress Releaseapi-26018528No ratings yet

- Conférence de Presse BCE JanvierDocument2 pagesConférence de Presse BCE JanvierToroloNo ratings yet

- FOMCpresconf20240501Document26 pagesFOMCpresconf20240501David SimõesNo ratings yet

- Monetary 20230614 A 1Document4 pagesMonetary 20230614 A 1Jhony SmithYTNo ratings yet

- FOMCpresconf 20230503Document25 pagesFOMCpresconf 20230503Edi SaputraNo ratings yet

- Fomc Statements - Side-By-sideDocument2 pagesFomc Statements - Side-By-sideurbanovNo ratings yet

- Fomc Pres Conf 20230614Document26 pagesFomc Pres Conf 20230614LAKHAN TRIVEDINo ratings yet

- FOMCpresconf 20230614Document5 pagesFOMCpresconf 20230614Jhony SmithYTNo ratings yet

- resconfDocument4 pagesresconfgothurded24No ratings yet

- Monetary 20230201 A 1Document4 pagesMonetary 20230201 A 1tamhid nahianNo ratings yet

- Federal Reserve: Unconventional Monetary Policy Options: Marc LabonteDocument37 pagesFederal Reserve: Unconventional Monetary Policy Options: Marc Labonterichardck61No ratings yet

- Monetary Policy Summary: Publication Date: 3 August 2017Document3 pagesMonetary Policy Summary: Publication Date: 3 August 2017TraderNo ratings yet

- Jerome Powell's Written TestimonyDocument5 pagesJerome Powell's Written TestimonyTim MooreNo ratings yet

- Summer Training ReportDocument76 pagesSummer Training ReportRibhanshu RajNo ratings yet

- Intro To Mathematical Finance Part I: Lecture 1: 1.1: The One-Period Binomial ModelDocument21 pagesIntro To Mathematical Finance Part I: Lecture 1: 1.1: The One-Period Binomial ModelSoham KumarNo ratings yet

- Bonds PayableDocument52 pagesBonds PayableJohn Charles Andaya100% (2)

- Account Statement 4000Document1 pageAccount Statement 4000ebmk oeibNo ratings yet

- Cmd. 00427991823303 Cmd. 00427991823303 Cmd. 00427991823303 Cmd. 00427991823303Document1 pageCmd. 00427991823303 Cmd. 00427991823303 Cmd. 00427991823303 Cmd. 00427991823303irfanNo ratings yet

- Wichita Old Town Warren Theatre LLC Term LoanDocument2 pagesWichita Old Town Warren Theatre LLC Term LoanBob WeeksNo ratings yet

- What Is International TradeDocument2 pagesWhat Is International Tradeeknath2000No ratings yet

- BRMDocument69 pagesBRMpatesweetu1No ratings yet

- Scam 1992 - A Web Series On Harshad Mehta ScamDocument2 pagesScam 1992 - A Web Series On Harshad Mehta ScamAavish GuptaNo ratings yet

- Negotiable Instrument (Discharge of Instrument)Document15 pagesNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- Telus 40042789 2023 03 25Document10 pagesTelus 40042789 2023 03 25Harold KumarNo ratings yet

- Soa300822Document1 pageSoa300822Sandy SavitraNo ratings yet

- Understanding Investment - Class 6 PDFDocument4 pagesUnderstanding Investment - Class 6 PDFDebabrattaNo ratings yet

- Cash and CequizDocument5 pagesCash and CequizMaria Emarla Grace CanozaNo ratings yet

- Rip-Off by The Federal Reserve (Revised)Document13 pagesRip-Off by The Federal Reserve (Revised)Oldereb100% (2)

- Financial InstrumentsDocument93 pagesFinancial InstrumentsLuisa Janelle BoquirenNo ratings yet

- BUDGET AT A GLANCE Full PDFDocument440 pagesBUDGET AT A GLANCE Full PDFTamilnadu KaatumanarkovilNo ratings yet

- Account Statement As of 05-06-2020 12:14:26 GMT +0530Document9 pagesAccount Statement As of 05-06-2020 12:14:26 GMT +0530Arun VeeraniNo ratings yet

- Discounted Cash Flow Valuation PDFDocument130 pagesDiscounted Cash Flow Valuation PDFayca_No ratings yet

- Sap Fi/Co: Transaction CodesDocument51 pagesSap Fi/Co: Transaction CodesReddaveni NagarajuNo ratings yet

- 158 634353431366610342 New Test 2Document14 pages158 634353431366610342 New Test 2Mara Shaira SiegaNo ratings yet

- Basic Finance Prelim Q1Document5 pagesBasic Finance Prelim Q1Michelle EsperalNo ratings yet

- NGN ArbitrageDocument4 pagesNGN Arbitragewraje01No ratings yet

- Cottco H1 2016 ResultsDocument2 pagesCottco H1 2016 ResultsaddyNo ratings yet

- Character, Ability, Margin, Purpose, Amount, Repayment, Insurance/Security or FiveDocument7 pagesCharacter, Ability, Margin, Purpose, Amount, Repayment, Insurance/Security or FiveRuohui ChenNo ratings yet

- PGBP NotesDocument24 pagesPGBP NotesYogesh Aggarwal100% (2)

- Americandownload b2 Extra Tasks and KeyDocument12 pagesAmericandownload b2 Extra Tasks and Keyangelos1apostolidisNo ratings yet