Professional Documents

Culture Documents

Solutions To Questions Due On 15 Dec.

Solutions To Questions Due On 15 Dec.

Uploaded by

Nikita Singh DhamiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions To Questions Due On 15 Dec.

Solutions To Questions Due On 15 Dec.

Uploaded by

Nikita Singh DhamiCopyright:

Available Formats

Solutions to questions due on 15 Dec.

2014

Question 1:

The costs that might be added in the Firing Department include: (1) costs transferred in from

the Mixing Department; (2) materials costs added in the Firing Department; (3) labor costs

added in the Firing Department; and (4) overhead costs added in the Firing Department.

Question 2:

Ending physical units = 50,000+390,000-410,000 = 30,000

Units transferred out .............................................................

Work in process, ending:

30,000 units 70% ............................................................

30,000 units 50% ............................................................

Equivalent units of production ...............................................

Equivalent Units

Materials

Conversion

410,000

410,000

21,000

431,000

15,000

425,000

Question 3

1.

Units transferred to the next process.......................................

Ending work in process:

Materials: 40,000 units 50% complete.............................

Conversion: 40,000 units 25% complete .........................

Equivalent units of production ................................................

2.

Cost of beginning work in process ........................................

Cost added during the period .................................................

Total cost (a) ..........................................................................

Equivalent units of production (b) .........................................

Cost per equivalent unit (a) (b) ...........................................

Materials

300,000

Conversion

300,000

20,000

320,000

Materials

$ 56,600

385,000

$441,600

320,000

$1.38

10,000

310,000

Conversion

$ 14,900

214,500

$229,400

310,000

$0.74

3.

Materials

Ending work in process inventory:

Equivalent units of production (see

above) ................................................

Cost per equivalent unit (see above) .......

Cost of ending work in process

inventory ...........................................

Units completed and transferred out:

Units transferred to the next process .......

Cost per equivalent unit

(see previous exercise) ......................

Cost of units completed and transferred

out......................................................

Conversion

Total

20,000

$1.38

10,000

$0.74

$27,600

$7,400

300,000

300,000

$1.38

$0.74

$414,000

$222,000

$35,000

$636,000

Question 4

1.

Ending physical units = 70,000 + 460,000- 450,000 = 80,000

Equivalent Units of Production

Transferred to next department ................................................

Ending work in process:

Materials: 80,000 units x 75% complete ..............................

Conversion: 80,000 units x 25% complete ...........................

Equivalent units of production ................................................

2.

Conversion

450,000

60,000

510,000

20,000

470,000

Cost per Equivalent Unit

Cost of beginning work in process ......................................

Cost added during the period ...............................................

Total cost (a) ........................................................................

Equivalent units of production (b) .......................................

Cost per equivalent unit, (a) (b)........................................

3.

Materials

450,000

Materials

$ 36,550

391,850

$428,400

510,000

$0.84

Conversion

$ 13,500

287,300

$300,800

470,000

$0.64

Applying Costs to Units

Materials

Ending work in process inventory:

Equivalent units of production ..........

Cost per equivalent unit ......................

Cost of ending work in process inventory

.........................................................

Conversion

60,000

$0.84

20,000

$0.64

$50,400

$12,800

Total

$63,200

Units completed and transferred out:

Units transferred to the next department

Cost per equivalent unit ......................

Cost of units completed and transferred

out ....................................................

450,000

$0.84

450,000

$0.64

$378,000

$288,000

$666,000

In-class question solutions:

1. A. Since Federal had accounted for 170,000 units (100,000 + 70,000), the company must

have started 108,000 units in May (170,000

62,000).

B. Equivalent units for conversion cost total 128,000 [100,000 + (70,000

40%)].

C. The conversion cost per equivalent unit is $6.25 [($90,000 + $710,000)

D. Ending work in process totals $315,000: materials, $140,000 (70,000

conversion, $175,000 [(70,000

40%)

$6.25].

128,000 units].

$2.00) +

E. Work-in-Process Inventory

2. A.

Direct materials

Direct labor

Applied Overhead

Transferred-in cost

Mixing department

$325,000

65,000

85,000

0

Total cost

B.

Work in Process-Cooking

Work in Process-Mixing

Cooking department Packaging department

$110,000

$90,000

35,000

80,000

30,000

95,000

$475,000

$650,000

$475,000

$650,000

$915,000

$475,000

$475,000

Work in Process-Packaging

Work in Process-Cooking

$650,000

Finished Goods

Work in Process-Packaging

$915,000

$650,000

$915,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 3 Sem Bcom - Business Ethics PDFDocument119 pages3 Sem Bcom - Business Ethics PDFAnkit Dubey81% (48)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- (Origins of Modern Wars) Joll, James - Martel, Gordon - The Origins of The First World War (2014, Routledge)Document357 pages(Origins of Modern Wars) Joll, James - Martel, Gordon - The Origins of The First World War (2014, Routledge)Pedro Villas100% (3)

- ACCG200 Lectures 2-11 HandoutDocument108 pagesACCG200 Lectures 2-11 HandoutNikita Singh DhamiNo ratings yet

- 79696Document25 pages79696Nikita Singh DhamiNo ratings yet

- Accg200 L12Document11 pagesAccg200 L12Nikita Singh DhamiNo ratings yet

- MBA 5890revDocument157 pagesMBA 5890revMeha DaveNo ratings yet

- Strategic ManagementDocument157 pagesStrategic ManagementNikita Singh DhamiNo ratings yet

- Learning From Inteligent Building As An Architect: Assignment 4Document3 pagesLearning From Inteligent Building As An Architect: Assignment 4Vinita KumariNo ratings yet

- Diwata Ramos LandinginDocument22 pagesDiwata Ramos LandinginJureeBonifacioMudanzaNo ratings yet

- Circular PMSMA and Extended PMSMA On 9th and 11th March 2024Document2 pagesCircular PMSMA and Extended PMSMA On 9th and 11th March 2024drkunigirikalpanaNo ratings yet

- Maartand Bhairav PrayogDocument3 pagesMaartand Bhairav PrayogPawan Madan100% (1)

- Latest Googly, 16-17Document33 pagesLatest Googly, 16-17James HelliwellNo ratings yet

- CongratulationsDocument4 pagesCongratulationsjamlean welNo ratings yet

- The Links Between Strategic Management and LeadershipDocument5 pagesThe Links Between Strategic Management and LeadershipASFInomaNo ratings yet

- Class Test Ch-8 - Accounting For Share Capital Time: 30 Mins 10 Marks Multiple Choice QuestionsDocument1 pageClass Test Ch-8 - Accounting For Share Capital Time: 30 Mins 10 Marks Multiple Choice QuestionsMayank Duhalni0% (1)

- PDF Report Coffee Drinker 11567Document14 pagesPDF Report Coffee Drinker 11567mr.modularNo ratings yet

- Research Ee LawsDocument6 pagesResearch Ee LawsMike AndayaNo ratings yet

- Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks)Document2 pagesEngine Model Lead Time (Weeks) Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks)dinduntobzNo ratings yet

- Athlete Registration FormDocument1 pageAthlete Registration Formrt5353No ratings yet

- The Greatest 100 Movies of All Time - AMCDocument27 pagesThe Greatest 100 Movies of All Time - AMCRobson MutzNo ratings yet

- H-Net - Vaughn On Haddick, ' Fire On The Water - China, America, and The Future of The Pacific, Second Edition' - 2023-05-09Document3 pagesH-Net - Vaughn On Haddick, ' Fire On The Water - China, America, and The Future of The Pacific, Second Edition' - 2023-05-090No ratings yet

- Julie - Universal Car Emulator Programs:: Program UseDocument7 pagesJulie - Universal Car Emulator Programs:: Program UseJacobo Antonio Camacho ZarateNo ratings yet

- Orders, Decorations, and Medals of SarawakDocument5 pagesOrders, Decorations, and Medals of SarawakAlfred Jimmy UchaNo ratings yet

- G.R. No. 173854Document6 pagesG.R. No. 173854sofiaqueenNo ratings yet

- Richard Dawkins - His Research and BooksDocument6 pagesRichard Dawkins - His Research and Booksmxyzptlk0072001No ratings yet

- PropagandaDocument29 pagesPropagandaEmi Ly100% (1)

- Settlement of Estate of Deceased PersonsDocument21 pagesSettlement of Estate of Deceased PersonsDan LocsinNo ratings yet

- Aggregate Planning - Supply Chain AnalyticsDocument2 pagesAggregate Planning - Supply Chain AnalyticsDevika Narula0% (1)

- The World A StageDocument9 pagesThe World A StagephatfaqNo ratings yet

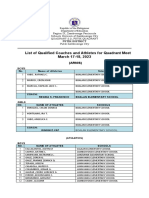

- List of Qualified Coaches and Athletes For Quadrant Meet: March 17-18, 2023Document11 pagesList of Qualified Coaches and Athletes For Quadrant Meet: March 17-18, 2023MA. LUCIA REBOLLOSNo ratings yet

- 1997 Asian Financial CrisisDocument31 pages1997 Asian Financial Crisisranjeetkumar23No ratings yet

- Bridge Is A Structure Which Provides Passage Over The Obstacles Like Valley, River, Road or RailwayDocument59 pagesBridge Is A Structure Which Provides Passage Over The Obstacles Like Valley, River, Road or RailwayVinay BagodiNo ratings yet

- Offensive Security: Penetration Test Report For Internal Lab and ExamDocument12 pagesOffensive Security: Penetration Test Report For Internal Lab and Examnobuyuki100% (1)

- Urban Design: - Morphology of Early Cities - Greek Agora - Roman ForumDocument10 pagesUrban Design: - Morphology of Early Cities - Greek Agora - Roman ForumMahesh kumarNo ratings yet

- Legal Status of Unborn Person, Dead Person and AnimalsDocument7 pagesLegal Status of Unborn Person, Dead Person and AnimalsRizwan Mughal100% (1)