Professional Documents

Culture Documents

Daily Equity Market Report-21 Jan 2015

Daily Equity Market Report-21 Jan 2015

Uploaded by

NehaSharmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report-21 Jan 2015

Daily Equity Market Report-21 Jan 2015

Uploaded by

NehaSharmaCopyright:

Available Formats

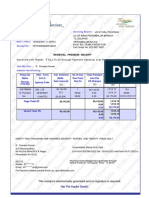

CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

DAILY EQUITY REPORT

21ST january 2015

CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

Daily Equity Report

INDIAN MARKET

INDIAN FACE

INDICES

CLOSE

PREVIOUS

SENSEX

28784.67

28,262.01

NIFTY

8695.60

8550.70

INDIAN EQUITY BENCHMARK indices Sensex and the Nifty

ended at fresh record closing highs led by financials and

ASIAN MARKET

index heavyweight ITC while metal stocks surged after

INDICES

CLOSE

PREVIOUS

better-than-expected fourth quarter economic growth from

NIKKEI

17,366.30

17,014.29

China.

HANG SENG

23,951.16

23,738.49

KOSPI

1,918.31

1,902.62

Further, Suven Life Sciences surged 6.28% on BSE after the

company said it has secured a total of four product patents

SECTORIAL INDICES

one each in Australia & Hong Kong and two product patents

INDICES

CLOSE

CHANGE (%)

CNX 100

8,695.60

1.69

S&P CNX 500

7080.65

1.27

CNX MIDCAP

12,949.85

0.36

tyre major MRF is in advanced talks to buy the company's

CNX 200

4,482.40

1.34

tyre unit in Uttrakhand.

BANK NIFTY

19,767.05

1.86

from Japan.

Kesoram Industries locked 20% upper circuit on reports that

GLOBAL FACE

TOP GAINERS

SCRIPT

CLOSE

CHANGE (%)

SSLT

204.50

5.88

HDFC

1,250.00

5.78

TATASTEEL

403.00

4.74

5.6%. In its World Economic Outlook Update, IMF pegged the

AXISBANK

552.15

4.39

country's growth rate at 6.5% for 2016-17..

TOP LOSERS

to 6.3% for 2015-16 against 6.4% made in October last year,

while retaining the forecast for the current financial year at

SCRIPT

CLOSE

CHANGE (%)

GAIL

429.00

-2.62

TATAPOWER

81.85

-1.15

DRREDDY

3300.00

-0.72

POWERGRID

146.90

-0.64

IMF has slightly cut projections for India's economic growth

European shares touched new seven-year highs after data

showed China's economic growth slowed less than feared and

on expectations the European Central Bank will launch a

quantitative easing programme later this week.

US stock index futures poised for a higher opening at the Wall

Street on Tuesday.

CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

Daily Equity Report

MARKET MOVERS UPSIDE

NIFTY SPOT

SCRIPT

CLOSE

ONGC

350.30

CHANGE

(%)

0.81

ITC

371.10

3.43

S3

S2

S1

8392

8525

8610

RELIANCE

903.05

2.66

HDFC BANK

1020.95

1.63

TREND

STRATEGY

BULLISH

BUY ON DIPS

PIVOT POINTS

P

R1

R2

8659

8744

SUPPORT

S1-8625

S2-8575

NIFTY

8792

R3

8926

RESISTANCE

R1-8735

R2-8815

MARKET MOVERS DOWNSIDE

SCRIPT

CLOSE

TCS

2500.45

CHANGE

(%)

[0.42]

MARUTI

3605.55

[0.57]

M&M

1325.25

[0.52]

POWER GRID

147.40

[0.3]

FII & DII ACTIVITY

INSTITUTION

NET BUY

(CR.)

NET SELL

(CR)

FII

4796

3520.41

DII

1517.7

2279.3

BANK NIFTY FUTURE

TREND

BULLISH

PIVOT POINTS

S3

NSE TOTALS

18946

INDICES

ADVANCES

DECLINES

NIFTY

37

13

BANK NIFTY

10

STRATEGY

BUY ON DIPS

S2

S1

R1

19334

19574

19722

19963

BANK NIFTY

SUPPORT

S1-19490

S2-19125

R2

R3

20111

20499

RESISTANCE

R1-19875

R2-20095

CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

Daily Equity Report

r

MARKET TALKS

Ramky Infra bags

Rs209.89 crore

order

that the Indian defence sector offer. It already supplying

worth

paramilitary ambulances to the armed forces since the last year.

Ramky Infrastructure announced that the JV (70% holding Ramky

Infrastructure) has been awarded the project worth Rs209.89 for

RBI asks banks to review base rate

every quarter

rehabilitation and upgradation of NH-43 from 180km to 241km to two

lane with paved shoulder in the state of Chattisgarh under NHDP-IV

RBI has asked banks to notify the base rate, at least once in

through EPC route by Ministry of Road Transport & Highways. The

every three months based on cost of funds, a move seen as a

development is positive for Ramky Infrastructure.

nudge to lenders to pass on changes in policy rate to borrowers.

At present, the review of the base rate does not have a fixed

Reliance

Communications

equity shares

schedule. While banks have the freedom to calculate cost of

allots

funds the methodology should be reasonable reasonable and

transparent provided and consistent.

Reliance Communications announced that the Committee of

Directors at their meeting held on Jan 20, 2015 have allotted

8,66,66,667 equity shares to Telecom Infrastructure Finance (TIFPL),

MRF in talks to buy Kesoram

Industries tyre unit

a Promoter Group company, against Warrants issued to them. As a

result, the Promoter Group's holding has gone up to 59.70% from

MRF, which is Indias largest tyre manufacturer, is in discussion

existing 58.25%.

with Birla group company Kesoram Industries to acquire its tyre

unit branded as Birla Tyres. Kesoram Industries had earlier

Force Motors sets sights on defence

sector

decided to restructure its businesses and hive off the tyre division

to reduce the debt on books. Birla Tyres has two manufacturing

facilities one in Orissa and the other in Uttrakhand which has an

Force Motors Limited, is actively looking at tapping the huge potential

excise duty benefit till 2019.

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any

responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.

Use of this report in no way constitutes a client/advisor relationship, all information we communicate to you (the subscriber) either through

our Web site or other forms of communications, are purely for informational purposes only. We recommend seeking individual investment

advice before making any investment, for you are assuming sole liability for your investments. Capital Stars will in no way have discretionary

authority over your trading or investment accounts.

All rights reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- VF Brands - Case Write Up - Group8Document6 pagesVF Brands - Case Write Up - Group8maheshNo ratings yet

- Nifty News Letter-18 September 2015Document8 pagesNifty News Letter-18 September 2015NehaSharmaNo ratings yet

- Nifty News Letter-28 August 2015Document8 pagesNifty News Letter-28 August 2015NehaSharmaNo ratings yet

- Nifty News Letter-25 August 2015Document7 pagesNifty News Letter-25 August 2015NehaSharmaNo ratings yet

- Nifty News-20 July 2015Document8 pagesNifty News-20 July 2015NehaSharmaNo ratings yet

- Nifty News-30 July 2015Document8 pagesNifty News-30 July 2015NehaSharmaNo ratings yet

- Nifty News-21 August 215Document8 pagesNifty News-21 August 215NehaSharmaNo ratings yet

- Nifty News Letter-26 August 2015Document8 pagesNifty News Letter-26 August 2015NehaSharmaNo ratings yet

- Nifty News-13 August 2015Document8 pagesNifty News-13 August 2015NehaSharmaNo ratings yet

- Newsletter MC XDocument6 pagesNewsletter MC XNehaSharmaNo ratings yet

- Nifty News-27 July 2015Document8 pagesNifty News-27 July 2015NehaSharmaNo ratings yet

- Daily Equity Report 5 February 2015Document4 pagesDaily Equity Report 5 February 2015NehaSharmaNo ratings yet

- Nifty News-24 July 2015Document8 pagesNifty News-24 July 2015NehaSharmaNo ratings yet

- Capitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MDocument8 pagesCapitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MNehaSharmaNo ratings yet

- Daily Equity Report 3 February 2015Document4 pagesDaily Equity Report 3 February 2015NehaSharmaNo ratings yet

- Daily Equity Report 6 February 2015Document4 pagesDaily Equity Report 6 February 2015NehaSharmaNo ratings yet

- Daily Equity Market Report-16 Jan 2015Document4 pagesDaily Equity Market Report-16 Jan 2015NehaSharmaNo ratings yet

- Daily Equity Report 2 February 2015Document4 pagesDaily Equity Report 2 February 2015NehaSharmaNo ratings yet

- Daily Equity Report 9 January 2015Document4 pagesDaily Equity Report 9 January 2015NehaSharmaNo ratings yet

- Daily Equity Report 8 January 2015Document4 pagesDaily Equity Report 8 January 2015NehaSharmaNo ratings yet

- Sectoral ApproachDocument44 pagesSectoral ApproachDSGNo ratings yet

- LIC ProofDocument1 pageLIC ProofkhumarpraveenNo ratings yet

- Case Study: 3) How Did Traditional Japanese Culture Benefit MatsushitaDocument8 pagesCase Study: 3) How Did Traditional Japanese Culture Benefit MatsushitashoaybkhanNo ratings yet

- Rabin - Incorporating Limited Rationality Into EconomicsDocument17 pagesRabin - Incorporating Limited Rationality Into EconomicsNicole ThomasNo ratings yet

- Kashato PDFDocument15 pagesKashato PDFEdelyn De la CruzNo ratings yet

- Modern Banking InstrumentsDocument18 pagesModern Banking InstrumentsZaeem Laher33% (3)

- 7 Mankiw7 26 10 2020Document15 pages7 Mankiw7 26 10 2020QuirkyNo ratings yet

- SWOT of Quality Progress in Saudi Arabia & The Road Map Forward 29 March 2008Document43 pagesSWOT of Quality Progress in Saudi Arabia & The Road Map Forward 29 March 2008ainulhaque786No ratings yet

- Chapter 18 Verbal ReasoningDocument38 pagesChapter 18 Verbal ReasoningJyoti MalhotraNo ratings yet

- Paras - 1678Document3 pagesParas - 1678Andrea RioNo ratings yet

- Micro Finance in Krishnagiri District:: A Tool For Poverty AlleviationDocument18 pagesMicro Finance in Krishnagiri District:: A Tool For Poverty AlleviationKumar KrNo ratings yet

- Perdue CaseDocument18 pagesPerdue CaseAbhishek UpadhyayNo ratings yet

- Invoice 179.14Document1 pageInvoice 179.14miroljubNo ratings yet

- Money, Banking and Public FinanceDocument17 pagesMoney, Banking and Public FinancePsycho BaaeNo ratings yet

- George Washington University's Center For Real Estate and Urban Analysis' New York WalkUP ReportDocument9 pagesGeorge Washington University's Center For Real Estate and Urban Analysis' New York WalkUP ReportEthan Rothstein100% (1)

- Chapter 5-Dayag-TheorisDocument1 pageChapter 5-Dayag-TheorisMazikeen DeckerNo ratings yet

- Myanmar Business Today - Vol 1, Issue 41 PDFDocument32 pagesMyanmar Business Today - Vol 1, Issue 41 PDFMyanmar Business TodayNo ratings yet

- Social Security VoluntaryDocument10 pagesSocial Security VoluntarydcsshitNo ratings yet

- Chapter 1 - Multinational Financial Management - OverviewDocument24 pagesChapter 1 - Multinational Financial Management - OverviewJean Pierre Naaman100% (2)

- Taganito Mining Corporation v. Commissioner of Internal RevenueDocument2 pagesTaganito Mining Corporation v. Commissioner of Internal RevenueRoland MarananNo ratings yet

- Debt Collector ScriptDocument4 pagesDebt Collector ScriptElcana Mathieu0% (1)

- Bloomberg Businessweek Europe - April 23 2018Document76 pagesBloomberg Businessweek Europe - April 23 2018Anh ThànhNo ratings yet

- Walmart Inc.: Monthly Rates of ReturnDocument11 pagesWalmart Inc.: Monthly Rates of ReturnChristopher KipsangNo ratings yet

- Fulcher, James (2015) Capitalism - A Very Short IntroductionDocument11 pagesFulcher, James (2015) Capitalism - A Very Short Introductionpandujb213No ratings yet

- Evolution of Competition Law in India (53444)Document7 pagesEvolution of Competition Law in India (53444)Sai DivakarNo ratings yet

- Candlestick Pattern Cheat SheetDocument1 pageCandlestick Pattern Cheat SheetBetro PemilioNo ratings yet

- PACRA Morning BriefDocument14 pagesPACRA Morning BriefafnaniqbalNo ratings yet

- Assignment of B.EDocument33 pagesAssignment of B.EpatelkkNo ratings yet

- BCK (Chapter 5)Document60 pagesBCK (Chapter 5)Isha BavdechaNo ratings yet