Professional Documents

Culture Documents

Finance Capital Pushes For Australian Economic "Restructuring"

Finance Capital Pushes For Australian Economic "Restructuring"

Uploaded by

Shane Mishoka0 ratings0% found this document useful (0 votes)

4 views2 pagesAn analysis of contemporary economy.

Original Title

econ-f19

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn analysis of contemporary economy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesFinance Capital Pushes For Australian Economic "Restructuring"

Finance Capital Pushes For Australian Economic "Restructuring"

Uploaded by

Shane MishokaAn analysis of contemporary economy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

World Socialist Web Site

wsws.org

Finance capital pushes for Australian

economic restructuring

By Nick Beams

19 February 2015

The ongoing turmoil in Australias governing

Liberal-National Coalition, which ten days ago saw

about 40 percent of the Liberal Partys federal MPs

vote to end Tony Abbotts prime ministership, was

sparked by mass opposition to the currently-stalled

spending cuts in the governments budget brought

down last May.

Two recent statements by corporate analysts,

however, make clear that for the dominant sections of

finance capital, the political impasse goes far beyond

the governments budgetary measures. They are

seeking nothing less than a restructuring of the

Australian economy, including a drastic reduction in

real wages, in order to make it internationally

competitive.

In a research note issued on Monday, JP Morgan

analyst Stephen Walters said Australia was sliding

down the precipice, due to glacial reform efforts.

The next day, former Treasury official and now chief

economist at the Edinburgh-based global asset manager

Standard Life Investments, Jeremy Lawson, told an

investment seminar that Australia needed a recession to

focus political minds on the growing imbalances in the

economy.

In his research note, Walters pointed to a

recession-like weakness in domestic demand as

investment in the mining industry fell away without

any replacement. We knew for some time a plunge of

mining investment was fast approaching, he said.

The economy is now sliding down a precipice pretty

much as expected, as the sector moves from expansion

to production. Investment in areas outside of

resources had been slow to appear.

Walters outlined what he considered to be the main

problems holding back investment spending. These

included chronic reform inertiawith the regressive

goods and services tax, introduced in 2000, being the

last major and enduring changeas well as lack of

spending on infrastructure.

But Walterss main focus was on wage levels and

working conditions. Australia now has, on key

measures, more rigid labour markets than many

competitors and punishingly high penalty rates, he

said, adding that Australias minimum wage is double

that in the US. In 2013, he noted, average weekly

earnings were 70 percent above the global mean.

Picking up on this theme, Business Spectator

columnist Alan Kohler wrote that while the circus in

Canberra was no doubt a factor in reduced investor

confidence, for most people the real problem is the

cost of doing business in Australia.

In a globalised world, and open economy, you dont

have to look much further than wage levels that are 70

percent above the global mean to discover why

businesses arent feeling that great and are not

investing, Kohler wrote.

During his seminar presentation, Lawson recalled the

experiences of the 1980s when the Hawke Labor

government invoked the worsening economic

climatesummed up in Treasurer Paul Keatings

phrase in 1986 that Australia was in danger of

becoming a banana republic. Labor pushed through

major economic restructuring, including the

privatisation of major state-owned enterprises and the

restructuring of wage rates and working conditions.

If you look at Australias history, major reform

episodes, tended to follow crises, Lawson said. Its

when you have that next recession, when

unemployment is not 6.5 percent but 8 or 9 or 10

percent, youll really concentrate minds.

In other words, only when wide sections of the

population are subjected to economic devastation will

World Socialist Web Site

governments be able to impose the agenda being

demanded by finance capital.

Lawson made clear the critical questions went far

beyond the budget and said the government had

decided to tackle the wrong problems. It has invested

in a lot of capital in some unpopular things that actually

arent going to be the critical determinants of whether

Australias potential growth rate and productivity

growth ends up being lifted, he said.

The critical determinants are those outlined by

Maurice Newman, the head of the Abbott

governments Business Advisory Council, shortly after

the government took office. Under conditions of falling

national income, due to the sharp downturn in

commodity prices, Newman said the Australian

minimum wage was far higher than the UK, Canada

and New Zealand and more than double US levels, in a

system dogged by rigidities.

The demands of finance are finding their reflection in

the manoeuvring over the Liberal leadership. Amid

growing criticism of Abbotts government in business

circles, leadership rival and Communications Minister

Malcolm Turnbull made an appearance on the Q&A

television program on Monday night to outline his

agenda, albeit somewhat guardedly because publicly, at

least, he is still professing loyalty to Abbott.

In speeches over the past few years Turnbull, who

has the closest connections with corporate finance and

banking, has emphasised that economic globalisation

signifies major changes for the Australian economy.

On Q&A, he placed the conflict over the budget in

that context.

Everything we do has to be designed to ensure that

our prosperity is secure, and that is by being more

productive, more innovative, smarter, faster, leaner,

he told the audience. That is what this budget repair

thing is all about.

These are the same free-market buzz words

employed during the restructuring carried out under

the Hawke and Keating governments, which resulted in

the redistribution of wealth up the income scale, the

closure of large sections of industry and the growth of

financial parasitism. Now in worsening global

economic conditions, finance is demanding that this

program be intensified.

With around a quarter of the last budgets measures

still blocked in the Senate and amid growing concerns

in ruling circles about the viability of the present

parliamentary system for carrying through major

economic changes, Turnbull indicated that he was

looking for collaboration with the Labor Party in

carrying out his program.

Both sides of politics, he said in the Q&A

discussion, agreed on the need for changes in

government revenue-raising and spending measures.

The Liberals should put forward their proposals while

Labor set out its alternative and then there should be a

discussion. A third set of measures would emerge,

possibly better than the two original plans.

The Labor Party has, for electoral reasons, opposed

some of the more egregious measures in the May

budget, while signing off on cuts worth billions of

dollars in funding to the states. It is now increasingly

making clear its readiness to carry through the demands

of the corporate elites.

Writing in todays Australian Financial Review,

shadow treasurer Chris Bowen said the Liberals had

not been honest either about the economic problems

or their solution. Instead, they engaged in Santa Claus

economics, with Treasurer Joe Hockey suggesting that

the return of a Liberal government would boost

business confidence and profits. Abbotts government

had not been serious about ending the age of

entitlement when at the same time it was promoting a

paid parental leave scheme.

The Labor Party has yet to announce specific

measures but Bowen wrote that it acknowledged

economic growth was not enough to return to a budget

surplusa clear indication that it is aligning itself with

the demands of finance for major cuts and

restructuring.

World Socialist Web Site

To contact the WSWS and the

Socialist Equality Party visit:

http://www.wsws.org

You might also like

- Back To Black: Budget 2009 PaperDocument44 pagesBack To Black: Budget 2009 PaperLuke BaileyNo ratings yet

- IB Economics - Real World Examples: Terms in This SetDocument21 pagesIB Economics - Real World Examples: Terms in This SetjoebidenyyzNo ratings yet

- Action and ReactionDocument3 pagesAction and ReactionShane Mishoka100% (11)

- HSC Economics Practice QuestionsDocument4 pagesHSC Economics Practice QuestionsAnkita Saini100% (2)

- Despite Headline Growth Figures, Australian National Accounts Point To ContractionDocument2 pagesDespite Headline Growth Figures, Australian National Accounts Point To ContractionRobert MillerNo ratings yet

- Election 2016 Malcolm Turnbull Is The Only Leader With A Genuine Growth AgendaDocument4 pagesElection 2016 Malcolm Turnbull Is The Only Leader With A Genuine Growth AgendaAnonymous KO1mh64TLUNo ratings yet

- Australian Prime Minister Reshuffles His Ministry: World Socialist Web SiteDocument2 pagesAustralian Prime Minister Reshuffles His Ministry: World Socialist Web SiteRobert MillerNo ratings yet

- Austerity Measures: Video: Political News of The Day - 60 Secs at A TimeDocument9 pagesAusterity Measures: Video: Political News of The Day - 60 Secs at A TimeLalitha SurasgarNo ratings yet

- MGMTDocument1 pageMGMTSuresh VaviaNo ratings yet

- Epi Briefing Paper: Regulatory UncertaintyDocument9 pagesEpi Briefing Paper: Regulatory Uncertaintyannawitkowski88No ratings yet

- Undermining The Resources Super Profits Tax 2013-152.1 (CC)Document24 pagesUndermining The Resources Super Profits Tax 2013-152.1 (CC)Aksatar AhsanNo ratings yet

- White House Economic Report Calls For Cutting Corporate TaxesDocument2 pagesWhite House Economic Report Calls For Cutting Corporate TaxesRobert MillerNo ratings yet

- The Forum: Our New Comment SectionDocument36 pagesThe Forum: Our New Comment SectionCity A.M.No ratings yet

- Seeing An EndDocument4 pagesSeeing An EndsuksesNo ratings yet

- Paul Craig Roberts: Economy US ViewpointsDocument3 pagesPaul Craig Roberts: Economy US Viewpointskwintencirkel3715No ratings yet

- Big Business and Bad GovernmentDocument12 pagesBig Business and Bad GovernmentJamaal MorganNo ratings yet

- Newton KuNe Neg 01 - Blue Valley Southwest OctasDocument27 pagesNewton KuNe Neg 01 - Blue Valley Southwest OctasEmronNo ratings yet

- Uk Productivity PuzzleDocument4 pagesUk Productivity Puzzleapi-53255207No ratings yet

- The Reason Ehy Uk Economy Need Plan BDocument3 pagesThe Reason Ehy Uk Economy Need Plan BekwonnaNo ratings yet

- Obama's Economic Policies Since Becoming President: Obama and The EconomyDocument7 pagesObama's Economic Policies Since Becoming President: Obama and The EconomyasfawmNo ratings yet

- Why in The World Are We All Keynesians Again? The Flimsy Case For Stimulus SpendingDocument20 pagesWhy in The World Are We All Keynesians Again? The Flimsy Case For Stimulus SpendingCato InstituteNo ratings yet

- Senate Hearing, 111TH Congress - The Road To Economic Recovery: Prospects For Jobs and GrowthDocument85 pagesSenate Hearing, 111TH Congress - The Road To Economic Recovery: Prospects For Jobs and GrowthScribd Government DocsNo ratings yet

- Space Aff GrapevineDocument25 pagesSpace Aff Grapevinegsd24337No ratings yet

- F P M P I U.S. E .: Iscal Olicy and Onetary Olicy Mpact On The ConomyDocument15 pagesF P M P I U.S. E .: Iscal Olicy and Onetary Olicy Mpact On The ConomyHeather Lindquist VenableNo ratings yet

- Weekly Market Commentary 10-24-11Document5 pagesWeekly Market Commentary 10-24-11monarchadvisorygroupNo ratings yet

- Coalition Challenged by Dual Roles As Global and National LeaderDocument3 pagesCoalition Challenged by Dual Roles As Global and National LeaderAnonymous tTk3g8No ratings yet

- Berita 3 November 2016 (Asli)Document2 pagesBerita 3 November 2016 (Asli)PuputNo ratings yet

- Phony Fear Factor - NYTimesDocument3 pagesPhony Fear Factor - NYTimesJosé Luis Pugés CasqueroNo ratings yet

- Bahan Berita 15 OktoberDocument2 pagesBahan Berita 15 OktoberPuputNo ratings yet

- Australia: Create A Comparison ChartDocument11 pagesAustralia: Create A Comparison ChartelmarcomonalNo ratings yet

- Structure: Lewis: Chapter 1 - An Overview of The Australian EconomyDocument7 pagesStructure: Lewis: Chapter 1 - An Overview of The Australian Economydesidoll_92No ratings yet

- Chris Bowen m2Document9 pagesChris Bowen m2Political AlertNo ratings yet

- Lessons For ObamaDocument4 pagesLessons For ObamaSwapnil ShethNo ratings yet

- Revenue Status Report FY 2011-2012 - General Fund 20111231Document19 pagesRevenue Status Report FY 2011-2012 - General Fund 20111231Infosys GriffinNo ratings yet

- Senate Hearing, 111TH Congress - Avoiding Another Lost Decade: How To Promote Job CreationDocument54 pagesSenate Hearing, 111TH Congress - Avoiding Another Lost Decade: How To Promote Job CreationScribd Government DocsNo ratings yet

- Executive Office of The President: Council of Economic AdvisersDocument12 pagesExecutive Office of The President: Council of Economic Adviserslosangeles100% (1)

- Campaign Media ReleaseDocument2 pagesCampaign Media ReleasePolitical AlertNo ratings yet

- Byron WienDocument3 pagesByron WienZerohedge100% (2)

- Losg Za MarchDocument4 pagesLosg Za MarchTedi NajdovskaNo ratings yet

- Morning News Notes: 2010-02-05Document2 pagesMorning News Notes: 2010-02-05glerner133926No ratings yet

- Facing The Economic CrisisDocument12 pagesFacing The Economic CrisisStathis PapastathopoulosNo ratings yet

- Cityam 2011-09-19Document36 pagesCityam 2011-09-19City A.M.No ratings yet

- Translate The Following Extract Into VietnameseDocument2 pagesTranslate The Following Extract Into VietnameseNhài NhàiNo ratings yet

- Weekly Economic Commentary 10-10-11Document8 pagesWeekly Economic Commentary 10-10-11monarchadvisorygroupNo ratings yet

- Boom's $190bn Windfall 'Wasted'Document3 pagesBoom's $190bn Windfall 'Wasted'doxagnosticNo ratings yet

- Obama Insists On Tax Hike For Rich As Part of Fiscal DealDocument4 pagesObama Insists On Tax Hike For Rich As Part of Fiscal DealTaj FatyNo ratings yet

- Chairman Tom Pauken: The Obama Administration's "Economic Stimulus" Plan Isn't Working by Tom PaukenDocument2 pagesChairman Tom Pauken: The Obama Administration's "Economic Stimulus" Plan Isn't Working by Tom Paukensheath24No ratings yet

- AGGREGATE DEMAND and SUPPLYDocument10 pagesAGGREGATE DEMAND and SUPPLYSonali TiwariNo ratings yet

- Equitable Growth: Washington CenterDocument69 pagesEquitable Growth: Washington Centerduttons930No ratings yet

- 05-03-11 Public Employee Unions Don't Get One Penny From Taxpayers and Can't Require Membership, But The Big Lie That They Do Is EverywhereDocument2 pages05-03-11 Public Employee Unions Don't Get One Penny From Taxpayers and Can't Require Membership, But The Big Lie That They Do Is EverywhereWilliam J GreenbergNo ratings yet

- OND Choeneck ING PLLC: MemorandumDocument17 pagesOND Choeneck ING PLLC: MemorandumrkarlinNo ratings yet

- Workchoices Roadblock To ProductivityDocument28 pagesWorkchoices Roadblock To ProductivityMark DuckettNo ratings yet

- Eco Commentary 2 FinalDocument5 pagesEco Commentary 2 FinalYo_YO_MaNo ratings yet

- The Wall Street Journal November 14 2016Document44 pagesThe Wall Street Journal November 14 2016Hameleo1000No ratings yet

- Australia Policy PDFDocument17 pagesAustralia Policy PDFHa LinhNo ratings yet

- The Three Factors Choking The U.S. Recovery: Urgent ReportDocument5 pagesThe Three Factors Choking The U.S. Recovery: Urgent ReportsebascianNo ratings yet

- 2010 0113 EconomicDataDocument11 pages2010 0113 EconomicDataArikKanasNo ratings yet

- SMH 23jul18Document5 pagesSMH 23jul18John GriffithNo ratings yet

- This Time Had Better Be Different: House Prices and The Banks Part 2Document39 pagesThis Time Had Better Be Different: House Prices and The Banks Part 2KamizoriNo ratings yet

- RT Hon Baroness Royall of Blaisdon Leader of The Opposition House of LordsDocument12 pagesRT Hon Baroness Royall of Blaisdon Leader of The Opposition House of Lordsapi-110464801No ratings yet

- Varo n28Document2 pagesVaro n28Shane MishokaNo ratings yet

- Writings of Trotsky From 1917Document3 pagesWritings of Trotsky From 1917Shane MishokaNo ratings yet

- Covid-19: Clusters and Stages ExplainedDocument4 pagesCovid-19: Clusters and Stages ExplainedShane MishokaNo ratings yet

- Prophetic Words: Lenin Internet ArchiveDocument5 pagesProphetic Words: Lenin Internet ArchiveShane MishokaNo ratings yet

- Pers 05n PDFDocument2 pagesPers 05n PDFShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí WvúhDocument3 pagesF, Dal Iudcjd Fjí WvúhShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: YS%, XLD FMD, Sish Hdmkfha Rekhka Ÿisï .Kkla W Awvx. JG .KSDocument2 pagesF, Dal Iudcjd Fjí Wvúh: YS%, XLD FMD, Sish Hdmkfha Rekhka Ÿisï .Kkla W Awvx. JG .KSShane MishokaNo ratings yet

- Home Top Story GMOA ProposesDocument6 pagesHome Top Story GMOA ProposesShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: Oyia .Kkla Ÿ.Syq Iudoaê Iykdodrh Lmamdÿjg Tfrysj Úfrdaoh MD SDocument2 pagesF, Dal Iudcjd Fjí Wvúh: Oyia .Kkla Ÿ.Syq Iudoaê Iykdodrh Lmamdÿjg Tfrysj Úfrdaoh MD SShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: Lïlre Mka SH Yd G%ïmag Tfrysj IgkDocument2 pagesF, Dal Iudcjd Fjí Wvúh: Lïlre Mka SH Yd G%ïmag Tfrysj IgkShane MishokaNo ratings yet

- The Strange Political Afterlife of Andrew Jackson: Trump Turns To American HistoryDocument3 pagesThe Strange Political Afterlife of Andrew Jackson: Trump Turns To American HistoryShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: Isßhdjg Tfrys Tlai A Ckmo Ñihs, M%Ydrh Iïnkaoj Isfuda Y Iaf.A Fy, Sorõj .Ek Udoh F.D FjhsDocument2 pagesF, Dal Iudcjd Fjí Wvúh: Isßhdjg Tfrys Tlai A Ckmo Ñihs, M%Ydrh Iïnkaoj Isfuda Y Iaf.A Fy, Sorõj .Ek Udoh F.D FjhsShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: Reishdkq Ks S (HD Yuqùu T, Sorõ Ùu Fjdiskagkfha Foaymd, K W Nqoh SJ% LrhsDocument2 pagesF, Dal Iudcjd Fjí Wvúh: Reishdkq Ks S (HD Yuqùu T, Sorõ Ùu Fjdiskagkfha Foaymd, K W Nqoh SJ% LrhsShane MishokaNo ratings yet

- Mass Protests Against Austerity and Social Inequality Shake Iranian RegimeDocument2 pagesMass Protests Against Austerity and Social Inequality Shake Iranian RegimeShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: W.%JK Hqojdoh Ueo Weußldkqjka F.Ka Ishhg 76la Uyd Hqoaohla MS, SN - J Ìhg M Aj WeDocument2 pagesF, Dal Iudcjd Fjí Wvúh: W.%JK Hqojdoh Ueo Weußldkqjka F.Ka Ishhg 76la Uyd Hqoaohla MS, SN - J Ìhg M Aj WeShane MishokaNo ratings yet

- US Accused of War Crimes in Air Strikes On Iraqi City of MosulDocument2 pagesUS Accused of War Crimes in Air Strikes On Iraqi City of MosulShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: Isf.A N, Ska Ixpdrh" Ô 20 Iuqæjg FMR Weußldkq-Hqfrda Ix - Ufha .Egqï Biau LrhsDocument2 pagesF, Dal Iudcjd Fjí Wvúh: Isf.A N, Ska Ixpdrh" Ô 20 Iuqæjg FMR Weußldkq-Hqfrda Ix - Ufha .Egqï Biau LrhsShane MishokaNo ratings yet

- Li, W Nqofha J.Lsu CK DJ U Megùug Okm S - Úyaf, Ailhka NDR F.K We S Fldka % A J .EkDocument2 pagesLi, W Nqofha J.Lsu CK DJ U Megùug Okm S - Úyaf, Ailhka NDR F.K We S Fldka % A J .EkShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: Fya%Iagdêlrkh Yd G%Ïmaf.A Uqia, Sï-Úfrdaë Úodhl KsfhdaDocument2 pagesF, Dal Iudcjd Fjí Wvúh: Fya%Iagdêlrkh Yd G%Ïmaf.A Uqia, Sï-Úfrdaë Úodhl KsfhdaShane MishokaNo ratings yet

- Iñ S Kdhlfhda Igkg Msúis, Xúu Lïlrejkag L, Aueíug Fhdackd LR SDocument2 pagesIñ S Kdhlfhda Igkg Msúis, Xúu Lïlrejkag L, Aueíug Fhdackd LR SShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: Wudth Jhikhg Úfrdaoh Mdñka Oyia .Kka CKHD Nkavdrfj, G /iafj SDocument2 pagesF, Dal Iudcjd Fjí Wvúh: Wudth Jhikhg Úfrdaoh Mdñka Oyia .Kka CKHD Nkavdrfj, G /iafj SShane MishokaNo ratings yet

- F, Dal Iudcjd Fjí Wvúh: 1905 Wreuh Iy Reishdkq Úma, Jfha Uqf, DamdhDocument10 pagesF, Dal Iudcjd Fjí Wvúh: 1905 Wreuh Iy Reishdkq Úma, Jfha Uqf, DamdhShane MishokaNo ratings yet

- Media List of AustraliaDocument8 pagesMedia List of AustraliaBB News International100% (1)

- C2 W5 Practice Challenge SolutionDocument28 pagesC2 W5 Practice Challenge SolutionMd Tawhidul HaqueNo ratings yet

- Business Valuation of Qantas Airways LimitedDocument4 pagesBusiness Valuation of Qantas Airways LimitedRyanNo ratings yet

- CMC Markets Product ScheduleDocument65 pagesCMC Markets Product ScheduleAsteebNo ratings yet

- 00 AFTS Final Report ConsolidatedDocument216 pages00 AFTS Final Report ConsolidatedFiona MarsdenNo ratings yet

- Australia ReportDocument73 pagesAustralia ReportzeynologyNo ratings yet

- Australian Economy - Australia Could Be First Domino To Fall' in CollapseDocument6 pagesAustralian Economy - Australia Could Be First Domino To Fall' in CollapseYC TeoNo ratings yet

- The Manager of The 21st CenturyDocument35 pagesThe Manager of The 21st CenturySheni Snaptu100% (1)

- JLL Australia Office Market Investment Review Apr 2010Document24 pagesJLL Australia Office Market Investment Review Apr 2010erolandsenNo ratings yet

- C2 W5 Practice ChallengeDocument22 pagesC2 W5 Practice ChallengeMd Tawhidul HaqueNo ratings yet

- The Australian EconomyDocument35 pagesThe Australian Economybiangbiang bangNo ratings yet

- Digital TV Channels Aust WideDocument119 pagesDigital TV Channels Aust WideHelen HelenopoulosNo ratings yet

- 5G Tower Suburb List August 2019Document10 pages5G Tower Suburb List August 2019Ken Murray0% (2)

- Challenge Tablas Semana 5Document32 pagesChallenge Tablas Semana 5Stefy Ortiz BdvNo ratings yet

- Memo Corporation Australia Company ExtractDocument15 pagesMemo Corporation Australia Company ExtractBilly BunterNo ratings yet

- Australian Real Estate Opportunities FundDocument16 pagesAustralian Real Estate Opportunities FundSam KingNo ratings yet

- Australian Electrical Div CompaniesDocument12 pagesAustralian Electrical Div CompaniesAnand ArjunanNo ratings yet

- Currency TraderDocument29 pagesCurrency TraderOuwehand OrgNo ratings yet

- Generations in Jazz Land Sale & Associated CompaniesDocument19 pagesGenerations in Jazz Land Sale & Associated CompaniesTillyNo ratings yet

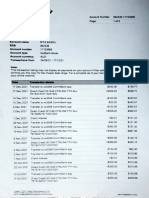

- Comonmvealthbank: List of TransactionsDocument5 pagesComonmvealthbank: List of Transactionsrita bassilNo ratings yet

- Country Link NetworkDocument1 pageCountry Link NetworkAmit JoshiNo ratings yet

- AMTA 2004 Annual Report PDFDocument27 pagesAMTA 2004 Annual Report PDFextra_ordinarymanNo ratings yet

- Bai 18540Document10 pagesBai 18540Suneel BhaskarNo ratings yet

- BEO6600 Group Ass1Document16 pagesBEO6600 Group Ass1vamsikrishnabNo ratings yet

- Human Resource Practices in AustraliaDocument10 pagesHuman Resource Practices in AustraliaTilak Salian100% (1)

- CompleteFreedom 3112 06mar2023Document38 pagesCompleteFreedom 3112 06mar2023Bong MagalitNo ratings yet

- MWV Web ServicesDocument48 pagesMWV Web ServicesRathna SubbuNo ratings yet

- Amr October 19Document128 pagesAmr October 19fernando quispialayaNo ratings yet