Professional Documents

Culture Documents

Fundamental and Technical Analysis - Technical Paper

Fundamental and Technical Analysis - Technical Paper

Uploaded by

Gauree AravkarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental and Technical Analysis - Technical Paper

Fundamental and Technical Analysis - Technical Paper

Uploaded by

Gauree AravkarCopyright:

Available Formats

2013

FUNDAMENTAL AND

TECHNICAL ANALYSIS

OF STOCK MARKETS

National Convention for CA Students Mumbai

Technical Session 1 Investment Opportunities

GAURI SHRIPAD ARAVKAR

VIVEK DOSHI & CO

Fundamental and Technical Analysis of Stock Markets

Contents

Stock Valuation Meaning and Methods of Valuation .................................................................... 3

Fundamental Vs. Technical Analysis Birds Eye view ..................................................................... 4

Role of Fundamental and Technical Analysis in Determining Stock Price ....................................... 5

Methodology used in Fundamental Analysis .................................................................................... 6

Methodology used in Technical Analysis .......................................................................................... 7

Balanced Application of both analysis necessary ........................................................................... 13

Case Study: Failure of Analysis in the light of Stock Manipulation ................................................ 14

References ........................................................................................................................................ 16

2|Page

Fundamental and Technical Analysis of Stock Markets

Stock Valuation Meaning and Methods of Valuation

Stock valuation is the method of calculating the theoretical worth of a companys

stock and thus that of the Company. The need of stock valuation arises for

variety of financial decisions few of which are listed below:

1.

2.

3.

4.

5.

6.

Investment Analysis

Capital Budgeting

Merger and Acquisition

Financial Reporting

Determining Tax Liability

Litigation

However, this paper focuses on the valuation of stock markets for facilitating the

investment decisions so as to make maximum profit.

The stock market is like a flea market where people buy & sell pieces of paper

called stock. There are owners of the corporations who want to raise money to

hire more employees, build factories or offices. They raise money by issuing

shares of stock in their corporation. On the other side, there are investors who

buy shares of stock in the corporation. The place both sides meet is the stock

market.

There are two basic methods for determining what stock to buy and sell Fundamental Analysis and Technical Analysis.

3|Page

Fundamental and Technical Analysis of Stock Markets

Fundamental Vs. Technical Analysis Birds Eye view

In a shopping mall, a fundamental analyst would go to each store, study the

product that was being sold, and then decide whether to buy it or not. By

contrast, a technical analyst would sit on a bench in the mall and watch people

go into the stores. Disregarding the intrinsic value of the products in the store,

the technical analyst's decision would be based on the patterns or activity of

people

going

into

each

store.

Fundamental

Analysis

Financial Position

Technical

Analysis

Chart and Trend

Analysis

Dow Theory

Balance Sheet

Financial Performance

Profit & Loss Account

Ratio Analysis

Past Prices and

Volume

Moving Average,

Support and

Resistance,Relative

Strength Index

4|Page

Fundamental and Technical Analysis of Stock Markets

Role of Fundamental and Technical Analysis in Determining

Stock Price

Fundamental analysis as it name signifies analysis of fundamentals of company

and economy analysis. Balance sheet is the back bone of a company. A good

company has strong balance sheet and fundamental analyst try to find the

intrinsic value of company by analyzing the balance sheet, Growth rate, Profit

and loss, Cash flow, Industry analysis and economic analysis. So in nut shell a

good company has high growth rate, low leverage, good management, and Low

P/E ratio compared with peers, Low debt-Equity Ratio.

Fundamental analysis is good for investment but main problem with fundamental

analysis is Difficulty in getting in depth information of company, lot of resource

is required for fundamental analysis and for most investor it is out of their hand,

unavailability of hidden news and difficulty to judge the companys valuation etc.

Here comes the importance of technical analysis.

Technical analyst uses the demand supply theory to judge the price and they

believe past price movement will have an impact on future movement also.

Share price increase or decrease whenever there is a change in fundamental and

it will be reflected in its demand/supply and in turn it will affect the price. So

technical analyst uses historical price/volume to judge the future price

movement of stock. He uses charting software and uses various tools like

moving average, oscillator to find the support level - share price at which there

is demand for share-Buy will occur and resistance level - share price at which

supply will occur-sell happens of share.

5|Page

Fundamental and Technical Analysis of Stock Markets

Methodology used in Fundamental Analysis

Economy

Analysis

Industry

Analysis

Company

Analysis

Economy Indicators

Social Indicators

Investment Scenario

Stock market Analysis

Sovereign Rating

Size and Dynamics

Industry Life Cycle

Demand Drivers

External Factors

Future Outlook

Competitive Position

Distinctive Edge

Segmental Analysis

Financial Analysis

Growth Prospects

6|Page

Fundamental and Technical Analysis of Stock Markets

Methodology used in Technical Analysis

Technical Analysis is based on the following assumptions:

The market discounts everything

Prices move in trends

History tends to repeat itself

Stock prices move in trends that persist for long periods. These trends can

be detected in charts. Thus past trends in market movements can be used

to forecast or understand the future. The lag between the time, a

technical analyst perceives a change in the value of a security and when

the investing public ultimately assesses this change provides a profit

opportunity to the chartist.

Dow Theory

Averages discount everything.

The market has three trends.

Major trend have three phases.

Volume must confirm the trend

This theory was first stated by Charles Dow.

Primary Trend Called the tide by Dow, this is the trend that defines the

long-term direction (up to several years).Secondary Trend Called the

waves by Dow, this is shorter-term departures from the primary trend

(weeks to months)

7|Page

Fundamental and Technical Analysis of Stock Markets

Eliot Wave Theory

Elliot stated that stock market moves in repetitive cycles. The Elliot Wave

Principle is based on a repeating 8-wave cycle, and each cycle is made up of

similar shorter-term cycles. These waves have a rhythmic pattern and these

patterns can be used to predict future prices of stocks and predict trends of the

market. These waves move with investor psychology i.e. waves show an upward

trend when crowd is positive and too much positivity leads to a downward trend

in the wave.

8|Page

Fundamental and Technical Analysis of Stock Markets

Trends

The meaning of trend in finance isn't all that different from the general definition

of the term - a trend is really nothing more than the general direction. A trend

represents a consistent change in prices (i.e. a change in investors

expectations) A trend line is a simple charting technique that adds a line to a

chart to represent the trend in the market or a stock.

Types of Trends

1. Uptrend

2. Downtrend

3. Sideways Trend

9|Page

Fundamental and Technical Analysis of Stock Markets

Support and Resistance

Support level is a price level where the price tends to find support as it is going

down

Resistance level is a price level where the price tends to find resistance as it is

going up

Importance of Support and Resistance Support and resistance analysis is an

important part of trends because it can be used to make trading decisions and

identify when a trend is reversing

Support and Resistance levels Support and Resistance levels are highly volatile

Traders should not buy and sell directly at these points as there may be

breakout also.

10 | P a g e

Fundamental and Technical Analysis of Stock Markets

Breakout

The penetration of support and resistance level is called breakout

Traders Remorse

Returning to the level of support or resistance after a breakout is called traders

remorse.

11 | P a g e

Fundamental and Technical Analysis of Stock Markets

Volume Indicators

A mathematical tool that can be applied on securitys price giving a result that

can be used to anticipate trends, volatility and price Indicators are used in two

main ways: to confirm price movement and to form buy and sell signals.

Moving Averages

A simple moving average is calculated by taking average of most recent closing

prices of n time period. Sometimes traders use two moving averages to

determine buy and sell decisions. Using a slow moving average (more days)

together with a fast moving average (fewer days) generates the following

trading strategies:

Buy when the faster moving average crosses the slower one (from below). Sell

when the faster moving average crosses the slower one (from above).

Buy when prices are above both the fast and slow moving averages. Sell when

prices are below both the fast and slow moving averages.

As with most tools of technical analysis, moving averages should not be used on

their own, but in conjunction with other tools that complement them. Using

moving averages to confirm other indicators and analysis can greatly enhance

technical analysis.

Relative Strength Index (RSI)

It compares the magnitude of recent gains to recent losses in an attempt to

determine overbought and oversold conditions of an asset

RSI= 100- 100/ (1+RS)

RS=EMA [U]/EMA [D] EMA- exponential moving average

U= Sig (close (today)-close (yesterday))

D= Sig (close (yesterday)-close (today))

12 | P a g e

Fundamental and Technical Analysis of Stock Markets

Balanced Application of both analysis necessary

No one method can give you the holy grail of profits. But what good traders and

investors can do is combine methods to provide a clearer picture of what is

happening and how to take advantage of opportunities in the share market.

No matter how you slice and dice the numbers, investing and trading is all about

choosing companies that are likely to increase in value for two main reasons:

1. The underlying business show potential and

2. Market forces are acting in its favor.

In the short run, strong fundamentals do not always indicate strong technical

patterns or vice versa. Often, technicals can continue to follow a strong or weak

pattern when fundamentals are at turning points, which may lead them to be out

of sync. Additionally, technical can be out of sync with fundamentals when there

is a shock to a stock, either positive or negative. Stocks tend to follow technicals

in the short run unless there is an unforeseen shock. Technical analysts say you

can respond real time to a stock and not have to wait for the next reporting date

or news disclosure, because the charts already interpret market sentiment, so

following the charts will lead to higher profits. Technical analysts believe that

stocks move even without disclosures because suppliers, competitors and

employees, invest in companies and without needing inside information, get a

sense of how the company is faring. These buying and selling activities define

the stock chart and pattern, and reflect the real-time stock behavior.

Therefore, even if the two have been out of sync in the short run, technicals and

fundamentals should be in sync in the long run. That's because in the long run,

fundamentals should win and drive the technical.

13 | P a g e

Fundamental and Technical Analysis of Stock Markets

Case Study: Failure of Analysis in the light of Stock

Manipulation

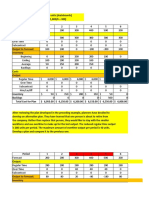

Ketan Parekh Scam

A Mumbai based stock broker chartered accountant by profession

KP took advantage of low liquidity in certain stocks which later came to be

known as K- 10 Stocks

Held significant stakes in the K- The buoyant stock10 companies

markets from January to July 1999 helped the K-10 stocks increase in

value substantially

As a result other brokers and fund managers started investing heavily in

these stocks

The K-10 Stocks

1. Aftek Infosys

2. Himachal Futuristic Communications

3. Global telesystems

4. DSQ software

5. Silverline Technology

6. Satyam computers

7. Pentamedia Graphics

8. Pritish Nandy Communications

9. Zee Telefilms

10.SSI

How it happened?

Formed a network of brokers

Identified and targeted 10 stocks

K-10 stock, KP Index

Zee telefilms went up from Rs. 127to Rs. 2330, Himachal Futuristic Rs.

194 to 2553

Badla System

Indigenous carry-forward system invented on the Bombay Stock

Exchange

Badla trading involved buying stocks with borrowed money.

The stock exchange acts as an intermediary Interest rate determined by

the demand for the underlying stock

Maturity not greater than 70 days

14 | P a g e

Fundamental and Technical Analysis of Stock Markets

How it happened?

When stock prices were high, they were pledged with banks as collateral

No problems as long prices were rising

Pay order fraud

Issued cheques to MMCB drawn on BOI

Went to BOI, SBI, and PNB and got pay orders discounted

How was it detected?

Stock market crash of 2000

KP started borrowing heavily

Attempted to rig the price upwards and later sell

But failed to do so due to the pressure exerted by International bear

cartel

IT department found discrepancies in sources of funds of KP

Routine market surveillance of 5 stocks

Systematic Flaws

Trading system lag of one week

Credit Check

High exposure allowed

Lack of records and margins at Calcutta stock exchange

Lending without proper collateral

Implications

One of the biggest Fall in BSE -700 points

KP and other traders were banned from trading for 17 years

Short selling was banned for 6 months.

Badla system was banned

All shares that were put as collaterals should be done so through NSE and

BSE.

Options and Index Future derivatives was introduced

10% additional deposit margins

15 | P a g e

Fundamental and Technical Analysis of Stock Markets

References

www.wikipedia.org/

www.investopedia.com/

http://www.slideshare.net/

16 | P a g e

You might also like

- All About Technical Analysis: The Easy Way to Get StartedFrom EverandAll About Technical Analysis: The Easy Way to Get StartedRating: 4.5 out of 5 stars4.5/5 (10)

- The Encyclopedia Of Technical Market Indicators, Second EditionFrom EverandThe Encyclopedia Of Technical Market Indicators, Second EditionRating: 3.5 out of 5 stars3.5/5 (9)

- Pro Trader SecretsDocument12 pagesPro Trader SecretsMd Nazmul IslamNo ratings yet

- Beginner's Guide To Technical & Fundamental AnalysisDocument31 pagesBeginner's Guide To Technical & Fundamental AnalysisAkshit Khanijo100% (2)

- Cfa - Technical Analysis ExplainedDocument32 pagesCfa - Technical Analysis Explainedshare757592% (13)

- Advanced Technical Analysis en PDFDocument23 pagesAdvanced Technical Analysis en PDFTarkeshwar Mahato75% (4)

- 21 Candlesticks Every Trader Should KnowDocument83 pages21 Candlesticks Every Trader Should KnowArmtin GhahremaniNo ratings yet

- Technical Analysis of StockDocument77 pagesTechnical Analysis of StockBhavesh RogheliyaNo ratings yet

- Executive Summary: Focus Group ReportDocument4 pagesExecutive Summary: Focus Group ReportkaranNo ratings yet

- Technical AnalysisDocument69 pagesTechnical Analysisjubin100% (1)

- Role of Technical Analysis As A Tool For Trading DecisionsDocument43 pagesRole of Technical Analysis As A Tool For Trading DecisionsDeepak Shrivastava100% (1)

- SWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)From EverandSWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)No ratings yet

- Become A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersFrom EverandBecome A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersNo ratings yet

- MTA - Technical Analysis Modern PerspectivesDocument45 pagesMTA - Technical Analysis Modern PerspectivesJanos Torok50% (2)

- Profit TriggersDocument66 pagesProfit TriggersSastryassociates Chartered100% (3)

- 02 Review On Technical AnalysisDocument50 pages02 Review On Technical AnalysisVaidyanathan Ravichandran100% (3)

- Technical Analysis 1Document61 pagesTechnical Analysis 1shruti.shinde100% (1)

- Notes On Technical AnalysisDocument40 pagesNotes On Technical Analysissandip sinha100% (1)

- Technical AnalysisDocument134 pagesTechnical AnalysisNakul Makhija88% (8)

- Vol-4 Introduction To Technical AnalysisDocument77 pagesVol-4 Introduction To Technical Analysissskendre100% (1)

- John J MurphyDocument4 pagesJohn J Murphyapi-383140450% (2)

- Master Technical AnalysisDocument7 pagesMaster Technical AnalysissatishdinakarNo ratings yet

- Technical AnalysisDocument247 pagesTechnical AnalysisHemangi Khopkar100% (1)

- Stock Valuation Fundamental AnalysisDocument14 pagesStock Valuation Fundamental Analysisdennise100% (1)

- II Charting Candlestick ChartsDocument4 pagesII Charting Candlestick ChartsdrkwngNo ratings yet

- Forex Risk ManagementDocument242 pagesForex Risk ManagementParvesh AghiNo ratings yet

- PhD-Technical Analysis in Financial Markets, Gerwin A. W. Griffioen University of AmsterdamDocument322 pagesPhD-Technical Analysis in Financial Markets, Gerwin A. W. Griffioen University of AmsterdamDeepika KaurNo ratings yet

- Delgado - Forex: Technical Analysis Chart Patterns.Document16 pagesDelgado - Forex: Technical Analysis Chart Patterns.Franklin Delgado Veras100% (4)

- Stock Trading HandbookDocument29 pagesStock Trading Handbooksan MunNo ratings yet

- Technical Analysis: Urali ArkataliDocument34 pagesTechnical Analysis: Urali ArkataliTalal AnsariNo ratings yet

- Technical Analysis Indicators 2Document55 pagesTechnical Analysis Indicators 2shruti.shindeNo ratings yet

- Technical Indicator ExplanationDocument4 pagesTechnical Indicator ExplanationfranraizerNo ratings yet

- Technical Analysis ElearnDocument44 pagesTechnical Analysis ElearnRavi Tomar100% (3)

- FMC Technical Part 1Document9 pagesFMC Technical Part 1Tafara MichaelNo ratings yet

- Technical AnalysisDocument47 pagesTechnical AnalysisANVESH SHETTYNo ratings yet

- Fundamental Analysys of Steel Sector CompaniesDocument38 pagesFundamental Analysys of Steel Sector Companiesvimee2401384100% (4)

- Technical Analysis: PDF Generated At: Wed, 02 Feb 2011 16:50:34 UTCDocument183 pagesTechnical Analysis: PDF Generated At: Wed, 02 Feb 2011 16:50:34 UTCb87208582100% (12)

- Technical InfosysDocument13 pagesTechnical InfosysPrakhar RatheeNo ratings yet

- How to have $uccess in Financial Market Investing & TradingFrom EverandHow to have $uccess in Financial Market Investing & TradingRating: 4 out of 5 stars4/5 (1)

- Options Trading Crash Course In Plain Simple English - The Beginners' Guide Book On How To Trade Option (Learn Both Basic And Advanced Strategies)From EverandOptions Trading Crash Course In Plain Simple English - The Beginners' Guide Book On How To Trade Option (Learn Both Basic And Advanced Strategies)No ratings yet

- How to Become a Successful Trader: The Trading Personality Profile: Your Key to Maximizing Profit with Any SystemFrom EverandHow to Become a Successful Trader: The Trading Personality Profile: Your Key to Maximizing Profit with Any SystemNo ratings yet

- Building Reliable Trading Systems Complete Self-Assessment GuideFrom EverandBuilding Reliable Trading Systems Complete Self-Assessment GuideNo ratings yet

- Why Financial Markets Rise Slowly but Fall Sharply: Analysing market behaviour with behavioural financeFrom EverandWhy Financial Markets Rise Slowly but Fall Sharply: Analysing market behaviour with behavioural financeNo ratings yet

- Retail Forex Trading for Beginners: 25 Tricks to ReForex TradingFrom EverandRetail Forex Trading for Beginners: 25 Tricks to ReForex TradingNo ratings yet

- Modern Auditing and Assurance Services 6th Edition Leung Solutions ManualDocument6 pagesModern Auditing and Assurance Services 6th Edition Leung Solutions ManualSonam ChophelNo ratings yet

- GIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaDocument5 pagesGIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaALexNo ratings yet

- Matahari Department Store TBK.: August 2018Document4 pagesMatahari Department Store TBK.: August 2018Ana SafitriNo ratings yet

- A Public Relations ApproachDocument33 pagesA Public Relations Approachmona_13mera7931100% (2)

- Internship Report On Merchandising Activities ofDocument56 pagesInternship Report On Merchandising Activities ofNoshaba MaqsoodNo ratings yet

- Basic FormulasDocument1 pageBasic FormulasDhanaperumal VarulaNo ratings yet

- Sales AgentsDocument3 pagesSales AgentsDavidCruzNo ratings yet

- Management Information System at THE CITY BANK LIMITED BangladeshDocument17 pagesManagement Information System at THE CITY BANK LIMITED BangladeshSimmons Ozil67% (3)

- Unit 4 - Week 5 - Management by ObjectivesDocument17 pagesUnit 4 - Week 5 - Management by ObjectivesDiana Elena ChiribasaNo ratings yet

- Examiners' Commentaries 2014: FN3092 Corporate FinanceDocument19 pagesExaminers' Commentaries 2014: FN3092 Corporate FinanceBianca KangNo ratings yet

- Quiz No 22 - TendersDocument5 pagesQuiz No 22 - TenderskanagarajodishaNo ratings yet

- Mos QuestionsDocument3 pagesMos QuestionsDurgesh AgnihotriNo ratings yet

- Chapter 1 - DDocument26 pagesChapter 1 - DSujani MaarasingheNo ratings yet

- Net Pacific Inc. Organizational Structure: Evelyn Morales Lito Tac-AnDocument1 pageNet Pacific Inc. Organizational Structure: Evelyn Morales Lito Tac-AnPatrick PenachosNo ratings yet

- State Bank of IndiaDocument48 pagesState Bank of Indiaanshukumar87No ratings yet

- Hidelink Men Formal Brown Genuine Leather Wallet: Grand Total 356.00Document3 pagesHidelink Men Formal Brown Genuine Leather Wallet: Grand Total 356.00Siva ReddyNo ratings yet

- Bank StatementDocument8 pagesBank StatementKayla McKnightNo ratings yet

- What Makes A Good Business Model, AnywayDocument2 pagesWhat Makes A Good Business Model, AnywayadillawaNo ratings yet

- CH 18Document9 pagesCH 18MBASTUDENTPUPNo ratings yet

- GXX - 0002 TableDocument63 pagesGXX - 0002 TableSupratim RayNo ratings yet

- MKC Case Study FinalDocument39 pagesMKC Case Study FinalxyzNo ratings yet

- Bank AuditDocument16 pagesBank AuditThunderHeadNo ratings yet

- eFDS 25 Pangunahing Kaalaman Sa PagbabangkoDocument5 pageseFDS 25 Pangunahing Kaalaman Sa PagbabangkoShai SdmpNo ratings yet

- 2238 8777 1 PBDocument9 pages2238 8777 1 PBMuhammad MulyawanNo ratings yet

- Jayant Sharad Kashid: General Manager - ProcurementDocument3 pagesJayant Sharad Kashid: General Manager - ProcurementJayant KashidNo ratings yet

- Project On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre DivisionDocument52 pagesProject On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre Divisiondave_sourabhNo ratings yet

- Aggregate Planning Example SolvedDocument16 pagesAggregate Planning Example SolvedAbdullah ShahidNo ratings yet

- Mercy Corps - Kebal - Case Study Analysis - Team 2Document14 pagesMercy Corps - Kebal - Case Study Analysis - Team 2ghighilanNo ratings yet

- Selection Process of Cavin Kare Pvt. LTDDocument69 pagesSelection Process of Cavin Kare Pvt. LTDYasir ShafiNo ratings yet