Professional Documents

Culture Documents

SBI Blue Chip Fund

SBI Blue Chip Fund

Uploaded by

Aj_2006Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SBI Blue Chip Fund

SBI Blue Chip Fund

Uploaded by

Aj_2006Copyright:

Available Formats

Factsheet as of December 2014

SBI Blue Chip Fund

S&P

-SBI

Growth

Bse

Blue

100

Chip Fund

Equity - Large Cap

Equity - Large Cap

Important Information

CRISIL Mutual Fund Rank

SBI Blue Chip Fund

Investment Objective

Inception Date

14-Feb-2006

1265.94

1.00

Sohini Andani

Fund Manager

Expense Ratio (%)*

2.56

Designation

Fund Manager

Min. Investment (Rs.)

5000

Qualification

B.Com, C.A.

Yrs of Experience

16

*data as of half-yearly portfolios of Sept 2014

Key Portfolio Attributes

Trailing Returns (%)

Portfolio P/E

Portfolio P/B

60.00

50.00

40.00

30.00

20.00

10.00

0.00

28.14

7.91

Dividend Yield (%)

0.93

NAV as on 31/12/2014

No. of Total Holdings

26.34

52

Benchmark Index

Index P/E

S&P BSE 100

NA

Index P/B

Value

Blend

Growth

N.A

N.A

Large Cap

N.A

N.A

N.A

Diversified

N.A

N.A

N.A

Small & Mid

Cap

SIP Returns

Period

3 YR SIP

Amt Invested

Value (Rs)

Scheme

Fund

S&P BSE 100

capitalisation

Avg AUM: Oct-Dec 2014 (Rs Cr.)

Exit Load (Max %)

Investment Style

To provide investors with opportunities for long-term growth in capital

through an active management of investments in a diversified basket of

equity stocks.

Returns (%)

6ms

1Yr

2Yrs^

3Yrs^

SI^

17.07

47.86

26.12

29.97

11.52

8.09

32.28

18.34

22.05

11.88

Benchmark

Value (Rs)

Returns (%)

5 YR SIP

7 YR SIP

36000

60000

84000

56674

31.75

101273

21.04

162038

18.42

49954

22.43

86428

14.56

136521

13.62

NA

^ Annualized

Important Ratios *

Concentration Analysis

Portfolio Beta

R Squared (%)

Standard Deviation (%)

Sharpe Ratio

Treynor Ratio

Jenson's Alpha (%)

0.82

89.24

14.15

3.76

0.65

23.58

Sortino Ratio

* Annualized

% to NAV

Exposure to CNX Nifty

Exposure to Benchmark

Top 5 Companies Exposure

Top 5 Sectors Exposure

Market Captialisation

56.25

77.66

22.70

47.24

Mid Cap

13%

5.00

Large Cap

87%

Top 10 Company Holdings

Top 10 Sector Holdings

Fund

8

6

4

2

0

Benchmark

30

Fund

Benchmark

20

Engineering

Auto

Ancillaries

Bearings

Personal Care

Refineries/Ma

rketing

Passenger/Uti

lity Vehicles

Cement

Pharmaceutic

als

Banks

Computers Software

Sun Pharma

Divis Labs

HDFC

HCL

Technologies

L&T

Motherson

Sumi Systems

ICICI Bank

TCS

Maruti Suzuki

India

HDFC Bank

10

History

Dec-14

Sep-14

Jun-14

Mar-14

Dec-13

Sep-13

Jun-13

CRISIL Mutual Fund Rank

AUM (Rs. Cr.)

Quarter End NAV

52 Weeks High NAV

52 Weeks Low NAV

1

1265.94

26.34

26.74

17.32

1

1070.01

24.67

25.01

15.96

2

930.58

22.50

22.50

14.47

2

800.99

19.13

19.13

14.47

2

734.51

17.82

17.84

14.47

2

690.08

15.96

17.43

14.47

2

798.51

16.23

17.43

13.78

Fund vis--vis Benchmark Historic Performance

Quarter on Quarter Performance

20.00

3500

3000

2500

2000

1500

1000

500

0

Fund

Fund

Benchmark

Benchmark

10.00

0.00

All data as on December 31, 2014

Address

Website

Phone No

Registrars

Dec-14

Sep-14

Jun-14

Mar-14

Dec-13

Sep-13

Jun-13

Mar-13

Dec-12

Sep-12

Jun-12

-10.00

Mar-12

Dec-14

May-14

Oct-13

Mar-13

Aug-12

Jan-12

Jun-11

Oct-10

Mar-10

Aug-09

Jan-09

Jun-08

Nov-07

Apr-07

Sep-06

Feb-06

Portfolio features equated with comparable NSE indices in place of S&P BSE indices

9th Floor, Crescenzo, C-38 & 39, G Block, Bandra Kurla Complex, Bandra (East), Mumbai 400051

partnerforlife@sbimf.com

www.sbimf.com

022 - 61793000

Computer Age Management Services Pvt. Ltd.

Disclaimer: CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers

reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of

Data / Report. This Report is not a recommendation to invest / disinvest in any company covered in the Report. CRISIL especially states that it has no financial liability whatsoever to the subscribers/ users/

transmitters/ distributors of this Report. CRISIL Research operates independently of, and does not have access to information obtained by CRISILs Ratings Division / CRISIL Risk and Infrastructure Solutions

Limited (CRIS), which may, in their regular operations, obtain information of a confidential nature. The views expressed in this Report are that of CRISIL Research and not of CRISILs Ratings Division / CRIS.

No part of this Report may be published / reproduced in any form without CRISILs prior written approval.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Estate Tax - ProblemsDocument6 pagesEstate Tax - ProblemsKenneth Bryan Tegerero Tegio100% (2)

- Acctng ProcessDocument4 pagesAcctng ProcessElaine YapNo ratings yet

- Marketing Strategies of NestleDocument54 pagesMarketing Strategies of NestleAj_2006No ratings yet

- Additional Schemes TableDocument6 pagesAdditional Schemes TableAj_2006No ratings yet

- Companies Profile Mutual FundDocument3 pagesCompanies Profile Mutual FundAj_2006No ratings yet

- Top MF CompaniesDocument7 pagesTop MF CompaniesAj_2006No ratings yet

- Latest Nav Report 0703151549 SsDocument253 pagesLatest Nav Report 0703151549 SsAj_2006No ratings yet

- Canara Robeco Emerging EquitiesDocument1 pageCanara Robeco Emerging EquitiesAj_2006No ratings yet

- SideshwarDocument1 pageSideshwarAj_2006No ratings yet

- Tata Equity Opportunities FundDocument1 pageTata Equity Opportunities FundAj_2006No ratings yet

- Pirangut Plant of Coca IN IndiaDocument11 pagesPirangut Plant of Coca IN IndiaAj_2006No ratings yet

- P PlantDocument1 pageP PlantAj_2006No ratings yet

- Entrepreneurship DevelopmentDocument7 pagesEntrepreneurship Developmentcadsathis100% (2)

- Development of Banking in NepalDocument4 pagesDevelopment of Banking in Nepaldipendra sharmaNo ratings yet

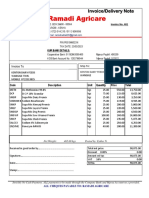

- Ramadi Agricare: Invoice/Delivery NoteDocument2 pagesRamadi Agricare: Invoice/Delivery NoteRamadi cyberNo ratings yet

- الفروقات المؤقتة ومحاسبة الضريبة المؤجلة في الشركات الفردية وفق النظام المحاسبي الماليDocument18 pagesالفروقات المؤقتة ومحاسبة الضريبة المؤجلة في الشركات الفردية وفق النظام المحاسبي الماليRime KessiraNo ratings yet

- Gasbill 5568246016 202112 20211228191312Document1 pageGasbill 5568246016 202112 20211228191312ahmedNo ratings yet

- DaffodilsDocument1 pageDaffodilschristyjaiNo ratings yet

- Chapter 1Document5 pagesChapter 1Zabin NaziaNo ratings yet

- History of Insurance-WWW - SELUR.TKDocument9 pagesHistory of Insurance-WWW - SELUR.TKselurtimaNo ratings yet

- Afm Question BankDocument11 pagesAfm Question Banknunnachandrahas2807No ratings yet

- Retail Installment Contract TemplateDocument4 pagesRetail Installment Contract TemplatenathaliaanitaNo ratings yet

- Fringe Benefits TaxDocument7 pagesFringe Benefits TaxRaymond JhulyanNo ratings yet

- Allowable Deductions Itemized Deductions (Sec 34, NIRC)Document9 pagesAllowable Deductions Itemized Deductions (Sec 34, NIRC)Angela ParadoNo ratings yet

- Entrepreneurship: Becamex Business SchoolDocument35 pagesEntrepreneurship: Becamex Business SchoolThương LinhNo ratings yet

- Sbi Statement Zakir NagarDocument12 pagesSbi Statement Zakir NagarLalit JainNo ratings yet

- Cable Industry in IndonesiaDocument85 pagesCable Industry in IndonesiaLucky Ariesandi100% (2)

- AFM Cash Budgeting Andria Ma'AmDocument9 pagesAFM Cash Budgeting Andria Ma'AmNavya KNo ratings yet

- PPDocument9 pagesPPEmmylouCasanovaNo ratings yet

- Chapter 8Document11 pagesChapter 8Ro-Anne Lozada0% (1)

- Shubh Sugar Co.Document12 pagesShubh Sugar Co.Krishna ParabNo ratings yet

- MP - 3 - Peso Growth FundDocument2 pagesMP - 3 - Peso Growth FundFrank TaquioNo ratings yet

- Impact of Investor Sentiments On The Indian Stock Market ReturnsDocument25 pagesImpact of Investor Sentiments On The Indian Stock Market ReturnsSuraj KashyapNo ratings yet

- EDISON Group Profile PDFDocument56 pagesEDISON Group Profile PDFAnonymous KAIphjNdLzNo ratings yet

- Forex NotesDocument24 pagesForex NotesPhotos Back up 2No ratings yet

- Radisson Hospitality Ab Annual Report 2019Document74 pagesRadisson Hospitality Ab Annual Report 2019Priya YadavNo ratings yet

- Project Report For UNOKEM - Unokem Resins Pvt. Ltd.Document31 pagesProject Report For UNOKEM - Unokem Resins Pvt. Ltd.Rahul PancholiNo ratings yet

- Afar 90Document133 pagesAfar 90pattNo ratings yet

- Ofqual Accredited Qualifications: Ofqual No. EDI Qualification Code LCCI Qualification Title Ofqual TitleDocument4 pagesOfqual Accredited Qualifications: Ofqual No. EDI Qualification Code LCCI Qualification Title Ofqual TitleWutyee LynnNo ratings yet

- Warren Buffet BiographyDocument8 pagesWarren Buffet BiographyMark allenNo ratings yet