Professional Documents

Culture Documents

Afm PDF

Afm PDF

Uploaded by

Bhavani Singh RathoreOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Afm PDF

Afm PDF

Uploaded by

Bhavani Singh RathoreCopyright:

Available Formats

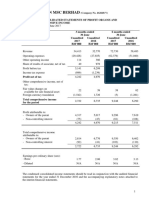

Consolidated Balance Sheet

as at 31st March, 2014

Notes

As at

31.03.2014

(` in Crores)

As at

31.03.2013

EQUITY AND LIABILITIES

Shareholders' Funds

Share Capital

Reserves and Surplus

2

3

Minority Interest

NON CURRENT LIABILITIES

Long Term Borrowings

Deferred Tax Liability (Net)

Other Long Term Liabilities

Long Term Provisions

95.92

3,943.30

4,039.22

246.02

95.92

3,288.37

3,384.29

160.77

4

5

6

7

CURRENT LIABILITIES

Short Term Borrowings

Trade Payables

Other Current Liabilities

Short Term Provisions

41.40

190.01

9.13

108.53

349.07

47.30

156.73

9.39

98.38

311.80

8

9

10

7

198.63

1,745.72

901.45

559.32

3,405.12

8,039.43

189.86

1,441.57

857.55

441.01

2,929.99

6,786.85

11 A

11 B

2,330.74

89.45

71.60

2,491.79

141.39

2,365.68

31.06

59.21

2,455.95

44.23

Total

ASSETS

NON CURRENT ASSETS

Fixed Assets

Tangible Assets

Intangible Assets

Capital work-in-progress

Goodwill on consolidation

27 C

Non-current Investments

Deferred Tax Assets (Net)

Long Term Loans and Advances

Other Non Current Assets

12

5

13

14

192.13

2.19

130.25

25.22

150.12

2.35

104.67

23.35

CURRENT ASSETS

Current Investments

Inventories

Trade Receivables

Cash and Bank Balances

Short Term Loans and Advances

Other Current Assets

15

16

17

18

13

19

529.06

2,069.86

1,110.28

931.66

246.46

169.14

5,056.46

8,039.43

145.56

1,830.29

980.88

736.69

214.60

98.16

4,006.18

6,786.85

Total

Significant Accounting Policies

Notes are an integral part of the financial statements.

As per our report of even date

1

For and on behalf of the Board

For B S R & Associates LLP

Chartered Accountants

F.R.N. 116231W

For Shah & Co.

Chartered Accountants

F.R.N. 109430W

Ashwin Choksi

Chairman

Bhavesh Dhupelia

Partner

Membership No: 042070

Ashish Shah

Partner

Membership No: 103750

Jayesh Merchant

CFO & Company Secretary,

President - Industrial JVs

Mumbai

14th May, 2014

Mumbai

14th May, 2014

Mumbai

14th May, 2014

82

Asian Paints Limited

K.B.S. Anand

Managing Director

& CEO

Dipankar Basu

Chairman of

Audit Committee

31 March, 2014

for the year ended

st

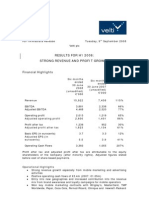

13,889.10

1,307.46

12,581.64

133.17

134.22

12,849.03

12,002.28

1,127.93

10,874.35

64.26

114.48

11,053.09

7,025.28

405.72

(90.28)

759.71

2,616.49

10,716.92

2,132.11

6,265.13

297.43

(149.56)

623.56

2,170.07

9,206.63

1,846.46

245.66

42.22

1,844.23

9.96

1,834.27

154.60

36.65

1,655.21

1,655.21

536.40

33.75

1.36

571.51

1,262.76

43.95

1,218.81

12.71

439.37

59.32

(3.00)

495.69

1,159.52

45.64

1,113.88

11.61

20 B

21

22A

22B

22C

23

24

11

25

30

Minority Interest

Net Profit Attributable to shareholders

Bhavesh Dhupelia

Partner

Membership No: 042070

Ashish Shah

Partner

Membership No: 103750

Jayesh Merchant

CFO & Company Secretary,

President - Industrial JVs

Mumbai

14th May, 2014

Mumbai

14th May, 2014

Mumbai

14th May, 2014

Dipankar Basu

Chairman of

Audit Committee

Annual Report 2013-14

83

Business Responsibility Report

Earnings per share (`) Basic and diluted

34

(Face value of ` 1 each)

Significant Accounting Policies.

1

Notes are an integral part of the financial statements.

As per our report of even date

For and on behalf of the Board

For B S R & Associates LLP

For Shah & Co.

Ashwin Choksi

K.B.S. Anand

Chartered Accountants

Chartered Accountants

Chairman

Managing Director

F.R.N. 116231W

F.R.N. 109430W

& CEO

Corporate Governance

20 A

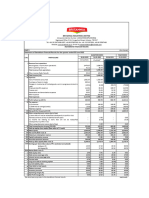

Consolidated Financial Statements

(` in Crores)

Year

2012-13

Standalone Financial Statements

Year

2013-14

Directors Report

(I) INCOME

Revenue from sale of goods and services (Net of discounts)

Less: Excise duty

Revenue from sale of goods and services (Net of discounts and excise duty)

Other Operating Revenue

Other Income

TOTAL REVENUE (I)

(II) EXPENSES

Cost of Materials Consumed

Purchases of Stock-in-Trade

Changes in inventories of finished goods, work in progress and stock-in-trade

Employee Benefits Expense

Other Expenses

Total (II)

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND

AMORTISATION (EBITDA) (I) - (II)

Depreciation and Amortisation Expense

Finance Costs

PROFIT BEFORE EXCEPTIONAL ITEM & TAX

Exceptional Item

PROFIT BEFORE TAX

Less : Tax Expenses

Current Tax

Deferred Tax

Short/(Excess) tax provision for earlier years

Total Tax Expenses

PROFIT AFTER TAX

Notes

Management Discussion & Analysis

Consolidated Statement of Profit and Loss

Consolidated Cash Flow Statement

31 March, 2014

for the year ended

st

(A)

Cash Flow From Operating Activities

Profit Before Tax

Adjustments for :

Depreciation, amortisation and exceptional item

Profit on sale of long term investments

Profit on sale of short term investments

Profit on Sale of fixed assets

Finance costs

Provision for doubtful debts and advances

Bad debts written off

Interest income

Dividend income

Other Non Cash Items

Net unrealised foreign exchange (gain)/ loss

Effect of exchange rates on translation of operating cashflows

Operating Profit before working capital changes

Adjustments for :

Inventories *#

Trade and Other Receivables *#

Trade and Other Payables *#

Cash generated from Operations

Income Tax paid (net of refund)

Net Cash generated from operating activities

2013-14

(` in Crores)

2012-13

1,834.27

1,655.21

255.62

(9.61)

(2.68)

(7.11)

42.22

4.74

1.35

(13.87)

(65.47)

(1.80)

(2.86)

13.51

154.60

(26.21)

(1.05)

(4.21)

36.65

3.66

7.18

(13.73)

(32.89)

4.71

2,048.31

1,783.92

(230.77)

(254.08)

316.70

1,880.16

(480.16)

1,400.00

(246.88)

(299.32)

387.53

1,625.25

(438.46)

1,186.79

(B)

Cash Flow from Investing Activities

Purchase of fixed assets *#

Sale of fixed assets

Purchase of long term investments #

Sale of long term investments

Profit on sale of short term Investments

(Investments)/Maturity of bank deposits (having original maturity more than three months)

Interest received

Dividend received

Amount infused by Minority Stakeholders in subsidiaries

Amount paid towards stake acquisition in subsidiary [Refer note 27 C (b)]

Net Cash used in investing activities

(249.21)

15.63

(871.59)

460.25

2.68

(4.54)

14.43

65.47

22.93

(58.90)

(602.85)

(643.78)

7.06

(246.90)

329.23

1.05

10.21

10.90

32.89

(499.34)

(C)

Cash Flow from Financing Activities

Proceeds from long term borrowings

Repayment of long term borrowings #

Proceeds from short term borrowings

Repayment of short term borrowings #

Finance costs paid

Dividend and Dividend tax paid (including dividend paid to Minority)

Net Cash used in financing activities

1.82

(19.38)

42.61

(61.98)

(42.31)

(546.69)

(625.93)

5.69

(6.10)

27.35

(128.50)

(37.09)

(462.35)

(601.00)

# Current year figures are net of adjustments pursuant to stake acquired in Sleek International Pvt. Ltd. [Refer note 27 C (a)]

* Previous year figures are net of non cash items pursuant to Composite Scheme of Restructuring [Refer note 28].

84

Asian Paints Limited

30.85

926.67

736.24

(` in Crores)

As at

31.03.2013

2.86

0.52

150.51

98.18

3.30

25.70

(b) Cash and Cash Equivalent comprises of : (Refer Note 18)

Cash on hand

Balances with Banks:

- Current Accounts

- Cash Credit Accounts

- Cheques on hand

15.07

33.79

- Deposits with Bank with maturity less than 3 months

46.51

89.26

- Unpaid dividend and fractional bonus shares account @

Investment in Liquid mutual funds and Government Securities

6.05

5.63

702.37

926.67

483.16

736.24

@ The Group can utilise these balances only towards settlement of unclaimed dividend and fractional bonus shares.

As per our report of even date

Consolidated Financial Statements

As at

31.03.2014

Standalone Financial Statements

Notes :

(a) The above Cash Flow Statement has been prepared under the Indirect Method as set out in the Accounting Standard-3 on

Cash Flow Statement.

Directors Report

(` in Crores)

2012-13

86.45

613.65

5.29

-

Management Discussion & Analysis

(D) Net Increase/(Decrease) In Cash and Cash Equivalents

Cash and cash equivalents as at 1st April

Net effect of exchange gain/ (loss) on cash and cash equivalents

Cash and Cash Equivalents acquired pursuant to stake acquisition in subsidiary

[Refer note 27C (a)]

Net Change in Cash and Cash Equivalents pursuant to Composite Scheme of

Restructuring [Refer Note 28]

Cash and Cash Equivalents as at 31st March

2013-14

171.22

736.24

16.62

2.59

For and on behalf of the Board

Ashwin Choksi

Chairman

Bhavesh Dhupelia

Partner

Membership No: 042070

Ashish Shah

Partner

Membership No: 103750

Jayesh Merchant

CFO & Company Secretary,

President - Industrial JVs

Mumbai

14th May, 2014

Mumbai

14th May, 2014

Mumbai

14th May, 2014

K.B.S. Anand

Managing Director

& CEO

Dipankar Basu

Chairman of

Audit Committee

Business Responsibility Report

For Shah & Co.

Chartered Accountants

F.R.N. 109430W

Corporate Governance

For B S R & Associates LLP

Chartered Accountants

F.R.N. 116231W

Annual Report 2013-14

85

Notes to Consolidated Financial Statements

Note 1 : Significant Accounting Policies

1.1 Basis of preparation of Consolidated Financial

Statements

All other assets and liabilities are classified as noncurrent.

For the purpose of current / non-current classification

of assets and liabilities, all the Group companies

have ascertained their normal operating cycle as 12

months. This is based on the nature of services and the

time between the acquisition of assets or inventories

for processing and their realization in cash and cash

equivalents.

(a) Basis of Accounting

(a) Tangible Fixed Assets

The preparation of consolidated financial statements

in conformity with Generally Accepted Accounting

Principles (GAAP) in India requires management

to make estimates and assumptions that affect the

reported amounts of assets and liabilities and the

disclosures of contingent liabilities on the date of

financial statements and reported amounts of income

and expenses during the period.

Tangible fixed assets are carried at the cost of acquisition

or construction, less accumulated depreciation and

impairment. The cost of fixed assets comprises of its

purchase price, including import duties and other nonrefundable taxes or levies and any directly attributable

cost of bringing the asset to its working condition for

its intended use. Expenses directly attributable to new

manufacturing facility during its construction period

are capitalized. Know-how related to plans, designs

and drawings of buildings or plant and machinery is

capitalized under relevant tangible asset heads. Profit

or loss on disposal of tangible assets is recognised in

the Statement of Profit and Loss.

(c) Current / Non-Current Classification

Any asset or liability is classified as current if it satisfies

any of the following conditions:

i.

ii. it is expected to be realized or settled within

twelve months from the reporting date;

iii. in the case of an asset,

it is held primarily for the purpose of being

traded; or

it is cash or cash equivalent unless it is

restricted from being exchanged or used

to settle a liability for at least twelve months

after the reporting date

iv.

(b) Intangible Assets

it is expected to be realized or settled or is

intended for sale or consumption in the Groups

normal operating cycle;

86

1.2 Tangible and Intangible Assets

(b) Use of Estimates

The financial statements have been prepared in

accordance with Generally Accepted Accounting

Principles (GAAP) in India and presented under

the historical cost convention on accrual basis of

accounting to comply with the accounting standards

prescribed in the Companies (Accounting Standards)

Rules, 2006 (as amended) and with the relevant

provisions of the Companies Act, 1956 and relevant

enacted provisions of the Companies Act, 2013 to the

extent applicable.

in the case of a liability, the Group does not have

an unconditional right to defer settlement of

the liability for at least twelve months from the

reporting date.

Asian Paints Limited

Intangible assets acquired separately are measured on

initial recognition at cost. Following initial recognition,

intangible assets are carried at cost less accumulated

amortization and accumulated impairment loss, if

any. Profit or loss on disposal of intangible assets is

recognised in the Statement of Profit and Loss.

Goodwill

Goodwill arising on the acquisition of a business

represents the excess of the cost of acquisition over the

Groups interest in the net fair value of the identifiable

assets and liabilities of the business recognised at the

date of acquisition. Goodwill is initially recognised as

an asset at cost and is subsequently measured at cost

less accumulated amortisation and any accumulated

impairment losses.

The unamortized carrying value of goodwill is tested

for impairment as at each balance sheet date. For the

purpose of impairment testing, goodwill is allocated

You might also like

- Montefiore Health System 2019 Financial StatementsDocument27 pagesMontefiore Health System 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Titan Co Financial ModelDocument15 pagesTitan Co Financial ModelAtharva OrpeNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Profit or LossDocument1 pageProfit or LossKryss Clyde TabliganNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Balance Sheet and Profit and Loss Account FormatDocument11 pagesBalance Sheet and Profit and Loss Account Formatpre.meh21No ratings yet

- Sirius XM Holdings Inc.: FORM 10-QDocument62 pagesSirius XM Holdings Inc.: FORM 10-QguneetsahniNo ratings yet

- dASE Statment Sinke - CBEDocument50 pagesdASE Statment Sinke - CBEHashim TuneNo ratings yet

- Q1 Financial Results 2022-23Document6 pagesQ1 Financial Results 2022-23Vee SundarNo ratings yet

- Consolidated Financial StatementDocument36 pagesConsolidated Financial StatementArt KingNo ratings yet

- ICBP Financial Results Summary 1Q20Document8 pagesICBP Financial Results Summary 1Q20ayun fauziah16No ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Comparative Statement of Profit and LossDocument2 pagesComparative Statement of Profit and LossAnindya BatabyalNo ratings yet

- Q3 Interim Condensed Consolidated FS 2019Document8 pagesQ3 Interim Condensed Consolidated FS 2019FaizanSulNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- RHB Group Soci SofpDocument3 pagesRHB Group Soci SofpAnis SuhailaNo ratings yet

- ADB Interim FinancialDocument17 pagesADB Interim FinancialNurul HidayahNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document10 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Consolidated Balance SheetDocument1 pageConsolidated Balance SheetSukhmanNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- 8 MIS November 2012Document129 pages8 MIS November 2012kr__santoshNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- YumBrandsInc 10Q Q2-2013Document58 pagesYumBrandsInc 10Q Q2-2013nitin2khNo ratings yet

- Willowglen MSC Berhad: (Company No. 462648-V)Document10 pagesWillowglen MSC Berhad: (Company No. 462648-V)Shungchau WongNo ratings yet

- Titan Shoppers Stop Ratio Analysis - 2014Document25 pagesTitan Shoppers Stop Ratio Analysis - 2014Jigyasu PritNo ratings yet

- HHB - Announcement - 1Q FY2022 Result - 20210803Document14 pagesHHB - Announcement - 1Q FY2022 Result - 20210803Dennis HaNo ratings yet

- Montefiore Health System Q3 2019 Financial StatementsDocument25 pagesMontefiore Health System Q3 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- NRSP-MFBL-Q3-Financials-Sept 2022 - V1Document15 pagesNRSP-MFBL-Q3-Financials-Sept 2022 - V1shahzadnazir77No ratings yet

- LilyDocument11 pagesLilySheeena OsiasNo ratings yet

- q1 Ifrs Usd Earnings ReleaseDocument26 pagesq1 Ifrs Usd Earnings Releaseashokdb2kNo ratings yet

- Financial Results Q1 August 2018Document13 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- BCBL Financial StatementDocument2 pagesBCBL Financial StatementTanvirNo ratings yet

- Q2 Fy2011-12 PDFDocument2 pagesQ2 Fy2011-12 PDFTushar PatelNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financials Q2 2017 FINALDocument22 pagesFinancials Q2 2017 FINALlazarpaladinNo ratings yet

- Balance Sheet: Share Capital and ReservesDocument42 pagesBalance Sheet: Share Capital and ReservesaaliaccaNo ratings yet

- 2nd Quarter Financial Statements 2020Document15 pages2nd Quarter Financial Statements 2020Ahm FerdousNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Wema-Bank-Financial Statement-2020Document24 pagesWema-Bank-Financial Statement-2020john stonesNo ratings yet

- Raymond Limited Financial StatementsDocument85 pagesRaymond Limited Financial StatementsVinay KukrejaNo ratings yet

- Unaudited Financial Results 30.06.2021 1Document11 pagesUnaudited Financial Results 30.06.2021 1Kartik AroraNo ratings yet

- Balance Sheet As at 31St March 2008:: Share Capital Share Application Money Received Pending Allotment of SharesDocument1 pageBalance Sheet As at 31St March 2008:: Share Capital Share Application Money Received Pending Allotment of Sharesbirat_thapa18No ratings yet

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiNo ratings yet

- Sibl-Fs 30 June 2018Document322 pagesSibl-Fs 30 June 2018Faizal KhanNo ratings yet

- Balance SheetDocument25 pagesBalance SheetImran AhmedNo ratings yet

- Results For H1 2008: Strong Revenue and Profit Growth: Financial HighlightsDocument18 pagesResults For H1 2008: Strong Revenue and Profit Growth: Financial HighlightsmixedbagNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- MMC BerhadDocument27 pagesMMC Berhadpuravi91No ratings yet

- Annexure 4116790Document31 pagesAnnexure 4116790ayesha ansariNo ratings yet

- Leucadia 2012 Q3 ReportDocument43 pagesLeucadia 2012 Q3 Reportofb1No ratings yet

- AESCorporation 10Q 20130808Document86 pagesAESCorporation 10Q 20130808Ashish SinghalNo ratings yet

- Balance-Sheet-Consolidated 20 19Document2 pagesBalance-Sheet-Consolidated 20 19Anand GovindanNo ratings yet

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677No ratings yet

- Consolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundDocument4 pagesConsolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundPuneet GeraNo ratings yet

- Fidelity National Financial, Inc.: FORM 10-QDocument76 pagesFidelity National Financial, Inc.: FORM 10-Qrocky6182002No ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Sail Annual Report - 2022.inddDocument11 pagesSail Annual Report - 2022.inddSandeep SharmaNo ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- Routes: Automatic RouteDocument4 pagesRoutes: Automatic RouteBhavani Singh RathoreNo ratings yet

- What Are Swarovski Crystals: More InformationDocument1 pageWhat Are Swarovski Crystals: More InformationBhavani Singh RathoreNo ratings yet

- Introduction of DerivativesDocument23 pagesIntroduction of DerivativesBhavani Singh RathoreNo ratings yet

- Good Risk and Bad RiskDocument6 pagesGood Risk and Bad RiskBhavani Singh RathoreNo ratings yet

- Name: Bharat ROLLNO: 141205 Cts Risk ProfilingDocument4 pagesName: Bharat ROLLNO: 141205 Cts Risk ProfilingBhavani Singh RathoreNo ratings yet

- B2B Marketing: Bhavani Singh Rathore Roll No - 141206Document3 pagesB2B Marketing: Bhavani Singh Rathore Roll No - 141206Bhavani Singh RathoreNo ratings yet

- Memorandom of AssociationDocument28 pagesMemorandom of AssociationBhavani Singh RathoreNo ratings yet

- Managerial EconomicsDocument3 pagesManagerial EconomicsBhavani Singh Rathore100% (2)

- Demand and Supply Analysis of Gold in IndianDocument11 pagesDemand and Supply Analysis of Gold in IndianBhavani Singh Rathore50% (2)

- Article Summary - Beware The Limit of Swot Analysis: Name: Bhavani Singh Rathore Roll No: 141206Document4 pagesArticle Summary - Beware The Limit of Swot Analysis: Name: Bhavani Singh Rathore Roll No: 141206Bhavani Singh RathoreNo ratings yet

- Corporate-Level Strategy Of: By: Syed Jamal Uddin Susman Kumar Das Venkata Phani PrudhviDocument5 pagesCorporate-Level Strategy Of: By: Syed Jamal Uddin Susman Kumar Das Venkata Phani PrudhviBhavani Singh RathoreNo ratings yet

- 1 Group AccountingDocument35 pages1 Group AccountingRSM PakistanNo ratings yet

- BUSINESS FINANCE Las Week 5 and 6Document9 pagesBUSINESS FINANCE Las Week 5 and 6ggonegvftNo ratings yet

- General InformationDocument79 pagesGeneral InformationRavi MoriNo ratings yet

- Course Module - Chapter 9 - Interest in Joint VenturesDocument9 pagesCourse Module - Chapter 9 - Interest in Joint VenturesMarianne DadullaNo ratings yet

- 1.-Explorers of The Future PDFDocument14 pages1.-Explorers of The Future PDFJoseNo ratings yet

- Saha Automobiles - 76-77Document63 pagesSaha Automobiles - 76-77Menuka SiwaNo ratings yet

- Term Debt Is Not Recorded As A LiabilityDocument3 pagesTerm Debt Is Not Recorded As A Liabilitychristian dagNo ratings yet

- CRI Healthcare Procedure Manual 240218Document40 pagesCRI Healthcare Procedure Manual 240218Poornima DeviNo ratings yet

- Stanley Furniture Announces Fourth Quarterand Total Year 3013 Operating ResultsDocument7 pagesStanley Furniture Announces Fourth Quarterand Total Year 3013 Operating Resultsjcf129erNo ratings yet

- SAP T CodesDocument79 pagesSAP T Codesनिपुण कुमारNo ratings yet

- Report Cycle. 3Document28 pagesReport Cycle. 3Akimanzi GloriaNo ratings yet

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- 36 - Balance SheetDocument3 pages36 - Balance SheetLara Lewis Achilles100% (2)

- Accountancy Auditing 2016Document7 pagesAccountancy Auditing 2016Abdul basitNo ratings yet

- This Study Resource Was: Business Combination Practical Accounting 2 Date of AcquisitionDocument6 pagesThis Study Resource Was: Business Combination Practical Accounting 2 Date of AcquisitionAnneShannenBambaDabuNo ratings yet

- CH 10 - End of Chapter Exercises SolutionsDocument57 pagesCH 10 - End of Chapter Exercises SolutionssaraNo ratings yet

- Speaker NotesDocument3 pagesSpeaker NoteskainatidreesNo ratings yet

- 1) Explain The Objectives of Financial Management, Interphase Between Finance and Other FunctionsDocument6 pages1) Explain The Objectives of Financial Management, Interphase Between Finance and Other FunctionsGovendhan PNo ratings yet

- Profit and Loss Account: Jet AirwaysDocument2 pagesProfit and Loss Account: Jet AirwaysSiddharth GuptaNo ratings yet

- BV2018 - MFRS 120 StandardDocument12 pagesBV2018 - MFRS 120 StandardAlexNo ratings yet

- Fin420 - Fin540oct 09Document12 pagesFin420 - Fin540oct 09Mohamad Noor ZhafriNo ratings yet

- ExchangeDocument6 pagesExchangeBea Marie Dejillas0% (1)

- Beginners' Guide To Asset Allocation, Diversification, and RebalancingDocument6 pagesBeginners' Guide To Asset Allocation, Diversification, and RebalancingIntasar32 AliNo ratings yet

- Final BY Mobile Catering Business PlanDocument11 pagesFinal BY Mobile Catering Business Plantumusiime robertNo ratings yet

- AFAR DAYAG - Anna Joy S. TalanDocument129 pagesAFAR DAYAG - Anna Joy S. TalanAllynna Joy62% (13)

- FI 305 - First Solar ProjectDocument23 pagesFI 305 - First Solar ProjectKhoai TâyNo ratings yet

- Depreciation Rates As Per Income-Tax Act, 1961Document18 pagesDepreciation Rates As Per Income-Tax Act, 1961Darshan JainNo ratings yet

- The Role of Cooperatives in MaDocument11 pagesThe Role of Cooperatives in MaDah LiaNo ratings yet

- Business Balance Sheet TemplateDocument5 pagesBusiness Balance Sheet TemplateAMIT PRAJAPATI100% (1)