Professional Documents

Culture Documents

LDDC101 DwntwnLouisReport3!27!13

LDDC101 DwntwnLouisReport3!27!13

Uploaded by

cottswdrbOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LDDC101 DwntwnLouisReport3!27!13

LDDC101 DwntwnLouisReport3!27!13

Uploaded by

cottswdrbCopyright:

Available Formats

KWA

Retail Development Planning

March 27, 2013

Alan Deslisle and Clark Welch

Louisville Economic Development Corp.

One Riverfront Plaza, 401 West Main Street, Suite 1702

Louisville, Kentucky 40202

(502) 584-6000

Gentleman,

The market survey concludes there is a reasonable, initial sales base for the feasibility of a new, tailored supermarket in Louisvilles downtown

market.

The survey further concludes that NuLu district is the most promising and logical location for the proposed supermarket. Other downtown sites

were considered and tested for a variety of format types, but NuLu has the best overall traits for that new stores success.

The sales forecasts relate to a hypothetical site, NuLu Location 1000, in midst of the district, and with a strong physical plan and operation. The

forecasts are first-pass assessment of the recommended stores performance potential. Youll have option for updated sales forecasts as details

emerge on an actual site and retailer.

Ill remain available to discuss the market survey with you and your prospective retailers and developers. This is an interesting and promising

location and it will take a carefully planned retail model in order to capture business from this markets variety of sectors.

Sincerely,

Keith R. Wicks.

Encl.:

(4) copies of Louisville Downtown Market Survey LDDC101

Louisville Downtown Retail Food Market Survey

East Market / NuLu District

Downtown Louisville; view south from river

NuLu, East Side District; View West to Downtown Fourth Street Live District

Project #LDDC101

Prepared for:

Louisville Downtown Development Corp.

March 27, 2013

Downtown Louisville, Kentucky Market Survey LDDC101

Page 3

Contents

Page

EXECUTIVE SUMMARY

Market Survey Purpose ..................................................................................................... 5

Recommended Downtown Supermarket Location .......................................................... 5

Survey Assumptions.......................................................................................................... 9

Conclusion and Sales Forecast Decision Matrix .............................................................. 18

Three Year Sales Forecasts by Scenario .......................................................................... 22

NuLu Location Demographic Profile Chart...................................................................... 24

Competitor Threats.......................................................................................................... 25

Recommendations and Retailer Candidates................................................................... 26

CURRENT MARKET

Trade Area Overview ...................................................................................................... 29

Competitor Evaluation ..................................................................................................... 37

Current market sales reports .......................................................................................... 38

SALES FORECASTS FOR A DOWNTOWN GROCERY STORE

Site Evaluations

NuLu Location 1000 ........................................................................................................ 42

Sales Reports

Scenario 1 25k sf fresh store at NuLu Location 1000 .................................................. 44

Scenario 2 35k sf fresh store at NuLu Location 1000 ................................................... 45

Scenario 3 35k sf discounter grocery at S. Downtown Location 3000 ........................ 46

APPENDIX

Trade Area Demographics .............................................................................................. set

Methodology and Qualifier ............................................................................................. 59

Definitions ........................................................................................................................ 60

Sources ............................................................................................................................. 61

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 4

Downtown Louisville Retail Food Market

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 5

EXECUTIVE SUMMARY

Louisville Downtown Development Corp. has commissioned Keith Wicks & Associates to conduct a market survey of Louisvilles

Downtown retail food market (aerial illustration on the previous page) for the purpose of:

1. Determining the most logical location for developing a new, full-service supermarket to service Downtowns variety of

consumer sectors.

2. Defining the most logical supermarket format for application to the recommended location, and making assumptions for the

development and retail model for prospective supermarket retailer.

The recommended supermarket location is downtowns East Market and NuLu (New Louisville) district because:

Best location for market access and servicing Downtowns mix of consumer sectors:

o Urban residents:

Convenience to east side communities situated within trade area: NuLu, Butcher town, Phoenix Hill,

Smoketown, Clifton and a portion of Highlands.

Competitive position to capture secondary trade from communities outside the trade area: Clifton Heights,

greater Highlands, Old Louisville, West Louisville and Jeffersontown, IN. NuLu benefits with arterial route

accesses to Downtowns hub and the broad scope of communities for primary and secondary business.

o Daytime business sector: 70,000 workers (lunch and secondary grocery needs) plus businesses (catering) in the

downtown market and a growing dynamic with infrastructure improvements and redevelopment projects throughout.

The daytime sector includes the hospital district situated four blocks south and the developing University Nucleus

Innovation Park (medical research campus) at NuLus west end. In particular NuLus infrastructure development

includes planned streetscape upgrades of the primary east/west arterial routes Main and Market Streets.

o Supplemental business from 13 million visitors annually to downtowns nearby hotels, business, healthcare and

education institutions, and entertainment.

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 6

NuLu Commercial District

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 7

A unique and complimentary business setting

o NuLu district compliments the proposed supermarket with the dynamic of the developing commercial district of arts,

dining and uptown lifestyle. It is an uptrend location fitting for an uptrend supermarket. In turn the proposed

supermarket can complement NuLu especially in adding substantial business traffic; the estimated number of weekly

supermarket transactions is range of 7-12,000 where a further estimated average of 1.5 persons per transaction (store

visit) infuses consistent, weekly traffic of 10-15,000 consumers.

NuLus growth trend is affected by the overall downtown dynamic but NuLus future growth in particular will be enhanced by:

o $13 million investment for a beautification plan and streetscape, by State of Kentucky and Louisville downtown

Development Corp. The plan is for improving the five blocks NuLus east side Home of Innocents campus and the west

end I-65/ University of Louisvilles Nucleus Innovation Park.

o NuLu Business Associations newly drafted Strategic Plan 2012; highlights from http://insiderlouisville.com.

launching a Live in NuLu marketing campaign.

working with Louisville Downtown Development Corp. to identify and quantify housing needs and wants in NuLu.

developing a committee to provide assistance in developing residential within existing buildings.

working with existing property managers and residential associations to fill vacancies.

encourage civic participation by welcoming current and potential residents to the association.

creating a residential boom to equal the business boom.

Upgrade streetscapes five blocks from Nucleus at Floyd Street east along Market Street to the Home of the Innocents.

The goal is to physically blend the gap between Nucleus and into the resurgent NuLu.

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 8

NuLu Images

New housing trends

East Market District/NuLu website http://eastmarketdistrict.com.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 9

Projected NuLu supermarket

The proposed supermarket is tested as hypothetical NuLu Site 1000 in midst of the district. The site is tested for a variety of

supermarket formats and stores sizes but this report narrows the results to the most logical retail models for store productivity relative

to size and $/square performance. The tests addressed independent and corporate retail models. The results indicate a size range of

25-35,000 sf which is would appear best suited by an independent retailer or cooperative operation:

A Fresh store format is judged the best opportunity to service this markets consumer groups especially regarding the substantial

daytime sector. The general assumption is for quality emphasized fresh fare and an overall fair value with price structure.

Baseline total store size is suggested at 25,000 square feet in order for competitive variety and fresh presentations; maximum size is

35,000 square feet given the real estate constraints in the market. NuLu Location 1000 is projected as:

Scenario 1 -- 25,000 sf fresh store. There isnt a suitable corporate retailer format at this size so this scenario is projected as an

aggressive development and retail model by an independent or cooperative retailer; conventional and natural products.

Scenario 2 -- 35,000 sf fresh store. This larger store size is projected as a stretch of Scenario 1s format. This might be considered by

a chain like Kroger and is in the size range of Whole Foods latest prototypes, but again like Scenario 1 is projected as an

aggressive development and retail model by an independent or cooperative retailer.

A smaller format of about 15,000 sf can be considered for an uptrend chain like Trader Joes (17,000 sf prototype with liquor) or for a

natural food cooperatives initial entry or possibly for converting an existing facility.

Conversely it might also be possible to assemble a larger parcel for at least 45,000 sf in order to consider a chains standard supermarket

format (e.g., Kroger) in the NuLu district, or for a discounter with grocery (e.g., Target) to position at South Downtown Location 2000.

And depending on details its possible that the grocery portion of a hypothetical downtown discounter wouldnt necessarily preclude

feasibility of also developing a NuLu supermarket because the formats and retail business factors are assumed to be distinctly different.

This survey does not test a price-impact format like Walmarts Neighborhood Market (36-44,000 sf) or Aldi and Save A Lot (15-17,000

sf), with citing less than full-service formats and little to no specialties, as well as being less than the suitable character for NuLu.

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 10

The supermarket formats present:

First-pass identification of sites and sales forecasts made without conceptual or detailed plans. The identified sites or one in proximity

are assumed to be workable, i.e., physically suitable for the proposed grocery store and economically feasible for development.

Forecasts are made with the general assumption of a freestanding grocery store development, but real estate and development costs

might lead to a larger and possibly mixed-use development in order for an acceptable ROI.

Weekly performances: the Downtown market demand, the assessed competitors sales volumes and the sales forecasts are weekly

performance which is the grocery industrys standard measure. The sales forecasts represent first year end, settled performance.

The sales forecasts and the related format assumptions are the baseline for prospective developers and retailers to consider for their

next step of drafting first-pass pro forma feasibility: sales forecast to cost of operation. Or to define the details of development and

forma, and request an updated sales forecast for a refined pro forma.

The forecasts are 24-months out: twelve months to store opening plus twelve months to first year end, settled performance (February

2014). Each scenarios sales reports include three-year growth forecasts which a prospective retailer can use to complete a pro forma

of sales potential to cost of development and operation.

The projected store opening is likely too soon for the actual processes to that point (LDDC decisions and marketing for developer and

retailer, development negotiations, design and construction). Therefore the forecasts are conservative should the opening date extend

significantly past the 24-months out timeline, as affected by inflation, housing growth and the continued area development.

The downtown market is an emerging area of new housing developments so that trend presents upside to the sales forecasts especially

beyond this surveys 24-month timeline to store opening. The market is surging with commercial and institutional developments for a

growing downtown dynamic that naturally has led to increased demand for new, urban housing which is occurring at East Market and

NuLu. Example of new housing contribution to the proposed grocery stores potential: 100 new housing units estimated at two

persons per unit add 200 consumers contributing $8,000 to weekly, market potential. The stores share of business from those new

consumers (residences in proximity of the site) range from 25% ($2,000) to upwards of 50% ($4,000) over and above the sales forecasts.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 11

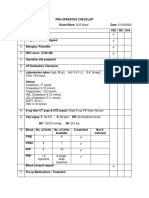

Fresh Store Format Assumptions

Presenting uptrend retail traits beginning with impact exterior retail character leading to a special shopping experience via interior

dcor, format, marketing, merchandising, food qualities and customer service. Although not assumed the store might benefit from a

LEED certified facility (leadership in energy and environmental design) for added character, cost savings and community relations.

Conventional and natural market product mix for broadest attraction to the variety of consumer sectors with this market.

Fair value pricing but this formats lead attraction is with the values in shopping experience, product quality and pricing structure.

Fresh fare and specialty attractions:

o Local and seasonal fresh fare sourcing in season (i.e., farm to market).

o Fresh meat; Choice grade quality; service and self-service merchandising.

o Fresh produce.

o Floral & gifts especially with proximity to the health care district.

o Expanded prepared foods including hot & cold deli, bakery, beverage and food bars, indoor Caf and outdoor seasonal patio.

Some form of catering for private and business affairs (i.e., limited vs. full service catering; group menu, delivery vs. pick-up).

o Contending Wine & Beer.

o Urban grocery service home order basis and options for delivery service (with a fee) to on-site pick up where the drive-up or

drive-thru facility is to be determined. There is business profile advantage with delivery service with business imagery on the

mobile delivery vehicles.

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 12

Fresh Store Traits

Prepared foods

Bulk & Organic Produce

Exterior theater & interior experience

European bakery

Prepared for Louisville Downtown Development Corp.

March 27, 2013

Quality meats & seafood

Floral & gifts

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 13

Other assumptions of the sales forecasts

2% annual inflation of retail food expenditures which is reasonable outlook in part accounting for increased wholesales

and operating costs.

General assumptions for the business setting and site:

Supportive business setting (i.e., streetscape, adjacent properties and adjacent businesses).

Supportive sight lines to transient traffic and for presenting business imagery. Those impressions will be

important toward optimizing business character as well as with helping expedite the business maturation time to

established business and profitability, which might need upfront cost relief to comfortably achieve that goal.

It will be imperative to project a store name and logo and beneficial to project a changing element of business

imagery (i.e., promotions, events, community messages) in order to maintain fresh attraction and to create a

competitive market position. Based at the storefront, probably including a side street wall and possibly needing

support of a roadside pylon sign.

Comfortable and safe parking lot lighting as well as security support.

Comfortable site ingress/egress and parking lot traffic flow.

Adequate parking, suggesting 4:1 ratio of total store size to parking stalls.

Bike racks to support the urban option.

Exterior patio for seasonal, outdoor events (i.e., product promotions, grill outs and holidays).

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 14

Scenario 1 retailer candidates there are no apparent local or regional independent retailer formats that stand out for visual

fresh store example, but the local Value Market retailer does have the potential to create the store in objective.

Examples of independent, fresh store retailers in other markets

freshseasons.com Victoria, MN

Heinens, Cleveland, OH, http://www.heinens.com/

dorothylane.com Dayton, OH

lundsandbyerlys.com Downtown Mpls., MN

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 15

There are natural market retailers to consider for the NuLu supermarket. Lexingtons Good Foods Market & Caf

(http://www.goodfoods.coop/) is a long-established and refined cooperative situated in an urban market in proximity of

University of Kentucky. The format is natural market based and with a substantial caf and food bar.

Rainbow Blossom is the local natural market retailer with experience and potential for expanding Rainbows current retail

model to a full-service supermarket. (http://www.rainbowblossom.com).

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 16

Other examples of successful, urban cooperative natural markets

http://seward.coop/ Minneapolis, MN

http://www.willystreet.coop/ Madison, WI

http://www.newpi.coop/ Iowa City, IA

http://www.berkshire.coop/

Prepared for Louisville Downtown Development Corp.

March 27, 2013

Great Barrington, MA

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 17

FYI -- chain retailer examples to consider for NuLu Location 1000 or a discounter at South Downtown Site 3000.

Whole Foods

Prepared for Louisville Downtown Development Corp.

February 11, 2013

Walmart

Target P Fresh

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 18

CONCLUSION

Louisvilles downtown market does offer a substantial market for the suggested fresh store. There is a broad mix of consumer

business sectors where the proposed new supermarket location will need a strong, initial awareness strategy, grand opening and

first year sustained marketing for developing the customer base.

NuLu is the best location for servicing Downtowns business sector and with noting that the east side untapped for convenient

supermarket service. A NuLu supermarket should help spur area residential growth interests and uptown lifestyle.

Nonetheless a supermarkets success in this situation relies on a well-tailored retail model and marketing strategy for an uptrend

fresh store supermarket.

The sales forecasts relate to a hypothetical site in NuLu district because an actual site is to be determined. The assumption is that

the site has supportive retail factors and a significant position in the district.

The 25k sf scenario can be considered a lean & mean size fresh store and produces this surveys best initial $/sf productivity. The

smaller format will rely on vertical merchandising and tight operations but can reasonably manage another fifty percent increase in

sales for a ceiling of around $350,000 or the option for expansion or relocation.

The 35k sf scenario is the more comfortable size for optimizing fresh traits and full-service grocery. It also is best for the markets

future growth. Future growth relates to both a growing workforce for daytime trade and trending new housing growth for

downtown and more particularly uptown for best market share for the NuLu location. What future growth means to this site is that

for every 100 new housing units added near the NuLu location the proposed supermarket has potential for +$2-4k in sales increase.

But the larger store scenario carries increased risk to maintain quality conditions during the initial business development phases

through the first 12-18 months of operations. And the larger store scenario could be challenging for assembling the 2+ acres.

The proposed stores initial business development could warrant upfront expense relief in order to increase expenses for business

development marketing.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 19

Downtown Louisville Supermarket Decision Matrix

Scenario

Store

Sales

Market

Size Forecast $/sf Share Draw

NuLu Location 1000

Fresh Store Scenario 1

25000

$210,172

$8.41

12.06%

Fresh Store Scenario 2

35000

$283,576

$8.18

16.27%

Comments

80% Projected as an aggressive plan and operation by

an independent retailer.

80% A stretch of Scenario 1 format, (i.e., same departments

and attractions; expanded presentations and variety).

1 -- Sales forecast is the weekly average by first year end; 12 months developed business.

2 -- $/sf is an indicator of a supermarket sites feasibility of a site's grocery store forecast in relation to anticipated costs with new

development,

$8/sf productivity is reasonable low end initial performance for a new supermarket, considering NuLus promising growth.

$10/sf is a reasonable matured productivity goal; three years is typical new supermarket timeline to matured business.

3 -- Draw is a variable in this surveys sales model. It explains the percent of store sales projected to come from the primary

residential market, i.e., trade areathe remainder comes from business sectors beyond the resident trade area (i.e., contiguous

neighborhoods, daytime sectors and capturing retail expenditures other than grocery (e.g., restaurants, liquor stores, floral).

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 20

Suggested department distributions

25,000 SF Fresh Store Suggested Distributions

Department

Distribution

Sales

Grocery

Health & Wellness

Meat

Produce

Floral & Gifts

Bakery

Deli/Prepared

Food

Frozen

Dairy

Wine & Beer

Gen. Merch.

34.00%

4.00%

12.00%

13.00%

1.00%

3.00%

$60,326

$7,097

$21,291

$23,066

$1,774

$5,323

7.00%

$12,420

7.00%

9.00%

7.00%

3.00%

$12,420

$15,969

$12,420

$5,323

Total

100.00%

$177,428

Scenario 1assumed to be an aggressive plan

and operation by an independent retailer

Conventional, natural & organic center store product.

Integrated or segregated department.

Meat & seafood, islands, some service case.

Bulk merchandising & locally sourced in-season.

Added potential with the health care business sectors.

Limits for on-site prep.; relies on truck-in partner.

Service hot & cold, food & beverage bars, caf, grab n'

go, limited catering. Outdoor patio in-season.

Energy efficient door case.

Doors and open multi-deck case.

Mix of value to quality values for all consumer sectors.

Doors and promotional merchandisers.

The suggested distributions will be altered upon details of the plan. The remaining scenarios are more so dependent on the

retailer/chain details and be updated upon that identification.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 21

35,000 SF Fresh Store Suggested Distributions

Commentsprojected as a "stretch" of the 25k sf

Department

Distribution

Sales

Scenario 1 format and with expanded variety and

greater presentations.

Grocery

Health & Wellness

Meat

Produce

Floral & Gifts

Bakery

Deli/Prepared

Food

Frozen

Dairy

Wine & Beer

Gen. Merch.

33.00%

5.00%

11.50%

12.50%

1.00%

3.00%

$82,997

$12,575

$28,923

$31,438

$2,515

$7,545

7.00%

$17,605

7.00%

9.00%

8.00%

3.00%

$17,605

$22,635

$20,120

$7,545

Conventional, natural & organic center store product.

Integrated or segregated department.

Meat & seafood, islands, some service case.

Bulk merchandising & locally sourced in-season.

Added potential with the health care business sectors.

Limits for on-site prep.; relies on truck-in partner.

Service hot & cold, food & beverage bars, caf, grab n'

go, limited catering. Outdoor patio in-season.

Energy efficient door case.

Doors and open multi-deck case.

Mix of value to quality values for all consumer sectors.

Doors and promotional merchandisers.

Total

100.00%

$251,505

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 22

THREE YEAR SALES GROWTH REPORTS

SCENARIO 1 25K SF FRESH STORE NULU SITE 1000

Facility Map Key = 1000.1

Dec 2014

Sales Forecast

Weekly Sales /SqFt

1st Year

2nd Year

3rd Year

210,172

222,440

235,070

8.41

8.90

9.40

Inflation is 1%

EXPLANATION OF SALES FORECAST

Fresh Store

Map Key 1000.1

------------Sales Transfer------------- --Total Transfer-Dec 2014 Percent

Dec 2015

Dec 2016

Sales Percent

Related Stores

Population

Inflation

Float

Outside Trade Area

163,248

3,225

1,665

0

42,034

77.67

1.53

0.79

0.00

20.00

4,587

3,386

1,842

0

2,454

4,498

3,581

2,024

0

2,526

172,333

10,192

5,531

0

47,014

73.31

4.34

2.35

0.00

20.00

Total

Cumulative

210,172

210,172

100.00

12,268

222,440

12,630

235,070

235,070

100.00

Takeaway from Related Stores

Map Key Name

1

2

3

224

327

348

753

Save-A-Lot

WM Nbhd Mkt

Value Market

Kroger

Kroger

Kroger

Kroger

Total

Cumulative

Prepared for Louisville Downtown Development Corp.

March 27, 2013

------------Sales Transfer-----------Dec 2014 Percent Dec 2015

Dec 2016

-Total TransferSales Percent

-6,853

-4,236

-17,498

-38,208

-19,185

-41,964

-35,305

-15.16

-14.66

-15.91

-19.19

-31.26

-19.10

-16.73

-205

-126

-509

-988

-522

-1,215

-1,022

-201

-124

-500

-966

-510

-1,193

-1,004

-7,259

-4,485

-18,508

-40,162

-20,217

-44,372

-37,330

-16.06

-15.52

-16.83

-20.18

-32.94

-20.20

-17.69

-163,248

-163,248

-18.65

-4,587

-167,835

-4,498

-172,333

-172,333

-19.69

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 23

SCENARIO 2 35K SF FRESH STORE AT NULU LOCATION 1000

Facility Map Key = 1000.2

Dec 2014

Sales Forecast

Weekly Sales /SqFt

1st Year

2nd Year

3rd Year

283,576

299,214

315,262

8.10

8.55

9.01

EXPLANATION OF SALES FORECAST

Mid-size Fr. Str

Map Key 1000.2

------------Sales Transfer------------- --Total Transfer-Dec 2014 Percent

Dec 2015

Dec 2016

Sales Percent

Related Stores

Population

Inflation

Float

Outside Trade Area

220,411

4,204

2,246

0

56,715

77.73

1.48

0.79

0.00

20.00

5,643

4,397

2,470

0

3,128

5,515

4,623

2,701

0

3,210

231,569

13,223

7,417

0

63,052

73.45

4.19

2.35

0.00

20.00

Total

Cumulative

283,576

283,576

100.00

15,638

299,214

16,049

315,262

315,262

100.00

Takeaway From Related Stores

Map Key Name

1

2

3

224

327

348

753

Save-A-Lot

WM Nbhd Mkt

Value Market

Kroger

Kroger

Kroger

Kroger

Total

Cumulative

Prepared for Louisville Downtown Development Corp.

February 11, 2013

------------Sales Transfer-----------Dec 2014 Percent Dec 2015

Dec 2016

-Total TransferSales Percent

-9,455

-5,840

-23,910

-50,257

-25,591

-57,229

-48,129

-22.26

-21.45

-23.14

-26.93

-46.70

-28.07

-24.34

-262

-161

-642

-1,178

-608

-1,509

-1,283

-257

-158

-629

-1,148

-591

-1,475

-1,257

-9,974

-6,159

-25,182

-52,583

-26,791

-60,212

-50,669

-23.48

-22.63

-24.37

-28.17

-48.89

-29.54

-25.62

-220,411

-220,411

-27.01

-5,643

-226,054

-5,515

-231,569

-231,569

-28.38

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 24

Consumer demographic chart Excel insert

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 25

Competitor threat:

There are no apparent, forthcoming competitor changes that would significantly affect the NuLu locations sales forecasts.

It is hypothetically possible that more than one new grocery location is developed in the downtown market, if the grocery formats

are distinctly different. An example is a downtown Target P Fresh and a NuLu fresh store which might co-exist.

4th & Oak, Site 4000 is a closed supermarket that has been targeted for re-opening. This survey judges that there would be little

interaction between a modest operation at that site and the NuLu location because of distance and the commercial buffers in

between. It is an existing 36,000 sf supermarket facility where feasibility is likely tied to Krogers continued position at 2nd &

Breckinridge, Map Key 348, which is an undersized store for the chain.

Construction issues

The proposed grocery stores opening date, operating budgets and business growth timeline could be affected by the forthcoming road

construction for the Ohio River bridge projects and with the planned upgrade of Kennedy Interchange, which might affect traffic

gravitation to a site. Those projects should be monitored and considered with development and store opening plans.

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 26

Recommendations

Store format: either a natural market cooperative or independent fresh store.

Store size: 25-35,000 square feet, with citing the issues against a larger store (performance potential and real estate).

Next steps toward the development goal:

o Identify the supermarket site and prepare a presentation for the prospective developers and retailers, including

information from this report.

o Determine development incentives for the proposed development and retailer especially with citing the retailers first

12-18 months of operation. Incentives: TIF or significant subsidy for the startup situation and costs; in my opinion at least

$100k.

o Suggested supermarket facility rent (backroom partitions, floor & ceiling treatment and stub-in for equipment utilities

hookup) is judged to be $10-$14 triple net, plus cam.

o Prepare a marketing package including information from this survey and a conceptual plan for the proposed site and

development, to present to prospective developers and retailers.

o Update sales forecasts as needed upon identification of the details from the developer and retailer.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 27

Prospective retail candidates

25-35,000 sf Fresh Store:

o Rainbow Blossom, existing Louisville grocery retailerunderstood to be in current communication with LDDC.

o Good Foods Market & Cafe, Lexington, Kentucky, general manager Anne Hopkins.

o NuLu Business Association potential for helping identify an initial steering committee for developing a community

cooperative supermarket.

o Value Market, Greg and James Neumann. http://www.valumarket.com/company-directory/, (502) 459-2221.

o (minimum 35,000 sf fresh store) Kroger Mid-South Division, David Prueter and Todd Metzmeier. 502-423-4993.

o Trader Joes

604 West Huntington Drive

Monrovia, CA 91016

626-358-8884

www.traderjoes.com

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 28

o Whole Foods -- excerpt from real estate website http://www.wholefoodsmarket.com/company-info/real-estate:

If you have a retail location you think would make a good site for Whole Foods Market, Inc., please review the following guidelines

carefully for consideration:

200,000 people or more in a 20-minute drive time

25,000-50,000 Square Feet

Large number of college-educated residents

Abundant parking available for our exclusive use

Standalone preferred, would consider complementary

Easy access from roadways, lighted intersection

Excellent visibility, directly off of the street

Must be located in a high traffic area (foot and/or vehicle)

Walmart new site submittal:

http://www.walmartrealty.com/LifeAtWalMart/ContactUs.aspx

Target www.target.com

Scott Nelson

Senior Vice President, Real Estate

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 29

CURRENT MARKET, DOWNTOWN LOUISVILLE

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 30

The delineated retail food market extends these distances from the downtown hub at Main Street and Clark Memorial Bridge:

North

0.2 mile to the Ohio River and state boundary which add to separating Indiana and Louisvilles downtown.

West

1.0 mile to the Roy Wilkerson Expressway, limited by the downtown commercial and industrial buffers.

South

1.5 miles to 4th Street, limited by distance, urban congestion and other competition.

East

2.3 miles up to and just into the Clifton community, limited by distance and road network.

2010 Population

2011 Population

Annual Growth

State of Kentucky

43,339,357

43,880,415 (12)

0.45%

Jefferson County

741,096

746,946

0.8%

City of Louisville

597,337

602,011

0.8%

2,469 (00)

n/a

Stable

Butchertown Community

661 (00)

n/a

Stable

Phoenix Hill Community

4,815 (00)

N/A

Stable

Clifton Heights Community

5062 (00)

n/a

Stable

The Highlands Community

30,000 (est.)

n/a

-0.8%

Smokehill Community

2,116

n/a

-0.8%

Downtown Market

34,111

34,111 (12)

-0.5%

94,341 (12)

n/a

Market Populations

Clifton Community

Downtown Daytime Sector

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 31

Estimated growth per internet sources including U.S. Census.

Louisvilles Downtown retail food market:

Resident consumers

Population

Weekly Potential

Dec 2012

34,111

$1,322,141

Competition

Float (i.e., leakage)

Float Percent

$1,020,000

Aggregate of the identified seven, primary competitors.

$302,141

Aggregate of secondary competition capturing small share of the market.

22.85 %

P.C.E.

Other Business Sectors

Daytime

$38.76

100,000

Average weekly expenditure per resident.

Potential

$1,260,000

Workers in the overall market but NuLu is estimated with competitive position about

70,000, with convenience to the health care district and competitive position for

downtowns core business district.

Lunch & secondary shopping sector.

Visitors

13,000,000

To businesses, university and health care institutions, hotels, entertainment and retail.

Potential

Not defined

The mix of consumers is too broad as is the range of reasons for a Downtown destination

visit, yet the proposed grocery store has potential to capture supplemental business

especially from visitors to NuLu and the health care district.

Resident retail sector as stated on the previous page:

Derived from the sales model constructed for this survey and used to forecast the subject stores performance potential. The

proposed store is projected to capture competitive share in relation to the retail format.

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 32

Daytime sector potential is estimated from two expenditures:

Food-away-from-home (restaurants, etc.) with an estimated daytime weekly expenditure average of $10 per worker.

Weekly secondary shopping potential estimated at $8 average per worker (20% of food-at-home expenditure). The proposed

grocery store is projected to with light market share against the much greater field of competition, 0.25& to 1% or $25-100k,

dependent on the format and site, and accounted for with the Draw factor for each scenarios projected store.

The retail format type, location and site affect the balance of business attracted from the two primary business sectors, to which the

NuLu district is best position for all-around convenience and competiveness.

The alternative sites can be made to work with respective tailoring to the situation and depending on site availability, details and costs,

but here too Site 1000 is judged to present the best opportunity for short- and long-term success.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 33

Communities that a NuLu supermarket location would service:

Source: Wikipedia

NuLu, the subject, primarily commercial district

East Market District also referred to as NuLu (a portmanteau of "New" and "Louisville"), is an unofficial district of Louisville,

Kentucky, situated along Market Street between downtown to the west and the Highland's neighborhoods to the east. A growing, hip

district, the area comprises parts of two of Louisville's oldest neighborhoods, Butchertown and Phoenix Hill. The district is home to

schools, churches, large and small businesses and some of the city's oldest homes and businesses. A destination street since

Louisville's founding, Market Street has played host to a variety of businesses throughout the city's history that have drawn

Louisvillians for generations to its addresses. There is limited housing in this area and potential for mixed-use growth.

Phoenix Hill, southeast of the trade area and with convenient access to NuLu.

Its boundaries are Market Street to the north, Preston Street to the west, Broadway to the south, and Baxter Avenue to the east.

The Phoenix Hill neighborhood, settled before 1850 by German immigrants, is now a rich tapestry of people and a diverse mix of

business, industry and residences. The neighborhood includes:

a large Medical District

a thriving arts district

a thriving entertainment district

social service agencies & agencies that serve the homeless

small family businesses and larger industry

single-family homes, market-rate apartment complexes and subsidized housing complexes

new and historic churches

It is a neighborhood of mixed but compatible uses. Much of the residential part of the neighborhood is included in the National

Historic District.

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 34

Clifton, east end of the trade area and convenient access to NuLu.

Unlike other Louisville neighborhoods, Clifton was developed over a period of 60 years, with the first homes built in the 1860s

sitting next to homes built in the 1910s, although nearly all homes were built in Victorian styles. Its residential areas are also

much less dense than other nearby areas like Butchertown or the Original Highlands. The Louisville and Lexington toll pike,

which is now called Frankfort Avenue, went through the heart of the area and was lined with small shops.

The area began to revitalize in the 1990s, as numerous restaurants, boutiques, and antique shops opened up along Frankfort

Avenue. Area attractions include the Kentucky School for the Blind and the American Printing House for the Blind.

Clifton is bounded by I-64, N Ewing Ave, Brownsboro Road, and Mellwood Ave.

The Highlands, with a portion situated in the southeast corner of the trade area; reasonable access to NuLu.

(It) contains a high density of nightclubs, eclectic businesses, and many upscale and fast food restaurants. It is centered along a

three-mile stretch of Bardstown Road and Baxter Avenue (US 31E/US 150) and is so named because it sits atop a ridge between

the middle and south forks of Beargrass Creek. The commercial area extends from the intersection of Bardstown Road and

Taylorsville Road/Trevillian Way in the south, to the intersection of Baxter Avenue and Lexington Road in the north, a length of

3.2 miles. A 1/2 mile section of nearby Barret Avenue also contains many similar businesses. The residential area is separated

from oth

er adjacent areas like Germantown and Crescent Hill by the south and north forks of Beargrass Creek. The middle

fork runs through Cherokee Park, and the south fork divides Germantown from Tyler Park, after flowing past several cemeteries

and undeveloped forests downstream from Joe Creason Park. Due to its large collection of night clubs and restaurants, it is locally

known as "Restaurant Row."[1]

The grid of streets east and west of Bardstown Road are mostly single-family residences and range from working-class

neighborhoods to some of the most expensive streets in Louisville, such as Spring Drive. One of Louisville's most famous Derby

partiesthe Barnstable Brown Party, hosted by Wrigley's Doublemint Twins Cyb and Patricia Barnstableis held at a home on

Spring Drive.[2]

In 2000, the Highlands had a population of nearly 33,000.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 35

Smoketown, Louisville, southeast end of the trade area and convenient access to the NuLu location.

A neighborhood one mile (1.6 km) southeast of downtown Louisville, Kentucky. Smoketown has been a historically black neighborhood since

the Civil War. It is the only neighborhood in the city that has had such a continuous presence.

The name apparently comes from the large number of (smoke-producing) kilns in the area during its early brick-making days. An 1823 newspaper

advertises a brickyard in the area as part of the farm and residence of "the late Mark Lampton", after whom Lampton Street is probably named. 9

of 20 brickyards in the city had Smoketown addresses according to a 1871 Caron's directory, although none remained by 1880, as apparently the

supply of clay from under the neighborhood had run out. The abandoned, water-filled clay pits may have given rise to the name "Frogtown" for the

neighborhood, which appeared in print in 1880.

Some residential development by whites of German ancestry began in the 1850s, but due to the arrival of thousands of freed slaves who moved

there from various parts of rural Kentucky after the Civil War, it was solidly African American by 1870. A streetcar line was extended down

Preston Street to Kentucky in 1865, spurring growth.

With its shotgun houses and narrow streets, Smoketown was a densely populated area with a population of over 15,000 by 1880. African

American property ownership was rare, with most living in properties rented from whites.

By the 1960s the area suffered from high crime and unemployment rates, causing massive population loss. Many of the old shotgun houses have

been razed and housing projects built in their place.

Albert E. Meyzeek Middle School is located in the neighborhood. Presbyterian Community Center is located in the Smoketown neighborhood.

Bates Memorial Missionary Baptist Church is located in Smoketown.

Smoketown is bounded by Broadway, CSX railroad tracks, Kentucky Street, and I-65. Since the 1950s, Smoketown has suffered from massive

depopulation. As of 2000, the population of Smoketown was 2,116, a decrease of over 38% from 1990

Prepared for Louisville Downtown Development Corp.

February 11, 2013

[1]

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 36

Old Louisville, least convenient to NuLu district yet reasonably accessible.

A historic district and neighborhood in central Louisville, Kentucky, USA. It is the third largest such district in the United States, and the largest

preservation district featuring almost entirely Victorian architecture.[2][3] It is also unique in that a majority of its structures are made of brick, and the

neighborhood contains the highest concentration of residential homes withstained glass windows in the U.S.[3] Many of the buildings are in

the Victorian-era styles of Romanesque, Queen Anne, Italianate, among others; and a large number of blocks have had few or no buildings razed.

There are also several 20th century buildings from 15 to 20 stories.

Old Louisville consists of about 48 city blocks and is located north of the University of Louisville's main campus and south of Broadway

and Downtown Louisville, in the central portion of the modern city.[4][5] The neighborhood hosts the renowned St. James Court Art Show on the first

weekend in October.

Despite its name, Old Louisville was actually built as a suburb of Louisville starting in the 1870s, nearly a century after Louisville was founded. It was

initially called the Southern Extension, and the name Old Louisville did not come until the 1960s. Old Louisville was initially home to some of

Louisville's wealthiest residents, but saw a decline in the early and mid-20th century. Following revitalization efforts and gentrification, Old Louisville

is currently home to a diverse population with a high concentration of students and young professionals.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 37

Downtown Louisville, KY Competitor Evaluation

Current Market Assessment

Map

Key

Market

Store

TSQFT

Sales

$/SF

Draw*

$ in T.A.

Kroger Food & Drug

26,000

$285,000 $10.96

90%

$256,500

924 S. 2nd Street

Remaining competitors situated 1.5 miles and greater from the heart of downtown:

Save A Lot

1

17,000

$85,000

$5.00

50%

$42,500

1311 S. Shelby St.

Walmart Nbhd. Mkt.

2

40,000

$325,000

$8.13

10%

$32,500

3101 Poplar Level Rd

w/pharmacy

Value Market

3

30,000

$250,000

$8.33

50%

$125,000

1250 Bardstown Road

Kroger Food, Drug,

224 Fuel

39,000

$520,000 $13.33

18%

$92,040

2200 Brownsboro Rd

w/pharmacy

327 Kroger Food & Drug

47,000

$530,000 $11.28

10%

$53,000

2710 W. Broadway

w/pharmacy

753 Kroger Food & Drug

69,000

$700,000 $10.14

10%

$70,000

1265 Goss Avenue

w/pharmacy

348

7 Competitors Totals

Competitors Averages

268,000

38,286

Total Float $

Total Market Potential

Prepared for Louisville Downtown Development Corp.

February 11, 2013

$2,695,000

$385,000

$10.06

$10.06

n/a

n/a

$671,540

$95,934

Share

Comments

Downtown retail food trade area: approximate

1.5 mile radius

st

19.40%

1 supermarket to service the downtown core

But not convenient to all consumer sectors.

3.86%

1.8 miles southeast of downtown's hub; situated

just outside of the trade area. Limited

st

The most distant competitor but 1 price-impact.

Light influence on the market. 3.6 miles.

2.4 miles southwest of downtown hub; Highlands.

Original & aged mall; tailored indep. format.

2.46%

9.45%

17.70%

6.01%

18.27%

2.3 miles east of downtown hub; Clifton.

1.9 miles east of NuLu. Food, drug & fuel store..

2.4 miles west of downtown's hub. Primarily

servicing West Sides lower-income consumers.

2.4 miles from downtown hub. Newly retrofitted

Wine & Spirits. Strong natural food performance.

77.15%

11.02%

$302,141

22.85%

$1,322,141

100.00%

Aggregate secondary competition including cstores, small independents like First Link on E.

Liberty, & distant competitors.

Downtown market' residents weekly retail food

potential.

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 38

LOUISVILLE CURRENT MARKET

DECEMBER, 2012

TRADE AREA TOTALS

Trade Area

Population

Potential

Facility Volume

Float Amount

Float Percent

P.C.E.

Dec 2012

34,111

1,322,141

1,020,000

302,141

22.85%

38.76

2010 Census Population

2012 Estimated Population

2017 Estimated Population

33,366

34,111

36,955

Current trade area population is 34,111 people and the average P.C.E. is $38.76, ranging from a high of $46.78 in Sector

26 to a low of $28.95 in Sector 12. The total potential is $1,322,141, and the 7 facilities identified are receiving

$1,020,000 or a 77.15% market share. Total float, which consists of minor facilities and leakage, is $302,141 or 22.85%.

The 2012 estimated median income for the trade area is $27,858 with an average household size of 1.71 people. Demographic

makeup is 59.7% white, 35.3% black, 0.0% Hispanic and 0.0% Asian. Additionally, 0.0% of the trade area residents are under

the age of 18, 0.0% are over the age of 65, 0.0% are in college housing and 0.0% are in military housing.

Facility Profile

2012

7

Number of Facilities - Total

Total Trade Area Potential

Facility Sales Within Trade Area

Facility Percent

Float

Float Percent

Highest Volume Facility

Kroger - Map Key 753

Largest Facility

Kroger - Map Key 753

$1,322,141

$1,020,000

77.15%

$302,141

22.85%

$690,000

Sales Per Total Area Square Foot - Average

High (Kroger - Map Key 224)

Low (Save-A-Lot - Map Key 1)

69,000 SF

$10.02

$13.33

$5.00

Combined, the 7 facilities contain a total of 268,000 square feet with total sales of $2,685,000. The facilities average

38,286 square feet and $383,571 in sales. The average sales per square foot is` $10.02. There are 7.86 square feet per

capita, 0.13 persons per square foot and 4,873 persons per facility.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 39

COMPETITORS MARKET POSITIONS

Facility

Map Key

1

2

3

224

327

348

753

---Dec 2012 --Volume

/SqFt

Name

Save-A-Lot

WM Nbhd Mkt

Value Market

Kroger

Kroger

Kroger

Kroger

Total

Average

Total

Area

Draw

60

10

50

45

15

90

35

85,000

325,000

250,000

520,000

530,000

285,000

690,000

5.00

8.13

8.33

13.33

11.28

10.96

10.00

17,000

40,000

30,000

39,000

47,000

26,000

69,000

2,685,000

383,571

10.02

268,000

38,286

Image

65

92

89

118

114

112

111

100

CHAIN SUMMARY

Chain

Name

# of

Facs

---------------------Chain Total-------------------Volume

Average

Size

Average

SaveALot

*Walmart

Value Market

*Kroger

1

1

1

4

85,000

325,000

250,000

2,025,000

Totals

Averages

2,685,000

85,000

325,000

250,000

506,250

17,000

40,000

30,000

181,000

Vol/

SqFt

Avg

Image

Market

Share

17,000

40,000

30,000

45,250

5.00

8.13

8.33

11.19

65

92

89

113

3.86

2.46

9.45

61.38

38,286

10.02

268,000

383,571

77.15

* Chain includes facilities with draw less than 29.99

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 40

MARKET SECTOR DATA DECEMBER, 2012

Sector

Map Key

-----Dec 2012----Population

PCE

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

801

977

785

814

1,229

863

495

976

1,069

977

1,503

1,562

1,181

813

741

1,249

1,604

796

1,013

856

767

898

1,094

708

874

868

1,186

2,382

927

958

1,164

869

1,112

Total

Average

34,111

Prepared for Louisville Downtown Development Corp.

March 27, 2013

36.74

32.87

35.36

38.76

42.35

35.25

31.90

42.81

40.77

31.48

31.54

28.95

35.83

35.84

31.66

31.75

37.94

38.86

40.38

42.12

42.14

46.71

44.08

42.66

44.87

46.78

46.22

37.73

43.98

42.87

43.30

41.11

41.20

Potential

29,431

32,119

27,759

31,549

52,044

30,417

15,788

41,781

43,579

30,753

47,404

45,212

42,314

29,138

23,462

39,655

60,858

30,936

40,909

36,053

32,323

41,947

48,220

30,206

39,219

40,602

54,819

89,862

40,766

41,071

50,405

35,723

45,818

-------Float------Percent

Amount

21.74

22.04

19.83

18.31

19.52

14.03

19.43

20.56

20.68

21.43

20.01

22.86

17.27

24.57

19.51

23.69

26.13

20.79

23.61

20.74

25.83

24.88

27.00

24.30

26.06

26.59

27.33

26.91

28.40

25.85

21.98

21.97

16.41

1,322,141

38.76

6,399

7,078

5,504

5,776

10,157

4,269

3,068

8,590

9,011

6,590

9,487

10,334

7,310

7,159

4,579

9,396

15,901

6,431

9,658

7,478

8,349

10,436

13,018

7,341

10,219

10,794

14,982

24,184

11,578

10,617

11,079

7,850

7,520

302,141

22.85

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 41

COMPETITOR MARKET SHARE BY SECTOR

Dec 2012

1

Facility Save-A-L

Sector

--M.S.--

2

WM Nbhd

--M.S.--

3

Value Ma

--M.S.--

224

Kroger

--M.S.--

327

Kroger

--M.S.--

348

Kroger

--M.S.--

753

Kroger

--M.S.--

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

2.95

1.16

3.55

1.95

4.89

3.03

6.11

1.97

8.49

10.57

5.64

2.95

16.17

3.63

12.81

7.85

3.59

11.16

7.42

9.45

4.18

3.49

1.17

1.87

.66

.80

.48

.70

.91

.03

.07

.03

.02

1.18

.52

1.22

.70

1.51

.92

1.74

.78

2.25

2.59

1.67

1.19

4.24

1.51

3.61

2.52

2.11

3.83

5.11

8.52

4.36

6.17

2.25

7.87

3.03

5.25

5.24

.49

1.21

.20

.32

.16

.11

.27

.30

.35

.32

.46

.46

.60

.72

.81

1.37

1.73

2.14

1.44

4.71

3.12

5.32

9.01

7.27

16.46

12.56

24.72

29.64

20.99

27.71

37.72

40.91

39.73

.52

6.88

.97

2.25

.88

.56

1.24

2.31

1.26

1.56

1.30

1.48

1.40

3.56

1.48

1.87

3.42

7.99

1.30

13.32

2.45

5.91

19.32

3.45

6.62

3.52

12.56

7.02

35.85

4.10

19.42

5.53

9.26

8.42

46.61

71.89

73.67

76.10

82.33

10.20

24.71

7.48

11.32

5.63

6.08

4.63

13.04

3.61

2.76

4.75

9.57

1.41

6.92

1.63

3.01

4.60

1.16

1.25

.78

1.39

.69

1.32

.33

.47

.24

.25

34.55

3.62

.26

.33

.20

.13

49.40

42.48

52.33

57.16

49.16

62.45

45.58

49.41

36.01

27.25

41.11

37.92

10.64

25.80

12.19

19.17

14.81

6.23

5.11

2.96

4.33

1.88

2.11

.68

.56

.35

.24

22.41

4.56

.07

.16

.06

.04

13.01

6.48

13.99

8.68

17.53

11.55

20.52

9.96

26.66

32.15

21.67

15.37

47.53

19.55

44.67

32.54

20.45

46.10

34.42

41.47

22.62

26.23

9.30

33.13

12.09

20.32

17.46

6.01

7.81

.74

1.22

.60

.40

Total

3.86

2.46

9.45

17.70

6.01

19.40

18.27

Prepared for Louisville Downtown Development Corp.

February 11, 2013

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 42

NuLu Location 100 Evaluation

A hypothetical supermarket site in midst of the NuLu commercial district.

Prepared for Louisville Downtown Development Corp.

March 27, 2013

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 43

NuLu Location 1000

The hypothetical site is assumed to be in midst of NuLu district or possibly at redevelopment of properties at NuLus west side and at

the west side of I-64.

Proposed

25-35k sf supermarket.

Business Setting

The proposed store is assumed to have significant position in the district and the associate character of the

NuLu business district.

Adjacent Roads

Primary access: E. Market and Main Streets; one-way, two-lane structure. Worn conditions; Market

Street has parallel parking; both roads with main street upgrade plans (streetscape improvement).

Secondary routes are feeder routes to nearby neighborhoods and commercial districts including the

hospital district located four blocks south.

FROM

ACCESSIBILITY

VISIBILITY

INGRESS/EGRESS

North and

South

Secondary routes south to the hospital

district and to area housing. The

freeway extends this locations reach.

Assumed to be limited and might

warrant roadside pylon signs.

East and

West

Market and Main Streets are primary

The supermarket is assumed to

arterial routes into downtown and east have good sight lines to traffic and

leading to the east side communities.

area activity.

Assumed comfortable.

Assumed comfortable.

2010 Traffic Counts

E. Market Street

E. Main Street

Parking & Traffic Flow

Assumed to be comfortable.

Overall Rating

NuLu is the markets best location for the proposed supermarket. The

challenge is to identify a site with supportive retail traits.

Prepared for Louisville Downtown Development Corp.

February 11, 2013

11,970 ADT.

11,030 ADT.

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 44

LOUISVILLE DOWNTOWN PROJECTED MARKET

24 MONTHS OUT TO STORE OPENING & 1ST YEAR END FORECAST

2.0% ANNUAL INFLATION RATE

TRADE AREA TOTALS

Trade Area

Population

Potential

Facility Volume

Float Amount

Float Percent

P.C.E.

Dec 2012

34,111

1,322,141

1,020,000

302,141

22.85

38.76

Dec 2014

35,248

1,394,568

1,075,671

318,896

22.87

39.56

% Change

3.33

5.48

5.46

5.55

2.08

SCENARIO 1 -- 25K SF FRESH STORE AT NULU LOCATION 1000

Facility

Map Key

1

2

3

224

327

348

753

1000.1

Name

Save-A-Lot

WM Nbhd Mkt

Value Market

Kroger

Kroger

Kroger

Kroger

Fresh Store

Forecast

---Dec 2014 --Volume

/SqFt

78,071

4.59

228,086

456,182

7.60

11.70

253,911

625,561

210,172

9.77

9.07

8.41

Current

----Dec 2012 ---Volume

/SqFt

85,000

5.00

325,000

8.13

250,000

8.33

520,000

13.33

530,000

11.28

285,000

10.96

690,000

10.00

0

0.00

T.A.

Diff.

-4,157

-2,590

-10,957

-28,718

-15,510

-27,980

-22,554

168,137

%

Chg

-8

-8

-9

-12

-20

-11

-9

0

Fcst

Total

Area

17,000

40,000

30,000

39,000

47,000

26,000

69,000

25,000

Draw

60

10

50

45

15

90

35

80

Image

65

92

89

118

114

112

111

85

Totals

* 2,577,687

2,685,000

55,671

Averages

322,211

8.80

383,571

10.02

36,625

98

The low draw for forecast volumes is 29.99. Forecast total includes low draw stores whose volumes are not shown.

NEW CHAIN REPORT

Chain

Name

SaveALot

*Walmart

Value Market

*Kroger

NuLu Fresh Str

# of

Facs

1

1

1

4

1

---------------------Chain Total-------------------Volume

Average

Size

Average

78,071

78,071

17,000

17,000

299,103

299,103

40,000

40,000

228,086

228,086

30,000

30,000

1,762,255

440,564

181,000

45,250

210,172

210,172

25,000

25,000

Totals

8

2,577,687

Averages

322,211

* Chain includes facilities with draw less than 29.99

Prepared for Louisville Downtown Development Corp.

March 27, 2013

Vol/

SqFt

4.59

7.48

7.60

9.74

8.41

293,000

Avg

Image

65

92

89

113

85

Market

Share

3.36

2.14

8.18

51.40

12.06

77.13

36,625

8.80

by: Keith Wicks & Associates

Downtown Louisville, Kentucky Market Survey LDDC101

Page 45

COMPETITORS NEW MARKET SHARES

Facility

Map Key

1

2

3

224

327

348

753

1000.1

Name

Save-A-Lot

WM Nbhd Mkt

Value Market

Kroger

Kroger

Kroger

Kroger

Fresh Store

-----Dec

M.S.

3.36

2.14

8.18

14.72

4.59

16.39

15.70

12.06

Totals

77.13

2014 ----Volume

46,843

29,910

114,043

205,282

63,990

228,520

218,947

168,137

1,075,671

SCENARIO 2 -- 35K SF MID-SIZE FRESH STORE AT NULU SITE 1000

Facility

Map Key

1

2

3

224

327

348

753

1000.2

Name

Save-A-Lot

WM Nbhd Mkt

Value Market

Kroger

Kroger

Kroger

Kroger

Mid-size Fr. Str

Forecast

---Dec 2014 --Volume

/SqFt

73,606

4.33

214,930

428,752

7.16

10.99

236,467

587,838

283,576

9.09

8.52

8.10

Current

----Dec 2012 ---Volume

/SqFt

85,000

5.00

325,000

8.13

250,000

8.33

520,000

13.33

530,000

11.28

285,000

10.96

690,000

10.00

0

0.00

T.A.

Diff.

-6,836

-4,237

-17,535

-41,062

-22,082

-43,680

-35,757

226,861

%

Chg

-13

-13

-14

-18

-28

-17

-15

0

Fcst

Total

Area

17,000

40,000

30,000

39,000

47,000

26,000

69,000

35,000

Draw

60

10

50

45

15

90

35

80

Image

65

92

89

118

114

112

111

90

Totals

* 2,490,579

2,685,000

55,672

Averages

311,322

8.22

383,571

10.02

37,875

99

The low draw for forecast volumes is 29.99. * Forecast total includes low draw stores whose volumes are not shown.

NEW CHAIN REPORT

Chain

# of

---------------------Chain Total-------------------Name

Facs

Volume

Average

Size

Average

SaveALot

1

73,606

73,606

17,000

17,000

*Walmart

1

282,625

282,625

40,000

40,000

Value Market

1

214,930

214,930

30,000

30,000

*Kroger

4

1,635,842

408,960

181,000

45,250

NuLu Fresh Str

1

283,576

283,576

35,000

35,000

Totals

8

2,490,579

303,000

Averages

311,322

37,875

* Chain includes facilities with draw less than 29.99

Prepared for Louisville Downtown Development Corp.

February 11, 2013

Vol/

SqFt

4.33

7.07

7.16

9.04

8.10

Avg

Image

65

92

89

113

90

Market

Share

3.17

2.03

7.71

47.97

16.27

77.13

8.22

by: Keith Wicks & Associates

Louisville, Kentucky. Downtown Retail Food Market Survey LDDC101

Page 46

COMPETITORS NEW MARKET SHARES

Facility

Map Key

1

2

3

224

327

348

753

1000.2

Totals

-----Dec

Name

M.S.

Save-A-Lot

3.17

WM Nbhd Mkt

2.03

Value Market

7.71

Kroger

13.83

Kroger

4.12

Kroger

15.26

Kroger

14.75

Mid-size Fr. Str 16.27

77.13

2014 ----Volume

44,164

28,263

107,465

192,938

57,418

212,820

205,743

226,861

1,075,672

SCENARIO 3 FYI

35K SF GROCER AS A PORTION OF A DISCOUNTER AT S. DOWNTOWN LOCATION 3000

Facility

Map Key

1

2

3

224

327

348

753

3000

Name

Save-A-Lot

WM Nbhd Mkt

Value Market

Kroger

Kroger

Kroger

Kroger

S. Downtown Loca.

Forecast

---Dec 2014 --Volume

/SqFt

83,602

4.92

258,199

518,019

8.61

13.28

245,349

677,046

234,408

9.44

9.81

6.70

Current

----Dec 2012 ---Volume

/SqFt

85,000

5.00

325,000

8.13

250,000

8.33

520,000

13.33

530,000

11.28

285,000

10.96

690,000

10.00

0

0.00

T.A.

Diff.

-839

176

4,099

-892

-23,858

-35,686

-4,534

117,204

%

Chg

-2

1

3

0

-30

-14

-2

0

Fcst

Total

Area

17,000

40,000

30,000

39,000

47,000

26,000

69,000

35,000

Draw

60

10

50

45

15

90

35

50

Image

65

92

89

118

114

112

111

70

Totals

* 2,714,332

2,685,000

55,671

Averages

339,292

8.96

383,571

10.02

37,875

96

The low draw for forecast volumes is 29.99. * Forecast total includes low draw stores whose volumes are not shown.

NEW CHAIN REPORT

Chain

# of

Name

Facs

SaveALot

1

*Walmart

1

Value Market

1

*Kroger

4

S. Downtown Loca.

1

---------------------Chain Total-------------------Volume

Average

Size

Average

83,602

83,602

17,000

17,000

326,761

326,761

40,000

40,000

258,199

258,199

30,000

30,000

1,811,362

452,841

181,000

45,250

234,408

234,408

35,000

35,000

Totals

8

2,714,332

Averages

339,292

* Chain includes facilities with draw less than 29.99