Professional Documents

Culture Documents

Tutorial 1 Time Value of Money PDF

Tutorial 1 Time Value of Money PDF

Uploaded by

Lâm TÚc NgânCopyright:

Available Formats

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Case Study 5-9Document7 pagesCase Study 5-9Dayan DudosNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Supply Chain ProfitabilityDocument31 pagesSupply Chain ProfitabilitysaiNo ratings yet

- Problem Set Time Value of MoneyDocument5 pagesProblem Set Time Value of MoneyRohit SharmaNo ratings yet

- Exercises - Corporate Finance 1Document12 pagesExercises - Corporate Finance 1Hông HoaNo ratings yet

- Time Value of MoneyDocument6 pagesTime Value of MoneyRezzan Joy Camara MejiaNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMNguyễn Quốc HưngNo ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- FM Tutorial TVM 2023.24Document5 pagesFM Tutorial TVM 2023.24Đức ThọNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Tutorial For Time Value of MoneyDocument4 pagesTutorial For Time Value of MoneyKim NgânNo ratings yet

- Tutorial 3Document4 pagesTutorial 3Nguyễn Quan Minh PhúNo ratings yet

- Time Value of Money Practice ProblemsDocument5 pagesTime Value of Money Practice ProblemsMarkAntonyA.RosalesNo ratings yet

- Time Value of Money 1Document5 pagesTime Value of Money 1k61.2211155018No ratings yet

- Engineering Economics Problem Set 1 PDFDocument1 pageEngineering Economics Problem Set 1 PDFMelissa Joy de GuzmanNo ratings yet

- Es FOR TIME VALUE OF MONEYDocument6 pagesEs FOR TIME VALUE OF MONEYphuongnhitran26No ratings yet

- Tutorial 2Document4 pagesTutorial 2Funny CatNo ratings yet

- Practice Questions On TVMDocument5 pagesPractice Questions On TVMANUP MUNDENo ratings yet

- Tutorial 2Document5 pagesTutorial 2K60 Trần Công KhảiNo ratings yet

- Assignment 1Document2 pagesAssignment 1Utsav PathakNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- TVM Practice Questions With AnswersDocument4 pagesTVM Practice Questions With AnswersAhmed NomanNo ratings yet

- Problems For Topic 3Document4 pagesProblems For Topic 3Quỳnh Anh TrầnNo ratings yet

- Tutorial 4 TVM ApplicationDocument4 pagesTutorial 4 TVM ApplicationTrần ThảoNo ratings yet

- University of Pennsylvania The Wharton SchoolDocument18 pagesUniversity of Pennsylvania The Wharton SchoolBassel ZebibNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Problem Set #2 Financial Management Professor KuhleDocument2 pagesProblem Set #2 Financial Management Professor KuhleYuRi LuvNo ratings yet

- Tutorial 2 (TVM) - Questions: Present Value Years Future ValueDocument2 pagesTutorial 2 (TVM) - Questions: Present Value Years Future ValueSadia R ChowdhuryNo ratings yet

- Final Exam Review-VrettaDocument4 pagesFinal Exam Review-VrettaAna Cláudia de Souza0% (2)

- Practice Set - TVMDocument2 pagesPractice Set - TVMVignesh KivickyNo ratings yet

- EconomicsDocument11 pagesEconomicsJorosh Laurente DelosoNo ratings yet

- 991財管題庫Document10 pages991財管題庫zzduble1No ratings yet

- Bài Tập ThêmDocument9 pagesBài Tập ThêmK59 Vu Nguyen Viet LinhNo ratings yet

- Time Value of Money 2Document6 pagesTime Value of Money 2k61.2211155018No ratings yet

- MidTermPractice FV PV Questions AnnuityDocument9 pagesMidTermPractice FV PV Questions AnnuityPurvi VayedaNo ratings yet

- TUTORIALDocument10 pagesTUTORIALViễn QuyênNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Nanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)cccqNo ratings yet

- TVM Questions IDocument4 pagesTVM Questions IRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet

- Assignemt - Chapter 2 - Time Value of MoneyDocument3 pagesAssignemt - Chapter 2 - Time Value of Money721d0042No ratings yet

- Assign 2Document3 pagesAssign 2Abdul Moqeet100% (1)

- Nanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)asdsadsaNo ratings yet

- Chapter 8. Time Value of Money. ExerciseDocument3 pagesChapter 8. Time Value of Money. ExerciseMai Linh LươngNo ratings yet

- BF Assign1Document3 pagesBF Assign1Mian Shawal67% (3)

- Question BankDocument3 pagesQuestion BankMuhammad HasnainNo ratings yet

- Handout2 PDFDocument2 pagesHandout2 PDFTheresiaVickaaNo ratings yet

- TUTORIALS TIME VALUE OF MONEY - SssDocument3 pagesTUTORIALS TIME VALUE OF MONEY - Ssssethsebeh496No ratings yet

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- FM A Assignment 19-40659-1Document11 pagesFM A Assignment 19-40659-1Pacific Hunter JohnnyNo ratings yet

- Time Value of Money AssignmentDocument1 pageTime Value of Money AssignmentawaischeemaNo ratings yet

- Additional Time Value ProblemsDocument2 pagesAdditional Time Value ProblemsBrian WrightNo ratings yet

- Assignment 1Document4 pagesAssignment 1Ahmad Ullah KhanNo ratings yet

- Workbook1 TimevalueofMoneyDocument2 pagesWorkbook1 TimevalueofMoneyDe BuNo ratings yet

- The 100-Year Mortgage is Coming: How to Position Your Family to Avoid It: Financial Freedom, #218From EverandThe 100-Year Mortgage is Coming: How to Position Your Family to Avoid It: Financial Freedom, #218No ratings yet

- Turn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138From EverandTurn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138No ratings yet

- FHA FULL Condo Questionnaire 12-09Document2 pagesFHA FULL Condo Questionnaire 12-09The Pinnacle TeamNo ratings yet

- Dexos1™ Gen 2 Brands - Lista CompletaDocument20 pagesDexos1™ Gen 2 Brands - Lista CompletaRoger ObregonNo ratings yet

- Momo Statement - 250783521544-1.pdf WENDocument27 pagesMomo Statement - 250783521544-1.pdf WENJonathan HAKIZIMANA0% (1)

- Hallstead Jewelers PDFDocument9 pagesHallstead Jewelers PDFRaghav JainNo ratings yet

- Trust DeedDocument5 pagesTrust Deedkoroukh100% (3)

- Six Sigma Black Belt Wk1-Define & MeasureDocument452 pagesSix Sigma Black Belt Wk1-Define & MeasureRaghavendra Narayanaswamy100% (11)

- Macroeconomics: Case Fair OsterDocument28 pagesMacroeconomics: Case Fair OsterMikhel BeltranNo ratings yet

- Line and Grade Evaluation ChecklistDocument1 pageLine and Grade Evaluation Checklistjuan dela cruzNo ratings yet

- Apollo Semiconductor Philippines Vs Commissioner January 14, 2015 GR No. 168950Document3 pagesApollo Semiconductor Philippines Vs Commissioner January 14, 2015 GR No. 168950Aerwin AbesamisNo ratings yet

- VM OlacabDocument2 pagesVM OlacabNikhil KatariaNo ratings yet

- Determination of BPL in IndiaDocument34 pagesDetermination of BPL in IndiaAbhimanyu Singh100% (1)

- Sole Proprietorship in MalaysiaDocument3 pagesSole Proprietorship in MalaysiaAimanAl-Bakir100% (1)

- DEAF CircularDocument48 pagesDEAF CircularNikita SalunkheNo ratings yet

- Introduction To International Business Chapter 1Document23 pagesIntroduction To International Business Chapter 1Mohd Haffiszul Bin Mohd Said100% (1)

- Document Rizal - 012038Document5 pagesDocument Rizal - 012038John Michael LesacaNo ratings yet

- (Lecture 5) Road User CostsDocument8 pages(Lecture 5) Road User Costsعلي صبحي عبد المنعمNo ratings yet

- 2009 KOF Index of Globalization: Definitions and SourcesDocument2 pages2009 KOF Index of Globalization: Definitions and SourcesAbby Sta AnaNo ratings yet

- Postal Manual Volume - 7Document189 pagesPostal Manual Volume - 7K V Sridharan General Secretary P3 NFPE100% (2)

- BOP Analysis of India, US and Germany From 2004-2014Document20 pagesBOP Analysis of India, US and Germany From 2004-2014Shruti GuptaNo ratings yet

- Heb 140X12 S275j0+arDocument1 pageHeb 140X12 S275j0+arvratsista agoritsaNo ratings yet

- A REPORT On Balance of PaymentDocument38 pagesA REPORT On Balance of PaymentPriaynk70% (23)

- L Oréal Travel Retail Presentation SpeechDocument6 pagesL Oréal Travel Retail Presentation Speechsaketh6790No ratings yet

- App Deped TemplateDocument15 pagesApp Deped TemplateKnoll ViadoNo ratings yet

- KEW320Document12 pagesKEW320نور فازاليناNo ratings yet

- Priya SinghDocument3 pagesPriya Singhsarvesh.bhartiNo ratings yet

- JamaicaDocument3 pagesJamaicaKelz YouknowmynameNo ratings yet

- U1VCMTQ5NDADocument3 pagesU1VCMTQ5NDAMūšť ÃphæNo ratings yet

- Capacity UtilisationDocument17 pagesCapacity UtilisationRaniiiNo ratings yet

Tutorial 1 Time Value of Money PDF

Tutorial 1 Time Value of Money PDF

Uploaded by

Lâm TÚc NgânOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 1 Time Value of Money PDF

Tutorial 1 Time Value of Money PDF

Uploaded by

Lâm TÚc NgânCopyright:

Available Formats

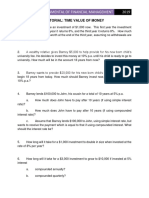

Fundamentals of Financial Management 2013

TUTORIAL Lecture 2

1. Textbook, Chapter 4: 4, 5, 6, 10, 15, 20, 22, 25, 28, 30, 31, 35, 44, 47, 50, 58, 60, 64, 74, 78.

2. A wealthy relative give Barney $5,000 to help provide for his new born childs university fee.

He decides to invest this money at 10% p.a. until his child is ready to go to university. How

much will be in the account 18 years from now?

3. Barney wants to provide $20,000 for his new born childs education, which will begin 18

years from today. How much should Barney invest now, if the interest rate is 10% p.a.?

4. How long will it take for a $1,000 investment to double in size when invested at the rate of

8% per year?

5. Suppose you have $500 to invest and you want to know how long will it take for this amount

to double in size if the interest rate is 10% p.a.

6. You borrow money on your credit card at 17.5% p.a., compounding quarterly. What is the

effective annual interest rate?

7. The following interest rates are being offered by three competing banks: 4% compounded

monthly; 4.1% compounded quarterly; 4.15% compounded annually. Which one is the most

attractive?

8. Barney lends $100,000 to John, his cousin in 10 years at 5% p.a.

a. How much John has to pay after 10 years ( if use simple interest rate)

b. How much John has to pay after 10 years ( if use compounded interest rate)

c. Assume that Barney lends $100,000 to John, using simple interest rate, but wants to

receive the payment which is equal to that if using compounded interest. What should

the interest rate be?

9. You have just received a letter from your aunt, which advises that she has written to you

into her will. On her passing, you will receive an inheritance of $50,000. Assuming r= 8% p.a.,

what is the inheritance worth in todays dollars if your aunt lives another 5 years? 15 years?

10. On a contract, you have a choice of receiving $25,000 six years from now or $50,000 twelve

years from now. At what implied compound annual interest rate should you be indifferent

between the two contracts?

11. You have just won the prize in the State lottery. A recent innovation is to offer prize winners

a choice of payoffs. You must choose one of the following prizes:

a. $1,000,000 paid immediately

b. $600,000 paid exactly one year from today, and another $600,000 paid exactly 3 years

from today

c. $70,000 payment at the end of each year forever (first payment occurs exactly 1 year

from today)

d. An immediate payment of $600,000, then beginning exactly 5 years from today, an

annual payment of $50,000 forever

e. An annual payment of $200,000 for the next 7 years (first payment occurs exactly 1 year

from today)

f. Require: you believe that 8% p.a. compounded annually is an appropriate discount rate.

Assuming you wish to maximize your current wealth, which is the best prize?

12. Ann buys a new computer. The stated price is $2,000, but the retailer has a special offer

whereby she has to pay $400 immediately and then another $400 each year of the next 7

years. If the interest rate is 8% p.a., what is the effective cash price?

Fundamentals of Financial Management 2013

13. Mr. and Mrs. Haiku have two offers for their apartment in Tokyo. The first calls for payment

of 50 million now and 50 million in one year. The second would pay 90 million

immediately. The appropriate interest rate is 4%. Which offer has the higher PV?

14. Muffin Megabucks is considering two different savings plans in 10 years. The first plan would

have her deposit $500 every six months, and she would receive an interest rate at 7% p.a.

(compounding semi-annually). Under the second plan she could deposit $1,000 every year

with the rate of interest of 7.5% p.a. (compounding annually)

15.

16.

17.

18.

19.

20.

21.

Which plan should Muffin use? (Assuming that the initial deposit of Plan 1 would be made 6

months from now, and with Plan 2, one year hence)

Kates financial advisor tells her that she will need $2 million to fund her retirement. She

plans to work for another 30 years before retiring. She will make 30 contributions to a

pension plan. How much will each contribution be, if the interest rate is 9% p.a.?

Mary has just retired and has $1 million in her retirement account. Her bank offers an

arrangement whereby the bank takes her $1 million now and pays her $110,000 at the end

of each year for the next 20 years. Is it a fair deal, if the offered rate is 10% p.a.?

Joe Hernandez has inherited $25,000 and wishes to purchase an annuity that will provide

him with a steady income over the next 12 years. He has heard that the local bank is

currently paying 6% p.a. (compounding annually). If he were to deposit his fund, what is the

equal amount would he be able to withdraw at the end of each year for 12 years?

Your company anticipates the introduction of environmental protection laws 3 years from

now. Under these laws, you will have to pay an environment tax of $5,000 at the end of each

year. If the rate is 6% p.a., what is the present value of your companys obligation under this

law?

Vernal Equinox wishes to borrow $10,000 for three years. A group of individuals agrees to

lend him this amount if he contracts to pay them $16,000 at the end of the 3 years. What is

the implicit compound annual interest rate implied by this contract?

The Happy Hang Glide Company is purchasing a building and has obtained a $190,000

mortgage loan for 20 years. The loan bears a compound interest rate of 17% p.a. and calls

for equal annual installment payments at the end of each of 20 years. What is the amount of

annual payment?

Mary enters into a loan agreement to borrow $90,000 to help finance the purchase of her

new home.

a. The agreement specifies the term of 20 years with monthly repayment at the fixed rate

of 9% p.a. (compounded monthly). What is her monthly payment?

b. Five years has passed. A rival lender offers to refinance Marys loan at the fixed rate of

8% p.a. (compounded monthly). The cost associated with this refinancing is $1,500.

Should she refinance?

c. Suppose 9 years have passed since Mary enters the original loan. Shes considering

making an extra payment of $10,000 off her loan. If she plans to keep the term of the

loan the same, how much will her monthly repayment reduce?

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Case Study 5-9Document7 pagesCase Study 5-9Dayan DudosNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Supply Chain ProfitabilityDocument31 pagesSupply Chain ProfitabilitysaiNo ratings yet

- Problem Set Time Value of MoneyDocument5 pagesProblem Set Time Value of MoneyRohit SharmaNo ratings yet

- Exercises - Corporate Finance 1Document12 pagesExercises - Corporate Finance 1Hông HoaNo ratings yet

- Time Value of MoneyDocument6 pagesTime Value of MoneyRezzan Joy Camara MejiaNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMNguyễn Quốc HưngNo ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- FM Tutorial TVM 2023.24Document5 pagesFM Tutorial TVM 2023.24Đức ThọNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Tutorial For Time Value of MoneyDocument4 pagesTutorial For Time Value of MoneyKim NgânNo ratings yet

- Tutorial 3Document4 pagesTutorial 3Nguyễn Quan Minh PhúNo ratings yet

- Time Value of Money Practice ProblemsDocument5 pagesTime Value of Money Practice ProblemsMarkAntonyA.RosalesNo ratings yet

- Time Value of Money 1Document5 pagesTime Value of Money 1k61.2211155018No ratings yet

- Engineering Economics Problem Set 1 PDFDocument1 pageEngineering Economics Problem Set 1 PDFMelissa Joy de GuzmanNo ratings yet

- Es FOR TIME VALUE OF MONEYDocument6 pagesEs FOR TIME VALUE OF MONEYphuongnhitran26No ratings yet

- Tutorial 2Document4 pagesTutorial 2Funny CatNo ratings yet

- Practice Questions On TVMDocument5 pagesPractice Questions On TVMANUP MUNDENo ratings yet

- Tutorial 2Document5 pagesTutorial 2K60 Trần Công KhảiNo ratings yet

- Assignment 1Document2 pagesAssignment 1Utsav PathakNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- TVM Practice Questions With AnswersDocument4 pagesTVM Practice Questions With AnswersAhmed NomanNo ratings yet

- Problems For Topic 3Document4 pagesProblems For Topic 3Quỳnh Anh TrầnNo ratings yet

- Tutorial 4 TVM ApplicationDocument4 pagesTutorial 4 TVM ApplicationTrần ThảoNo ratings yet

- University of Pennsylvania The Wharton SchoolDocument18 pagesUniversity of Pennsylvania The Wharton SchoolBassel ZebibNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Problem Set #2 Financial Management Professor KuhleDocument2 pagesProblem Set #2 Financial Management Professor KuhleYuRi LuvNo ratings yet

- Tutorial 2 (TVM) - Questions: Present Value Years Future ValueDocument2 pagesTutorial 2 (TVM) - Questions: Present Value Years Future ValueSadia R ChowdhuryNo ratings yet

- Final Exam Review-VrettaDocument4 pagesFinal Exam Review-VrettaAna Cláudia de Souza0% (2)

- Practice Set - TVMDocument2 pagesPractice Set - TVMVignesh KivickyNo ratings yet

- EconomicsDocument11 pagesEconomicsJorosh Laurente DelosoNo ratings yet

- 991財管題庫Document10 pages991財管題庫zzduble1No ratings yet

- Bài Tập ThêmDocument9 pagesBài Tập ThêmK59 Vu Nguyen Viet LinhNo ratings yet

- Time Value of Money 2Document6 pagesTime Value of Money 2k61.2211155018No ratings yet

- MidTermPractice FV PV Questions AnnuityDocument9 pagesMidTermPractice FV PV Questions AnnuityPurvi VayedaNo ratings yet

- TUTORIALDocument10 pagesTUTORIALViễn QuyênNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Nanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)cccqNo ratings yet

- TVM Questions IDocument4 pagesTVM Questions IRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet

- Assignemt - Chapter 2 - Time Value of MoneyDocument3 pagesAssignemt - Chapter 2 - Time Value of Money721d0042No ratings yet

- Assign 2Document3 pagesAssign 2Abdul Moqeet100% (1)

- Nanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)asdsadsaNo ratings yet

- Chapter 8. Time Value of Money. ExerciseDocument3 pagesChapter 8. Time Value of Money. ExerciseMai Linh LươngNo ratings yet

- BF Assign1Document3 pagesBF Assign1Mian Shawal67% (3)

- Question BankDocument3 pagesQuestion BankMuhammad HasnainNo ratings yet

- Handout2 PDFDocument2 pagesHandout2 PDFTheresiaVickaaNo ratings yet

- TUTORIALS TIME VALUE OF MONEY - SssDocument3 pagesTUTORIALS TIME VALUE OF MONEY - Ssssethsebeh496No ratings yet

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- FM A Assignment 19-40659-1Document11 pagesFM A Assignment 19-40659-1Pacific Hunter JohnnyNo ratings yet

- Time Value of Money AssignmentDocument1 pageTime Value of Money AssignmentawaischeemaNo ratings yet

- Additional Time Value ProblemsDocument2 pagesAdditional Time Value ProblemsBrian WrightNo ratings yet

- Assignment 1Document4 pagesAssignment 1Ahmad Ullah KhanNo ratings yet

- Workbook1 TimevalueofMoneyDocument2 pagesWorkbook1 TimevalueofMoneyDe BuNo ratings yet

- The 100-Year Mortgage is Coming: How to Position Your Family to Avoid It: Financial Freedom, #218From EverandThe 100-Year Mortgage is Coming: How to Position Your Family to Avoid It: Financial Freedom, #218No ratings yet

- Turn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138From EverandTurn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138No ratings yet

- FHA FULL Condo Questionnaire 12-09Document2 pagesFHA FULL Condo Questionnaire 12-09The Pinnacle TeamNo ratings yet

- Dexos1™ Gen 2 Brands - Lista CompletaDocument20 pagesDexos1™ Gen 2 Brands - Lista CompletaRoger ObregonNo ratings yet

- Momo Statement - 250783521544-1.pdf WENDocument27 pagesMomo Statement - 250783521544-1.pdf WENJonathan HAKIZIMANA0% (1)

- Hallstead Jewelers PDFDocument9 pagesHallstead Jewelers PDFRaghav JainNo ratings yet

- Trust DeedDocument5 pagesTrust Deedkoroukh100% (3)

- Six Sigma Black Belt Wk1-Define & MeasureDocument452 pagesSix Sigma Black Belt Wk1-Define & MeasureRaghavendra Narayanaswamy100% (11)

- Macroeconomics: Case Fair OsterDocument28 pagesMacroeconomics: Case Fair OsterMikhel BeltranNo ratings yet

- Line and Grade Evaluation ChecklistDocument1 pageLine and Grade Evaluation Checklistjuan dela cruzNo ratings yet

- Apollo Semiconductor Philippines Vs Commissioner January 14, 2015 GR No. 168950Document3 pagesApollo Semiconductor Philippines Vs Commissioner January 14, 2015 GR No. 168950Aerwin AbesamisNo ratings yet

- VM OlacabDocument2 pagesVM OlacabNikhil KatariaNo ratings yet

- Determination of BPL in IndiaDocument34 pagesDetermination of BPL in IndiaAbhimanyu Singh100% (1)

- Sole Proprietorship in MalaysiaDocument3 pagesSole Proprietorship in MalaysiaAimanAl-Bakir100% (1)

- DEAF CircularDocument48 pagesDEAF CircularNikita SalunkheNo ratings yet

- Introduction To International Business Chapter 1Document23 pagesIntroduction To International Business Chapter 1Mohd Haffiszul Bin Mohd Said100% (1)

- Document Rizal - 012038Document5 pagesDocument Rizal - 012038John Michael LesacaNo ratings yet

- (Lecture 5) Road User CostsDocument8 pages(Lecture 5) Road User Costsعلي صبحي عبد المنعمNo ratings yet

- 2009 KOF Index of Globalization: Definitions and SourcesDocument2 pages2009 KOF Index of Globalization: Definitions and SourcesAbby Sta AnaNo ratings yet

- Postal Manual Volume - 7Document189 pagesPostal Manual Volume - 7K V Sridharan General Secretary P3 NFPE100% (2)

- BOP Analysis of India, US and Germany From 2004-2014Document20 pagesBOP Analysis of India, US and Germany From 2004-2014Shruti GuptaNo ratings yet

- Heb 140X12 S275j0+arDocument1 pageHeb 140X12 S275j0+arvratsista agoritsaNo ratings yet

- A REPORT On Balance of PaymentDocument38 pagesA REPORT On Balance of PaymentPriaynk70% (23)

- L Oréal Travel Retail Presentation SpeechDocument6 pagesL Oréal Travel Retail Presentation Speechsaketh6790No ratings yet

- App Deped TemplateDocument15 pagesApp Deped TemplateKnoll ViadoNo ratings yet

- KEW320Document12 pagesKEW320نور فازاليناNo ratings yet

- Priya SinghDocument3 pagesPriya Singhsarvesh.bhartiNo ratings yet

- JamaicaDocument3 pagesJamaicaKelz YouknowmynameNo ratings yet

- U1VCMTQ5NDADocument3 pagesU1VCMTQ5NDAMūšť ÃphæNo ratings yet

- Capacity UtilisationDocument17 pagesCapacity UtilisationRaniiiNo ratings yet