Professional Documents

Culture Documents

Banking Financial Services & Insurance - 2013

Banking Financial Services & Insurance - 2013

Uploaded by

rishi2studyCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Jasmin's Black Book ProjectDocument67 pagesJasmin's Black Book ProjectJasmin John Sara83% (12)

- 2000 Banking Awareness MCQsDocument193 pages2000 Banking Awareness MCQsSniper Souravsharma100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- DocxDocument5 pagesDocxLorraine Mae Robrido100% (2)

- Kotak Mahindra Bank E-Mailed StatementDocument4 pagesKotak Mahindra Bank E-Mailed StatementManish KumarNo ratings yet

- IT ITeS Telecom Media Education 2013Document61 pagesIT ITeS Telecom Media Education 2013rishi2studyNo ratings yet

- Accounting Standards - 10 - 11 - 12 - Group 4Document29 pagesAccounting Standards - 10 - 11 - 12 - Group 4rishi2studyNo ratings yet

- Name Stream Time Order: Panel 1 Gurukula Room 7Document5 pagesName Stream Time Order: Panel 1 Gurukula Room 7rishi2studyNo ratings yet

- Quotation - Cum - Proforma Invoice: Sanskriti Team MDI Gurgaon 8826924005Document2 pagesQuotation - Cum - Proforma Invoice: Sanskriti Team MDI Gurgaon 8826924005rishi2studyNo ratings yet

- Indian Bank Case Study - GesDocument5 pagesIndian Bank Case Study - Gesvamsi krishNo ratings yet

- Student Fees Collection Slip: (This Deposit Slip Will Only Be Allowed For)Document2 pagesStudent Fees Collection Slip: (This Deposit Slip Will Only Be Allowed For)Mainuddin ShIkderNo ratings yet

- 2013-Trujillo-Ponce-What Determines The Profitability of Banks-Evidence From Spain-Accounting & FinanceDocument26 pages2013-Trujillo-Ponce-What Determines The Profitability of Banks-Evidence From Spain-Accounting & Financewrecker_scorpionNo ratings yet

- BPI Vs Suarez G.R. No. 167750Document10 pagesBPI Vs Suarez G.R. No. 167750JetJuárezNo ratings yet

- For Their Own Account or For The Account of OthersDocument4 pagesFor Their Own Account or For The Account of OthersMay Angelica TenezaNo ratings yet

- Pa1 1402Document11 pagesPa1 1402Joris YapNo ratings yet

- What Is AccountingDocument76 pagesWhat Is AccountingMa Jemaris Solis0% (1)

- Money Chapter NotesDocument7 pagesMoney Chapter NotesChandan TenduNo ratings yet

- FABM2 12 Quarter2 Week2 3Document15 pagesFABM2 12 Quarter2 Week2 3Princess DuquezaNo ratings yet

- Benificiary/Remittance Details CPQ3946000 CEN 01 2019 NTPC 12106562277Document1 pageBenificiary/Remittance Details CPQ3946000 CEN 01 2019 NTPC 12106562277manphool singhNo ratings yet

- Coa MyobDocument4 pagesCoa Myobalthaf alfadliNo ratings yet

- 4 Preparing A Bank ReconciliationDocument9 pages4 Preparing A Bank ReconciliationSamuel DebebeNo ratings yet

- Allied Banking Corporation vs. Sps. MacamDocument2 pagesAllied Banking Corporation vs. Sps. MacamMarvien BarriosNo ratings yet

- Liquidity Ratio AnalysisDocument43 pagesLiquidity Ratio AnalysisBaburam LamaNo ratings yet

- An Overview of The Financial System: ChoiceDocument32 pagesAn Overview of The Financial System: ChoiceHaris Fadžan0% (1)

- ECON 206 Sample MC Questions Midterm 2Document6 pagesECON 206 Sample MC Questions Midterm 2James DeenNo ratings yet

- ABM Business - Mathematics 11 Week 1Document4 pagesABM Business - Mathematics 11 Week 1Dominic jarinNo ratings yet

- Banking ProjectDocument24 pagesBanking ProjectHaseeb ParachaNo ratings yet

- UBL Internship ReportDocument102 pagesUBL Internship ReportkamilbismaNo ratings yet

- Vivas CaseDocument3 pagesVivas CaseSur ReyNo ratings yet

- Fdic Deposit-Insurance-At-A-Glance-EnglishDocument2 pagesFdic Deposit-Insurance-At-A-Glance-EnglishSamNo ratings yet

- Prakas ON Anti-Money Laundering and Combating The Financing of TerrorismDocument25 pagesPrakas ON Anti-Money Laundering and Combating The Financing of TerrorismChoung Mi AkehurstNo ratings yet

- Online Banking of Sunrise Bank Limited.: A Project Work ReportDocument28 pagesOnline Banking of Sunrise Bank Limited.: A Project Work ReportSachin JhaNo ratings yet

- FIIM Assignment 01Document13 pagesFIIM Assignment 01Firaol DelesaNo ratings yet

- Nepalese Banking Crisis ExplainedDocument5 pagesNepalese Banking Crisis ExplainedChandan SapkotaNo ratings yet

- General Terms and ConditionsDocument47 pagesGeneral Terms and ConditionsCharmaine CorpuzNo ratings yet

Banking Financial Services & Insurance - 2013

Banking Financial Services & Insurance - 2013

Uploaded by

rishi2studyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Financial Services & Insurance - 2013

Banking Financial Services & Insurance - 2013

Uploaded by

rishi2studyCopyright:

Available Formats

Unnati Investment Management

and Research Group

Sector Report 2013

____________________________

Banking, Financial Services and Insurance

Prepared By:

Darshan Gandhi

Adit Agrawal

(1)

Unnati Investment Management & Research Group

BFSI Sector Report

Contents

Banking................................................................................................................................................ 5

What is a bank? ................................................................................................................................... 5

How does a bank function? ................................................................................................................ 5

Financial analysis of a bank ................................................................................................................. 5

Balance sheet ...................................................................................................................................... 5

Income statement ............................................................................................................................... 7

Understanding the Business model of a bank .................................................................................... 8

The Banking Sector in India............................................................................................................... 11

Reserve Bank of India........................................................................................................................ 11

Major Banking Sector Reforms since 1991 ....................................................................................... 11

Commercial banks............................................................................................................................. 13

Specialized Banks .............................................................................................................................. 16

Institutional Banks ............................................................................................................................ 16

NBFCs ................................................................................................................................................ 16

Co-operative banks ........................................................................................................................... 16

Basel - Capital Accord Norms ............................................................................................................ 17

Basel I Norms .................................................................................................................................... 17

Basel II Norms ................................................................................................................................... 17

Basel III Norms .................................................................................................................................. 17

Major Differences between BASEL 2 and BASEL 3 Norms ................................................................ 18

Are Indian banks adequately prepared for migration to Basel III regime?....................................... 19

Classification of Assets ...................................................................................................................... 20

Provisioning of Assets ....................................................................................................................... 21

Menace of Rising NPAs ..................................................................................................................... 21

Corporate Debt Restructuring .......................................................................................................... 22

Financial Inclusion ............................................................................................................................. 23

Priority Sector Lending ...................................................................................................................... 23

Macroeconomic Factors affecting Banks .......................................................................................... 24

Current Account Deficit .................................................................................................................... 24

Poor Governance .............................................................................................................................. 24

Fiscal Deficit ...................................................................................................................................... 24

Inflation ............................................................................................................................................. 25

(2)

Unnati Investment Management & Research Group

BFSI Sector Report

GAAR ................................................................................................................................................. 26

Money Supply ................................................................................................................................... 26

Liquidity............................................................................................................................................. 27

Quantitative Easing (Bond Buying Program/Asset Purchase Program) ............................................ 28

RBI liquidity tightening measures ..................................................................................................... 28

Insurance........................................................................................................................................... 29

Classification of the insurance sector ............................................................................................... 29

Bank Insurance Model or Bancassurance ......................................................................................... 29

Overview of the insurance sector in India ........................................................................................ 30

New developments in the insurance industry .................................................................................. 31

Government Role in the Insurance Sector ........................................................................................ 31

Outlook for the Insurance Industry................................................................................................... 31

Non-Banking Financial Services ........................................................................................................ 33

The NBFC sector in India ................................................................................................................... 33

Regulations related to the NBFC sector in India ............................................................................... 35

Microfinance ..................................................................................................................................... 36

Mutual Funds .................................................................................................................................... 37

Other Financial Services .................................................................................................................... 38

RBI Credit and Monetary Policy ........................................................................................................ 39

Cash Reserve Ratio ............................................................................................................................ 39

Repo Rate .......................................................................................................................................... 39

Reverse Repo Rate ............................................................................................................................ 39

Statutory Liquidity Ratio ................................................................................................................... 39

Bank Rate .......................................................................................................................................... 40

Capital Adequacy Ratio(CAR) ............................................................................................................ 40

Other Financial Instruments ............................................................................................................. 41

Bonds and Debentures...................................................................................................................... 41

Commercial papers ........................................................................................................................... 41

The Indian Debt Market .................................................................................................................... 41

Outlook of the Indian Debt Market .................................................................................................. 41

Credit Ratings .................................................................................................................................... 42

Currency Exchange............................................................................................................................ 42

HDFC Bank......................................................................................................................................... 44

Yes Bank ............................................................................................................................................ 45

(3)

Unnati Investment Management & Research Group

BFSI Sector Report

Sector Outlook .................................................................................................................................. 46

(4)

Unnati Investment Management & Research Group

BFSI Sector Report

Banking

The Banking sector is one of the most important sectors of the Indian economy. As such, it is highly

regulated with the responsibility being in the hands of The Reserve Bank of India (RBI). Given the

ability of the banking sector to affect the economy, this sector is one of the most regulated sectors

in India. A strong and viable banking industry is extremely necessary for economic progress while a

weak banking sector is a cause for problems in the economy. Banking is used for policy transmissions

and for sustaining economic growth.

What is a bank?

A bank is a financial institution which acts as an intermediary between borrowers and lenders. It

takes in deposits from lenders and gives it to borrowers. In the process, it earns the difference

between interest received from borrowers and interest paid to lenders.

How does a bank function?

A bank pools in money from a large number of lenders (known as depositors). In return, it gives

them a return on investment which is commonly known as interest. The money which the bank

receives from depositors is given to borrowers, who pay interest on the amount borrowed. The

difference in the interest received and the interest paid is the income for the bank, which the bank

uses to pay for its expenses and any amount left is profit for the bank. Banks take in money from a

large number of depositors and lend money to a large number of borrowers. This creates a flow of

money in the banking system while also spreading the risks associated with lending to a large

number of borrowers. Banks charge money for acting as intermediary in managing this flow of

money and any risks they are undertaking by the giving of loans.

Financial analysis of a bank

Before the financial analysis of a bank we need to be clear about the various elements of a banks

balance sheet and income statement.

Balance sheet

A banks balance sheet summarizes its assets and liabilities at any point of time. These terms are

explained below with respect to a bank's balance sheet.

Capital and Liabilities: These include the Banks net worth and the obligations of the bank to

external entities. These include

(a) Share Capital and Reserves and Surplus: Share Capital is the initial money put in by investors or

raised through an IPO, FPO or a rights issue. Reserves and Surplus includes net profit transferred to

the balance sheet.

(b) Deposits: There are four types of deposit accounts, these are

(5)

Unnati Investment Management & Research Group

BFSI Sector Report

i) Savings Account: This is the most basic account available with a bank. This is operated by

individuals who use it to deposit their money and operate the account with a cheque book. There is

generally a minimum balance requirement for these accounts with this amount differing based on

the location of the branch in which the account is located. The interest rate on these accounts was

fixed by RBI at 4% per annum, but was de-regulated in 2011 allowing banks to give higher rates of

interest. Currently banks like Yes Bank, Indusind Bank and Kotak Mahindra Bank (to name a few) are

paying higher interest rates than the standard 4%. Interest on a savings account is calculated on a

daily basis.

ii) Current Account: This is an account mainly used by businesses and has very frequent deposits and

withdrawals. This account has no minimum balance and there is no limit on the number of

withdrawals in a current account. Interest is also not paid on a current account. These accounts also

allow for the facility of overdraft for businesses. This account is usually operated by means of cheque

books.

Savings account and current account are examples of demand deposit accounts.

iii) Recurring deposit Account: This type of account is mostly used by individuals who want the

benefits of a fixed deposit but do not have a lump sum to deposit at one time. Hence they deposit a

relatively small amount every month. The interest paid on recurring deposits is paid on the amount

that has been already deposited. The interest paid on these accounts is usually equal to the interest

paid on fixed deposits.

iv) Fixed deposit Account: This type of account reflects deposits that are made by depositing a lump

sum amount for a fixed tenure. The interest rates offered are the highest for this type of account.

This type of deposit is the most stable source of income for the bank.

Recurring deposit account and fixed deposit account are examples of term deposit accounts.

(c) Borrowings: In order to meet their obligations, banks also raise money through wholesale

funding. This includes funds borrowed from RBI or raised through the capital debt market via

instruments such as debentures, bonds, certificate of deposits, commercial papers and short term

borrowings from other banks and financial institutions. The cost of debt raised by banks depends

upon the credit rating of the bank. The cost of wholesale funding is generally high but banks raise

money through this method when they need funds for expansion but are unable to get them

through deposits which are a cheaper option. Banks may also raise funds from overseas debt market

to take advantage of low interest rates. Banks like HDFC Bank, Bank of India and SBI have recently

raised debt through this method.

(d) Other Liabilities and provisions: This includes bills payable, interest accrued, contingent

provisions against standard assets and proposed dividend (including tax on dividend).

Assets: An asset is a resource that leads to a future inflow of economic benefits. For a bank, assets

include (a) Fixed Assets: These include office buildings (if owned), furniture, computers and other items

such as ATM machines. However, it constitutes a very small part of assets for a bank because most

of its branches run on rent/lease.

(b) Loans and advances: Loan refers to money which is lent to a borrower by a bank. Banks charge

interest on loans and this is their primary source of income. An advance is money given to you now

(6)

Unnati Investment Management & Research Group

BFSI Sector Report

but to be taken out of money you would make in the future. Loans can be categorized into short

term/long term, secured/unsecured loans. These include mortgages, credit card loans, overdrafts

etc.

(c) Government Bonds and other approved securities: It is a statutory requirement that every bank

in India has to maintain a certain percentage of its deposits in the form of gold or approved

securities with the RBI. This requirement is known as statutory liquidity ratio (SLR). Currently the SLR

rate is 23%. The sanctioned upper limit for SLR is 40 %.

(d) Cash and cash equivalents and balances with RBI: This includes the cash that banks are required

to keep with RBI. This is known as the cash reserve ratio (CRR). Currently this is 4.00 %. Banks do not

earn any interest on this amount.

(e) Other assets: This includes investment made by banks and can be a source of income for the

bank.

Income statement

This is the banks Profit and Loss account, the various elements of which are given as:

(a) Interest income: The primary income of the bank comes from this category. This includes the

interest earned on loans and advances. This also includes interest on loans given to other financial

institutions and banks and deposits with the RBI, and any interest earned on bonds which the bank

owns.

(b) Non Interest income: This is income primarily derived from fees which the bank charges. This

includes deposit and transaction fees, annual fees (for services like credit cards), brokerage fees etc.

Non Interest is a less volatile form of income since it does not depend as much on interest rate

changes as interest income. A higher proportion leads to more stable earnings.

(c) Interest expense: This represents the interest paid by a bank on deposits, wholesale borrowings,

and loans taken from RBI or from other financial institutions.

(d) Operating expense: This includes expenses which are incurred in running the day to day

operations of the bank, namely costs like salaries, rent, depreciation, advertising etc.

(e) Provisions: Since not each and every loan will be paid back in full, banks have to make provisions

for these loans. Banks thus set aside a percentage of their income to account for these possible

losses. This ensures that the bank remains solvent and there are no sudden unexpected huge losses

to the bank. The amount set aside for provisioning depends on the size of a bank's assets and the

risk associated with each type of asset. The norms for provisioning are decided by the RBI.

(7)

Unnati Investment Management & Research Group

BFSI Sector Report

Understanding the Business model of a bank

As explained above, a bank functions by giving loans to individuals, corporates and other entities and

charging interest on the amount lent. This amount is raised by taking deposits from individuals,

corporates and other entities along with loans from other banks and financial institutions and RBI. It

pays interest on this amount. Besides this, other sources of income for banks include income from

treasury operations, advisory, trade finance and retail fees. However, for most banks these sources

contribute only a small but growing portion of their income as compared to interest income.

Majority of the profits for the bank are associated with the difference between interest received and

the interest paid.

Net Interest margin (NIM): This is a measure of profitability of a bank. This is the difference between

the interest income received and the interest paid out of relative assets. A higher NIM means that

the bank is generating higher income from its assets.

CASA ratio: As discussed earlier, there are many different types of deposit accounts available in a

bank. These include savings account, current account, term deposits (recurring and fixed deposit).

Out of these four accounts, the highest interest is paid on term deposits while the lowest interest is

paid on current and savings account. While most banks dont pay any interest on the current

account, they pay a low rate of interest on savings accounts. Hence, higher the CASA ratio, higher

the amount of cheap funds available to the bank, which means a higher operating efficiency due to

higher Net Interest Margin (NIM).

Let us now look at the balance sheet and P&L account of a bank in order to understand its

operations in a better manner.

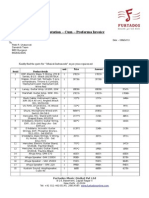

The following table shows the various assets and liabilities listed under the balance sheet of a bank:

(Figures in Mn. INR)

Particulars

Average balance

Assets:

Cash and balances with RBI

635000

Loans Given: I

Housing Mortgage

1800000

Consumer loans (includes auto, education and personal loans)

Credit card loans

600000

16000

Loans given to enterprises and corporate

8000000

Investments in Government bonds :II

4340000

Investments in other interest earning assets: III

347000

Total Earning Assets (I+II+III)

15103000

Fixed Assets

120000

Total Assets

15858000

Liabilities:

(8)

Unnati Investment Management & Research Group

BFSI Sector Report

Share Capital

20000

Reserves and Surplus

1400000

Interest Bearing liabilities (Deposits): I

Savings account deposits

3500000

Current account deposits

2100000

Recurring account deposits

800000

Fixed Deposits

5300000

Borrowings: II

From RBI

80000

From other financial institutions

1500000

Total interest Bearing liabilities: I+II

13280000

Non interest bearing liabilities

1158000

Total Liabilities

15858000

Since most of the income and expense of a bank is in the form of interest and the interest rates for

each type of asset or liability is known, a bank's balance sheet is very important and to a fairly large

extent determines its income statement. This is unlike other businesses where there is no direct

relation between balance sheet and the income statement and income and expenditure cannot be

estimated from balance sheet.

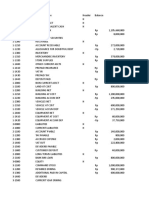

Now let us look at how the balance sheet may be used to estimate the income statement of a bank:

(Figures in Mn. INR)

Particulars

Average

balance

Assets:

Cash and balances with RBI

Loans Given: I

Housing Mortgage

Rate of Interest

Interest

Income /

(Expense)

635000

0.00%

1800000

11.50%

2,07,000

600000

12.30%

73,800

16000

8000000

4340000

20.00%

14.00%

8.00%

3,200

11,20,000

3,47,200

Consumer loans (includes auto, education

and personal loans)

Credit card loans

Loans given to enterprises and corporates

Investments in Government bonds :II

Investments in other interest earning

assets: III

Total Earning Assets (I+II+III)

Fixed Assets

347000

9.00%

31,230

15103000

120000

11.80%

0.00%

17,82,430

0

Total Assets

15858000

Liabilities:

Share Capital

Reserves and Surplus

Interest Bearing liabilities (Deposits): I

20000

1400000

(9)

17,82,430

0.00%

0.00%

Unnati Investment Management & Research Group

BFSI Sector Report

Savings account deposits

Current account deposits

Recurring account deposits

Fixed Deposits

Borrowings: II

From RBI

From other financial institutions

Total interest Bearing liabilities: I+II

Non interest bearing liabilities

3500000

2100000

800000

5300000

4.00%

0.00%

8.50%

9.00%

(1,40,000)

(68,000)

(4,77,000)

80000

1500000

13280000

1158000

7.25%

8.50%

6.16%

0.00%

(5,800)

(1,27,500)

(8,18,300)

-

Total Liabilities

15858000

(8,18,300)

Now we have the interest income and expense of bank from its balance sheet and it can be used to

construct its income statement as given. The values for interest income and expenditure have been

taken directly from the calculations done in the balance sheet.

(Figures in Mn. INR)

Particulars

Interest Earned

Interest Expenditure

Net Interest income

Other income

Current

17,82,430

8,18,300

9,64,130

1,58,000

Total Income

Operating expense

Provisions for bad debts

Total Expenditure

Earnings before Tax

Taxes

11,22,130

3,00,000

1,00,000

4,00,000

7,22,130

2,38,303

Earnings after Tax

4,83,827

It is clearly visible from the above tables that most of the income of a bank comes from interest on

its assets and hence balance sheet is the most important accounting statement when evaluating a

bank. Hence, the size of bank depends upon the size of balance sheet.

(10)

Unnati Investment Management & Research Group

BFSI Sector Report

The Banking Sector in India

The banking sector in India is controlled by the Reserve Bank of India (RBI).

Reserve Bank of India

The Reserve Bank of India (RBI), which commenced operations on April 1, 1935, is at the centre of

Indias financial system. Hence it is called the Central Bank. It has a fundamental commitment of

maintaining the nations monetary and financial stability. It started as a private shareholders bank

but was nationalized in 1949, under the Reserve Bank (Transfer of Public Ownership) Act, 1948.

RBI is banker to the Central Government, State Governments and Banks.

Key functions of RBI include:

Monetary policy formulation

Supervision of Banking companies, Non-banking Finance companies and Financial Sector,

Primary Dealers and Credit Information Bureaus

Regulation of money market, government securities market, foreign exchange market and

derivatives linked to these markets

Management of foreign currency reserves of the country and its current and capital account

Issue and management of currency

Oversight of payment and settlement systems

Development of banking sector

Research and statistics

While RBI performs these functions, the actual banking needs of individuals, companies and other

establishments are majorly met by banking institutions (called commercial banks) and nonbanking

finance companies that are regulated by RBI.

RBI exercises its supervisory powers over banks under the Banking Companies Act, 1949, which later

became Banking Regulation Act, 1949.

Major Banking Sector Reforms since 1991

The economic reforms initiated in 1991 also embraced the banking system. Following are the major

reforms aimed at improving efficiency, productivity and profitability of banks:

New banks licensed in private sector to inject competition in the system - 10 in 1993 and 2 more

in 2003. Another lot of new banks will be licensed in the next few months

Aggregate foreign investment (FDI, FII and NRI) up to 74% allowed in private sector banks

Listing of PSBs on stock exchanges and allowing them to access capital markets for augmenting

their equity, subject to maintaining Government shareholding at a minimum of 51%. Private

shareholders represented on the Board of PSBs

Progressive reduction in statutory pre-emption (SLR and CRR) to improve the resource base of

banks so as to expand credit available to private sector. SLR currently at 23% (38.5% in 1991) and

CRR at 4% (15% in 1991)

Adoption of international best practices in banking regulation. Introduction of prudential norms

on capital adequacy, IRAC (income recognition, asset classification, provisioning), exposure

norms etc.

Phased liberalisation of branch licensing. Banks can now open branches in Tier 2 to Tier 6

centres without prior approval from the Reserve Bank

Deregulation of a complex structure of deposit and lending interest rates to strengthen

competitive impulses, improve allocative efficiency and strengthen the transmission of

monetary policy

Base rate (floor rate for lending) introduced (July 2010). Prescription of an interest rate floor on

savings deposit rate withdrawn (October 2011)

Functional autonomy to PSBs

(11)

Unnati Investment Management & Research Group

BFSI Sector Report

Use of information technology to improve the efficiency and productivity, enhance the payment

and settlement systems and deepen financial inclusion

Improvements in the risk management culture of banks

Next are the various types of banking and non- banking financial institutions which function under

the guidelines laid by RBI.

The general overview of India's banking sector can be given as:

RBI

Commercial

Banks

Nationalize

d Banks

SBI and

Associate

Banks

Specialized

Banks

Foreign

Banks

Private

Sector

Banks

Old Private

Sector

Banks

New

Private

Sector

Banks

Regional

Rural Banks

Institutional

Banks

Non Banking

Financial

Institutions

Co-operative

Banks

Land

Mortgage

IFCI

Asset

Finance

companies

Primary

Credit

societies

Rural Credit

SFCs

Investment

companies

State Cooperative

banks

Industrial

Development

IRBI

Loan

companies

Central cooperative

banks

Housing

Finance

Infrastructure

Finance

companies

EXIM Bank

Systematically

important

core

investment

companies

NABARD

SIDBI

(12)

Unnati Investment Management & Research Group

BFSI Sector Report

Commercial banks

A commercial bank may be defined as a financial institution that provides services, such as accepting

deposits, giving business loans and auto loans, mortgage lending, and basic investment products like

savings accounts and certificates of deposit. In addition to giving short-term loans, commercial banks

also give medium-term and long-term loans to business enterprises.

Commercial banks are of the following five types:

Nationalized banks

SBI and associates

Regional rural banks

Private sector banks

Foreign banks

The distribution of deposits, credit given and national coverage is shown below:

Source: RBI, Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks: December 2012

(13)

Unnati Investment Management & Research Group

BFSI Sector Report

Source: RBI, Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks: December 2012

Source: RBI, Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks: December 2012

(14)

Unnati Investment Management & Research Group

BFSI Sector Report

Public sector banks (Nationalized, SBI and associates)

These are banks where majority stake (minimum 51%) is held by the Government of India. IDBI Bank,

State Bank of India and its five associates and 19 nationalized banks fall under this segment. These

banks are listed in the stock market.

State Bank of India and its associates are - State Bank of India, State Bank of Bikaner and Jaipur,

State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala and State Bank of Travancore.

Together, they have the largest number of bank branches in India with a network of almost 20,000

branches and over 35,000 ATMs. They have the largest share of public deposits with 22.5% of

deposits and 22.6% of credit. This group is also the countrys biggest in terms of asset size - about Rs.

21.8 lakh crores worth of assets wherein SBIs assets are worth Rs. 16.2 lakh crores.

Other Nationalized Banks are - Allahabad Bank, Andhra Bank, Bank of Baroda, Bank of India, Bank of

Maharashtra, Canara Bank, Central Bank of India, Corporation Bank, Dena Bank, Indian Bank, Indian

Overseas Bank, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, Syndicate

Bank, UCO Bank, Union Bank of India, United Bank of India and Vijaya Bank. Many of these banks

were private banks earlier but were nationalized by the government in pursuance with its socialist

objectives. The primary objective of nationalized banks is to meet the social requirements of

providing financial inclusion and services to the weaker sections of the society.

Private Sector Banks

These are banks for which majority of share capital is held by private individuals. These banks can be

classified into two categories:

Old Private Sector Banks

The private banks, which existed and were not nationalized at the time of bank nationalization that

took place during 1969 and 1980, are known to be the old private sector banks. These were not

nationalized, because of their small size and regional focus. Some of the main old private sector

banks are Catholic Syrian Bank, Federal Bank, ING Vysya Bank, Dhanlaxmi Bank and Karnataka Bank.

New Private Sector Banks

These are the Private Banks which were set up post liberalization, with the introduction of reforms in

the banking sector. The entry of new private sector banks was permitted after the Banking

Regulation Act was amended. Banking licenses were given in two phases. In the first phase, in 1994

banks like HDFC and ICICI were given licenses. In the next round of bank licenses, in 2004 banks like

Yes Bank were set up. The prominent new private sector banks are HDFC Bank, ICICI Bank, Axis Bank,

Yes Bank and Kotak Mahindra Bank.

Foreign Banks

Foreign banks have their registered and head offices in a foreign country but operate their branches

in India. The RBI permits these banks to operate either through branches; or through wholly-owned

subsidiaries. The primary activity of most foreign banks in India has been in the corporate segment.

In addition to the entry of the new private banks in the mid-90s, the increased presence of foreign

banks in India has also contributed to boosting competition in the banking sector.

As of 31st March 2013, there were 43 Foreign Banks who had branches in India; 46 banks had

representative offices in India. There were a total of 331 branches of foreign banks in India with

Standard Chartered Bank (101) having the highest number of branches.

(15)

Unnati Investment Management & Research Group

Bank

BFSI Sector Report

Country Of

origin

Number of

Branches

Standard Chartered Bank

UK

101

HSBC Limited

Hong Kong

50

Citibank N.A.

USA

42

The Royal Bank of Scotland N.V.

Netherlands

31

Deutsche Bank

Germany

18

The other major foreign banks are DBS Bank, Barclays and BNP Paribas.

As per new Government regulations, foreign banks with more than 20 branches will have to conform

to priority sector lending norms of providing 40% credit to the priority sector which includes

agriculture, micro and small enterprises, education, housing and export credit.

Till recently, the 40% priority sector loan norm was applicable to local banks; for foreign banks it was

32%. Even within this, 12% could have been given as export credit. Now, the credit option has also

been removed and only export credit to the priority sector will be treated as priority sector credit.

The new norms come into effect from August, 2018.

Specialized Banks

There are some banks, which cater to the requirements and provide overall support for setting up

business in specific areas of activity. EXIM Bank, SIDBI and NABARD are examples of such banks.

They engage themselves in some specific area or activity and thus, are called specialized banks.

Institutional Banks

These are banks which were set up by the Government with the purpose of catering to the needs of

the Industry. These banks provide low cost funds to borrowers. Examples include institutions like

IFCI and the State Financial Corporations (SFCs).

NBFCs

Non-Banking Financial institutions or NBFCs are those financial institutions which provide financial

services without meeting the general definition of bank. These institutions do not hold a banking

license. Despite this, they provide a wide range of financial services and are regulated by the RBI.

NBFCs offer most of the services offered by the conventional banking system including loans and

credit facilities, education funding, retirement plans, wealth management and trading in money

markets. NBFCs can accept public deposits but they cannot demand deposits. NBFCs do not form a

part of the payment and settlement system and hence cannot issue cheques drawn on self. NBFCs

are discussed in more detail later in the report.

Co-operative banks

A co-operative bank is a financial entity which belongs to its members, who are at the same time the

owners and the customers of their bank. Co-operative banks are often created by persons belonging

to the same local or professional community or sharing a common interest. Co-operative banks

generally provide their members with a wide range of banking services (loans, deposits, banking

accounts, etc.). Co-operative banks are formed under the Co-operative societies act. Co-operative

banks are run on not for profit basis.

(16)

Unnati Investment Management & Research Group

BFSI Sector Report

Basel - Capital Accord Norms

Basel, a city in Switzerland is the headquarters of Bureau of International Settlement (BIS), which

fosters co-operation among central banks with a common goal of financial stability and common

standards of banking regulations. Every two months, BIS hosts a meeting of the governor and senior

officials of central banks of member countries. Currently there are 27 member nations in the

committee which also includes India. Basel guidelines refer to broad supervisory standards

formulated by this group of central banks - called the Basel Committee on Banking Supervision

(BCBS). The set of agreements by the BCBS, which mainly focuses on risks to banks and the financial

system, is called the Basel accord. The purpose of the accord is to ensure that financial institutions

have enough capital to meet obligations and absorb unexpected losses. India has accepted Basel

accords for the banking system.

Basel I Norms

In 1988, BCBS introduced capital measurement system called Basel capital accord, also called as

Basel I. It focused almost entirely on credit risk. It defined capital and structure of risk weights for

banks. The minimum capital requirement was fixed at 8% of risk weighted assets (RWA). RWA means

assets with different risk profiles. For example, an asset backed by collateral would carry lesser risks

as compared to personal loans, which have no collateral. The G-10 countries agreed to apply the

common minimum capital standards to their banking industries by end of 1992. India adopted Basel

I guidelines in 1999.

Basel II Norms

In June 2004, Basel II guidelines were published by BCBS, which were considered to be the refined

and reformed versions of Basel I accord. The guidelines were based on three parameters, which the

committee calls it as pillars:

1. Capital Adequacy Requirements: Banks should maintain a minimum capital adequacy

requirement of 8% of risk assets.

2. Supervisory Review: According to this, banks were needed to develop and use better risk

management techniques in monitoring and managing all the three types of risk that a bank faces,

viz. credit, market and operational risk.

3. Market Discipline: This needs increased disclosure requirements. Banks need to mandatorily

disclose their CAR, risk exposure, etc. to the central bank.

Basel III Norms

In 2010, Basel III guidelines were released. These guidelines were introduced in response to the

financial crisis of 2008. A need was felt to further strengthen the system as banks in the developed

economies were under-capitalized, over-leveraged and had a greater reliance on short-term funding.

Also the quantity and quality of capital under Basel II were deemed insufficient to contain any

further risk. Basel III norms aim at making most banking activities such as their trading book

activities more capital-intensive. The guidelines aim to promote a more resilient banking system by

focusing on four vital banking parameters viz. capital, leverage, funding and liquidity.

Capital Adequacy Ratio (

R) =

Tier 1 Capital + Tier 2 Capital

Risk weighted assets

(17)

Unnati Investment Management & Research Group

BFSI Sector Report

Tier 1 Capital: Tier I capital is equal to sum of equity capital and disclosed reserves.

Tier 2 Capital: Tier 2 capital is secondary bank capital that includes items such as undisclosed

reserves, loss reserves, term debts etc.

Significance of Tier 1 and Tier 2 Capital:

Tier 1 capital absorbs losses without a bank being required to cease trading and

Tier 2 capital absorbs losses if the bank winds-up its business.

Thus, Capital adequacy ratio acts as a cushion in the event of loss or default, and protects the

depositors.

Major Differences between BASEL 2 and BASEL 3 Norms

Basel II

Requirements

8%

Minimum Ratio of Total Capital to Risk Weighted Assets

2%

Minimum Ratio of Common Equity to Risk Weighted Assets

4%

Tier 1 Capital to Risk Weighted Assets

None

Capital Conservation Buffer Capital to Risk Weighted Assets

None

Leverage Ratio

None

Countercyclical Buffer

None

Minimum Liquidity Coverage Ratio

None

Minimum Net Stable Funding Ratio

* Basel III requirements will be phased-in progressively till 2018

Basel III*

11.5%

4.5% to 7%

6%

2.5%

3%

0% to 2.5%

100%

100%

Changes proposed in BASEL III over BASEL II norms:

(a) Better Capital Quality: One of the key elements of Basel III is the introduction of much stricter

definition of capital. Better quality capital means the higher loss-absorbing capacity. This in turn will

mean that banks will be stronger, allowing them to better withstand periods of stress.

(b) Capital Conservation Buffer: Another key feature of Basel III is that now banks will be required to

hold a capital conservation buffer. The buffer will be an additional 2.5% Common Equity Tier 1

capital requirement. The aim of asking to build conservation buffer is to ensure that banks maintain

a cushion of capital that can be used to absorb losses during periods of financial and economic

stress.

(c) Countercyclical Buffer: This is also one of the key elements of Basel III. The countercyclical buffer

has been introduced with the objective to increase capital requirements in good times and decrease

the same in bad times. The buffer will slow banking activity when it overheats and will encourage

lending when times are tough i.e. in bad times. The buffer will range from 0% to 2.5% and will

extend the capital conservation buffer previously described.

(d) Minimum Common Equity and Tier 1 Capital Requirements: The minimum requirement for

common equity, the highest form of loss-absorbing capital, has been raised under Basel III from 2%

to 4.5% of total risk-weighted assets. The overall Tier 1 capital requirement, consisting of not only

common equity but also other qualifying financial instruments, will also increase from the current

minimum of 4% to 6%. Although the minimum total capital requirement will remain at the current

8% level, yet the required total capital will increase to 11.5% when combined with the capital

conservation buffer.

(18)

Unnati Investment Management & Research Group

BFSI Sector Report

(e) Leverage Ratio: A review of the financial crisis of 2008 has indicted that the value of many assets

fell quicker than assumed from historical experience. Thus, now Basel III rules include a leverage

ratio to serve as a safety net. A leverage ratio is the relative amount of Tier 1 capital to total assets

(not risk-weighted). This aims to put a cap on swelling of leverage in the banking sector on a global

basis. 3% leverage ratio of Tier 1 will be tested before a mandatory leverage ratio is introduced in

January 2018.

(f) Liquidity Ratios: Under Basel III, a framework for liquidity risk management will be created. A

new Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) are to be introduced in a

phased manner starting 2015 and 2018, respectively.

The goal of the liquidity coverage ratio (LCR) is to ensure that banks have adequate, high quality

liquid assets to survive a short-term stress scenario. The definition of the standard is as follows:

.

stock of high-quality liquid assets

.

100%

total net cash outflows over the next 30 calendar days

The goal of the net stable funding ratio (NSFR) is to protect banks over a longer time horizon. The

net stable funding ratio promotes a sustainable maturity structure for assets and liabilities by

creating incentives for banks to use more stable funding sources.

available amount of stable funding

required amount of stable funding

100%

Available stable funding sources (ASF) include Capital, preferred stock with a maturity of more than

one year, liabilities with an effective maturity of more than one year, non-maturity deposits and

time deposits that would be expected to stay at the bank in periods of extended stress, the

proportion of wholesale funds that would be expected to stay at the bank in periods of extended

stress.

The building blocks of Basel III are by and large higher and better quality capital; an internationally

harmonised leverage ratio to constrain excessive risk taking; capital buffers which would be built up

in good times so that they can be drawn down in times of stress; minimum global liquidity

standards; and stronger standards for supervision, public disclosure and risk management.

Are Indian banks adequately prepared for migration to Basel III regime?

With Commercial banks having already adopted standardized approaches under Basel II, by and

large barring some, Indian Private Banks will be in a comfortable position to adjust to the new capital

rules both in terms of quantum and quality. However, Public Sector banks might find themselves on

a slippery ground, doubt is reinforced with the data of last quarter which has shown a significant

increase in NPAs in some of the Public Sector Banks.

According to RBI estimates, Indian Banks will need an additional capital of Rs 500,000 crores to meet

the Basel 3 norms. Out of this, the total equity capital would be Rs 175,000 crores while the rest

would be non-equity capital. Government Banks would require Rs 90,000 crores of infusion from the

Government in the form of equity if it has to retain its present ownership of Public Sector Banks.

Basel III requires higher and better quality capital and since, the cost of equity capital is high. The

average Return on Equity (RoE) of the Indian banking system for the last three years has been

approximately 14%. Implementation of Basel III is expected to result in a decline in Indian banks' RoE

in the short-term.

(19)

Unnati Investment Management & Research Group

BFSI Sector Report

Classification of Assets

1. Standard Assets:

Assets which do not disclose any problem and do not carry more than the normal risk attached to

the business. Such assets are not non-performing assets.

2. Non-performing Assets (NPA)

The definition of NPA as given by RBI is an asset, which ceases to generate income for a bank.

Hence it is a loan, the payment of which is unlikely to be received. Any loan is recognized as NPA

only when the receipt of payment for it 'remains due' for a specified period of time.

A NPA is a loan or advance where:

a. Interest or instalment remains overdue for over 90 days in case of a term loan.

b. The account remains 'out of order' in case of overdraft/cash credit facility. A current account is

treated as 'out of order' if outstanding balance is in excess of sanctioned limits or when it is

within sanctioned limits and there are no credits for 90 days or are not enough to cover the

charges for interest debited.

c. The bill remains overdue for a period of more than 90 days in the case of bills purchased and

discounted.

d. Agricultural loans are classified as NPAs, if, for short duration crops, instalment of principal or

interest remains overdue for two crop seasons; for long duration crops, this period is taken to be

one crop season.

e. In case of derivative and liquidity transactions, if the dues for these remain unpaid for 90 days.

According to norms, any income received from NPAs is recorded only when it is received.

Banks are required to classify non-performing assets further into the following three categories

based on the period for which the asset has remained non-performing and the realisability of the

dues:

a. Sub-standard assets:

A sub-standard asset would be one, which has remained NPA for a period less than or equal to 12

months. Such an asset will have well defined credit weaknesses that jeopardise the liquidation of the

debt and is characterised by the distinct possibility that the banks will sustain some loss, if

deficiencies are not corrected.

b. Doubtful assets:

An asset would be classified as doubtful if it has remained in the substandard category for a period

of 12 months. A loan classified as doubtful has all the weaknesses inherent in assets that were

classified as sub-standard, with the added characteristic that the weaknesses make collection or

liquidation in full - on the basis of currently known facts, conditions and values - highly questionable

and improbable.

c. Loss assets:

An asset would be considered as a loss asset if loss has been identified by the bank or by internal /

external auditors or by RBI inspection, but the amount has not been written off, wholly or in part.

Such assets are considered uncollectible and of so little value that their continuance as bankable

assets is not warranted, even though there may be some salvage or recovery value.

(20)

Unnati Investment Management & Research Group

BFSI Sector Report

Provisioning of Assets

Provisioning Coverage Ratio (PCR) - 70% is essentially the ratio of provisioning to gross nonperforming assets and indicates the extent of funds a bank has kept aside to cover loan losses so

that it does not find itself out of cash when that asset is actually written-off.

According to RBI Norms, Sub-standard assets require a provision of 15%, doubtful assets, depending

on their age, carry a provision of 25%-100%, while banks are required to make 100% provision for

loss assets.

Menace of Rising NPAs

The gross NPA ratio (the ratio of loans accounts which have defaulted on interest or principle

beyond 90 days to the total bank loans) of Indian banks as on March 2013, was at 3.23 % and the net

NPA ratio works out to 1.56 %.

Cumulatively, the standard restructured loans and NPAs of the banking system, as of March 2013,

account for 9.25% as against 7.6 % in March 2012 of the total advances. The share of public sector

bank is higher which has raised asset quality concerns. This proportion is rising at a faster pace as the

systems loan growth is moderating, but problem loans continue to be on the rise.

Why is it Important It hampers almost all forms of operations, some of which are:

Profitability: Declining net interest margins (NIMs), rising credit costs, money getting blocked

due to a weak macro-economic environment, large rupee depreciation, vulnerability of a large

number of infrastructure projects and the rising yields will have significant bearing on the

earnings and asset quality of the banks. The profitability of bank decreases not only by the

amount of NPAs but NPAs lead to opportunity cost as well equivalent to profit from this

projected invested in some other return earning project/asset. So NPAs not only affect current

profit but also future stream of profit, which may lead to loss of some long-term beneficial

opportunity. Another impact of reduction in profitability is low RoI (return on investment), which

adversely affects the current earning of a bank.

Liquidity: Money gets blocked; decreased profit leads to lack of enough cash at hand which

leads to borrowing money for shortest period of time which leads to an additional cost to the

company. Difficulty in operating the functions of a bank due to lack of money is another impact

of NPAs.

Involvement of management: Time and efforts of management is another indirect cost which

bank has to bear due to NPAs. Time and efforts of management in handling and managing NPAs

would have diverted to some fruitful activities, which would have given good returns. Nowadays

banks have special employees to deal and handle NPAs, which is an additional cost to the bank.

Public Sentiment: There is a definite loss of faith associated with the NPA numbers rising and

this cannot be compensated by larger profits. See SBI & its NPA Story for more information:

State Bank of India (SBI), the country's largest lender, topped the list of banks with the highest gross

NPAs (in percentage terms) during the quarter among BSE-Bankex constituents (13 Banks). The gross

NPA to advances for SBI, which has seen a steady increase in bad loans, surged to 5.56% in AprilJune, the highest since the quarter ending March 2011. Gross NPAs have increased 81 basis points

(0.81%) for SBI during the quarter. Private sector banks have not seen much deterioration in asset

quality and have managed to maintain their NPAs at low levels.

(21)

Unnati Investment Management & Research Group

BFSI Sector Report

Corporate Debt Restructuring

CDR is a framework to ensure timely and transparent mechanism for restructuring the corporate

debts of viable entities facing problems, outside the purview of BIFR, DRT and other legal

proceedings, for the benefit of all concerned. It is a pre-emptive effort by debtors as well as lenders

to steer clear the corporates from moving into a state from where recovery becomes almost an

elusive distant dream.

According to the new rules, promoter's contribution has been raised to 20% (from 15%) of the

sacrifice made by lenders or 2% of the restructured loan, whichever is higher. Besides, the money

has to be paid upfront. Banks will have to increase provisioning on restructured assets to 3.50% for

March 2014, and subsequently to 4.25% and 5% for March 2015 and March 2016, respectively. At

present, banks set aside 2.75% of their income as provisions. To discourage banks from liberally

restructuring loans, RBI has said that from April 2015 an account will have to be classified as substandard as soon as it is restructured. However, for new projects RBI has relaxed the condition under

which a loan has to be categorised as a restructured asset. Currently, banks have to restructure

loans if the date of commencement of commercial operation is delayed by six months. The new

regulations have extended this to one year. Till then, the loan will be treated as a standard asset.

Debt restructuring is a tool to offer aid to borrowers in distress, owing to circumstances beyond the

borrowers control such as a general downturn in the economy or a sector. It might also be

warranted by legal or other issues that cause delays, particularly in cases of project implementation.

As of June, lenders had approved CDR packages for 415 companies, with aggregate debt of Rs

2,50,279 crore.

(22)

Unnati Investment Management & Research Group

BFSI Sector Report

Financial Inclusion

Financial Inclusion is the process of ensuring access to appropriate financial products and services

needed by all sections of the society in general and vulnerable groups such as weaker sections and

low income groups in particular at an affordable cost in a fair and transparent manner by

mainstream institutional players.

Key Regulatory Points

Domestic Scheduled Commercial Banks have been permitted to freely open branches in Tier 2 to Tier

6 centres. Banks have been mandated to open 25 % of all new branches in unbanked rural centres. It

will end up giving an extreme impetus to the industry as whole, its reach and scope will strengthen

its image and provide solidarity in bad times. Moreover, it will find many new applications for the

banks apart from its regular day to day functionalities. However, it will pinch its bottom line in the

short term and if banks are unable to achieve operational efficiency it will become a huge burden for

the industry.

Priority Sector Lending

Banks were assigned a special role in the economic development of the country, besides ensuring

the growth of the financial sector. The banking regulator, the Reserve Bank of India, has hence

prescribed that a portion of bank lending should be for developmental activities, which it calls the

priority sector. For local banks and foreign banks with more than 20 branches, both the public and

private sectors have to lend 40 % of their Adjusted Net Bank Credit to the priority sector as defined

by RBI, foreign banks have to lend 32% of their ANBC to the priority sector, with 18% of the loans

should be given to agriculture and 10% to the weaker sections of the society.

Agriculture (Direct and Indirect finance): Direct finance to agriculture shall include short,

medium and long term loans given for agriculture and allied activities.

Small Scale Industries (Direct and Indirect Finance): All loans given to SSI units which are

engaged in manufacture, processing or preservation of goods.

Small Business / Service Enterprises: It shall include small business, retail trade, professional &

self-employed persons, small road & water transport operators and other service enterprises

Micro Credit: Provision of credit and other financial services and products of very small amounts

not exceeding Rs. 50,000 per borrower to the poor in rural, semi-urban and urban areas.

Education loans: Education loans include loans and advances granted to only individuals for

educational purposes up to Rs. 10 lakhs for studies in India and Rs. 20 lakhs for studies abroad.

Housing loans: Loans to individuals up to Rs. 25 lakhs in metropolitan centres with population

above ten lakhs and Rs. 15 lakhs in other centres for purchase/construction of a dwelling unit

per family excluding loans sanctioned to banks own employees and loans given for repairs to

the damaged houses of individuals up to Rs.2 lakhs in rural and semi-urban areas and up to Rs.5

lakhs in urban areas.

(23)

Unnati Investment Management & Research Group

BFSI Sector Report

Macroeconomic Factors affecting Banks

Indian banks are currently under lot of pressure from a large number of macroeconomic factors

which are threatening to derail the growth of Indian Banks. These include

Current Account Deficit

Current account deficit occurs when a country's total imports of goods, services and transfers is

greater than the country's total export of goods, services and transfers. This situation makes a

country a net debtor to the rest of the world.

India's current account deficit (CAD) hit a record high 4.8 percent of gross domestic product (GDP) in

FY13, fuelled by rising imports of oil and gold. The current account gap for the entire 2012-13

financial year was $87.8 billion, compared with $78.2 billion a year earlier. Ill-effects of rising CAD

includes depreciating rupee, reducing foreign investors confidence, dearth of liquidity, Investment

downgrades, lesser availability of capital for domestic players etc.

The main reasons put forth by the Finance ministry for the widening of the CAD are lower exports

and higher degree of imports of oil, coal and yellow metal gold. As otherwise, high imports of capital

goods and equipment reflect the growth in an economy that though is not the case with the Indian

economy.

In order to keep the balance of payment intact, high CAD figures then have to be financed which

thus increases the reliance on foreign funds or capital account. The Indian economy was

safeguarded and in fact was at the mercy of the foreign capital which came in through FDI and FII.

But global economic outlook which spares none of the economies has cast its effect strongly on

India. The bond buying programme or quantitative easing (QE) measures that were undertaken by

the US Federal Reserve in the wake of the sub-prime crisis of 2008-2009 is likely to be wind down as

the economy has shown signs of recovery. What this means is that easy liquidity through QE

measures would ensure that foreign institutional investors gradually pull off from the Indian

markets, raising fresh worries for financing the CAD. High net fund inflows and increase in export

activities could save the crisis-ridden Indian economy.

Poor Governance

Government of India has largely been unable to boost the investment sentiments for domestic as

well as foreign investors. With scams becoming every day news and the magnitude breaking all

ceilings, India finds itself in a very precarious situation where a robust structural change is required

to make ends meet, however what has been proposed falls largely out of place as they lack the

complete majority to ensure their clearances. Also, scams and out of place regulations have created

a lot of stress on the banks assets as more often than not they end up turning into NPAs, moreover

there is an added pressure of credit downgrades across sectors, none of which is uncorrelated to our

Banking Industry. There have been many fiscal incentive initiatives which impinges the countrys

exchequer quite hard like MGNREGA, Food Security Bill etc. which diverts the money from the

market to fund these activities and thus reducing the overall supply of money and subsequently

increasing the cost of capital in the market.

Fiscal Deficit

Every year, the Government puts out a plan for its income and expenditure for the coming year. This

is known as the annual Union Budget. A budget is said to have a fiscal deficit when the Government's

expenditure exceeds its income. When faced with deficits governments have one of the two options:

To raise money through taxes in order to bridge the deficit

To borrow more money in order to meet its spending requirements

Economic effects of fiscal deficit

The size of fiscal deficit has substantial effect on the economy of the India. While small amounts of

fiscal deficits generally have a positive effect on the economy, large amounts are detrimental for the

(24)

Unnati Investment Management & Research Group

BFSI Sector Report

health of the economy. A large fiscal deficit is a hindrance to economic growth. Governments

generally borrow more money thereby leading to a shortage of funds for the industry and a rise in

interest rates. This hurts industrial growth in the country. Governments can also resort to printing

money to pay off their debts and this could also increase inflation.

The Indian Situation

Indias fiscal deficit has remained high for the past six years and has exceeded budget estimates.

From a low of 3.17% of the GDP in 2007-08 it has climbed to 4.89 % in 2012-13. Coupled with a high

inflation, this has adversely affected the economic growth in the country.

Indias fiscal deficit during the April13-July13 period was Rs. 3.41 trillion ($50.91 billion), or 62.8%

of the full-year target (4.8% of GDP). Net tax receipts for the first four months of the current fiscal

year to March 2014 touched Rs1.45 trillion while total expenditure was Rs5.21 trillion.

The high interest rate along with lack of investments in the productive sectors of the economy has

brought economic growth in the country to a 10 year low. The most worrying fact about this

situation is that most of the deficit is due to high government spending on payment of interest on its

debts, which effectively means that the deficit is not leading to any productive activity. Another

downside associated with a high deficit is that rating agencies have threatened to downgrade Indias

sovereign credit ratings. This would mean India losing its investment grade status (it has the lowest

investment grading, BBB-). This would mean flight of foreign capital from India and pushing

borrowing costs even higher which is not good for economic growth.

Inflation

Effect of Inflation on Banking of India

Inflation figures released by the government based on the Wholesale Price Index WPI climbed to

5.79% for July 2013 as compared to the same month in 2012. The globally more preferred Consumer

Price Index (CPI) - that is calculated by looking at prices at retail markets, from where consumers buy

goods is no longer the main marker of inflation (what is called as headline inflation) by the

government was considerably high at 9.87%.

The rate of food inflation in particular has been high for quite a long period, with latest figures in July

(WPI) showing a near 12% increase in prices since a year ago. Vegetable prices in particular have

shown a whopping 47% increase over the year, so much so, that news reports point out that even

middle class families have cut down on their vegetable expenses, and are narrowing down their

preferred diet. With depreciation of rupee, it will increase further. Inflation is one the major factors

which affects Indian Economy on a very vast scale and scope. Higher inflation has led to a

depreciating currency vis-a-vis its counterpart.

Inflation has a profound effect on the sentiments and savings-investment pattern of households of

the country, a higher inflation leaves less with people to save or invest, moreover with high inflation

people demand more of their investments and savings pushing the cost of deposit in the upward

direction. Also, they become more risk averse and has tendency to rely more on physical assets

rather than on financial assets. For example, there is huge demand for gold in our country which has

made our Balance of Payments (BoP) go out of sync and has led to huge currency depreciations and

it also makes the money unavailable for other productive purposes.

High Inflation is thus a major worry for RBI. So, RBI frames its monetary policies in a manner which

has a focus of having a balancing act between growth and inflation and the same has a direct impact

on the funding rates available to banks and subsequently the economy.

(25)

Unnati Investment Management & Research Group

BFSI Sector Report

GAAR

GAAR stands for General Anti Avoidance Rules. GAAR provides the tax authorities the power to deny

tax benefits to any entity if it has carried out a transaction with the sole intention of tax avoidance.

GAAR also proposes to tax investments coming in through the Mauritius route into India. Mauritius

is the largest source of foreign investments into India, because of a double taxation treaty between

India and Mauritius. Another problem with GAAR is that the onus lies on the assessee to prove that

there was no tax avoidance related to a transaction.