Professional Documents

Culture Documents

Deferred Tax and Business Combinations: IFRS 3/IAS 12

Deferred Tax and Business Combinations: IFRS 3/IAS 12

Uploaded by

direhitCopyright:

Available Formats

You might also like

- SAICA Trainee Induction 2 - Assessment Process - Slides - Jan 202 4Document80 pagesSAICA Trainee Induction 2 - Assessment Process - Slides - Jan 202 4htaljaard90No ratings yet

- Credit Pitch Overview - SampleDocument15 pagesCredit Pitch Overview - SampleChintu KumarNo ratings yet

- An Investment MemoDocument3 pagesAn Investment MemoIlyass El-MansouryNo ratings yet

- Scrum Master Interview QuestionsDocument93 pagesScrum Master Interview QuestionsTanmoy Das100% (11)

- Should The General Manager Be FiredDocument10 pagesShould The General Manager Be FiredAbdul MohidNo ratings yet

- ICMR Center For Management Research: The Fall of Arthur Andersen: Organizational Culture IssuesDocument12 pagesICMR Center For Management Research: The Fall of Arthur Andersen: Organizational Culture Issuesteddy henrietteNo ratings yet

- Practive LBO StepsDocument19 pagesPractive LBO Stepszzduble1100% (1)

- 12 Things Not To Do in M&ADocument15 pages12 Things Not To Do in M&Aflorinj72No ratings yet

- Anatomy of A Private Equity Fund StartupDocument5 pagesAnatomy of A Private Equity Fund StartupTarek Osman100% (1)

- Factors Determining The Performance of Early Stage High-Technology Venture Capital Funds - A Review of The Academic LiteratureDocument67 pagesFactors Determining The Performance of Early Stage High-Technology Venture Capital Funds - A Review of The Academic LiteraturedmaproiectNo ratings yet

- Disposal of Subsidiary PDFDocument9 pagesDisposal of Subsidiary PDFCourage KanyonganiseNo ratings yet

- Negotiated Acquisitions of Companies Subsidiaries and Divisions CH 11 + 12Document82 pagesNegotiated Acquisitions of Companies Subsidiaries and Divisions CH 11 + 12Tinn ApNo ratings yet

- Real-Time Data Analytics Case StudiesDocument37 pagesReal-Time Data Analytics Case StudiesHarrison HayesNo ratings yet

- Outline Trim MbaDocument28 pagesOutline Trim Mbakaran_girotra_1No ratings yet

- Deferred Tax IAS 12 by CPA Dr. Peter NjugunaDocument53 pagesDeferred Tax IAS 12 by CPA Dr. Peter Njugunafmsalehin9406No ratings yet

- Equity Analysis and DCF Cashflow GuideDocument22 pagesEquity Analysis and DCF Cashflow GuideChristopher GuidryNo ratings yet

- M&a PpaDocument41 pagesM&a PpaAnna LinNo ratings yet

- SBIC Program OverviewDocument26 pagesSBIC Program OverviewAnibal WadihNo ratings yet

- Mastering Revenue Growth in M&ADocument7 pagesMastering Revenue Growth in M&ASky YimNo ratings yet

- LBO ModellingDocument22 pagesLBO ModellingRoshan PriyadarshiNo ratings yet

- EBITDA On Steroids - Private Equity InternationalDocument8 pagesEBITDA On Steroids - Private Equity InternationalAlexandreLegaNo ratings yet

- Business Combinations - PPADocument83 pagesBusiness Combinations - PPAAna SerbanNo ratings yet

- PitchBook US Institutional Investors 2016 PE VC Allocations ReportDocument14 pagesPitchBook US Institutional Investors 2016 PE VC Allocations ReportJoJo GunnellNo ratings yet

- Should-Cost Modelling: Using Monte-Carlo Simulation in Excel (With Templates)Document18 pagesShould-Cost Modelling: Using Monte-Carlo Simulation in Excel (With Templates)Roque gonzales mera100% (1)

- Valuation Wha You Need To KnowDocument3 pagesValuation Wha You Need To KnowVarenka RodriguezNo ratings yet

- The Handbook of Financing GrowthDocument6 pagesThe Handbook of Financing GrowthJeahMaureenDominguezNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Private Equity Portfolio Company FeesDocument78 pagesPrivate Equity Portfolio Company Feesed_nycNo ratings yet

- The Ultimate SaaS LTV Cheat SheetDocument2 pagesThe Ultimate SaaS LTV Cheat SheetSangram PatilNo ratings yet

- A16Z - 16 More Startup MetricsDocument20 pagesA16Z - 16 More Startup MetricsPegase15100% (1)

- Common Errors in DCF ModelsDocument12 pagesCommon Errors in DCF Modelsrslamba1100% (2)

- Buffett On ValuationDocument7 pagesBuffett On ValuationAyush AggarwalNo ratings yet

- How Much Money Does Your New Venture NeedDocument10 pagesHow Much Money Does Your New Venture NeedFabiana Elena AparicioNo ratings yet

- Preparing Your Company For A Liquidity EventDocument14 pagesPreparing Your Company For A Liquidity EventTawfeegNo ratings yet

- Strategic Buyers Vs Private EquityDocument20 pagesStrategic Buyers Vs Private EquityGaboNo ratings yet

- Why Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock MarketDocument8 pagesWhy Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock Marketpjs15No ratings yet

- Private Equity PDFDocument8 pagesPrivate Equity PDFKartik ChaudhryNo ratings yet

- Asset Deals, Share DealsDocument49 pagesAsset Deals, Share DealsAnna LinNo ratings yet

- Framing Global DealsDocument35 pagesFraming Global DealsLeonel Konga100% (1)

- A GUIDE FOR RAISING VC MONEY - Tanzania Private SectorDocument28 pagesA GUIDE FOR RAISING VC MONEY - Tanzania Private SectorJoel CharlesNo ratings yet

- Practitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeDocument23 pagesPractitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeAli Gokhan KocanNo ratings yet

- Regulatory Framework of M&ADocument5 pagesRegulatory Framework of M&ARaghuramNo ratings yet

- Venture Capital ProjectDocument102 pagesVenture Capital ProjectAliya KhanNo ratings yet

- Tech Private Equity Demystified: February 2022Document16 pagesTech Private Equity Demystified: February 2022adamzane133No ratings yet

- Wedbush Software Security Quarterly Q1 24Document46 pagesWedbush Software Security Quarterly Q1 24A RNo ratings yet

- Preqin Compensation and Employment Outlook Private Equity December 2011Document9 pagesPreqin Compensation and Employment Outlook Private Equity December 2011klaushanNo ratings yet

- Private Equity Part 1 - LongDocument45 pagesPrivate Equity Part 1 - LongLinh Linh NguyễnNo ratings yet

- ARK Invest Thematic Investment ProcessDocument6 pagesARK Invest Thematic Investment ProcessDarriall PortilloNo ratings yet

- Troubled Company: H L H & ZDocument54 pagesTroubled Company: H L H & Zstatuskuota100% (1)

- Banker BlueprintDocument58 pagesBanker BlueprintGeorge TheocharisNo ratings yet

- Fund ManagementDocument12 pagesFund ManagementstabrezhassanNo ratings yet

- Private Equity and Pricing Value CreationDocument12 pagesPrivate Equity and Pricing Value CreationANUSHKA GOYALNo ratings yet

- 6 Unit 8 Corporate RestructureDocument19 pages6 Unit 8 Corporate RestructureAnuska JayswalNo ratings yet

- Case29trx 130826040031 Phpapp02Document14 pagesCase29trx 130826040031 Phpapp02Vikash GoelNo ratings yet

- Chapter7DistressedDebtInvestments Rev2a HKBComments 08-02-14 SGMReplyDocument40 pagesChapter7DistressedDebtInvestments Rev2a HKBComments 08-02-14 SGMReplyJamesThoNo ratings yet

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- Mastering Illiquidity: Risk management for portfolios of limited partnership fundsFrom EverandMastering Illiquidity: Risk management for portfolios of limited partnership fundsNo ratings yet

- Wealth Management in the New Economy: Investor Strategies for Growing, Protecting and Transferring WealthFrom EverandWealth Management in the New Economy: Investor Strategies for Growing, Protecting and Transferring WealthNo ratings yet

- Valuation for M&A: Building and Measuring Private Company ValueFrom EverandValuation for M&A: Building and Measuring Private Company ValueNo ratings yet

- Acca AfmDocument61 pagesAcca AfmBhavya HandaNo ratings yet

- Corbal Brand StoreDocument3 pagesCorbal Brand StoreYrishinadh ACCANo ratings yet

- 21-1361558 City of Warren - Forensic Accounting REPORTDocument16 pages21-1361558 City of Warren - Forensic Accounting REPORTdaneNo ratings yet

- Mini Project - Docx - 5 - 6 - 920230228112814Document3 pagesMini Project - Docx - 5 - 6 - 920230228112814RAHUL DUTTANo ratings yet

- AMTE 324 Topic 2Document25 pagesAMTE 324 Topic 2Kim RioverosNo ratings yet

- 16d. SOP For IPR CompressedDocument29 pages16d. SOP For IPR CompressedHappy TVNo ratings yet

- Repayment of Term/Fixed Deposits in BanksDocument2 pagesRepayment of Term/Fixed Deposits in BanksMohammad Sazid AlamNo ratings yet

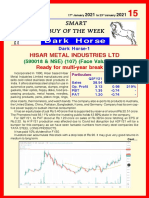

- Dark Horse-3Document2 pagesDark Horse-3kavin photosNo ratings yet

- Equity Analysis Primer WhartonDocument37 pagesEquity Analysis Primer Whartonjiazhi93No ratings yet

- Final Project On Religare SecuritiesDocument49 pagesFinal Project On Religare SecuritiesShivam MisraNo ratings yet

- Thesis On Marketing Strategy of AirtelDocument7 pagesThesis On Marketing Strategy of Airtellucynaderfortwayne100% (2)

- RitikaDocument73 pagesRitikahanshikagupta6No ratings yet

- Redefining HR Using People Analytics The Case of GoogleDocument6 pagesRedefining HR Using People Analytics The Case of Googlerodrigo.igo12No ratings yet

- MT760 - GOLD FCO Liberty Local Miners LTD - MT 760 (5 - 10 MT)Document8 pagesMT760 - GOLD FCO Liberty Local Miners LTD - MT 760 (5 - 10 MT)Inverplay CorpNo ratings yet

- Project Management For ManagersDocument186 pagesProject Management For ManagersbanismNo ratings yet

- Jarir InvoiceDocument1 pageJarir Invoiceahmadr940No ratings yet

- India and China: A Special Economic Analysis: New Tigers of AsiaDocument60 pagesIndia and China: A Special Economic Analysis: New Tigers of AsiaLiang WangNo ratings yet

- Industrial Management PDFDocument2 pagesIndustrial Management PDFSAKSHI0% (1)

- T24 CustomerDocument28 pagesT24 CustomerMahmoud Shoman75% (4)

- Group 13 Excel AssignmentDocument6 pagesGroup 13 Excel AssignmentNimmy MathewNo ratings yet

- Concurrent Audit References 28-12-2012Document12 pagesConcurrent Audit References 28-12-2012Sj RaoNo ratings yet

- Matriz FodaDocument3 pagesMatriz FodaAloonne ParkerNo ratings yet

- Solved For Many Years MR K The President of KJ IncDocument1 pageSolved For Many Years MR K The President of KJ IncAnbu jaromiaNo ratings yet

- Features of Modular Production System AreDocument2 pagesFeatures of Modular Production System AreDrBollapu SudarshanNo ratings yet

- Ebook Dont Be Afraid of The Big Bad WolfDocument9 pagesEbook Dont Be Afraid of The Big Bad WolfGiridhar KuppalaNo ratings yet

- Gartner MQ 2013 - Sourcing SuitesDocument53 pagesGartner MQ 2013 - Sourcing SuitesJawad ShahzadNo ratings yet

- F5 Mapit Workbook Questions PDFDocument88 pagesF5 Mapit Workbook Questions PDFalvin1deosaranNo ratings yet

- SW Vendor Evaluation Matrix TemplateDocument4 pagesSW Vendor Evaluation Matrix TemplateDavid TingNo ratings yet

Deferred Tax and Business Combinations: IFRS 3/IAS 12

Deferred Tax and Business Combinations: IFRS 3/IAS 12

Uploaded by

direhitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deferred Tax and Business Combinations: IFRS 3/IAS 12

Deferred Tax and Business Combinations: IFRS 3/IAS 12

Uploaded by

direhitCopyright:

Available Formats

pwc.

com/ifrs

Practical guide to IFRS

Deferred Tax and Business Combinations:

IFRS 3/IAS 12

At a glance

The calculation of deferred tax can be one of the most complex areas of accounting in a

business combination. The acquirer should recognise and measure deferred tax in

accordance with IAS 12.

Contents

At a glance

Deferred tax The basics

Process overview

Step 1

Step 2

Step 3

Step 4

Tax in the financial statements comprises current and deferred tax. Current tax is

based largely on the amounts included in the tax return. These might bear little

resemblance to the amounts in the financial statements. Tax laws and accounting

standards often require that income, expenditure, assets and liabilities are recognised

and measured differently. For example, expenditure accrued in the financial

statements might only be tax deductible when paid in the future. Deferred tax

accounting addresses these differences.

Step 5

10

Outside basis

difference

13

Deferred tax accounting compares the amount recorded in the financial statements

(the book base) with the amount attributable to that asset or liability for tax purposes

(the tax base). The tax base is established by individual territory tax rules. However,

the principles and the process used to recognise and measure deferred tax assets and

deferred tax liabilities in acquisition accounting are the same, no matter where the

acquisition occurs. This guide goes through the process, step by step, of determining

deferred tax in a business combination.

Business combinations could involve the acquisition of different types of enterprise.

Some enterprises (such as limited liability partnerships) do not pay tax directly, and

the profits are taxable in the hands of the investor. These are known as tax

transparent entities. This guide focuses on the acquisitions of corporations that are

taxable entities.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Process overview

The process to be followed in acquisition accounting is:

Step 1

Transaction

Taxable

Non-taxable

Step 2

Temporary

Differences

Step 3

Tax Benefits

Step 4

Measure &

Recognise

Deferred

Tax

Step 5

Election

Calculate

Goodwill

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Step 1: Identify the type of transaction.

Determine whether the transaction is non-taxable (where the acquirer purchases the

shares of an entity) or taxable (where the acquirer purchases the individual assets and

liabilities). This usually has an impact on the tax base in step 2.

Step 1A: Initial purchase price allocation.

All assets acquired and liabilities assumed should be recognised and measured at the

acquisition date in accordance with IFRS 3. This is done before considering the

deferred tax consequences in step 2 onwards.

Step 2: Calculate the temporary differences on identifiable assets and

liabilities at the date of acquisition.

Identify the tax base of all assets and liabilities recognised in acquisition accounting

and compare this with the book base of those assets and liabilities at the acquisition

date. Determine whether the resulting temporary differences are deductible temporary

differences or taxable temporary differences.

Step 3: Identify any additional tax benefits.

Identify any additional tax attributes that arise from the acquisition (for example, the

acquirees tax loss, tax credit, or other carry-forwards). Determine whether a deferred

tax asset can be recognised.

Step 4: Measure all temporary differences and recognise deferred tax

assets and liabilities.

Measure temporary differences and tax attributes identified in steps 2 and 3, and

recognise deferred tax assets or deferred tax liabilities. [IFRS 3 para 24]. Deferred

tax assets and deferred tax liabilities are measured at the tax rates that are expected to

apply to the period when the asset is realised or the liability is settled.

Step 5: Calculate and recognise goodwill.

Calculate goodwill, including the deferred tax assets and deferred tax liabilities

recognised in step 4, as part of the identifiable net assets at the acquisition date. A

deferred tax liability arising from the initial recognition of goodwill is not recognised. A

deferred tax asset is recognised for excess tax-deductible goodwill, subject to the usual

recognition criteria.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Step 1: Type of transaction

An acquirer could either buy the share capital of an entity or buy the entitys

identifiable assets and liabilities directly. The structure of the transaction will have an

impact on the tax base of those assets and liabilities.

Taxable transactions (assets and liabilities)

A taxable transaction arises where an acquirer purchases the assets and liabilities

directly. The seller typically pays tax on the sale of the assets. The acquirer typically

obtains tax basis equal to the price paid for the acquired assets and liabilities. Where

the acquisition price exceeds the aggregate fair value of identifiable assets acquired and

liabilities assumed, the excess is often treated as goodwill for tax purposes. The

goodwill might or might not be tax deductible.

Non-taxable transactions (shares)

A non-taxable transaction arises where an acquirer purchases the shares of an entity.

The selling shareholders typically pay tax on any gain on the sale of their shares, and

the acquirer typically obtains tax basis for the cost of the shares. The tax base of the

identifiable assets and liabilities of the acquired entity typically passes over to the

acquirer at pre-acquisition amounts, and no new tax goodwill is created. Any tax

goodwill of the acquiree that arose in a previous acquisition might carry over and will

be considered in determining temporary differences.

Some jurisdictions, such as the US, provide an option to elect to treat the acquisition of

shares as a taxable transaction.

Step 2: Temporary differences

A temporary difference is the difference between the carrying amount of an asset or

liability in the statement of financial position (its book base) and the amount that is

attributable to that asset or liability for tax purposes (its tax base). Tax laws differ by

jurisdiction; so, each acquired entity and each tax jurisdiction should be evaluated

separately to determine the tax base of the acquired assets and assumed liabilities.

Temporary differences typically arise from the following in a business combination:

remeasurement at fair value in accordance with IFRS 3;

recognition of previously unrecognised assets and liabilities; and

manner of recovery of the specific asset or liability.

Remeasurement of fair value in accordance with IFRS 3

IFRS 3 requires almost all of the acquirees identifiable assets and liabilities to be

recognised at their fair value at the acquisition date. The tax base depends on the type

of transaction identified in step 1.

Tax base in a taxable transaction

The tax base in a taxable transaction is likely to be the fair value of the individual assets

and liabilities according to the local tax law. This often means that no temporary

differences arise at the acquisition date, other than those that arise from goodwill.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Tax base in a non-taxable transaction

The tax base of individual assets and liabilities in a non-taxable transaction is likely to

stay the same as the acquirees pre-acquisition tax base. Remeasurement to acquisition

date fair value will create an additional temporary difference.

Example 1

Company X acquires Company Y. Company Y has an asset recorded in its financial

statements with the following values:

Carrying amount CU120

Tax base CU80

Fair value at acquisition CU150

Question: How would the deferred taxes related to that asset be recorded in a taxable

and non-taxable business combination?

Answer:

The asset would be recorded at its fair value of CU150 on the acquisition date (book

base). The old tax base is likely to carry over (CU80) in a non-taxable transaction. The

tax base is likely to be the fair value (CU150) in a taxable transaction.

This is illustrated in the table:

Non-Taxable Transaction

Book Base

Tax Base

Temporary Difference

150

80

70

150

Taxable Transaction

150

Previously unrecognised assets and liabilities (non-taxable transaction)

An acquirer might also recognise assets and liabilities that were not recognised by the

acquiree in its financial statements prior to the acquisition date. This can result in the

recognition of intangible assets in a business combination, such as a brand name, inprocess R&D or customer relationships. [IFRS 3 para 13]. Likewise, contingent

liabilities will be recognised in a business combination.

The intangible is recognised at fair value at the acquisition date (the book base). No tax

deduction is typically allowed through amortisation or on sale of the asset; this is

because the acquiree did not purchase the asset. So the tax base is nil. This results in a

temporary difference that should be recognised in acquisition accounting.

The temporary difference will decrease over time if the intangible is amortised in the

financial statements. The temporary difference will remain until the intangible is

impaired, or until it is sold if the intangible has an indefinite life.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Example 2

A customer relationship is identified on the acquisition date and recognised at fair

value of CU1,300. The tax basis of the intangible asset is zero, because no deduction is

allowed in the tax jurisdiction. The tax rate is 40%.

Question: What is the deferred tax effect of recognising the intangible asset?

Answer:

The customer relationship creates an additional temporary difference equal to the fair

value of the intangible at the acquisition date. The following entry is recorded at the

acquisition date:

Dr

Intangible asset

CU1,300

Cr

Deferred tax liability

CU250

Cr

Goodwill

CU780

The temporary difference deferred tax liability should be adjusted in subsequent

periods for amortisation if the intangible has a definite useful life.

The same principle applies to the recognition of contingent liabilities: a contingent

liability is recognised at fair value at the acquisition date in accordance with IFRS 3.

Contingent liabilities are not generally recognised for tax purposes until the amounts

are fixed and reasonably determinable or, in some jurisdictions, until they are paid.

These items have no tax basis on the acquisition date, and the difference between the

fair value recognised in the financial statements and the tax base of nil results in a

temporary difference and a deferred tax asset in acquisition accounting.

Example 3

Assume a contingent liability is recorded at fair value of CU1,000 on the date of

acquisition in a non-taxable business combination. The tax basis of the contingent

liability is zero. When the liability is settled, the entity will receive a tax deduction for

the amount paid. The tax rate is 40%.

Question: What is the deferred tax effect of recognising the contingent liability?

Answer:

The contingent liability creates a temporary difference at the acquisition date, because

it has a zero tax basis and will result in a tax deduction when it is settled. The following

entry is recorded at the acquisition date:

Dr

Deferred tax asset

CU400

Dr

Goodwill

CU600

Cr

Contingent liability

CU1,000

The temporary difference deferred tax asset should be adjusted in subsequent periods

as the amount of the contingent liability changes.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Previously unrecognised assets and liabilities (taxable transaction)

The accounting for contingent liabilities in a taxable transaction is more complicated,

and depends on whether and how settlement of the liability will be deductible under

the local tax rules.

There are two approaches to accounting for this temporary difference:

1.

The tax basis of the goodwill is adjusted by the amount recorded for the

contingency where settlement of the contingent liability would result in taxdeductible goodwill.

2. The contingency is treated as a separate tax-deductible item if it will be deducted

separately when paid. A deferred tax asset is recorded in acquisition accounting,

because the liability (when settled) will result in a future tax deduction.

Manner of recovery

The way in which an asset is going to be used can affect its tax base. The carrying

amount of an asset might be recovered through use, sale, or both. The tax

consequences of using an asset are sometimes different from the consequences of

selling the asset, and this might directly affect the tax that would be payable in the

future. Assets might sometimes be revalued or indexed to inflation for tax purposes

only if the asset is sold (that is, the tax basis is increased for the purpose of determining

capital gain income but not regular income). The expected manner of recovery is

considered to determine the future tax consequences and corresponding deferred taxes

in acquisition accounting.

Example 4

An item of plant, property and equipment is recorded at fair value of CU10m at the

acquisition date. It will be depreciated over 10 years. Accounting depreciation is not

deductible for tax purposes. If the plant is used in the business for its full 10-year life, it

will be fully consumed and will have to be scrapped. No tax deductions will be available

for scrapping the asset. If the asset is sold, the cost of the asset of CU8m is deductible

on sale. The tax rate is 40% and is not affected by the manner of recovery.

Question: What is the impact of the manner of recovery on the tax base of the asset?

Answer:

Management needs to consider how it expects to recover the assets carrying amount to

determine the tax base. The tax base will be zero if the asset is to be used in the

business. A temporary difference of CU10m arises and a deferred tax liability of CU4m

is recognised. The deferred tax liability is reduced as the asset is depreciated.

The tax base will be CU8m if the asset is to be sold. A temporary difference of CU2m

arises and a deferred tax liability of CU0.8m is recognised. The deferred tax liability is

released when the asset is sold.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Step 3: Tax benefits?

A business combination can result in the recognition of additional tax attributes that

could not be recognised by the acquiree before the acquisition. The acquiree might

have tax losses, tax credits or other carry-forwards that can be used against future

taxable profits of the expanded group.

A deferred tax asset is recorded only if it is probable that sufficient taxable profit will

be available against which deductible temporary differences or other carry-forwards

can be utilised. An acquiree might have tax losses where no deferred tax asset had been

recognised because future profits were not probable. However, those losses might

become available for use by other entities within the group following the acquisition

allowing the recognition criteria to be met.

Sources of taxable profit

It is necessary to consider all available evidence to determine whether a deferred tax

asset is recognised at the date of acquisition.

There are a number of sources of future taxable income that might arise from a

business combination:

the acquirer has sufficient taxable temporary differences that will generate

taxable income;

the acquiree has sufficient taxable temporary differences arising from the

recognition of assets at fair value that will generate taxable income;

the acquirer anticipates that there might be sufficient other income (this could

include profits elsewhere in the group, if these can be offset by the acquirees

losses under the relevant tax laws); or

tax planning opportunities might reduce future expenses or create additional

taxable income.

The recoverability of deferred tax assets is reassessed at each reporting date.

Subsequent changes in deferred tax assets are not recognised in

acquisition accounting.

What about the acquirers benefits?

The acquirer might also have unused tax losses for which a deferred tax asset can be

recognised as a result of the business combination. This is a transaction of the acquirer,

and so it is recognised outside acquisition accounting.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Step 4: Measure and recognise

Steps 2 and 3 identify the temporary differences. These are measured, and the resulting

deferred tax assets and liabilities are recognised in step 4. There are two types of

temporary difference: a temporary taxable difference is a difference that will give rise

to future taxable income, and therefore a deferred tax liability; and a deductible

temporary difference gives rise to a future tax deduction, and therefore a deferred

tax asset.

Deferred tax assets and deferred tax liabilities are recognised for substantially all

temporary differences and acquired tax loss and credit carry-forwards, subject to the

usual recognition criteria.

There are two exceptions:

1. temporary differences for goodwill that is not tax deductible, and

2. the difference between the carrying amount of the subsidiarys net assets in the

consolidated financial statements and the parents tax basis in the shares of the

subsidiary (see the section on outside basis difference below). [IAS 12 paras 19,

39; IFRS 3 paras 24, 25].

What tax rate should be used?

All temporary differences identified are measured using the tax rates that are expected

to apply in the period when the asset will be realised or the liability settled.

An acquirer should consider the effects of the business combination to determine the

applicable tax rate for each jurisdiction (and, in some cases, for individual

temporary differences).

The applicable rate is determined based on enacted or substantially enacted tax rates,

even if the parties considered apparent or expected changes in tax rates in their

negotiations. The applicable tax rate(s) used to measure deferred taxes should be

determined based on the relevant rate(s) in the jurisdictions where the acquired assets

are recovered and the assumed liabilities are settled. This is usually the

acquirees rates.

The manner of recovery (see step 2 for more detail) of an asset can also affect the tax

rate (for example, some jurisdictions will have one rate for capital gains and a different

rate for income tax). The manner of recovery or settlement of each of the assets and

liabilities is identified before the applicable rate is determined.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

pwc.com/ifrs

Step 5: Calculate goodwill

Deferred tax assets and deferred tax liabilities recognised in step 4 form part of the

total identifiable net assets of the acquiree used to calculate goodwill.

Example 5

On 1 January 20X5, entity H acquired all the share capital of entity S for CU1,500,000.

The fair values of the identifiable assets and liabilities of entity S at the date of

acquisition are set out below, together with their tax bases in entity S's tax

jurisdictions. Any goodwill arising on the acquisition is not deductible for tax purposes.

The tax rates in entity H's and entity S's tax jurisdictions are 30% and 40%

respectively.

Net assets acquired

Book Base

(FV)

Tax

Base

Temporary

Difference

Land and buildings

700

500

200

Property, plant and equipment

270

200

70

80

100

(20)

Accounts receivable

150

150

Cash

130

130

Total Assets

1,330

1,080

250

Accounts payable

(160)

(160)

Retirement benefit obligations

(100)

Net assets before deferred tax liability

1,070

Inventory

100

920

150

Question: What amount of deferred tax and goodwill is recorded on acquisition?

Answer:

A taxable temporary difference arises of CU150, which is the difference between the

fair value (CU1,070) of the assets and liabilities acquired and their tax base (CU920).

This results in the recognition of a net deferred tax liability on acquisition of entity S of

CU60 (CU150 @ 40%)

The fair value of the identifiable assets and liabilities at the acquisition date is now

CU1,010 (CU1,070 CU60), resulting in goodwill of CU490:

Purchase consideration

Fair values of entity S's identifiable assets and liabilities (1070-60)

Goodwill arising on acquisition

1,500

(1,010)

490

The deferred tax on other temporary differences arising on acquisition is provided at

40% (not 30%), because taxes will be payable or recoverable in entity S's tax

jurisdictions when the temporary differences are reversed. No deferred tax is

recognised on the goodwill, even though it is not tax deductible.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

10

pwc.com/ifrs

Goodwill is sometimes tax deductible, usually through an annual amortisation (or

equivalent) deduction or a deduction when the associated business is subsequently

sold, reducing the taxable gain on sale.

A temporary difference could arise on tax-deductible goodwill. This usually

arises from:

the tax and accounting rules differing on the amount of consideration;

different valuations of assets and liabilities; or

the amounts being allocated differently (impairment vs amortisation).

The deductibility of goodwill

A temporary difference could arise initially (that is, at acquisition) or subsequently. IAS

12 sets out the circumstances in which temporary differences arising from goodwill can

be recognised. To help with this, goodwill is split in two components (components 1

and 2) under US GAAP. The same principle is applied under IFRS, although there is no

specific guidance. The concept of component 1 and component 2 goodwill can be

helpful when calculating the deferred tax impact of goodwill. Component 1 is the

element of book base and the element of the tax base that are equal. An excess that

leads to a temporary difference is called component 2. Component 2 arises from either

the book base or the tax value being higher. This is illustrated in the following diagram:

Initial recognition

The initial recognition of a temporary difference depends on whether component 2

goodwill arises from the book value or the tax value.

A temporary taxable difference arises if the book value is higher than the tax base. IAS

12 does not allow a deferred tax liability to be recognised on the initial recognition of

goodwill. This is because a deferred tax liability would reduce the fair value of

identifiable assets and increase book goodwill. The overall impact is to gross up

goodwill, which does not provide useful information.

A deductible temporary difference arises if the tax base is higher than the book base. A

deferred tax asset is recognised if the recognition criteria are met (that is, realisation

will depend on available future taxable profit).

A deferred tax asset complicates the calculation of goodwill. The additional asset

increases the net assets acquired, which reduces the book base of goodwill in the

financial statements, leading to a larger temporary difference. To solve this issue, an

iterative formula is used to determine goodwill and the deferred tax asset:

(tax rate/(1 tax rate)) preliminary temporary difference (PTD) = deferred tax asset

This formula sometimes needs to be adjusted, and it cannot always be used in more

complex business combinations (for example, where there is not a single tax rate or

there is a gain in bargain purchase). Where this is the case, we would advise

consultation.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

11

pwc.com/ifrs

Example 6

A taxable acquisition results in initial book goodwill of CU450. A separate

determination for taxes results in tax-deductible goodwill of CU600. The difference

between book and tax goodwill is CU150. Assume a tax rate of 40%.

Question: How is the deferred tax asset calculated?

Answer:

Without the iterative formula, the deferred tax asset would be calculated as:

(CU600 CU450) 40% = CU60

The recognition of an additional asset of CU60 would reduce book goodwill to CU390.

There is now a bigger temporary difference of (CU600 CU390) = CU210. This

process continues; so, to simplify the calculation, we use the following formula:

(tax Rate/(1 tax Rate)) x preliminary temporary difference (PTD) = deferred tax asset

(40%/(1 40%)) CU150 = deferred tax asset of CU100

The acquirer records a deferred tax asset for CU100, with a corresponding decrease in

book goodwill. Goodwill for financial reporting purposes is CU350, and a deferred tax

asset of CU100 is recorded. The resulting deferred tax asset reflects the temporary

difference related to goodwill, as illustrated below:

(Tax goodwill book goodwill) 40% = deferred tax asset

(CU600 CU350) 40% = CU100

Subsequent treatment

No deferred tax liability is recorded initially where the carrying amount of goodwill

exceeds the tax base. A deferred tax liability is recognised subsequently if component 1

goodwill changes. No deferred tax liability is recognised for a change in component 2

goodwill (excess).

Example 7

The carrying amount of goodwill is initially CU100 with a tax base of zero. At the end of

year 1, the goodwill is impaired by CU10.

Question: What is the deferred tax effect of the initial and subsequent measurement

of goodwill?

Answer:

The initial taxable temporary difference is CU20, but this cannot be recognised.

The tax base of goodwill has reduced to CU64 (CU80 80%) by the end of year 1, but

the carrying amount remains unchanged. The reduction of CU16 in component 1

goodwill is measured and recognised as a deferred tax liability.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

12

pwc.com/ifrs

Example 8

The carrying amount of goodwill is initially CU100, with a tax base of CU80. A

deduction is allowed for tax purposes at 20% per year. No impairment has occurred in

year 1.

Question: What is the deferred tax effect of the initial and subsequent measurement of

goodwill?

Answer:

The initial taxable temporary difference is CU20, but this cannot be recognised.

The tax base of goodwill has reduced to CU64 (CU80 80%) by the end of year 1, but

the carrying amount remains unchanged. The reduction of CU16 in component 1

goodwill is measured and recognised as a deferred tax liability.

Calculating goodwill was the last step in the process for acquisition accounting. The

purchase price allocation can now be finalised.

Deferred tax impacts other areas of group accounting. The main impact is

discussed below.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

13

pwc.com/ifrs

Outside basis difference

This practical guide has focused on looking inside the entity, comparing the book base

and the tax base of individual assets and liabilities (the inside basis differences).

However, the parents investment in the subsidiary can also give rise to a temporary

difference and deferred tax accounting in a non-taxable transaction; this is called an

outside basis difference. It arises when the carrying amount of the subsidiary in the

consolidated financial statements is different from the tax base, which often relates to

the cost of the investment at the date of acquisition.

Example 9

Entity X acquires 100% of entity Y for CU1,000, which is the tax base of the

investment. The fair value of the identifiable assets and liabilities of entity Y at the

acquisition date were CU800, giving rise to goodwill of CU200.

Question: What is the outside basis difference on the acquisition date?

Answer:

The carrying amount of the investment in entity Y is CU1,000, made up of goodwill of

CU200 and the fair value of the net assets of CU800.

The tax base is the consideration for the investment of CU1,000.

There is no outside basis difference on the acquisition date.

There is often no temporary difference on an outside basis at the acquisition date.

However, some complexities (including contingent consideration and acquisition

costs) can result in the carrying amount being different from the tax base. We would

advise consultation if either of these items arises.

Subsequent treatment

The carrying amount of the investment will change after the acquisition date; for

example, where:

the investee earns profits post acquisition;

the exchange rate changes on a foreign subsidiary; or

the carrying amount of the investment is impaired.

These changes will alter the book basis of the investment, but not the tax basis, and

they could give rise to a temporary difference. IAS 12 provides an exception for

recognising the deferred tax arising on the outside basis difference. The exception is

required if the parent controls the timing of the reversal of the temporary difference,

and it is probable that the temporary difference will not reverse in the

foreseeable future.

This exception applies to all subsidiaries, branches, associates, and interests in joint

ventures under IFRS if the criteria are met.

Subsidiary

The ability to control the reversal is always assumed if the investment is a subsidiary,

because a parentsubsidiary relationship is one of control. Management should then

determine if the subsidiarys profits will be distributed or if the subsidiary will be sold

in the foreseeable future. This will most likely depend on whether there is an intention

either to declare dividends or to sell the subsidiary. Management often concludes that

the subsidiary will continue to re-invest its earnings rather than remit them, but this is

not always the case.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

14

pwc.com/ifrs

Associate

The acquirer has significant influence, but not control, over an associate, and so the

control over timing of the reversal cannot be assumed. The acquirer recognises a

deferred tax liability on the outside basis difference, unless there is an enforceable

agreement that the associates profits will not be distributed in the foreseeable future.

Joint arrangement

The terms of the contractual arrangement between venturers over the distribution of

profits will determine whether deferred tax should be recognised for the temporary

difference arising in connection with a joint arrangement.

Deferred tax asset

The outside tax basis of an investment might exceed the book basis. IAS 12 prohibits

the recognition of a deferred tax asset for an investment in a subsidiary, branch,

associate or joint venture unless the temporary difference will reverse in the

foreseeable future and taxable profit will be available against which the temporary

difference can be utilised.

Where can I find more information?

For more information about deferred tax in business combinations, please also

refer to:

Chapter 13 of the IFRS Manual of Accounting;

Chapter 5 of the Global Guide to Business Combinations; and

US Guide to Accounting for Income Taxes.

This publication has been prepared for general guidance on matters of interest only, and does not constitute

professional advice. You should not act upon the information contained in this publication without obtaining

specific professional advice. No representation or warranty (express or implied) is given as to the accuracy

or completeness of the information contained in this publication, and, to the extent permitted by law,

PricewaterhouseCoopers LLP, its members, employees and agents do not accept or assume any liability,

responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in

reliance on the information contained in this publication or for any decision based on it.

2013 PricewaterhouseCoopers LLP. All rights reserved. In this document, "PwC" refers to the UK member

firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see

www.pwc.com/structure for further details.

PwC: Practical guide to IFRS, Deferred Tax and Business Combinations: IFRS 3/IAS 12

15

You might also like

- SAICA Trainee Induction 2 - Assessment Process - Slides - Jan 202 4Document80 pagesSAICA Trainee Induction 2 - Assessment Process - Slides - Jan 202 4htaljaard90No ratings yet

- Credit Pitch Overview - SampleDocument15 pagesCredit Pitch Overview - SampleChintu KumarNo ratings yet

- An Investment MemoDocument3 pagesAn Investment MemoIlyass El-MansouryNo ratings yet

- Scrum Master Interview QuestionsDocument93 pagesScrum Master Interview QuestionsTanmoy Das100% (11)

- Should The General Manager Be FiredDocument10 pagesShould The General Manager Be FiredAbdul MohidNo ratings yet

- ICMR Center For Management Research: The Fall of Arthur Andersen: Organizational Culture IssuesDocument12 pagesICMR Center For Management Research: The Fall of Arthur Andersen: Organizational Culture Issuesteddy henrietteNo ratings yet

- Practive LBO StepsDocument19 pagesPractive LBO Stepszzduble1100% (1)

- 12 Things Not To Do in M&ADocument15 pages12 Things Not To Do in M&Aflorinj72No ratings yet

- Anatomy of A Private Equity Fund StartupDocument5 pagesAnatomy of A Private Equity Fund StartupTarek Osman100% (1)

- Factors Determining The Performance of Early Stage High-Technology Venture Capital Funds - A Review of The Academic LiteratureDocument67 pagesFactors Determining The Performance of Early Stage High-Technology Venture Capital Funds - A Review of The Academic LiteraturedmaproiectNo ratings yet

- Disposal of Subsidiary PDFDocument9 pagesDisposal of Subsidiary PDFCourage KanyonganiseNo ratings yet

- Negotiated Acquisitions of Companies Subsidiaries and Divisions CH 11 + 12Document82 pagesNegotiated Acquisitions of Companies Subsidiaries and Divisions CH 11 + 12Tinn ApNo ratings yet

- Real-Time Data Analytics Case StudiesDocument37 pagesReal-Time Data Analytics Case StudiesHarrison HayesNo ratings yet

- Outline Trim MbaDocument28 pagesOutline Trim Mbakaran_girotra_1No ratings yet

- Deferred Tax IAS 12 by CPA Dr. Peter NjugunaDocument53 pagesDeferred Tax IAS 12 by CPA Dr. Peter Njugunafmsalehin9406No ratings yet

- Equity Analysis and DCF Cashflow GuideDocument22 pagesEquity Analysis and DCF Cashflow GuideChristopher GuidryNo ratings yet

- M&a PpaDocument41 pagesM&a PpaAnna LinNo ratings yet

- SBIC Program OverviewDocument26 pagesSBIC Program OverviewAnibal WadihNo ratings yet

- Mastering Revenue Growth in M&ADocument7 pagesMastering Revenue Growth in M&ASky YimNo ratings yet

- LBO ModellingDocument22 pagesLBO ModellingRoshan PriyadarshiNo ratings yet

- EBITDA On Steroids - Private Equity InternationalDocument8 pagesEBITDA On Steroids - Private Equity InternationalAlexandreLegaNo ratings yet

- Business Combinations - PPADocument83 pagesBusiness Combinations - PPAAna SerbanNo ratings yet

- PitchBook US Institutional Investors 2016 PE VC Allocations ReportDocument14 pagesPitchBook US Institutional Investors 2016 PE VC Allocations ReportJoJo GunnellNo ratings yet

- Should-Cost Modelling: Using Monte-Carlo Simulation in Excel (With Templates)Document18 pagesShould-Cost Modelling: Using Monte-Carlo Simulation in Excel (With Templates)Roque gonzales mera100% (1)

- Valuation Wha You Need To KnowDocument3 pagesValuation Wha You Need To KnowVarenka RodriguezNo ratings yet

- The Handbook of Financing GrowthDocument6 pagesThe Handbook of Financing GrowthJeahMaureenDominguezNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Private Equity Portfolio Company FeesDocument78 pagesPrivate Equity Portfolio Company Feesed_nycNo ratings yet

- The Ultimate SaaS LTV Cheat SheetDocument2 pagesThe Ultimate SaaS LTV Cheat SheetSangram PatilNo ratings yet

- A16Z - 16 More Startup MetricsDocument20 pagesA16Z - 16 More Startup MetricsPegase15100% (1)

- Common Errors in DCF ModelsDocument12 pagesCommon Errors in DCF Modelsrslamba1100% (2)

- Buffett On ValuationDocument7 pagesBuffett On ValuationAyush AggarwalNo ratings yet

- How Much Money Does Your New Venture NeedDocument10 pagesHow Much Money Does Your New Venture NeedFabiana Elena AparicioNo ratings yet

- Preparing Your Company For A Liquidity EventDocument14 pagesPreparing Your Company For A Liquidity EventTawfeegNo ratings yet

- Strategic Buyers Vs Private EquityDocument20 pagesStrategic Buyers Vs Private EquityGaboNo ratings yet

- Why Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock MarketDocument8 pagesWhy Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock Marketpjs15No ratings yet

- Private Equity PDFDocument8 pagesPrivate Equity PDFKartik ChaudhryNo ratings yet

- Asset Deals, Share DealsDocument49 pagesAsset Deals, Share DealsAnna LinNo ratings yet

- Framing Global DealsDocument35 pagesFraming Global DealsLeonel Konga100% (1)

- A GUIDE FOR RAISING VC MONEY - Tanzania Private SectorDocument28 pagesA GUIDE FOR RAISING VC MONEY - Tanzania Private SectorJoel CharlesNo ratings yet

- Practitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeDocument23 pagesPractitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeAli Gokhan KocanNo ratings yet

- Regulatory Framework of M&ADocument5 pagesRegulatory Framework of M&ARaghuramNo ratings yet

- Venture Capital ProjectDocument102 pagesVenture Capital ProjectAliya KhanNo ratings yet

- Tech Private Equity Demystified: February 2022Document16 pagesTech Private Equity Demystified: February 2022adamzane133No ratings yet

- Wedbush Software Security Quarterly Q1 24Document46 pagesWedbush Software Security Quarterly Q1 24A RNo ratings yet

- Preqin Compensation and Employment Outlook Private Equity December 2011Document9 pagesPreqin Compensation and Employment Outlook Private Equity December 2011klaushanNo ratings yet

- Private Equity Part 1 - LongDocument45 pagesPrivate Equity Part 1 - LongLinh Linh NguyễnNo ratings yet

- ARK Invest Thematic Investment ProcessDocument6 pagesARK Invest Thematic Investment ProcessDarriall PortilloNo ratings yet

- Troubled Company: H L H & ZDocument54 pagesTroubled Company: H L H & Zstatuskuota100% (1)

- Banker BlueprintDocument58 pagesBanker BlueprintGeorge TheocharisNo ratings yet

- Fund ManagementDocument12 pagesFund ManagementstabrezhassanNo ratings yet

- Private Equity and Pricing Value CreationDocument12 pagesPrivate Equity and Pricing Value CreationANUSHKA GOYALNo ratings yet

- 6 Unit 8 Corporate RestructureDocument19 pages6 Unit 8 Corporate RestructureAnuska JayswalNo ratings yet

- Case29trx 130826040031 Phpapp02Document14 pagesCase29trx 130826040031 Phpapp02Vikash GoelNo ratings yet

- Chapter7DistressedDebtInvestments Rev2a HKBComments 08-02-14 SGMReplyDocument40 pagesChapter7DistressedDebtInvestments Rev2a HKBComments 08-02-14 SGMReplyJamesThoNo ratings yet

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- Mastering Illiquidity: Risk management for portfolios of limited partnership fundsFrom EverandMastering Illiquidity: Risk management for portfolios of limited partnership fundsNo ratings yet

- Wealth Management in the New Economy: Investor Strategies for Growing, Protecting and Transferring WealthFrom EverandWealth Management in the New Economy: Investor Strategies for Growing, Protecting and Transferring WealthNo ratings yet

- Valuation for M&A: Building and Measuring Private Company ValueFrom EverandValuation for M&A: Building and Measuring Private Company ValueNo ratings yet

- Acca AfmDocument61 pagesAcca AfmBhavya HandaNo ratings yet

- Corbal Brand StoreDocument3 pagesCorbal Brand StoreYrishinadh ACCANo ratings yet

- 21-1361558 City of Warren - Forensic Accounting REPORTDocument16 pages21-1361558 City of Warren - Forensic Accounting REPORTdaneNo ratings yet

- Mini Project - Docx - 5 - 6 - 920230228112814Document3 pagesMini Project - Docx - 5 - 6 - 920230228112814RAHUL DUTTANo ratings yet

- AMTE 324 Topic 2Document25 pagesAMTE 324 Topic 2Kim RioverosNo ratings yet

- 16d. SOP For IPR CompressedDocument29 pages16d. SOP For IPR CompressedHappy TVNo ratings yet

- Repayment of Term/Fixed Deposits in BanksDocument2 pagesRepayment of Term/Fixed Deposits in BanksMohammad Sazid AlamNo ratings yet

- Dark Horse-3Document2 pagesDark Horse-3kavin photosNo ratings yet

- Equity Analysis Primer WhartonDocument37 pagesEquity Analysis Primer Whartonjiazhi93No ratings yet

- Final Project On Religare SecuritiesDocument49 pagesFinal Project On Religare SecuritiesShivam MisraNo ratings yet

- Thesis On Marketing Strategy of AirtelDocument7 pagesThesis On Marketing Strategy of Airtellucynaderfortwayne100% (2)

- RitikaDocument73 pagesRitikahanshikagupta6No ratings yet

- Redefining HR Using People Analytics The Case of GoogleDocument6 pagesRedefining HR Using People Analytics The Case of Googlerodrigo.igo12No ratings yet

- MT760 - GOLD FCO Liberty Local Miners LTD - MT 760 (5 - 10 MT)Document8 pagesMT760 - GOLD FCO Liberty Local Miners LTD - MT 760 (5 - 10 MT)Inverplay CorpNo ratings yet

- Project Management For ManagersDocument186 pagesProject Management For ManagersbanismNo ratings yet

- Jarir InvoiceDocument1 pageJarir Invoiceahmadr940No ratings yet

- India and China: A Special Economic Analysis: New Tigers of AsiaDocument60 pagesIndia and China: A Special Economic Analysis: New Tigers of AsiaLiang WangNo ratings yet

- Industrial Management PDFDocument2 pagesIndustrial Management PDFSAKSHI0% (1)

- T24 CustomerDocument28 pagesT24 CustomerMahmoud Shoman75% (4)

- Group 13 Excel AssignmentDocument6 pagesGroup 13 Excel AssignmentNimmy MathewNo ratings yet

- Concurrent Audit References 28-12-2012Document12 pagesConcurrent Audit References 28-12-2012Sj RaoNo ratings yet

- Matriz FodaDocument3 pagesMatriz FodaAloonne ParkerNo ratings yet

- Solved For Many Years MR K The President of KJ IncDocument1 pageSolved For Many Years MR K The President of KJ IncAnbu jaromiaNo ratings yet

- Features of Modular Production System AreDocument2 pagesFeatures of Modular Production System AreDrBollapu SudarshanNo ratings yet

- Ebook Dont Be Afraid of The Big Bad WolfDocument9 pagesEbook Dont Be Afraid of The Big Bad WolfGiridhar KuppalaNo ratings yet

- Gartner MQ 2013 - Sourcing SuitesDocument53 pagesGartner MQ 2013 - Sourcing SuitesJawad ShahzadNo ratings yet

- F5 Mapit Workbook Questions PDFDocument88 pagesF5 Mapit Workbook Questions PDFalvin1deosaranNo ratings yet

- SW Vendor Evaluation Matrix TemplateDocument4 pagesSW Vendor Evaluation Matrix TemplateDavid TingNo ratings yet