Professional Documents

Culture Documents

The North Face China Finding True North (DIR)

The North Face China Finding True North (DIR)

Uploaded by

lukaszCopyright:

Available Formats

You might also like

- Ebook Strategic Management Competitiveness and Globalization Concepts and Cases 14E PDF Full Chapter PDFDocument67 pagesEbook Strategic Management Competitiveness and Globalization Concepts and Cases 14E PDF Full Chapter PDFsamuel.chapman41697% (38)

- A Study On Diffusion of Digital Camera InnovationsDocument19 pagesA Study On Diffusion of Digital Camera InnovationsShambhavi AryaNo ratings yet

- Newlife WheelysDocument35 pagesNewlife WheelysAnuragNo ratings yet

- Think Small - Volkswagen's Ad CampaignDocument1 pageThink Small - Volkswagen's Ad CampaignKate VoitsNo ratings yet

- Nelson v. AppleDocument25 pagesNelson v. AppleMikey Campbell100% (1)

- Shanghai Tang Marketing AnalysisDocument12 pagesShanghai Tang Marketing AnalysisJeremy Koh100% (1)

- Asset Management DocumentationDocument98 pagesAsset Management DocumentationPascal LussacNo ratings yet

- Ewm Production IntegrationDocument78 pagesEwm Production IntegrationDipak BanerjeeNo ratings yet

- Jordan Belfort and Steve Jobs Literacy PaperDocument4 pagesJordan Belfort and Steve Jobs Literacy Paperapi-272958820No ratings yet

- Cannes Lions 2012 Winning Campaigns Mobile enDocument60 pagesCannes Lions 2012 Winning Campaigns Mobile enotávio_leite_5No ratings yet

- Apple Brand AuditDocument6 pagesApple Brand AuditSrinivas SrinuNo ratings yet

- Media Plan - Johnson's Baby PowderDocument33 pagesMedia Plan - Johnson's Baby PowderyechueNo ratings yet

- Global Forces and The European Brewing IndustryDocument9 pagesGlobal Forces and The European Brewing IndustryMurtaza ShaikhNo ratings yet

- Ogilvy FinalDocument38 pagesOgilvy FinalAnisha Jaisinghani100% (1)

- Innosight Overview Brochure PDFDocument15 pagesInnosight Overview Brochure PDFAneesh KallumgalNo ratings yet

- Session 2 - Fyre FestivalDocument5 pagesSession 2 - Fyre FestivalNadege SalagackiNo ratings yet

- Burts Bees Wax Case AnalysisDocument7 pagesBurts Bees Wax Case AnalysisArpit Pandey100% (1)

- Calvin Klien CaseDocument4 pagesCalvin Klien CaseTanvi RajdeNo ratings yet

- Cannes Lions 2010 Promo PR Direct enDocument176 pagesCannes Lions 2010 Promo PR Direct enotávio_leite_5No ratings yet

- Cannes Lions 2012 Winning Campaigns PR enDocument66 pagesCannes Lions 2012 Winning Campaigns PR enotávio_leite_5No ratings yet

- Cannes Lions 2012 Winning Campaigns Titanium Integrated enDocument26 pagesCannes Lions 2012 Winning Campaigns Titanium Integrated enotávio_leite_5No ratings yet

- Viral Marketing by Muhammad Iqrash AwanDocument10 pagesViral Marketing by Muhammad Iqrash AwanMuhammad Iqrash AwanNo ratings yet

- Clio Awards 2013 1 enDocument364 pagesClio Awards 2013 1 enGerardo OGNo ratings yet

- Sony Corporation Market ManagementDocument39 pagesSony Corporation Market Managementvampire79100% (1)

- Case 02Document7 pagesCase 02emrekiratliNo ratings yet

- Cannes Lions 2011 Winners For Press enDocument268 pagesCannes Lions 2011 Winners For Press enotávio_leite_5No ratings yet

- Cannes Lions 2013 enDocument1,540 pagesCannes Lions 2013 enotávio_leite_5No ratings yet

- The Fyre Festival - Mona Liza OliscoDocument3 pagesThe Fyre Festival - Mona Liza OliscoMona Liza OliscoNo ratings yet

- Jewish Standard Media Kit 2016Document6 pagesJewish Standard Media Kit 2016New Jersey Jewish StandardNo ratings yet

- Cannes Lions 2011 Winners For Media enDocument112 pagesCannes Lions 2011 Winners For Media enotávio_leite_5No ratings yet

- Red Bull NikeDocument10 pagesRed Bull NikeUdevir SinghNo ratings yet

- NewsCred Millennial MindDocument45 pagesNewsCred Millennial MindA3documentosNo ratings yet

- 10 Mega Trends That Are Reshaping The WorldDocument101 pages10 Mega Trends That Are Reshaping The WorldanaNo ratings yet

- Cannes Lions 2012 Winning Campaigns Branded Content enDocument52 pagesCannes Lions 2012 Winning Campaigns Branded Content enotávio_leite_5No ratings yet

- Acknowledgement: Name: Viraj S Wadkar DateDocument67 pagesAcknowledgement: Name: Viraj S Wadkar DateViraj WadkarNo ratings yet

- Cannes Lions 2011 Winners For Titanium enDocument26 pagesCannes Lions 2011 Winners For Titanium enotávio_leite_5No ratings yet

- LOreal Brandstorm 2014 - Case Study PDFDocument10 pagesLOreal Brandstorm 2014 - Case Study PDFAlina MadalinaNo ratings yet

- Case Study On VodafoneDocument4 pagesCase Study On VodafonekalaswamiNo ratings yet

- UMD Annual Report SpreadsDocument21 pagesUMD Annual Report SpreadsNickDeMicheleNo ratings yet

- Asia Injury Prevention Foundation - Winning Vietnam's Helmet WarDocument12 pagesAsia Injury Prevention Foundation - Winning Vietnam's Helmet WarVuong LuuNo ratings yet

- Cannes Lions 2014 Branded Content Entertainment enDocument63 pagesCannes Lions 2014 Branded Content Entertainment engogsieteNo ratings yet

- Telecom Branding WhitepaperDocument20 pagesTelecom Branding Whitepaperfkhater100% (11)

- Publicis Groupe SDocument4 pagesPublicis Groupe SRage ArceoNo ratings yet

- Cannes Lions 2019 - PR Lions ShortlistDocument1 pageCannes Lions 2019 - PR Lions Shortlistadobo magazineNo ratings yet

- The New Consumers: The Influence Of Affluence On The EnvironmentFrom EverandThe New Consumers: The Influence Of Affluence On The EnvironmentNo ratings yet

- Casestudyonapple 171008173042Document10 pagesCasestudyonapple 171008173042Nischal Singh AttriNo ratings yet

- Why Is This Brief Here?Document3 pagesWhy Is This Brief Here?RISHIRAJ SENGUPTANo ratings yet

- Mindrock Silicon Valley Guide En21Document47 pagesMindrock Silicon Valley Guide En21KevinNo ratings yet

- Sony Brand AuditDocument1 pageSony Brand AuditManan BatraNo ratings yet

- Cannes Lions 2012 Winning Campaigns Promo enDocument84 pagesCannes Lions 2012 Winning Campaigns Promo enotávio_leite_5No ratings yet

- Ibo-03 2020-21Document22 pagesIbo-03 2020-21arun1974No ratings yet

- A Study of Marketing Strategy of Television Industry in LucknowDocument82 pagesA Study of Marketing Strategy of Television Industry in LucknowManjeet SinghNo ratings yet

- Consumer Behivour Towards SnickerDocument26 pagesConsumer Behivour Towards Snickerakshay hemrajaniNo ratings yet

- Kidzania Shaping A Strategic Service Vision For The FutureDocument34 pagesKidzania Shaping A Strategic Service Vision For The FutureAdrian NewNo ratings yet

- Cannes Lions Winning CampaignsDocument4 pagesCannes Lions Winning CampaignskoshaNo ratings yet

- Doing Business in ThailandDocument51 pagesDoing Business in ThailandNha KyNo ratings yet

- Tourism Industry Profile IndiaDocument23 pagesTourism Industry Profile IndiaPrince Satish Reddy50% (2)

- Brand Positioning of PVR - DS57 M257Document83 pagesBrand Positioning of PVR - DS57 M257Sujay Vikram Singh100% (1)

- A Case Study Branding A LifestyleDocument8 pagesA Case Study Branding A LifestyleAzhar KhanNo ratings yet

- Inside Steve's Brain (Review and Analysis of Kahney's Book)From EverandInside Steve's Brain (Review and Analysis of Kahney's Book)No ratings yet

- HKMagazine 07042014Document48 pagesHKMagazine 07042014apparition9No ratings yet

- Simon An Holt Nation BrandingDocument4 pagesSimon An Holt Nation BrandingGaus SamdaniNo ratings yet

- Brand The Beloved CountryDocument34 pagesBrand The Beloved CountryKyle RathNo ratings yet

- AnimejsDocument27 pagesAnimejsJesus RodriguezNo ratings yet

- Advance Data StructuresDocument184 pagesAdvance Data StructureskamsiNo ratings yet

- Direct and Oblique Translation: Module 3: Central Issues in TranslationDocument1 pageDirect and Oblique Translation: Module 3: Central Issues in TranslationSilvia ZamurcaNo ratings yet

- RESMETH Instructors ManualDocument32 pagesRESMETH Instructors ManualportucasbasNo ratings yet

- Einstein - Remarks On Bertrand RussellDocument15 pagesEinstein - Remarks On Bertrand RussellGabriel Rogé Such100% (1)

- Presented By-Anshul Kumbhare Siddhant Mhatre: Boiler AccessoriesDocument10 pagesPresented By-Anshul Kumbhare Siddhant Mhatre: Boiler AccessoriesHarshvardhan Singh ChauhanNo ratings yet

- Purchasing & Supply Management: Issues To Be AddressedDocument11 pagesPurchasing & Supply Management: Issues To Be AddressedprashantsrathorNo ratings yet

- Daniel Wahba - Optional Logarithmic AssigmentDocument6 pagesDaniel Wahba - Optional Logarithmic Assigmentdanielwahba2006No ratings yet

- Learning Module 1 Computer 7 Quarter 1Document8 pagesLearning Module 1 Computer 7 Quarter 1Rowmil Mariano PerueloNo ratings yet

- M8 McKissick SheavesDocument18 pagesM8 McKissick Sheavesmahmoud heikal100% (1)

- Feature: SFP Optical Module 1 .25G Double Optical Fiber 20kmDocument2 pagesFeature: SFP Optical Module 1 .25G Double Optical Fiber 20kmDaniel Eduardo RodriguezNo ratings yet

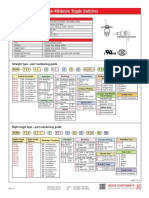

- SW-TS40T Series Sub-Miniature Toggle Switches: Straight Type - Part Numbering GuideDocument4 pagesSW-TS40T Series Sub-Miniature Toggle Switches: Straight Type - Part Numbering GuideVALTERNo ratings yet

- Bar Bending Schedule (Service BLDG)Document20 pagesBar Bending Schedule (Service BLDG)Rania SaiedNo ratings yet

- Bestcom-Considerate ComputingDocument8 pagesBestcom-Considerate ComputingĐức Nguyễn TuấnNo ratings yet

- Centripetal Force Grade 12 PhysicsDocument15 pagesCentripetal Force Grade 12 Physicssrinidhi innaniNo ratings yet

- Crown WAV60 Operator Manual - CompressedDocument39 pagesCrown WAV60 Operator Manual - CompressedHector PeñaNo ratings yet

- Valkokari TIMReview August2015Document8 pagesValkokari TIMReview August2015Héctor BallesterosNo ratings yet

- Feeling Comfortable With Logic Analyzers PDFDocument24 pagesFeeling Comfortable With Logic Analyzers PDFJ dosherNo ratings yet

- Java Atm PtojectDocument10 pagesJava Atm PtojectKrinal kathiriyaNo ratings yet

- 109is 37150 - 50310Document2 pages109is 37150 - 50310dip461No ratings yet

- SQL JoinsDocument59 pagesSQL Joinssunny11088No ratings yet

- A Study On Problem and Prospects of Women Entrepreneur in Coimbatore and Tirupur QuestionnaireDocument6 pagesA Study On Problem and Prospects of Women Entrepreneur in Coimbatore and Tirupur QuestionnaireAsheek ShahNo ratings yet

- Mina Meid Bypass Panel For Reseller - GSM-ForumDocument2 pagesMina Meid Bypass Panel For Reseller - GSM-ForumYohan RodriguezNo ratings yet

- Microprocessor Book PDFDocument4 pagesMicroprocessor Book PDFJagan Eashwar0% (4)

- Victron With Pylon Configuration SettingsDocument3 pagesVictron With Pylon Configuration Settingswarick mNo ratings yet

- A New Framework For Developping and Evaluating Complex InterventionsDocument11 pagesA New Framework For Developping and Evaluating Complex InterventionsyomellamocumbiaNo ratings yet

- Foreword Edgar Morin Path of Complexity - Alfonso MontuoriDocument32 pagesForeword Edgar Morin Path of Complexity - Alfonso MontuoriFrancisco LionNo ratings yet

The North Face China Finding True North (DIR)

The North Face China Finding True North (DIR)

Uploaded by

lukaszCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The North Face China Finding True North (DIR)

The North Face China Finding True North (DIR)

Uploaded by

lukaszCopyright:

Available Formats

The North Face China: Finding True North

Tom Richardson and Morgan Cao

Warc Prize for Asian Strategy

Entrant, 2012

Title:

Author(s):

Source:

Issue:

The North Face China: Finding True North

Tom Richardson and Morgan Cao

Warc Prize for Asian Strategy

Entrant, 2012

The North Face China: Finding True North

Tom Richardson and Morgan Cao

Campaign details

Brand owner: VF Corporation

Agencies: OgilvyOne, Shanghai

Brand: The North Face

Country: China

Channels used: Events and experiential, Games and competitions, Internet - general, Online video, Outdoor, out-of-home,

Point-of-purchase, in-store media, Print - general, unspecified, Public relations, Social media, Sponsorship - event or property,

Word of mouth and viral

Media budget: 1 - 3 million

Executive summary

In recent years, researchers have started to whisper the unthinkable that white-collar workers in Chinese cities are

beginning to doubt the ideal of success that they've been brought up with. The ferocious pursuit of money and career has

come at a cost that people can sense but can't easily articulate.

When the Chinese say they 'can't find North', it means they've lost their way or their sense of direction in life. It's a deeply felt

idiom, now more so than ever. So The North Face (TNF) created a series of epic events that immersed people in 'real-life'

experiences, enjoying activities along a route that headed from the southern city of Guangzhou to the 'True North' of China.

Timing and frustrated ambition combined to spark a reaction. The campaign generated 3.2 million website hits and one million

posts on social networks and microblogs, and 21 magazines and a documentary film crew followed the route. Most importantly

of all, sales grew by 46%, thrashing Columbia (32%) and the category (29%).

Market background and business objectives

Market background summary

The outdoor-apparel market in China is growing quickly. From just US$10m in 2001, it grew to be worth more than US$1bn by

2011. Between 2010 and 2011, the market grew by around 30% year-on-year.

Downloaded from warc.com

Competition

Given all the opportunity there is, outdoor apparel is a fiercely competitive market. There are 325 international outdoor brands

and 229 domestic brands registered in China, and because apparel is a fragmented category with low barriers to entry, there

are a large number of brands trading on price.

Position in the market

The North Face is still an upstart in this category, with mainland China sales of just US$90 million in 2011. At the start of 2011,

awareness of the brand was just 7% significantly lower than Columbia (18%) and Toread (14%).

Objectives

Our key objective was to keep up with category sales growth for 2011. But we also believed that we had to peg our results

against our key rival, Columbia, because the outdoor category is growing so quickly from a low base and is consolidating more

every year. The North Face was trying to eat into Columbia's market share quickly, by planting a flag firmly in the ground as

the authentic outdoor brand. Our aims were to:

l

Outgrow a rapidly expanding category (estimated to be 30% sales value growth in 2011)

Eat away at Columbia's market share

Increase brand awareness to 15%

Establish The North Face as the most 'authentic' outdoor brand in China.

Insight and strategic thinking

Cultural context

During the Middle Ages, China was seen by its people as a balanced society. Mandarins living in large settlements offered

moral leadership, while farmers fed the country. The town and the countryside were valued equally highly. But from around

1850, as international trade brought riches to the cities, urban life became the pinnacle of aspiration.1

From 1979, this trend accelerated dramatically. From 1995 to 2005, around 120 million people flooded into the cities, which

were seen as centres of both wealth and culture. As urbanisation gathered pace, rural China became defined by the character

'T?' (?), meaning dirty, crude or uncivilised.2

This makes it uniquely difficult to sell outdoor adventure as an aspiration to Chinese people. The North Face doesn't just need

to grow its brand; it has to sell a lifestyle that goes against the dominant narrative of development.

Research

While researching the cultural context of rural China, the TNF team dug up a fascinating academic paper, which indicated that

this dominant narrative might have weaknesses.3 The paper looked at the phenomenon of 'Nongjiale' ('Happy Farmer') in

Liaoning Province, arguing that people who lived in cities were driving to the countryside at weekends to eat, drink and live

like peasants. We researched this further and found signs of a similar pattern emerging across China.

In the context of what the team already knew about dissatisfaction with urban life, this gave The North Face confidence that

the outdoor lifestyle could be revived in China. But they knew they had to make outdoor challenges and achievements

Downloaded from warc.com

resonate with those who'd been brought up in the city.

Since Deng Xioaping's Open Door policy was introduced in 1978, Chinese urban professionals have been funnelled into a

prescribed route for success: a good university, a good salary, property ownership and sensible investment. This ideal is not

immediately vulnerable money will remain the dominant indicator of success in China for the foreseeable future but as our

target audience travels and earns more, they start looking for more out of life, which gives the ideal of success a nuance.

The TNF team spoke to people who said that money was a moving target always out of reach and never enough. In pursuit

of it, they were forgetting what was important to them and losing their way. There were four strands to this strategy:

Firstly, it was vital to needle people into questioning the direction their lives had taken, while simultaneously pointing them in a

new direction. The bitter pill of insecurity had to be sweetened by aspiration. Because the TNF team was trying to affect a

fundamental change in the way people related to success, we knew that we had to root our strategy in a timeless truth, rather

than a current trend.

Secondly, the campaign had to be authentic and participatory; it couldn't just appeal to emotion. True to TNF's broader

ambition of creating a culture of outdoor exploration, it was important to balance a sense of achievement with making it easy

for people to get outdoors.

Thirdly, it had to be based on teamwork. Crucially, research told TNF that, unlike many western explorers, the Chinese

explorer's ideal of the outdoors was not solitary. As Richard Nisbett points out in The Geography of Thought, western ideals

tend to be built on the Greek idea of agency, or self-determination, whilst Chinese ideals are built on the bonds of

companionship, which foster trust, and mutuality in a group.4

And finally, it had to be social. It had to allow people to share their achievements in return for recognition.

How was this strategy different?

The ambition of the TNF brand, in the words of APAC General Manager Jacob Uhland, is to "inspire a movement of outdoor

exploration." So we knew that our key message had to both act as a call to action, and give The North Face a truly authentic

outdoor identity.

The conventional wisdom of the outdoor category in China has been that it's impossible to sell the outdoors. However, you can

sell the outdoor aspiration but you have to make it relevant to the modern urban lifestyle, incorporating street wear, graphic

design and music. Many brands had always talked about 'the outdoors' in an abstract sense, but not bothered to show people

how to connect.

The North Face decided that it didn't want to make these compromises, and would gamble on its ability to not just market a

brand, but to create a culture.

'Finding True North,' aimed to forge an enduring link between the outdoors, The North Face, and a search for life's direction.

Rather than a foreign concept clumsily forced into a Chinese context, it was a cultural strategy born of China itself.

Implementation

Creative approach

Downloaded from warc.com

With the strategy in place, copywriters started playing around with the cultural context of 'north' and 'never stop exploring'.

They struck on the Chinese idiom 'can't find North', and realised it could be turned on its head as a rallying cry to join a series

of outdoor activities.

The TNF team then designed a route from Guangzhou in the south of China, to Mohe in the far north, that took in 10 cities

along the way and recruited people through social media to join our mission 'to the North'. In each city, the 'True North' team

designed a series of outdoor activities (hiking, mountain biking etc) that took people from the centre to the northernmost point.

At each checkpoint, people were able to unlock 'achievement badges' via their phones, which were then shared across social

media.

The top nine performers in the first nine cities were invited to join an exclusive group that would set out from Mohe, in northern

China, to find the country's 'True North'.

Media mix

Remaining faithful to The North Face's aim to plant a flag of authenticity, and so differentiate it from its rivals, this campaign

was built around outdoor events on the 'True North' trail. But to kick the buzz up a level:

l

We invited outdoor and urban lifestyle media to a launch event in Guangzhou

We built installations in our stores so that people could track the team's progress

We spent less than one-third of our budget on strategic print/OOH to build awareness of the event

We created a campaign website, integrated with social media, where people could sign up to events, track progress and

get tips for getting out there

We partnered with Weibo and location-based, mobile social network Jiepang.com to allow people to check in and win

badges that acknowledged their achievement.

Downloaded from warc.com

Breakdown of spend (US$2.94m) by individual media

l

Traditional media (OOH/print): US$1.4m

Digital: US$540,000

Activation: US$300,000

PR: US$250,000.

Performance against objectives

Outperform projected category sales growth of 30% in 2011

With the outdoor category expected to grow by around 30% in 2011, The North Face aimed to outperform category value

growth. In reality, this campaign helped TNF to grow 58% more than the category.

Downloaded from warc.com

(Source: The North Face China Sales Report, 2010, 2011)

Eating away at Columbia's market share

Perhaps the best indication of the impact of the strategy comes from comparing media spend with the impact of that spend.

TNF was massively outspent by Columbia, but achieved significantly higher sales growth, in that:

l

every US$1m The North Face spent on media in 2011 returned 1.15% sales growth

every US$1m Columbia spent on media in 2011 returned just 0.35% sales growth.

(Source: Maxus/GroupM data tracking)

Improve brand awareness from 7% to 15%

This campaign was like a snowball that just grew and grew as it rolled downhill. The momentum generated by our outdoor

events led to:

l

3.28 million hits on the campaign website

1 million posts on social networks and microblogs

162,544 badges unlocked by Jiepang.com mobile check-in (the highest number in the history of the site)

More than 50,000 followers on Sina Weibo, three times more than just a year earlier

21 magazines writing 111 articles about the campaign

One documentary film for The Travel Channel

RMB13.5m (US$2.14m) earned media value

257% increase in total brand awareness (see below)

Total awareness and purchase, 2010 vs 2011

Downloaded from warc.com

(Source: Maxus/GroupM data tracking, Agency PR tracking report, Sina Weibo analytics, Jiepang.com, IPSOS ASI Brand

Awareness Report, The North Face China Sales Report 2010, 2011)

Improve perception of The North Face as the most 'authentic' outdoor brand in China

Interestingly, The North Face's awareness to intention-to-purchase conversion rate was significantly higher than its rivals in

2011, suggesting that those with any interest in the category now see TNF as the 'real deal'.

(Source: IPSOS ASI Brand Awareness Report, The North Face China Sales Report 2010, 2011)

Lessons learned

The Chinese dream is changing

The surge of materialism and fierce ambition triggered by Deng Xiaoping's reforms in 1978 has been remarkable for its

endurance. But now it is changing, slowly and irresistibly. While 'face' will always be an important concept in China, now

Downloaded from warc.com

success is not being measured by the accumulation of 'things'. The middle-class Chinese are on the cusp of post-materialism.

Outdoor brands have to lead by example

In a culture where outdoor exploration has a short history, outdoor brands still have to show people how. Everything about the

brand has to embody the outdoor lifestyle. These brands should have the courage to take up the challenge of building a

culture, rather than satisfying themselves with flogging kit.

Acknowledgement

Brands should create social environments that incentivise exploration, by rewarding explorers with peer approval. The key to

the success of this campaign was the use of achievement badges that could be unlocked at checkpoints and shared with

friends. Although the western exploration ideal has a romantic strain of isolation and self-reliance, the Chinese don't see

connectivity as contrary to the experience of the outdoors.

The elite explorer team arrive in Mohe, China's 'True North'

Footnotes

1. The Search for Modern China, Jonathan D. Spence, W.W. Norton & Co., 1991.

2. Dr Michael Griffiths, Discovery, Shanghai

3. Chinese Consumers: The Romantic Reappraisal, Michael B. Griffiths, M. Chapman, F. Christiansen, Ethnography 11 (3)

4. The Geography of Thought: How Asians and Westerners Think Differently, Richard E. Nisbett, Simon & Schuster, 2003

Copyright Warc 2012

Downloaded from warc.com

Warc Ltd.

85 Newman Street, London, United Kingdom, W1T 3EX

Tel: +44 (0)20 7467 8100, Fax: +(0)20 7467 8101

www.warc.com

All rights reserved including database rights. This electronic file is for the personal use of authorised users based at the subscribing company's office location. It may not be reproduced, posted on intranets, extranets

or the internet, e-mailed, archived or shared electronically either within the purchasers organisation or externally without express written permission from Warc.

Downloaded from warc.com

10

You might also like

- Ebook Strategic Management Competitiveness and Globalization Concepts and Cases 14E PDF Full Chapter PDFDocument67 pagesEbook Strategic Management Competitiveness and Globalization Concepts and Cases 14E PDF Full Chapter PDFsamuel.chapman41697% (38)

- A Study On Diffusion of Digital Camera InnovationsDocument19 pagesA Study On Diffusion of Digital Camera InnovationsShambhavi AryaNo ratings yet

- Newlife WheelysDocument35 pagesNewlife WheelysAnuragNo ratings yet

- Think Small - Volkswagen's Ad CampaignDocument1 pageThink Small - Volkswagen's Ad CampaignKate VoitsNo ratings yet

- Nelson v. AppleDocument25 pagesNelson v. AppleMikey Campbell100% (1)

- Shanghai Tang Marketing AnalysisDocument12 pagesShanghai Tang Marketing AnalysisJeremy Koh100% (1)

- Asset Management DocumentationDocument98 pagesAsset Management DocumentationPascal LussacNo ratings yet

- Ewm Production IntegrationDocument78 pagesEwm Production IntegrationDipak BanerjeeNo ratings yet

- Jordan Belfort and Steve Jobs Literacy PaperDocument4 pagesJordan Belfort and Steve Jobs Literacy Paperapi-272958820No ratings yet

- Cannes Lions 2012 Winning Campaigns Mobile enDocument60 pagesCannes Lions 2012 Winning Campaigns Mobile enotávio_leite_5No ratings yet

- Apple Brand AuditDocument6 pagesApple Brand AuditSrinivas SrinuNo ratings yet

- Media Plan - Johnson's Baby PowderDocument33 pagesMedia Plan - Johnson's Baby PowderyechueNo ratings yet

- Global Forces and The European Brewing IndustryDocument9 pagesGlobal Forces and The European Brewing IndustryMurtaza ShaikhNo ratings yet

- Ogilvy FinalDocument38 pagesOgilvy FinalAnisha Jaisinghani100% (1)

- Innosight Overview Brochure PDFDocument15 pagesInnosight Overview Brochure PDFAneesh KallumgalNo ratings yet

- Session 2 - Fyre FestivalDocument5 pagesSession 2 - Fyre FestivalNadege SalagackiNo ratings yet

- Burts Bees Wax Case AnalysisDocument7 pagesBurts Bees Wax Case AnalysisArpit Pandey100% (1)

- Calvin Klien CaseDocument4 pagesCalvin Klien CaseTanvi RajdeNo ratings yet

- Cannes Lions 2010 Promo PR Direct enDocument176 pagesCannes Lions 2010 Promo PR Direct enotávio_leite_5No ratings yet

- Cannes Lions 2012 Winning Campaigns PR enDocument66 pagesCannes Lions 2012 Winning Campaigns PR enotávio_leite_5No ratings yet

- Cannes Lions 2012 Winning Campaigns Titanium Integrated enDocument26 pagesCannes Lions 2012 Winning Campaigns Titanium Integrated enotávio_leite_5No ratings yet

- Viral Marketing by Muhammad Iqrash AwanDocument10 pagesViral Marketing by Muhammad Iqrash AwanMuhammad Iqrash AwanNo ratings yet

- Clio Awards 2013 1 enDocument364 pagesClio Awards 2013 1 enGerardo OGNo ratings yet

- Sony Corporation Market ManagementDocument39 pagesSony Corporation Market Managementvampire79100% (1)

- Case 02Document7 pagesCase 02emrekiratliNo ratings yet

- Cannes Lions 2011 Winners For Press enDocument268 pagesCannes Lions 2011 Winners For Press enotávio_leite_5No ratings yet

- Cannes Lions 2013 enDocument1,540 pagesCannes Lions 2013 enotávio_leite_5No ratings yet

- The Fyre Festival - Mona Liza OliscoDocument3 pagesThe Fyre Festival - Mona Liza OliscoMona Liza OliscoNo ratings yet

- Jewish Standard Media Kit 2016Document6 pagesJewish Standard Media Kit 2016New Jersey Jewish StandardNo ratings yet

- Cannes Lions 2011 Winners For Media enDocument112 pagesCannes Lions 2011 Winners For Media enotávio_leite_5No ratings yet

- Red Bull NikeDocument10 pagesRed Bull NikeUdevir SinghNo ratings yet

- NewsCred Millennial MindDocument45 pagesNewsCred Millennial MindA3documentosNo ratings yet

- 10 Mega Trends That Are Reshaping The WorldDocument101 pages10 Mega Trends That Are Reshaping The WorldanaNo ratings yet

- Cannes Lions 2012 Winning Campaigns Branded Content enDocument52 pagesCannes Lions 2012 Winning Campaigns Branded Content enotávio_leite_5No ratings yet

- Acknowledgement: Name: Viraj S Wadkar DateDocument67 pagesAcknowledgement: Name: Viraj S Wadkar DateViraj WadkarNo ratings yet

- Cannes Lions 2011 Winners For Titanium enDocument26 pagesCannes Lions 2011 Winners For Titanium enotávio_leite_5No ratings yet

- LOreal Brandstorm 2014 - Case Study PDFDocument10 pagesLOreal Brandstorm 2014 - Case Study PDFAlina MadalinaNo ratings yet

- Case Study On VodafoneDocument4 pagesCase Study On VodafonekalaswamiNo ratings yet

- UMD Annual Report SpreadsDocument21 pagesUMD Annual Report SpreadsNickDeMicheleNo ratings yet

- Asia Injury Prevention Foundation - Winning Vietnam's Helmet WarDocument12 pagesAsia Injury Prevention Foundation - Winning Vietnam's Helmet WarVuong LuuNo ratings yet

- Cannes Lions 2014 Branded Content Entertainment enDocument63 pagesCannes Lions 2014 Branded Content Entertainment engogsieteNo ratings yet

- Telecom Branding WhitepaperDocument20 pagesTelecom Branding Whitepaperfkhater100% (11)

- Publicis Groupe SDocument4 pagesPublicis Groupe SRage ArceoNo ratings yet

- Cannes Lions 2019 - PR Lions ShortlistDocument1 pageCannes Lions 2019 - PR Lions Shortlistadobo magazineNo ratings yet

- The New Consumers: The Influence Of Affluence On The EnvironmentFrom EverandThe New Consumers: The Influence Of Affluence On The EnvironmentNo ratings yet

- Casestudyonapple 171008173042Document10 pagesCasestudyonapple 171008173042Nischal Singh AttriNo ratings yet

- Why Is This Brief Here?Document3 pagesWhy Is This Brief Here?RISHIRAJ SENGUPTANo ratings yet

- Mindrock Silicon Valley Guide En21Document47 pagesMindrock Silicon Valley Guide En21KevinNo ratings yet

- Sony Brand AuditDocument1 pageSony Brand AuditManan BatraNo ratings yet

- Cannes Lions 2012 Winning Campaigns Promo enDocument84 pagesCannes Lions 2012 Winning Campaigns Promo enotávio_leite_5No ratings yet

- Ibo-03 2020-21Document22 pagesIbo-03 2020-21arun1974No ratings yet

- A Study of Marketing Strategy of Television Industry in LucknowDocument82 pagesA Study of Marketing Strategy of Television Industry in LucknowManjeet SinghNo ratings yet

- Consumer Behivour Towards SnickerDocument26 pagesConsumer Behivour Towards Snickerakshay hemrajaniNo ratings yet

- Kidzania Shaping A Strategic Service Vision For The FutureDocument34 pagesKidzania Shaping A Strategic Service Vision For The FutureAdrian NewNo ratings yet

- Cannes Lions Winning CampaignsDocument4 pagesCannes Lions Winning CampaignskoshaNo ratings yet

- Doing Business in ThailandDocument51 pagesDoing Business in ThailandNha KyNo ratings yet

- Tourism Industry Profile IndiaDocument23 pagesTourism Industry Profile IndiaPrince Satish Reddy50% (2)

- Brand Positioning of PVR - DS57 M257Document83 pagesBrand Positioning of PVR - DS57 M257Sujay Vikram Singh100% (1)

- A Case Study Branding A LifestyleDocument8 pagesA Case Study Branding A LifestyleAzhar KhanNo ratings yet

- Inside Steve's Brain (Review and Analysis of Kahney's Book)From EverandInside Steve's Brain (Review and Analysis of Kahney's Book)No ratings yet

- HKMagazine 07042014Document48 pagesHKMagazine 07042014apparition9No ratings yet

- Simon An Holt Nation BrandingDocument4 pagesSimon An Holt Nation BrandingGaus SamdaniNo ratings yet

- Brand The Beloved CountryDocument34 pagesBrand The Beloved CountryKyle RathNo ratings yet

- AnimejsDocument27 pagesAnimejsJesus RodriguezNo ratings yet

- Advance Data StructuresDocument184 pagesAdvance Data StructureskamsiNo ratings yet

- Direct and Oblique Translation: Module 3: Central Issues in TranslationDocument1 pageDirect and Oblique Translation: Module 3: Central Issues in TranslationSilvia ZamurcaNo ratings yet

- RESMETH Instructors ManualDocument32 pagesRESMETH Instructors ManualportucasbasNo ratings yet

- Einstein - Remarks On Bertrand RussellDocument15 pagesEinstein - Remarks On Bertrand RussellGabriel Rogé Such100% (1)

- Presented By-Anshul Kumbhare Siddhant Mhatre: Boiler AccessoriesDocument10 pagesPresented By-Anshul Kumbhare Siddhant Mhatre: Boiler AccessoriesHarshvardhan Singh ChauhanNo ratings yet

- Purchasing & Supply Management: Issues To Be AddressedDocument11 pagesPurchasing & Supply Management: Issues To Be AddressedprashantsrathorNo ratings yet

- Daniel Wahba - Optional Logarithmic AssigmentDocument6 pagesDaniel Wahba - Optional Logarithmic Assigmentdanielwahba2006No ratings yet

- Learning Module 1 Computer 7 Quarter 1Document8 pagesLearning Module 1 Computer 7 Quarter 1Rowmil Mariano PerueloNo ratings yet

- M8 McKissick SheavesDocument18 pagesM8 McKissick Sheavesmahmoud heikal100% (1)

- Feature: SFP Optical Module 1 .25G Double Optical Fiber 20kmDocument2 pagesFeature: SFP Optical Module 1 .25G Double Optical Fiber 20kmDaniel Eduardo RodriguezNo ratings yet

- SW-TS40T Series Sub-Miniature Toggle Switches: Straight Type - Part Numbering GuideDocument4 pagesSW-TS40T Series Sub-Miniature Toggle Switches: Straight Type - Part Numbering GuideVALTERNo ratings yet

- Bar Bending Schedule (Service BLDG)Document20 pagesBar Bending Schedule (Service BLDG)Rania SaiedNo ratings yet

- Bestcom-Considerate ComputingDocument8 pagesBestcom-Considerate ComputingĐức Nguyễn TuấnNo ratings yet

- Centripetal Force Grade 12 PhysicsDocument15 pagesCentripetal Force Grade 12 Physicssrinidhi innaniNo ratings yet

- Crown WAV60 Operator Manual - CompressedDocument39 pagesCrown WAV60 Operator Manual - CompressedHector PeñaNo ratings yet

- Valkokari TIMReview August2015Document8 pagesValkokari TIMReview August2015Héctor BallesterosNo ratings yet

- Feeling Comfortable With Logic Analyzers PDFDocument24 pagesFeeling Comfortable With Logic Analyzers PDFJ dosherNo ratings yet

- Java Atm PtojectDocument10 pagesJava Atm PtojectKrinal kathiriyaNo ratings yet

- 109is 37150 - 50310Document2 pages109is 37150 - 50310dip461No ratings yet

- SQL JoinsDocument59 pagesSQL Joinssunny11088No ratings yet

- A Study On Problem and Prospects of Women Entrepreneur in Coimbatore and Tirupur QuestionnaireDocument6 pagesA Study On Problem and Prospects of Women Entrepreneur in Coimbatore and Tirupur QuestionnaireAsheek ShahNo ratings yet

- Mina Meid Bypass Panel For Reseller - GSM-ForumDocument2 pagesMina Meid Bypass Panel For Reseller - GSM-ForumYohan RodriguezNo ratings yet

- Microprocessor Book PDFDocument4 pagesMicroprocessor Book PDFJagan Eashwar0% (4)

- Victron With Pylon Configuration SettingsDocument3 pagesVictron With Pylon Configuration Settingswarick mNo ratings yet

- A New Framework For Developping and Evaluating Complex InterventionsDocument11 pagesA New Framework For Developping and Evaluating Complex InterventionsyomellamocumbiaNo ratings yet

- Foreword Edgar Morin Path of Complexity - Alfonso MontuoriDocument32 pagesForeword Edgar Morin Path of Complexity - Alfonso MontuoriFrancisco LionNo ratings yet