Professional Documents

Culture Documents

HHHHH

HHHHH

Uploaded by

nikhils88Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HHHHH

HHHHH

Uploaded by

nikhils88Copyright:

Available Formats

SUMMER TRAINING REPORT SUBMITTED TOWARDS

THE PARTIAL FULFILLMENT OF POST GRADUATE

DEGREE IN INTERNATIONAL BUSINESS

CREDIT APPRAISAL AND

RISK RATING IN PUNJAB

NATIONAL BANK

SUBMITTED BY:

KRITIKA ARORA

MBA-IB (2009-20011)

Roll No. : A1802009075

INDUSTRY GUIDE

GUIDE

Mr. ARUN KUMAR NIJHAWAN

MITTAL

FACULTY

Mr.AJIT

SENIOR MANAGER

SENIOR FACULTY

AMITY INTERNATIONAL BUSINESS SCHOOL,

NOIDA

Credit Appraisal and Risk Rating at PNB

AMITY UNIVERSITY UTTAR PRADESH

CREDIT SECTION, CIRCLE OFFICE: DELHI, 4th FLOOR, RAJENDRA BHAWAN, RAJENDRA PLACE, NEW DELHI

TELE; 25744450 Fax: 25731252

------------------------------------------------------------------------------------------------------------------------------------------------------------

TO WHOM IT MAY CONCERN

This is to certify that KRITIKA ARORA, a student of Amity International

Business School, Noida, undertook a project on CREDIT APPRAISAL

AND RISK MANAGEMENT at PUNJAB NATIONAL BANK from 1st

May to 30th June.

Ms.KRITIKA ARORA has successfully completed the project under the

guidance of Mr.ARUN KUMAR NIJHAWAN. She is a sincere and hardworking student with pleasant manners.

We wish all success in her future endeavors.

Mr. ARUN KUMAR NIJHAWAN

Senior Manager

Circle Office Delhi

Amity International Business School,Noida

Credit Appraisal and Risk Rating at PNB

Punjab National Bank

CERTIFICATE OF ORIGIN

This is to certify that Ms. KRITIKA ARORA, a student of Post Graduate Degree in MBA in

INTERNATIONAL BUSINESS, Amity International Business School, Noida has worked in the

Credit Department of Punjab National Bank, Circle Office Delhi and has submitted this

project report entitled Credit Appraisal and Risk Rating at PUNJAB NATIONAL BANK,

under the able guidance and supervision of Mr. ARUN KUMAR NIJHAWAN, SENIOR

MANAGER, PUNJAB NATIONAL BANK. The period for which she was on training was for 8

weeks, starting from 1st MAY to 30th June.

This Summer Internship report has the requisite standard for the partial fulfillment the Post

Graduate Degree in International Business. To the best of our knowledge no part of this report has

been reproduced from any other report and the contents are based on original research.

Dr. Ajit Mittal

Professor

AIBS

Kritika Arora

Student

MBA in International Business

Amity International Business School

Amity International Business School,Noida

Credit Appraisal and Risk Rating at PNB

ACKNOWLEDGEMENT

Every work involves efforts and inputs of various kinds and people. I am thankful to all those

people who have been helpful enough to me to the extent of their being instrumental in the

completion and accomplishment of the project entitled Credit Appraisal and Risk Rating at

Punjab National Bank.

I sincerely acknowledge with deep sense of gratitude to my project guide Mr. A K Nijhawan

Senior Manager, Credit, PNB Circle Office, for enhancing my understanding of the subject and

enabling me to appreciate finer nuances of the subject.

I would also like to express my deepest gratitude to Mr. Rohit Grover (Chief Manager, Credit),

Ms. Trilochan Kaur Anand (Manager, Credit), Mr. Sarkar (Senior Manager, Credit Risk

Management Department) and the entire Credit Department for their help and guidance, without

which the completion of this project would have been extremely difficult.

Lastly, I would like to thank Mr. Nehal Ahad (Chief Manager, HR) as he found me credible

enough to work for PNB and selected me for challenging project.

Amity International Business School,Noida

Credit Appraisal and Risk Rating at PNB

Kritika Arora

A1802009075

MBA in International Business

Amity International Business School

Amity International Business School,Noida

Credit Appraisal and Risk Rating at PNB

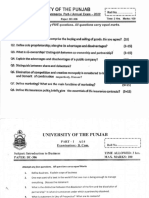

CHAPTER PLAN

Table of Content

PART - 1

CHAPTER 1

EXECUTIVE SUMMARY..

CHAPTER 2

INTRODUCTION TO CREDIT APPRAISAL

10

CHAPTER 3

OBJECTIVES...

12

CHAPTER 4

RESEARCH METHODOLOGY.

13

CHAPTER 5

INDUSTRY PROFILE.

14

CHAPTER 6

COMPANY PROFILE.

17

CHAPTER 7

REVIEW OF LITERATURE.

19

CHAPTER 8

CHAPTER 9

7.1

Working Capital Assessment.

7.2

Assessment of Term Loans 30

7.3

Basel Accord & Risk Management.. 31

CREDIT APPRAISAL

19

33

8.1

Introduction. 33

8.2

Market Analysis

34

8.3

Technical Analysis.

36

8.4

Financial Analysis.. 38

8.5

Management & Organizational Analysis 45

8.6

Credit Appraisal Checklist 46

CREDIT RISK MANAGEMENT

49

9.1

Credit Risk... 49

9.2

Credit Risk Management System in PNB... 49

CHAPTER 10

POST SANCTION FOLLOW UP OF LOANS.. 55

CHAPTER 11

ANALYSIS & INTERPRETATION..

Amity International Business School,Noida

57

Credit Appraisal and Risk Rating at PNB

11.1

PNBs Loan Policy. 57

.....

11.1.2

Basic Tenets of the Policy...

11.1.3

Methods of Lending.

Credit Appraisal Process at PNB

11.2.1

Flowchart...

11.2.2

Brief on the Process.

11.2.3

Risk Rating of the Borrower.

11.2.4

Determination of the Applicable Rate of Interest .

11.2.5

Post Sanction Follow Up

11.1.1

11.2

CHAPTER 12

Objective

CASE STUDY- ABC PARTS PVT LTD

12.1

12.2

....

Credit Appraisal of ABC PARTS Pvt. Ltd...

Borrowers Profile

I.

Management

Evaluation

II.

Business

Evaluation

III.

Technical

Evaluation

...

IV.

Legal

Evaluation

V.

CHAPTER 13

57

58

60

60

60

62

65

66

68

68

71

71

73

75

77

...

78

Financial

Evaluation

...

12.3

Present Proposal.

12.4

Security

12.5

Credit Risk Rating..

12.6

Recommendations..

CONCLUSION & RECOMMENDATIONS...

Conclusion..

Findings.

Recommendations......

Amity International Business School,Noida

57

84

89

90

94

95

95

97

98

Credit Appraisal and Risk Rating at PNB

Limitations... 99

REFERENCES......... 100

PART 2

CHAPTER 14

CUSTOMER SATISFACTION.

102

14.1 Customer Satisfaction....

102

14.2 Statement of the Problem....................

103

14.3

14.4

CHAPTER 15

Need for the Study.

103

Scope of the Study..

104

14.5

Objective of the Study

104

14.6

Sample Method...

105

14.7

Method of Data Collection..

106

ANALYSIS & INTERPRETATION.

107

15.1

Share of Different Types of Accounts.

107

15.2

Ratios of the Services Offered by PNB

109

15.3

Reason for Selecting PNB

111

15.4

Consumers Willingness To Recommend PNB To Others....

15.5 Satisfaction of Respondents With Services Offered by PNB

113

115

Branch

CHAPTER 16

CHAPTER 17

BANKING OPERATIONS IN BRANCH OFFICES .

117

16.1 Opening of Saving Account by Individual

117

16.2

Cash Deposit

127

16.3

Cash Payment..

131

16.4 ATM Management & Maintenance Operation

133

16.5 Customer Facilities & Conveniences

136

CONCLUSION & RECOMMENDATION

137

17.1 Suggestion & Recommendation..

137

17.2 Limitation of the Study....

139

Amity International Business School,Noida

Credit Appraisal and Risk Rating at PNB

17.3

Chapter

Conclusion..

140

EXECUTIVE SUMMARY

This project was undertaken at the Punjab National Bank Circle Office Delhi, at the Credit

Department. Financial requirements for Project Finance and Working Capital purposes are taken

care of at the Credit Department. Companies that intend to seek credit facilities approach the

bank. Primarily, credit is required for following purposes:

a.

Working capital finance

b. Term loan for mega projects

c.

Non Fund Based Limits like Letter of Guarantee, Letter of Credit etc.

Project Financing discipline includes understanding the rationale for project financing, how to

prepare the financial plan, assess the risks, design the financing mix, and raise the funds. In

addition, one must understand some project financing plans have succeeded while others have

failed. A knowledge-base is required regarding the design of contractual arrangements to support

project financing; issues for the host government legislative provisions, public/private

infrastructure partnerships, public/private financing structures; credit requirements of lenders, and

how to determine the project's borrowing capacity; how to analyze cash flow projections and use

them to measure expected rates of return; tax and accounting considerations; and analytical

techniques to validate the project's feasibility

Project finance is different from traditional forms of finance because the credit risk associated

with the borrower is not as important as in an ordinary loan transaction; what is most important is

the identification, analysis, allocation and management of every risk associated with the project.

The purpose of this project is to explain, in a brief and general way, the manner in which risks are

approached by financiers in a project finance transaction. Such risk minimization lies at the heart

of project finance. Efficient management of credit portfolio is of utmost importance as it has a

tremendous impact on the Banks assets quality & profitability. The ongoing financial reforms

Amity International Business School,Noida

Credit Appraisal and Risk Rating at PNB

have no doubt provided unparallel opportunities to banks for growth, but have simultaneously

exposed them to various risks, which need to be effectively managed.

The concept of Credit Management is undergoing radical changes. Credit Risk in all exposures

calls for precise measuring and monitoring for taking considered credit decisions with suitable

risk mitigants, risk premium, etc. Credit portfolio should be well diversified in various promising

sectors with a cautious approach to be adopted in risky segments.

Also, lending continues to be a primary function in banking. In the liberalized Indian economy,

clientele have a wide choice. External Commercial Borrowings and the domestic capital markets

compete with banks. In another dimension, retail lending- both personal advances and SME

advances- competes with corporate lending for funds and for human resources. But lending by

nature cannot be an aggressive selling activity, disregarding the risks involved. Bank has to be

competitive without compromising on the basic integrity of lending. The quality of the Banks

credit portfolio has a direct and deep impact on the Banks profitability.

The study has been conducted with the purpose of getting in-depth knowledge about the credit

appraisal and credit risk management procedure in the organization for the above said first two

purposes.

Amity International Business School,Noida

10

Credit Appraisal and Risk Rating at PNB

Chapter

CREDIT APPRAISAL AN INTRODUCTION

Project / Credit appraisal is a skill which has to be acquired by study and supplemented by

practice. Intuitive guess work has little place in appraising the credit rating or credit needs of a

corporate unit. The credit managers of banks and Non Banking Finance Companies (NBFCs) are

duty bound to accept or reject a proposal on the basis of its viability or non - viability.

Project / Credit appraisal is done by banks or financial institutions by obtaining credit information

of the borrowing company.

Credit information of the borrowing company can be obtained by the following sources:

1. Banks and Financial Institution

2. Bank References

3. Trade References

4. Credit Rating Agencies

5. Published Books: Basic information about a company may be taken from printed sources

like the Stock Exchange Year book, Corporate Path finders data base, etc.

6. Company Financial Reports

7. Press Reports

8. Stock Market Opinion

9. Charges Registered: Charges created on the assets of a company have to be registered

with the Registrar of Companies.

10. Personal discussion

11. Factory Visit

Amity International Business School,Noida

11

Credit Appraisal and Risk Rating at PNB

12. Study of Financial Statements: Financial analysis determines the significant operating

and financial characteristics of a firm form accounting data and financial statements.

Analysis can be done through:

a. Ratio Analysis

b. Trend analysis: Trend analysis can be through:

i. Intra firm comparison that is review of the trend of the ratios over the years

within the firm and

ii. Inter firm comparison.

c. Reading of notes to accounts and other information: Careful reading and

analysis of the notes on accounts, one can gauge the policies of the management,

performance of the company, and its future planning.

Information required to be submitted by the Company (Borrower) to the Bank

The company should make sure that the following information required for processing credit

requests are collected by the company for submitting it to the bank or financial institution in order

to obtain the required credit facility:

1. Basic background information on the company:

2. Required facility

3. Key industry dynamics:

4. Management:

5. Management information system: Details of the planning, controlling and monitoring

systems which have been put in place have to given.

6. Financials

7. Details of the Security to be pledged:

8. Present banking relationship: The bank requires full details of the present credit facilities

being enjoyed at the moment.

Amity International Business School,Noida

12

Credit Appraisal and Risk Rating at PNB

Chapter

OBJECTIVES

To study broad contours of management of credit, the loan policy, credit appraisal for

business units i.e. for working capital loan or Term Loan

To understand the basis of credit risk rating and its significance

To utilize the above learning and appraise the creditworthiness organizations those

approach PUNJAB NATIONAL BANK for credit. This would entail undertaking of the

following procedures:

i.

Management Evaluation

ii.

Business / Industry Evaluation

iii.

Technical Evaluation

iv.

Legal Evaluation

v.

Financial Evaluation

vi.

Credit Risk Rating

Amity International Business School,Noida

13

Credit Appraisal and Risk Rating at PNB

Chapter

RESEARCH METHODOLOGY

The methodology being used involves two basic sources of information primary sources and

secondary source.

Primary sources of Information

Meetings and discussion with the Chief Manager and the Senior Manager of both Credit

and Credit Risk Management Department

Meetings with the clients

Secondary sources of Information

Loan Policy and Internal Circulars of the bank

Research papers, power point presentations and PDF files prepared by the bank and its

related officials

Referring to information provided by CIBIL, Income Tax files, Registrar of Companies

(Ministry of Corporate Affairs), and Auditor reports

Amity International Business School,Noida

14

Credit Appraisal and Risk Rating at PNB

Chapter

5INDUSTRY PROFILE

THE INDIAN BANKING INDUSTRY

The last decade has seen many positive developments in the Indian banking sector. The growth in

the Indian Banking Industry has been more qualitative than quantitative and it is expected to

remain the same in the coming years. Based on the projections made in the "India Vision 2020"

prepared by the Planning Commission, the report forecasts that the pace of expansion in the

balance-sheets of banks is likely to decelerate. The total assets of all scheduled commercial banks

by end-March 2010 is estimated at Rs 40,90,000 crores. That will comprise about 65 per cent of

GDP at current market prices as compared to 67 per cent in 2002-03. Bank assets are expected to

grow at an annual composite rate of 13.4 per cent during the rest of the decade as against the

growth rate of 16.7 per cent that existed between 1994-95 and 2002-03. It is expected that there

will be large additions to the capital base and reserves on the liability side.

The Indian Banking Industry can be categorized into non-scheduled banks and scheduled banks.

Scheduled banks constitute of commercial banks and co-operative banks. There are about 67,000

branches of Scheduled banks spread across India. As far as the present scenario is concerned the

Banking Industry in India is going through a transitional phase.

The Public Sector Banks (PSBs), which are the base of the Banking sector in India account for

more than 78 per cent of the total banking industry assets. Unfortunately they are burdened with

excessive Non Performing assets (NPAs), massive manpower and lack of modern technology. On

the other hand the Private Sector Banks are making tremendous progress. They are leaders in

Internet banking, mobile banking, phone banking, ATMs. As far as foreign banks are concerned

they are likely to succeed in the Indian Banking Industry.

Currently, banking in India is generally fairly mature in terms of supply, product range and reacheven though reaching rural India still remains a challenge for the private sector and foreign banks.

In terms of quality of assets and capital adequacy, Indian banks are considered to have clean,

Amity International Business School,Noida

15

Credit Appraisal and Risk Rating at PNB

strong and transparent balance sheets relative to other banks in comparable economies in its

region. The Reserve Bank of India is an autonomous body, with minimal pressure from the

government. The stated policy of the Bank on the Indian Rupee is to manage volatility but without

any fixed exchange rate-and this has mostly been true. With the growth in the Indian economy

expected to be strong for quite some time-especially in its services sector-the demand for banking

services, especially retail banking, mortgages and investment services are expected to be strong.

One may also expect M&As, takeovers, and asset sales.

In March 2006, the Reserve Bank of India allowed Warburg Pincus to increase its stake in Kotak

Mahindra Bank (a private sector bank) to 10%. This is the first time an investor has been allowed

to hold more than 5% in a private sector bank since the RBI announced norms in 2005 that any

stake exceeding 5% in the private sector banks would need to be vetted by them.

Currently, India has 88 scheduled commercial banks (SCBs) - 28 public sector banks (that is with

the Government of India holding a stake), 29 private banks (these do not have government stake;

they may be publicly listed and traded on stock exchanges) and 31 foreign banks. They have a

combined network of over 53,000 branches and 17,000 ATMs. According to a report by ICRA

Limited, a rating agency, the public sector banks hold over 75 percent of total assets of the

banking industry, with the private and foreign banks holding 18.2% and 6.5% respectively.

The policy makers, which comprise the Reserve Bank of India (RBI), Ministry of Finance and

related government and financial sector regulatory entities, have made several notable efforts to

improve regulation in the sector. The sector now compares favorably with banking sectors in the

region on metrics like growth, profitability and non-performing assets (NPAs). Indian banks have

compared favorably on growth, asset quality and profitability with other regional banks over the

last few years. The banking index has grown at a compounded annual rate of over 51 per cent

since April 2001 as compared to a 27 per cent growth in the market index for the same period.

The interplay between policy and regulatory interventions and management strategies will

determine the performance of Indian banking over the next few years. Management success will

be determined on three fronts:

Amity International Business School,Noida

16

Credit Appraisal and Risk Rating at PNB

i.

Fundamentally upgrading organizational capability to stay in tune with the changing

market

ii.

Adopting value-creating M&A as an avenue for growth

iii.

Continually innovating to develop new business models to access untapped

opportunities

Opportunities and Challenges for the Players

The bar for what it means to be a successful player in the sector has been raised. Four challenges

must be addressed before success can be achieved.

i.

The market is seeing discontinuous growth driven by new products and services that

include opportunities in credit cards, consumer finance and wealth management on the

retail side, and in fee-based income and investment banking on the wholesale banking

side. These require new skills in sales & marketing, credit and operations

ii.

Banks will no longer enjoy windfall treasury gains that the decade-long secular

decline in interest rates provided

iii.

With increased interest in India, competition from foreign banks will only intensify

iv.

Given the demographic shifts resulting from changes in age profile and household

income, consumers will increasingly demand enhanced institutional capabilities and

service levels from banks

Amity International Business School,Noida

17

Credit Appraisal and Risk Rating at PNB

Chapter

COMPANY PROFILE

Punjab National Bank (PNB) was set up in 1895 in Lahore - and has the distinction of being the

first Indian bank to have been started solely with Indian capital. The bank was nationalized in July

1969 along with 13 other banks. Today, PNB is a professionally managed bank with a successful

track record of over 110 years. The bank has the 2nd largest branch network in India, with 4525

branches including 432 extension counters spread throughout the country. PNB was ranked as

248th biggest bank in the world by Bankers Almanac, London. Punjab National Bank is not only

the first bank to specialize in credit rating models in India but also the first one to launch image

based cheque transaction system for collection of intra bank intercity cheques thereby providing

credits merely in 48 hrs in 13 cities.

To be a Leading Global Bank with Pan India footprints and become

CORPORATE VISION

a household brand in the Indo-Gangetic Plains providing entire

range of financial products and services under one roof

MISSION

Banking for the unbanked

With over 56 million satisfied customers and 5002 offices, PNB has continued to retain its

leadership position amongst the nationalized banks. From its modest beginning; the bank has

grown in size and stature to become a front-line banking institution in India at present. Based on

its sound and prudent banking experience and consistent profit performance, PNB looks

confidently to the futurethe name you can bank upon

Amity International Business School,Noida

18

Credit Appraisal and Risk Rating at PNB

PNB has achieved significant growth in business which at the end of March 2010 amounted to Rs

4,35,931 crore. Today, with assets of more than Rs 2,96,633 crore, PNB is ranked as the 3rd

largest bank in the country (after SBI and ICICI Bank) and has the 2nd largest network of

branches (5002 offices including 5 overseas branches ). During the FY 2009-10, with 40.85%

share of CASA deposits, the bank achieved a net profit of Rs 3905 crore. Bank has a strong capital

base with capital adequacy ratio of 14.16% as on Mar10 as per Basel II with Tier I and Tier II

capital ratio at 9.15% and 5.01% respectively. As on March10, the Bank has the Gross and Net

NPA ratio of 1.71% and 0.53% respectively. During the FY 2009-10, its ratio of Priority Sector

Credit to Adjusted Net Bank Credit at 40.5% & Agriculture Credit to Adjusted Net Bank Credit at

19.7% was also higher than the stipulated requirement of 40% & 18%.

The performance highlights of the bank in terms of business and profit are shown below:

Parameters

Operating Profit

Net Profit

Mar'08

4006

2049

Mar'09

5744

3091

Mar'10

7326

3905

CAGR(%)

22.29

23.98

Deposit

166457

209760

249330

14.42

Advance

119502

154703

186601

16.01

Total Business

285959

364463

435931

15.09

(Rs in Crore)

ORGANIZATIONAL STRUCTURE

HEAD OFFICE

CIRCLE OFFICE

BRANCH OFFICE

Amity International Business School,Noida

19

Credit Appraisal and Risk Rating at PNB

Chapter

REVIEW OF LITERATURE

7.1 WORKING CAPITAL AND ITS ASSESSMENT

The objective of running any industry is earning profits. An industry will require funds to acquire

fixed assets like land and building, plant and machinery, equipments, vehicles etc and also to

run the business i.e. its day to day operations.

Working capital is defined, as the funds required for carrying the required levels of current assets

to enable the unit to carry on its operations at the expected levels uninterruptedly. Thus working

capital required (WCR) is dependent on

i.

The volume of activity (viz. level of operations i.e. Production and Sales)

ii.

The activity carried on viz. manufacturing process, product, production programme, and

the materials and marketing mix.

The purpose of assessing the WC requirement of the industry is to determine how the total

requirements of funds will be met. The two sources for meeting these requirements are the units

long-term sources (like capital and long term borrowings) and the short-term borrowings from

banks. The long-term resources available to the unit are called the liquid surplus or Net Working

Capital (NWC).

It can be explained by visualizing the process of setting up of industry. The units starts with a

certain amount of capital, which will not normally be sufficient, even to meet the cost of fixed

assets. The unit, therefore, arranges for a long-term loan from a financial institution or a bank

towards a part of the cost of fixed assets. From these two sources after meeting the cost of fixed

assets some funds remain to be used for working capital. This amount is the Net Working Capital

or Liquid Surplus and will be one of the sources of meeting the working capital requirements.

The remaining funds for working capital have to be raised from banks; banks normally provide

working capital finance by way of advantage against stocks and sundry debtors. Banks, however,

do not finance the full amount of funds required for carrying inventories and receivables: and

Amity International Business School,Noida

20

Credit Appraisal and Risk Rating at PNB

normally insist on the stake of the enterprise at every stage, by way of margins. Bank finance is

normally restricted to the amount of funds locked up less a certain percentage of margins. Margins

are imposed with a view to have adequate stake of the promoter in the business both to ensure his

adequate interest in the business and to act as a protection against any shocks that the business

may sustain. The margins stipulated will depend on various factors like salability, quality,

durability, price fluctuations in the market for the commodity etc. taking into account the total

working capital requirements as assessed earlier, the permissible limit, up to which the bank

finance cab be granted is arrived.

While granting working capital advances to a unit, it will be necessary to ensure that a reasonable

proportion of the working capital is met from the long-term sources viz. liquid surplus. Normally,

liquid surplus or net working capital be at least 25% of the working capital requirement

(corresponding to the benchmark current ratio of 1.33), though this may vary depending on the

nature of industry/ trade and business conditions.

Various methods for assessment of Working Capital are discussed in detail:

1. Operating cycle method:

Any manufacturing activity is characterized by a cycle of operations consisting of purchase of

raw materials for cash, converting them into finished goods and realizing cash by sale of these

finished goods. The time that lapses between cash outlay and cash realization by sale of finished

goods and realization of sundry debtors is known as length of operating cycle. That is, the

operating cycle consists of:

i.

Time taken to acquire raw materials and average period for which they are in store.

ii.

Conversion process time

iii.

Average period for which finished goods are in store and

iv.

Average collection period of receivables (sundry debtors).

Amity International Business School,Noida

21

Credit Appraisal and Risk Rating at PNB

Operating Cycle is also called cash-to-cash and indicates how cash is converted into raw

materials, stocks in process, finished goods, bills (receivables) and finally backs to cash. Working

capital is the total cash that is circulating in this cycle. Therefore, working capital can be turned

over or deployed after completing the cycle. Factors, which influence working capital

requirement, are Level of operating expenses and Length of operating cycle.

Any reduction in either of the both will mean reduction in working capital requirement or indicate

an efficient working capital management.

It can thus be concluded that by improving that by improving the working capital turnover ratio

(i.e. by reducing the length of operating cycle) a better management (utilization) of working

capital results. It is obvious that any reduction in the length of the operating cycle can be achieved

only by better management only by better management of one or more of the individual phases of

the operating cycle period for which raw materials are in store, conversion process time, period

for which finished goods are in store and collection period of receivables. Looking at whole

problem from another angle, we find that we can set up extremely clear guidelines for working

capital management viz. examining the length of each of the phases of the operating cycle to

assess the scope for reduction in one or more of these phases.

The length of the operating cycle is different from industry to industry and from one firm to

another within the same industry. For instance, the operating cycle of a pharmaceutical unit would

be quite different from one engaged in the manufacture of machine tools. The operating cycle

concept enables to assess working capital need of each enterprise keeping in view the peculiarities

of the industry it is engaged in and its scale of operations. Operating cycle is an important

management tool in decision making.

FUND

RM

Amity International Business School,Noida

SIP

RECEIVABLES

FUND

22

Credit Appraisal and Risk Rating at PNB

2.

Traditional method of assessment of working capital requirement

The operating cycle concept serves to identify the areas requiring improvement for the purpose of

control and performance review. But, as bankers, we require a more detailed analysis to assess the

various components of working capital requirement viz., finance for stocks, bills etc.

Bankers provide working capital finance for holding an acceptable level of current assets viz. raw

materials, stock-in-process, finished goods and sundry debtors for achieving a predetermined level

of production and sales. Quantification of these funds required to be blocked in each of these

items of current assets at any time will, therefore provide a measure of the working capital

requirement of an industry.

Raw material: Any industrial unit has to necessarily stock a minimum quantum of materials used

in its production to ensure uninterrupted production. Factors, which affect or influence the funds

requirement for holding raw material, are:

i.

Average consumption of raw materials.

ii.

Their availability locally or form places outside, easy availability / scarcity,

number of sources of supply

iii.

Time taken to procure raw materials (procurement time or lead time)

iv.

Imported or indigenous.

v.

Minimum quantity supplied by the market (Minimum Order Quantity (MOQ)).

vi.

Cost of holding stocks (e.g. insurance, storage, interest)

vii.

Criticality of the item.

viii.

Transport and other charges (Economic Order Quantity (EOQ)).

ix.

Availability on credit or against advance payment in cash.

x.

Seasonality of the materials.

This raw material requirement is generally expressed as so many months requirement

(consumption).

Stock in process: Barring a few exceptional types of industries, when the raw material get

converted into finished products within few hours, there is normally a time lag or delay or period

Amity International Business School,Noida

23

Credit Appraisal and Risk Rating at PNB

of processing only after which the raw materials get converted into finished product. During this

period of processing, the raw materials get converted into finished goods and expenses are being

incurred. The period of processing may vary from a few hours to a number of months and unit

will be blocked working funds in the stock-in-process during this period. Such funds blocked in

SIP depend on:

i.The processing time

ii.Number of products handled at a time in the process

iii.Average quantities of each product, processed at each time (batch quantity)

iv.The process technology

v.Number of shifts.

Finished goods: All products manufactured by an industry are not sold immediately. It will be

necessary to stock certain amount of goods pending sale. This stock depends on:

i.

Whether the manufacture is against firm order or against anticipated order

ii.

Supply terms

iii.

Minimum quantity that can be dispatched

iv.

Transport availability and transport cost

v.

Pre-dispatch inspection

vi.

Seasonality of goods

vii.

Variation in demand

viii.

Peak level/ low level of operations

ix.

Marketing arrangement- e.g. direct sale to consumers or through dealers/

wholesalers.

The requirement of funds against finished goods is expressed so many months cost of production.

Sundry debtors (receivables): Sales may be affected under three different methods:

i.

Against advance payment

ii.

Against cash

iii.

On credit

Amity International Business School,Noida

24

Credit Appraisal and Risk Rating at PNB

A unit grants trade credit because it expects this investment to be profitable. It would be in the

form of sales expansion and fresh customers or it could be in the form of retention of existing

customers. The extent of credit given by the industry normally depends upon:

i. Trade practices

ii. Market conditions

iii. Whether it is bulky by the buyer

iv. Seasonality

v. Price advantage

Even in cases where no credit is extended to buyers, the transit time for the goods to reach the

buyer may take some time and till the cash is received back, the unit will have to be cut out of

funds. The period from the time of sale to receipt of funds will have to be reckoned for the

purpose of quantifying the funds blocked in sundry debtors. Even though the amount of sundry

debtors according to the units books will be on the basis of Sale Price, the actual amount blocked

will be only the cost of production of the materials against which credit has been extended- the

difference being the units profit margin- (which the unit does not obviously have to spend). The

working capital requirement against Sundry Debtors will therefore be computed on the basis of

cost of production (whereas the permissible bank finance will be computed on basis of sale value

since profit margin varies from product to product and buyer to buyer and cannot be uniformly

segregated from the sale value).

The working capital requirement is expressed as so many months cost of production.

Expenses: It is customary in assessing the working capital requirement of industries, to provide

for 1 months expenses also. A question might be raised as to why expenses should be taken

separately, whereas at every stage the funds required to be blocked had been taken into account.

This amount is provided merely as a cushion, to take care of temporary bottlenecks and to enable

the unit to meet expenses when they fall due. Normally 1-month total expenses, direct and

indirect, salaries etc. are taken into account.

Amity International Business School,Noida

25

Credit Appraisal and Risk Rating at PNB

While computing the working capital requirements of a unit, it will be necessary to take into

account 2 other factors,

i.

Is the credit received on purchases- trade credit is a normal practice in trading

circles. The period of such credit received varies from place to place, material to

material and person to person. The amount of credit received on purchases reduces

the working capital funds required by the unit.

ii.

Industries often receive advance against orders placed for their products. The

buyers, in certain cases, have to necessarily give advance to producers e.g. custom

made machinery. Such funds are used for the working capital of an industry. It can

be thus summarized as follows:

Raw materials

Months requirement

Rs. A

Stock-in-process

Months (cost of Production)

Rs. B

Finished Goods

Months cost of Production required to be stocked

Rs. C

Sundry Debtors

Months cost of Production (o/s credits)

Rs. D

Expenses

One month(normally)

Rs. E

Total Current Assets

A+B+C+D+E

Credit received on Purchases

(months Purchase value)

Rs. F

Advance payment on order

received

Rs. G

WORKING CAPITAL REQUIRED (H) = (A+B+C+D+E)- (F+G)

Amity International Business School,Noida

26

Credit Appraisal and Risk Rating at PNB

3.

Projected Annual Turnover Method for SME units (Nayak Committee)

For SME units, which enjoy fund based working capital limits up to Rs.5 crore, the minimum

working capital limit should be fixed on the basis of projected annual turnover. 25% of the output

or annual turnover value should be computed as the quantum of working capital required by such

unit. The unit should be required to bring in 5% of their annual turnover as margin money and the

Bank shall provide 20% of the turnover as working capital finance. Nayak committee guidelines

correspond to working capital limits as per the operating cycle method where the average

production/ processing cycle is taken to be 3 months.

Example:

Anticipated Annual Output (A)

120

Working Capital Requirement: 25% of A (B)

30

Margin : 5% of A (C)

Maximum Permissible Bank Finance (B-C)

24

In Rs lacs

Important clarifications:

i.

The assessment of WC limits should be done both as per Projected Turnover Method and

Traditional Method; the higher of the two is to be sanctioned as credit limit. If the

operating cycle is more than 3 months, there is no restriction on extending finance at more

than 20% of the turnover provided that the borrower should bring n proportionally higher

stake in relation to his requirements of bank finance.

ii.

While the approach of extending need based credit will be kept in mind, the financial

strengths of the unit is also important, the later aspect assumes greater significance so as to

take care of quality of banks assets. The margin requirement, as a general rule, should not

be diluted.

Amity International Business School,Noida

27

Credit Appraisal and Risk Rating at PNB

4. MPBF Method (Tandon and Chore Committee Recommendations)

The Tandon Committee was appointed to suggest a method for assessing the working capital

requirements and the quantum of bank finance. Since at that time, there was scarcity of banks

resources, the Committee was also asked to suggest norms for carrying current assets in different

industries so that bank finance was not drawn more than the minimum required level. The

Committee was also asked to devise an information system that would provide, periodically,

operational data, business forecasts, production plan and resultant credit needs of units. Chore

Committee, which was appointed later, further refined the approach to working capital

assessment. The MPBF method is the fall out of the recommendations made by Tandon and Chore

Committee.Regarding approach to lending: the committee suggested three methods for assessment

of working capital requirements.

i.

First Method of lending: According to this method, Banks would finance up to a max. of

75% of the working capital gap (WCG= the total current assets - current liabilities other

than bank borrowing) and the balance 25 % of the WCG considered as margin is to come

out of long term source i.e. owned funds and term borrowings. This will give rise to a

minimum current ratio of 1.17:1. The difference of (1.17-1) represents the borrowers

margin which is popularly known as Net Working Capital (NWC) of the unit

ii.

Second Method of lending: As per the 2nd method Bank will finance maximum up to 75%

of total current assets (TCA) & Borrowers has to provide a minimum of 25% of total

current assets as the margin out of long term sources. This will give a minimum current

ratio of 1.33:1

iii.

Third Method of lending: Same as 2nd method, but excluding core current assets from

total assets and the core current assets is financed out of long term funds. The term core

current assets refers to the absolute minimum level of investment in current assets, which

is required at all times to carry out minimum level of business activity. The current ratio is

further improved i.e. 1.79: 1

Amity International Business School,Noida

28

Credit Appraisal and Risk Rating at PNB

Example:

Current Liabilities

Current assets

Creditors for purchase

Other current liability

Bank borrowings

100 Raw material

200

50 Stock in process

20

200 Finished goods

Total Current Liabilities

90

Receivables

50

Other current assets

10

350 Total Current Assets

370

(In Rs lacs)

Calculating NWC

First method of lending

Second method of lending

Total CA

370 Total CA

Less: CL Bank

Borrowing

150 Less: 25% of CA

Third method of lending

370 Total CA

92

Less: core CA from

LT

370

95

275

Working Capital Gap

25% of WCG from

long term sources

MPBF

Current ratio

220

Less: CL - Bank

Borrowing

55

165 MPBF

1.17: 1 Current ratio

Amity International Business School,Noida

150 Less: 25% from LTS

Less: CL Bank

Borrowing

128 MPBF

1.33: 1 Current ratio

69

150

56

1.79: 1

29

Credit Appraisal and Risk Rating at PNB

The above example shows that the contribution of margin by the borrower increases when

financing is shifted from First method to Second method which is known to be stringent from

borrower point of view (Third method was not accepted by RBI).

5.

Projected Balance Sheet Method (PBS)

The PBS method of assessment will be applicable to all borrowers who are engaged in

manufacturing, services and trading activities who require fund based working capital finance of

Rs. 25 lacs and above. In case of SSI borrowers, who require working capital credit limit up to Rs.

5 cr, the limit shall be computed on the basis of Nayak Committee formula as well as that based

on production and operating cycle of the unit and the higher of the two may be sanctioned.. The

assessment will be based on the borrowers projected balance sheet, the funds flow planned for

current/ next year and examination of the profitability, financial parameters etc. unlike the MPBF

method, it will not be necessary in this method to fix or compute the working capital finance on

the basis of a stipulated minimum level of liquidity (Current Ratio). The working capital

requirement worked out is based on the following:

i.

CMA assessment method is continued with certain modifications.

ii.

Analysis of the Profit and Loss account, Balance Sheet, Funds flow etc. for the past

periods is done to examine the profitability, financial position, and financial

management etc of the business.

iii.

Scrutiny and validation of the projected income and expenses in the business and

projected changes in the financial position (sources and uses of funds). This is carried

out to examine whether these parameters are acceptable from the angle of liquidity,

overall gearing, efficiency of operations etc.

In the PBS method, the borrowers total business operations, financial position, management

capabilities etc. are analysed in detail to assess the working capital finance required and to

evaluate the overall risk. The assessment procedure is as follows:

i.

Collection of financial information from the borrower

ii.

Classification of current assets / current liabilities

Amity International Business School,Noida

30

Credit Appraisal and Risk Rating at PNB

iii.

Verification of projected levels of inventory/ receivables/ sundry creditors

iv.

Evaluation of liquidity in the business operation

v.

Validation of bank finance sought

Amity International Business School,Noida

31

Credit Appraisal and Risk Rating at PNB

7.2 ASSESSMENT OF TERM LOANS

Term Loans are generally granted to finance capital expenditure, i.e. for acquisition of land,

building and plant and machinery, required for setting up a new industrial undertaking or

expansion/diversification of an existing one and also for acquisition of movable fixed assets.

Term Loans are also given for modernization, renovation, etc. to improve the product quality or

increase the productivity and profitability.

The basic difference between short-term facilities and term loans is that short-term facilities are

granted to meet the gap in the working capital and are intended to be liquidated by realization of

assets, whereas term loans are given for acquisition of fixed assets and have to be liquidated from

the surplus cash generated out of earnings. They are not intended to be paid out of the sale of the

fixed assets given as security for the loan. This makes it necessary to adopt a different approach

in examining the application of the borrowers for term credits.

For the assessment to Term Loan Techno Economic Feasibility Study is done. The success of a

feasibility study is based on the careful identification and assessment of all of the important issues

for business success. A detailed Project Report is submitted by an entrepreneur, prepared by a

approved agency or a consultancy organization. Such report provides in-depth details of the

project requesting finance. It includes the technical aspects, Managerial Aspect, the Market

Condition and Projected performance of the company. It is necessary for the appraising officer to

cross check the information provided in the report for determining the worthiness of the project.

The feasibility study is a part of Credit Appraisal process and the same is discussed in the

following chapter.

Amity International Business School,Noida

32

Credit Appraisal and Risk Rating at PNB

7.3 BASEL ACCORD & RISK MANAGEMENT

The Basel accord/accords refer to the banking supervision accords namely Basel I and Basel II

issued by the Basel Committee on Banking Supervision (BCBS).

BASEL I ACCORD

The 1988 Basel Accord primarily addressed banking in the sense of deposit taking and lending.

The main focus was Credit Risk. It described the strength of the Bank as measured by the Capital

employed. Accordingly it put a minimum level of capital adequacy (Capital to Credit Risk

Weighted Assets ratio) at 8%. Basel I allocated 4 risk weights i.e. 0%, 20, 50% and 100% to

different exposure types, based on the risk perceived on the exposure types under the credit

portfolio. Basel I provided a set norm for capital allocation which helped many banks to allocate

capital to counter the risks faced by them.

CRAR

Capital

Risk Weighted Assets (Credit Risk+ Market Risk +Operational Risk)

Tier I

Capital

Paid Up Equity Capital + Statutory Reserves + Other disclosed free

reserves + Capital Reserves representing surplus arising out of sale

proceeds of Assets + Innovative Perpetual Debt instruments

CAPITAL

Tier II

Revaluation Reserves (at a discount of 55%) + General Provisions and

Capital

Loss Reserves + Subordinated Debt +

Hybrid

Debt

Capital

Instruments

Risk Weighted Assets

Basel I introduced the concept of Risk Weighted Assets (RWA).

All the assets of a bank

(advances, investments, fixed assets etc.) carry certain amount of risk. In proportion to the

quantum of this risk, bank must maintain capital. Quantification of risk is done in percentage (0%,

20%, 50% etc.). Exposure when multiplied with these percentages gives risk based value of

assets. These assets are also called Risk Weighted Assets (RWA).

Amity International Business School,Noida

33

Credit Appraisal and Risk Rating at PNB

BASEL II ACCORD

Banking has changed dramatically since the Basel I document of 1988. Advances in risk

management and the increasing complexity of financial activities / instruments prompted

international supervisors to review the appropriateness of regulatory capital standards under Basel

I. To meet this requirement, the Basel I accord was amended and refined which came out as the

Basel II document. The Basel II document is structured into three parts. Each part is called as a

pillar. Thus these three parts constitute three pillars of Basel II.

PILLAR I

PILLAR II

PILLAR III

This pillar is compatible with the credit risk, market risk and operational

risk. The regulatory capital will be focused on these three risks

This pillar gives the bank responsibility to exercise the best ways to manage

the risk specific to that bank. It also casts responsibility on the supervisors to

review and validate banks risk measurement models.

This pillar is on market discipline is used to leverage the influence that other

market players can bring

DIFFERENCE BETWEEN

BASEL I

BASEL II

Limited role of collateral as risk mitigant

Recognizes wide range of Collateral &

Guarantees as risk mitigant

Not recognizing Operational Risk

Recognizes Operational Risk and prescribes

explicit capital charge for

Risk weights assignment on transaction

basis

3 Risk weight assignment on risk rating basis

4

5

Not recognizing tenure or remaining time

to maturity of exposures in risk

assessment

Provisions are through Asset

Classification.

Amity International Business School,Noida

Recognizes the tenure or remaining time to

maturity of exposures in risk assessment

5 Provisions are through Expected Loss

34

Credit Appraisal and Risk Rating at PNB

Estimation

Chapter

CREDIT APPRAISAL

8.1 INTRODUCTION

Effectiveness of Credit Management in the bank is highlighted by the quality of its loan portfolio.

Every Bank is striving hard to ensure that its credit portfolio is healthy and that Non Performing

Assets are kept at lowest possible level, as both of these factors have direct impact on its

profitability. In the present scenario efficient project appraisal has assumed a great importance as

it can check and prevent induction of weak accounts to our loan portfolio. All possible steps need

to be taken to strengthen pre sanction appraisal as always Prevention is better than Cure. With

the opening up of the economy rapid changes are taking place in the technology and financial

sector exposing banks to greater risks, which can be broadly classified as under:

Industry Risks

Government regulations and policies, availability of infrastructure facilities,

Industry Rating, Industry Scenario & Outlook, Technology Up gradation,

availability of inputs, product obsolescence, etc.

Business Risks

Operating efficiency, competition faced from the units engaged in similar

products, demand and supply position, cost of labor, cost of raw material

and other inputs, pricing of product, surplus available, marketing, etc.

Management Risks

Background, integrity and market standing/ reputation of promoters,

organizational set up and management hierarchy, expertise/competence of

persons holding key position in the organization, delegation and

decentralization of authority, achievement of targets, track record in

execution of project, debt repayment, industry relations etc.

Financial Risks

Financial strength/standing of the promoters, reliability and reasonableness

of projections, past financial performance, reliability of operational data and

Amity International Business School,Noida

35

Credit Appraisal and Risk Rating at PNB

financial ratios, adequacy of provisioning for bad debts, qualifying remarks

of auditors/inspectors etc.

In light of the foregoing risks, the banks appraisal methodology should keep pace with ever

changing economic environment. The appraisal system aims to determine the credit

needs/requirements of the borrower taking into account the financial resources of the client. The

end objective of the appraisal system is to ensure that there is no under - financing or over financing. Following are the aspects, which need to be scrutinized and analyzed while appraising:

Amity International Business School,Noida

36

Credit Appraisal and Risk Rating at PNB

8.2 MARKET ANALYSIS

(Demand & Potential)

The market demand and potential is to be examined for each product item and its

variants/substitutes by taking into account the selling price of the products to be marketed vis-avis prices of the competing products/substitutes, discount structure, arrangement made for after

sale service, competitors' status and their level of operation with regard to production and products

and distribution channels being used etc. Critical analysis is required regarding size of the market

for the product(s) both local and export, based on the present and expected future demand in

relation to supply position of similar products and availability of the other substitutes as also

consumer preferences, practices, attitudes, requirements etc. Further, the buy-back arrangements

under the foreign collaboration, if any, and influence of Government policies also needs to be

considered for projecting the demand. Competition from imported goods, Government Import

Policy and Import duty structure also need to be evaluated.

Amity International Business School,Noida

37

Credit Appraisal and Risk Rating at PNB

8.3 TECHNICAL ANALYSIS

In a dynamic market, the product, its variants and the product-mix proposed to be manufactured in

terms of its quality, quantity, value, application and current taste/trend requires thorough

investigation.

Location and Site

Based on the assessment of factors of production, markets, Govt. policies and other factors,

Location (which means the broad area) and Site (which signifies specific plot of land) selected for

the Unit with its advantages and disadvantages, if any, should be such that overall cost is

minimized. It is to be seen that site selected has adequate availability of infrastructure facilities

viz. Power, Water, Transport, Communication, state of information technology etc. and is in

agreement with the Govt. policies. The adequacy of size of land and building for carrying out its

present/proposed activity with enough scope for accommodating future expansion needs to be

judged.

Raw Material

The cost of essential/major raw materials and consumables required their past and future price

trends, quality/properties, their availability on a regular basis, transportation charges, Govt.

policies regarding regulation of supplies and prices require to be examined in detail. Further, cost

of indigenous and imported raw material, firm arrangements for procurement of the same etc.

need to be assessed.

Plant & Machinery, Plant Capacity and Manufacturing Process

The selection of Plant and Machinery proposed to be acquired whether indigenous or imported

has to be in agreement with required plant capacity, principal inputs, investment outlay and

production cost as also with the machinery and equipment already installed in an existing unit,

Amity International Business School,Noida

38

Credit Appraisal and Risk Rating at PNB

while for the new unit it is to be examined whether these are of proven technology as to its

performance. The technology used should be latest and cost effective enabling the unit to compete

in the market. Purchase of reconditioned/old machinery is to be dealt in terms of laid down

guidelines. Compatibility of plant and machinery, particularly, in respect of imported technology

with quality of raw material is to be kept in view. Also plant and machinery and other equipments

needed for various utility services, their supply position, specification, price and performance as

also suppliers' credentials, and in case of collaboration, collaborators' present and future support

requires critical analysis. Plant capacity and the concept of economic size has a major bearing on

the present and future plans of the entrepreneur(s) and should be related to the availability of raw

material, product demand, product price and technology.

The selected process of manufacturing indicating the adequacy, availability and suitability of

technology to be used along with plant capacity, manufacturing process needs to studied in detail

with capacities at various stages of production being such that it facilitates optimum utilization

and ensures future expansion/ debottlenecking, as and when required. It is also to be ensured that

arrangements are made for inspection at intermediate/final stages of production for ensuring

quality of goods on successful commencement of production and completion, wherever required.

Amity International Business School,Noida

39

Credit Appraisal and Risk Rating at PNB

8.4 FINANCIAL ANALYSIS

The aspects which need to be analyzed under this head should include cost of project, means of

financing, cost of production, break-even analysis, financial statements as also profitability/funds

flow projections, financial ratios, sensitivity analysis which are discussed as under:

Cost of Project & Means of Financing

a. The major cost components of any project are land and building including transfer,

registration and development charges as also plant and machinery, equipment for auxiliary

services, including transportation, insurance, duty, clearing, loading and unloading charges

etc. It also involves consultancy and know-how expenses which are payable to foreign

collaborators or consultants who are imparting the technical know-how. Recurring annual

royalty payment is not reflected under this head but is accounted for under the profitability

statements. Further, preliminary expenses, such as, cost of incorporation of the Company, its

registration, preparation of feasibility report, market surveys, pre-operative expenses like

salary, travelling, start up expenses, mortgage expenses incurred before commencement of

commercial production also form part of cost of project. Also included in it are capital issue

expenses which can be in the form of brokerage, commission, advertisement, printing,

stationery etc. Finally, provisions for contingencies to meet any unforeseen expenses, such

as, price escalation or any other expense which have been inadvertently omitted like margin

for working capital requirements required to complete the production cycle, interest during

construction period, etc. are also part of capital cost of project. It is to be ensured while

appraising the project that cost and various estimates given are realistic and there is no

under/over estimation. Further, these cost components should be supported by proper

quotations, specifications and justifications of land, machinery and know-how expenses etc.

ii. Besides Banks loan, the project cost is normally financed by bringing capital by the

promoters and shareholders in the form of equity, debentures, unsecured long term loans and

deposits raised from friends and relatives which are not repayable till repayment of Bank's

loan. Resources are raised for financing project by raising term loans from Institutions/Banks

Amity International Business School,Noida

40

Credit Appraisal and Risk Rating at PNB

which are repayable over a period of time, deferred term credits secured from suppliers of

machinery which are repayable in installments over a period of time. The above is an

illustrative list, as the promoters have now started raising funds through Euro-issues, Foreign

Currency loans, premium on capital issues, etc. which are sometimes comparatively cheap

means of finance.

Subsidies and development loans provided by the Central/State

Government in notified backward districts to attract entrepreneurs are also means of financing

a project. It is to be ascertained that requirement of finance has been properly tied-up for

unhindered implementation of a project. The financing structure accepted must be in

consonance with generally accepted levels along with adequate Promoters' stake.

The

resourcefulness, willingness and capacity of promoter to contribute the same have also to be

investigated.

In case of project finance, the promoter/borrower may bring in upfront his contribution (other

than funds to be provided through internal generation) and the branches should commence its

disbursement after the stipulated funds are brought in by the promoter/borrower. A condition

to this effect should be stipulated by the sanctioning authority in case of project finance, on

case to case basis depending upon the resourcefulness and capacity of the promoter to

contribute the same.

It should be ensured that at any point of time, the promoters

contribution should not be less than the proportionate share.

Profitability Statement

The profitability statement which is also known as `Income and Expenditure Statement' is

prepared after considering the net sales figure and details of direct costs/expenses relating to raw

material, wages, power, fuel, consumable stores/spares and other manufacturing expenses to arrive

at a figure of gross profit. Thereafter, all other expenses like salaries, office expenses, packing,

selling/distribution, interest, depreciation and any other overhead expenses and taxes are taken

into account to arrive at the figure of net profit. The projections of profit/loss are prepared for a

period covering the repayment of term loans. The economic appraisal includes scrutinizing all the

items of cost, and examining the assumptions, if any, to ensure that these are realistic and

Amity International Business School,Noida

41

Credit Appraisal and Risk Rating at PNB

achievable.

There should not be any optimism or pessimism in working out profitability

projections since even a little change in the product-mix from non-remunerative to remunerative

or vice-versa can distort the picture. While preparing profitability projections, the past trends of

performance in an industry and other environmental factors influencing the cost and revenue items

should also be considered objectively.

Generally speaking, a unit may be considered as financially viable, progressive and efficient if it

is able to earn enough profits not only to service its debts timely but also for future

development/growth.

Break-Even Analysis

Analysis of break-even point of a business enterprise would help in knowing the level of output

and sales at which the business enterprise just breaks even i.e. there is neither profit nor loss. A

business earns profit if it operates at a level higher than the break-even level or break-even point.

If, on the other hand, production is below this level, the business would incur loss. The breakeven point in an algebraic equation can be put as under:

Break-even point

(Volume or Units)

Total Fixed Cost / (Sales price per unit - Variable Cost per unit)

Break-even point

(Sales in rupees)

(Total Fixed Cost x Sales) / (Sales - Variable Costs)

The fixed costs include all those costs which tend to remain the same up to a certain level of

production while variable costs are those costs which tend to change in proportion with the

volume of production. As regards unit sales price, it is generally the same for all levels of output.

The break-even analysis can help in making vital decisions relating to fixation of selling price

make or buy decision, maximizing production of the item giving higher contribution etc. Further,

the break-even analysis can help in understanding the impact of important cost factors, such as,

power, raw material, labor, etc. and optimizing product-mix to improve project profitability.

Amity International Business School,Noida

42

Credit Appraisal and Risk Rating at PNB

Fund-Flow Statement

A fund-flow statement is often described as a Statement of Movement of Funds or where got:

where gone statement. It is derived by comparing the successive balance sheets on two specified

dates and finding out the net changes in the various items appearing in the balance sheets.

A critical analysis of the statement shows the various changes in sources and applications (uses) of

funds to ultimately give the position of net funds available with the business for repayment of the

loans. A projected Fund Flow Statement helps in answering the under mentioned points.

How much funds will be generated by internal operations/external sources?

How the funds during the period are proposed to be deployed?

Is the business likely to face liquidity problems?

Balance Sheet Projections

The financial appraisal also includes study of projected balance sheet which gives the position of

assets and liabilities of a unit at a particular future date. In other words, the statement helps to

analyze as to what an enterprise owns and what it owes at a particular point of time.

An appraisal of the projected balance sheet data of the unit would be concerned with whether the

projections are realistic looking to various aspects relating to the same industry.

Financial Ratios

While analyzing the financial aspects of project, it would be advisable to analyze the important

financial ratios over a period of time as it may tell us a lot about a unit's liquidity position,

managements' stake in the business, capacity to service the debts etc. The financial ratios which

are considered important are discussed as under:

Amity International Business School,Noida

43

Credit Appraisal and Risk Rating at PNB

Ratio

Formula

Remarks

There cannot be a rigid rule to a satisfactory debtequity ratio, lower the ratio higher is the degree of

protection enjoyed by the creditors. These days the

debt equity ratio of 1.5:1 is considered reasonable.

It, however, is higher in respect of capital intensive

Debt-Equity

Ratio

Debt (Term Liabilities)

have a substantial stake in the project.

Equity

(Where, Equity = Share capital,

in view while agreeing to a less favorable ratio.

free reserves, premium on

In financing highly capital intensive projects like

shares, , etc. after adjusting loss

infrastructure, cement, etc. the ratio could be

considered at a higher level.

Debt + Depreciation +

Net Profit (After Taxes)

Service

Coverage

Ratio

Other

features like quality of management should be kept

balance)

Debt-

projects. But it is always desirable that owners

+ Annual interest on long

This ratio of 1.5 to 2 is considered reasonable. A

very high ratio may indicate the need for lower

moratorium period/repayment of loan in a shorter

schedule. This ratio provides a measure of the

term debt

ability of an enterprise to service its debts i.e.

Annual interest on long

`interest'

and

`principal

repayment'

besides

term debt + Repayment

indicating the margin of safety. The ratio may vary

of debt

from industry to industry but has to be viewed with

circumspection when it is less than 1.5.

Tangible Net Worth (Paid

up Capital + Reserves

and Surplus

3

TOL / TNW

Ratio

Intangible Assets)

Total outside Liabilities

(Total Liability - Net

This ratio gives a view of borrower's capital

structure. If the ratio shows a decreasing trend, it

indicates that the borrower is relying more on his

own funds and less on outside funds and vice versa

Worth)

Amity International Business School,Noida

44

Credit Appraisal and Risk Rating at PNB

Operating Profit (Before

Taxes excluding Income

4

Profit-Sales

from other Sources)

Ratio

This ratio gives the margin available after meeting

cost of manufacturing. It provides a yardstick to

measure the efficiency of production and margin on

Sales

sales price i.e. the pricing structure

This ratio is of a primary importance to see how

best the assets are used. A rising trend of the ratio

Sales5

reveals that borrower has been making efficient

Sales

Tangible

Assets Ratio

Total Assets - Intangible

Assets

utilization of his assets. However, caution needs to

be exercised when fixed assets are old and

depreciated, as in such cases the ratio tends to be

high because the value of the denominator of the

ratio is very low.

Higher the ratio greater the short term liquidity.

This ratio is indicative of short term financial

position of a business enterprise. It provides margin

as well as it is measure of the business enterprise to

Current

Ratio

Current Assets

Current Liabilities

pay-off the current liabilities as they mature and its

capacity to withstand sudden reverses by the

strength of its liquid position. Ratio analysis gives

indications; to be made with reference to overall

tendencies and parameters in relation to the project.

Sales

Output

7

Investment

Ratio

Total capital employed

(in fixed & current

assets)

Amity International Business School,Noida

This ratio is indicative of the efficiency with which

the total capital is turned over as compared to other

units in similar lines.

45

Credit Appraisal and Risk Rating at PNB

Internal Rate of Return

The discount rate often used in capital budgeting that makes the net present value of all cash flows

from a particular project equal to zero. Higher a project's IRR the more desirable it is to undertake

the project. IRR should be higher than the Cost of the project (interest rate in case of project

financing)

Sensitivity Analysis

While preparing and appraising projects certain assumptions are made in respect of certain

critical/sensitive variables like selling price/cost price per unit of production, product-mix, plant

capacity utilization, sales etc. which are assigned a `VALUE' after estimating the range of

variation of such variables. The `VALUE' so assumed and taken into consideration for arriving at

the profitability projections is the `MOST LIKELY VALUE'. Sensitivity Analysis is a systematic

approach to reduce the uncertainties caused by such assumptions made. The Sensitivity Analysis

helps in arriving at profitability of the project wherein critical or sensitive elements are identified

which are assigned different values and the values assigned are both optimistic and pessimistic

such as increasing or reducing the sale price/sale volume, increasing or reducing the cost of inputs

etc. and then the project viability is ascertained. The critical variables can then be thoroughly

examined by generally selecting the pessimistic options so as to make possible improvements in

the project and make it operational on viable lines even in the adverse circumstances.

Amity International Business School,Noida

46

Credit Appraisal and Risk Rating at PNB

8.5 MANAGEMENT & ORGANIZATION ANALYSIS

Appraisal of project would not be complete till it throws enough light on the person(s) behind the

project i.e. management and organization of the unit. It is seen that some projects may fail not

because these are not viable but because of the ineffectiveness of the management and the

organization in controlling various functions like production, marketing, finance, personnel, etc.

The appraisal report should highlight the strengths and weaknesses of the management by

commenting on the background, qualifications, experience, and capability of the promoter, key

management personnel, and effectiveness of the internal control systems, relation with labor,

working conditions, wage structure, and the other assigned essential functions. In case the

promoter(s) have interest, in other concerns as Proprietor or Partner or Director, the appraisal

report should also comment on their performance in such concerns.

A business is more vulnerable if decision making in all the functional areas rests with a particular

person, in other words, `one man show'. Further, the management and the organization should be

conducive to the size and type of business. In case it is not so, it should be ensured that