Professional Documents

Culture Documents

Auto Monthly Update: November, 2011

Auto Monthly Update: November, 2011

Uploaded by

RounakCopyright:

Available Formats

You might also like

- NADA Data 2014Document20 pagesNADA Data 2014Luiz Felipe ScolariNo ratings yet

- Auto & Power Industries Portfolio AnalysisDocument35 pagesAuto & Power Industries Portfolio AnalysisHK SahuNo ratings yet

- Conect 2Document1 pageConect 2Barrikelo Cash BerryNo ratings yet

- Mahindra & Mahindra 1Document6 pagesMahindra & Mahindra 1Ankit SinghalNo ratings yet

- Auto SectorUpdate October2012Document12 pagesAuto SectorUpdate October2012Angel BrokingNo ratings yet

- MotoGaze - ICICI February 2013Document18 pagesMotoGaze - ICICI February 2013Vivek MehtaNo ratings yet

- Green Shoots Turning Into Steady Growth!!!: Motogaze - September, 2014Document14 pagesGreen Shoots Turning Into Steady Growth!!!: Motogaze - September, 2014nnsriniNo ratings yet

- Mahindra & Mahindra 2Document6 pagesMahindra & Mahindra 2Ankit SinghalNo ratings yet

- Autos 2011.12 Nomura - November Auto SalesDocument8 pagesAutos 2011.12 Nomura - November Auto SalespradyumndagaNo ratings yet

- Automobile Sector: Pre-Budget Buying Boosts SalesDocument11 pagesAutomobile Sector: Pre-Budget Buying Boosts SalesAngel BrokingNo ratings yet

- Autos: PV & 2Ws Lead Cvs DragDocument14 pagesAutos: PV & 2Ws Lead Cvs DragumaganNo ratings yet

- Automobile Sector Result UpdatedDocument11 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- Auto Sector, January 2013Document12 pagesAuto Sector, January 2013Angel BrokingNo ratings yet

- Auto Sector Update, February 2013Document13 pagesAuto Sector Update, February 2013Angel BrokingNo ratings yet

- IDirect Motogaze Aug16Document16 pagesIDirect Motogaze Aug16umaganNo ratings yet

- Automobile Sector Result UpdatedDocument11 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- Auto Sector Update, June 2013Document12 pagesAuto Sector Update, June 2013Angel BrokingNo ratings yet

- Auto Sector Update November 2011Document11 pagesAuto Sector Update November 2011Angel BrokingNo ratings yet

- TVS Motor - Company UpdateDocument5 pagesTVS Motor - Company UpdateVineet GalaNo ratings yet

- Autos: Cvs Struggle 2Ws and Pvs OutshineDocument14 pagesAutos: Cvs Struggle 2Ws and Pvs OutshineDinesh ChoudharyNo ratings yet

- JLR Monthly Update March 2013Document6 pagesJLR Monthly Update March 2013Angel BrokingNo ratings yet

- Uvs & Scooters Drive Growth in June!!!: Motogaze July 2016Document16 pagesUvs & Scooters Drive Growth in June!!!: Motogaze July 2016khaniyalalNo ratings yet

- JLR Monthly Update February 2013Document6 pagesJLR Monthly Update February 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Automobile Sector: A Mixed ShowDocument11 pagesAutomobile Sector: A Mixed ShowAngel BrokingNo ratings yet

- IndiNivesh Best Sectors Stocks Post 2014Document49 pagesIndiNivesh Best Sectors Stocks Post 2014Arunddhuti RayNo ratings yet

- Automobile Sector: Eyeing The Festival SeasonDocument10 pagesAutomobile Sector: Eyeing The Festival SeasonAngel BrokingNo ratings yet

- Auto Sector Update, July 2013Document13 pagesAuto Sector Update, July 2013Angel BrokingNo ratings yet

- Ashok Leyland Valuation - ReportDocument17 pagesAshok Leyland Valuation - Reportbharath_ndNo ratings yet

- Bns AutoDocument8 pagesBns Autosurapong2005No ratings yet

- Autos - Pent-Up Demand in OctDocument8 pagesAutos - Pent-Up Demand in OctTariq HaqueNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument5 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- SH 2013 Q2 2 ICRA AutomobilesDocument5 pagesSH 2013 Q2 2 ICRA AutomobilesAnkanksha ShardaNo ratings yet

- Credit Rating of Tata MotorsDocument11 pagesCredit Rating of Tata MotorsSharonNo ratings yet

- Growth Sustains in May!!!: Motogaze June 2016Document16 pagesGrowth Sustains in May!!!: Motogaze June 2016umaganNo ratings yet

- Automobile Industry in India ADocument16 pagesAutomobile Industry in India ANamita VirmaniNo ratings yet

- 2015 Automotive Industry Outlook and Strategic InsightDocument36 pages2015 Automotive Industry Outlook and Strategic InsightPallavi ReddyNo ratings yet

- Dashboard: Speedometer Data TrackDocument28 pagesDashboard: Speedometer Data TrackSandesh TrivediNo ratings yet

- JLR Monthly Update, May 2013Document6 pagesJLR Monthly Update, May 2013Angel BrokingNo ratings yet

- Automobile Sector Result UpdatedDocument10 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- JLR Monthly Update, June 2013Document6 pagesJLR Monthly Update, June 2013Angel BrokingNo ratings yet

- JLR Monthly Update, July 2013Document6 pagesJLR Monthly Update, July 2013Angel BrokingNo ratings yet

- Aaditya Jain - Tata MotorsDocument2 pagesAaditya Jain - Tata MotorsAaditya JainNo ratings yet

- Auto Sector Monthly Update-040411Document13 pagesAuto Sector Monthly Update-040411anuragchogtuNo ratings yet

- Automobiles Industry ReportDocument5 pagesAutomobiles Industry ReportvaasurastogiNo ratings yet

- Indian Commercial Vehicle Sector: Trends & Outlook: July 2010Document15 pagesIndian Commercial Vehicle Sector: Trends & Outlook: July 2010aniljainwisdomNo ratings yet

- Auto Industy Demand AnalysisDocument8 pagesAuto Industy Demand Analysisppc1110No ratings yet

- IDBICapital Auto Sep2010Document73 pagesIDBICapital Auto Sep2010raj.mehta2103No ratings yet

- Automobile Sales - September 2013: Car, CV Sales Stay Weak, But Improvement in Two-WheelersDocument3 pagesAutomobile Sales - September 2013: Car, CV Sales Stay Weak, But Improvement in Two-WheelersTariq HaqueNo ratings yet

- Mad MarketDocument6 pagesMad MarketShawn ByunNo ratings yet

- Automobile Sector: Muted Festival DemandDocument12 pagesAutomobile Sector: Muted Festival DemandAngel BrokingNo ratings yet

- Final Report Mahindra & MahindraDocument11 pagesFinal Report Mahindra & MahindraDurgesh TamhaneNo ratings yet

- Automobile Sector Result UpdatedDocument12 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- Growth of Automobile Industry and Its Economic Impact: An Indian PerspectiveDocument5 pagesGrowth of Automobile Industry and Its Economic Impact: An Indian PerspectiveAna IyerNo ratings yet

- Global Scenario: Automobile IndustryDocument21 pagesGlobal Scenario: Automobile IndustryAbhishek ChaudharyNo ratings yet

- Astra International: All's Still in OrderDocument11 pagesAstra International: All's Still in OrdererlanggaherpNo ratings yet

- Auto Volumes Automobile Assembler Auto Sales in Fy15 Record An Impressive 31% Yoy Growth!Document4 pagesAuto Volumes Automobile Assembler Auto Sales in Fy15 Record An Impressive 31% Yoy Growth!Waqas Ashraf KhanNo ratings yet

- Mahindra & Mahindra LTD: Key Financial IndicatorsDocument4 pagesMahindra & Mahindra LTD: Key Financial IndicatorsIntigate NoidaNo ratings yet

- Autos MalaysiaDocument45 pagesAutos MalaysiaNicholas AngNo ratings yet

- Motorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryFrom EverandMotorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiper Motors, Wiper Blades & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandWiper Motors, Wiper Blades & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Universal Joint Dimensional DataDocument48 pagesUniversal Joint Dimensional Datamohammed mostafaNo ratings yet

- Edisi Agustus 2017: Merk Type Kendaraan Harga Qty/Dus Golongan Angker Dinamo StarterDocument49 pagesEdisi Agustus 2017: Merk Type Kendaraan Harga Qty/Dus Golongan Angker Dinamo StarterAlexander LautanNo ratings yet

- Coberturax431paddiagun3master4 PDFDocument2 pagesCoberturax431paddiagun3master4 PDFMario TapiaNo ratings yet

- Forecast Access Q2 Fy2019Document1 pageForecast Access Q2 Fy2019Fuad IhsanNo ratings yet

- Hino RMDocument2 pagesHino RMIRGI ARYA PRIYAMBODONo ratings yet

- Maruti Suzuki Alto ReviewDocument2 pagesMaruti Suzuki Alto ReviewGomati Pratheb100% (1)

- Filtros Combustible FamelDocument9 pagesFiltros Combustible Famelrichard44927No ratings yet

- Allomatic Catalog 03 15 13 PDFDocument319 pagesAllomatic Catalog 03 15 13 PDFVictor Hugo Benitez PaezNo ratings yet

- Buku Manual Diesel Seri 4 J Isuzu - EngDocument88 pagesBuku Manual Diesel Seri 4 J Isuzu - EngMoodyNT100% (2)

- Tipuri Ulei PDFDocument1 pageTipuri Ulei PDFZool Car زول كارNo ratings yet

- Bascolin Corporation: Global Pioneer of Overall Solution in Diesel SystemsDocument8 pagesBascolin Corporation: Global Pioneer of Overall Solution in Diesel SystemsKeyla OrtegaNo ratings yet

- Catalog of RBS Honda ListDocument35 pagesCatalog of RBS Honda Listcbaautoparts197No ratings yet

- DTCO Overview 1 Okt 2012 (Incompatable Tackographs)Document3 pagesDTCO Overview 1 Okt 2012 (Incompatable Tackographs)asefeeNo ratings yet

- Volkswagen Zoznam VozidielDocument33 pagesVolkswagen Zoznam VozidielaycarambuaNo ratings yet

- Mercedes W113 Air Flap Seal W113 SLDocument1 pageMercedes W113 Air Flap Seal W113 SLSergio SantosNo ratings yet

- Fiat Body EsquemasDocument4 pagesFiat Body EsquemasnelsonNo ratings yet

- 46332678426Document2 pages46332678426Rhendy anggaraNo ratings yet

- Catalogo KYB 2009Document94 pagesCatalogo KYB 2009Jenny Mora LeonNo ratings yet

- Jashanpreet EnqDocument7 pagesJashanpreet EnqChandra BhushanNo ratings yet

- Cummins PartsDocument3 pagesCummins PartsISLAM TUBENo ratings yet

- VTR 249 PDFDocument2 pagesVTR 249 PDFRamesh BabuNo ratings yet

- Am-6082ーsolicitud de Cotizacion 555 (07!09!2023)Document2 pagesAm-6082ーsolicitud de Cotizacion 555 (07!09!2023)Diego LópezNo ratings yet

- GasketDocument72 pagesGasketpganoelNo ratings yet

- Who Makes The Most Reliable CarsDocument1 pageWho Makes The Most Reliable CarsDarius KovessiNo ratings yet

- Piese Import Dacia 1310 1.3LDocument69 pagesPiese Import Dacia 1310 1.3LMatei Andrei RazvanNo ratings yet

- Table 2Document6 pagesTable 2ForAccount LoginsNo ratings yet

- Coachmen Owners Manual-1978Document40 pagesCoachmen Owners Manual-1978OnetwothreefourfunkNo ratings yet

- Tata Company ProfileDocument14 pagesTata Company ProfileNishan ShettyNo ratings yet

- ??classic & Sports Car UK - October 2020 PDFDocument238 pages??classic & Sports Car UK - October 2020 PDFnardobarrini100% (1)

Auto Monthly Update: November, 2011

Auto Monthly Update: November, 2011

Uploaded by

RounakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auto Monthly Update: November, 2011

Auto Monthly Update: November, 2011

Uploaded by

RounakCopyright:

Available Formats

SECTOR UPDATE

Auto Monthly Update

November,

2014

November, 2011

Auto Monthly Update

November sales provides another twinkle of hope

After witnessing lower than expected volumes in the festive season, major OEMs

have reported healthy growth in volumes in November. On a YoY basis, the highest

came in from M&HCVs, followed by passenger vehicles, two-wheelers, with tractors

being the weakest. On an absolute basis, going by the past five-to-six months trend,

volumes were broadly disappointing for most.

Sales of top companies including Maruti Suzuki, Hyundai, Honda and Tata Motors

rose in November, while Mahindra & Mahindras (M&M) volumes continued to fall.

Total monthly sales in November jumped 10.43% over the corresponding month in

2013. In two wheeler segment, Hero Moto Corp and TVS Motors reported increase in

total volumes on YoY basis, while Bajaj Auto reported decline in volumes..

SECTOR UPDATE

Outlook

Given a slew of new models slated to hit showrooms in addition to falling fuel prices,

we expect consumer sentiments to improve driving higher footfalls at dealerships. It is

believed that the perceived improvement in consumer sentiment is yet to translate

into better sales for the automotive industry. However, the industry is confident of the

long-term growth potential of the market and continues to be cautiously optimistic in

the near-term.

Additionally, discounts are at their peak and sales of diesel vehicles are tapering off

as the price differential between the two fuels is dropping sharply. Going by the

market scenario, industry expect the challenging times to continue till some major

announcements take place in the upcoming budget to improve customer sentiments.

th

Monthly Auto Update

Friday, 5 December, 2014

Auto Monthly Update

Total Motor Vehicles Sales

Total Car Sales

Motor Vehicles sales growth YOY

Sep-14

Car sales growth YOY

Source: IAS, Ventura Research Estimates

Two wheeler & motorcycle sales (Quarterly)

Two wheeler & motorcycles sales growth (YOY)

60

25%

50

20%

15%

40

10%

30

5%

20

Total Two Wheeler Sales

Total Motor Cycles Sales

Motorcycles growth YOY

Source: IAS, Ventura Research Estimates

Two wheeler growth YOY

Source: IAS, Ventura Research Estimates

th

Monthly Auto Update

Friday, 5 December, 2014

Sep-14

Jun-14

Mar-14

Dec-13

Sep-13

Jun-13

Mar-13

Dec-12

Sep-12

Jun-12

Dec-11

Sep-14

Jun-14

Mar-14

Dec-13

Sep-13

Jun-13

Mar-13

-10%

Dec-12

-5%

Mar-12

0%

10

Sep-12

Unit in Lakhs

SECTOR UPDATE

Source: IAS, Ventura Research Estimates

Jun-14

Dec-11

Sep-14

Jun-14

Mar-14

Dec-13

Sep-13

Jun-13

Mar-13

Dec-12

Sep-12

Jun-12

Mar-12

Dec-11

Sep-11

Mar-14

Dec-13

Sep-13

Jun-13

Mar-13

10

Dec-12

Unit in Lakhs

12

Sep-12

20%

15%

10%

5%

0%

-5%

-10%

-15%

-20%

-25%

14

Jun-12

Motor vehicles and car sales growth (YoY)

Mar-12

Motor vehicles and car sales Quarterly

Auto Monthly Update

Maruti Suzuki India Ltd

|CMP: `3,397 | M.Cap: `1,02,616 crore|

Robust sales number

SECTOR UPDATE

After witnessing a poor performance during the festive season owing to the fewer

working days, Maruti Suzuki India reported a growth of 20% to 110,147 cars in the

month of November 2014. Domestic sales during the month stood at 100,024 units,

up 17% from 85,510 units in the same period previous year. Sales of mini & compact

passenger cars, including Alto, A-Star, and WagonR were up 33.7% at 75,085 units

as against 56,162 units in the same month previous year.

Exports for the month zoomed by 52.7%, as the company shipped-out 10,123 units

from 6,630 units sold abroad in the comparable period last year. The premium sedanKizashi on the other hand, failed to attract any buyers in the country. Interestingly,

many customers have opted for Omni and Eeco, as the two vans outperformed in the

month with 12,203 units in November, resulting in 52.1% of growth.

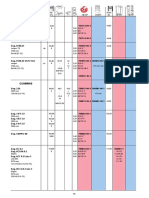

Maruti Suzuki India Ltd

Nov-14

Nov-13 YOY %

Oct-14

MOM %

YTDFY14

YTDFY13

YOY %

A:Mini & Compact

75,085

56,162

33.7

72,836

3.1

1,225,947

1,118,822

9.6

0.0

189

-99.5

12,203

8,021

52.1

10,453

16.7

187,135

175,291

6.8

7,221

15,486

-53.4

7,753

-6.9

290,084

306,643

-5.4

94,509

79,670

18.6

91,042

3.8

1,703,167

1,600,945

6.4

5,515

5,840

-5.6

6,027

-8.5

105,030

118,672

-11.5

100,024

85,510

17.0

97,069

3.0

1,808,197

1,719,617

5.2

10,123

6,630

52.7

6,904

46.6

180,512

191,155

-5.6

110,147

92,140

19.5

103,973

5.9

1,988,709

1,910,772

4.1

A:Executive

C:Vans

A:Super Compact & Mid size

Total Passenger Cars

B:UV

Domestic sales

Exports sales

Total sales

th

Monthly Auto Update

Friday, 5 December, 2014

Auto Monthly Update

Total Vehicle Sales and its growth in % YoY

zzz

1.2

0.9

0.6

0.3

Total vehicle sales

70%

60%

50%

40%

30%

20%

10%

0%

-10%

-20%

Total volumes grew by 19.5% YoY

basis

Vehicle sales growth YOY

Source: MSIL, Ventura Research Estimates

Domestic A: Mini & Compact Vehicle

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

100%

80%

60%

40%

Mini and Compact vehicle

grew by 33.7% YoY basis

20%

0%

-20%

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Units in lakhs

SECTOR UPDATE

0.0

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Units in lakhs

1.5

Sales

Sales growth YOY

Source: MSIL, Ventura Research Estimates

th

Monthly Auto Update

Friday, 5 December, 2014

Auto Monthly Update

Mahindra & Mahindra

|CMP: `1,290 | M.Cap: `80,151 crore|

Overall performance weak

SECTOR UPDATE

In the month of November, Mahindra and Mahindra has reported a 20.4% percent

decline in sales with about 49,625 units as against 62,374 units that were sold in the

same month last year led by the overall sentiment and high interest rates. Sales of

passenger vehicles including Scorpio, XUV 500, Xylo, Bolero and Verito stood at

13,765 units, compared to 16,771 units in November 2013, down 18%. Exports were

down 27 per cent to 2,192 units from 2,993 units in the same period a year earlier.

The company is hopeful that reducing international crude prices and the subsequent

lowering of fuel prices should help in the revival of demand in the coming months.

The delayed rains and sowing have led to a sluggish growth in the tractor industry,

thereby leading to M&Ms Farm Equipment Sector de-growth of 33.7% in total sales.

Domestic sales stood at 14,207 units, as against 22,343 units during November 2013.

Unseasonal rains and hail during March has impacted sentiment leading to lower

tractor sales. However, the management is confident of its newly launched Arjun

Novo tractor, which has been very well received in the market and hope that this will

help drive sales in a challenging environment.

M&M

Nov-14

Nov-13 YOY %

Oct-14

MOM %

YTDFY14

YTDFY13

YOY %

UV's

26,513

29,957

-11.5

34,066

-22.2

649,152

717,325

-9.5

3,363

582

443

27,095

Verito - MRPL

LCV's - Inclusive of MNAL

Total 4 wheelers

3 wheelers

Domestic Sales

Exports - M&M

Exports - Logan - MRPL

31.4

530

9.8

30,400

-10.9

34,596

5,005

5,861

-14.6

32,100

36,261

2,192

2,994

13,621

17,193

-20.8

-21.7

662,773

737,881

-10.2

5,678

-11.9

101,776

106,779

-4.7

-11.5

40,274

-20.3

764,549

844,660

-9.5

-26.8

2,502

-12.4

47,958

51,052

-6.1

Export Sales

2,192

2,994

-26.8

2,502

-12.4

47,958

51,052

-6.1

Total Sales (A)

34,292

39,255

-12.6

42,776

-19.8

812,507

895,712

-9.3

14,207

22,343

-36.4

30,800

-53.9

431,450

399,917

7.9

1,126

776

45.1

1,107

1.7

18,951

19,011

-0.3

Total Sales (B)

15,333

23,119

-33.7

31,907

-51.9

450,401

418,928

7.5

Grand Total sales (A+B)

49,625

62,374

-20.4

74,683

-33.6

1,262,908

1,314,640

-3.9

Tractors

Domestic

Exports

th

Monthly Auto Update

Friday, 5 December, 2014

Auto Monthly Update

Sales excluding 2 wheelers & tractors

es

0.6

25%

20%

15%

10%

5%

0%

-5%

-10%

-15%

-20%

-25%

-30%

Units in lakhs

0.5

0.4

0.3

0.2

0.1

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

0.0

PV volumes were decreased

by 12.6%, showing revival

signs.

Growth YOY

Source: M&M, Ventura Research Estimates

Total tractor sales

0.4

Units in lakhs

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

0.3

0.2

0.1

0.0

Tractor volumes posted a

de-growth of 33.6% YoY.

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

SECTOR UPDATE

Total sales

Tractor Sales

Tractor Growth in YOY

Source: M&M , Ventura Research Estimates

th

Monthly Auto Update

Friday, 5 December, 2014

Auto Monthly Update

Tata Motors

|CMP: `524 | M.Cap:`1,41,170 crore|

Back on Road!

SECTOR UPDATE

After the gap of almost two years, Tata Motors reported a growth of 2% in November,

2014 to 41,720 vehicles. Domestic sales of Tata commercial and passenger vehicles

remained flat at 37,427 units as compared to year-ago period. Sales of passenger

vehicles in the domestic market in November stood at 12,021 units, up 16% from

10,376 units in the same month last year. In the commercial vehicles segment,

domestic sales declined by 5% to 25,406 units during the month from 26,816 units in

November last year.

Exports during the month stood at 4,293 units as against 3,671 units in the year-ago

month, up 17%. On the cumulative basis, sales in the LCV business declined 32.2%

to 400,105 vehicles while medium and heavy commercial vehicle (M&HCV) sales

declined 13.8% to 186,419 vehicles. Export number also declined by 2% to 82,576

units over the same period.

Tata Motors

M&HCV

Nov-14

Nov-13 YOY %

Oct-14

MOM %

YTDFY14

YTDFY13

YOY %

9,452

6,823

38.5

10,352

-8.7

186,419

216,216

-13.8

15,954

19,993

-20.2

16,897

-5.6

400,105

590,404

-32.2

1,735

2,466

-29.6

1,917

-9.5

48,399

68,304

-29.1

Cars

10,286

7,910

30.0

9,594

7.2

170,282

248,092

-31.4

Domestic Sales (A)

37,427

37,192

0.6

38,760

-3.4

805,205

1,123,016

-28.3

4,293

3,671

16.9

4,059

5.8

82,576

84,249

-2.0

41,720

40,863

2.1

42,819

-2.6

887,781

1,207,265

-26.5

LCV

UV

Export Sales (B)

Total Sales (A+B)

th

Monthly Auto Update

Friday, 5 December, 2014

Auto Monthly Update

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0.0

5%

0%

-5%

-10%

-15%

-20%

-25%

-30%

-35%

-40%

-45%

Volume witnessed a growth of

2.1%

Total vehicle sales

Vehicle sales growth YOY

Source: TML, Ventura Research Estimates

UV + Car sales and its growth in % YoY

0.2

Units in lakhs

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

-60%

-70%

-80%

0.1

0.0

UV + Car Sales grew by

11.9%

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

SECTOR UPDATE

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Units in lakhs

Total Vehicles sales and its growth in % YoY

UV+Cars

UV+Cars sales growth YOY

Source: TML, Ventura Research Estimates

th

Monthly Auto Update

Friday, 5 December, 2014

Auto Monthly Update

Ashok Leyland

|CMP: `53 | M.Cap: `15,225 crore|

On growth track!

In the month of November, Ashok Leyland had sold 7,732 units, reporting a growth of

43.9%. The companys M&HCV sales stood at 5,204 units as compared to 2,715

units, a year ago. Decline in LCVs (Dost & Stile) continues, although pace has

moderated to ~3% decline in Nov14 to ~2,528 units. Management has indicated

improved demand outlook for 2H led by acceleration in economic activity.

Nov-14

Nov-13 YOY %

Oct-14

MOM %

YTDFY14

YTDFY13

YOY %

CV-excl SCV (Dost)

5,204

2,715

91.7

5,838

-10.9

104,515

117,316

-10.9

SCV (Dost)

2,528

2,660

-5.0

2,537

-0.4

46,276

54,313

-14.8

Total Sales

7,732

5,375

43.9

8,375

-7.7

150791

171629

-12.1

Total vehicles sales and its growth in % YoY

0.2

Units in lakhs

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

0.1

0.0

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

SECTOR UPDATE

Ashok Leyland

Total vehicle sales

Vehicle sales growth YOY

Source: ALL, Ventura Research Estimates

th

Monthly Auto Update

Friday, 5 December, 2014

10

Auto Monthly Update

Hero MotoCorp

|CMP: `3,176 | M.Cap:` 63,434 crore|

Healthy performance

It added that new launches, including ZMR, Splendor iSmart, Splendor Pro

Classic and Passion have been driving the volume across the segment. In October,

HMCL inaugurated a manufacturing plant at Neemrana in Rajasthan. The company

has lined up a total investment of Rs 5,000 crore across the globe, including

manufacturing plants in Columbia and Bangladesh. New plants are also coming up at

Gujarat and Andhra Pradesh and Hero Global Centre for research and design at

Kukas in Rajasthan.

Hero MotoCorp

Nov-14

Total Sales - Motorcycles

547,413

Nov-13 YOY %

530,530

3.2

Oct-14 MOM %

575,056

-4.8

YTDFY14

YTDFY13

10,771,964

10,207,026

YOY %

5.5

Total vehicles sales and its growth in % YoY

7.0

35%

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

-15%

6.0

Units in lakhs

5.0

4.0

3.0

2.0

1.0

0.0

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

SECTOR UPDATE

For the month of November, Hero MotoCorp reported healthy performance with

reporting a growth of 3.2% in its total sales to 547,413 units. As per the management,

the November dispatch is lower than last year on account of the holidays due to

Diwali, while there were no such holidays in the November of 2011, the festive period

being in October last year.

Sales in Units

Growth Rates YOY

Source: HMCL, Ventura Research Estimates

th

Monthly Auto Update

Friday, 5 December, 2014

11

Auto Monthly Update

Bajaj Auto

|CMP: `2,615 | M.Cap:` 75,685 crore|

Marginal de-growth

Bajaj Autos motorcycle sales for the month of November reported a marginal degrowth of 0.2% to 309,259 units as compared 309,888 units in the same month last

year. The sales for November 2014, comprised of motor cycle sales of 2,61,948 units

and commercial vehicle sales of 47,311 units. Export sales stood at 1,65,733 units

compared to 1,33,000 units in November 2013.

Bajaj Auto

Nov-14

Motorcycles

336,923

MOM %

YTDFY13

5,794,595

6,092,869

(0)

YOY %

261,948

278,000

-5.8

336,923

-22.3

5,794,595

6,092,869

-4.9

3 wheeler

47,311

31,888

48.4

49,094

-3.6

814,080

779,809

4.4

Total sales

309,259

309,888

-0.2

386,017

-19.9

6,608,675

6,872,678

-3.8

Domestic

143,526

176,888

-18.9

227,470

-36.9

3,724,747

4,260,627

-12.6

Exports

165,733

133,000

24.6

158,547

4.5

2,868,544

2,581,772

11.1

(0)

-22.3

YTDFY14

278,000

Total 2 wheelers

-5.8

Oct-14

261,948

Scooters

-4.9

-

Two Wheeler sales and its growth in % YoY

4.0

3.0

2.0

1.0

0.0

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Units in lakhs

SECTOR UPDATE

Nov-13 YOY %

Two wheelers sales in units

15%

10%

5%

0%

-5%

-10%

-15%

-20%

-25%

Growth Rates YOY

e

Source: BAL, Ventura Research Estimates

th

Monthly Auto Update

Friday, 5 December, 2014

12

Auto Monthly Update

TVS Motors

|CMP: `254 | M.Cap:` 12,098 crore|

Pick up in scooters and 3 wheeler volumes

TVS Motors has posted a robust growth of 36% in total sales in the month of

November14, at 220,046 units against 161,908 units YoY. Exports witnessed a

growth of 54.5% at 39,215 units in November14, as against 25,388 units during

November 2013. Total two wheeler sales increased by 35.6% to 210,979 units from

155,604 units recorded in November 2013. Scooters sales grew by 62.3% increasing

to 62,332 units in November 2014. Motorcycles sales grew by 40.6% to 86,424 units.

The recently launched TVS StaR City+ has been well received in the market.

TVS Motors

Nov-14

Nov-13 YOY %

Oct-14

YTDFY14

YTDFY13

YOY %

Motorcycles

86,424

61,471

40.6

90,779

-4.8

1,462,717

1,289,508

13.4

Scooters

62,223

38,331

62.3

70,571

-11.8

963,606

740,791

30.1

Mopeds

62,332

55,802

11.7

70,640

-11.8

1,247,855

1,260,908

-1.0

210,979

155,604

35.6

231,990

-9.1

3,674,178

3,291,207

11.6

3 Wheelers

9,067

6,304

43.8

9,054

0.1

152,694

102,582

48.9

Total sales

220,046

161,908

35.9

241,044

-8.7

3,826,872

3,393,789

12.8

2 wheelers - Domestic

171,764

135,218

27.0

197,135

-12.9

3,188,445

2,922,471

9.1

39,215

25,388

54.5

34,855

12.5

518,194

392,815

31.9

Total 2 Wheelers

2 wheelers - Exports

MOM %

1.1

1.0

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0.0

Scooters sales & growth trend (YoY)

50%

Units in lakhs

40%

30%

20%

10%

0%

-10%

Motor Cycle Sales

60%

40%

20%

0%

-20%

yoy Growth (%)

Source: TVS, Ventura Research Estimates

Two wheeler & motorcycles sales growth (YOY)

45

40

35

30

15

80%

Scooters

Two wheeler & motorcycle sales (Quarterly)

20

100%

yoy Growth (%)

Source: TVS, Ventura Research Estimates

Monthly

Auto Update

25

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0.0

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Units in lakhs

Motorcycle sales & growth trend (YoY)

Unit in Lakhs

SECTOR UPDATE

Three wheeler sales of the company registered a robust growth of 43.8%, growing

from 9,067 units.

13

35%

30%

25%

20%

15%

10%

5%

0%

th

Friday, 5 December, 2014

SECTOR UPDATE

Auto Monthly Update

Ventura Securities Limited

Corporate Office: C-112/116, Bldg No. 1, Kailash Industrial Complex, Park Site, Vikhroli (W), Mumbai 400079

This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable,

but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities

mentioned in their articles. Neither Ventura Securities Limited nor any of the contributors accepts any liability arising out of the above

information/articles. Reproduction in whole or in part without written permission is prohibited. This report is for private circulation.

th

Monthly Auto Update

Friday, 5 December, 2014

14

You might also like

- NADA Data 2014Document20 pagesNADA Data 2014Luiz Felipe ScolariNo ratings yet

- Auto & Power Industries Portfolio AnalysisDocument35 pagesAuto & Power Industries Portfolio AnalysisHK SahuNo ratings yet

- Conect 2Document1 pageConect 2Barrikelo Cash BerryNo ratings yet

- Mahindra & Mahindra 1Document6 pagesMahindra & Mahindra 1Ankit SinghalNo ratings yet

- Auto SectorUpdate October2012Document12 pagesAuto SectorUpdate October2012Angel BrokingNo ratings yet

- MotoGaze - ICICI February 2013Document18 pagesMotoGaze - ICICI February 2013Vivek MehtaNo ratings yet

- Green Shoots Turning Into Steady Growth!!!: Motogaze - September, 2014Document14 pagesGreen Shoots Turning Into Steady Growth!!!: Motogaze - September, 2014nnsriniNo ratings yet

- Mahindra & Mahindra 2Document6 pagesMahindra & Mahindra 2Ankit SinghalNo ratings yet

- Autos 2011.12 Nomura - November Auto SalesDocument8 pagesAutos 2011.12 Nomura - November Auto SalespradyumndagaNo ratings yet

- Automobile Sector: Pre-Budget Buying Boosts SalesDocument11 pagesAutomobile Sector: Pre-Budget Buying Boosts SalesAngel BrokingNo ratings yet

- Autos: PV & 2Ws Lead Cvs DragDocument14 pagesAutos: PV & 2Ws Lead Cvs DragumaganNo ratings yet

- Automobile Sector Result UpdatedDocument11 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- Auto Sector, January 2013Document12 pagesAuto Sector, January 2013Angel BrokingNo ratings yet

- Auto Sector Update, February 2013Document13 pagesAuto Sector Update, February 2013Angel BrokingNo ratings yet

- IDirect Motogaze Aug16Document16 pagesIDirect Motogaze Aug16umaganNo ratings yet

- Automobile Sector Result UpdatedDocument11 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- Auto Sector Update, June 2013Document12 pagesAuto Sector Update, June 2013Angel BrokingNo ratings yet

- Auto Sector Update November 2011Document11 pagesAuto Sector Update November 2011Angel BrokingNo ratings yet

- TVS Motor - Company UpdateDocument5 pagesTVS Motor - Company UpdateVineet GalaNo ratings yet

- Autos: Cvs Struggle 2Ws and Pvs OutshineDocument14 pagesAutos: Cvs Struggle 2Ws and Pvs OutshineDinesh ChoudharyNo ratings yet

- JLR Monthly Update March 2013Document6 pagesJLR Monthly Update March 2013Angel BrokingNo ratings yet

- Uvs & Scooters Drive Growth in June!!!: Motogaze July 2016Document16 pagesUvs & Scooters Drive Growth in June!!!: Motogaze July 2016khaniyalalNo ratings yet

- JLR Monthly Update February 2013Document6 pagesJLR Monthly Update February 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Automobile Sector: A Mixed ShowDocument11 pagesAutomobile Sector: A Mixed ShowAngel BrokingNo ratings yet

- IndiNivesh Best Sectors Stocks Post 2014Document49 pagesIndiNivesh Best Sectors Stocks Post 2014Arunddhuti RayNo ratings yet

- Automobile Sector: Eyeing The Festival SeasonDocument10 pagesAutomobile Sector: Eyeing The Festival SeasonAngel BrokingNo ratings yet

- Auto Sector Update, July 2013Document13 pagesAuto Sector Update, July 2013Angel BrokingNo ratings yet

- Ashok Leyland Valuation - ReportDocument17 pagesAshok Leyland Valuation - Reportbharath_ndNo ratings yet

- Bns AutoDocument8 pagesBns Autosurapong2005No ratings yet

- Autos - Pent-Up Demand in OctDocument8 pagesAutos - Pent-Up Demand in OctTariq HaqueNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument5 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- SH 2013 Q2 2 ICRA AutomobilesDocument5 pagesSH 2013 Q2 2 ICRA AutomobilesAnkanksha ShardaNo ratings yet

- Credit Rating of Tata MotorsDocument11 pagesCredit Rating of Tata MotorsSharonNo ratings yet

- Growth Sustains in May!!!: Motogaze June 2016Document16 pagesGrowth Sustains in May!!!: Motogaze June 2016umaganNo ratings yet

- Automobile Industry in India ADocument16 pagesAutomobile Industry in India ANamita VirmaniNo ratings yet

- 2015 Automotive Industry Outlook and Strategic InsightDocument36 pages2015 Automotive Industry Outlook and Strategic InsightPallavi ReddyNo ratings yet

- Dashboard: Speedometer Data TrackDocument28 pagesDashboard: Speedometer Data TrackSandesh TrivediNo ratings yet

- JLR Monthly Update, May 2013Document6 pagesJLR Monthly Update, May 2013Angel BrokingNo ratings yet

- Automobile Sector Result UpdatedDocument10 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- JLR Monthly Update, June 2013Document6 pagesJLR Monthly Update, June 2013Angel BrokingNo ratings yet

- JLR Monthly Update, July 2013Document6 pagesJLR Monthly Update, July 2013Angel BrokingNo ratings yet

- Aaditya Jain - Tata MotorsDocument2 pagesAaditya Jain - Tata MotorsAaditya JainNo ratings yet

- Auto Sector Monthly Update-040411Document13 pagesAuto Sector Monthly Update-040411anuragchogtuNo ratings yet

- Automobiles Industry ReportDocument5 pagesAutomobiles Industry ReportvaasurastogiNo ratings yet

- Indian Commercial Vehicle Sector: Trends & Outlook: July 2010Document15 pagesIndian Commercial Vehicle Sector: Trends & Outlook: July 2010aniljainwisdomNo ratings yet

- Auto Industy Demand AnalysisDocument8 pagesAuto Industy Demand Analysisppc1110No ratings yet

- IDBICapital Auto Sep2010Document73 pagesIDBICapital Auto Sep2010raj.mehta2103No ratings yet

- Automobile Sales - September 2013: Car, CV Sales Stay Weak, But Improvement in Two-WheelersDocument3 pagesAutomobile Sales - September 2013: Car, CV Sales Stay Weak, But Improvement in Two-WheelersTariq HaqueNo ratings yet

- Mad MarketDocument6 pagesMad MarketShawn ByunNo ratings yet

- Automobile Sector: Muted Festival DemandDocument12 pagesAutomobile Sector: Muted Festival DemandAngel BrokingNo ratings yet

- Final Report Mahindra & MahindraDocument11 pagesFinal Report Mahindra & MahindraDurgesh TamhaneNo ratings yet

- Automobile Sector Result UpdatedDocument12 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- Growth of Automobile Industry and Its Economic Impact: An Indian PerspectiveDocument5 pagesGrowth of Automobile Industry and Its Economic Impact: An Indian PerspectiveAna IyerNo ratings yet

- Global Scenario: Automobile IndustryDocument21 pagesGlobal Scenario: Automobile IndustryAbhishek ChaudharyNo ratings yet

- Astra International: All's Still in OrderDocument11 pagesAstra International: All's Still in OrdererlanggaherpNo ratings yet

- Auto Volumes Automobile Assembler Auto Sales in Fy15 Record An Impressive 31% Yoy Growth!Document4 pagesAuto Volumes Automobile Assembler Auto Sales in Fy15 Record An Impressive 31% Yoy Growth!Waqas Ashraf KhanNo ratings yet

- Mahindra & Mahindra LTD: Key Financial IndicatorsDocument4 pagesMahindra & Mahindra LTD: Key Financial IndicatorsIntigate NoidaNo ratings yet

- Autos MalaysiaDocument45 pagesAutos MalaysiaNicholas AngNo ratings yet

- Motorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryFrom EverandMotorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiper Motors, Wiper Blades & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandWiper Motors, Wiper Blades & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Universal Joint Dimensional DataDocument48 pagesUniversal Joint Dimensional Datamohammed mostafaNo ratings yet

- Edisi Agustus 2017: Merk Type Kendaraan Harga Qty/Dus Golongan Angker Dinamo StarterDocument49 pagesEdisi Agustus 2017: Merk Type Kendaraan Harga Qty/Dus Golongan Angker Dinamo StarterAlexander LautanNo ratings yet

- Coberturax431paddiagun3master4 PDFDocument2 pagesCoberturax431paddiagun3master4 PDFMario TapiaNo ratings yet

- Forecast Access Q2 Fy2019Document1 pageForecast Access Q2 Fy2019Fuad IhsanNo ratings yet

- Hino RMDocument2 pagesHino RMIRGI ARYA PRIYAMBODONo ratings yet

- Maruti Suzuki Alto ReviewDocument2 pagesMaruti Suzuki Alto ReviewGomati Pratheb100% (1)

- Filtros Combustible FamelDocument9 pagesFiltros Combustible Famelrichard44927No ratings yet

- Allomatic Catalog 03 15 13 PDFDocument319 pagesAllomatic Catalog 03 15 13 PDFVictor Hugo Benitez PaezNo ratings yet

- Buku Manual Diesel Seri 4 J Isuzu - EngDocument88 pagesBuku Manual Diesel Seri 4 J Isuzu - EngMoodyNT100% (2)

- Tipuri Ulei PDFDocument1 pageTipuri Ulei PDFZool Car زول كارNo ratings yet

- Bascolin Corporation: Global Pioneer of Overall Solution in Diesel SystemsDocument8 pagesBascolin Corporation: Global Pioneer of Overall Solution in Diesel SystemsKeyla OrtegaNo ratings yet

- Catalog of RBS Honda ListDocument35 pagesCatalog of RBS Honda Listcbaautoparts197No ratings yet

- DTCO Overview 1 Okt 2012 (Incompatable Tackographs)Document3 pagesDTCO Overview 1 Okt 2012 (Incompatable Tackographs)asefeeNo ratings yet

- Volkswagen Zoznam VozidielDocument33 pagesVolkswagen Zoznam VozidielaycarambuaNo ratings yet

- Mercedes W113 Air Flap Seal W113 SLDocument1 pageMercedes W113 Air Flap Seal W113 SLSergio SantosNo ratings yet

- Fiat Body EsquemasDocument4 pagesFiat Body EsquemasnelsonNo ratings yet

- 46332678426Document2 pages46332678426Rhendy anggaraNo ratings yet

- Catalogo KYB 2009Document94 pagesCatalogo KYB 2009Jenny Mora LeonNo ratings yet

- Jashanpreet EnqDocument7 pagesJashanpreet EnqChandra BhushanNo ratings yet

- Cummins PartsDocument3 pagesCummins PartsISLAM TUBENo ratings yet

- VTR 249 PDFDocument2 pagesVTR 249 PDFRamesh BabuNo ratings yet

- Am-6082ーsolicitud de Cotizacion 555 (07!09!2023)Document2 pagesAm-6082ーsolicitud de Cotizacion 555 (07!09!2023)Diego LópezNo ratings yet

- GasketDocument72 pagesGasketpganoelNo ratings yet

- Who Makes The Most Reliable CarsDocument1 pageWho Makes The Most Reliable CarsDarius KovessiNo ratings yet

- Piese Import Dacia 1310 1.3LDocument69 pagesPiese Import Dacia 1310 1.3LMatei Andrei RazvanNo ratings yet

- Table 2Document6 pagesTable 2ForAccount LoginsNo ratings yet

- Coachmen Owners Manual-1978Document40 pagesCoachmen Owners Manual-1978OnetwothreefourfunkNo ratings yet

- Tata Company ProfileDocument14 pagesTata Company ProfileNishan ShettyNo ratings yet

- ??classic & Sports Car UK - October 2020 PDFDocument238 pages??classic & Sports Car UK - October 2020 PDFnardobarrini100% (1)