Professional Documents

Culture Documents

Get Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment Payment

Get Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment Payment

Uploaded by

ManishCopyright:

Available Formats

You might also like

- Suggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?Document12 pagesSuggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?lixvanter0% (1)

- CH 03 SMDocument107 pagesCH 03 SMapi-234680678No ratings yet

- Accounting Assignment PDFDocument18 pagesAccounting Assignment PDFMohammed SafwatNo ratings yet

- Export Import Proposal SampleDocument30 pagesExport Import Proposal Sampleapi-268237919100% (1)

- Level I of CFA Program 6 Mock Exam June 2020 Revision 1Document43 pagesLevel I of CFA Program 6 Mock Exam June 2020 Revision 1JasonNo ratings yet

- Afw 1000 Final Q s1 2014Document17 pagesAfw 1000 Final Q s1 2014Mohammad RashmanNo ratings yet

- ACCO 310/4: Concordia University John Molson School of Business Department of AccountingDocument10 pagesACCO 310/4: Concordia University John Molson School of Business Department of AccountingMiruna CiteaNo ratings yet

- Chapter 2 Problems and SolutionDocument19 pagesChapter 2 Problems and SolutionSaidurRahaman100% (1)

- Comprehensive Exam ADocument12 pagesComprehensive Exam Ajdiaz_646247100% (2)

- Sol. Man. - Chapter 10 She 1Document9 pagesSol. Man. - Chapter 10 She 1Miguel AmihanNo ratings yet

- MB0041 - Summer 2014Document3 pagesMB0041 - Summer 2014Rajesh SinghNo ratings yet

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonNo ratings yet

- MB0041-Finance & Management Accounting Mba 1 Semester Assignment Set - 1Document12 pagesMB0041-Finance & Management Accounting Mba 1 Semester Assignment Set - 1Abhinav TelidevaraNo ratings yet

- Bba 4002Document14 pagesBba 4002Windy TanNo ratings yet

- 10 Exercises BE Solutions-1Document40 pages10 Exercises BE Solutions-1loveliangel0% (2)

- Park DocumentDocument23 pagesPark Documentchitharanjan kotekarNo ratings yet

- 41Document20 pages41Rinku PatelNo ratings yet

- Vishal Kiran Dhoble - Adl01 PDFDocument14 pagesVishal Kiran Dhoble - Adl01 PDFvishald13No ratings yet

- NCERT Questions - Financial Statements (Final Accounts) - Evero PDFDocument53 pagesNCERT Questions - Financial Statements (Final Accounts) - Evero PDFYogendra PatelNo ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- Quiz 2 Version 1 SolutionDocument6 pagesQuiz 2 Version 1 SolutionEych MendozaNo ratings yet

- C01 Modelquestionpaper AnswersDocument28 pagesC01 Modelquestionpaper AnswersLogs MutaNo ratings yet

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- IGNOU MCA MCS-35 Solved Question Papers June 2009Document14 pagesIGNOU MCA MCS-35 Solved Question Papers June 2009Pankaj BassiNo ratings yet

- Peg Sept11 p1Document18 pagesPeg Sept11 p1patriciadouceNo ratings yet

- PDFDocument3 pagesPDFPooja RanaNo ratings yet

- Imt 59Document3 pagesImt 59Prabhjeet Singh GillNo ratings yet

- Fa4e SM Ch03Document82 pagesFa4e SM Ch03michaelkwok1No ratings yet

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparreNo ratings yet

- ErrorsDocument8 pagesErrorsShariff MohamedNo ratings yet

- CH 3Document94 pagesCH 3api-3088239320% (1)

- DeVry BUSN 379 Complete Course - LatestDocument8 pagesDeVry BUSN 379 Complete Course - Latestdhol112No ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Oracle: Questions & Answers (Demo Version - Limited Content)Document6 pagesOracle: Questions & Answers (Demo Version - Limited Content)SamHasNo ratings yet

- Advanced AccountingDocument13 pagesAdvanced AccountingprateekfreezerNo ratings yet

- HOSP1860 4 AdjustingtheaccountsDocument6 pagesHOSP1860 4 AdjustingtheaccountsLule RamaNo ratings yet

- Extra Questions - Financial Statements (Final Accounts) - Everonn - Class-11th CommerceDocument26 pagesExtra Questions - Financial Statements (Final Accounts) - Everonn - Class-11th Commerceganesh86.1250% (4)

- Accounting 4Document8 pagesAccounting 4syopiNo ratings yet

- BSBFIM501 ASS3 NiranDocument14 pagesBSBFIM501 ASS3 NiranMaykiza NiranpakornNo ratings yet

- 1Z0 960demo PDFDocument8 pages1Z0 960demo PDFcdeccanNo ratings yet

- CAT - T3 FREE Online CBE Based Mock ExamDocument6 pagesCAT - T3 FREE Online CBE Based Mock ExamACCALIVENo ratings yet

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocument3 pagesGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- Vendor: Oracle Exam Code: 1Z0-215 Exam Name: Oracle EBS R12: General Ledger andDocument8 pagesVendor: Oracle Exam Code: 1Z0-215 Exam Name: Oracle EBS R12: General Ledger andMSAMHOURINo ratings yet

- M 14 Final Financial Reporting Guideline AnswersDocument16 pagesM 14 Final Financial Reporting Guideline Answersmj192No ratings yet

- Modul Jawaban Koeliah: Akuntansi BiayaDocument16 pagesModul Jawaban Koeliah: Akuntansi BiayaAndika Putra SalinasNo ratings yet

- The Exam Include 10 Question - Don't Use Red Pen or A Pencil Question 1: Put ( ) or (×) - Make Your Answer in A Table in The Answer SheetDocument4 pagesThe Exam Include 10 Question - Don't Use Red Pen or A Pencil Question 1: Put ( ) or (×) - Make Your Answer in A Table in The Answer Sheetfade1993100% (1)

- Microsoft Word - Examiner's Report PM D18 FinalDocument7 pagesMicrosoft Word - Examiner's Report PM D18 FinalMuhammad Hassan Ahmad MadniNo ratings yet

- Swarnarik Chatterjee 23405018005 CA2 Management AccountingDocument9 pagesSwarnarik Chatterjee 23405018005 CA2 Management AccountingRik DragneelNo ratings yet

- Ac1025 Excza 11Document18 pagesAc1025 Excza 11gurpreet_mNo ratings yet

- Corporate FinanceDocument6 pagesCorporate Financejayesh jhaNo ratings yet

- Practice MT2 SolutionDocument15 pagesPractice MT2 SolutionKionna TamaraNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisAngel MallariNo ratings yet

- Curve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCCDocument7 pagesCurve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCC037boyNo ratings yet

- CPT Term PaperDocument4 pagesCPT Term Paperafmzqaugqrckgg100% (1)

- BUS1AFB - Assignment 2 - Semester 1 2021 - FINALDocument4 pagesBUS1AFB - Assignment 2 - Semester 1 2021 - FINALChi NguyenNo ratings yet

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentNoumanNo ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- Project Report On "Buying Behaviour of Gold With Regards To Tanisq "Document57 pagesProject Report On "Buying Behaviour of Gold With Regards To Tanisq "vivekNo ratings yet

- BaiduDocument29 pagesBaiduidradjatNo ratings yet

- Indian Logistics IndustryDocument79 pagesIndian Logistics IndustryMOHITKOLLINo ratings yet

- Finance-Chapter-1 3Document25 pagesFinance-Chapter-1 3marketing bbs 2nd year pdfNo ratings yet

- Section 2: Important Chart Patterns: Inside/Outside ReversalDocument20 pagesSection 2: Important Chart Patterns: Inside/Outside Reversalancutzica2000No ratings yet

- FAR ReviewerDocument3 pagesFAR ReviewerMich ClementeNo ratings yet

- Business PlanDocument14 pagesBusiness PlanJM ReynanciaNo ratings yet

- The Credit SystemDocument6 pagesThe Credit SystemJamil MacabandingNo ratings yet

- Analysis of Pakistan Cement SectorDocument43 pagesAnalysis of Pakistan Cement SectorLeena SaleemNo ratings yet

- IHH Investor Presentation - Fortis Transaction (20180716)Document23 pagesIHH Investor Presentation - Fortis Transaction (20180716)HIMANSHU SHEKHARNo ratings yet

- Zakat Declaration Form CZ501Document2 pagesZakat Declaration Form CZ501syed suleman shahNo ratings yet

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- Tariff Petition of LESCO For FY 2013-14Document85 pagesTariff Petition of LESCO For FY 2013-14Ab CNo ratings yet

- Aset FinansialDocument48 pagesAset FinansialMichaelNo ratings yet

- Financial Statement Analysis of Exide IndustriesDocument11 pagesFinancial Statement Analysis of Exide IndustriesSrihari KumarNo ratings yet

- Investopedia ExplainsDocument28 pagesInvestopedia ExplainsPankaj JoshiNo ratings yet

- Pas 14 Segment ReportingDocument3 pagesPas 14 Segment ReportingrandyNo ratings yet

- Kochi Metro Rail ProjectDocument7 pagesKochi Metro Rail ProjectDilip79No ratings yet

- Positioning and Repositioning of AirtelDocument15 pagesPositioning and Repositioning of AirtelAmy Johnson0% (1)

- How Should The Mongolian Government Keep Balance Between Maintaining Its National Security and Pursuing Economic BenefitsDocument85 pagesHow Should The Mongolian Government Keep Balance Between Maintaining Its National Security and Pursuing Economic BenefitsThanh ThuyNo ratings yet

- Compendium Petitioner AnonymousDocument105 pagesCompendium Petitioner Anonymouspratham mohantyNo ratings yet

- A Summer Projectreport ON Profitability Analysis of Mahindra and MahindraDocument38 pagesA Summer Projectreport ON Profitability Analysis of Mahindra and MahindraSunill SamantaNo ratings yet

- RA 8791 General Banking ActDocument22 pagesRA 8791 General Banking ActStephanie Mei100% (1)

- Accounting For BondsDocument11 pagesAccounting For BondsChrisus Joseph SarchezNo ratings yet

- FINC2011 Tutorial 4Document7 pagesFINC2011 Tutorial 4suitup100100% (3)

- Scope and Objectives of Financial ManagementDocument23 pagesScope and Objectives of Financial ManagementAnkit KumarNo ratings yet

Get Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment Payment

Get Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment Payment

Uploaded by

ManishOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Get Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment Payment

Get Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment Payment

Uploaded by

ManishCopyright:

Available Formats

Get fully solved assignment

100% trusted website bcoz we use installment payment

smu mba/bba/bca/mca assignment winter season (april/may exam) 2013 sem (I , II , III , IV) in only Rs 700/

sem ( 6 sub) or Rs 125/question paper.

You can pay in 5 installment of Rs 125-125 if u have any doubt.

For solutionmail us on computeroperator4@gmail.com with your question subject code or question paper

if urgent then

Call us on 08273413412 , 08791490301 or

web- www.smuassignment.in

www.assignmenthelpforall.blogspot.in

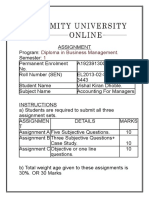

MB0041- FINANCIAL AND MANAGEMENT ACCOUNTING

Q1 Give the classification of Accounts according to accounting equation approach with its meaning and examples.

Compare the traditional approach with modern approach of accounting equation approach. Analyze the

transaction under traditional approach.

a. 20.1.2011 Paid salary Rs. 30,000

b. 20.1.2011 Paid rent by cheque Rs. 8,000

c. 21.1.2011 Goods withdrawn for personal use Rs. 5,000

d. 25.1.2011 Paid an advance to suppliers of goods Rs. 1,00,000

e. 26.1.2011 Received an advance from customers Rs. 3,00,000

f. 31.1.2011 Paid interest on loan Rs. 5,000

g. 31.1.2011 Paid instalment of loan Rs. 25,000

h. 31.1.2011 Interest allowed by bank Rs. 8,000

(Classification of accounting equation approach with meaning and examples , Analysis of transaction with

accounts involved-nature of account affects and debit/credit )

Solution:

Q2. The following trial balance was extracted from the books of Chetan, a small businessman. Do you think it is

correct? If not, rewrite it in the correct form.

Debits

Rs.

Credits

Rs.

Stock

Purchases

Returns outwards

Discount received

Wages and salaries

Rent and rates

Sundry debtors

Bank Overdraft

8250

12750

700

800

2500

1850

7600

2450

Capital

Sales

Returns inwards

Discount allowed

Scooty

Carriage charges

Sundry creditors

Bills payable

10000

15900

1590

800

1750

700

7250

690

(Journal entries of all the transactions, Conclusion)

Answer: no, its not the right way. General entries of all the transaction in proper way are given in the below table

Conclusion:

Title provided at the top shows the name of the entity and accounting period end for which the trial balance

has been prepared.

Q3 From the given trial balance draft an Adjusted Trial Balance.

Trial Balance as on 31.03.2011

Rs.

Debit balances

Rs.

Credit balances

Furniture

and

Bank Over Draft

16000

10000

Fittings

400000

Buildings

500000

Capital Account

Sales Returns

1000

Purchase Returns 4000

Bad Debts

2000

Sundry Creditors 30000

5000

Sundry Debtors

25000

Commission

235000

Purchases

90000

Sales

Advertising

20000

Cash

10000

Taxes and Insurance 5000

General Expenses

7000

Salaries

20000

695000

TOTAL

690000

TOTAL

Adjustments:

1. Charge depreciation at 10% on Buildings and Furniture and fittings.

2. Write off further bad debts 1000

3. Taxes and Insurance prepaid 2000

4. Outstanding salaries 5000

5. Commission received in advance1000

(Preparation of ledger accounts, Preparation of trial balance )

Solution:

Ledger accounts

Furniture and fittings a/c

Dr.

Particulars

To bal b/d

Cr.

Rs. Particulars

10000 By Depreciation

By bal c/d

Total

To bal b/d

10000 Total

Rs.

1000

9000

10000

9000

Q4. Compute trend ratios and comment on the financial performance of Infosys Technologies Ltd. from the following

extract of its income statements of five years. (in Rs. Crore)

(Source: Infosys Technologies Ltd. Annual Report)

(Preparation of trend analysis, Preparation of trend ratios, Conclusion)

Solution:

Infosys Technologies Ltd.

Q5. Give the meaning of cash flow analysis and put down the objectives of cash flow analysis. Explain the

preparation of cash flow statement.

(Meaning of cash flow analysis, Objectives of cash flow analysis, Explanation of preparation of cash flow

analysis)

Answer:

Meaning of Cash Flow Analysis

Cash flow analysis is an important tool of financial analysis. It is the process of understanding the change in position

with respect to cash in the current year and the reasons responsible for such a change. Incidentally, the analysis also helps

us to understand whether the investing and financing decision taken by the company during the year are appropriate are

not. Cash flow analysis is presented in the form of a statement. Such a statement is called a cash flow statement.

Q6. Write the assumptions of marginal costing. Differentiate between absorption costing and marginal

costing.

(Assumptions of marginal costing (all 7 points), Differences of marginal and absorption costing (Includes

all 8 points)

Answer:

Assumptions of Marginal Costing

Marginal costing is based on the following assumptions:

1. Segregation of cost into fixed and variable

The whole principle of marginal costing is based on the idea that some costs vary with production while some costs

dont. Therefore, it is assumed that a clear bifurcation between fixed and variable costs is possible. Even if some Get

fully solved assignment

100% trusted website bcoz we use installment payment

smu mba/bba/bca/mca assignment winter season (april/may exam) 2013 sem (I , II , III , IV) in only Rs 700/

sem ( 6 sub) or Rs 125/question paper.

You can pay in 5 installment of Rs 125-125 if u have any doubt.

For solutionmail us on computeroperator4@gmail.com with your question subject code or question paper

if urgent then

Call us on 08273413412 , 08791490301 or

web- www.smuassignment.in

www.assignmenthelpforall.blogspot.in

You might also like

- Suggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?Document12 pagesSuggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?lixvanter0% (1)

- CH 03 SMDocument107 pagesCH 03 SMapi-234680678No ratings yet

- Accounting Assignment PDFDocument18 pagesAccounting Assignment PDFMohammed SafwatNo ratings yet

- Export Import Proposal SampleDocument30 pagesExport Import Proposal Sampleapi-268237919100% (1)

- Level I of CFA Program 6 Mock Exam June 2020 Revision 1Document43 pagesLevel I of CFA Program 6 Mock Exam June 2020 Revision 1JasonNo ratings yet

- Afw 1000 Final Q s1 2014Document17 pagesAfw 1000 Final Q s1 2014Mohammad RashmanNo ratings yet

- ACCO 310/4: Concordia University John Molson School of Business Department of AccountingDocument10 pagesACCO 310/4: Concordia University John Molson School of Business Department of AccountingMiruna CiteaNo ratings yet

- Chapter 2 Problems and SolutionDocument19 pagesChapter 2 Problems and SolutionSaidurRahaman100% (1)

- Comprehensive Exam ADocument12 pagesComprehensive Exam Ajdiaz_646247100% (2)

- Sol. Man. - Chapter 10 She 1Document9 pagesSol. Man. - Chapter 10 She 1Miguel AmihanNo ratings yet

- MB0041 - Summer 2014Document3 pagesMB0041 - Summer 2014Rajesh SinghNo ratings yet

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonNo ratings yet

- MB0041-Finance & Management Accounting Mba 1 Semester Assignment Set - 1Document12 pagesMB0041-Finance & Management Accounting Mba 1 Semester Assignment Set - 1Abhinav TelidevaraNo ratings yet

- Bba 4002Document14 pagesBba 4002Windy TanNo ratings yet

- 10 Exercises BE Solutions-1Document40 pages10 Exercises BE Solutions-1loveliangel0% (2)

- Park DocumentDocument23 pagesPark Documentchitharanjan kotekarNo ratings yet

- 41Document20 pages41Rinku PatelNo ratings yet

- Vishal Kiran Dhoble - Adl01 PDFDocument14 pagesVishal Kiran Dhoble - Adl01 PDFvishald13No ratings yet

- NCERT Questions - Financial Statements (Final Accounts) - Evero PDFDocument53 pagesNCERT Questions - Financial Statements (Final Accounts) - Evero PDFYogendra PatelNo ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- Quiz 2 Version 1 SolutionDocument6 pagesQuiz 2 Version 1 SolutionEych MendozaNo ratings yet

- C01 Modelquestionpaper AnswersDocument28 pagesC01 Modelquestionpaper AnswersLogs MutaNo ratings yet

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- IGNOU MCA MCS-35 Solved Question Papers June 2009Document14 pagesIGNOU MCA MCS-35 Solved Question Papers June 2009Pankaj BassiNo ratings yet

- Peg Sept11 p1Document18 pagesPeg Sept11 p1patriciadouceNo ratings yet

- PDFDocument3 pagesPDFPooja RanaNo ratings yet

- Imt 59Document3 pagesImt 59Prabhjeet Singh GillNo ratings yet

- Fa4e SM Ch03Document82 pagesFa4e SM Ch03michaelkwok1No ratings yet

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparreNo ratings yet

- ErrorsDocument8 pagesErrorsShariff MohamedNo ratings yet

- CH 3Document94 pagesCH 3api-3088239320% (1)

- DeVry BUSN 379 Complete Course - LatestDocument8 pagesDeVry BUSN 379 Complete Course - Latestdhol112No ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Oracle: Questions & Answers (Demo Version - Limited Content)Document6 pagesOracle: Questions & Answers (Demo Version - Limited Content)SamHasNo ratings yet

- Advanced AccountingDocument13 pagesAdvanced AccountingprateekfreezerNo ratings yet

- HOSP1860 4 AdjustingtheaccountsDocument6 pagesHOSP1860 4 AdjustingtheaccountsLule RamaNo ratings yet

- Extra Questions - Financial Statements (Final Accounts) - Everonn - Class-11th CommerceDocument26 pagesExtra Questions - Financial Statements (Final Accounts) - Everonn - Class-11th Commerceganesh86.1250% (4)

- Accounting 4Document8 pagesAccounting 4syopiNo ratings yet

- BSBFIM501 ASS3 NiranDocument14 pagesBSBFIM501 ASS3 NiranMaykiza NiranpakornNo ratings yet

- 1Z0 960demo PDFDocument8 pages1Z0 960demo PDFcdeccanNo ratings yet

- CAT - T3 FREE Online CBE Based Mock ExamDocument6 pagesCAT - T3 FREE Online CBE Based Mock ExamACCALIVENo ratings yet

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocument3 pagesGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- Vendor: Oracle Exam Code: 1Z0-215 Exam Name: Oracle EBS R12: General Ledger andDocument8 pagesVendor: Oracle Exam Code: 1Z0-215 Exam Name: Oracle EBS R12: General Ledger andMSAMHOURINo ratings yet

- M 14 Final Financial Reporting Guideline AnswersDocument16 pagesM 14 Final Financial Reporting Guideline Answersmj192No ratings yet

- Modul Jawaban Koeliah: Akuntansi BiayaDocument16 pagesModul Jawaban Koeliah: Akuntansi BiayaAndika Putra SalinasNo ratings yet

- The Exam Include 10 Question - Don't Use Red Pen or A Pencil Question 1: Put ( ) or (×) - Make Your Answer in A Table in The Answer SheetDocument4 pagesThe Exam Include 10 Question - Don't Use Red Pen or A Pencil Question 1: Put ( ) or (×) - Make Your Answer in A Table in The Answer Sheetfade1993100% (1)

- Microsoft Word - Examiner's Report PM D18 FinalDocument7 pagesMicrosoft Word - Examiner's Report PM D18 FinalMuhammad Hassan Ahmad MadniNo ratings yet

- Swarnarik Chatterjee 23405018005 CA2 Management AccountingDocument9 pagesSwarnarik Chatterjee 23405018005 CA2 Management AccountingRik DragneelNo ratings yet

- Ac1025 Excza 11Document18 pagesAc1025 Excza 11gurpreet_mNo ratings yet

- Corporate FinanceDocument6 pagesCorporate Financejayesh jhaNo ratings yet

- Practice MT2 SolutionDocument15 pagesPractice MT2 SolutionKionna TamaraNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisAngel MallariNo ratings yet

- Curve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCCDocument7 pagesCurve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCC037boyNo ratings yet

- CPT Term PaperDocument4 pagesCPT Term Paperafmzqaugqrckgg100% (1)

- BUS1AFB - Assignment 2 - Semester 1 2021 - FINALDocument4 pagesBUS1AFB - Assignment 2 - Semester 1 2021 - FINALChi NguyenNo ratings yet

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentNoumanNo ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- Project Report On "Buying Behaviour of Gold With Regards To Tanisq "Document57 pagesProject Report On "Buying Behaviour of Gold With Regards To Tanisq "vivekNo ratings yet

- BaiduDocument29 pagesBaiduidradjatNo ratings yet

- Indian Logistics IndustryDocument79 pagesIndian Logistics IndustryMOHITKOLLINo ratings yet

- Finance-Chapter-1 3Document25 pagesFinance-Chapter-1 3marketing bbs 2nd year pdfNo ratings yet

- Section 2: Important Chart Patterns: Inside/Outside ReversalDocument20 pagesSection 2: Important Chart Patterns: Inside/Outside Reversalancutzica2000No ratings yet

- FAR ReviewerDocument3 pagesFAR ReviewerMich ClementeNo ratings yet

- Business PlanDocument14 pagesBusiness PlanJM ReynanciaNo ratings yet

- The Credit SystemDocument6 pagesThe Credit SystemJamil MacabandingNo ratings yet

- Analysis of Pakistan Cement SectorDocument43 pagesAnalysis of Pakistan Cement SectorLeena SaleemNo ratings yet

- IHH Investor Presentation - Fortis Transaction (20180716)Document23 pagesIHH Investor Presentation - Fortis Transaction (20180716)HIMANSHU SHEKHARNo ratings yet

- Zakat Declaration Form CZ501Document2 pagesZakat Declaration Form CZ501syed suleman shahNo ratings yet

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- Tariff Petition of LESCO For FY 2013-14Document85 pagesTariff Petition of LESCO For FY 2013-14Ab CNo ratings yet

- Aset FinansialDocument48 pagesAset FinansialMichaelNo ratings yet

- Financial Statement Analysis of Exide IndustriesDocument11 pagesFinancial Statement Analysis of Exide IndustriesSrihari KumarNo ratings yet

- Investopedia ExplainsDocument28 pagesInvestopedia ExplainsPankaj JoshiNo ratings yet

- Pas 14 Segment ReportingDocument3 pagesPas 14 Segment ReportingrandyNo ratings yet

- Kochi Metro Rail ProjectDocument7 pagesKochi Metro Rail ProjectDilip79No ratings yet

- Positioning and Repositioning of AirtelDocument15 pagesPositioning and Repositioning of AirtelAmy Johnson0% (1)

- How Should The Mongolian Government Keep Balance Between Maintaining Its National Security and Pursuing Economic BenefitsDocument85 pagesHow Should The Mongolian Government Keep Balance Between Maintaining Its National Security and Pursuing Economic BenefitsThanh ThuyNo ratings yet

- Compendium Petitioner AnonymousDocument105 pagesCompendium Petitioner Anonymouspratham mohantyNo ratings yet

- A Summer Projectreport ON Profitability Analysis of Mahindra and MahindraDocument38 pagesA Summer Projectreport ON Profitability Analysis of Mahindra and MahindraSunill SamantaNo ratings yet

- RA 8791 General Banking ActDocument22 pagesRA 8791 General Banking ActStephanie Mei100% (1)

- Accounting For BondsDocument11 pagesAccounting For BondsChrisus Joseph SarchezNo ratings yet

- FINC2011 Tutorial 4Document7 pagesFINC2011 Tutorial 4suitup100100% (3)

- Scope and Objectives of Financial ManagementDocument23 pagesScope and Objectives of Financial ManagementAnkit KumarNo ratings yet