Professional Documents

Culture Documents

155.ASX IAW Aug 16 2012 16.33 Preliminary Final Report

155.ASX IAW Aug 16 2012 16.33 Preliminary Final Report

Uploaded by

ASX:ILH (ILH Group)Copyright:

Available Formats

You might also like

- Interim Report Q4 2012 EngDocument25 pagesInterim Report Q4 2012 Engyamisen_kenNo ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocument14 pagesASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)No ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Balance Sheet of John Limited As OnDocument19 pagesBalance Sheet of John Limited As OnAravind MaitreyaNo ratings yet

- Different: ... and Better Than EverDocument4 pagesDifferent: ... and Better Than EverViral PatelNo ratings yet

- Universal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFDocument27 pagesUniversal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- 2012 Annual Financial ReportDocument76 pages2012 Annual Financial ReportNguyễn Tiến HưngNo ratings yet

- Colcom Press Results Dec2011Document1 pageColcom Press Results Dec2011Kristi DuranNo ratings yet

- NT Pharma - Annual Results Announcement For The Year Ended 31 December 2012 PDFDocument38 pagesNT Pharma - Annual Results Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- 4.JBSL AccountsDocument8 pages4.JBSL AccountsArman Hossain WarsiNo ratings yet

- Lecture 1 CHP 1 No SolutionsDocument20 pagesLecture 1 CHP 1 No SolutionsHarry2140No ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 pagesChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888No ratings yet

- 2011 Financial Statements NESTLE GROUPDocument118 pages2011 Financial Statements NESTLE GROUPEnrique Timana MNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Advanced Financial Accounting & Reporting AnswerDocument13 pagesAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

- Financial Statements Review Q4 2010Document17 pagesFinancial Statements Review Q4 2010sahaiakkiNo ratings yet

- The Siam Cement Public and Its Subsidiaries: Company LimitedDocument73 pagesThe Siam Cement Public and Its Subsidiaries: Company LimitedMufidah 'mupmup'No ratings yet

- Tute3 Reliance Financial StatementsDocument3 pagesTute3 Reliance Financial Statementsvivek patelNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Unvr - LK Audit 2012Document79 pagesUnvr - LK Audit 2012Abiyyu AhmadNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Apple IncorporatedDocument5 pagesApple IncorporatedVincent Jake NaputoNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- Hannans Half Year Financial Report 2010Document18 pagesHannans Half Year Financial Report 2010Hannans Reward LtdNo ratings yet

- Qfs 1q 2012 - FinalDocument40 pagesQfs 1q 2012 - Finalyandhie57No ratings yet

- From Account To Account Revenue 41110 41290 Gross ProfitDocument4 pagesFrom Account To Account Revenue 41110 41290 Gross ProfitAravind AllamNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarNo ratings yet

- Tut 4 - Reliance Financial StatementsDocument3 pagesTut 4 - Reliance Financial StatementsJulia DanielNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Quarterly Report PDFDocument1 pageQuarterly Report PDFNasef MohdNo ratings yet

- KHIND Annual Report MalaysiaDocument77 pagesKHIND Annual Report MalaysiakokueiNo ratings yet

- Samba Statements 11 +12Document46 pagesSamba Statements 11 +12Shyair GanglaniNo ratings yet

- Utilico Annual Report 2013Document90 pagesUtilico Annual Report 2013AdiSto10No ratings yet

- Financial Statement Case StudyDocument11 pagesFinancial Statement Case StudyGayle Tadler50% (2)

- First-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsDocument23 pagesFirst-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsphuawlNo ratings yet

- Hannans Half Year Financial Report 2011Document18 pagesHannans Half Year Financial Report 2011Hannans Reward LtdNo ratings yet

- 174.ASX IAW Feb 27 2013 17.36 Half Yearly Report and AccountsDocument28 pages174.ASX IAW Feb 27 2013 17.36 Half Yearly Report and AccountsASX:ILH (ILH Group)No ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2012Document6 pagesProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliNo ratings yet

- Apple 10QDocument57 pagesApple 10QadsadasMNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- CNXX JV 2012 Verkort 5CDocument77 pagesCNXX JV 2012 Verkort 5CgalihNo ratings yet

- Consolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)Document25 pagesConsolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)sudhak111No ratings yet

- Bank AlfalahDocument66 pagesBank AlfalahShahid MehmoodNo ratings yet

- Annual Report: Registered OfficeDocument312 pagesAnnual Report: Registered OfficeDNo ratings yet

- Jiangchen Intl - Announcement of Annual Results For The Financial Year Ended 31 December 2012 PDFDocument34 pagesJiangchen Intl - Announcement of Annual Results For The Financial Year Ended 31 December 2012 PDFalan888No ratings yet

- Royale Furniture Holdings Limited: Annual Results For The Year Ended 31 December 2012Document18 pagesRoyale Furniture Holdings Limited: Annual Results For The Year Ended 31 December 2012alan888No ratings yet

- Half-Year Report Julius Baer Group LTDDocument24 pagesHalf-Year Report Julius Baer Group LTDEvgeny SkorobogatkoNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 260.ASX ILH March 16 2015 Sale of Shares in Law Central and Capricorn CompletedDocument2 pages260.ASX ILH March 16 2015 Sale of Shares in Law Central and Capricorn CompletedASX:ILH (ILH Group)No ratings yet

- 248.ASX ILH Dec 10 2014 Trading HaltDocument1 page248.ASX ILH Dec 10 2014 Trading HaltASX:ILH (ILH Group)No ratings yet

- 253.ASX ILH Dec 24 14.19 Binding Agreement Restructuring AnnouncementDocument2 pages253.ASX ILH Dec 24 14.19 Binding Agreement Restructuring AnnouncementASX:ILH (ILH Group)No ratings yet

- 252.ASX ILH Dec 24 14.18 2014 Binding Agreement ReachedDocument2 pages252.ASX ILH Dec 24 14.18 2014 Binding Agreement ReachedASX:ILH (ILH Group)No ratings yet

- 247.ASX ILH Dec 3 2014 Becoming A Substantial Holder FRENCHDocument2 pages247.ASX ILH Dec 3 2014 Becoming A Substantial Holder FRENCHASX:ILH (ILH Group)No ratings yet

- 235.ASX ILH Oct 22 2014 First Quarter Financial UpdateDocument2 pages235.ASX ILH Oct 22 2014 First Quarter Financial UpdateASX:ILH (ILH Group)No ratings yet

- 236.ASX ILH Oct 22 2014 Investor PresentationDocument18 pages236.ASX ILH Oct 22 2014 Investor PresentationASX:ILH (ILH Group)No ratings yet

- 227.ASX IAW Aug 29 2014 Preliminary Financial ReportDocument16 pages227.ASX IAW Aug 29 2014 Preliminary Financial ReportASX:ILH (ILH Group)No ratings yet

- Message of Po3 Ronald Villanueva Daguro Monday Flag Raising Ceremony of PSJLC June 1, 2015Document4 pagesMessage of Po3 Ronald Villanueva Daguro Monday Flag Raising Ceremony of PSJLC June 1, 2015menchayNo ratings yet

- GST EntriesDocument5 pagesGST EntriessrestanandNo ratings yet

- NIBIN Fact SheetDocument2 pagesNIBIN Fact Sheet13WMAZNo ratings yet

- Government Finance: Taxation in The United States United States Federal BudgetDocument7 pagesGovernment Finance: Taxation in The United States United States Federal BudgetKatt RinaNo ratings yet

- Case Law About Gift IntervivosDocument2 pagesCase Law About Gift IntervivosCynthia Amweno0% (1)

- Evolution of Conveyancing in KenyaDocument2 pagesEvolution of Conveyancing in KenyaRayoh SijiNo ratings yet

- Mngt13 Chapter 3Document11 pagesMngt13 Chapter 3Ariane VergaraNo ratings yet

- Government Procurement AgreementDocument15 pagesGovernment Procurement AgreementSuyashRawatNo ratings yet

- Project - Law of InsuranceDocument11 pagesProject - Law of Insuranceanam khanNo ratings yet

- Changing Seats Re-Domiciliation To Curaçao FinalDocument2 pagesChanging Seats Re-Domiciliation To Curaçao FinalRicardo NavaNo ratings yet

- Isaca Crisc SampleDocument50 pagesIsaca Crisc SampleKirthika BojarajanNo ratings yet

- Cornell Notes Financial AidDocument3 pagesCornell Notes Financial AidMireille TatroNo ratings yet

- Seatwork 10.6.21Document6 pagesSeatwork 10.6.21Ashley MarloweNo ratings yet

- COMPROMISDocument26 pagesCOMPROMISRavi VermaNo ratings yet

- Evolution of The Indian Insolvency and Bankruptcy CodeDocument22 pagesEvolution of The Indian Insolvency and Bankruptcy CodeSid KaulNo ratings yet

- IEEE 24748-5 - 2017 - SW Development PlanningDocument48 pagesIEEE 24748-5 - 2017 - SW Development Planningangel tomas guerrero de la rubiaNo ratings yet

- Erin Cullaro Response To Notary ComplaintDocument8 pagesErin Cullaro Response To Notary ComplaintForeclosure Fraud100% (1)

- Offer Letter SathwikDocument3 pagesOffer Letter SathwikRaviteja PavanNo ratings yet

- 4 Judicial Affidavit RuleDocument4 pages4 Judicial Affidavit RuleHanifa Shereen Biston AliNo ratings yet

- SECURITY or PHYSICAL SECURITY or RISK ASSESSMENTDocument3 pagesSECURITY or PHYSICAL SECURITY or RISK ASSESSMENTapi-1216271390% (1)

- Islamic Religious StudiesDocument10 pagesIslamic Religious StudiesBockarie MarahNo ratings yet

- M-40k Notice of Denial of Expedited FS or Inability To Issue FSDocument1 pageM-40k Notice of Denial of Expedited FS or Inability To Issue FShooNo ratings yet

- Principles of Electric Circuits - 9780135073094 - Ejercicio 41 - QuizletDocument5 pagesPrinciples of Electric Circuits - 9780135073094 - Ejercicio 41 - QuizletasdfNo ratings yet

- ApplicationDocument3 pagesApplicationSusanaNo ratings yet

- In Sunny SpainDocument3 pagesIn Sunny SpainAnonymous ht2L8xP100% (1)

- Strategy For History MainsDocument6 pagesStrategy For History MainsGrayHawk100% (1)

- 10 04 033 SPCDocument1 page10 04 033 SPCMichael Ben-DorNo ratings yet

- UEFA Direct September 2007Document24 pagesUEFA Direct September 2007cristobal_77grNo ratings yet

- Ru Ad Ak2Document1 pageRu Ad Ak2Jeremy SydorNo ratings yet

- Compound Interest and SIDocument2 pagesCompound Interest and SISanathoi MaibamNo ratings yet

155.ASX IAW Aug 16 2012 16.33 Preliminary Final Report

155.ASX IAW Aug 16 2012 16.33 Preliminary Final Report

Uploaded by

ASX:ILH (ILH Group)Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

155.ASX IAW Aug 16 2012 16.33 Preliminary Final Report

155.ASX IAW Aug 16 2012 16.33 Preliminary Final Report

Uploaded by

ASX:ILH (ILH Group)Copyright:

Available Formats

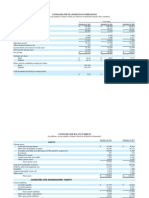

INTEGRATED LEGAL HOLDINGS LIMITED

ACN 120 394 194

ASX Appendix 4E

RESULTS FOR ANNOUNCEMENT TO THE MARKET

Current reporting period:

Previous corresponding period:

Year ended 30 June 2012

Year ended 30 June 2011

Percentage change

UP(+)/DOWN(-)

Amount

$A

+11%

31,690,208

+14%

32,406,865

Profit from ordinary activities after tax attributable to

members

-13%

1,116,006

Net profit for the period attributable to members

-13%

1,116,006

Percentage change

UP(+)/DOWN(-)

30 Jun 2012

/share

-22%

-22%

1.10

1.10

EARNINGS

Revenue from ordinary activities

Revenue and other income from ordinary activities

EARNINGS PER SHARE

Basic earnings per share

Diluted earnings per share

DIVIDENDS

Percentage

change

UP(+)/DOWN(-)

Amount

per share

Franked

amount per

share at 30%

Australian

tax rate

0.8 cents

0.6 cents

0.8 cents

0.6 cents

2012 FINAL

2012 final dividend (fully entitled shares)

Previous corresponding period

+33%

Record date for determining entitlements to the 2012 final dividend

Payment date for 2012 final dividend

12 October 2012

2 November 2012

DIVIDEND REINVESTMENT PLAN

The Company operates a dividend reinvestment plan (DRP). Further details are disclosed in the

dividend details section of this report.

DRP discount rate

Date for receipt of DRP election notices

5%

19 October 2012

INTEGRATED LEGAL HOLDINGS LIMITED

ACN 120 394 194

ASX Appendix 4E

RESULTS FOR ANNOUNCEMENT TO THE MARKET

Following is a brief explanation of directional and percentage changes to revenue and profit. For

a full analysis please refer to the Companys ASX release dated 16 August 2012.

The Company achieved a full year net profit after tax of $1,116,006 for 2011/12. This

compared with a net profit after tax of $1,286,670 for the full year 2010/11, a decrease of

13%. The net profit after tax result represented earnings per share of 1.10 cents per share,

compared to 1.41 cents last year.

The profit result was achieved on a strong Revenue and Other Income increase of 14% to

$32.41m, up from $28.48m in 2010/11. Growth in revenue was a combination of some

organic growth and growth through acquisitions in particularly.

After a solid first half, the Company experienced exceptionally difficult trading conditions in

May and June 2012 which affected the performances of all member firms and substantially

accounted for the reduced profit result. However, the Directors are pleased to note that

trading conditions improved considerably in July 2012 and into August 2012 with revenues

picking up strongly to expected levels.

The Directors note that the PLN Lawyers acquisition which was effective 1 August 2011,

performed well during the year.

Final Dividend 2011/12

The Directors have declared a fully franked final dividend in respect of 2011/12 of 0.8 cents

per share, up from 0.6 cents fully franked in the previous corresponding period.

The dividend will have a record date of 12 October 2012 and a payment date of 2 November

2012.

The dividend reinvestment plan will operate with respect to the final dividend.

2011/12

$m

2010/11

$m

% Change

Revenue and Other

Income

32.41

28.48

14%

Net Profit after Tax

1.12

1.29

-13%

Earnings per Share

1.10 cents

1.41 cents

-22%

Dividends Declared

2011/12

Dividends

Interim 0.0 cents

Final 0.8 cents

Total 0.8 cents

Interim 0.3 cents

Final 0.6 cents

Total 0.9 cents

AUDIT REPORT

The preliminary final report is based on accounts which are in the process of being audited.

2

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Statement of Financial Position

Note

ASSETS

Current Assets

Cash and cash equivalents

Trade and other receivables

Work in progress

Income tax receivable

Total Current Assets

CONSOLIDATED

30 June

30 June

2012

2011

$

$

1,312,035

10,789,460

2,288,190

31,063

14,420,748

2,460,760

7,826,873

2,499,220

12,782

12,799,635

1,342,820

14,590,139

167,540

2,862

16,103,361

30,524,109

1,170,294

12,900,557

29,700

14,614

3,435

14,118,600

26,918,235

LIABILITIES

Current Liabilities

Trade and other payables

Interest bearing loans and borrowings

Provisions

Other liabilities

Total Current Liabilities

3,941,157

676,225

1,074,147

404,072

6,095,601

3,813,598

2,536,259

986,593

255,769

7,592,219

Non-Current Liabilities

Trade and other payables

Interest bearing loans and borrowings

Provisions

Deferred tax liabilities

Other liabilities

Total Non-Current Liabilities

TOTAL LIABILITIES

NET ASSETS

4,794,054

347,625

106,733

118,205

5,366,617

11,462,218

19,061,891

37,554

143,325

306,092

137,038

689,344

1,313,353

8,905,572

18,012,663

33,917,382

(16,926,589)

2,071,098

19,061,891

33,397,152

(16,926,589)

1,542,100

18,012,663

Non-Current Assets

Plant and equipment

Goodwill

Intangible assets

Prepayments

Other assets

Total Non-Current Assets

TOTAL ASSETS

EQUITY

Issued Capital

Accumulated Losses

Reserves

TOTAL EQUITY

6

7

8

The above Statement of Financial Position should be read in conjunction with the accompanying notes

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Statement of Comprehensive Income

Note

Professional fees

Total revenue

CONSOLIDATED

2012

2011

$

$

31,690,208

28,313,125

31,690,208

28,313,125

Movement in fair value of financial liabilities

Interest revenue

Other income

Total other income

Total revenue and other income

559,861

112,781

44,015

716,657

32,406,865

153,015

9,336

162,351

28,475,476

(2,814,989)

(22,105,248)

(530,198)

(459,652)

(3,849,582)

(836,018)

(350,513)

(41,644)

(30,987,844)

1,419,021

(303,015)

1,116,006

1,116,006

(2,338,627)

(18,579,646)

(412,841)

(359,123)

(3,335,793)

(1,351,267)

(143,193)

(41,415)

(26,561,905)

1,913,571

(626,901)

1,286,670

1,286,670

(574)

792

(574)

1,115,432

792

1,287,462

1.10

1.10

1.41

1.41

Occupancy expenses

Salaries and employee benefits expenses

Depreciation and amortisation expenses

Advertising and marketing expenses

Administrative expenses

Other expenses

Finance costs

Share based payments expense

Total expenses

Profit before income tax

Income tax expense

Profit after income tax

Net profit for the year

Other comprehensive income

Net (losses)/gains on available-for-sale financial assets

Other comprehensive (losses)/income for the year,

net of tax

Total comprehensive income for the year

Basic earnings per share (cents)

Diluted earnings per share (cents)

3(a)

3(b)

3(c)

3(d)

The above Statement of Comprehensive Income should be read in conjunction with the accompanying notes

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Statement of Cash Flows

Note

Cash flows from operating activities

Receipts from customers

Interest received

Other revenue

Payments to suppliers and employees

Interest and other costs of finance paid

Income tax paid

Net cash flows (used in)/from operating activities

Cash flows from investing activities

Purchase of plant and equipment

Proceeds from the disposal of plant and equipment

Payment for the acquisition of businesses net of

cash acquired

Net cash flows used in investing activities

Cash flows from financing activities

Proceeds from loans received

Repayment of borrowings

Payments for share issue expenses

Dividends paid

Net cash flows from financing activities

Net (decrease)/increase in cash held

Cash and cash equivalents at the beginning of the

financial year

Cash and cash equivalents at the end of the financial

year

CONSOLIDATED

2012

2011

$

$

32,026,219

112,781

44,015

(32,924,236)

(250,222)

(346,897)

(1,338,340)

30,069,018

153,015

9,336

(28,365,293)

(81,891)

(552,446)

1,231,739

(829,767)

1,491

(209,596)

-

(1,253,580)

(2,081,856)

(979,148)

(1,188,744)

5,583,027

(2,857,058)

(13,017)

(448,735)

2,264,217

1,546,545

(643,929)

(17,389)

(441,556)

443,671

(1,155,979)

486,666

2,435,615

1,948,949

1,279,636

2,435,615

The above Statement of Cash Flows should be read in conjunction with the accompanying notes

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Statement of Changes in Equity

CONSOLIDATED

Balance as at 1 July 2010

Issued

Capital

$

32,160,426

Accumulated

Losses

$

Net

Unrealised

Gains/(Losses)

Reserve

$

(16,688,184)

(1,441)

-

General

Reserve

$

Total

Equity

$

727,113

16,197,914

1,286,670

1,286,670

Profit for the year

Other comprehensive income

Total comprehensive income for the

year

792

792

1,286,670

Transfer to general reserve

(238,405)

238,405

Dividends paid

(709,439)

(709,439)

41,415

41,415

1,207,483

1,207,483

(17,389)

(17,389)

5,217

5,217

792

1,287,462

Transactions with owners in their

capacity as owners

Share based payments

Issue of shares

Transaction costs on issue of shares

Income tax on items taken directly to or

transferred from equity

Balance as at 30 June 2011

CONSOLIDATED

Balance as at 1 July 2011

33,397,152

Issued

Capital

$

33,397,152

(16,926,589)

Accumulated

Losses

$

(16,926,589)

(649)

Net

Unrealised

Losses

Reserve

$

1,542,749

General

Reserve

$

18,012,663

Total

Equity

$

(649)

1,542,749

18,012,663

1,116,006

1,116,006

Profit for the year

Other comprehensive losses

Total comprehensive (losses)/income for

the year

(574)

(574)

1,116,006

1,115,432

(586,434)

(586,434)

41,644

41,644

Issue of shares

487,700

487,700

Transaction costs on issue of shares

(13,017)

(13,017)

3,903

3,903

(574)

Transactions with owners in their

capacity as owners

Dividends paid

Share based payments

Income tax on items taken directly to or

transferred from equity

Balance as at 30 June 2012

33,917,382

(16,926,589)

(1,223)

2,072,321

19,061,891

The above Statement of Changes in Equity should be read in conjunction with the accompanying notes

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Notes to the Financial Statements

1) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

These preliminary consolidated financial statements relate to Integrated Legal Holdings Limited and

the entities it controlled during the year ended 30 June 2012.

2) SEGMENT INFORMATION

Operating segments

The Integrated Legal Holdings Group has identified its operating segments based on the internal

management reporting that is used by the executive management team (the chief operating

decision maker) in assessing performance and allocating resources.

Integrated Legal Holdings Limiteds operating segments have been identified based on how the

financial and operating results of the Group are monitored and presented internally to the executive

management team. The reportable segments are based on aggregated operating segments

determined by the similarity of the products sold and the services provided, as these are the sources

of the Groups major risks and have the most effect on the rates of return.

For the year ended 30 June 2011, management identified a Legal Services Division and Information

Technology Division as operating segments. Changes to how the financial and operating results of

the Group are monitored and presented internally during the year ended 30 June 2012 have resulted

in these Divisions being dissolved and the Group is now segmented into one reportable segment.

Argyle Lawyers, Civic Legal, Signet Lawyers, Talbot Olivier and Integrated Legal Holdings Limiteds

Head Office Division are operating segments within the legal services sector in the Australian market

and have been aggregated to one reportable segment given the similarity of the services provided,

method in which services are delivered, types of customers and regulatory environment.

As the Group is aggregated into one reportable segment, there are no inter-segment transactions.

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Notes to the Financial Statements

3) REVENUE AND EXPENSES

Consolidated

2012

2011

$

$

Revenue and expenses from continuing operations

a) Other income

Dividends received

Sundry income

b) Depreciation and amortisation expenses

Depreciation of plant and equipment

Amortisation of:

o Equipment under finance lease

o Identified intangible assets

c) Other expenses

Author royalty fees

Consulting fees

Bad and doubtful debts

Bank fees

Other expenses

d) Finance costs

Interest other entities

Interest accretion

133

43,882

44,015

126

9,210

9,336

500,498

371,633

29,700

530,198

5,568

35,640

412,841

55,308

118,812

431,034

210,830

20,034

836,018

84,032

119,503

930,772

202,143

14,817

1,351,267

307,694

42,819

350,513

128,718

14,475

143,193

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Notes to the Financial Statements

4) DIVIDENDS DECLARED

2012

Cents

per share

a) Dividends declared, recognised

and paid

Interim dividend (fully franked)

b) Dividends declared and not

recognised

Final dividend (fully franked)(c)

0.8

c) Final Dividend Details

Amount per share

Amount franked

Record date to determine entitlements to the dividend

Date the final dividend is payable

2011

Total

$

Cents

per share

Total

$

0.3

267,883

816,276

0.6

582,986

0.8 cents

Fully franked at a 30% tax rate

12 October 2012

2 November 2012

d) Unrecognised dividends

A 2012 final dividend of 0.8 cents per ordinary fully paid share, fully franked at 30% was announced

on 16 August 2012 and is payable on 2 November 2012 to shareholders registered on 12 October

2012. The 2012 final dividend has not been recognised in the financial report because it was

determined, declared and publicly announced subsequent to year end.

The final dividend amount of $816,276 has been determined based on the number of eligible

ordinary shares on issue at the date of this financial report. No further shares are expected to be

issued which will be entitled to participate in the dividend.

The Groups DRP will apply to the 2012 final dividend.

e) Dividend Reinvestment Plan

The Company operates a dividend reinvestment plan (DRP) which offers eligible shareholders the

opportunity to reinvest all or part of their dividends in additional shares in the Group. The Shares

are issued at a 5% discount to the volume weighted average price of shares sold on the ASX during a

period of 10 trading days (rounded to the nearest half cent), with the period commencing on the

second trading day after the dividend record date.

The last date for receipt of an election notice for participation in the DRP with respect to the above

final dividend is 19 October 2012.

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Notes to the Financial Statements

5) CASH AND CASH EQUIVALENTS

CONSOLIDATED

2012

2011

$

$

Cash at bank and in hand

1,312,035

2,460,760

Cash at bank earns interest at floating rates based on daily bank deposit rates. The carrying amounts

of cash and cash equivalents approximate fair value.

CONSOLIDATED

2012

2011

$

$

Reconciliation to statement of cash flows

For the purposes of the statement of cash flows, cash and cash

equivalents comprise the following at 30 June:

Cash at bank and in hand

Short-term deposits

Bank overdrafts

1,308,285

3,750

(32,399)

1,279,636

1,532,538

928,222

(25,145)

2,435,615

10

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Notes to the Financial Statements

6) ISSUED CAPITAL

a) Ordinary shares

Consolidated

2012

Shares

Fully paid shares

Partly paid shares

Forfeited shares held in trust

Consolidated

2011

Shares

100,203,515

2,131,000

(300,000)

102,034,515

95,908,111

1,256,217

97,164,328

Consolidated

2012

$

Consolidated

2011

$

33,800,242

129,589

(12,449)

33,917,382

33,321,656

75,496

33,397,152

Shares

86,484,666

$

32,160,426

Issue of shares to The Argyle Partnership in final satisfaction of

deferred consideration payable on 22 September 2010

1,800,000

180,000

Issue of shares in part satisfaction of 2010 Principal profit share

entitlement on 16 December 2010

125,000

15,000

Issue of shares to vendors of Wojtowicz Kelly Legal on 1 February

2011

5,727,000

744,600

Issue of shares under Dividend Reinvestment Plan on 2 May 2011

2,143,112

267,883

a) Movements in ordinary share capital

Opening balance as at 1 July 2010

Costs associated with shares issued on the acquisition of Wojtowicz

Kelly Legal, net of tax

Issue of shares under the Deferred Employee Share Plan

(12,172)

884,550

41,415

Balance as at 30 June 2011

97,164,328

33,397,152

Opening balance as at 1 July 2011

Shares

97,164,328

$

33,397,152

Issue of shares at 11.50 cents per share to vendors of PLN Lawyers

in part satisfaction of consideration payable on 1 August 2011

3,043,478

350,000

Issue of shares under the Dividend Reinvestment Plan

1,251,926

137,700

Costs associated with issuing shares

Income tax on items taken directly to or transferred from equity

Issue of shares under the Deferred Employee Share Plan

Forfeited shares under the Deferred Employee Share Plan

Balance as at 30 June 2012

(13,017)

874,783

(300,000)

3,903

54,093

(12,449)

102,034,515

33,917,382

11

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Notes to the Financial Statements

7) ACCUMULATED LOSSES

Consolidated

2012

2011

$

$

Accumulated losses

(16,926,589)

(16,926,589)

Balance at beginning of year

Transfer to general reserve (refer note 8)

Balance at end of the year

(16,926,589)

(16,926,589)

(16,688,184)

(238,405)

(16,926,589)

8) RESERVES

Net losses on available-for-sale financial assets

General reserve(1)

Balance at end of the year

(1)

Consolidated

2012

2011

$

$

(1,223)

(649)

2,072,321

1,542,749

2,071,098

1,542,100

Due to accumulated losses incurred prior to the listing of the company on 17 August 2007,

the Directors resolved to isolate profits derived from trading activities since listing through

the establishment of a General Reserve.

During the period, $nil was transferred to the General Reserve from Accumulated Losses

(2011: $238,405).

12

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Notes to the Financial Statements

9) BUSINESSES COMBINATIONS

Acquisition of PLN Lawyers Pty Ltd

Effective 1 August 2011, Integrated Legal Holdings Limited acquired the legal business of PLN

Lawyers Pty Ltd under tuck-in arrangements with the existing member firm Argyle Lawyers Pty Ltd.

The acquisition supports the Companys business strategy to identify quality legal businesses to join

the Group through acquisition, and support these businesses as part of a network towards above

market growth, improved business performance and Group synergies.

The consideration for the acquisition was a combination of cash plus 3,043,478 shares at 11.5 cents

per share, and includes a deferred cash component payable in September 2012 subject to the PLN

business achieving revenue and profitability targets for the period to 30 June 2012. The acquisition

is structured with significant employment restraints and conditions. The cash component of the

purchase consideration has been funded from surplus cash reserves.

The following constitutes the calculation of the consideration given and the fair value of net assets

acquired:

$

Consideration

Cash

1,100,000

Deferred cash consideration

232,653

Total cash consideration

1,332,653

Shares issued at fair value

350,000

Total acquisition cost

1,682,653

Net assets acquired

Assets

Plant and equipment

Accumulated depreciation

Net deferred tax asset

Total assets acquired

Liabilities

Provision for employee entitlements

Net deferred tax liability

Total liabilities acquired

Net liabilities acquired

Goodwill on acquisition

Fair

Value

$

Carrying

Amount

$

34,860

(22,573)

6,005

18,292

34,860

(22,573)

12,287

20,017

5,204

25,221

(6,929)

1,689,582

20,017

20,017

(7,730)

13

INTEGRATED LEGAL HOLDINGS LIMITED

APPENDIX 4E - PRELIMINARY FINAL REPORT

FOR THE YEAR ENDED 30 JUNE 2012

ACN 120 394 194

Notes to the Financial Statements

The acquirees contribution to the net profit of the Group cannot be determined as this business has

been incorporated into Argyles business, and it is impracticable to disclose the total revenue and

profit for the combined entity as though the acquisition had taken place at the beginning of the

period.

Cash outflows acquired legal practices

Cash outflows during the year ended 30 June 2012 relating to acquisitions were as follows:

$

PLN Lawyers Pty Ltd (1 August 2011):

- Cash Consideration

Wojtowicz Kelly Legal (1 February 2011):

- Deferred cash consideration

- Contingent cash consideration

Net consolidated cash outflow

1,100,000

125,000

28,580

1,253,580

10) SUBSEQUENT EVENTS

Investment in Rockwell Bates Pty Ltd

On 2 July 2012 the Company entered into a Share Purchase Agreement to acquire a 25% interest in

the legal practice of Rockwell Bates.

The Company will have the option to increase its interest to a 49% investment over the next two

years.

The consideration for the initial transaction is a combination of the issue of 3,152,958 shares at the

Volume Weighted Average Price on acquisition date and cash.

The Company will acquire a further investment of 12% on each of 1 July 2013 and 1 July 2014 at fair

value.

The acquisition is structured with the usual ILH employment restraints and conditions, consistent

with the Companys disciplined acquisition model and strict criteria.

Final Dividend 2011/12

The Directors have declared a fully franked final dividend in respect of 2011/12 of 0.8 cents per

share, up from 0.6 cents fully franked in the previous corresponding period.

The dividend will have a record date of 12 October 2012 and a payment date of 2 November 2012.

The dividend reinvestment plan will operate with respect to the final dividend.

14

You might also like

- Interim Report Q4 2012 EngDocument25 pagesInterim Report Q4 2012 Engyamisen_kenNo ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocument14 pagesASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)No ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Balance Sheet of John Limited As OnDocument19 pagesBalance Sheet of John Limited As OnAravind MaitreyaNo ratings yet

- Different: ... and Better Than EverDocument4 pagesDifferent: ... and Better Than EverViral PatelNo ratings yet

- Universal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFDocument27 pagesUniversal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- 2012 Annual Financial ReportDocument76 pages2012 Annual Financial ReportNguyễn Tiến HưngNo ratings yet

- Colcom Press Results Dec2011Document1 pageColcom Press Results Dec2011Kristi DuranNo ratings yet

- NT Pharma - Annual Results Announcement For The Year Ended 31 December 2012 PDFDocument38 pagesNT Pharma - Annual Results Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- 4.JBSL AccountsDocument8 pages4.JBSL AccountsArman Hossain WarsiNo ratings yet

- Lecture 1 CHP 1 No SolutionsDocument20 pagesLecture 1 CHP 1 No SolutionsHarry2140No ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 pagesChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888No ratings yet

- 2011 Financial Statements NESTLE GROUPDocument118 pages2011 Financial Statements NESTLE GROUPEnrique Timana MNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Advanced Financial Accounting & Reporting AnswerDocument13 pagesAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

- Financial Statements Review Q4 2010Document17 pagesFinancial Statements Review Q4 2010sahaiakkiNo ratings yet

- The Siam Cement Public and Its Subsidiaries: Company LimitedDocument73 pagesThe Siam Cement Public and Its Subsidiaries: Company LimitedMufidah 'mupmup'No ratings yet

- Tute3 Reliance Financial StatementsDocument3 pagesTute3 Reliance Financial Statementsvivek patelNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Unvr - LK Audit 2012Document79 pagesUnvr - LK Audit 2012Abiyyu AhmadNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Apple IncorporatedDocument5 pagesApple IncorporatedVincent Jake NaputoNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- Hannans Half Year Financial Report 2010Document18 pagesHannans Half Year Financial Report 2010Hannans Reward LtdNo ratings yet

- Qfs 1q 2012 - FinalDocument40 pagesQfs 1q 2012 - Finalyandhie57No ratings yet

- From Account To Account Revenue 41110 41290 Gross ProfitDocument4 pagesFrom Account To Account Revenue 41110 41290 Gross ProfitAravind AllamNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarNo ratings yet

- Tut 4 - Reliance Financial StatementsDocument3 pagesTut 4 - Reliance Financial StatementsJulia DanielNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Quarterly Report PDFDocument1 pageQuarterly Report PDFNasef MohdNo ratings yet

- KHIND Annual Report MalaysiaDocument77 pagesKHIND Annual Report MalaysiakokueiNo ratings yet

- Samba Statements 11 +12Document46 pagesSamba Statements 11 +12Shyair GanglaniNo ratings yet

- Utilico Annual Report 2013Document90 pagesUtilico Annual Report 2013AdiSto10No ratings yet

- Financial Statement Case StudyDocument11 pagesFinancial Statement Case StudyGayle Tadler50% (2)

- First-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsDocument23 pagesFirst-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsphuawlNo ratings yet

- Hannans Half Year Financial Report 2011Document18 pagesHannans Half Year Financial Report 2011Hannans Reward LtdNo ratings yet

- 174.ASX IAW Feb 27 2013 17.36 Half Yearly Report and AccountsDocument28 pages174.ASX IAW Feb 27 2013 17.36 Half Yearly Report and AccountsASX:ILH (ILH Group)No ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2012Document6 pagesProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliNo ratings yet

- Apple 10QDocument57 pagesApple 10QadsadasMNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- CNXX JV 2012 Verkort 5CDocument77 pagesCNXX JV 2012 Verkort 5CgalihNo ratings yet

- Consolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)Document25 pagesConsolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)sudhak111No ratings yet

- Bank AlfalahDocument66 pagesBank AlfalahShahid MehmoodNo ratings yet

- Annual Report: Registered OfficeDocument312 pagesAnnual Report: Registered OfficeDNo ratings yet

- Jiangchen Intl - Announcement of Annual Results For The Financial Year Ended 31 December 2012 PDFDocument34 pagesJiangchen Intl - Announcement of Annual Results For The Financial Year Ended 31 December 2012 PDFalan888No ratings yet

- Royale Furniture Holdings Limited: Annual Results For The Year Ended 31 December 2012Document18 pagesRoyale Furniture Holdings Limited: Annual Results For The Year Ended 31 December 2012alan888No ratings yet

- Half-Year Report Julius Baer Group LTDDocument24 pagesHalf-Year Report Julius Baer Group LTDEvgeny SkorobogatkoNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 260.ASX ILH March 16 2015 Sale of Shares in Law Central and Capricorn CompletedDocument2 pages260.ASX ILH March 16 2015 Sale of Shares in Law Central and Capricorn CompletedASX:ILH (ILH Group)No ratings yet

- 248.ASX ILH Dec 10 2014 Trading HaltDocument1 page248.ASX ILH Dec 10 2014 Trading HaltASX:ILH (ILH Group)No ratings yet

- 253.ASX ILH Dec 24 14.19 Binding Agreement Restructuring AnnouncementDocument2 pages253.ASX ILH Dec 24 14.19 Binding Agreement Restructuring AnnouncementASX:ILH (ILH Group)No ratings yet

- 252.ASX ILH Dec 24 14.18 2014 Binding Agreement ReachedDocument2 pages252.ASX ILH Dec 24 14.18 2014 Binding Agreement ReachedASX:ILH (ILH Group)No ratings yet

- 247.ASX ILH Dec 3 2014 Becoming A Substantial Holder FRENCHDocument2 pages247.ASX ILH Dec 3 2014 Becoming A Substantial Holder FRENCHASX:ILH (ILH Group)No ratings yet

- 235.ASX ILH Oct 22 2014 First Quarter Financial UpdateDocument2 pages235.ASX ILH Oct 22 2014 First Quarter Financial UpdateASX:ILH (ILH Group)No ratings yet

- 236.ASX ILH Oct 22 2014 Investor PresentationDocument18 pages236.ASX ILH Oct 22 2014 Investor PresentationASX:ILH (ILH Group)No ratings yet

- 227.ASX IAW Aug 29 2014 Preliminary Financial ReportDocument16 pages227.ASX IAW Aug 29 2014 Preliminary Financial ReportASX:ILH (ILH Group)No ratings yet

- Message of Po3 Ronald Villanueva Daguro Monday Flag Raising Ceremony of PSJLC June 1, 2015Document4 pagesMessage of Po3 Ronald Villanueva Daguro Monday Flag Raising Ceremony of PSJLC June 1, 2015menchayNo ratings yet

- GST EntriesDocument5 pagesGST EntriessrestanandNo ratings yet

- NIBIN Fact SheetDocument2 pagesNIBIN Fact Sheet13WMAZNo ratings yet

- Government Finance: Taxation in The United States United States Federal BudgetDocument7 pagesGovernment Finance: Taxation in The United States United States Federal BudgetKatt RinaNo ratings yet

- Case Law About Gift IntervivosDocument2 pagesCase Law About Gift IntervivosCynthia Amweno0% (1)

- Evolution of Conveyancing in KenyaDocument2 pagesEvolution of Conveyancing in KenyaRayoh SijiNo ratings yet

- Mngt13 Chapter 3Document11 pagesMngt13 Chapter 3Ariane VergaraNo ratings yet

- Government Procurement AgreementDocument15 pagesGovernment Procurement AgreementSuyashRawatNo ratings yet

- Project - Law of InsuranceDocument11 pagesProject - Law of Insuranceanam khanNo ratings yet

- Changing Seats Re-Domiciliation To Curaçao FinalDocument2 pagesChanging Seats Re-Domiciliation To Curaçao FinalRicardo NavaNo ratings yet

- Isaca Crisc SampleDocument50 pagesIsaca Crisc SampleKirthika BojarajanNo ratings yet

- Cornell Notes Financial AidDocument3 pagesCornell Notes Financial AidMireille TatroNo ratings yet

- Seatwork 10.6.21Document6 pagesSeatwork 10.6.21Ashley MarloweNo ratings yet

- COMPROMISDocument26 pagesCOMPROMISRavi VermaNo ratings yet

- Evolution of The Indian Insolvency and Bankruptcy CodeDocument22 pagesEvolution of The Indian Insolvency and Bankruptcy CodeSid KaulNo ratings yet

- IEEE 24748-5 - 2017 - SW Development PlanningDocument48 pagesIEEE 24748-5 - 2017 - SW Development Planningangel tomas guerrero de la rubiaNo ratings yet

- Erin Cullaro Response To Notary ComplaintDocument8 pagesErin Cullaro Response To Notary ComplaintForeclosure Fraud100% (1)

- Offer Letter SathwikDocument3 pagesOffer Letter SathwikRaviteja PavanNo ratings yet

- 4 Judicial Affidavit RuleDocument4 pages4 Judicial Affidavit RuleHanifa Shereen Biston AliNo ratings yet

- SECURITY or PHYSICAL SECURITY or RISK ASSESSMENTDocument3 pagesSECURITY or PHYSICAL SECURITY or RISK ASSESSMENTapi-1216271390% (1)

- Islamic Religious StudiesDocument10 pagesIslamic Religious StudiesBockarie MarahNo ratings yet

- M-40k Notice of Denial of Expedited FS or Inability To Issue FSDocument1 pageM-40k Notice of Denial of Expedited FS or Inability To Issue FShooNo ratings yet

- Principles of Electric Circuits - 9780135073094 - Ejercicio 41 - QuizletDocument5 pagesPrinciples of Electric Circuits - 9780135073094 - Ejercicio 41 - QuizletasdfNo ratings yet

- ApplicationDocument3 pagesApplicationSusanaNo ratings yet

- In Sunny SpainDocument3 pagesIn Sunny SpainAnonymous ht2L8xP100% (1)

- Strategy For History MainsDocument6 pagesStrategy For History MainsGrayHawk100% (1)

- 10 04 033 SPCDocument1 page10 04 033 SPCMichael Ben-DorNo ratings yet

- UEFA Direct September 2007Document24 pagesUEFA Direct September 2007cristobal_77grNo ratings yet

- Ru Ad Ak2Document1 pageRu Ad Ak2Jeremy SydorNo ratings yet

- Compound Interest and SIDocument2 pagesCompound Interest and SISanathoi MaibamNo ratings yet