Professional Documents

Culture Documents

CashFlowTool (Revised Aug2010)

CashFlowTool (Revised Aug2010)

Uploaded by

Ann LockhartCopyright:

Available Formats

You might also like

- Homework #2 - CourseraDocument8 pagesHomework #2 - Courserainbarexy67% (6)

- ADMS 2510 Sample Final ExamDocument11 pagesADMS 2510 Sample Final ExamGrace 'Queen' IfeyiNo ratings yet

- Recording Transactions: Using The Method of Journal EntriesDocument50 pagesRecording Transactions: Using The Method of Journal EntriesHasanAbdullah100% (1)

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- Intro To Financial Accounting CourseraDocument10 pagesIntro To Financial Accounting CourseraSirius BlackNo ratings yet

- Short Term Financial PlanningDocument8 pagesShort Term Financial PlanningHassan MohsinNo ratings yet

- FabmmDocument11 pagesFabmmdianne ballonNo ratings yet

- Review Problems 1rDocument8 pagesReview Problems 1rYousefNo ratings yet

- Bookkeeping ExamDocument6 pagesBookkeeping Examhanny6135No ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- Week 2 - 1Document8 pagesWeek 2 - 1Bala MuruganNo ratings yet

- International FInanceDocument3 pagesInternational FInanceJemma JadeNo ratings yet

- FABM Final Output Practice Set CDocument11 pagesFABM Final Output Practice Set CDianne BallonNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Group ProjectDocument7 pagesGroup ProjectMohammed ademNo ratings yet

- Course Project1 InstructionsDocument4 pagesCourse Project1 InstructionsEnock RutoNo ratings yet

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamNo ratings yet

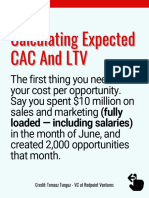

- Calculating Expected CAC and LTVDocument11 pagesCalculating Expected CAC and LTVmamaNo ratings yet

- Old Assignment For Practice at TutorialDocument3 pagesOld Assignment For Practice at TutorialKhalil Ben JemiaNo ratings yet

- Final Exam Autumn 2011 v1Document38 pagesFinal Exam Autumn 2011 v1peter kongNo ratings yet

- Computing Cash Flows: Interest and EquivalenceDocument6 pagesComputing Cash Flows: Interest and Equivalencechhetribharat08No ratings yet

- Finance ProjectdfixedDocument4 pagesFinance Projectdfixedapi-302664379No ratings yet

- 3.00 Points: Problem 4-19 Schedule of Cash Receipts (LO2)Document11 pages3.00 Points: Problem 4-19 Schedule of Cash Receipts (LO2)Ebtisam. G.aNo ratings yet

- FM Individual Final Project 2021Document3 pagesFM Individual Final Project 2021Limatono Nixon 7033RVXLNo ratings yet

- Final MortgageDocument5 pagesFinal Mortgageapi-301270815No ratings yet

- Principles of Managerial FinanceDocument37 pagesPrinciples of Managerial FinanceAngela VeronikaNo ratings yet

- POST Final Exam 2 April 2006-1Document12 pagesPOST Final Exam 2 April 2006-1Bi ChenNo ratings yet

- FINANCIAL ACCOUNTING AND ANALYSIS AssignmentDocument5 pagesFINANCIAL ACCOUNTING AND ANALYSIS AssignmentnikitaNo ratings yet

- Cash Budgets 2Document9 pagesCash Budgets 2Kopanang LeokanaNo ratings yet

- Interest Rates - What Every Investor Needs To KnowDocument5 pagesInterest Rates - What Every Investor Needs To KnowricharddunneNo ratings yet

- C 10chap10Document103 pagesC 10chap10Aya ObandoNo ratings yet

- Written Assignment Unit 6Document7 pagesWritten Assignment Unit 6Ubong AkpekongNo ratings yet

- Understanding Cash Flow Analysis: File C3-14 December 2009 WWW - Extension.iastate - Edu/agdmDocument4 pagesUnderstanding Cash Flow Analysis: File C3-14 December 2009 WWW - Extension.iastate - Edu/agdmVijayabhaskarareddy VemireddyNo ratings yet

- IGNOU MCA MCS-35 Solved Question Papers June 2009Document14 pagesIGNOU MCA MCS-35 Solved Question Papers June 2009Pankaj BassiNo ratings yet

- Financial AssumptionsDocument13 pagesFinancial AssumptionsnorlieNo ratings yet

- Cashflow SheetDocument1 pageCashflow SheetB FeNo ratings yet

- Financial Statements Questionnaire - 2011: Name Email Home: Phone Home: Email Work: Phone Work: Fax: MobileDocument7 pagesFinancial Statements Questionnaire - 2011: Name Email Home: Phone Home: Email Work: Phone Work: Fax: MobileIdrees HafeezNo ratings yet

- Monte Carlo - Cash Budget Models Outline and CorrelationsDocument13 pagesMonte Carlo - Cash Budget Models Outline and CorrelationsphanhailongNo ratings yet

- Budjet and PlannigDocument10 pagesBudjet and Plannigprakash009kNo ratings yet

- CZ ChurnopediaGuide 8.5x11 FINALDocument21 pagesCZ ChurnopediaGuide 8.5x11 FINALRevati TilokaniNo ratings yet

- 2week v2Document10 pages2week v2Sirius BlackNo ratings yet

- Exercise For Mid TestDocument11 pagesExercise For Mid TestNadia NathaniaNo ratings yet

- Ch3 For Myself v2 AccountingDocument83 pagesCh3 For Myself v2 AccountinglamdamuNo ratings yet

- FINANCIAL MANAGEMENT - New BookletDocument29 pagesFINANCIAL MANAGEMENT - New BookletElla JohnstonNo ratings yet

- BudgetingDocument9 pagesBudgetingshobi_300033% (3)

- P1 March 2011 For PublicationDocument24 pagesP1 March 2011 For PublicationmavkaziNo ratings yet

- FIN 370 Week 5 Questions and Problem Sets (Solutions)Document3 pagesFIN 370 Week 5 Questions and Problem Sets (Solutions)KyleWalkeer0% (2)

- Adjusting EntriesDocument23 pagesAdjusting Entriestoobaahmedkhan100% (1)

- Humber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsDocument5 pagesHumber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsAnisaNo ratings yet

- Question and Answer - 41Document31 pagesQuestion and Answer - 41acc-expert0% (1)

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- Principles of Accounting Help Lesson #4: Adjusting EntriesDocument23 pagesPrinciples of Accounting Help Lesson #4: Adjusting EntriesRuffa Garcia100% (1)

- ACCT 211 Introductory Accounting I Mock Final Exam 2016Document4 pagesACCT 211 Introductory Accounting I Mock Final Exam 2016Nguyễn Ngọc MaiNo ratings yet

- God Is GoodDocument12 pagesGod Is GoodBekama Abdii Koo TesfayeNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- MBA 503 - Exam 1Document6 pagesMBA 503 - Exam 1Harshitha AnudeepNo ratings yet

- Assignment 2Document2 pagesAssignment 2Ankush MitraNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- MODULARIS e AccessoriesDocument7 pagesMODULARIS e AccessoriesHoliuk AndrewNo ratings yet

- Analisis Minat Mahasiswa Mendengarkan Aplikasi Musik Berbayar Dan Unduhan Musik GratisDocument8 pagesAnalisis Minat Mahasiswa Mendengarkan Aplikasi Musik Berbayar Dan Unduhan Musik GratisjeasdsdasdaNo ratings yet

- Resume Template Work ExDocument1 pageResume Template Work ExvishNo ratings yet

- Microsoft Certified: Azure Solutions Architect Expert - Skills MeasuredDocument8 pagesMicrosoft Certified: Azure Solutions Architect Expert - Skills Measuredcooldsr2110No ratings yet

- Chapter 3 Ethics, Fraud and Internal ControlDocument44 pagesChapter 3 Ethics, Fraud and Internal ControlFarah ByunNo ratings yet

- 07-Oct. ..... (Nilam...Document3 pages07-Oct. ..... (Nilam...krishna vermaNo ratings yet

- Power and Communication Line InterferrenceDocument22 pagesPower and Communication Line InterferrenceFUNNY_dAM100% (4)

- Unit 2 Creativity PDFDocument40 pagesUnit 2 Creativity PDFNabilah100% (1)

- Financial Projection For Re-Org 2020 & 2021Document32 pagesFinancial Projection For Re-Org 2020 & 2021Mitchie Binarao BaylonNo ratings yet

- Introduction To Get Connected PDFDocument50 pagesIntroduction To Get Connected PDFOkeke Anthony Emeka100% (1)

- Introduction Bootstrap v4.6Document3 pagesIntroduction Bootstrap v4.6Idea Activa d.o.o.No ratings yet

- Copper Cathode - Ajith Kumar DR AggarwalDocument1 pageCopper Cathode - Ajith Kumar DR AggarwalDr M R aggarwaal100% (1)

- System Modes K POS InterfaceDocument27 pagesSystem Modes K POS InterfaceIvaylo IvanovNo ratings yet

- SIHI Applications and Products E 092011Document9 pagesSIHI Applications and Products E 092011Menze de JongeNo ratings yet

- Retaliatory Hacking: The Hack Back: The Legality ofDocument4 pagesRetaliatory Hacking: The Hack Back: The Legality ofjay.reaper4No ratings yet

- Mandate Vision Mission DostDocument11 pagesMandate Vision Mission DostsarahbansilNo ratings yet

- 02 The Accounting Equation PROBLEMSDocument7 pages02 The Accounting Equation PROBLEMSJohn Carlos Galit AdarayanNo ratings yet

- Morcom Public Safety DASDocument2 pagesMorcom Public Safety DASAla'a AbdullaNo ratings yet

- Advantages and Disadvantages of Integrated CircuitDocument5 pagesAdvantages and Disadvantages of Integrated CircuitBappy HossainNo ratings yet

- Yanmar Mini Excavator Vio25Document8 pagesYanmar Mini Excavator Vio25ashahulhjNo ratings yet

- Aadipandey Teri MbaDocument101 pagesAadipandey Teri MbaADITYA PANDEY100% (1)

- Volvo Penta GensetDocument4 pagesVolvo Penta Gensetafandybaharuddin100% (1)

- Catalog YaweiDocument35 pagesCatalog Yaweihongngoc2003.vnNo ratings yet

- Industrial Training: Hutchison Essar South Ltd. (Punjab)Document34 pagesIndustrial Training: Hutchison Essar South Ltd. (Punjab)Manoj KumarNo ratings yet

- EduLearn Feb14Document182 pagesEduLearn Feb14Lina Handayani HNo ratings yet

- Teaching With Simulations: What Are Instructional Simulations?Document4 pagesTeaching With Simulations: What Are Instructional Simulations?Norazmah BachokNo ratings yet

- Ace Resort Case StudyDocument4 pagesAce Resort Case StudySakshi AgarwalNo ratings yet

- Fernandez vs. VillegasDocument2 pagesFernandez vs. VillegasedreaNo ratings yet

- Jcpenney Mini-Case 1. What Strategy Was The New Ceo at Jcpenney Seeking To Implement Given The Generic Strategies Found in Chapter 4?Document1 pageJcpenney Mini-Case 1. What Strategy Was The New Ceo at Jcpenney Seeking To Implement Given The Generic Strategies Found in Chapter 4?Leah C.No ratings yet

CashFlowTool (Revised Aug2010)

CashFlowTool (Revised Aug2010)

Uploaded by

Ann LockhartOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CashFlowTool (Revised Aug2010)

CashFlowTool (Revised Aug2010)

Uploaded by

Ann LockhartCopyright:

Available Formats

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

<<Please describe the assumptions used in estimating your monthly sales for Product/Service 1(i.e. 100 units at $20 each).

Include explanations for any fluctuations during the year>>

<<Please describe the assumptions used in estimating your monthly sales for Product/Service 2 (i.e. 100 units at $20 each).

Include explanations for any fluctuations during the year>>

<<Please describe the assumptions used in estimating your monthly sales for Product/Service 3 (i.e. 100 units at $20 each).

Include explanations for any fluctuations during the year>>

<<Please describe the assumptions used in estimating your monthly sales for Product/Service 4 (i.e. 100 units at $20 each).

Include explanations for any fluctuations during the year>>

<<Describe what other loans you expect to be receiving>>

<<Please describe Other Source 1 and the liklihood or circunstances under which these funds will be received>>

<<Please describe Other Source 2 and the liklihood or circunstances under which these funds will be received>>

<<Please describe Other Source 3 and the liklihood or circunstances under which these funds will be received>>

<<Please describe what Start-up Costs will be incurred or what Long-Term Assets (i.e. equiment or software) will be

purchased>>

<<Please describe the assumptions used in estimating operating costs and the breakdown (i.e. rent $800, gas $100, insurance

$80). Inculde

explanations

for any fluctuations

during the

year>>and inventory costs and the breakdown (i.e. admin supplies

<<Please

describe

the assumptions

used in estimating

supplies

$20, raw materials $300, inventory $60). Include explanations for any fluctuations during the year. Keep in mind that inventory

expense should be directly related to sales revenue>>

<<Please describee staff breakdown (i.e. 2 staff paid $1000 per month) and/or amount of expected own withdrawals>>

<<What is your estimated payback period? Visit www.accessccf.com and use the Loan Calculator Tool to determine what your

monthly payment would be.>>

<<Please describe the assumptions used in estimating Other Costs 1. Include explanations for any fluctuations during the

year.>>

<<Please describe the assumptions used in estimating Other Costs 2. Include explanations for any fluctuations during the

year.>>

12 Month Cash Flow Projection

IMPORTANT GUIDE TO COMPLETING THIS WORKSHEET

Fill in Orange boxes with the month and year (i.e. November 2010) for the next 12-months. Begin with the month you expect to

be receiving the ACCESS Loan

Fill in Green boxes with your dollar value estimates for each of the categories, the totals will be automatically calcuated for you.

<<...>>

Replace Blue Text with your own response or descriptions. Not all categories may be relevant to you.

Notes A-O Provide more detailed explanations/support for assumptions in each corresponding category, in the spaces provided below.

Months

6

10

11

12 Total

Notes

Cash IN:

Sales

<<Product/Service 1>>:

<<Product/Service 2>>:

<<Product/Service 3>>:

<<Product/Service 4>>:

Owner Contribution

ACCESS Loan

Other Loans

Other Cash Sources

<<Source 1>>:

<<Source 2>>:

<<Source 3>>:

A

B

C

D

E

0

0

0

0

0

0

0

F

G

H

0

0

0

Total Cash IN:

Cash OUT:

Start-up Costs/Asset Purchases

Operating Expenses

Supplies & Inventory

Wages, Benefits and Withdrawals

Taxes

Loan Payments

Other Costs

<<Other 1>>:

<<Other 2>>:

I

J

K

L

M

0

0

0

0

0

0

N

O

0

0

Total Cash OUT:

Total Cash IN less Total Cash OUT:

Balance, start of month

Plus Total Cash IN

Less Total Cash OUT

Balance, end of month

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

You might also like

- Homework #2 - CourseraDocument8 pagesHomework #2 - Courserainbarexy67% (6)

- ADMS 2510 Sample Final ExamDocument11 pagesADMS 2510 Sample Final ExamGrace 'Queen' IfeyiNo ratings yet

- Recording Transactions: Using The Method of Journal EntriesDocument50 pagesRecording Transactions: Using The Method of Journal EntriesHasanAbdullah100% (1)

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- Intro To Financial Accounting CourseraDocument10 pagesIntro To Financial Accounting CourseraSirius BlackNo ratings yet

- Short Term Financial PlanningDocument8 pagesShort Term Financial PlanningHassan MohsinNo ratings yet

- FabmmDocument11 pagesFabmmdianne ballonNo ratings yet

- Review Problems 1rDocument8 pagesReview Problems 1rYousefNo ratings yet

- Bookkeeping ExamDocument6 pagesBookkeeping Examhanny6135No ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- Week 2 - 1Document8 pagesWeek 2 - 1Bala MuruganNo ratings yet

- International FInanceDocument3 pagesInternational FInanceJemma JadeNo ratings yet

- FABM Final Output Practice Set CDocument11 pagesFABM Final Output Practice Set CDianne BallonNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Group ProjectDocument7 pagesGroup ProjectMohammed ademNo ratings yet

- Course Project1 InstructionsDocument4 pagesCourse Project1 InstructionsEnock RutoNo ratings yet

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamNo ratings yet

- Calculating Expected CAC and LTVDocument11 pagesCalculating Expected CAC and LTVmamaNo ratings yet

- Old Assignment For Practice at TutorialDocument3 pagesOld Assignment For Practice at TutorialKhalil Ben JemiaNo ratings yet

- Final Exam Autumn 2011 v1Document38 pagesFinal Exam Autumn 2011 v1peter kongNo ratings yet

- Computing Cash Flows: Interest and EquivalenceDocument6 pagesComputing Cash Flows: Interest and Equivalencechhetribharat08No ratings yet

- Finance ProjectdfixedDocument4 pagesFinance Projectdfixedapi-302664379No ratings yet

- 3.00 Points: Problem 4-19 Schedule of Cash Receipts (LO2)Document11 pages3.00 Points: Problem 4-19 Schedule of Cash Receipts (LO2)Ebtisam. G.aNo ratings yet

- FM Individual Final Project 2021Document3 pagesFM Individual Final Project 2021Limatono Nixon 7033RVXLNo ratings yet

- Final MortgageDocument5 pagesFinal Mortgageapi-301270815No ratings yet

- Principles of Managerial FinanceDocument37 pagesPrinciples of Managerial FinanceAngela VeronikaNo ratings yet

- POST Final Exam 2 April 2006-1Document12 pagesPOST Final Exam 2 April 2006-1Bi ChenNo ratings yet

- FINANCIAL ACCOUNTING AND ANALYSIS AssignmentDocument5 pagesFINANCIAL ACCOUNTING AND ANALYSIS AssignmentnikitaNo ratings yet

- Cash Budgets 2Document9 pagesCash Budgets 2Kopanang LeokanaNo ratings yet

- Interest Rates - What Every Investor Needs To KnowDocument5 pagesInterest Rates - What Every Investor Needs To KnowricharddunneNo ratings yet

- C 10chap10Document103 pagesC 10chap10Aya ObandoNo ratings yet

- Written Assignment Unit 6Document7 pagesWritten Assignment Unit 6Ubong AkpekongNo ratings yet

- Understanding Cash Flow Analysis: File C3-14 December 2009 WWW - Extension.iastate - Edu/agdmDocument4 pagesUnderstanding Cash Flow Analysis: File C3-14 December 2009 WWW - Extension.iastate - Edu/agdmVijayabhaskarareddy VemireddyNo ratings yet

- IGNOU MCA MCS-35 Solved Question Papers June 2009Document14 pagesIGNOU MCA MCS-35 Solved Question Papers June 2009Pankaj BassiNo ratings yet

- Financial AssumptionsDocument13 pagesFinancial AssumptionsnorlieNo ratings yet

- Cashflow SheetDocument1 pageCashflow SheetB FeNo ratings yet

- Financial Statements Questionnaire - 2011: Name Email Home: Phone Home: Email Work: Phone Work: Fax: MobileDocument7 pagesFinancial Statements Questionnaire - 2011: Name Email Home: Phone Home: Email Work: Phone Work: Fax: MobileIdrees HafeezNo ratings yet

- Monte Carlo - Cash Budget Models Outline and CorrelationsDocument13 pagesMonte Carlo - Cash Budget Models Outline and CorrelationsphanhailongNo ratings yet

- Budjet and PlannigDocument10 pagesBudjet and Plannigprakash009kNo ratings yet

- CZ ChurnopediaGuide 8.5x11 FINALDocument21 pagesCZ ChurnopediaGuide 8.5x11 FINALRevati TilokaniNo ratings yet

- 2week v2Document10 pages2week v2Sirius BlackNo ratings yet

- Exercise For Mid TestDocument11 pagesExercise For Mid TestNadia NathaniaNo ratings yet

- Ch3 For Myself v2 AccountingDocument83 pagesCh3 For Myself v2 AccountinglamdamuNo ratings yet

- FINANCIAL MANAGEMENT - New BookletDocument29 pagesFINANCIAL MANAGEMENT - New BookletElla JohnstonNo ratings yet

- BudgetingDocument9 pagesBudgetingshobi_300033% (3)

- P1 March 2011 For PublicationDocument24 pagesP1 March 2011 For PublicationmavkaziNo ratings yet

- FIN 370 Week 5 Questions and Problem Sets (Solutions)Document3 pagesFIN 370 Week 5 Questions and Problem Sets (Solutions)KyleWalkeer0% (2)

- Adjusting EntriesDocument23 pagesAdjusting Entriestoobaahmedkhan100% (1)

- Humber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsDocument5 pagesHumber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsAnisaNo ratings yet

- Question and Answer - 41Document31 pagesQuestion and Answer - 41acc-expert0% (1)

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- Principles of Accounting Help Lesson #4: Adjusting EntriesDocument23 pagesPrinciples of Accounting Help Lesson #4: Adjusting EntriesRuffa Garcia100% (1)

- ACCT 211 Introductory Accounting I Mock Final Exam 2016Document4 pagesACCT 211 Introductory Accounting I Mock Final Exam 2016Nguyễn Ngọc MaiNo ratings yet

- God Is GoodDocument12 pagesGod Is GoodBekama Abdii Koo TesfayeNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- MBA 503 - Exam 1Document6 pagesMBA 503 - Exam 1Harshitha AnudeepNo ratings yet

- Assignment 2Document2 pagesAssignment 2Ankush MitraNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- MODULARIS e AccessoriesDocument7 pagesMODULARIS e AccessoriesHoliuk AndrewNo ratings yet

- Analisis Minat Mahasiswa Mendengarkan Aplikasi Musik Berbayar Dan Unduhan Musik GratisDocument8 pagesAnalisis Minat Mahasiswa Mendengarkan Aplikasi Musik Berbayar Dan Unduhan Musik GratisjeasdsdasdaNo ratings yet

- Resume Template Work ExDocument1 pageResume Template Work ExvishNo ratings yet

- Microsoft Certified: Azure Solutions Architect Expert - Skills MeasuredDocument8 pagesMicrosoft Certified: Azure Solutions Architect Expert - Skills Measuredcooldsr2110No ratings yet

- Chapter 3 Ethics, Fraud and Internal ControlDocument44 pagesChapter 3 Ethics, Fraud and Internal ControlFarah ByunNo ratings yet

- 07-Oct. ..... (Nilam...Document3 pages07-Oct. ..... (Nilam...krishna vermaNo ratings yet

- Power and Communication Line InterferrenceDocument22 pagesPower and Communication Line InterferrenceFUNNY_dAM100% (4)

- Unit 2 Creativity PDFDocument40 pagesUnit 2 Creativity PDFNabilah100% (1)

- Financial Projection For Re-Org 2020 & 2021Document32 pagesFinancial Projection For Re-Org 2020 & 2021Mitchie Binarao BaylonNo ratings yet

- Introduction To Get Connected PDFDocument50 pagesIntroduction To Get Connected PDFOkeke Anthony Emeka100% (1)

- Introduction Bootstrap v4.6Document3 pagesIntroduction Bootstrap v4.6Idea Activa d.o.o.No ratings yet

- Copper Cathode - Ajith Kumar DR AggarwalDocument1 pageCopper Cathode - Ajith Kumar DR AggarwalDr M R aggarwaal100% (1)

- System Modes K POS InterfaceDocument27 pagesSystem Modes K POS InterfaceIvaylo IvanovNo ratings yet

- SIHI Applications and Products E 092011Document9 pagesSIHI Applications and Products E 092011Menze de JongeNo ratings yet

- Retaliatory Hacking: The Hack Back: The Legality ofDocument4 pagesRetaliatory Hacking: The Hack Back: The Legality ofjay.reaper4No ratings yet

- Mandate Vision Mission DostDocument11 pagesMandate Vision Mission DostsarahbansilNo ratings yet

- 02 The Accounting Equation PROBLEMSDocument7 pages02 The Accounting Equation PROBLEMSJohn Carlos Galit AdarayanNo ratings yet

- Morcom Public Safety DASDocument2 pagesMorcom Public Safety DASAla'a AbdullaNo ratings yet

- Advantages and Disadvantages of Integrated CircuitDocument5 pagesAdvantages and Disadvantages of Integrated CircuitBappy HossainNo ratings yet

- Yanmar Mini Excavator Vio25Document8 pagesYanmar Mini Excavator Vio25ashahulhjNo ratings yet

- Aadipandey Teri MbaDocument101 pagesAadipandey Teri MbaADITYA PANDEY100% (1)

- Volvo Penta GensetDocument4 pagesVolvo Penta Gensetafandybaharuddin100% (1)

- Catalog YaweiDocument35 pagesCatalog Yaweihongngoc2003.vnNo ratings yet

- Industrial Training: Hutchison Essar South Ltd. (Punjab)Document34 pagesIndustrial Training: Hutchison Essar South Ltd. (Punjab)Manoj KumarNo ratings yet

- EduLearn Feb14Document182 pagesEduLearn Feb14Lina Handayani HNo ratings yet

- Teaching With Simulations: What Are Instructional Simulations?Document4 pagesTeaching With Simulations: What Are Instructional Simulations?Norazmah BachokNo ratings yet

- Ace Resort Case StudyDocument4 pagesAce Resort Case StudySakshi AgarwalNo ratings yet

- Fernandez vs. VillegasDocument2 pagesFernandez vs. VillegasedreaNo ratings yet

- Jcpenney Mini-Case 1. What Strategy Was The New Ceo at Jcpenney Seeking To Implement Given The Generic Strategies Found in Chapter 4?Document1 pageJcpenney Mini-Case 1. What Strategy Was The New Ceo at Jcpenney Seeking To Implement Given The Generic Strategies Found in Chapter 4?Leah C.No ratings yet