Professional Documents

Culture Documents

Computerized Accounting System: To Create A New Company File

Computerized Accounting System: To Create A New Company File

Uploaded by

dayananda123Copyright:

Available Formats

You might also like

- ACC 700 Final Project Guidelines and RubricDocument13 pagesACC 700 Final Project Guidelines and RubricJoy SupanikaNo ratings yet

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- Introduction To QuickBooks For FarmersDocument93 pagesIntroduction To QuickBooks For Farmerslaraworden100% (4)

- Business Plan On Garment ShopDocument73 pagesBusiness Plan On Garment ShopFaheem Zahid100% (4)

- Oracle Finance Functional Interview Questions and AnswersDocument8 pagesOracle Finance Functional Interview Questions and AnswersMohd Nadeem AhmedNo ratings yet

- How To Write A Financial PlanDocument6 pagesHow To Write A Financial PlanGokul SoodNo ratings yet

- Marijuana Business Plan TemplateDocument18 pagesMarijuana Business Plan TemplatePeter JamesNo ratings yet

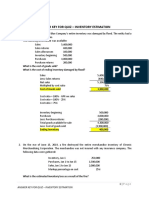

- Answer Key For Quiz - Inventory EstimationDocument6 pagesAnswer Key For Quiz - Inventory EstimationMelogen Labrador100% (3)

- Blue Nile Case Analysis EssayDocument9 pagesBlue Nile Case Analysis EssayMohammad Junaid HanifNo ratings yet

- Examples of Customized Charts of AccountsDocument33 pagesExamples of Customized Charts of AccountsDennis lugodNo ratings yet

- Welcome To The Topic On Sales Order To CashDocument17 pagesWelcome To The Topic On Sales Order To CashYogesh Mane0% (1)

- How To Allocate Payroll Taxes in QuickBooksDocument13 pagesHow To Allocate Payroll Taxes in QuickBooksfaramos06No ratings yet

- SABTLECTURE07Document26 pagesSABTLECTURE07namudajiyaNo ratings yet

- Chapter 3Document18 pagesChapter 3Severus HadesNo ratings yet

- Reflection Paper - SAP Business OneDocument6 pagesReflection Paper - SAP Business OnePrincess JimelNo ratings yet

- Documentation of The FunctionsDocument6 pagesDocumentation of The FunctionsGillian Mae CumlatNo ratings yet

- Freshbooks Group-4 BSA-3BDocument11 pagesFreshbooks Group-4 BSA-3BGia Sarah Barillo BandolaNo ratings yet

- A. QB Lesson 6Document28 pagesA. QB Lesson 6Shena Mari Trixia Gepana100% (1)

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- QB Sample Rep RTDocument18 pagesQB Sample Rep RTArnel Miranda MengoteNo ratings yet

- Revenue Recognition ConfigurationDocument5 pagesRevenue Recognition Configurationsheruf_aliNo ratings yet

- Software Detail enDocument13 pagesSoftware Detail enSudtana Rattanadilok Na PhuketNo ratings yet

- Wave AppDocument10 pagesWave AppV ChandriaNo ratings yet

- Start Up Capital (Start Up Budget) and Its SourcesDocument19 pagesStart Up Capital (Start Up Budget) and Its SourcesJaymilyn Rodas SantosNo ratings yet

- MG 10 - Fatimatus Zehroh - Summary SAP Unit 4Document15 pagesMG 10 - Fatimatus Zehroh - Summary SAP Unit 4Fatimatus ZehrohNo ratings yet

- AR Receivable Interview QuestionsDocument5 pagesAR Receivable Interview QuestionsKrishna Victory100% (1)

- Setting Up Accounting FunctionDocument4 pagesSetting Up Accounting FunctionSamir PradhanNo ratings yet

- QuickBooks 2019 Manual WAM Gym Chapter 5 (Rev 04-24) + Case StudiesDocument25 pagesQuickBooks 2019 Manual WAM Gym Chapter 5 (Rev 04-24) + Case StudiesKelis SmithNo ratings yet

- Welcome To The Accounting For Sales and Purchasing TopicDocument24 pagesWelcome To The Accounting For Sales and Purchasing TopicAnna LewandowskaNo ratings yet

- Chapter 4 2010Document22 pagesChapter 4 2010BeamlakNo ratings yet

- Training 3Document28 pagesTraining 3Dhwani MehtaNo ratings yet

- Chapter 5 - Revenue CycleDocument6 pagesChapter 5 - Revenue Cycleviox reyesNo ratings yet

- Intergration With Sales Order ManagementDocument6 pagesIntergration With Sales Order ManagementYudita Dwi Nur'AininNo ratings yet

- Sample Estimate Created in Quickbooks Online: Page - 145Document8 pagesSample Estimate Created in Quickbooks Online: Page - 145Nyasha MakoreNo ratings yet

- Software AssignmentDocument9 pagesSoftware Assignmentmelkamuaemiro1No ratings yet

- Basic Concepts in Oracle APDocument28 pagesBasic Concepts in Oracle APrv90470No ratings yet

- Sage One Accounting Getting Started Guide 1Document82 pagesSage One Accounting Getting Started Guide 1romeoNo ratings yet

- Data MigrationDocument29 pagesData MigrationAhmed SamirNo ratings yet

- Daylong Training On QuickBooks OnlineDocument45 pagesDaylong Training On QuickBooks OnlineMoshiar RahmanNo ratings yet

- Accounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingDocument40 pagesAccounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingusmanNo ratings yet

- Clearing Open ItemsDocument45 pagesClearing Open Itemssama greedyNo ratings yet

- QB Basic ReportsDocument6 pagesQB Basic Reportsvanosoy19No ratings yet

- AP PrepareDocument51 pagesAP Preparebujjipandu7100% (1)

- Account ReceivablesDocument285 pagesAccount ReceivablesOgwuche Oche SimonNo ratings yet

- Accounting SystemDocument22 pagesAccounting SystemAnkit NagdeoNo ratings yet

- Five Accounting Principles That You Should KnowDocument4 pagesFive Accounting Principles That You Should KnowRomnick Pascua TuboNo ratings yet

- Yamuna Managerial AccountsDocument10 pagesYamuna Managerial AccountsSathyaPriya RamasamyNo ratings yet

- Cash Sales Document GuideDocument28 pagesCash Sales Document GuideRanjeet SinghNo ratings yet

- ASientos Sap B1 - 90 - TB1100 - 01 - 01 PDFDocument27 pagesASientos Sap B1 - 90 - TB1100 - 01 - 01 PDFartigasNo ratings yet

- Orca Share Media1617763030485 6785389949818179229Document15 pagesOrca Share Media1617763030485 6785389949818179229Cindie Jane T JaymeNo ratings yet

- AP Concepts Part1 Oracle 11Document14 pagesAP Concepts Part1 Oracle 11JayantaNo ratings yet

- Top Ten QuickBooks TricksDocument28 pagesTop Ten QuickBooks TricksHarryTendulkarNo ratings yet

- QuickBooks 2014 Pro and Premier User GuideDocument20 pagesQuickBooks 2014 Pro and Premier User GuideHapluckyNo ratings yet

- ReportsDocument4 pagesReportscarlaNo ratings yet

- OpenMiracle SRSDocument16 pagesOpenMiracle SRSOmerZiaNo ratings yet

- Oracle Accounts PayableDocument84 pagesOracle Accounts PayableNitya PriyaNo ratings yet

- SAP B1 - Sales ARDocument3 pagesSAP B1 - Sales ARRhon Ryan TamondongNo ratings yet

- QBO Reviewer Part 2Document13 pagesQBO Reviewer Part 2claireipx1No ratings yet

- Research Paper On Account ReceivableDocument7 pagesResearch Paper On Account Receivableafeazleae100% (1)

- TallyDocument17 pagesTallyShahil Kumar 4No ratings yet

- Management Accounting Jargons/ Key TerminologiesDocument11 pagesManagement Accounting Jargons/ Key Terminologiesnimbus2050No ratings yet

- Lesson 5: Customers and Sales Part 1Document30 pagesLesson 5: Customers and Sales Part 1Not Going to Argue Jesus is KingNo ratings yet

- Johnson N JohnsonDocument48 pagesJohnson N JohnsonKing Nitin Agnihotri57% (7)

- Introduction of MNC'SDocument48 pagesIntroduction of MNC'SMitali AmagdavNo ratings yet

- Tesco Financial Analysis Rap 8 PDFDocument36 pagesTesco Financial Analysis Rap 8 PDFSyed Irfan100% (1)

- Ma 2 AccaDocument18 pagesMa 2 AccaRielleo Leo67% (3)

- Microsoft Powerpoint - Chapter 6 - Tender Documentation.Document53 pagesMicrosoft Powerpoint - Chapter 6 - Tender Documentation.Azzri FazrilNo ratings yet

- Chapter 3 (Arcadia)Document22 pagesChapter 3 (Arcadia)sweetangle98No ratings yet

- Income Statement - FormatDocument3 pagesIncome Statement - FormatkudoginNo ratings yet

- Chapter 8Document30 pagesChapter 8Connor DayNo ratings yet

- Performance Measurement, Compensation, and Multinational ConsiderationsDocument32 pagesPerformance Measurement, Compensation, and Multinational ConsiderationsSugim Winata EinsteinNo ratings yet

- Doctrine of Piercing The Veil of Corporation Fiction (Digests)Document8 pagesDoctrine of Piercing The Veil of Corporation Fiction (Digests)Tina SiuaganNo ratings yet

- ch15 PDFDocument9 pagesch15 PDFRetno Tri SeptiyaniNo ratings yet

- Supply Chain Management: An IntroductionDocument9 pagesSupply Chain Management: An IntroductionBindu SajithNo ratings yet

- Oracle R12 - FSG ReportDocument27 pagesOracle R12 - FSG Reportnikhil438alwalaNo ratings yet

- 2013 Marks 15 Years of Shopwise: What's InsideDocument20 pages2013 Marks 15 Years of Shopwise: What's InsideKillua HunterNo ratings yet

- Overhead Cost - Computation and Control: by Sudha AgarwalDocument34 pagesOverhead Cost - Computation and Control: by Sudha AgarwalAkhil VashishthaNo ratings yet

- Goodyear PPT PDF FreeDocument26 pagesGoodyear PPT PDF FreePrabodhDekaNo ratings yet

- Learner Guide HDB Resale Procedure and Financial Plan - V2Document0 pagesLearner Guide HDB Resale Procedure and Financial Plan - V2wangks1980No ratings yet

- Vendi Vending MachineDocument9 pagesVendi Vending MachineSamiullah SarwarNo ratings yet

- Review For Final ExamDocument5 pagesReview For Final ExamwillvxdNo ratings yet

- Business Development Encompasses A Wide Scope of Ideas, Activities, and InitiativesDocument3 pagesBusiness Development Encompasses A Wide Scope of Ideas, Activities, and InitiativesharabassNo ratings yet

- Insurance - Functions, Principles, Selling Process.Document16 pagesInsurance - Functions, Principles, Selling Process.Gokul SriramNo ratings yet

- MB0039 SLM Unit 12Document16 pagesMB0039 SLM Unit 12Kamal RaiNo ratings yet

- Setting Up An Online BusinessDocument5 pagesSetting Up An Online Businesssmimtiaz8958No ratings yet

- Porter 5 Forces AnalysisDocument9 pagesPorter 5 Forces AnalysisÓscar Del RealNo ratings yet

- Presentation On "Big Bazaar": Saurabh KeshriDocument23 pagesPresentation On "Big Bazaar": Saurabh KeshriSaurabh KeshrwaniNo ratings yet

Computerized Accounting System: To Create A New Company File

Computerized Accounting System: To Create A New Company File

Uploaded by

dayananda123Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computerized Accounting System: To Create A New Company File

Computerized Accounting System: To Create A New Company File

Uploaded by

dayananda123Copyright:

Available Formats

12/14/2014

Computerized Accounting

System

FM 4133

B. Sc. in Financial Management (Special) Degree Program

Sabaragamuwa University of Sri Lanka

Faculty of Management Studies

Presented by

H.R.Sampath

To create a new company file

File Menu

New company

There are several methods to start a company file in

Quick book enterprise solution

1.

2.

3.

4.

Express start

Detailed start

Create a new company file base on the existing one

Convert data which we already entered to other accounting soft ware to

quick book enterprise solution

12/14/2014

12/14/2014

Before starting posting of transactions to quick

book, company must create several important

accounts named;

A complete list of a company's accounts and their balances. Use it to

track how much money your company has, how much money it owes,

how much money is coming in, and how much is going out. When you

created your QuickBooks company file, QuickBooks set up a chart of

accounts for the company.

The accounts that appear on the balance sheet are called "balance sheet

accounts." Other accounts track particular kinds of expenses or income.

Chart of Accounts

Customer list

Vendor list

Employee list

Inventory list

Bank details

There are several optional places to create chart of

accounts;

List menu

Accounts menu

Company menu

12/14/2014

12/14/2014

To check the transaction history, you must select use register option in

chart of account.

This report shows, in sequential order, all the transactions related to

the name or payee who appears on the transaction you selected. For

example, if you selected Company check account, the report shows all

the transactions you made through this account.

12/14/2014

The Working Trial Balance window gathers in one place the

information you need for end-of-period tasks.

In this window, you can:

See your client's net income.

Review and edit transactions in your client's accounts, including

the Retained Earnings account.

Select different date ranges to review.

Enter adjusting journal entries.

Enter a work paper reference for an account.

12/14/2014

This list contains the items you've set up for the services and goods

you buy and sell, as well as special items that perform calculations

(subtotals, discounts, and sales tax). These items appear as line items

on your sales and purchase forms.

12/14/2014

12/14/2014

Use the Add/Edit Multiple List Entries window to add and edit multiple

inventory items and non-inventory items. You can also copy and paste

list information from Excel directly into QuickBooks using this

window.

We use this option to calculate the sales price of items that have both

a cost and a sales price.

You'll see the effect of the default markup percentage when you

create inventory part, inventory assembly, non-inventory part,

service, and other charge items. When you enter the item's cost,

QuickBooks calculates the sales price and enters it in the Sales Price

field.

For example, entering a cost of 10.00 when the markup is 25%

causes QuickBooks to fill in the sales price as 12.50. If you don't

want to use the default markup for an item, change the sales price

that QuickBooks fills in.

12/14/2014

You must you sales receipt, when your customers pay in full at the time they

receive your service or product, then you don't have to track how much they

owe you. However, you might want to track each sale, calculate its sales tax, or

print a receipt for the sale. In that case, use a sales receipt.

You can also use a sales receipt to create a summary of sales income and sales

tax owed. You can summarize daily or weekly sales on a sales receipt.

If customers pay in advance, either in part or in full, you should not use a sales

receipt.

A cash sale, and using a sales receipt, requires full payment at the time you

record the sale.

You can change item prices one at a time or several at once, and you can

adjust prices by a fixed amount or by a percentage.

10

12/14/2014

When you build an assembly a build transaction occurs. Each

component used in the assembly (inventory part or an assembly

item nested within the assembly) is removed from quantity on

hand and the newly built assembly item is added to quantity on

hand.

By using current availability option, you can quickly determine the

available quantity of inventory part items and inventory assembly

items.

When you buy inventory items, you need to record them in QuickBooks

to keep your inventory quantities accurate.

11

12/14/2014

When you received the bill that arrived with the goods you ordered, you

must use this option.

Use this process if you have already received goods in QuickBooks and

have now received the vendor bill.

Use this process if you have already received goods in QuickBooks and

have now received the vendor bill.

12

12/14/2014

This reports shows information about the unit of measure sets you've

defined, including the set name, the base unit, and the default purchasing,

sales, and shipping units.

The Price Level list stores all the price levels you've created. The name

and type, either fixed percentage or per item, are included.

Price levels let you set custom pricing for different customers or jobs.

Once you create a price level and associate it with one or more customers

or jobs, each time you create an invoice, estimate, sales receipt, sales

order or credit memo for those customers or jobs, QuickBooks

automatically pulls up the correct custom price for a customer or job.

You create price levels, then use them on sales forms to adjust the price

of an item. You can also manually adjust the prices while creating a sales

form.

13

12/14/2014

The Billing Rate Level list stores all the billing rate levels that have been

created. Billing rate levels let you set custom service item rates based on

who did the work. The name and type of each billing rate level, either

fixed hourly rate or custom hourly rate per service item, is displayed.

You can have up to 100 billing rate levels.

The Payroll Item list holds the payroll items that are currently set up in

QuickBooks. The list is initially grouped by item type, but you can resort

by item name.

If you want to create a new pay roll schedule, you must use pay roll set

up wizard.

14

12/14/2014

If you want to create a new pay roll schedule, you must use pay roll set

up wizard.

This report shows each workers compensation code and its rate. If you

entered a new rate for a code, and the rate hasn't started yet, the new rate

and its start date appear in the Next Rate and Next Rate Effective Date

columns.

Use the Favorites menu to quickly access up to 30 of your favorite

QuickBooks menu items in one convenient place.

15

12/14/2014

Accountant menu gives you easy access to the QuickBooks features that

accountants use most.

Customer menu can use to add new customers, to create estimate, to

raise sales orders, invoicing, entering the customer collections, ect.

16

12/14/2014

When you don't have enough inventory available to fulfill all your sales

orders, use the Sales Order Fulfillment Worksheet to plan which sales

orders to fulfill first.

If you have an invoice you want to send to multiple customers, you don't

need to create a separate invoice for each customer. Instead, you can

create a single batch.

QuickBooks automatically uses the existing terms, sales tax rate, and

send method for each customer.

In addition, batch invoicing has a some limitations. Batch invoicing isn't

available if your company file tracks multiple currencies. Also, when you

create batch invoices, QuickBooks doesn't check the customer's credit

limit or let you use price levels.

17

12/14/2014

If the customers pay in full at the time they receive your service or

product, then you don't have to track how much they owe you. However,

you might want to track each sale, calculate its sales tax, or print a

receipt for the sale. In that case, use a sales receipt.

You can also use a sales receipt to create a summary of sales income and

sales tax owed. You can summarize daily or weekly sales on a sales

receipt.

When you receive payments from customers, you can either deposit each

payment directly into a QuickBooks bank account or you can group

payments together to be moved to that account later. You can choose the

method you prefer for depositing payments.

You can create new invoices charging finance charge for the customers

who dont settle their due in due cause.

18

12/14/2014

Vendor menu is used to add new vendors, enter bills, to raise purchase

orders, ect.

19

12/14/2014

You can enter bills for your inventory and non-inventory parts, services,

and fixed assets.

Entering a bill for items does not affect the inventory quantity on hand.

You must enter an item receipt to receive the items. You can enter a bill

for items before you receive them.

Use the Pay Bills window to view and pay the bills you've already enter

to the system.

This menu is used to add new employees, enter payroll information,

create new pay roll schedules, raise pay checks, estimate and record

working time, ect.

20

12/14/2014

21

12/14/2014

If you need to cancel out the amount of a check, you can void the check

or delete it.

Voiding a check only changes the amount to zero, but keeps the empty

transaction in QuickBooks (other information is unchanged, for example

the name of the payee, address, and date). A voided check also displays

VOID in the memo field.

22

You might also like

- ACC 700 Final Project Guidelines and RubricDocument13 pagesACC 700 Final Project Guidelines and RubricJoy SupanikaNo ratings yet

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- Introduction To QuickBooks For FarmersDocument93 pagesIntroduction To QuickBooks For Farmerslaraworden100% (4)

- Business Plan On Garment ShopDocument73 pagesBusiness Plan On Garment ShopFaheem Zahid100% (4)

- Oracle Finance Functional Interview Questions and AnswersDocument8 pagesOracle Finance Functional Interview Questions and AnswersMohd Nadeem AhmedNo ratings yet

- How To Write A Financial PlanDocument6 pagesHow To Write A Financial PlanGokul SoodNo ratings yet

- Marijuana Business Plan TemplateDocument18 pagesMarijuana Business Plan TemplatePeter JamesNo ratings yet

- Answer Key For Quiz - Inventory EstimationDocument6 pagesAnswer Key For Quiz - Inventory EstimationMelogen Labrador100% (3)

- Blue Nile Case Analysis EssayDocument9 pagesBlue Nile Case Analysis EssayMohammad Junaid HanifNo ratings yet

- Examples of Customized Charts of AccountsDocument33 pagesExamples of Customized Charts of AccountsDennis lugodNo ratings yet

- Welcome To The Topic On Sales Order To CashDocument17 pagesWelcome To The Topic On Sales Order To CashYogesh Mane0% (1)

- How To Allocate Payroll Taxes in QuickBooksDocument13 pagesHow To Allocate Payroll Taxes in QuickBooksfaramos06No ratings yet

- SABTLECTURE07Document26 pagesSABTLECTURE07namudajiyaNo ratings yet

- Chapter 3Document18 pagesChapter 3Severus HadesNo ratings yet

- Reflection Paper - SAP Business OneDocument6 pagesReflection Paper - SAP Business OnePrincess JimelNo ratings yet

- Documentation of The FunctionsDocument6 pagesDocumentation of The FunctionsGillian Mae CumlatNo ratings yet

- Freshbooks Group-4 BSA-3BDocument11 pagesFreshbooks Group-4 BSA-3BGia Sarah Barillo BandolaNo ratings yet

- A. QB Lesson 6Document28 pagesA. QB Lesson 6Shena Mari Trixia Gepana100% (1)

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- QB Sample Rep RTDocument18 pagesQB Sample Rep RTArnel Miranda MengoteNo ratings yet

- Revenue Recognition ConfigurationDocument5 pagesRevenue Recognition Configurationsheruf_aliNo ratings yet

- Software Detail enDocument13 pagesSoftware Detail enSudtana Rattanadilok Na PhuketNo ratings yet

- Wave AppDocument10 pagesWave AppV ChandriaNo ratings yet

- Start Up Capital (Start Up Budget) and Its SourcesDocument19 pagesStart Up Capital (Start Up Budget) and Its SourcesJaymilyn Rodas SantosNo ratings yet

- MG 10 - Fatimatus Zehroh - Summary SAP Unit 4Document15 pagesMG 10 - Fatimatus Zehroh - Summary SAP Unit 4Fatimatus ZehrohNo ratings yet

- AR Receivable Interview QuestionsDocument5 pagesAR Receivable Interview QuestionsKrishna Victory100% (1)

- Setting Up Accounting FunctionDocument4 pagesSetting Up Accounting FunctionSamir PradhanNo ratings yet

- QuickBooks 2019 Manual WAM Gym Chapter 5 (Rev 04-24) + Case StudiesDocument25 pagesQuickBooks 2019 Manual WAM Gym Chapter 5 (Rev 04-24) + Case StudiesKelis SmithNo ratings yet

- Welcome To The Accounting For Sales and Purchasing TopicDocument24 pagesWelcome To The Accounting For Sales and Purchasing TopicAnna LewandowskaNo ratings yet

- Chapter 4 2010Document22 pagesChapter 4 2010BeamlakNo ratings yet

- Training 3Document28 pagesTraining 3Dhwani MehtaNo ratings yet

- Chapter 5 - Revenue CycleDocument6 pagesChapter 5 - Revenue Cycleviox reyesNo ratings yet

- Intergration With Sales Order ManagementDocument6 pagesIntergration With Sales Order ManagementYudita Dwi Nur'AininNo ratings yet

- Sample Estimate Created in Quickbooks Online: Page - 145Document8 pagesSample Estimate Created in Quickbooks Online: Page - 145Nyasha MakoreNo ratings yet

- Software AssignmentDocument9 pagesSoftware Assignmentmelkamuaemiro1No ratings yet

- Basic Concepts in Oracle APDocument28 pagesBasic Concepts in Oracle APrv90470No ratings yet

- Sage One Accounting Getting Started Guide 1Document82 pagesSage One Accounting Getting Started Guide 1romeoNo ratings yet

- Data MigrationDocument29 pagesData MigrationAhmed SamirNo ratings yet

- Daylong Training On QuickBooks OnlineDocument45 pagesDaylong Training On QuickBooks OnlineMoshiar RahmanNo ratings yet

- Accounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingDocument40 pagesAccounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingusmanNo ratings yet

- Clearing Open ItemsDocument45 pagesClearing Open Itemssama greedyNo ratings yet

- QB Basic ReportsDocument6 pagesQB Basic Reportsvanosoy19No ratings yet

- AP PrepareDocument51 pagesAP Preparebujjipandu7100% (1)

- Account ReceivablesDocument285 pagesAccount ReceivablesOgwuche Oche SimonNo ratings yet

- Accounting SystemDocument22 pagesAccounting SystemAnkit NagdeoNo ratings yet

- Five Accounting Principles That You Should KnowDocument4 pagesFive Accounting Principles That You Should KnowRomnick Pascua TuboNo ratings yet

- Yamuna Managerial AccountsDocument10 pagesYamuna Managerial AccountsSathyaPriya RamasamyNo ratings yet

- Cash Sales Document GuideDocument28 pagesCash Sales Document GuideRanjeet SinghNo ratings yet

- ASientos Sap B1 - 90 - TB1100 - 01 - 01 PDFDocument27 pagesASientos Sap B1 - 90 - TB1100 - 01 - 01 PDFartigasNo ratings yet

- Orca Share Media1617763030485 6785389949818179229Document15 pagesOrca Share Media1617763030485 6785389949818179229Cindie Jane T JaymeNo ratings yet

- AP Concepts Part1 Oracle 11Document14 pagesAP Concepts Part1 Oracle 11JayantaNo ratings yet

- Top Ten QuickBooks TricksDocument28 pagesTop Ten QuickBooks TricksHarryTendulkarNo ratings yet

- QuickBooks 2014 Pro and Premier User GuideDocument20 pagesQuickBooks 2014 Pro and Premier User GuideHapluckyNo ratings yet

- ReportsDocument4 pagesReportscarlaNo ratings yet

- OpenMiracle SRSDocument16 pagesOpenMiracle SRSOmerZiaNo ratings yet

- Oracle Accounts PayableDocument84 pagesOracle Accounts PayableNitya PriyaNo ratings yet

- SAP B1 - Sales ARDocument3 pagesSAP B1 - Sales ARRhon Ryan TamondongNo ratings yet

- QBO Reviewer Part 2Document13 pagesQBO Reviewer Part 2claireipx1No ratings yet

- Research Paper On Account ReceivableDocument7 pagesResearch Paper On Account Receivableafeazleae100% (1)

- TallyDocument17 pagesTallyShahil Kumar 4No ratings yet

- Management Accounting Jargons/ Key TerminologiesDocument11 pagesManagement Accounting Jargons/ Key Terminologiesnimbus2050No ratings yet

- Lesson 5: Customers and Sales Part 1Document30 pagesLesson 5: Customers and Sales Part 1Not Going to Argue Jesus is KingNo ratings yet

- Johnson N JohnsonDocument48 pagesJohnson N JohnsonKing Nitin Agnihotri57% (7)

- Introduction of MNC'SDocument48 pagesIntroduction of MNC'SMitali AmagdavNo ratings yet

- Tesco Financial Analysis Rap 8 PDFDocument36 pagesTesco Financial Analysis Rap 8 PDFSyed Irfan100% (1)

- Ma 2 AccaDocument18 pagesMa 2 AccaRielleo Leo67% (3)

- Microsoft Powerpoint - Chapter 6 - Tender Documentation.Document53 pagesMicrosoft Powerpoint - Chapter 6 - Tender Documentation.Azzri FazrilNo ratings yet

- Chapter 3 (Arcadia)Document22 pagesChapter 3 (Arcadia)sweetangle98No ratings yet

- Income Statement - FormatDocument3 pagesIncome Statement - FormatkudoginNo ratings yet

- Chapter 8Document30 pagesChapter 8Connor DayNo ratings yet

- Performance Measurement, Compensation, and Multinational ConsiderationsDocument32 pagesPerformance Measurement, Compensation, and Multinational ConsiderationsSugim Winata EinsteinNo ratings yet

- Doctrine of Piercing The Veil of Corporation Fiction (Digests)Document8 pagesDoctrine of Piercing The Veil of Corporation Fiction (Digests)Tina SiuaganNo ratings yet

- ch15 PDFDocument9 pagesch15 PDFRetno Tri SeptiyaniNo ratings yet

- Supply Chain Management: An IntroductionDocument9 pagesSupply Chain Management: An IntroductionBindu SajithNo ratings yet

- Oracle R12 - FSG ReportDocument27 pagesOracle R12 - FSG Reportnikhil438alwalaNo ratings yet

- 2013 Marks 15 Years of Shopwise: What's InsideDocument20 pages2013 Marks 15 Years of Shopwise: What's InsideKillua HunterNo ratings yet

- Overhead Cost - Computation and Control: by Sudha AgarwalDocument34 pagesOverhead Cost - Computation and Control: by Sudha AgarwalAkhil VashishthaNo ratings yet

- Goodyear PPT PDF FreeDocument26 pagesGoodyear PPT PDF FreePrabodhDekaNo ratings yet

- Learner Guide HDB Resale Procedure and Financial Plan - V2Document0 pagesLearner Guide HDB Resale Procedure and Financial Plan - V2wangks1980No ratings yet

- Vendi Vending MachineDocument9 pagesVendi Vending MachineSamiullah SarwarNo ratings yet

- Review For Final ExamDocument5 pagesReview For Final ExamwillvxdNo ratings yet

- Business Development Encompasses A Wide Scope of Ideas, Activities, and InitiativesDocument3 pagesBusiness Development Encompasses A Wide Scope of Ideas, Activities, and InitiativesharabassNo ratings yet

- Insurance - Functions, Principles, Selling Process.Document16 pagesInsurance - Functions, Principles, Selling Process.Gokul SriramNo ratings yet

- MB0039 SLM Unit 12Document16 pagesMB0039 SLM Unit 12Kamal RaiNo ratings yet

- Setting Up An Online BusinessDocument5 pagesSetting Up An Online Businesssmimtiaz8958No ratings yet

- Porter 5 Forces AnalysisDocument9 pagesPorter 5 Forces AnalysisÓscar Del RealNo ratings yet

- Presentation On "Big Bazaar": Saurabh KeshriDocument23 pagesPresentation On "Big Bazaar": Saurabh KeshriSaurabh KeshrwaniNo ratings yet